Green finance is a sustainable force in promoting green development. China’s social financing structure determines the key role that green credit plays in sustainable development. Under the dual pressure of future economic downturn and huge capital gaps, it is worth exploring whether to continue promoting green credit that conforms to the long-term market mechanism. From the perspective of Chinese commercial banks, this paper analyzes whether promoting green credit is compatible with the incentives and their profit maximization goals.

- green credit

- “Two High and One Surplus”

- financial results

- Introduction

1. Introduction

According to the Statistical Review of World Energy (70th edition) released by BP, by 2020 China’s carbon emissions will account for 30.3% of the global total [1]. The success or failure of China’s energy conservation and emission reduction projects will affect the overall global carbon neutrality. On the other hand, environmental problems are difficult for many developing countries in the world to avoid during their development process. As a developing country with a huge economic volume, how China realizes green, low-carbon, and circular development will provide a model for the economic transformation of the latecomers. Some scholars estimate that in order to achieve the goal of “carbon peak”, the whole country needs to invest an additional CNY 3–4 trillion every year, with the fiscal revenue only meeting 10–15% of the capital gap [2,3], and investments should mainly rely on social financing. By the end of 2020, bank credit financing still accounted for 61% of total social financing. Therefore, green credit is the most important force affecting green finance in China. In fact, CIB Research estimates that green credit accounts for more than 90% of all green financing. (As of the first half of 2019, the green credit balance of China’s 21 major banks was CNY 10.6 trillion, and the balance of domestic green bonds was only CNY 708.78 billion. The bank mainly issued green financial bond funds to issue green credit. Excluding the green financial bonds, the balance of the non-financial enterprise green bonds was only CNY 293.96 billion, less than 3% of the green credit scale. The balances of the other green financing scales were smaller. (Source: http://greenfinance.xinhua08.com/a/20191227/1905011.shtml (accessed on 16 March 2022))). On the other hand, since the beginning of the 21st century, China has faced the problem of environmental pollution during the process of the country’s development. The government has always emphasized environmental protection and sustainable development and has frequently introduced policies for industrial structure adjustments, but these policies have always achieved poor results [4–7]. In essence, the massive development of high energy consumption and heavy-pollution industries has benefited from large inflows of credit funds (based on the bank loan data of the listed enterprises, Liu Xiliang and Wen Shuyang (2019) also found that “six of the top ten industries with the amount of credit are highly polluting industries, and the average emission of the top ten industries with the amount of loan is about twice that of other industries”) [8,9]. The unbalanced allocation of credit resources objectively promotes the continuous expansion of industries with high rates of energy consumption and pollution and aggravates the environmental pollution and environmental costs incurred on the path towards economic growth. Therefore, the environmental problems caused by the industrial structure [10,11] can be attributed to the “financial mismatch” status of credit resources.

Therefore, green development must rely on optimizing the function of the financial allocation of resources, and green credit will be the most key link. In fact, the Chinese government has taken full action. For example, financial institutions, especially commercial banks, are asked to disclose environmental information, with banking financial institutions being required to regularly disclose financial information on their social and environmental responsibilities and on their support for energy conservation and emission reduction as well as to constantly refine their statistical standards for green credit information. In terms of financial discounts for eligible green credit, green credit and green bonds should become eligible collateral for re-lending by commercial banks. Local governments are also rolling out policies to support green finance. For example, Zhejiang province took the lead by issuing the Guiding Opinions on Financial Support to Achieve Peak Carbon Neutrality, established a positive list of credit supports for green and low-carbon development, and set up “zero carbon” pilot units and low-carbon industrial parks. In addition, a series of measures have been introduced, such as setting up carbon accounts for key enterprises and public institutions with carbon emissions and fostering regional environmental rights trading markets. Since 2016, Xiamen has offered different degrees of incentives, loan discounts, and risk-sharing compensation to the financial industry based on the scale of green credit.

The essence of green credit is to solve the externalities of the environment and finance for the green transformation of the economy. Its role in environmental protection is self-evident, and the relevant economic research focuses more on the market mechanism of green credit. In the short term, green development policies will have a certain impact on the national economy, especially in some traditional industries with high levels of pollution and energy consumption. For developing countries, such industries are the pillar of their national economy in the early stages of development. Additionally, the role of green credit through financial leverage has further increased the influence of this impact. On the other hand, the global economy is under downward pressure due to the impact of COVID-19, while it is also being buffeted by various extreme events that have severely affected financial stability. In this context, should we strengthen our confidence and further promote economic transformation with green credit? Are green credit policy incentives compatible in the market economy? Before answering these questions, we must further clarify the market operation mechanism of green credit. This paper studies the market logic of green credit from the perspective of Chinese commercial banks and tries to determine the long-term market effect of green credit from the starting point of whether green credit is in line with the interests of commercial banks.

- Related Literature

2. Related Content of Green Finance in Line with the Long-Term Market Mechanism

The so-called green credit policy refers to a series of policies that allow commercial banks, policy banks, and other financial institutions to offer preferential interest rates for loans to enterprises or institutions that are engaged in ecological protection and the development and utilization of new sources of energy and that develop and produce anti-pollution facilities; meanwhile, the policy also includes a high, punishment interest rate that is implemented to limit loans for the investment and working capital of new projects carried out by polluting means of production and enterprises. The purpose is to guide the flow of funds and loans into the enterprises and institutions that promote the national environmental protection cause and to appropriately withdraw from the enterprises and projects that destroy and pollute the environment to realize the “green allocation” of funds [12]. The capital allocation function of green credit means that the role of environmental governance can be carried out from the initial stages of the production process and can run through the whole production stage; that is, the incentive and restraint effect of green credit has the characteristics of initial governance and whole-cycle governance [13]. The earliest official proposals for green credit date back to the early 1990s, when the United Nations Environmental Program Finance Initiative (UNEPFI) issued the “Statement by Financial Institutions on the Environment and Sustainable Development” [14], which stressed the need to incorporate environmental factors into standard risk-assessment processes. Its main goal was to require the banking industry to consider environmental factors in its management activities and to encourage the private sector to invest in environmentally beneficial technologies and services. The Equator Principles, advocated for by the World Bank Group, provide a framework for environmental and social-risk assessment in project financing, including the risk classification of different types of projects, and list topics related to environmental assessment processes, monitoring, and follow-up guidance. At present, 56 financial institutions around the world, including Citigroup, Standard Chartered, and HSBC, have become Equator Principle Financial Institutions (“EPFIs”), accounting for more than 90% of the global project financing market. By the end of 2021, nine Chinese mainland commercial banks had incorporated the Equator Principles, which are also the practical blueprint for green credit in China’s banking industry (From the Preamble of the Equator Principles, www.equator-principles.com (accessed on 16 March 2022)).

Much of the research on green credit is based on a corporate perspective. Chinese enterprises are usually highly dependent on external financing, and credit resources are the “blood” of enterprise development. There is a long-term “financial mismatch” in China, where financial resources are concentrated in state-owned enterprises, large enterprises, and hot industries [15,16], and the enterprises with high levels of pollution and energy consumption mentioned above are mainly subject to government intervention [17,18] and credit rationing [19,20]. The green credit policy tries to change this “financial mismatch” phenomenon by introducing high-pollution investment into higher financing constraints and by internalizing the negative externality of corporate pollution emissions, thus having a profound impact on China’s industrial patterns.

From the implementation effect, there is a lot of evidence that green credit boosts the green and high-quality development of the economy. For enterprises in high-polluting industries, the green credit policy significantly reduces the credit financing of enterprises in heavy-polluting industries, which not only redirects the resources from low-efficiency enterprises to high-efficiency enterprises [21], but also promotes the green innovation in high-polluting enterprises [13,22]. Green credit has a significant effect on reducing the friction costs and risk coefficients in various industries [23]. On the other hand, the national conditions result in green credit having policy effects that cause enterprises to show certain Chinese characteristics. For example, the credit-approval features of Chinese commercial banks that emphasize mortgages [24] cause green credit policies to have less of an impact on highly polluting enterprises with high fixed assets [25]. Sun et al. [26] found that green credit policies can motivate Chinese enterprises to focus on front-end prevention and control rather than on terminal emission reduction.

The research results on the impact of green credit on commercial banks are divided. Many scholars believe that green credit has a positive effect on commercial banks. First, the implementation of a green credit policy can improve the social image of commercial banks from the perspectives of media attention and recognition from customers, employees, and partners. For example, more social reports on green credit [27] and the disclosure of public announcements [28] can enable commercial banks to gain more public trust by improving their reputation. In contrast, there is evidence that commercial banks regard some major polluting enterprises as important loan-provision objects that will affect their green reputation, lead to the loss of high-quality customer resources, and result in reductions and fluctuations in the financial performance level [29]. Second, the implantation of a green policy can reduce the environmental risks of the loan customer. In the literature, environmental risk generally includes climate risk and environmental-regulation risk. China’s current credit resources flow into industries with high energy consumption, high pollution, and excess capacity (hereinafter referred to as the “Two High and One Surplus”) [8,9]; this process makes the value of the credit assets of commercial banks more sensitive to environmental regulations, energy price fluctuations, and market demand changes. There is evidence that green credit can effectively reduce the probability of loan losses caused by environmental regulations [30,31]. Climate risk affects the ability for loans to be repaid by changing the business cash flow of borrowers [32].

Scholars who hold a neutral view emphasize case-by-case analysis. The impact of green credit on commercial banks is moderated by several factors, such as bank size: large banks have advantages such as cost amortization and customer resources and can benefit more from increasing the proportion of green credit [33]. However, the research results of Zhang Lin and Lian Yonghui [34] are in contrast to this. Tong Menghua et al. [35] believe that commercial banks will lose customers due to “one-size-fits-all” carbon emission reduction policies and advocate for the establishment of a “carbon emission reduction credit risk warning system for industrial enterprises” to ensure that commercial banks can maximize their interests when implementing green credit policies.

In terms of methods, most of the research in the literature takes the financial index of commercial banks as the explained variable and the proportion of green credit as the core explanatory variable to establish panel data linear regression. In terms of the explained variables, many scholars take return on total assets as the explained variable [34,36]. Some scholars have also used self-built comprehensive indexes as the explained variables, such as the bank competitiveness index [37] or the comprehensive evaluation index [38,39].

The relevant literature not only analyzes the positive effects of green credit policies on commercial banks from the perspectives of social responsibility and environmental risks, but also points out the negative effects of green credit policies from the aspects of increased costs and customer loss. Most research methods use return on assets or comprehensive financial indicators as the explained variables and the core of green credit as an accounted-for explained variable in a controlled variable linear regression series. These rich research methods and empirical conclusions allow us not only to further explore the green financial market mechanism and to lay a solid foundation, but also to leave space for further research, with potential avenues of research including updating the data, as most of China’s green credit research data are from 2017 and are related to commercial banks. The existing green credit data imperfectly disclose regulations, meaning that free disclosure exists in terms of disclosing the green credit data of commercial banks. Thus, due to the lack-of-interruption phenomenon, it is difficult to update the data. Additionally, 2016 represents the first year of green finance in China, and the data from subsequent years are more meaningful. The sample size needs to be expanded. Additionally, due to limited relevant information regarding disclosure regulation defects, the vast majority of the literature is limited to listed companies that disclose their data to commercial banks, and most banks and some influential city businesses come to the market late. This not only causes under-represented defects, but also partly explains the use of the same methods in the literature; however, different results have been achieved, and the three research methods need to be enriched. The return on assets or return on equity is taken as the explained variable, and its fluctuation is easily affected by changes in the asset structure (for example, the return on assets decreases due to capital and stock increases). However, most of the studies in the literature do not control this variable, resulting in differences in the research conclusions. A single income index fails to fully describe the operation of commercial banks, while the comprehensive indicator method fails to grasp the phased coordination under multiple objectives (for example, when the non-performing loan ratio is low, the pursuit of the maximum return rate is a more important goal).

This paper will make adjustments to the above points, try to explain the differences in the conclusions of previous studies, and analyze the effect of green credit on commercial banks from the two angles of financial results and operation efficiency. The research in this paper mainly analyzes the theoretical analysis of the two types of innovation. (1) When analyzing the theory, there is a distinct lack of research on the impact mechanism in most of the literature, with most studies establishing a regression model of the financial indicators of green credit and commercial banks and discussing the effects of green credit policies on the financial performance of commercial banks from the empirical results of the model. In contrast, we have carried out a full research methodology on the impact mechanism: on the one hand, it reveals that the characteristics of green credit, “low risk and high income”, are important mechanisms for improving the business situation of commercial banks. On the other hand, combined with the conclusions in the literature and of the financial analyses, different index types affect the modeling results, with the modeling results pointing out that capital expansion is too fast and that the decline in the efficiency of internal resources is the main reason for the decline in asset yields and that green credit policies can help improve the “overcapacity” in commercial banks. (2) In the empirical analysis, this paper establishes a data envelope analysis model with undesirable output and dynamically analyzes the operation efficiency of commercial banks in China, innovatively proving the argument through the utilization and efficient configuration of internal resources.

- Financial Comparison between “Green” and “Two High and One Surplus”Enterprises

3. Financial Comparison between “Green” and “Two High and One Surplus”Enterprises

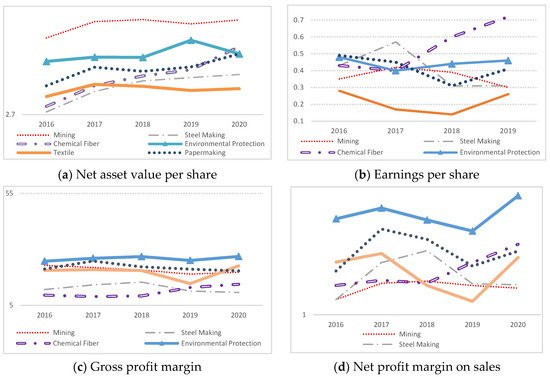

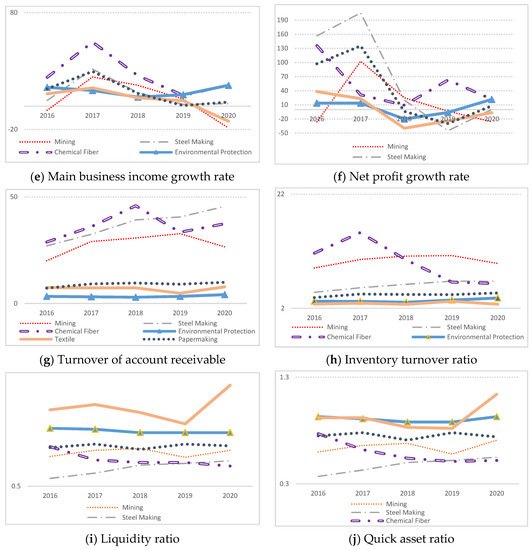

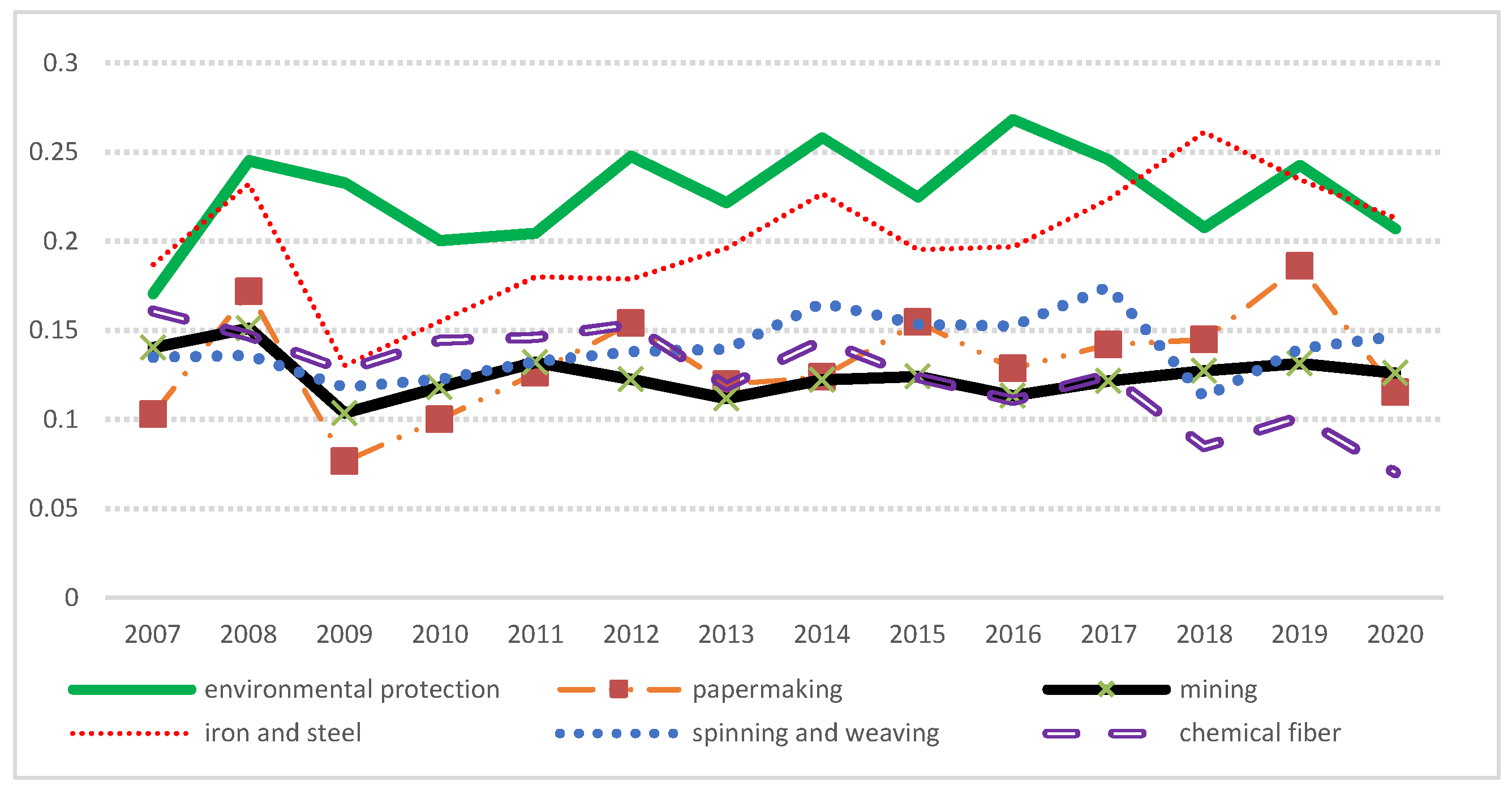

The main purpose of green credit policies is not only to increase the proportion of credit for green projects, but also to reduce the loans to “Two High and One Surplus” enterprises. Changing the credit structure of commercial banks is reflected in the proportion of these two types of corporate loans. Financial analysis is the most important link in the loan approval process of commercial banks. According to the financial analysis , it was found that, compared to the “Two High and One Surplus” industries, the environmental protection industry is better, but its financing costs are high (Figures 1-3).

Figure 1. Financial comparison between green industries and the “Two High and One Surplus” industries.

Figure 1. Financial comparison between green industries and the “Two High and One Surplus” industries.

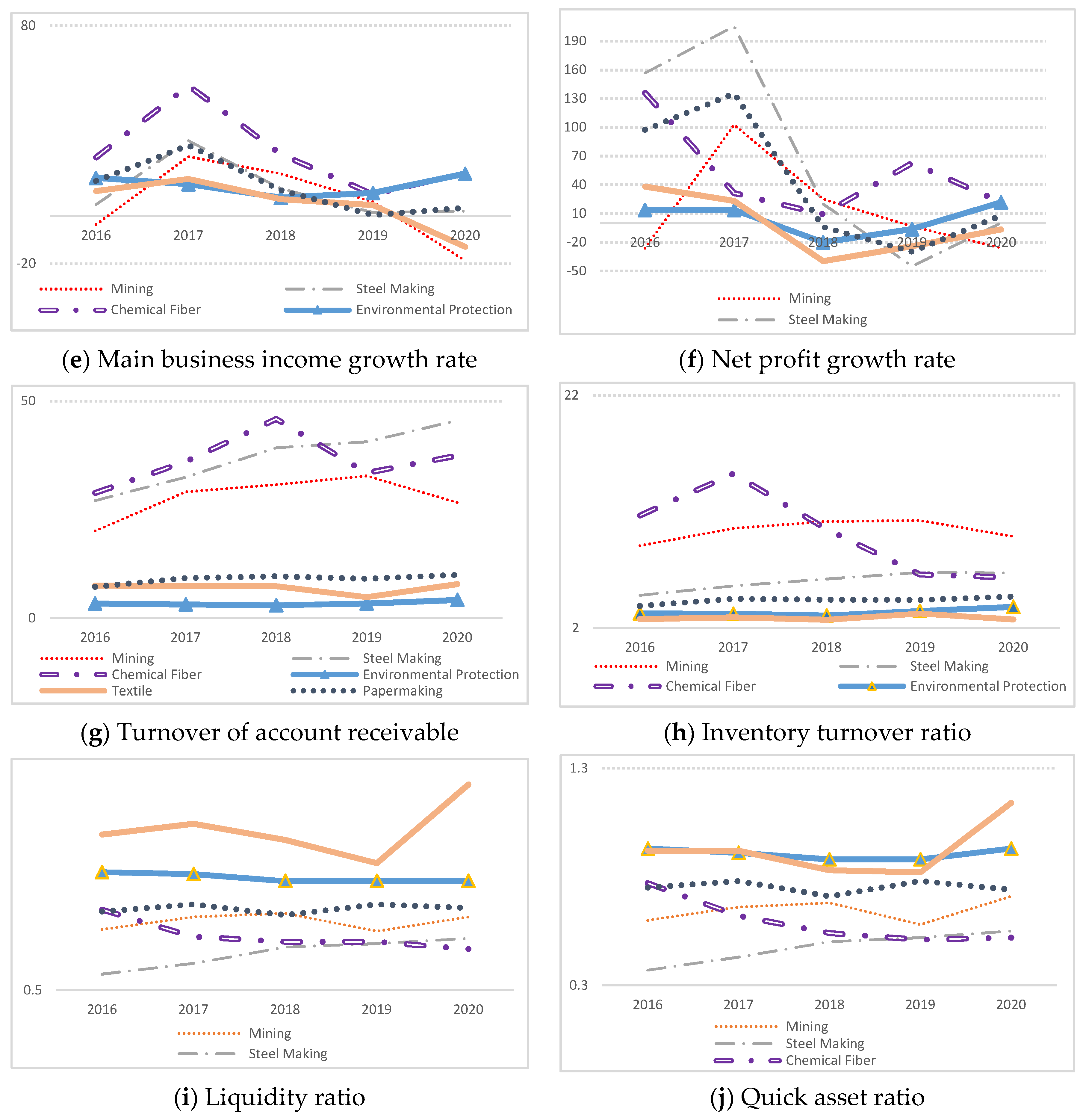

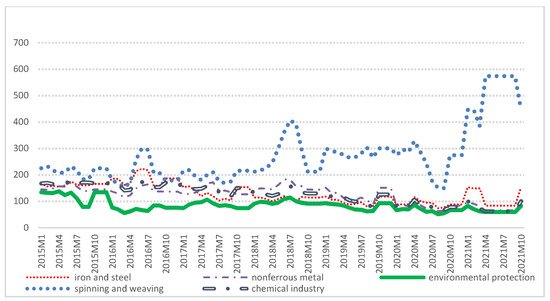

Figure 2. Interest-bearing debt interest rate: environmental protection industry and “Two High and One Surplus” industries.

Figure 2. Interest-bearing debt interest rate: environmental protection industry and “Two High and One Surplus” industries.

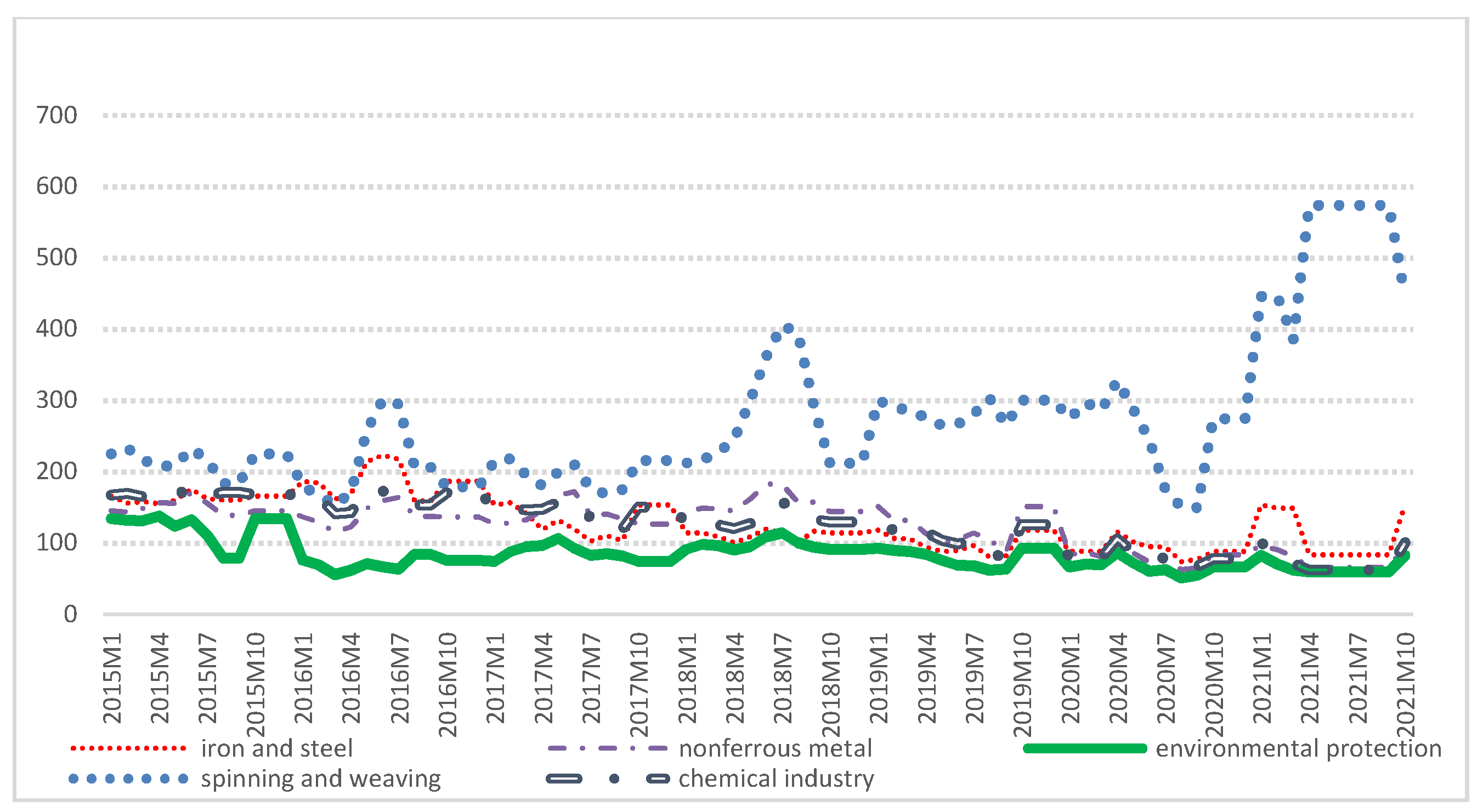

Figure 3. Credit spread (median): industrial debt.

Figure 3. Credit spread (median): industrial debt.4. Do Green Credit Policies Boost Profits?

- Do Green Credit Policies Boost Profits?

This section analyzes the influence of green credit ratio on the financial indicators of Chinese commercial banks through regression method. It is pointed out that the differences in conclusions from the literature are due to the selection of model variables. The root cause of these differences may be the rapid expansion of the capital of commercial banks in the sample period, resulting in a decline in the internal factor allocation efficiency. The empirical analysis proves that increasing the green credit ratio can increase the total profits of commercial banks and puts forward that green credit policies can solve the “overcapacity” problems that are experienced by commercial banks to a certain extent.

5. Green Credit and Bank Operating Efficiency

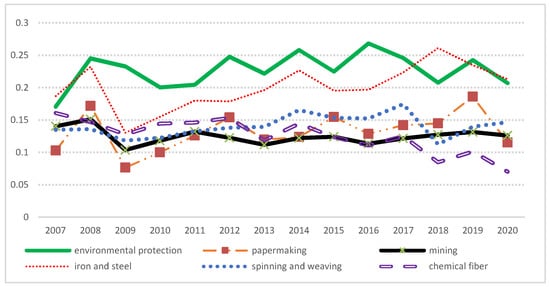

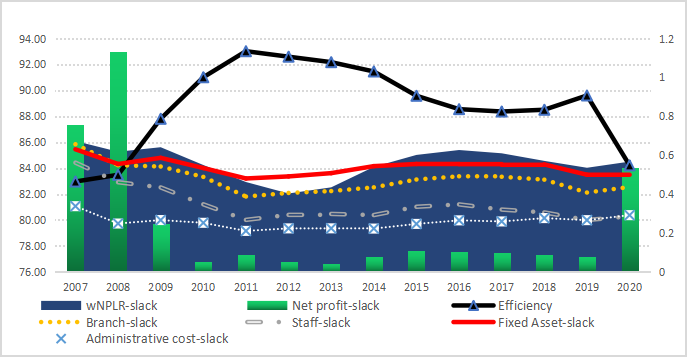

Section 5 analyzes the allocation efficiency of the internal resources of commercial banks from the perspective of input–output efficiency to prepare for the fourth part of the restudyearch. In terms of methods, an SBM-DEA model containing undesirable output (the non-performing loan ratio) was established, and the weights of the output variables were innovatively and dynamically coordinated. The results (Figure 4) show that the efficiency measurements for China's commercial banks largely conform to the economic reality, and the analysis of the slack variables effectively revealed the main reasons for the changes in the operating efficiency of commercial banks at various stages.

Figure 4.

Average operating efficiency and slack variables.

Through regression analysis, it is found that green credit policies mainly improve the overall operating efficiency of commercial banks from two aspects: (1) it improves the utilization efficiency of various internal resources, and (2) it improves the overall allocation efficiency of resources.

References

- BP. Statistical Review of World Energy 2021, 70th ed.; BP: London, UK, 2021.

- Ma, J. The Evolution of and Prospect for Green Finance in China. Comp. Econ. Soc. Syst. 2016, 6, 25–32.

- Sequoiacap. Towards Zero Carbon—A Green Revolution Based on Scientific and Technological Innovation; Sequoiacap: London, UK, 2021.

- Zhou, L.A. The Incentive and Cooperation of Government Officials in the Political Tournaments an Interpretation of the Prolonged Local: Protectionism and Duplicative Investments in China. Econ. Res. J. 2004, 6, 33–40.

- Jiang, F.; Cao, J. Market Failure or Institutional Weakness—The Argument, Defect and New Development in Research of Redundant Construction Formation Mechanism. China Ind. Econ. 2009, 1, 53–64.

- Jiang, F.; Geng, Q.; Lv, D.; Li, X. Mechanism of Excess Capacity Based on China’s Regional Competition and Market Distortion. China Ind. Econ. 2012, 6, 44–56.

- Zhang, J. Research on the formation and resolution of Overcapacity in China from the perspective of industrial policy. Inq. Econ. Issues 2015, 2, 10–14.

- Dong, Q.; Wen, S.; Liu, X. Credit Allocation, Pollution, and Sustainable Growth: Theory and Evidence from China. Emerg. Mark. Financ. Trade 2019, 56, 2793–2811.

- Liu, X.; Wen, S. Should Financial Institutions be Environmentally Responsible in China? Facts, Theory and Evidence. Econ. Res. J. 2019, 54, 38–54.

- Ma, L.; Zhang, X. The Spatial Effect of China’s Haze Pollution and the Impact from Economic Change and Energy Structure. China Ind. Econ. 2014, 4, 19–31.

- Wang, M.; Huang, Y. China’s Environmental Pollution and Economic Growth. China Econ. Q. 2015, 14, 557–578.

- Zhou, H.; Jian, L.; Li, G.P. Corporate Social Responsibility and Credit Spreads on Corporate Bonds—An Empirical Study Based on China’s Public Companies. Account. Res. 2016, 5, 18–25+95. Deng, Y. Build “green Credit” for enterprise energy saving and emission reduction. Shanghai Securities News, 20 July 2007.

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. Wang, X.; Wang, Y. Research on the Green Innovation Promoted by Green Credit Policies. Manag. World 2021, 37, 173–188+11.

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.Y.; Mishra, D.R. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. United Nations Environment Programme Finance Initiative. UNEP Statement by Financial Institutions on the Environment & Sustainable Development; United Nations Environment Programme Finance Initiative: Geneva, Switzerland, 1997.

- Li, G.; Wei, X. Definition, Measurements and Economic Consequences of Corporate Social Responsibility: A Survey on Theories of Corporate Social Responsibility. Account. Res. 2014, 8, 33–40+96. Boyreau-Debray, G.; Wei, S.J. Pitfalls of a State-Dominated Financial System: The Case of China; Social Science Electronic Publishing: New York, NY, USA, 2004.

- Li, G.; Zhang, Q.; Zhou, H. Corporate Social Responsibility and Financial Performance: Theory, Methods and Tests. Econ. Perspect. 2014, 6, 138–148. Shao, T. Financial mismatch, Ownership structure and Return on capital: A study of Chinese industrial firms from 1999 to 2007. J. Financ. Res. 2010, 9, 51–68.

- Goss, A.; Roberts, G.S. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. Berger, A.N.; Hasan, I.; Zhou, M. Bank ownership and efficiency in China: What will happen in the world’s largest nation? J. Bank. Financ. 2009, 33, 113–130.

- He, D.; Zhang, X. Reflections on some problems of carrying out green credit in China’s commercial banks. Shanghai Financ. 2007, 12, 4–9. Garcia-Herrero, A.; Gavila, S.; Santabarbara, D. What explains the low profitability of Chinese banks? J. Bank. Financ. 2009, 33, 2080–2092.

- Duffie, D.; Lando, D. Term structures of credit spreads with incomplete accounting information. Econometrica 2001, 69, 633–664. Ma, J.; Wu, B. Floating interest rate policy differential pricing strategy and credit rationing for farmers by financial institutions. J. Financ. Res. 2012, 4, 155–168.

- Zhou, H.; Li, G.; Lin, W. Corporate Social Responsibility and the Cost of Debt Financing: Based on the Evidence of Shanghai Stock Exchange Listed Companies Issued Bonds. In Proceedings of the 2014 Annual Conference of Environmental Accounting Committee of Accounting Society of China, Nanjing, China, 25–26 October 2014; p. 15. Zhan, M.; Wang, X.; Ying, C. Interest Rate Regulation, Behavior Distortion of Banks’ Credit Allocation and the Financial Restriction of China’s Listed Companies. China Econ. Q. 2013, 12, 1255–1276.

- Lin, W. Analysts Forecast and Corporate Bonds Credit Spreads—Based on the Data of Chinese Corporate Bonds in 2008–2012. Account. Res. 2013, 8, 69–75. Zhang, X.; Ge, J. Green finance policies and optimization of resources allocation efficiency in China. Ind. Econ. Res. 2021, 6, 15–28.

- Gelb, D.S.; Strawser, J.A. Corporate social responsibility and financial disclosures: An alternative explanation for increased disclosure. J. Bus. Ethics 2001, 33, 1–13. Wang, L.; Xu, J.; Li, C. The Mechanism and Stage Evolution of Green Financial Policy Promoting Enterprise Innovation. Soft Sci. 2021, 12, 81–87.

- Richardson, A.J.; Welker, M. Social disclosure, financial disclosure and the cost of equity capital. Account. Organ. Soc. 2001, 26, 597–616. Chen, W.; Hu, D. An Analysis of the Functional Mechanism and Effect of Green Credit on Industrial Upgrading. J. Jiangxi Univ. Financ. Econ. 2011, 4, 12–20.

- Niu, H.; Zhang, X.; Zhang, P. Institutional Change and Effect Evaluation of Green Finance Policy in China: Evidence from Green Credit Policy. Manag. Rev. 2020, 32, 3–12. Qiang, X.; Fang, S. Does Reform on Security Interests System Affect Corporate Debt Financing? Evidence from a Natural Experiment in China. Econ. Res. J. 2017, 5, 146–160.

- Lu, J.; Yan, Y.; Wang, T. The Microeconomic Effects of Green Credit Policy—From the Perspective of Technological Innovation and Resource Reallocation. China Ind. Econ. 2021, 1, 174–192.

- Sun, J.; Wang, F.; Yin, H.; Zhang, B. Money Talks: The Environmental Impact of China’s Green Credit Policy. J. Policy Anal. Manag. 2019, 38, 653–680.

- Shen, X. The Research on Green-Credit, Green Reputation and Financial Performance of Commercial Banks; Nanjing University of Finance and Economics: Nanjing, China, 2011; p. 47.

- Chami, R.; Cosimano, T.F.; Fullenkamp, C. Managing ethical risk: How investing in ethics adds value. J. Bank. Financ. 2002, 26, 1697–1718.

- Thompson, P.; Cowton, C.J. Bringing the environment into bank lending: Implications for environmental reporting. Br. Account. Rev. 2004, 36, 197–218.

- Aintablian, S.; Mcgraw, P.A.; Roberts, G.S. Bank monitoring and environmental risk. J. Bus. Financ. Account. 2007, 34, 389–401.

- Zhou, Y.; Luo, Y. Financial ecological environment, green reputation and credit financing: An empirical study of A-share heavily polluting listed companies. South China Financ. 2017, 8, 21–32.

- The Study Group of Green Finance, ICBC. A Study of ESG Green Rating and Green Index. Financ. Forum 2017, 22, 3–14.

- Guo, W.; Liu, Y. Green Credit, Cost-Benefit Effect and Profitability of Commercial Banks. South China Financ. 2019, 9, 40–50.

- Zhang, L.; Lian, Y. How Does Green Credit Affect the Financial Performance of Commercial Banks? From the Perspective of Income Structure Decomposition of Banks. South China Financ. 2020, 2, 45–56.

- Tong, M. Early Warning Research on Carbon Emission Reduction Credit Risk of Industrial Enterprises Based on FM Model. J. Quant. Tech. Econ. 2021, 38, 147–165.

- He, L.; Wu, C.; Zhong, Z.; Zhu, J. Green Credit, Internal and External Policies, and the Competitiveness of Commercial Banks: An Empirical Study of Nine Listed Commercial Banks. Financ. Econ. Res. 2018, 33, 91–103.

- Gao, X.; Gao, G. A Study on the Relation between the Scale of Green Credit and the Competitiveness of Commercial Banks. Econ. Probl. 2018, 7, 15–21.

- Ma, Y.; Du, C. Are Equator Principles Conductive to the Operational Efficiency of China’s commercial Banks? With Industrial Bank as a Case. Contemp. Financ. Econ. 2015, 7, 57–65.

- Liao, J.; Hu, W.; Yang, D. Dynamic Analysis of the Effect of Green Credit on Bank Operating Efficiency—Based on Panel VAR Model. Collect. Essays Financ. Econ. 2019, 2, 57–64.