Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Energy & Fuels

Oman has huge potential for lithium exploitation and production, considering the enormous quantities of spodumene and seawater salt with high-grade lithium available, developing efficient regulations and rules to protect investors’ rights, and reducing the environmental risks associated with the production and recycling of lithium-ion batteries.

- lithium

- clean energy

- electric vehicle

- manufacturing

- investment

1. Introduction

The current pattern of human behavior in energy consumption and pollution makes the realization of the United Nations’ Sustainable Development Goals, which aim to achieve economic, social, and environmental sustainability by 2030, far-reaching. Many pressing economic and environmental challenges are caused by individual mobility patterns, including the intensity of fossil fuel use and its ensuing effects on the supply of fossil fuels, as well as the emissions of pollutants such as nitrogen oxides (NOx) and sulfur dioxide (SO2). As the U.S. Environmental Protection Agency [1] pointed out, the annual carbon dioxide emissions from a typical passenger car are around 4.6 metric tons. Thus, the transition to renewable energy can reduce the production of carbon footprints [2]

In the pursuit of energy for sustainable development, electric vehicles (EVs) and hybrid electric vehicles (HEVs) offer clean energy solutions to reduce the pollution and greenhouse gas emissions generated from fossil fuels. Graham [3] classified EVs as Battery Electric Cars (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). While conventional gasoline vehicles convert about 17% to 21% of the energy stored in fuel to power the wheels, EVs transfer roughly 59% to 62% of electrical energy from the power source to power the wheels [4]. However, securing enough power output to meet the vehicle’s demands for power performance and improving energy economy are major challenges. Numerous studies have underscored lithium’s advantageous material properties, including the lightest metal and the highest electrochemical potential, as well as the advantages of lithium-ion batteries, including their high power density, high energy density, and long service life [5]. These properties have attracted energy specialists and industrialists, so the demand for lithium is expected to increase tenfold by 2035 because of the quick adoption of EVs in the context of energy transitions [6]. As demand increases, the world needs to raise its lithium supply to fulfill the growing demand [7,8]. By 2040, the demand for copper and aluminum could rise by almost a third, nickel by two-thirds, cobalt by 200%, and lithium by 600% [9].

The lithium market is also expected to grow exponentially. In the eighth Clean Energy Ministerial meeting in June 2017, governmental and non-governmental organizations such as the EV30@30 Campaign sought to increase the market share of EVs to 30% by 2030 [10]. This campaign was backed by China, Japan, and India, where EVs account for the bulk of vehicle sales [11]. The global market for EVs is anticipated to reach USD 354.80 billion by 2028 [12]. Following its commitment to achieve net zero carbon emissions by 2060, Saudi Arabia aspires for at least 30% of its cars to be electric by 2030 [13]. Aiming to produce 150,000 vehicles annually at the King Abdullah Economic City, the EV firm Lucid revealed a long-term plan to construct the first international production facility in Saudi Arabia. The United Arab Emirate (UAE) completed its first EV production facility in Dubai Industrial City, built at a total cost of USD 408 million, to address the rising demand for green mobility and is expected to produce 55,000 automobiles annually [14]. Oman also established its first EV factory in Suwaiq to produce 1248 cars annually as early as 2025 [15].

Lithium is a chemical element with the symbol Li. Pure lithium is a silvery-white metal that is soft, light, and the least dense metal among solid chemical elements at standard conditions of temperature and pressure. Due to its highly reactive nature, the lithium element is not found in nature in its free form. At room temperature and in a completely dry medium, lithium remains for a relatively long time before it turns into lithium nitride due to its interaction with air nitrogen. In the wet medium, a gray layer of lithium hydroxide forms on the surface of pure lithium. Seawater contains lithium in the form of salt with a constant concentration of 0.14 to 0.25 parts per million and an estimated total mass of 230 billion tons.

2. Lithium Ores

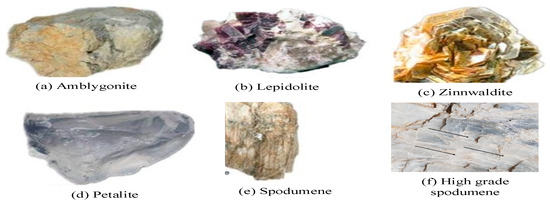

Lithium ores are frequently found as pegmatites, which are intrusive igneous rocks made primarily of interlocking quartz, feldspar, spodumene, and mica mineral grains [17]. Lithium in pegmatites can be transformed into lithium carbonate or lithium hydroxide, with battery manufacturers becoming more and more interested in the latter. Lithium minerals include spodumene, petalite, lepidolite, and amblygonite, which are present in lithium pegmatite ores [18]. Other lithium minerals listed in the literature include zinnwaldite, triphylite, and eucryptite [17,19]. Spodumene is the mineral with the greatest economic significance among lithium-rich pegmatite minerals [20]. Table 1 shows lithium minerals and their concentration.

Table 1. Lithium minerals and their concentration.

| Mineral | Formula | Content % Li2O | |

|---|---|---|---|

| Theoretical | Actual | ||

| Spodumene | LiAl[SiO3]2 | 8.1 | 4.5–8.0 |

| Petalite | LiAlSi4O10 | 4.89 | 2–4 |

| Lepidolite | KLiAl2Si3O10(OH, F)3 | 5.9 | 1.2–5.9 |

| Amblygonite | LiAl[PO4][F,OH] | 10.1 | 4.5–10 |

| Zinnwaldite | K[Li,Al,Fe]3[Al,Si]4O10[F,OH]2 | 4.13 | 3.3–7.7 |

| Eucryptite | LiAlSiO4 | 11.9 | 11.9 |

Granitic pegmatites have the highest concentration of lithium. The two most significant of these minerals are petalite (Li2O, Al2O3, and 4SiO2) and spodumene (Li2O, Al2O3, 8SiO2). Theoretically, the Li2O content of spodumene is 8.03%. Spodumene is regarded as the most significant lithium ore material because of its high lithium concentration. While typical spodumene concentrates appropriate for the manufacturing of lithium carbonate normally include 6–7% Li2O (75–87% spodumene), a typical run-of-mine ore can contain as little as 1–2% Li2O [23]. Zinnwaldite, Petalite, Lepidolite, Spodumene, and Triphylite all have more lithium than Amblygonite/Montebrasite [24]. Figure 1 and Figure 2 show the common ore to extract lithium.

Figure 1. Lithium ores. Source: [25].

Figure 2. Samples of lithium ore and locations. Source: [24].

3. Global Lithium Deposits and Extraction Projects

Most lithium is found in hard rock ores and brines in China, Chile, Argentina, and Australia [26]. There are several factories recognized for producing lithium concentrate from ores across the globe, according to the SGS Mineral Services Switzerland [23] and Evan [27]. Amongst these factories are Sichuan Aba, Maerkang, and Jiajika from China; Mt Cattlin, Mt Marion, Bald Hill, and Greenbushes from Australia; Bikita from Zimbabwe; Bernic Lake from Canada; Mibra from Brazil; and Kings Mountain from the United States. Table 2 lists the lithium mineral deposits and estimated resources found in ore deposits around the world.

Table 2. Lithium mineral deposits and estimated resources in ore deposits around the world.

| Country | Deposits | Main Mineral (s) | Estimated Reserves (Mt) |

|---|---|---|---|

| Afghanistan | Helmand Basin, Katawaz Basin, Taghawkor | Spodumene | NA |

| Australia | Greenbushes, Mt Marion, Mt Cattlin, Bald Hill | Spodumene | 0.79 |

| Austria | Koralpe | Spodumene | 0.10 |

| Brazil | Aracuai/Cachoeira, Mibra/Minas Gerais | Petalite, Spodumene | 0.92 |

| Canada | Barraute/Quebec, Bernic Lake/Tanco, James Bay, La Corne, La Motte, Yellowknife | Spodumene | 2.41 |

| China | Daoxian, Gajika, Jaijika, Maerkang, Ningdu, Yichun | Lepidolite, petalite, spodumene | 2.40 |

| Congo | Kitotolo, Manono | Spodumene | 3.80 |

| Finland | Länttä | Spodumene | 0.68 |

| Mali | Bougouni | Amblygonite | 0.03 |

| Portugal | Barroso | Petalite | 0.01 |

| Namibia | Karibib | Petalite | 0.15 |

| Russia | Belerechenskoe, Etykinskoe, Goltsovoe, Kolmorzerskoe, Voronietundrovskoe | Spodumene, lepidolite | 3.69 |

| Serbia | Jadar Valley | Jadarite | 1.00 |

| USA | Bessemer City, Kings Mountain Belt, McDermitt/Kings Valley, North Carolina | Spodumene, hectorite | 13.8 |

| Zimbabwe | Barkam, Bikita, Kamativi, Masvingo | Spodumene, petalite | 0.73 |

In Europe, lithium is found in large quantities in Portugal, Germany, France, the Czech Republic, Finland, and Austria. Portugal is currently the leading producer of lithium in Europe, contributing 1.6% of global output in 2019, with around 60,000 metric tons of proven reserves. According to Savannah Resources PLC [29], the Barroso mine in the north of Portugal could hold about 285,900 metric tons of lithium oxide, which is sufficient to meet the demand in Europe for several decades. Portuguese lithium is not marketed to the automotive industry but rather to the ceramics and glassware industries [30]. Other lithium projects in Europe have just started or are underway. In Germany, Vulcan Energy conducted a pilot project in the Upper Rhine Valley, using geothermal energy to draw lithium-rich brine from the Upper Rhine to manufacture “zero-carbon” green lithium. The company claims that it generated 57.1% lithium hydroxide, above the standard specifications for a battery grade of 56.5%, and commercial production is anticipated to begin in 2025 [29]. In France, Imerys developed the Exploitation de MIca Lithinifère par Imerys (EMILI) Project to extract lithium from a deposit in the Massif Central (Allier), with an expected annual production of 34,000 metric tons of lithium hydroxide from 2028 over 25 years. In the Czech Republic, European Metals Holding operates the Cinovec Project, with an estimated annual production of 30,000 metric tons of lithium that is suitable for batteries over the next 25 years. In Austria, European Lithium operates the Wolfsberg Project in Carinthia, with an estimated annual production of 10,000 metric tons of lithium hydroxide, which is sufficient to start manufacturing batteries for about 200,000 electric automobiles from 2025. In Finland, Keliber Oy is expected to produce 15,000 metric tons of lithium hydroxide annually starting in 2025.

Fifty-three percent of the world’s lithium reserves are in Bolivia, Chile, and Argentina, raising the importance of the emerging blue energy economy [31]. Lithium is produced in the United States, Canada, and Mexico. With 6 million tons of lithium carbonate equivalent, Lithium Americas Corp. in the USA runs the Thacker Pass lithium project [30]. With an anticipated 46-year life cycle, this mine is thought to have 179.4 million tons of proven and probable reserves, which contain 3.1 million tons of lithium carbonate equivalent [32]. In Canada, Nemaska Lithium owns and operates the Whabouchi Lithium Project in central Quebec, with an anticipated annual production of 205,000 tons. With a 33-year life cycle, this mine is thought to have 36.6 million tons of proven and probable reserves with a grade of 1.3% Li2O [32]. Spodumene, lepidolite, amblygonite, petalite, and eucryptite are only a few of the more than 100 distinct minerals found in complex-zoned pegmatites known as the Bernic Lake group in Manitoba [22]. In Mexico, the largest lithium deposit is developed by Sonora Lithium (SLL) and is thought to have 243.8 million tons of proven and probable reserves, which contain 4.5 million tons of lithium carbonate equivalent [32].

In Australia, Altura Mining owns and operates the Pilgangoora Lithium–Tantalum Project, located in Western Australia’s Pilbara region, with almost 108.2 million tons of lithium, graded at 1.25% Li2O, 120 ppm Ta2O5, and 1.17% Fe2O3, respectively. Also, Covalent Lithium operates the Forestania Greenstone Belt in Mt. Holland with an estimate of 94.5 million tons of proved and probable reserves with a 1.5% Li2O grade [32]. Talison Lithium, which is owned by the Chinese mining firm Tianqi Lithium, manages the Greenbushes Lithium Project, with around 86.4 million tons of proved and probable reserves with a Li2O grade of 2.35% [32]. Two processing facilities are part of the Greenbushes Lithium Operations; one of them creates lithium concentrate of a technical level, and the other creates lithium concentrate of a chemical grade. In 2018, spodumene concentrate production began at the Bald Hill Lithium–Tantalum mine in the Eastern Goldfields, which is jointly owned by Tawana Resources and Alliance Mineral Assets Limited, with ore deposits estimated at 18.3 million tons and 1.18% Li2O [22].

In Africa, Mali and Zimbabwe have proven lithium reserves in large quantities. In Mali, the Australian mining company Mali Lithium owns and operates the Goulamina Lithium mine, situated in southern Mali’s Bougouni region. With a 16-year life cycle, this mine is thought to have 103 million tons of resources that are identified and inferred at grade 1.34% Li2O and 31.2 million tons of probable reserves graded at 1.56% Li2O. In Zimbabwe, another Australian mining firm, Prospect Resources, owns and operates the Arcadia Lithium Project, which is thought to have 29.8 million tons of proved and probable reserves graded at 1.31% Li2O. Spodumene, petalite, lepidolite, eucryptite, and amblygonite are among the principal lithium minerals found in Bikita pegmatite [33]. Tantalum, tin, beryl, and pollucite are also among the high-tonnage minerals found in the Bikita pegmatite region, along with 23,000 million tons of lithium [34].

4. Lithium Usage

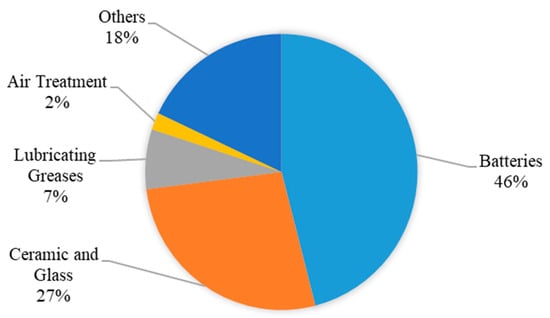

Lithium is widely used in various industries and sectors, such as the manufacturing of batteries and electrical devices, pharmaceuticals, the medical sector, and the new energy sector [25]. In the glass and ceramics industries, the ability of lithium oxides to resist heat allowed them to be used in the glass industry to improve their specifications and properties. Lithium is also the main ingredient in the ceramics industry due to its ability to reduce thermal coefficients, thus improving the heat-related properties of ceramics. Lithium isotopes are used in the manufacture of nuclear and hydrogen weapons and bombs, and some of them are used in nuclear reactors to cool them to avoid disasters if the temperature of these reactors rises. In the medical field, lithium helps to treat headaches and the effects of alcoholism while also helping diabetics, maintaining the integrity of the kidneys, and treating arthritis and diseases resulting from excessive thyroid secretions. Lithium is a mood-stabilizing drug used to treat or control manic episodes in people with bipolar disorder, or manic-depressive disorder, which causes episodes of depression and mania. Lithium salts and oxides are used in many things we use in our daily lives. Figure 3 shows the global lithium end-use market shares in 2016.

Figure 3. Global end-use market shares of lithium in 2016. Source: [35].

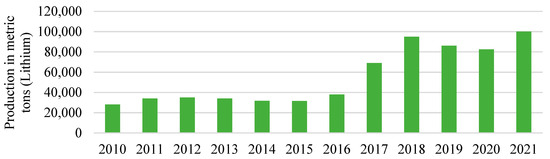

Figure 4 shows the annual consumption of lithium in metric tons between 2010 and 2021 worldwide. The global lithium consumption increased from 28,100 metric tons in 2010 to 100,000 metric tons in 2021, doubling in 2017 to 69,000 tons from 38,000 in the previous year. This demand for lithium is expected to rise as the markets for lithium batteries are rapidly expanding, including stationary energy storage systems, mobile phones, and electric cars [36]. Although there are many kinds of batteries, the performance and durability of the lithium-ion battery have made it the clear leader.

Figure 4. Annual consumption of lithium in metric tons worldwide. Source: [37].

Battery technology is developing and becoming more sophisticated due to increased demand for EVs. According to Bloomberg New Energy Finance (BNEF) analysis [38], many applications could benefit from using cheap batteries. This includes energy shifting, buying electricity at a discount rate, and utilizing it later, and peaking in the bulk power system. Switching to EVs puts pressure on most nations to create the legal framework and physical infrastructure necessary to ensure clean electricity output and lower carbon emissions.

This entry is adapted from the peer-reviewed paper 10.3390/su152015173

This entry is offline, you can click here to edit this entry!