Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 3 by Vivi Li and Version 2 by Elena Vechkinzova.

Solving production problems in the field of hydrogen energy, as well as ensuring the transportation of hydrogen raw materials with minimal losses, will allow in the foreseeable future to overcome the local scale of its capabilities and bring hydrogen energy to the international level, including replacing traditional gas or using it as a resource. In line with global trends, the development of hydrogen energy in the Russian Federation is taking place.

- водородная энергия

- водородные стратегии

- декарбонизация энергии

- водородные проекты

- Россия

- keyword hydrogen energy

- hydrogen strategies

- energy decarbonization

- hydrogen projects

- Russia

1. Introduction

The current stage of the development of hydrogen energy, both on a global scale and at the level of individual countries, can still be considered only the beginning of the era of hydrogen. Many innovations have appeared in this area so far, unfortunately, mainly at the level of ideas that do not always successfully pass the experiment stage in companies and research centers using various sources of funding.

On the one hand, a powerful impetus to the development of hydrogen energy around the world is given by the “green agenda” being pursued not only at the economic but also at the political level, related to ensuring the energy transition to renewable energy sources. This agenda has become especially relevant as a result of the current energy problems and the unprecedented rise in prices for hydrocarbon resources. As a result, state and international organizations have stepped up the process of adopting and implementing incentive measures, including financial, tax and other measures aimed at ensuring not only the decarbonization of the energy sector but also the uninterrupted supply of national energy systems with reliable energy sources. The search for solutions to the problems of innovative development of the oil and gas industry, as well as the identification of opportunities for the development of “green energy” in order to ensure the energy security of the countries of the Eurasian Economic Union, including the Russian Federation, was reflected in previous studies by the authors of the review [1,2][1][2].

On the other hand, the technical possibilities for the development of hydrogen energy are still associated with high production costs, problems of storage and delivery of hydrogen to consumers. That is why the emphasis of the developers of hydrogen energy technologies is not only on projects that are cheaper in terms of current and investment costs but also on those that will best solve consumer problems, including in terms of introducing into production and using the capabilities of the existing infrastructure.

Solving production problems in the field of hydrogen energy, as well as ensuring the transportation of hydrogen raw materials with minimal losses, will allow in the foreseeable future to overcome the local scale of its capabilities and bring hydrogen energy to the international level, including replacing traditional gas or using it as a resource.

In line with global trends, the development of hydrogen energy in the Russian Federation is taking place. It is necessary to note the existing scientific groundwork and significant competitive advantages in this area. Prospects for the development of the Russian hydrogen industry are set out in the adopted strategic documents, which define the export-oriented orientation of the industry as a further trend and the development of hydrogen infrastructure as a necessary condition for its implementation.

2. Overview of Key Trends in the Development of Hydrogen Energy

To date, in many countries of the world, there is already serious groundwork in the form of implemented hydrogen projects. This prompted the governments of these countries to draw up framework documents regulating the development of this area—hydrogen strategies. The main focus of the adopted strategies is aimed at ensuring the economic feasibility of introducing promising technologies developed in the field of hydrogen energy. The fact is that traditional methods of producing hydrogen are, firstly, energy-consuming, and secondly, they are associated with carbon dioxide emissions. Therefore, it is necessary to ensure the production of hydrogen with a low carbon footprint and at an acceptable cost, as well as to solve the technical and technological problems of its storage and transportation. Among the examples of successful implementation of projects in the field of hydrogen energy, wresearchers can highlight the commissioning in 2021 of the world’s largest power plant on hydrogen fuel cells (Icheon, Korea). The Shinincheon Bitdream power plant generates about 80 MW of electricity, providing electricity to 250,000 households and heat to 44,000 households. The construction of the power plant was carried out for 5 years, and since 2017, the costs have amounted to USD 292 million. In order to provide the power plant with raw hydrogen materials, it is planned to launch a plant for the production of liquefied hydrogen with a capacity of 30 thousand tons per year in 2023. Another project has been launched in Hwaseong. In 2024, it is also planned to launch an 80 MW hydrogen fuel cell power plant. The implementation of such projects in South Korea is based on the idea of not so much reducing the cost of electricity (currently, this is not possible) but increasing its environmental friendliness [3]. Another trend in the development of hydrogen energy is associated with the use of two types of fuel in the operation of power plants—natural gas and hydrogen. Therefore, in 2023–2024, the Tallawara B power plant is planned to be commissioned in Australia. It is assumed that the power plant will run on natural gas for the first 10 years, and then, gradually being modernized, it will be configured to burn environmentally friendly hydrogen. The power plant capacity is 300 MW, providing electricity to 150 thousand households; the project cost is USD 64 million. Despite the debatability of this project (due to the fact that the transition to hydrogen raw materials will occur only after 10 years), it can be considered as a variant of moving along the path of developing hydrogen energy and implementing energy decarbonization [4]. The next trend is hydrogen transport. Hydrogen engines have been known to exist since the 19th century. However, hydrogen cars exist mainly as a concept, and only a few models have been able to reach party production. This is due to the fact that despite significant advantages in terms of quality, hydrogen fuel remains expensive. In addition, the problems related to the storage of hydrogen and the harmful effects on the metal parts of the cylinder–piston group of the machine have not been fully resolved, and the gas station infrastructure has not been developed. Nevertheless, well-known automobile concerns, including VW, GM, Daimler AG and BMW, are showing interest in the development of this direction in the automotive industry. The governments of a number of countries are solving infrastructural problems. Thus, by 2030 China plans to install at least 1000 hydrogen filling stations, Japan already has more than 100, and Germany has more than 50. Currently, there is practically no serial production of cars with hydrogen engines. However, there are several models that have already gained recognition: Toyota Mirai, Honda Clarity, Ford Airstream, BMW Hydrogen 7, Hyundai Nexo and some others [5].3. Development Strategy for the Russian Hydrogen Market

Focusing on global decarbonization trends, the Russian Federation is also quite active in research and development in the field of hydrogen energy, given that it has significant experience in the field of hydrogen energy technologies. Head of the Analytical Center for Energy Policy and Security of the Institute of Oil and Gas Problems of the Russian Academy of Sciences A. Mastepanov (2020) [45][6], citing sources [46[7][8],47], while reviewing the development of hydrogen energy in Russia, notes that, in fact, hydrogen research in Russia began back in the 1930s (the effect of hydrogen additives to gasoline on automobile engines was studied). Examples of the use of hydrogen as a motor fuel during the Second World War are noted. More extensive research in the field of development and application of hydrogen technologies was carried out in the 1970s as part of the implementation of the state program “Hydrogen Energy”. At the same time, the emphasis was on the use of atomic energy for the production of hydrogen. Significant state investments in hydrogen energy in the Soviet period made it possible to create a significant scientific and technical reserve in this area, which, however, was largely lost after the collapse of the Soviet Union. A new stage of energy development began in the early 2000s. Thus, in 2003, the non-profit National Hydrogen Energy Association was established, whose tasks included research in the development of the fuel cell industry. As in in foreign countries, there are certain results in the Russian Federation: hydrogen cars, trams and the first hydrogen filling stations began to appear. Developments are being made on the use of hydrogen at nuclear power plants as energy storage devices. Hydrogen is used in the production of ammonia, methane, oil refining, etc. Currently, the production of hydrogen in the Russian Federation is about 5 million tons per year. In June 2020, Russia adopted the Energy Strategy for the period up to 2035 [48][9], the purpose of which is to develop the production and consumption of hydrogen in the Russian Federation and ensure Russia’s entry into the ranks of the world leaders in its production and export. The main objectives of the strategy include the following:- -

-

Creation of infrastructure to provide the transportation and use of pure hydrogen and as part of various mixtures;

- -

-

Expansion of hydrogen production from natural gas, using renewable energy sources and nuclear power plants;

- -

-

Further development of low-carbon hydrogen production technologies;

- -

-

Expansion of the domestic market;

- -

-

Improvement of the regulatory and legal framework in the field of hydrogen energy;

- -

-

Development of international cooperation and access to foreign markets.

- -

-

The North-West Cluster (St. Petersburg and the Leningrad region, located on the Baltic coast of Russia) will export hydrogen to European countries, and it will also specialize in the implementation of measures to reduce the carbon footprint of export-oriented enterprises;

- -

-

The Eastern Cluster (Sakhalin Region, an island in the Russian Far East) will export hydrogen to the countries of the Asia-Pacific region, and it will also specialize in the development of hydrogen infrastructure in the field of transport and energy;

- -

-

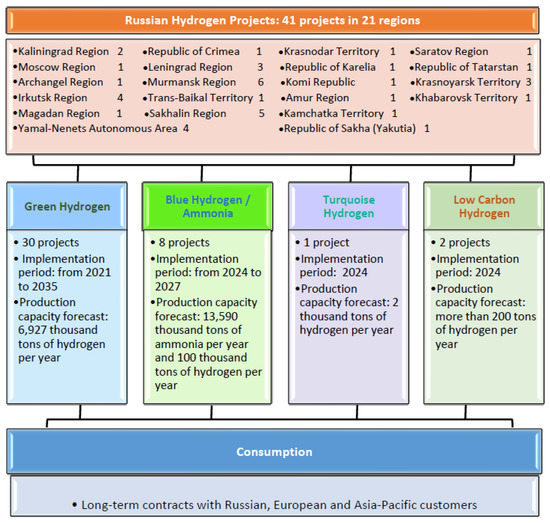

The Arctic Cluster (Yamal-Nenets Autonomous Okrug, in the North-West of Siberia) will provide a low-carbon electricity supply to the Russian Arctic.Figure 62 shows a general description of hydrogen projects in Russia.

Figure 51. Hydrogen projects in Russia [51]. Note: the map of Russia shows the location and numbers of projects. The project profile is presented in Appendix A.Hydrogen projects in Russia [13]. Note: the map of Russia shows the location and numbers of projects.Gazprom and Rosatom will become the first producers of hydrogen In 2024, the companies will launch pilot plants for the production of hydrogen—at nuclear power plants, gas production enterprises and raw material processing plants. Until 2024, Gazprom will study the use of hydrogen and methane–hydrogen fuel in gas installations (GTE, gas boilers, etc.) and as a motor fuel in various types of transport. In 2024, Rosatom will build a test site for hydrogen-powered rail transport for the subsequent transfer of trains to hydrogen fuel cells. The costs associated with the production of hydrogen directly depend on the efficiency of the applied technologies. Table 21 shows data reflecting the present value of hydrogen production in Russia (calculated data from the Energy Research Institute of the Russian Academy of Sciences 2020). Calculations of the present value of hydrogen production are based on a formula of three components, discounted over the entire life horizon of the technology: capital costs, costs for the incoming energy carrier and semi-fixed operating costs. The economic meaning of the reduced cost indicator is that it reflects the minimum level of the price of hydrogen, which guarantees the break-even investment in the “hydrogen factory” [52][14]. The present value indicators are higher than the simple costs of hydrogen production reflected in Table 1.

Figure 51. Hydrogen projects in Russia [51]. Note: the map of Russia shows the location and numbers of projects. The project profile is presented in Appendix A.Hydrogen projects in Russia [13]. Note: the map of Russia shows the location and numbers of projects.Gazprom and Rosatom will become the first producers of hydrogen In 2024, the companies will launch pilot plants for the production of hydrogen—at nuclear power plants, gas production enterprises and raw material processing plants. Until 2024, Gazprom will study the use of hydrogen and methane–hydrogen fuel in gas installations (GTE, gas boilers, etc.) and as a motor fuel in various types of transport. In 2024, Rosatom will build a test site for hydrogen-powered rail transport for the subsequent transfer of trains to hydrogen fuel cells. The costs associated with the production of hydrogen directly depend on the efficiency of the applied technologies. Table 21 shows data reflecting the present value of hydrogen production in Russia (calculated data from the Energy Research Institute of the Russian Academy of Sciences 2020). Calculations of the present value of hydrogen production are based on a formula of three components, discounted over the entire life horizon of the technology: capital costs, costs for the incoming energy carrier and semi-fixed operating costs. The economic meaning of the reduced cost indicator is that it reflects the minimum level of the price of hydrogen, which guarantees the break-even investment in the “hydrogen factory” [52][14]. The present value indicators are higher than the simple costs of hydrogen production reflected in Table 1. Characteristics of hydrogen projects in Russia.Table 21.Present value of hydrogen production in Russia based on electricity from various sources and methane.

Characteristics of hydrogen projects in Russia.Table 21.Present value of hydrogen production in Russia based on electricity from various sources and methane.Applied Technology Present Value of Hydrogen Production by Years, $/kg 2020–2025 2030–2035 Based on electricity from:

solar power plant12.2 5.6 wind power station 6.7 4.0 hydroelectric power station 3.5 3.0 nuclear power station 3.2 2.3 Steam reforming of methane plus CO2 capture and storage 1.7 1.6 Compiled from source [52][14].Great economic prospects for the symbiosis of nuclear and hydrogen energy in combination with renewable energy for Russia were considered in the study by Zhiznin S.Z. et al. [53][15]. The authors believed that the implementation of these technological areas in Russia will allow the formation of a new sustainable global energy system—alternative energy. Activity in the development of the Russian Arctic zone has increased the demand for autonomous hydrogen energy supply projects. Prospects and features are discussed in detail in the study by Kolomeytseva, A.A. et al. [54][16]. Solving the problems of energy supply to isolated regions of the Far North and the Far East, including on the basis of hydrogen energy, is considered in the studies of the following authors: Kopteva, A. et al. [55][17], Kirsanova, N.Y. et al. [56][18], Berezikov, S.A. et al. [57][19]. European countries, primarily Germany, as well as countries in the Asia-Pacific region, such as South Korea, China and Japan, can act as potential foreign partners. Prospects for international cooperation in the framework of hydrogen projects in Russia: German authors in their study write that “Even though Russia remains somewhat skeptical about hydrogen’s much-vaunted transformative potential, it is interested in using its natural gas wealth to become a leading exporter of this new energy carrier and views Germany as a key partner in this effort” [58][20]. In December 2020, Russian Deputy Prime Minister for Energy Alexander Novak announced the development of a Russian-German roadmap for hydrogen and the possible implementation of pilot deliveries of hydrogen to Germany [59][21]. In April 2021, the Russian Federation and Germany signed a Declaration on cooperation in the field of sustainable energy, one of the areas of which is hydrogen energy [60][22]. It was assumed that the Declaration would become the basis for cooperation in the field of hydrogen energy, the development of innovative technologies and research in this area, the promotion of technical and economic cooperation of interested organizations and assistance in attracting investors; however, the difficult geopolitical situation and the imposition of multiple sanctions against Russia violate outlined plans. The possibilities of a pilot project for the supply of Russian hydrogen to Japan are also being studied in detail: the Japanese Development Institute NEDO is focused on the test implementation of hydrogen import supply chains as part of the roadmap of the program for building a hydrogen society [61][23]. Research and Markets consider in detail the market and the main actors of hydrogen projects in Russia [62][24]. The list of specific projects, their participants and prospective production volumes and the technologies used are given in Appendix A. Experts note [63][25] that when entering the global hydrogen market, Russia can take advantage of its competitive advantages, such as a significant energy base (large reserves of gas, coal, the potential of nuclear power plants and renewable energy sources), a developed oil refining and chemical industry that uses steam reforming of methane and electrolysis, geographic proximity to potential consumers of hydrogen (Europe and the countries of the Asia-Pacific region), the existing scientific background, and the existing transport infrastructure. Russia has real opportunities to create export-oriented production of low-carbon (“blue”) hydrogen from natural gas, as well as environmentally friendly (“red (orange)” and “green”) hydrogen based on water electrolysis using nuclear power plants and renewable energy sources. The Institute for Natural Monopolies Problems, in the analytical report “Hydrogen: Market Formation and Prospects for Russia”, compared potential hydrogen exporters in terms of some indicators that characterize their strengths and weaknesses in this area (Table 32). It can be noted that in each of the considered exporting countries, there are both strengths and weaknesses.Table 32. Comparison of Russia and its potential competitors in the export of hydrogen.Indicator Russia Australia Chile Norway Saudi Arabia Oman UAE Morocco Tunisia Namibia Mauritania Priority type of hydrogen that the country plans to produce low carbon low carbon renewable low carbon low carbon renewable low carbon renewable renewable renewable renewable Degree of geographical proximity, including to markets: EU countries high low low high average Japan average average high high low average 0.3 no data 5–10 Japan and South Korea high average low low average average average low low low low Planned export volume Agreements at the national level in the field of hydrogen, including: Australia 0.5 no data 6.75 with Germany − + + − + Chile 0.6 + − − * + + − no data 18 with Japan/South Korea +/− +/+ −/− −/− +/− −/− +/+ −/− −/− Russia −/− −/− 2.75–2.9 (6.4) no data 11.3–11.9 (30) Current projects for the production of “renewable” hydrogen − + + + − − − − − − − Current CCS projects − + − + + − + − − − − Installed RES capacities (SPP and WPP), GW 3.5 27.1 5.4 4.1 0.4 0.2 2.5 2.1 0.3 0.2 0.1 Level of fresh water scarcity low-medium high high low very high very high very high high high high medium-high Note: * The agreement on cooperation in the field of hydrogen between Morocco and Germany was concluded in June 2020. In May 2021, its validity was terminated by Morocco, Source [64][26].The prospects for hydrogen exports from Russia to world markets look moderate. Russia’s main advantages are its proximity to potential sales markets and the availability of significant fresh water resources. The weaknesses of Russia are the low level of international activity in this area and the lack of technologies tested in Russia for the production of “low-carbon” and “renewable” hydrogen and for its transportation. All countries engaged in the production of “low-carbon” hydrogen, unlike Russia, have experience in implementing technologies for capturing and storing carbon dioxide. Let uresearchers compare the prospects of Russia with some countries in terms of the planned volumes of import and export of hydrogen, taken from the strategic documents of the countries (Table 43). Japan’s hydrogen needs outlined in the country’s hydrogen roadmap can theoretically be met by Australia and Chile both by 2030 and 2050. At the same time, the hydrogen strategies of these countries involve diversifying hydrogen supplies and reaching other markets. Germany’s needs by 2030 may be substantial enough that Russia could take advantage of it under favorable circumstances. At the same time, Russia’s optimistic plans to export 30 million tons of hydrogen by 2050 do not seem entirely justified, given that Japan plans to consume only 5–10 million tons by this period. In this regard, the indicator of 11 million tons looks optimal, provided that cooperation with Japan and South Korea is boosted.Table 43. Planned volumes of imports and exports of hydrogen according to the hydrogen strategies and road maps of countries, million tons [64].Planned volumes of imports and exports of hydrogen according to the hydrogen strategies and road maps of countries, million tons [26].Country 2030 2035 2050 Planned import volume Germany 2.3–2.9 1.9–2.5 no data Notes: for Russia, in parentheses are optimistic export plans.The degree of conditionality of such estimates is extremely high; since the data are not available for all countries, they are incomplete but allowed uresearchers to draw some conclusions:- -

-

The speed with which decisions should be made, including international cooperation in the field of hydrogen, is important;

- -

-

It is important to develop technologies to occupy their niche in the emerging global hydrogen market.

References

- Matkovskaya, Y.; Vechkinzova, E.; Petrenko, Y.; Steblyakova, L. Problems of Innovative Development of Oil Companies: Actual State, Forecast and Directions for Overcoming the Prolonged Innovation Pause. Energies 2021, 14, 837.

- Steblyakova, L.P.; Vechkinzova, E.; Khussainova, Z.; Zhartay, Z.; Gordeyeva, Y. Green Energy: New Opportunities or Challenges to Energy Security for the Common Electricity Market of the Eurasian Economic Union Countries. Energies 2022, 15, 5091.

- Dnews; Detinich, G. The World’s Largest Hydrogen Fuel Cell Power Plant Has Started Operating in South Korea. Daily Digital Digest, 12 November 2021. Available online: https://3dnews.ru/1053587/v-yugnoy-koree-zarabotala-krupneyshaya-v-mire-elektrostantsiya-na-vodorodnih-toplivnih-elementah (accessed on 15 September 2022).

- EnergyAustralia. News. EnergyAustralia Gives Green Light to Australia’s First Net Zero Emissions, Hydrogen/Gas Power Plant, 4 May 2021. Available online: https://fuelcellsworks.com/news/energyaustralia-gives-green-light-to-australias-first-net-zero-emissions-hydrogen-gas-power-plant/ (accessed on 15 September 2022).

- AutoGeek. Blog about High Technologies. Hydrogen Cars: Features, Characteristics, TOP 7 Models: Kiev, Ukraine. 2019. Available online: https://autogeek.com.ua/hydrogen-fuel-cell-electric-vehicles/ (accessed on 15 September 2022).

- Mastepanov, A. Hydrogen Power Engineering in Russia: State and Prospects. Energy Policy 2020, 12, 54–65. Available online: https://cyberleninka.ru/article/n/vodorodnaya-energetika-rossii-sostoyanie-i-perspektivy (accessed on 29 September 2022).

- Ponomarev-Stepnoy, N. Hydrogen is a New Key Product of Rosatom: Lecture. Atomic Expert 2020. Available online: https://atomicexpert.com/hydrogen_project_rosatom (accessed on 29 September 2022).

- Dyatel, T. Hydrogen at the Gate. How Russia is Trying to Enter a New Market. Коммерсантъ 2020, 184, 10. Available online: https://www.kommersant.ru/doc/4521376 (accessed on 29 September 2022).

- Russia’s Energy Strategy for the Period up to 2035. Approved by the Decree of the Government of the Russian Federation of 9 June 2020. Ministry of Energy of the Russian Federation. Available online: https://minenergo.gov.ru/node/1026 (accessed on 29 September 2022).

- Action Plan “Development of Hydrogen Energy in Russia Until 2024”. Approved by the Decree of the Government of the Russian Federation of 12 October 2020. Ministry of Energy of the Russian Federation. Available online: https://minenergo.gov.ru/node/19194 (accessed on 29 September 2022).

- The Concept of Hydrogen Energy Development in the Russian Federation. Approved by the Decree of the Government of the Russian Federation of 5 August 2021. Ministry of Energy of the Russian Federation. Available online: http://static.government.ru/media/files/5JFns1CDAKqYKzZ0mnRADAw2NqcVsexl.pdf (accessed on 29 September 2022).

- Russia’s concepts for developing hydrogen. Global Energy, 12 August 2021. Available online: https://globalenergyprize.org/en/2021/08/12/russias-concepts-for-developing-hydrogen/ (accessed on 29 September 2022).

- Ministry of Industry and Trade of Russia. Available online: https://minpromtorg.gov.ru/docs/#!atlas_rossiyskih_proektov_po_proizvodstvu_nizkouglerodnogo_i_bezuglerodnogo_vodoroda_i_ammiaka (accessed on 29 September 2022).

- Veselov, F.; Solyanik, A. The Economics of Hydrogen Production, Considering Exports and the Russian Market. Energy Policy: A Social and Business Scientific Journal, 4 May 2022. Available online: https://energypolicy.ru/ekonomika-proizvodstva-vodoroda-s-uchetom-eksporta-i-rossijskogo-rynka/energoperehod/2022/09/04/ (accessed on 2 October 2022).

- Zhiznin, S.; Timokhov, V.; Gusev, A. Economic aspects of nuclear and hydrogen energy in the world and Russia. Int. J. Hydrogen Energy 2020, 45, 31353–31366.

- Kolomeytseva, A.A.; Finger, M.P.; Krivorotov, A.K. Nuclear and Hydrogen Prospects for the Russian Arctic. In Energy of the Russian Arctic; Salygin, V.I., Ed.; Palgrave Macmillan: Singapore, 2022.

- Kopteva, A.; Kalimullin, L.; Tcvetkov, P.; Soares, A. Prospects and Obstacles for Green Hydrogen Production in Russia. Energies 2021, 14, 718.

- Kirsanova, N.Y.; Lenkovets, O.M.; Nikulina, A.Y. Renewable Energy Sources (RES) as a Factor Determining the Social and Economic Development of the Arctic Zone of the Russian Federation. In Proceedings of the 18th International Multidisciplinary Scientific GeoConference SGEM2018, Albena, Bulgaria, 2–8 July 2018; Available online: https://www.sgem.org/index.php/elibrary?view=publication&task=show&id=1649 (accessed on 2 October 2022).

- Berezikov, S. Structural changes and innovation economic development of the Arctic regions of Russia. J. Min. Inst. 2019, 240, 716. Available online: https://pmi.spmi.ru/index.php/pmi/article/view/13252 (accessed on 2 October 2022).

- Zabanova, Y.; Westphal, K. Russia in the Global Hydrogen Race: Advancing German-Russian Hydrogen Cooperation in a Strained Political Climate; Stiftung Wissenschaft und Politik: Berlin, Germany, 2021; SWP Comment 34.

- Frolov, A.; Kalinin, M. Russia Taking a Stand in Global Hydrogen Race. Baker McKenzie, 3 February 2021. Available online: https://www.bakermckenzie.com/en/insight/publications/2021/02/russia-taking-a-stand-in-global-hydrogen-race (accessed on 2 October 2022).

- The Ministry of Energy of Russia and the Ministry of Economy and Energy of Germany Signed a Joint Declaration of Intent on Cooperation in the Field of Sustainable Energy. Ministry of Energy of the Russian Federation. Available online: https://minenergo.gov.ru/node/20562 (accessed on 29 September 2022).

- Holkin, D. (Ed.) Prospects of Russia in the Global Hydrogen Fuel Market; Expert-Analytical Report; EnergyNet Infrastructure Center: Moscow, Russia, 2019; Available online: https://www.eprussia.ru/upload/iblock/ede/ede334adeb4c282549a71d6fec727d64.pdf (accessed on 30 September 2022).

- Russia Hydrogen Market Report 2021. CISION PR Newswire, 16 July 2021. Available online: https://www.prnewswire.com/news-releases/russia-hydrogen-market-report-2021-301335507.html (accessed on 30 September 2022).

- Hydrogen Energy: Points of Growth. Digest 20 (27). Neftegaz-2021: Monthly Information and Analytical Publication. Available online: http://oilandgasforum.ru/data/files/20_w%20eb.pdf (accessed on 29 September 2022).

- Institute of Problems of Natural Monopolies. Analytical report “Hydrogen: Market Formation and Prospects of Russia”. Available online: http://ipem.ru/content/vodorod-formirovanie-rynka-i-perspektivy-rossii/ (accessed on 6 November 2022).

More