China is a bank-dominated country; therefore, the sustainability of the Chinese banking industry is important for economic development. In this paper, data envelopment analysis (DEA) was combined with the Malmquist index, and we statically and dynamically analyzed the efficiency of listed banks during the period 2012–2017. The results showed that 12 of the 17 banks improved their technical efficiency. The technical efficiency of three banks remained the same, whilst that of two banks had dropped slightly by less than 1.0%. The Chinese government has learned from the lessons of past financial crises to find a way to forestall financial crisis, and implemented macroprudential policy, therefore the banking industry has actively served the real economy and promoted economic development while paying attention to the prevention of financial risks. According to the report of The Banker in 2018, for the first time, the four biggest banks in China topped the list of the Top 1000 World Banks. The research showed that, the Chinese government applied macroprudential framework in the banking supervision, and the listed banks effectively resisted financial risks and realized steady growth. We believe that the macroprudential framework plays a positive role in the economic development and financial stability in China.

- data envelopment analysis (DEA)

- efficiency

- total factor productivity

- listed banks

- finance

- macroprudential framework

- financial supervision

- financial risks

- financial stability

- economic development

1. Introduction

Finance is the core element of the modern economy. As a bank-dominated country, it is important for the national economy to achieve sustainable and healthy development of the Chinese banking industry. Therefore, the Chinese government has been paying significant attention to policy making and planning of the banking industry. In 2012, the former Chinese president Hu Jingtao pointed out that the Chinese government was going to enhance financial supervision and improve the competitiveness of financial institutions, including banks [1]. In the following year, the report on the work of the government also underlined the importance of improving the competitiveness of banks [2]. Recently, the five-year plan (2016–2020) stressed that the government should accelerate financial reform, enhance the efficiency of finance in serving the real economy, and improve the service quality and management levels of financial institutions [3]. In 2017, Chinese president Xi Jinping pointed out that the Chinese economy has been transitioning from a stage of rapid growth to an era of high-quality growth, which means that China will pursue an economy with better quality, higher efficiency, and an increased total factor of productivity. In addition, the reform of the financial system should be strengthened in order to serve the real economy better, and the financial supervision framework should be enhanced to forestall financial risks [4].

In 2008, the global financial crisis caused by the subprime mortgage crisis in the United States severely damaged the global financial system. At the annual meeting of the World Economic Forum held in January 2017, Chinese president Xi Jinping emphasized that the extravagant profit-seeking behaviours of the financial capital, as well as the serious lack of financial supervision, caused the global financial crisis. Therefore, we need to strengthen the ability of financial markets to resist risks [5]. Researchers found that the lack of effective macroprudential concept was an important reason for the crisis [6][7]. Over the years, international organizations, regulatory authorities of various countries, and academics have begun to pay more attention to the development of the theory and practice of constructing a macroprudential framework, and there is an international consensus on strengthening financial supervision and preventing risks [7][8].

The idea of macroprudential policy is that the rational behavior of individual financial institutions may be irrational from the perspective of the financial system. In boom times, the credit expansion of banks may result in financial crises; however, people find it hard to get a loan from banks during a credit crunch, which may contribute to worsening financial instability. Therefore, the aim of macroprudential policy is to reduce the probability and the huge costs of systemic financial risks. Furthermore, the proximate objective of macroprudential policy is to decrease stress on the financial system and its ultimate objective is to reduce the loss of output resulting from financial instability [9][10]. Macroprudential policy has played an important role in mitigating systemic risk and creating a suitable financial environment [7][11]. Additionally, Xu Zhong, the director of the research bureau of the People's Bank of China, pointed out that during the process of opening China's financial industry to the outside world, it is necessary to open up steadily and orderly on the premise of improving macroprudential management, strengthening financial supervision, and improving the transparency of the financial markets. Thus, international competitiveness of the financial system can be improved, and the reform and development of the financial sector can be pushed to a new level in the new era. Moreover, the reinforcement of macroprudential management concentrates on the interaction between finance and the economy, which is conducive to the better financial support for development of the real economy [12][13][14].

At present, the direction of financial supervision is shifting from microprudential policy to a combination of microprudential and macroprudential policies. For instance, Basel III emphasizes the concept of macroprudential supervision. According to the development and changes of the economic and financial situation, the People's Bank of China, being the central bank of China, has continuously improved the macroprudential policy framework and constructed the Macro Prudential Assessment (MPA) system in 2016. The MPA system supervises the financial institutions in terms of capital and leverage, assets and liabilities, liquidity, pricing behavior, asset quality, cross-border financing risk, and the implementation of credit policy. Since the first quarter of 2017, the central bank incorporated off-balance-sheet financing into broad credit indicators for MPA. Moreover, in the report of the 19th National Congress of the Communist Party of China (CPC) in October 2017, it was formally put forward that macroprudential policy and monetary policy should be the two pillars of the regulatory framework of the financial system [4].

Benefiting from the deepening of reforms and the improvement of policy frameworks, China's banking industry has achieved steady growth, even in the post-crisis period. According to the statistics disclosed by the China Banking Regulatory Commission (CBRC), the total assets of China's Banking Financial Institutions (BFC) increased from 128.5455 trillion yuan to 252.4040 trillion yuan during the period from 2012–2017, with an average growth rate of 11.90%. Additionally, the number of employees who work in the BFC grew from 3,362,000 in 2012 to 4,090,000 in 2016. However, whether the efficiency of the banking industry is growing along with the rapid growth of the industry has become a focus of public attention. Moreover, whether a bank operates efficiently is associated with the sustainability of the bank. Additionally, as mentioned above, the sustainable development of the banking industry, especially in China, is important for economic growth as the banking industry could affect many other industries. In addition, according to Reference [15], most research focuses on the efficiency of banks in developed countries. However, development of the banking industry is not the same in developed countries and in developing countries. Therefore, research on the banking industry in developing countries will be quite interesting. Moreover, the studies will be of importance as China plays a more important role in the development of the global economy [16][17][18]. In all, our study concerning Chinese banks will fill the gap in previous studies. Furthermore, the DEA-based efficiency evaluation based on the latest data can depict the status quo of the banking industry in China well.

2. Development

To accurately and comprehensively measure bank efficiency, we review the related literatures which have evaluated banking efficiency in different ways. Some research concentrated on measuring the efficiency of a bank and compared the performance of different banks through statistical analysis using accounting ratios. However, the traditional measure of efficiency using a single input and output cannot fully evaluate the performance of banks. Moreover, the evaluation based on accounting indicators may aggregate the performance of a bank in certain perspectives [19][20][21]. Therefore, we aim to measure the efficiency of a bank with multi-inputs and outputs efficiently, and we have found that data envelopment analysis is suitable for our research. Data envelopment analysis (DEA) is an efficient way to measure the relative efficiency of a decision-making unit (DMU), in comparison to the best performer in the sample. Additionally, DEA is suitable for analyzing the efficiency of DMUs with multi-inputs and outputs which can comprehensively depict performance. In addition, we do not need to preassign the form of the production function. More importantly, the combination of DEA and the Malmquist index model contributes to the dynamic analysis of the efficiency of DMUs [22][23][24].

In recent years, DEA has been widely used for efficiency evaluation in different areas, especially in the banking industry (see Chen et al. [25] for the detailed development of the related studies). Moreover, DEA has been considered as an efficient way to explore banking efficiency [26]. For instance, Staub, Souza, and Tabak believed that efficiency evaluation using DEA was valuable for bank managers and financial supervisors [27]. LaPlante and Paradi applied DEA in evaluating the bank branch efficiency of a Canadian bank [28]. Chortareas et al. measured the productivity of commercial banks in Latin American countries using DEA [29]. More researchers are interested in analyzing the efficiency of the Chinese banking industry. Based on DEA, Zhang [23] calculated the efficiency of three types of commercial banks in China during the period from 1997–2001, and the results showed that the average technical efficiency of the joint-stock commercial banks was high and stable, whilst that of the city commercial banks was significantly lower and more volatile. Additionally, the average efficiency of the state-owned commercial banks was stable and only the efficiency of JSYH (for simplicity, we use the abbreviation of China Construction Bank Corporation based on the Chinese Pinyin) ranked in the Top 20 amongst commercial banks during the period. Liu [30] analyzed the technical efficiency of 15 commercial banks, including state-owned and joint-stock commercial banks, from 2000 to 2002 and found that the average technical efficiency of the banking industry was 0.797, which showed that input slacks existed for most banks. Moreover, the three-year average technical efficiency of the joint-stock banks was higher than that of the state-owned ones. Additionally, scale inefficiency had been the main cause of the decreasing technical efficiency for the two types of banks. Furthermore, using the methodology of DEA, we could measure a bank's efficiency in a given year. However, if we want to know whether the efficiency of a bank increased or decreased between two time periods or we are interested in whether there exists technical progress during the periods, the best choice is to make a combination of the DEA and the Malmquist index. Using DEA, Pang [31] found that the efficiency of city and joint-stock commercial banks was higher than that of the state-owned ones. Additionally, the application of the Malmquist index showed that there was an increase of the total factor productivity of the banking industry during the period from 2000–2004. Based on panel data for 15 commercial banks from 2005 to 2009, Zhu et al. [32] found that the technical efficiency of the state-owned banks was higher than that of the joint-stock banks in each year within the sample period, which was different from the results of prior studies.

In this paper, to consider the accuracy, consistency, and accessibility of data, the commercial banks listed in the Chinese A-share stock markets were chosen as our research object. By the end of 31 December 2017, there were 25 banks listed on the A-share stock market according to the industrial classification of listed companies. Moreover, we excluded firms with data which was not publicly disclosed in the sample period, and 17 firms were subsequently selected as the sample. The financial figures of the listed firms were manually collected from the publicly-disclosed financial reports over the period of 2012–2017.

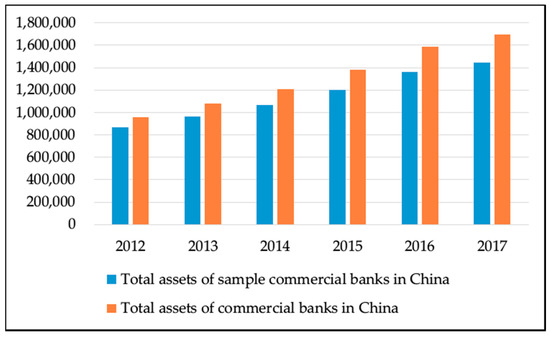

Based on the statistics derived from the China Banking Regulatory Commission (CBRC), we made the following bar chart which describes the trends of total assets of the sample banks and all the commercial banks in China. According to Figure 1, in recent years, the total assets of both the sample and all the commercial banks in China have realized a steady growth. Furthermore, the total assets of the sample, including the state-owned commercial banks, the joint-stock commercial banks, and the city commercial banks, account for more than 80% of the total assets in the Chinese banking industry during the sample period. This is indicative that the sample banks have a good representativeness in China's banking industry.

Figure 1. The trends of the total assets (the unit of the total assets is 100 million RMB) of commercial banks (2012–2017).

The rest of the paper is organized as follows. The next section introduces the methodology of the measurement of bank efficiency and shows the sample and the variable selection. In Section 3, we describe the data. Then, we make an efficiency evaluation of the banking industry, statically and dynamically. Additionally, we classify the banks by their ownership types and analyze bank efficiency in detail. Section 4 discusses the results and conclusions.

3. Findings

In this paper, we collected the data of seventeen listed commercial banks, which covered more than 80% of the total assets of the Chinese banking industry, showing good representativeness. Firstly, we evaluated the technical efficiency and calculated the Malmquist total factor productivity of the banks during the period from 2012–2017, based on the methodology of the DEA model and Malmquist index model. Secondly, the decomposition of the Malmquist index provided a useful way to see the technical change and the change in efficiency of the banks during the sample period. Moreover, we subdivided the banking industry according to the ownership types of the banks, analyzed the changes of the banks' efficiency, and conducted the efficiency comparison.

In summary, since the global financial crisis and the European debt crisis, the global economy has been recovering slowly, and the volatility of the financial markets has intensified. The Chinese government responded to the crisis actively and implemented macroprudential policy. The Chinese banking industry actively served the real economy and promoted the development of the national economy, whilst paying attention to the prevention of financial risks. As mentioned above, all the banks in the sample suffered from the negative technical progress of different extents; however, we observed the growth of both pure technical efficiency and scale efficiency, which contributed to the development of the industry. In addition, we found that banks of different ownership types showed their own characteristics. Moreover, we found that, in terms of the six-year average technical efficiency, the joint-stock banks performed the best, which was consistent with the study of Zhang [23]. However, our study also showed that the technical efficiency of the three types of banks was stable and the efficiency gaps between banks of different types were small, which was different from Zhang [23]. Furthermore, we studied the development of pure technical efficiency and scale efficiency of the three types of banks, which fills the gap in prior studies (e.g., Zhu et al. [32]). For the first time, the four biggest banks in China topped the list of the Top 1000 World Banks released by The Banker in July 2018, and the rankings of GSYH, JSYH, ZGYH and NYYH were 1, 2, 3 and 4. This is a good start for the Chinese banking industry, and it showed the positive influence of macroprudential policy on the sustainability of the Chinese banking industry.

The entry is from 10.3390/math6100184

References

- Comprehensively Deepen the Reform of the Financial System. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFD2012&filename=ZGJR201223000 (accessed on 16 June 2018).

- The Report on the Work of the Government. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CCND&dbname=CCNDLAST2013&filename=RMRB201303190015 (accessed on 16 June 2018).

- Deepen the Reform of the Financial System. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFDLAST2016&filename=ZGJR201522003 (accessed on 16 June 2018).

- Xi, J.P. Secure a Decisive Victory in Building a Moderately Prosperous Society in All Respects and Strive for the Great Success of Socialism with Chinese Characteristics for a New Era: Delivered at the 19th National Congress of the Communist Party of China; People’s Publishing House: Beijing, China, 2017.

- Xi, J.P. Jointly Shoulder Responsibility of Our Times, Promote Global Growth. Available online: http://www.xinhuanet.com/english/2017-01/18/c_135991184.htm (accessed on 16 June 2018).

- Issing, O. Some lessons from the financial market crisis. Int. Financ. 2009, 12, 431–444.

- Zhou, X.C. The responses of financial policies to the financial crisis. J. Financ. Res. 2011, 1, 1–14. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFD2011&filename=JRYJ201101003 (accessed on 30 December 2017).

- Yellen, J.L. Macroprudential supervision and monetary policy in the post-crisis world. Bus. Econ. 2011, 46, 3–12.

- Baker, A. The new political economy of the macroprudential ideational shift. New Political Econ. 2013, 18, 112–139. [Green Version]

- Borio, C.; Drehmann, M. Towards an operational framework for financial stability: ‘Fuzzy’ measurement and its consequences. BIS Work. Pap. 2009, 284.

- Zhang, X.H. The exploration of macroprudential policy in China. China Financ. 2017, 11, 23–25. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFDLAST2017&filename=ZGJR201711012 (accessed on 30 December 2017).

- Xu, Z. Treating Correctly the Further Opening of the Financial Industry to the Outside World. Available online: http://www.xinhuanet.com/money/2018-03/29/c_129840060.htm (accessed on 16 June 2018).

- Xu, Z. Modernization of China’s Financial System and Governance System in the New Era. Econ. Res. J. 2018, 7, 4–20. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFDTEMP&filename=JJYJ201807002 (accessed on 6 September 2018).

- Zhang, J.H. Realizing the positive interaction between finance and economy. China Financ. 2012, 7, 54–56. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFD2012&filename=ZGJR201207032 (accessed on 6 January 2017).

- Ariss, R.T. On the implications of market power in banking: Evidence from developing countries. J. Bank Financ. 2010, 34, 765–775.

- Jiang, H.; Han, L. Does Income Diversification Benefit the Sustainable Development of Chinese Listed Banks? Analysis Based on Entropy and the Herfindahl–Hirschman Index. Entropy 2018, 20, 255.

- Huang, T.-H.; Lin, C.-I.; Chen, K.-C. Evaluating efficiencies of Chinese commercial banks in the context of stochastic multistage technologies. Pac. Basin Financ. J. 2017, 41, 93–110.

- Wu, M.; Li, C.; Fan, J.; Wang, X.; Wu, Z. Assessing the global productive efficiency of Chinese banks using the cross-efficiency interval and VIKOR. Emerg. Mark. Rev. 2018, 34, 77–86.

- Sherman, H.D.; Gold, F. Bank branch operating efficiency: Evaluation with data envelopment analysis. J. Bank Financ. 1985, 9, 297–315.

- Huang, X.; Wang, F.H. Efficiency difference of Chinese and German state-owned banks. J. World Econ. 2003, 2, 1–7. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFD2003&filename=SJJJ200302009 (accessed on 6 January 2018).

- Zhang, R.F. Factors affecting China’s banking stability and the correspondent stability strategy in the course of opening. Financ. Econ. 2007, 8, 1–7. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFD2007&filename=CJKX200708000 (accessed on 6 January 2018).

- Lee, P.; Park, Y.-J. Eco-efficiency evaluation considering environmental stringency. Sustainability 2017, 9, 661.

- Zhang, J.H. The DEA-based research of the efficiency of Chinese state-owned commercial banks and the empirical analysis of the period 1997–2001. J. Financ. Res. 2003, 3, 11–25. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFD2003&filename=JRYJ200303002 (accessed on 6 January 2018).

- Wei, Q.L. Data envelopment analysis (DEA). Sci. Bull. 2000, 17, 1793–1808. Available online: http://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFD2000&filename=KXTB200017000 (accessed on 6 January 2018).

- Chen, Z.; Matousek, R.; Wanke, P. Chinese bank efficiency during the global financial crisis: A combined approach using satisficing DEA and Support Vector Machines. N. Am. J. Econ. Financ. 2018, 43, 71–86.

- Zha, Y.; Liang, N.; Wu, M.; Bian, Y. Efficiency evaluation of banks in China: A dynamic two-stage slacks-based measure approach. Omega 2016, 60, 60–72.

- Staub, R.B.; da Silva e Souza, G.; Tabak, B.M. Evolution of bank efficiency in Brazil: A DEA approach. Eur. J. Oper. Res. 2010, 202, 204–213.

- LaPlante, A.E.; Paradi, J. Evaluation of bank branch growth potential using data envelopment analysis. Omega 2015, 52, 33–41. [Green Version]

- Chortareas, G.E.; Garza-García, J.G.; Girardone, C. Financial deepening and bank productivity in Latin America. Eur. J. Financ. 2011, 17, 811–827.

- Liu, H.T. The measurement of Chinese commercial banks. Econ. Sci. 2004, 6, 48–58.

- Pang, R.Z. Efficiency of Our Commercial Banks and Analysis of the Change in Productivity. Financ. Forum 2006, 5, 10–14.

- Zhu, N.; Li, J.; Wu, Q.; Cheng, W.L. The analysis of the production efficiency of Chinese commercial banks and the total factor productivity change. Economist 2012, 9, 56–61.