Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

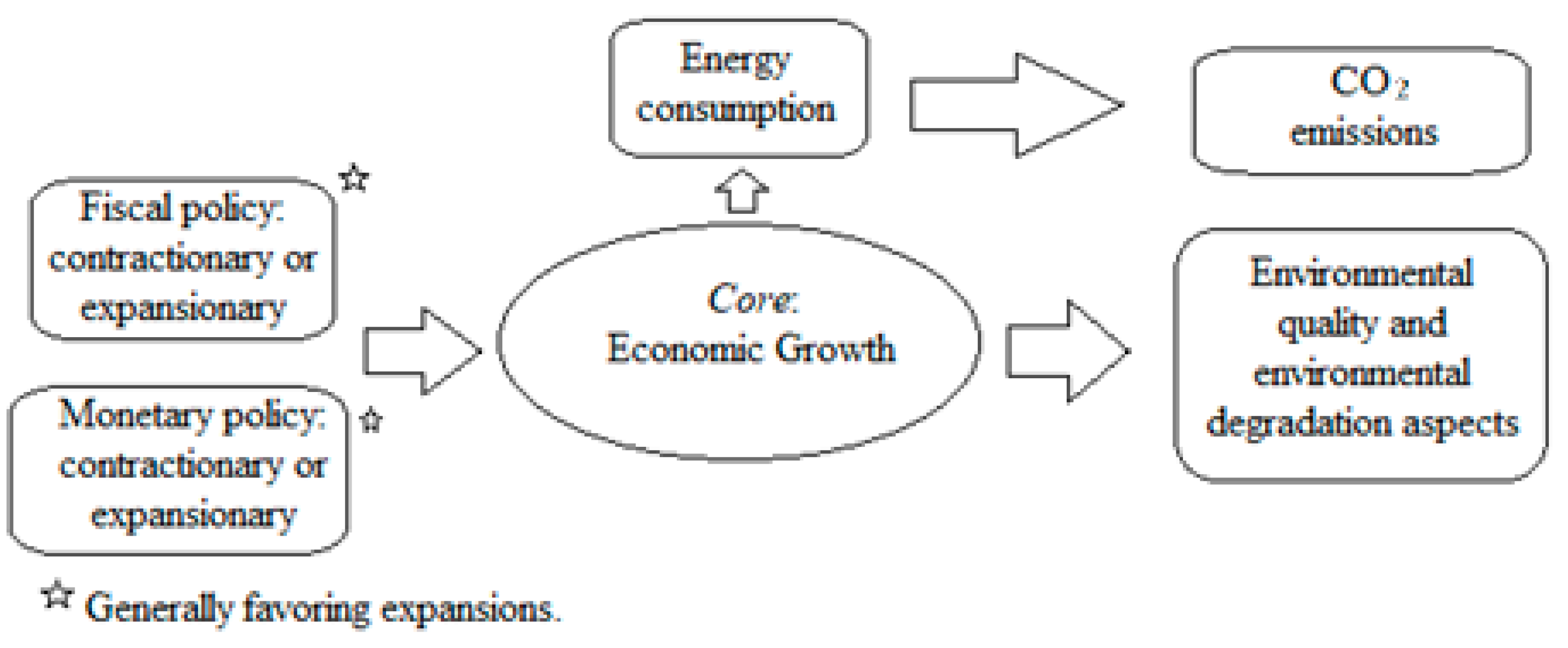

Governments use fiscal and monetary policies to direct the economy toward economic expansion. However, both policies could have impacts on the environment.

- monetary policy

- fiscal policy

- environmental sustainability

1. Introduction

Environmental issues on a global scale, such as warming temperatures and unusual weather patterns, are getting worse. The rise in carbon dioxide emissions (CO2e) is one of the most critical environmental problems confronting the world today. Burning fossil fuels is the main cause of CO2e. The environmental degradation (ED) brought on by increasing energy consumption (EC) has been another problem for the global economy in addition to positive effects of continuing of economic growth (EG) unless coupled with efficient environmental policies.

A graphical presentation of the conceptual framework is given in Figure 1. Economic policies, namely, fiscal policy (FP) and monetary policy (MP), have an important influence on the environment and ED. Both policies are the main policy tools of the policymakers to influence economic activity. While policies generally favor expansions overs contractions, generated economic prosperity also necessitates an incline in energy consumption. Hence, economic policies aiming at growth has adverse effects on the environmental sustainability.

Figure 1. Conceptual Framework.

In practice, economic business cycles are subject to relatively longer durations for expansions compared to recessions, a finding occurring due to the intention of the policy maker to achieve economic growth to avoid recessions and to encourage economic growth. In the case of recessions, the policies also aim at expansion to achieve recovery from these recessions advocating FP and MP policies to shift the economy back to the phase of growth. However, from an environmentalist perspective, growth generates greenhouse gases. Therefore, achieving environmental sustainability and economic growth simultaneously leads to a dilemma for many economies between growth and environment unless growth policies cannot be coupled with a solid commitment to smart solutions which counterbalance the negative effects of expansionist policies on the environment.

These smart solutions include a strong commitment to renewable energy including solar, wind and various other forms, the greening of manufacturing and distribution channels, strong social awareness of green and circular economy and avoiding such consumption habits, application of carbon tax policies in FP and green and sustainable financial markets’ policies under MP, subsidies for investments to carbon-capture technologies and great commitment net-zero policies with great commitment. Though this is the case, the motivation of the economic policies is mainly growth based, hindering the commitment to smart solutions given above since they are either considered as being costly or taken with a lack of willingness, since such measures could slow down economic expansions. Political motives also lead to political cycles generally aiming at the achievement of longer-lasting economic expansions. However, in the long run, the ongoing climate change with the continuing trend of CO2e shows a lack of commitment and leads to questioning the sustainability of economic policies environmentally and economically. FP and MP should work together to implement adaptation and mitigation solutions to reverse climate change and global warming. Therefore, the investigation of the long-run nexus between FP and MP policies and the CO2 emissions necessitates nonlinear analyses which take the asymmetric nature of policies and the nonlinear response of ED to economic policies.

At present, the recent literature points to the finding that the net effect of MP and FP is towards contributing to environmental damage. Ensuring sustainability is vital in this context as it brings to light important concerns about maintaining a balance between EG and environmental sustainability in FP and MP. Central banks may contribute to environmental change by implementing MP by managing interest rates and controlling inflation and by affecting the quantity of money in the economy [1]. Among other things, interest rate changes have an impact on how much energy is consumed and how much pollution is produced. Industrialists choose conventional technology over green investments in reaction to contractionary MP, and as a result, pollutant emissions rise as a result of greater usage of less ecologically friendly technologies. FP has the potential to enhance environmental quality. Environmental quality and overall energy usage are directly and indirectly correlated with FP instruments. Government expenditure changes may end up either from an expansionary (EFP) or from a contractionary (CFP) fiscal policy. To boost industrial production, EFP also causes less eco-friendly technology to use more fossil fuels and CO2e [1][2][3]. Moreover, tax incentives in the FP have positive and a considerable outcome on CO2e [4][5]. Yuelan et al., in the Chinese case, and Halkos and Paizanos, in the US case, both study fiscal instruments and obtain results, which stress that economic policies have significant effects on CO2e and environmental degradation [6][7].

Recent studies investigated how fiscal decentralization could transform the pace of ED. Accordingly, fiscal decentralization is noted to enhance the efficiency of public spending, which leads to improved resource allocation and increase in allocative efficiency leads to lowering the CO2e [8]. According to Oates, who focused on economic development and fiscal decentralization, decentralization occurs as GDP per capita incline and governments are fiscally more centralized for developing nations compared to the developed nations [9]. It has been found that increased government size and regulatory red tape speed up economic activity, which, as a result, speeds up CO2e [10]. Millimet examines the effects of decentralized environmental policy making in the USA and show that decentralization leads to race-to-top, the empirical findings of the paper show increasing hazardous emissions at low levels of GDP, and the process is reversed at higher development levels [11]. Accordingly, fiscal decentralization is considered as aiding regional governments in improving the effectiveness of resource allocation, which is also anticipated to aid in environmental sustainability [11]. Cheng et al. highlight fiscal policy efficiency in terms of decentralization and how it might improve environmental quality [12]. According to evidence at the micro level, firms’ environmental performance improves after fiscal decentralization [13]. Therefore, the above-mentioned field links the concept of fiscal decentralization occurring at high levels of income and development possibly leading to improvement in environment.

Recent studies examined the relationship between MP and ED as well as FP simultaneously [1][14][15]. Among these, Chishti et al. emphasized the importance of additional variables in this research [15]. The association between MP, fossil fuel and CO2e is emphasized [16]. Noureen et al. study the effects of monetary and fiscal policies with the CS-ARDL model in addition to renewable energy, fossil fuel consumption and GDP for development economies [16]. In their study, an important conclusion is the environmental degradation effect of both monetary and fiscal policies pursued to achieve economic expansions [16]. Therefore, recent research has taken the impacts of both MP and FP on ED simultaneously. However, the nonlinear and asymmetric relationships in addition to the asymmetric long-run associations between MP, FP and environmental degradation have not been investigated, not to mention the bootstrapping to ARDL techniques to avoid spurious cointegration relations. Although a set of papers aimed at investigating nonlinear associations between fiscal and monetary policies and emissions, the nonlinear causal links in addition to bootstrapping cointegration to evaluate the existence of non-spurious cointegration relations is another field that has not yet been addressed.

2. CO2 Emissions in Economy

The recent literature has drawn attention to the effects of MP and FP economic policies on the environment and various methods had been employed empirically including econometric techniques allowing investigation of long-run dynamics. Further, a selected set of research to be given below investigated the relation between the economic policies and ED with nonlinear methods which include the nonlinear autoregressive distributed lag model (NARDL). NBARDL method integrates nonlinearity defined as in the NARDL model to control for degenerate cases as proposed for BARDL modeling. Further, researchers extends the investigation of FP-MP-ED nexus with the vector autoregressive type generalization of NBARDL to NBVARDL method to investigate nonlinear causality. If an overlook is provided, a consensus of the literature showed that expansionary economic policies affect the environment negatively while contractionary policies affect the environment in the opposite direction.

Given the above-mentioned focus, the literature is reviewed below. The first strand of the literature focuses on MP policy and its environmental impacts. As typical, by centering on MP policies, Annicchiarico and Di Dio have explored the influence of the central bank on ED in a set of papers [17]. In their study, the New Keynesian (NK) model is integrated with MP policies, and they extended the NK model to NK-ED model, which assumes MP being unneutral to environmental degradation [18]. Inflation instability is a challenge as it has both short-term benefits in preventing environmental harm and long-term implications for MP. When there are MP shocks, the discount rate increases, reducing aggregate demand and EG, which leads to lesser ED due to decreased economic activity resulting in lowered CO2e. To successfully address ED, an extremely countercyclical MP strategy is desired. The central bank is showing a growing interest in green finance, as evidenced by two recent articles by Pan et al. and Chen et al. [19][20]. These studies propose a model called environmental dynamic stochastic general equilibrium (E-DSGE) that takes into account both MP and ED. Qingquan et al. investigate the impact of MP on CO2e from 1990 to 2014 by incorporating CO2e and MP in addition to including several control variables such as human capital, income, urbanization, remittances and fossil fuels [1]. Their findings highlight a long-lasting positive relationship between EMP and CO2e by using panel dynamic least squares (LS), panel fully modified LS estimators and Kao and Pedroni cointegration tests [1].

A recent study that investigated the effect of MP shows that higher discount rates applied by the MP authority incentivize individuals to reduce consumption and increase savings; as a result, MP policy discourages producers’ decisions on new capital investments [20]. During this process, MP stabilizes the level of CO2e [20]. Among the papers that differentiate between contractionary and expansionary MP (henceforth CMP and EMP), Fu et al. use quantile regressions with the method of moments to demonstrate that CMP policy at its major quantiles effectively reduces ED while moderate fiscal expansion speeds up emissions [21]. Chan uses the DSGE approach to inquire about the possibility that macroeconomic policies are more effective at limiting environmentally dangerous gases. Their conclusions suggested that the CMP, when combined with inclined interest rates, would successfully lower economic activity and, as a result, aggregate demand and ED [22]. It is emphasized that tight MP (CMP) at high levels could help on cutting CO2e, but also lower societal well-being while pursuing environmental sustainability [22]. The overall evaluation of the previous two studies suggests an effective reduction in emissions if high levels of contraction are achieved with CMP; however, this policy, if pursued, necessitates very high levels of it, which would infer negative effects on the societies.

A second set of the literature centered on FP policies. By focusing on the nexus between FP and ED, López et al. provided evidence that the level of government expenditures affects ED [23]. Abbass et al. investigate the effects of FP with different FP variables including health and education expenditures in addition to overall government expenditures in Pakistan for 1976–2018 period with the VAR model under five FP scenarios [24]. Their findings indicated mitigation effects on CO2e of health and education expenditures while tax revenues led to inclines in CO2e [24]. Adewuyi found an adverse association among public spending and CO2e, both directly and indirectly [25]. Halkos and Paizanos compared the differences of the indirect and direct effects of public expenditures on ED [7]. According to an analysis by Katircioglu and Katircioglu on the Turkish economy, it is obtained that public spending has a long-term and significantly negative outcome on environment and air quality. [26]. Using a dataset on an urban level, Zhang et al. demonstrated the effects of public expenditures as a proxy to FP on the environmental damages [27]. By concentrating on sulfur dioxide levels as pollutants, Huang highlighted the nexus between government expenditures, the main tool to generate EG through FP and environmental protection policies using spatial econometric approaches [28]. By inspecting the connection between FP and ED in China, FP is found to increase environmental worsening; vertical fiscal imbalance is found to have strong implications on ED [29]. Ullah et al. assess the nonlinear impacts of MP and FP measures on ED in Pakistan for the 1985–2019 period with the NARDL method [30]. Their results emphasize the implications on CO2e of both positive and negative FP shocks which also highlight the positive impacts of policies in the short-run, while producing negative implications on ED in the long-run [30]. The authors conclude that monetary and fiscal shocks have good long-term environmental effects but have negative short-term environmental effects [30]. Chishti et al. explore the potential consequences of expansionary and contractionary FP (henceforth EFP and CFP) [15]. Their findings indicated that CFP affects CO2e in the BRICS economies as well as EMP and CMP by using robust techniques of cointegration [15]. They displayed that EFP intensifies the negative effects of CO2e; CFP mitigates the adverse impacts of CO2e, EMP weakens and CMP increases the negative effects on CO2e [15]. In the context of effects of macroeconomic policies, Yu et al. showed that economic policy uncertainty has strong effects on CO2e and they highlighted the role of energy intensity and fuel mix channels on the negative effects of economic policies on the ED with the use of provincial level data [31].

The level of fiscal decentralization has been covered in several research. The regional ED level is lower in high-level fiscal autonomy regions; because they have appropriate budgets for environmental governance and rigorous environmental regulations [8][32][33][34][35][36][37]. The fact that fiscal decentralization significantly raises the regional ED level is another persuasive factor [29]. Fiscal decentralization would cause local administrations to loosen environmental laws to attract foreign investment and to achieve increases in tax revenue; however, the process degrades the environment due to bad environmental governance [37]. Nevertheless, there are studies in the literature that specify that the connection between the Chinese decentralization model of FP and its relation to ED is not linear [8][32].

Recently, NARDL modeling of nonlinear cointegration has gained relevance in the environmental economics literature. In the context of MP and energy consumption (EC) nexus, the contrasting results from linear and nonlinear ARDL are highlighted. By providing comparative results with linear ARDL and nonlinear NARDL, Sohail et al. explore asymmetric MP uncertainty and asymmetric effects of MP on non-renewable and renewable EC [38]. Sohail et al. underline contrasting results between those achieved by linear ARDL relative to nonlinear NARDL and by omitting nonlinearity, the linear ARDL analysis reveals no significant effect of MP uncertainty on the consumption of fossil fuel energy in either the short or the long term [38]. With NARDL, in contrast, increasing (lessening) MP uncertainty in the US has adverse (positive) impacts on fossil-fuel energy [38]. Within a panel setting of a selected developing country, Noureen et al. explore the dynamic links from MP and FP policy, economic growth, EC, fossil fuel and renewable energy and three different ED proxies for confirmatory reasons with Westerlund cointegration, cross-sectional dependence ARDL (CS-ARDL) method to control the bias in panel ARDL settings due to cross-sectional dependence, and the asymmetric effects of MP and FP are underlined [16]. In terms of these effects, the expansionary MP and FP are found to be increasing ED while contractionary policies are effective to mitigate ED [16]. Further, according to causality test results of [16], ED causally impacts economic policies and they underline macroeconomic policies as being sensitive to ED [16].

In addition to the literature that showed that both MP and FP have consequences on the environment, various studies integrated the effects of the additional variables with a developing and developed country perspective. Bletsas et al. integrate institutional quality and bureaucratic quality in the public sector to the relation of MP, FP and CO2e [39]. Their empirical results, which were based on a sample of 95 economies, demonstrated that GDP, public expenditures and central bank dependence are the primary causes of ED in addition to negative effects of institutional quality and government inefficiency [39]. They underline that the central bank result is one of the important ones. It has been demonstrated that achieving an effective decrease in emissions requires central bank independence and a reduction in governmental influence over central banks [39]. By examining the roles of climate-related green financial policy instruments with panel quantile regressions on CO2e, the significance of financial development and the positive effects of EC on CO2e in the higher quantiles are highlighted [40]. With their findings, D’Orazio and Dirks demonstrate that green financial instruments have negative coefficient estimates in the long- and short-term, therefore reducing CO2e [40]. For a sample of ASEAN countries from 1990 to 2019, Mughal et al. analyze these implications of economic policy [2]. According to their results, increasing interest rates in line with CMP lowers CO2e; however, EMP has the reverse effect, it causes emissions to increase; regarding FP, government spending increases CO2e in the long-term, but in the short-term, both EFP and CFP produce same outcome, despite the limited impact of contractionary measures [2]. Bhowmik et al. assess the connection between trade policy, FP and MP uncertainty and emissions and the so-called environmental Phillips Curve hypothesis [41]. They demonstrate that MP uncertainty raises CO2e, but a surprising outcome is that FP uncertainty works in the other direction, with no short-term emission impacts of uncertainty in economic policies and long-term emission consequences of economic policies [41]. Mahmood et al. investigate the influences of MP and FP on consumption-based CO2 in GCC nations and highlight the long-run benefits of MP in addition to scale benefits, as well as long-run and short-run benefits of FP on achieving sustainability [42].

This entry is adapted from the peer-reviewed paper 10.3390/su151310463

References

- Qingquan, J.; Khattak, S.I.; Ahmad, M.; Ping, L. A New Approach to Environmental Sustainability: Assessing the Impact of Monetary Policy on CO2 Emissions in Asian Economies. Sustain. Dev. 2020, 28, 1331–1346.

- Mughal, N.; Kashif, M.; Arif, A.; Guerrero, J.W.G.; Nabua, W.C.; Niedbała, G. Dynamic Effects of Fiscal and Monetary Policy Instruments on Environmental Pollution in ASEAN. Environ. Sci. Pollut Res. Int. 2021, 28, 65116–65126.

- Xin, D.; Ahmad, M.; Khattak, S.I. Impact of Innovation in Climate Change Mitigation Technologies Related to Chemical Industry on Carbon Dioxide Emissions in the United States. J. Clean. Prod. 2022, 379, 134746.

- Dongyan, L. Fiscal and Tax Policy Support for Energy Efficiency Retrofit for Existing Residential Buildings in China’s Northern Heating Region. Energy Policy 2009, 37, 2113–2118.

- Liu, J.; Gong, E.; Wang, X. Economic Benefits of Construction Waste Recycling Enterprises under Tax Incentive Policies. Environ. Sci. Pollut. Res. 2022, 29, 12574–12588.

- Yuelan, P.; Akbar, M.W.; Hafeez, M.; Ahmad, M.; Zia, Z.; Ullah, S. The Nexus of Fiscal Policy Instruments and Environmental Degradation in China. Environ. Sci. Pollut. Res. 2019, 26, 28919–28932.

- Halkos, G.E.; Paizanos, E.A. The Effects of Fiscal Policy on CO2 Emissions: Evidence from the U.S.A. Energy Policy 2016, 88, 317–328.

- He, Q. Fiscal Decentralization and Environmental Pollution: Evidence from Chinese Panel Data. China Econ. Rev. 2015, 36, 86–100.

- Oates, W. Fiscal Decentralization and Economic Development. Natl. Tax J. 1993, 46, 237–243.

- Bardhan, P. Corruption and Development: A Review of Issues. J. Econ. Lit. 1997, 35, 1320–1346.

- Millimet, D.L. Assessing the Empirical Impact of Environmental Federalism. J. Reg. Sci. 2003, 43, 711–733.

- Cheng, Y.; Awan, U.; Ahmad, S.; Tan, Z. How Do Technological Innovation and Fiscal Decentralization Affect the Environment? A Story of the Fourth Industrial Revolution and Sustainable Growth. Technol. Forecast Soc. Chang. 2021, 162, 120398.

- Wen, H.; Lee, C.-C. Impact of Fiscal Decentralization on Firm Environmental Performance: Evidence from a County-Level Fiscal Reform in China. Environ. Sci. Pollut. Res. 2020, 27, 36147–36159.

- Rahman, Z.U.; Ahmad, M. Modeling the Relationship between Gross Capital Formation and CO2 (a)Symmetrically in the Case of Pakistan: An Empirical Analysis through NARDL Approach. Environ. Sci. Pollut. Res. 2019, 26, 8111–8124.

- Chishti, M.Z.; Ahmad, M.; Rehman, A.; Khan, M.K. Mitigations Pathways towards Sustainable Development: Assessing the Influence of Fiscal and Monetary Policies on Carbon Emissions in BRICS Economies. J. Clean Prod. 2021, 292, 126035.

- Noureen, S.; Iqbal, J.; Chishti, M.Z. Exploring the Dynamic Effects of Shocks in Monetary and Fiscal Policies on the Environment of Developing Economies: Evidence from the CS-ARDL Approach. Environ. Sci. Pollut. Res. 2022, 29, 45665–45682.

- Annicchiarico, B.; Di Dio, F. Environmental Policy and Macroeconomic Dynamics in a New Keynesian Model. J. Environ. Econ. Manag. 2015, 69, 1–21.

- Annicchiarico, B.; Di Dio, F. GHG Emissions Control and Monetary Policy. Environ. Resour. Econ. 2017, 67, 823–851.

- Pan, C.-L.; Qiu, J.; Chen, Z.; Pan, Y.-C. Literature Review and Content Analysis: Internet Finance, Green Finance, and Sustainability. In Proceedings of the 5th International Conference on Financial Innovation and Economic Development (ICFIED) 2020, Sanya, China, 10–12 January 2020; pp. 347–352.

- Chen, C.; Pan, D.; Huang, Z.; Bleischwitz, R. Engaging Central Banks in Climate Change? The Mix of Monetary and Climate Policy. Energy Econ. 2021, 103, 105531.

- Fu, H.; Guo, W.; Sun, Z.; Xia, T. Asymmetric Impact of Natural Resources Rent, Monetary and Fiscal Policies on Environmental Sustainability in BRICS Countries. Resour. Policy 2023, 82, 103444.

- Chan, Y.T. Are Macroeconomic Policies Better in Curbing Air Pollution than Environmental Policies? A DSGE Approach with Carbon-Dependent Fiscal and Monetary Policies. Energy Policy 2020, 141, 111454.

- López, R.; Galinato, G.I.; Islam, A. Fiscal Spending and the Environment: Theory and Empirics. J. Environ. Econ. Manag. 2011, 62, 180–198.

- Abbass, K.; Song, H.; Khan, F.; Begum, H.; Asif, M. Fresh Insight through the VAR Approach to Investigate the Effects of Fiscal Policy on Environmental Pollution in Pakistan. Environ. Sci. Pollut. Res. 2022, 29, 23001–23014.

- Adewuyi, A.O. Effects of Public and Private Expenditures on Environmental Pollution: A Dynamic Heterogeneous Panel Data Analysis. Renew. Sustain. Energy Rev. 2016, 65, 489–506.

- Katircioglu, S.; Katircioglu, S. Testing the Role of Fiscal Policy in the Environmental Degradation: The Case of Turkey. Environ. Sci. Pollut. Res. Int. 2018, 25, 5616–5630.

- Zhang, Q.; Zhang, S.; Ding, Z.; Hao, Y. Does Government Expenditure Affect Environmental Quality? Empirical Evidence Using Chinese City-Level Data. J. Clean Prod. 2017, 161, 143–152.

- Huang, J.T. Sulfur Dioxide (SO2) Emissions and Government Spending on Environmental Protection in China—Evidence from Spatial Econometric Analysis. J. Clean Prod. 2018, 175, 431–441.

- Huang, Y.; Zhou, Y. How Does Vertical Fiscal Imbalance Affect Environmental Pollution in China? New Perspective to Explore Fiscal Reform’s Pollution Effect. Environ. Sci. Pollut. Res. 2020, 27, 31969–31982.

- Ullah, S.; Ozturk, I.; Sohail, S. The Asymmetric Effects of Fiscal and Monetary Policy Instruments on Pakistan’s Environmental Pollution. Environ. Sci. Pollut. Res. 2021, 28, 7450–7461.

- Yu, J.; Shi, X.; Guo, D.; Yang, L. Longjian YangEconomic policy uncertainty (EPU) and firm carbon emissions: Evidence using a China provincial EPU index. Ener. Econ. 2021, 94, 105071.

- Liu, L.; Zhao, Y.; Gong, X.; Liu, S.; Li, M.; Yang, Y.; Jiang, P. Threshold Effect of Environmental Regulation and Green Innovation Efficiency: From the Perspective of Chinese Fiscal Decentralization and Environmental Protection Inputs. Int. J. Environ. Res. Public Health 2023, 20, 3905.

- Ma, G.; Mao, J. Fiscal Decentralisation and Local Economic Growth: Evidence from a Fiscal Reform in China. Fisc. Stud. 2018, 39, 159–187.

- Park, S.; Kim, S. Does Fiscal Decentralization Affect Local Governments’ Strategic Behaviours? Evidence from South Korea. Pac. Econ. Rev. 2023, 28, 124–141.

- Zou, X.; Lei, C.; Gao, K.; Hu, C. Impact of Environmental Decentralization on Regional Green Development. J. Environ. Dev. 2019, 28, 412–441.

- Onofrei, M.; Oprea, F.; Iaţu, C.; Cojocariu, L.; Anton, S.G. Fiscal Decentralization, Good Governance and Regional Development—Empirical Evidence in the European Context. Sustainability 2022, 14, 7093.

- Zahra, S.; Badeeb, R.A. The Impact of Fiscal Decentralization, Green Energy, and Economic Policy Uncertainty on Sustainable Environment: A New Perspective from Ecological Footprint in Five OECD Countries. Environ. Sci. Pollut. Res. Int. 2022, 29, 54698.

- Sohail, M.T.; Xiuyuan, Y.; Usman, A.; Majeed, M.T.; Ullah, S. Renewable Energy and Non-Renewable Energy Consumption: Assessing the Asymmetric Role of Monetary Policy Uncertainty in Energy Consumption. Environ. Sci. Pollut. Res. 2021, 28, 31575–31584.

- Bletsas, K.; Oikonomou, G.; Panagiotidis, M.; Spyromitros, E. Carbon Dioxide and Greenhouse Gas Emissions: The Role of Monetary Policy, Fiscal Policy, and Institutional Quality. Energies 2022, 15, 4733.

- D’Orazio, P.; Dirks, M.W. Exploring the Effects of Climate-Related Financial Policies on Carbon Emissions in G20 Countries: A Panel Quantile Regression Approach. Environ. Sci. Pollut. Res. 2022, 29, 7678–7702.

- Bhowmik, R.; Syed, Q.R.; Apergis, N.; Alola, A.A.; Gai, Z. Applying a Dynamic ARDL Approach to the Environmental Phillips Curve (EPC) Hypothesis amid Monetary, Fiscal, and Trade Policy Uncertainty in the USA. Environ. Sci. Pollut. Res. Int. 2022, 29, 14914–14928.

- Mahmood, H.; Adow, A.H.; Abbas, M.; Iqbal, A.; Murshed, M.; Furqan, M. The Fiscal and Monetary Policies and Environment in GCC Countries: Analysis of Territory and Consumption-Based CO2 Emissions. Sustainability 2022, 14, 1225.

This entry is offline, you can click here to edit this entry!