1. India

1.1. Individual Indicators of India’s Macroeconomics

India’s economic growth in 2022 was 6.7%, with an anticipated GDP of 5.6% for the years 2023 to 2024. Currently, India is ranked 59 out of 152 countries in the GlobalData Country Risk Index [

8]. A direct result of the present regulations of the Securities and Exchange Board of India (SEBI) is that India’s equity market has become world-class and attractive due to concerted efforts towards regulation and liberalization. According to the World Bank, local organisations, listed as a constituent of GDP, increased from 80.8% in 2019 to 97.3% in 2020 in India, thereby increasing the country’s equity significantly and exceeding China’s percentage of GDP, being 83.2% [

9].

1.2. India’s Energy Policy

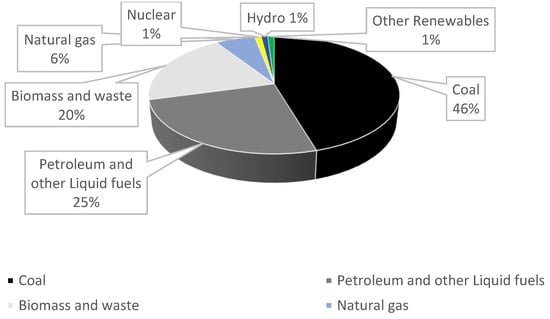

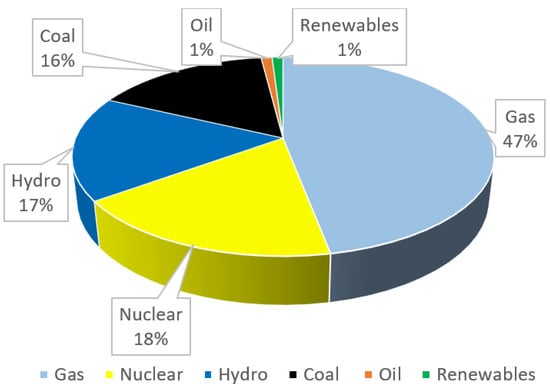

India’s current energy mix comprises 46% coal, 25% petroleum (and other liquid fuels), 20% biomass and waste, 6% natural gas, 1% nuclear, 1% hydroelectric and 1% other sources of renewable energy, as shown in

Figure 1 [

10]. The social impact on the Indian population is a key focus and the energy plan enforces it as a pivotal point to transition harmoniously. It considers the quality of life of low-income rural communities, who make up approximately 700 million people and are forced to use biomass as fuel to cook their meals [

10]. The Prime Minister of the Indian Government, Narendra Modi, announced that India is committed to zero CO

2 emissions by 2070 at the COP 26 meeting held in Glasgow in 2021 [

11].

Figure 1. India’s current energy mix.

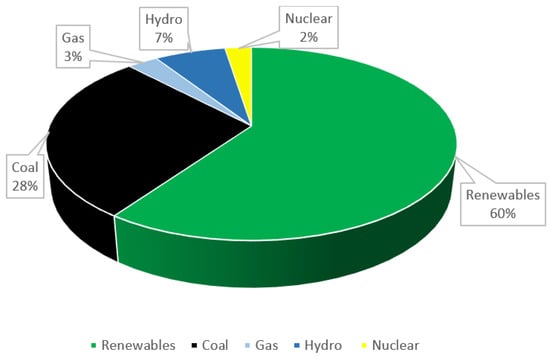

A draft version of the country’s new National Electricity Plan (NEP) from the Central Electricity Authority (CEA) was published for communal participation and includes an appraisal of the detailed electricity capacity expansion plans for 2032 [

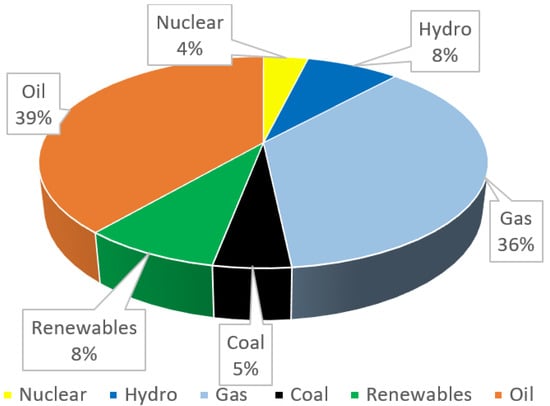

12]. The predicted expansion of generating power plants will be approximately 40%, from 623 GW to 866 GW. The bulk of the increase of 214 GW is expected to be from renewable energy sources, with approximately 69% contributed by solar photovoltaics (PV). An additional 10 GW from an offshore wind power plant is also expected by 2032. Therefore, renewable energy is expected to contribute a total of 60% (approximately 516 GW) of the total electricity supply by 2032. The contribution of fossil fuel electricity production is expected to decline by 2032, from 46% to 28%. Gas power plants’ installed capability is projected to decrease to 3% by 2032. The hydro-electric power contribution of 69 GW is also expected to increase to 7% by 2032 as depicted in

Figure 2. A nuclear power plant capacity of 22.5 GW will contribute 2.5% to the electricity pool [

13].

Figure 2. India’s envisioned 2032 energy mix.

The unavailability of affordable electricity results in poor air quality (rural populations resort to using easily obtainable fuel sources like wood for open fires to prepare meals and for heating during colder seasons), which negatively impacts the health of low-income rural communities and the environment. This was exacerbated by the COVID-19 pandemic and financially constrained the electricity sector. In the year 2021, the air quality in some cities in India rated among other similarly positioned countries as the poorest globally due to the distribution of utility companies using coal, petroleum and other liquid fuels (having low efficiency and high CO

2 emissions) as major electricity generation sources [

13]. The country, with its population of one billion, is the world’s third-largest electricity consumer and is fed by 71% fossil fuel (coal 46%, petroleum and other fossil fuels 25%) power plants [

10]; however, in compliance with energy policy, India has approved budgets and committed to transition towards 50% renewable energy by 2030 [

14].

India has adopted an implementation strategy where 38% of the total energy market will be from renewable energy sources with an emphasis on solar energy technologies [

15]. The urgency spearheading the international reaction to climate-related change is a fundamental priority which India has committed to. India is seen as a huge participant in the world’s energy ecosystem, with energy consumption that has doubled the energy demand from year 2000. Commendable success was achieved in 2019 when electricity connections were completed to meet the demand of approximately 900 million citizens [

10]. The global COVID-19 pandemic has delayed progress towards environmentally friendly fuel technology aimed at reducing greenhouse gases (GHG); however, the pandemic resulted in a slow economic growth of 35% in comparison with a forecasted economic growth of 50% between the years 2019 and 2030, which will contribute to delaying the impact of and transition to green fuels [

16].

The sustainable development case shows how India could increase its green energy investment to produce a faster peak, resulting in a decline in GHG emissions in synergy with zero-CO

2 emissions targets [

16]. This would be a positive impact for speedily attaining the Sustainable Development Goals (SDG). It is important to reiterate that the economic growth of the country has been led predominantly by the nonmanufacturing sector instead of the electricity-dependant industrial and commercial sector. This has slowed down the rate of industrialisation and urbanisation, but it is about to change, as 270 million people are likely to become urbanised in the next 20 years, giving rise to exponential growth in the infrastructure required to support this parabolic increase [

16]. The expansion would also support the ILO’s 2015 policy as huge infrastructure projects will increase the country’s labour requirements, thereby increasing the employment rate.

In conclusion, India’s commitment to the JET plans is further reinforced by the G7 countries, including Norway, Denmark and the European Union (EU). The Just Energy Transition Partnership (JETP) will financially empower India to reduce climate-changing emissions from power production. India reiterated the country’s commitment to contributing to eradicating global warming by achieving the following Just Energy Transition objectives/goals [

10].

-

A target of 500 GW non-fossil electricity capacity by 2030;

-

A renewable energy contribution of 50% of electricity demands by 2030;

-

A forecasted decrease in CO2 emissions by one billion tonnes from present to 2030;

-

A decline by 45% of the CO2 intensity of the economy by 2030, referenced with 2005 emissions;

-

A zero-carbonisation goal by 2070.

2. China

2.1. Individual Indicators of China’s Macroeconomics

The real GDP growth of China was 4.5% in 2022, and it is predicted to be 4.8% in 2023, while consumption (use of goods and services) was 6.5% in 2022 (Macroeconomic Outlook Report: China, 2023). The World Bank conducting business rank for China in 2022 was 31 out of 190 countries. China’s electrical and electronic trade magnitude is forecasted to grow at a compound annual growth rate (CAGR) of 11.6% from year 2021 to 2025 to a targeted monetary amount of $3.3 trillion in the year 2025 [

21].

2.2. China’s Energy Policy

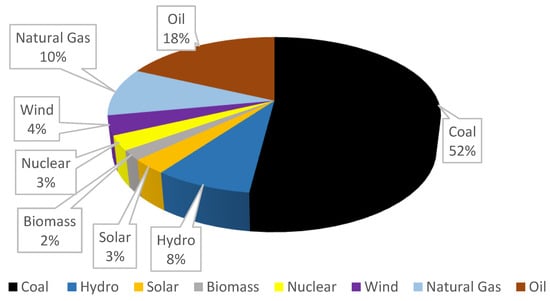

The current energy mix of China comprises 52% coal, 3% solar, 2% biomass, 10% natural gas, 3% nuclear, 8% hydro, 4% wind and 18% oil as shown in

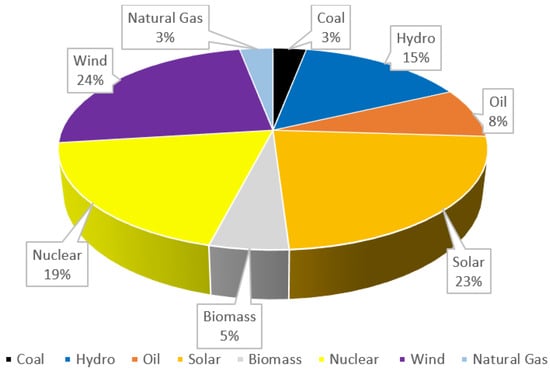

Figure 3. China’s planned transition by 2060 would result in a composition of 3% coal, 23% solar, 5% biomass, 3% natural gas, 19% nuclear, 15% hydro, 24% wind and 8% oil by 2060 as depicted in

Figure 4. With the Accelerated Transition Scenario (ATS) and the Announced Pledges Scenario (APS), China has been adding nuclear (70 GW) (20 new reactors) and solar (110 GW) capacity to cater for the requirements of 33 million homes [

22].

Figure 3. China’s current energy mix.

Figure 4. China’s envisioned energy mix by 2060.

China has been a major player in the world energy market since becoming the world’s biggest energy consumer in 2009 [

23]. The country is ranked first on the world carbon emissions rankings and is one of the world’s leading CO

2 producers, contributing 33% of the world’s CO

2 discharge [

22]. Power-producing plants are the origin of approximately 90% of the country’s GHG, highlighting that energy plans are imperative for carbon neutrality [

23]. China believes in collaborative engagements with the IEA and other countries with the common vision of eliminating carbon emissions. The spin-off from achieving net-zero carbonisation is envisaged to foster China’s sustainable economic and environmental development goals while cultivating prosperity in improving technology leadership, resulting in sustainable economic growth led by innovation [

23]. One of China’s noteworthy achievements and contributions globally is that it produces and supplies 70% of electric vehicle battery demand. The rapid rate of solar plant deployment has mitigated their environmental impact to being the second-largest consumer of oil globally. It must also be noted that China is the biggest supplier of steel and cement, which makes up more than 50% of the global demand. The impact is that the carbon emissions generated by these plants are astronomical and are deemed to be more than the European Union’s carbon emissions [

23].

3. Russia

3.1. Individual Indicators of Russia’s Macroeconomics

The real GDP growth of Russia was 2.1% in 2022, and it is predicted to be 1.2% in the year 2023 [

26]. Unemployment is at a record low of 3.5% and is forecasted to remain low to 2026 with the challenge of the Russia–Ukraine war. Russia’s current-account surplus was declining rapidly to approximately 73% in the first quarter of 2023. However, increased oil and gas exports were at record highs in the year 2022. The Russian ministry reduced its forecast by 50% for the present unused budget in the year 2023 from $158 billion to $87 billion, with the commerce budget surplus prediction reduced from $228 billion to $152 billion [

26].

Prior to the Russia–Ukraine war, Russia, like numerous resource-affluent and electricity-exporting countries, had begun JET; however, this progress slowed due to challenges to its implementation, such as the country’s financial status, which is highly dependent on hydrocarbon export income. From 2000 to 2005, Russia managed to raise energy-resource exports substantially, i.e., by 56%, thereby accelerating economic growth and reinforcing Russia’s position in the global arena as an energy superpower [

27]. The worldwide economic recession in 2008 resulted in significantly reduced energy-resource exports. After the recession, the years 2011 to 2014 saw inflated oil costs as a result of poor international trade demand and declining petrodollar income, adversely affecting GDP (the oil price was $110 per barrel). Income from oil and gas global sales decreased from the high prices of 2008 to 2012, compounded by decreasing prices for hydrocarbons; however, in 2017, hydrocarbons supplemented 25% of GDP and represented 39% of Russia’s planned income, 65% of export revenue and 25% of total funding to the Russian economy [

28]. Global renewable energy objectives and the transition towards zero carbonization is causing a significant decrease in hydrocarbon export revenues in Russia and is exacerbated by the Russia–Ukraine war.

3.2. Russia’s Energy Policy

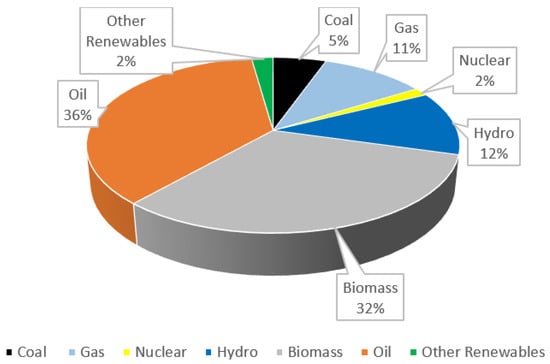

Electricity is produced mainly from gas, which accounts for 47%; coal accounts for 16%; hydroelectric accounts for 17%; nuclear accounts for 18%; oil accounts for 1%; and renewables account for 1%, as illustrated in

Figure 5. The country’s tactical behaviour with respect to JET is paramount for Russia and the planet. Numerous features of macroeconomics, institutional frameworks in the power production industry and climate change and technology plans or policies exist which define the Federation’s strategy towards the energy transition [

29].

Figure 5. Current Russian energy mix.

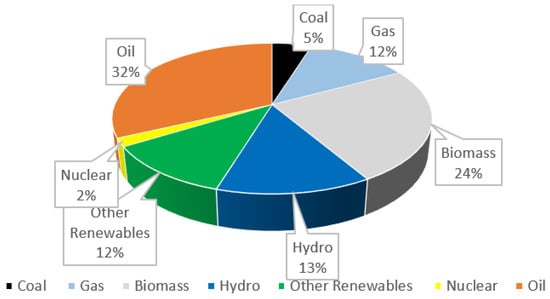

Figure 6 illustrates the envisaged 2030 energy mix with the successful execution of the Energy Strategy of Russia (ESR, 2010): gas 36%, coal 5%, hydroelectric 8%, nuclear 4%, oil 39% and renewables 8% [

29]. Russia ranked fourth in the world emissions rankings and is ranked as the fourth-largest primary energy consumer globally. Russia’s climate-change-related policies are undergoing improvement, with opportunities to bridge gaps and develop the required strategies to improve climate–energy interface effectiveness [

30]. Russia is committed to the United Nations Framework Convention on Climate Change (UNFCCC) and the Kyoto Protocol (Russia achieved its CO

2 aspiration of 5% below the 1990 level for the first commitment period between 2008 and 2012). Furthermore, the country supplies 10% of the world’s energy fuel sources, 5% of international electricity usage and 16% of foreign commercial dealing in energy [

30]. Russia is currently classified as the largest supplier of power fuels (ranked first in gas, second in oil and third in coal [

29]. Taking cognisance of this fact, the country’s planned intention with JET is mutually beneficial for national and international outcomes.

Figure 6. Russia’s envisioned energy mix by 2030.

The 2022 Russia–Ukraine war has unfortunately negatively affected the global energy transition with financial and trade sanctions imposed on Russia by the European Union (EU) countries, the United Kingdom (UK) and the United States of America (USA). President Putin has halted the supply of coal, oil and gas to the countries that were dependent on these supplies in response to the abovementioned sanctions imposed on the country. Inevitably, this is causing an energy crisis, mostly for the EU countries, while the USA is using their oil reserves to dampen the effects of the crisis and prevent the increase in energy cost in their country. Other countries have had no choice but to refurbish and recommission their fossil fuel power plants to try to curb their energy challenges. This crisis has fortunately resulted in a positive spin-off, with short-term contingency plans to soften the impact on populations affected by the energy crisis, and governments are rapidly initiating longer-term actions: the United States of America’s (USA) Inflation Reduction Act (IRA), the European Union’s (EU) Fit for 55 package and REPowerEU, Japan’s Green Transformation (GT) programme, Korea’s intention to expand the portion of nuclear and other renewable sources in their energy mix and renewable aspirations in India and China [

27].

4. Brazil

4.1. Individual Indicators of Brazil’s Macroeconomics

The real GDP growth of Brazil was 1.2% in the year 2022 and is predicted to be 1.6% in the year 2023, while consumption (use of goods and services) was 3.2% in the year 2022 [

36]. The World Bank’s conducting business ranking for Brazil in the year 2022 was 91 out of 190 countries. There was a significant increase in international tourism in Brazil by 107.5% in 2021 despite the COVID-19 pandemic, and this is predicted to grow by 61.5% in the years 2022 to 2023 [

36].

4.2. Brazil’s Energy Policy

Brazil has the greenest energy mix, with the use of renewable energy such as hydro, wind, solar, bioenergy and geothermal power plants which contribute 46% of the country’s energy requirements [

37]. After China and Canada, Brazil is the third-largest hydroelectricity producer globally. Brazil’s hydroelectric sector has almost unlimited potential, which has not been fully exploited given that the country has the capacity to construct numerous hydroelectric power plants [

38]. A total electricity demand of 77% is produced from hydropower (hydro is 12% of the total energy source but is used as a major source to produce electricity), the rest being generated from coal, gas and other renewables in Brazil [

38]. With its dependency on hydropower, Brazil is vulnerable to potential power supply shortages in drought years, as experienced during 2001 and 2002 when the country had severe droughts which resulted in an energy supply crisis [

38].

The energy mix is depicted in

Figure 7, where oil accounts for 36%, biomass accounts for 32%, hydro accounts for 12%, gas accounts for 11%, coal accounts for 5%, nuclear accounts for 2% and other renewables (wind, solar, etc.) account for 2% [

37]. Brazil is the fifth-biggest country globally by ground area and is rated second amongst the top ten economies by magnitude of GDP [

39]. Brazil is a major ally in commerce and at times a competitor of the USA with respect to energy fuels (e.g., petroleum and ethanol). The country was massively reliant on imports for its energy resources, but has now become an energy exporter that produces more energy than it consumes after 35 years of policy development to promote domestic energy resources (hydro, fossil fuels, biomass, gas, wind, nuclear and solar) [

37]. Brazil is the tenth-biggest producer of electricity globally and the eighth-leading world user of energy [

37]. Brazil’s energy security has been significantly challenged throughout its history: major energy sources were inadequate including ethanol fuel for cars (at the beginning of the 1990s); droughts resulted in reduced hydropower (at the beginning of the 2000s); and expectations that the provincial energy from Bolivia and natural gas from Argentina would improve energy security were not met [

39]. Bolivia’s choice to nationalise their oil and gas sites surprised Brazil as a major setback, particularly as Brazil did not interpret the country as a dominion. The nationalization specifically shocked Petrobras, which was Brazil’s oil company and had an approximately $1 billion financial stake in Bolivia [

39]. Argentina added to the crisis by implementing policies that restricted the country’s capacity to achieve its natural gas foreign commerce agreements. Being dependent on providers for a reliable energy source was identified as a risk to Brazil; however, by adopting better enabling strategies to encourage energy production and diversification, Brazil succeeded in achieving momentous growth through energy security advancements [

39]. Argentina nationalised its energy resources as it recognised European and American organisations as wings of EU and U.S. dominion. Brazil, as a former colony, did not anticipate an associate Latin country to terminate Brazil’s partnership, as Brazil did not deem the country as under dominion rule as with the likes of the United Kingdom, Spain and Portugal [

39]. An incentivised reduced borrowing rate and funding plans, together with fair prices, was established for electric power bidding initiatives, which resulted in the wind power industry expanding substantially in the country.

Figure 7. Brazil’s current energy mix.

Solar energy, as a source for distributed generation, is becoming an effective source of energy. The use of flexible fuel cars renders ethanol a widely used fuel. There was a blend mandate for 27.5% in gas including the opportunity of operating on 100% ethanol coupled with biodiesel mixing plans in the year 2018 [

37]. Natural gas is a significant alternative and can be used as a transition fossil fuel until the year 2050, while other green energy sources are being phased in to decrease the use of fossil fuels. The Climate Transparency Policy Paper: Energy Transition in Brazil provides the generic energy plan for the country and determines initiatives, identifying gaps and prospects to accomplish greenhouse gas (GHG) emission alleviation objectives, providing policies and legislation to sustain vigorous evolution of the energy sector [

37]. Brazil’s renewable energy resources make up 46% of all primary energy resources and 85% of electricity generation. Currently, non-renewable energy sources comprise approximately 57% of the full primary energy supply, and 32.7% is utilised in the transport industry [

37]. Brazilian energy intensity has been constant from the year 1990, below 4 TJ/million US$ [

37]. Brazil’s entire GHG production is approximately 1.6 billion tons of CO

2 and ranks 12th on the world emission rankings [

40]. Power sector investments were made in renewable energy from 2000 to 2013 due to structural reform in the energy sector. This led to changes in energy policy, which was more focused on the production of electricity by IPPs and thus increased usage of renewable energy from 48% to 51%. Wind power was the majority investment in the power sector between the years 2014 and 2016. Solar energy investments were augmented considerably to approximately 35% of overall funding in the power sector by 2016 [

37].

Funding authorised and approved for 2021 included fourteen solar photovoltaic plants (SPV), eight wind farms, two hydropower plants and one biomass-fired thermo-power plant, adding a further 880 MW capacity into the National Integrated System (SIN) [

41].

Figure 8 shows the future envisaged energy mix improving to a greener energy mix with the additional capital injection of the Brazilian government executing their energy transition strategy. A total of $4.5 billion and 4040 employment opportunities are projected to be created, which is in compliance with ILO 2015. Wind power grew as a substitute aimed at the expansion of the electricity sector subsequent to the energy emergency of 2001 and is currently ninth in international volume (13 GW), with an average capacity factor of 40%, representing 8% of Brazil’s electricity sector in terms of connected electrical power capacity.

Figure 8. Brazil’s envisioned energy mix by 2030.

The overall potential in Brazil is approximately 300 GW [

41]. The Ministry of Mines and Energy has forecasted growth of 125% by 2026, when the predicted target of 28.6% wind power in the total capacity of the power pool in Brazil will be installed. It is estimated by the Brazilian Industrial Development Agency (ABDI) that by 2026 the wind power sector will produce approximately 200,000 novel permanent and ancillary employments [

42,

43]. The wind energy value chain has been rising due to the incentives offered by the government (tax exemptions, long-term financing, etc.). The country has considerably advanced their industrialised structure in the wind power sector to assemble the wind turbines, with the fabrication of numerous modules (towers, blades, subcomponents of the pivot and the nacelle) locally, hereby reducing the quantity of imported components compared to previous years [

41].

5. History of Energy Policy in SA

5.1. South Africa’s Social and Economic Context in Comparison with the Rest of the BRICS Partners

South Africa makes up 1% of the world’s land area with a population of 59 million people, which is 1.9% of the BRICS countries’ total population [

2]. The BRICS countries make up 30% of the world’s territory. The average life expectancy of South Africans is 64 years, which coincidentally is the lowest amongst the BRICS countries [

2]. South Africa’s GDP growth rate is 2.1%, in comparison with an average GDP growth rate of 3.32% in the BRICS countries.

5.2. Individual Indicators of South Africa’s Macroeconomics

Real GDP growth was 2.1% in the year 2022 and is predicted to be 4.8% in the year 2023, while consumption (use of goods and services) was 6.5% in 2022 [

52]. The World Bank’s business ranking for South Africain the year 2022 was 71 out of 190 countries. South Africa is rich in various natural resources (gold, diamonds, coal, iron ore, etc.) with the mining industry being one of the largest employers, providing the country with huge export revenue while supporting the local labour force. The large agricultural landscape of South Africa is also a crucial economic strength [

52].

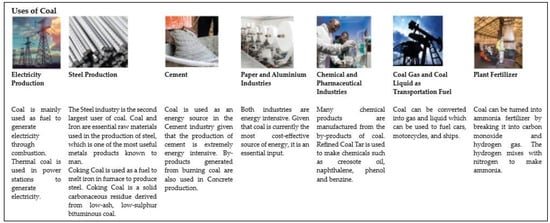

5.3. Current Energy Mix in South Africa

South Africa is the seventh-largest producer of coal, with most of the coal used to fuel fossil fuel power stations locally and internationally [

53]. Coal, although used extensively as a fuel source, also contributes to many other industrial processes, such as steel production, cement processing, the paper and aluminium industries, chemical and pharmaceutical activities, coal gas and coal liquid for transportation energy and plant fertiliser, as detailed in

Figure 9 [

54]. South Africa traded 69 million tons of coal, valued at $5 billion, making it the country’s fourth-most valuable mineral exported after gold ($201 billion), diamonds ($11 billion) and platinum ($8.5 billion), funding 4.5% of foreign income [

53]. South Africa’s domestic trade of approximately 183 million tons of coal created revenue more than 20% greater than for the coal exported [

53]. Price, nonetheless, is not an acceptable justification for comparative tardiness. Cognisant of this fact, the coal mining labour force will be extremely concerned with the future reduction of coal usage in the generation of electrical power when it is replaced with cleaner and greener fuel sources, as it has a direct correlation with future job losses due to reduced coal-mining activity. If not managed sensitively and with appropriate engagement with labour, initiatives towards decarbonisation and most initiatives of the Just Energy Transition (JET) will be derailed [

53].

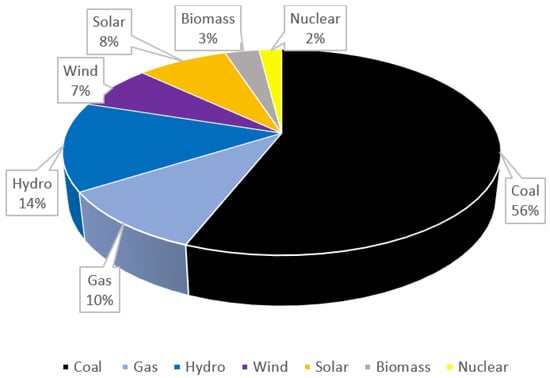

Coal is not an infinite resource, and demonstrating and reiterating this fact is crucial to JET and the drive to achieve the target of zero carbon emissions by 2050 to reduce global warming and climate change. Coal resources must be conserved to realistic levels, and the current global picture must be changed, as illustrated in

Figure 10, where the present energy resources are 56% coal, 14% hydro, 10% wind, 8% solar, 7% gas, 3% biomass and 2% nuclear. It is apparent that coal is required for the future sustainability of various vital industries that are highly dependent on coal, including the pharmaceutical industry, which is overlooked due to the insignificant volumes of coal used in comparison with the large volumes consumed in the energy sector [

55].

Figure 10. South African power plants’ fuel sources.

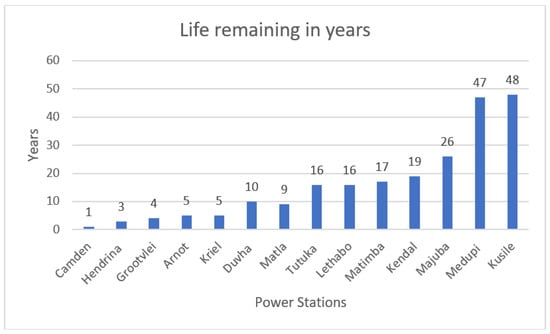

In South Africa, most fossil fuel power stations are in their mid- to end-of-life phases with reference to the designed lifespan of 50 years, as illustrated in

Figure 11 [

56].

Figure 11. South Africa’s fossil fuel power stations’ economical life.

5.4. Insights into the Just Energy Transition in South Africa

South Africa, as a developing country, initially did not commit to reducing carbon emissions. However, the Kyoto protocol and subsequent post-Kyoto protocol international initiatives aimed at the reduction of GHGs, to which South Africa has voluntarily committed itself, has had an influence on government with regards to energy policy [

57,

58]. This is in the form of mandating the use of significantly more renewable energy sources, as seen in the Integrated Resource Plan (IRP 2010 and 2019) as well as, more specifically, addressing fossil fuels for electricity generation. The government took the stance in 2008 that all future fossil-fuel-fired power plants will only be licensed if they are carbon capture and sequestration (CCS)-compliant. This initiated a process of investigating viable renewable energy sources [

57].

In South Africa, there are significant shortcomings with labour and urgent remedial action is required for compliance with the International Labour Organisation’s (ILO) 2015 policies on environmentally friendly fuel sources and the adaptation of technologies to utilise single or multiple renewable fuel sources. There is also a huge necessity to bridge the gap in conventional funding methodology versus green funding imperatives [

59]. Presently, the policies are not clear, but there are various collaborative initiatives with South African government departments (the Presidential Climate Commission (PCC), Labour, Environment, the Mineral Council of South Africa, Trade, and Industry and Competition), Eskom, Sasol, the Council for Scientific and Industrial Research (CSIR), the National Business Initiative (NBI), Business Unity South Africa (BUSA), and the private and public sectors, aimed at evaluating and charting a course and bridging gaps for the Just Energy Transition (JET). The Presidential Climate Commission (PCC) report provides confirmation that the South African government is pursuing the Just Energy Transition (JET) with conviction, but time will tell whether the transition will indeed be a just one. The Climate Investment Funds (CIF) announced the launch of the Accelerating Coal Transition (ACT) program in April 2021. ACT will be a catalyst in speeding up the transition from fossil fuels, predominantly coal, in a consistent and sequential approach, with governance, human resources and infrastructure, which are the three pillars of the program [

60].

The CIF issued a call for Expressions of Interest (EOI), to which South Africa issued a response in June 2021, and it was favourably received in August 2021 with a proposal to concentrate on the decarbonisation of the electrical energy sector in the context of its Just Energy Transition (JET) initiatives. The CIF announced that South Africa’s proposal was selected for the preparation of approximately $500 million in funding by the government in cooperation with the World Bank (WB) and the African Development Bank (AfDB) in October 2021 [

60]. The PCC completed South Africa’s Just Energy Transition Investment Plan (JET-IP) in 2022. The JET framework focused on ensuring a just and equitable transition to net-zero CO

2 emissions in South Africa by 2050. The JET plans provide the required guidelines for various planning and policy-setting processes, ensuring the JET framework can achieve synergy across all JET planning in the country. The PCC commissioned numerous research studies with integrated public consultations to support the development of the JET plan in the year 2021. The studies and consultations aided in uncovering fundamental challenges to JET in South Africa, paving the way for a development of the JET framework that is practical, synchronised, executable and aligned to the requirements of all social partners [

60]. The PCC report contains the findings of the assessments and consultations, emphasizing critical considerations for the development of the Just Transition framework. The information derived and extracted from each related study was used to develop a vision and to establish policies to support a just and equitable transition, supporting sustainable livelihoods, financing the transition, improving water security and creating good governance structures to manage JET [

60].

These engagements are with reference to the 2015 ILO guidelines for a just transition towards environmentally sustainable economies and communities for all South Africans [

6]. The ILO principles place emphasis on solid social confluence and pathways to energy sustainability [

6]. Policies must conform, stimulate and realise necessary value and rights that are critical to energy sustainability. Clear policies across the economic, environmental, social, education/training and labour groups are essential to deliver an empowering environment for enterprises, labour, financiers and users to embrace and drive the evolution to environmentally sustainable and comprehensive economies and humanities [

6].

South Africa’s NDC was submitted to the UNFCCC in the year 2021, with a pledge for net-zero CO

2 emissions by 2050 [

18]. In addition, the revised NDC caters for the country’s economy, including “farming, forestry, other land uses, energy, industrial practices, product usage, waste, and five (CO

2, CH

4, N

2O, HFCs and PFCs)” types of gas management [

61]. South Africa can be commended as it is the only BRICS member to categorically refer to and mention the Just Energy Transition in the country’s NDC [

61]. The NDC refers to the “just transition” as follows [

61]:

-

“In South Africa, a just transition is core to shifting our development pathway to increased sustainability, fostering climate resilient and low GHG emissions development, while providing a better life for all.”

-

“A just transition means leaving no-one behind. It requires procedural equity to lead to equitable outcomes. A just transition is at the core of implementing climate action in South Africa, as detailed in both the mitigation and adaptation goals presented below. As South Africa indicated at the UN Secretary General’s Climate Action Summit in 2019, as part of ensuring a just transition we will need to put measures in place that plan for workforce reskilling and job absorption, social protection and livelihood creation, incentivising new green sectors of our economy, diversifying coal dependent regional economies, and developing labour and social plans as and when ageing coal-fired power plants and associated coal production infrastructure are decommissioned. Similar measures will be necessary to adapt to the impacts of climate change.”

-

“The just transition will also need international cooperation and requires solidary and concrete support. Ensuring that no one is left behind as we move from a high GHG emission, low employment energy development pathway to a low emission, climate-resilient and job-rich pathway, is central to our national work on development and climate change.”

The Presidential Climate-Change Commission (PCC) was established for oversight over the country’s JET. The NDC included the function and duty of the PCC. The PCC conducted major discussions over two years to develop the 2050 Vision and Pathways for a Just Transition and included in the JET decarbonisation and an economy and labour force that would be resilient to the transition [

60]. South Africa will implement the 2050 Vision and Pathways for a Just Transition to minimise the temperature rise to 1.5 °C in compliance with the Paris Climate Change Agreement. At this stage, stakeholder engagements on JET have taken place predominately at the national level, organised by the PCC and the National Planning Commission (NPC) [

5]. The NPC has played a vital role with regard to Just Energy Transition (JET) policy development.

The NPC completed a multi-stakeholder social partner dialogue (SPD) for JET in the year 2019. The objective of the SPD was aimed at formulating a comprehensible national strategy that can be sufficiently funded and put into motion. The SPD outlined potential transition pathways in line with ILO’s framework on the just transition [

62]. These pathways relate to energy, land use and water. Mpumalanga and the Free State Province were prioritised as geographical locations for the first Just Transition implementation, being part of the Just Energy Transition (JET). In Mpumalanga, energy, water and land are interconnected, as the province has 80% of the fossil fuel power generation plants in the country. Hence, the JET immediately impacts Mpumalanga province and ensures that all three sectors are worked on simultaneously and in synergy. The Free State province will concentrate on water, land and, to a lesser extent, the gold mines [

62].

Just Energy Transition Partnership (JETP)

The Just Energy Transition Partnership (JETP) is a voluntary funding partnership between developing and developed (or wealthier) countries that are highly dependent on fossil fuels, where developed countries support developing countries in accelerating decarbonisation and the transition towards clean energy with social justice in mind [

63].

The South African (SA) government, Eskom (SA’s power utility company) and a few developed countries (France, Germany, the United Kingdom (UK), the United States of America (USA) and the European Union (EU)) had numerous engagements that resulted in the conceptualisation of the JETP. Initially, the concept concentrated on a Just Transition Transaction, as advocated by South African think tanks and Eskom. The requirements for financing mean that economic, technology and adverse social challenges converge for vastly fossil-fuel-reliant countries, as has become evident. The impetus was born of necessity, as Eskom, a deeply indebted power utility, needed to commission renewable energy power plants through a bespoke financial agreement that conventional climate finance did not clearly accommodate [

63].

The first JETP, between South Africa and the International Partners Group (IPG), consisting of France, Germany, the United Kingdom, the United States of America, the European Union and the Climate Investment Funds (CIF), was announced at COP26 in Glasgow, UK, in 2021. This was inclusive of the JET execution plan for 2023 to 2027 in support of South Africa’s decarbonisation plans [

64]. In support of South Africa’s JET initiative, the Independent Partners Group (IPG) will provide the country with a sum of $8.5 billion over a five-year period (2023 to 2027) to support its electrical power sector, initiate a green hydrogen sector and advance new energy vehicle (NEV) development [

64].

The South African JETP is the most improved in terms of governance, negotiation, and investment configuration. It provides a framework for assessing the relationship between equity and Article 2.1(c) of the Paris Agreement, with its attention on justice and its proposal for bespoke finance arrangements, which can have a huge influence on aligning future finance flows to further the Paris Agreement’s aims [

63]. The JETP is led and directed by the purposefully formed Presidential Climate Finance Task Team directed by President Cyril Ramaphosa. The Presidency, South Africa, 2022, is the key interface between the South African government and the IPG. The financial proposal was considered, and the Just Energy Transition Investment Plan (JET IP) emerged via this process with the technical backing of a secretariat [

64]. A political declaration by South Africa and the IPG made the initial proposal conditional to agreement on the investment framework, effectively rendering it a precondition for the provision of financing for South Africa’s JETP [

65].

This entry is adapted from the peer-reviewed paper 10.3390/su16020703