Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

International economic cooperation accelerates the flow of capital, technology, labor, and other factors between different countries, which promotes global sustainable development. Building infrastructure construction is an important way to strengthen social development, and absorbing foreign capital is an effective way for developing countries to improve their infrastructure and to promote economic development.

- international infrastructure investment

- location choice

- influencing factors

1. Introduction

Infrastructure construction is crucial to sustainable and coordinated economic, social, and environmental development [1][2][3]. On one hand, infrastructure is the foundation of social development, and specifically, strong infrastructure improves the quality of life as well as the health and well-being of residents by providing living, health, and education facilities such as roads, housing, electricity facilities, sanitation facilities, irrigation facilities, hospitals, and schools [4][5][6]. On the other hand, infrastructure is the motivation of economic development, for instance, infrastructure upgrades can reduce operating costs in economic activities, make it easier for people to access resources, and facilitate the learning of technologies [7][8]. High-quality infrastructure is an important prerequisite for the sustainable development of digital economy, smart cities, and Industry 4.0 technologies [9].

In developing countries or regions, the lack of reliable infrastructure has long been considered as a major factor that is hindering economic and social development [10]. For example, in sub-Saharan Africa, the lack of infrastructure has limited economic development and productivity improvement [11]. Many countries and organizations have recognized the importance of infrastructure and have prioritized infrastructure investment and construction [12][13]. When a country’s public infrastructure cannot meet demand, and when the financial capacity of the government and the domestic private sector is limited, international capital is a viable option to employ to fill the infrastructure financing gap.

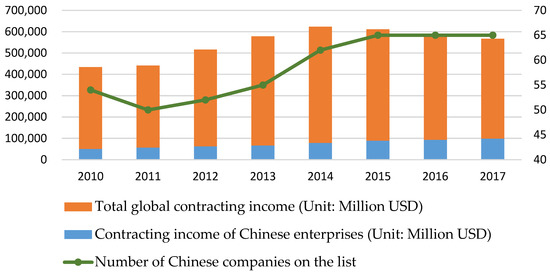

Considering that international investment is of great significance to infrastructure construction in developing countries or regions, China has actively fulfilled its responsibilities as a major country and has contributed its own strength to its infrastructure development. In “the Belt and Road Initiative” proposed by China in 2013, infrastructure connectivity was set as a priority [14][15][16]. The establishment of two major multilateral financial institutions under the Belt and Road Initiative, the Asian Infrastructure Investment Bank and the Silk Road Fund, aims to provide financial support and to enhance cross-border investment in countries. Investment and social capital from financial institutions can provide financial support for overseas infrastructure projects contracted by Chinese engineering enterprises, such as build-operate-transfer (BOT) projects, public–private partnership (PPP) projects, and finance–design–procurement-construction (F-EPC) projects [1]. A total of 65 Chinese Engineering enterprises entered the Engineering News-Record (ENR) Top 250 list of international contractors in 2017, as shown in Figure 1.

Figure 1. The ranking of Chinese engineering enterprises in ENR.

Chinese engineering enterprises’ contracting income accounted for 21.1% of the global total income in that year, accounting for the highest proportion [17]. The contractor plays an important intermediary role in China’s foreign infrastructure cooperation [18]. By analyzing the data and the experience of Chinese contractors and exploring the influencing factors of China’s investment in international engineering projects, it will help improve the efficiency of China’s foreign infrastructure investment.

Existing studies regarding China’s investment in international engineering projects (CIIEP) lack considering the investment conditions of the host country [19][20] and mainly focus on individual project of a country [21][22]. Researchers identified six major factors affecting international infrastructure investment, and accordingly, establishes a set of models on the factors influencing choice of international infrastructure investment location. With the support of data covering 134 countries and regions, the results reveal the influences of infrastructure quality, bilateral diplomatic visits, and resource endowment on CIIEP. The outcomes of the study not only provide a theoretical framework for engineering enterprises to make decisions on international infrastructure investment but also have policy implications for developing countries to attract international infrastructure investment.

2. The Impact of the Infrastructure Condition

The analysis results of models show that the quality of a host country’s infrastructure has a significant impact on CIIEP.

First, CIIEP tends to choose countries or regions with good highway infrastructure conditions. In other words, countries with poor quality road infrastructure face greater difficulties in attracting infrastructure investment, which indicates that high-quality road infrastructure is very basic and necessary for infrastructure construction activities, including the transportation of machinery and materials needed for construction activities. Infrastructure construction in the environment of poor-quality highway infrastructure will produce more project cost and more time limit pressure.

Hence, for low-income developing countries facing the pressure of public expenditure, the government should consider highway infrastructure construction to be the key development priority and then invest the limited budget in road infrastructure construction first, so as to lay a good foundation for attracting more infrastructure investment in the future. Developmental financial institutions such as the World Bank and the Asian Development Bank should pay attention to the importance and the particularity of road infrastructure, should invest in road infrastructure in low-income developing countries, and should shoulder development responsibilities.

Second, there is a significant negative correlation between port infrastructure conditions and CIIEP. CIIEP significantly tends to choose countries or regions with low port infrastructure conditions. Maritime transportation is the long-distance trade transportation mode with the lowest transportation cost. Chinese enterprises continue to investigate and track countries or regions with low port infrastructure conditions and focus on port construction or investment opportunities.

Finally, there is a significant negative correlation between the quality of power infrastructure and CIIEP. CIIEP significantly tends to choose countries or regions with a low quality of power infrastructure. Sufficient and stable power supply is of great significance to national living standards and to national industrial development. For example, the Bishkek Thermal Power Plant renovation project in Kyrgyzstan, the Jimpur Wind power project in Pakistan, the Karot hydropower project in Pakistan, and so on. These projects are helping countries with low-quality power infrastructure gain momentum.

3. The influence of diplomatic activities

Bilateral diplomatic visits have a significant positive impact on CIIEP. The more active the bilateral diplomatic visits are, the higher the new contract amount of China’s foreign contracted projects in the country will be. The results reveal that high-level diplomatic visits can build platforms, create opportunities, and sign contracts to directly promote cooperation on infrastructure projects.

4. The impact of resource endowment

CIIEP obviously tends to choose resource-rich countries or regions, including those with fossil fuel resources, ore resources, and metal resources, which confirms that resource exchange is an important motivation of CIIEP. Building long-term partnerships with countries rich in natural resources through infrastructure projects could help China gain more resources for its future development. Resource-based countries can make use of their own resource advantages and can strengthen cooperation with China in the field of infrastructure, so as to transform their resource advantages into infrastructure advantages.

This entry is adapted from the peer-reviewed paper 10.3390/su151411072

References

- Wang, Y.; Lee, H.W.; Tang, W.; Whittington, J.; Qiang, M. Structural Equation Modeling for the Determinants of International Infrastructure Investment: Evidence from Chinese Contractors. J. Manag. Eng. 2021, 37, 04021033.

- Kong, Q.; Li, R.; Jiang, X.; Sun, P.; Peng, D. Has transportation infrastructure development improved the quality of economic growth in China’s cities? A quasi-natural experiment based on the introduction of high-speed rail. Res. Int. Bus. Financ. 2022, 62, 101726.

- Munyasya, B.M.; Chileshe, N. Towards Sustainable Infrastructure Development: Drivers, Barriers, Strategies, and Coping Mechanisms. Sustainability 2018, 10, 4341.

- Lim, H.W.; Zhang, F.; Fang, D.; Peña-Mora, F.; Liao, P.C. Corporate Social Responsibility on Disaster Resilience Issues by International Contractors. J. Manag. Eng. 2021, 37, 04020089.

- Shi, Y.; Zhang, T.; Jiang, Y. Digital Economy, Technological Innovation and Urban Resilience. Sustainability 2023, 15, 9250.

- Lenferink, S.; Tillema, T.; Arts, J. Towards sustainable infrastructure development through integrated contracts: Experiences with inclusiveness in Dutch infrastructure projects. Int. J. Proj. Manag. 2013, 31, 615–627.

- Achour, H.; Belloumi, M. Investigating the causal relationship between transport infrastructure, transport energy consumption and economic growth in Tunisia. Renew. Sustain. Energy Rev. 2016, 56, 988–998.

- Sun, C.; Li, S.; Luo, Q.; Zhao, J.; Qi, Z. Research on the Efficiency of Urban Infrastructure Investment under the Constraint of Carbon Emissions, Taking Provincial Capitals in China as an Example. Sustainability 2023, 15, 9305.

- Raja Santhi, A.; Muthuswamy, P. Pandemic, War, Natural Calamities, and Sustainability: Industry 4.0 Technologies to Overcome Traditional and Contemporary Supply Chain Challenges. Logistics 2022, 6, 81.

- Fay, M.; Leipziger, D.; Wodon, Q.; Yepes, T. Achieving child-health-related Millennium Development Goals: The role of infrastructure. World Dev. 2005, 33, 1267–1284.

- Eberhard, A.; Rosnes, O.; Shkaratan, M.; Vennemo, H. Africa’s Power Infrastructure: Investment, Integration, Efficiency; The World Bank: Washington, DC, USA, 2011.

- Han, L.; Zhang, S.; Ma, P.; Gao, Y. Management Control in International Joint Ventures in the Infrastructure Sector. J. Manag. Eng. 2019, 35, 04018051.

- Haussner, D.; Maemura, Y.; Matous, P. Exploring Internationally Operated Construction Projects through the Critical Incident Technique. J. Manag. Eng. 2018, 34, 04018025.

- NDRC. Vision and Actions on Jointly Building Silk Road Economic Belt and 21st-Century Maritime Silk Road; National Development and Reform Commission: Beijing, China, 2015.

- Wang, G.; Zhang, H.; Xia, B.; Wu, G.; Han, Y. Relationship between Internationalization and Financial Performance: Evidence from ENR-Listed Chinese Firms. J. Manag. Eng. 2020, 36, 04019044.

- OECD. The Belt and Road Initiative in the global trade, investment and finance landscape. In OECD Business and Finance Outlook 2018; OECD: Paris, France, 2018; pp. 61–101.

- ENR. Engineering News Record’s (ENR) 2018 Top 250 International Contractors. 2018. Available online: https://www.enr.com/toplists/2022-Top-250-International-Contractors-Preview (accessed on 13 June 2023).

- Zhang, H. The aid-contracting nexus: The role of the international contracting industry in China’s overseas development engagements. China Perspect. 2020, 17–27.

- Jiang, L.; Liu, S.; Zhang, G. The impact of Asian Infrastructure Investment Bank on OFDI: Evidence from China. Appl. Econ. 2023, 1–16.

- Zhao, J.; Lee, J. The Belt and Road Initiative, Asian infrastructure investment bank, and the role of enterprise heterogeneity in China’s outward foreign direct investment. Post-Communist Econ. 2021, 33, 379–401.

- Zhang, M. Beyond infrastructure: Re-thinking China’s foreign direct investment in Malaysia. Pac. Rev. 2021, 34, 1054–1078.

- Chaziza, M. The significant role of Oman in China’s maritime silk road initiative. Contemp. Rev. Middle East 2019, 6, 44–57.

This entry is offline, you can click here to edit this entry!