Value innovation, as defined by Kim and Mauborgne, and Kim and Mauborgne, is making “the competition irrelevant by offering fundamentally new and superior buyer value in existing markets and by enabling a quantum leap in buyer value to create new markets”. The concept of value innovation is a summation of analytical outcomes from 150 strategic moves spanning more than 30 companies, worldwide, in approximately 30 industries, as well as a study for the business launched of approximately 100 companies to quantify the influence of value innovation on a company’s growth in revenues and profits. From a company perspective, Mohanty, Mele, Mele, Russo Spenaviewed value innovation as resource integration and superior competency development; meanwhile, Setijonodescribed value innovation as “creating stakeholder value through radical (disruptive)-attractive quality”, where the logic behind it is to provide a total solution, extraordinary experiences, and cost reduction through product, service, and delivery platforms.

1. Introduction

As a key of differentiation and strategic logic of high growth, value innovation has received considerable attention from many scholars in the past two decades. The concept of value innovation was first introduced by Kim and Mauborgne in 1997 to avoid head-to-head competition and create new market spaces with irrelevant competition factors instead. Later, Kim and Mauborgne [1] developed the blue ocean strategy (BOS) as an actionable analytic tool and framework for a value innovation business approach. “Blue ocean” denotes the business opportunities of value innovation that focus on developing quantum leaps in value for customers and shareholders and creating an uncontested market that makes the competition irrelevant with the existing fiercely competitive market or “red ocean” [1].

Over the past 20 years, value innovation has been linked with many business approaches in strategic management and marketing planning fields, such as competitive advantage, superior performance, customer value, shareholder value, high profitability, and sustainable growth. Many researchers have also investigated value innovation in various research domains, including value chain, idea creation, business model adaption, process redesign, and implementation techniques. They merged blue ocean’s analytic tools with other research areas, especially strategy canvas and four action framework techniques. Such investigations and merging have resulted in the lack of conceptual clarity, in which some researchers and companies seem to address value innovation for technological breakthroughs [2,3,4,5,6], whereas others focus on organizational innovations and business marketing techniques [7,8,9,10,11,12,13,14]. Despite this divergence in researchers’ perspectives, the optimum goals of adopting value innovation remain almost similar, which is advantageous for long-term survival and success.

Recently, the rapid market transformation associated with unexpected global issues, such as COVID-19, climate change, population ageing, and critical raw materials scarcities, escalates the importance for firms to link their innovation strategies with business performance and sustainability. This gives value innovation a broader perspective of adding sustainability dimension to the mean of value for customers and shareholders. According to Yang and Jang [15], “corporate sustainability will be profitable only when the business model includes a goal of sustainability”. The improvements of a sustainability-oriented form of innovations are beyond technological changes to changes in processes, operation practices, business models, and business systems [16]. Thus, building a new value innovation business model, with the means of sustainability and the intangible resource-integration perspective, has become a necessity for a firm to enhance business performance, competitive advantage, and sustainable growth.

2. Value Innovation Front-End

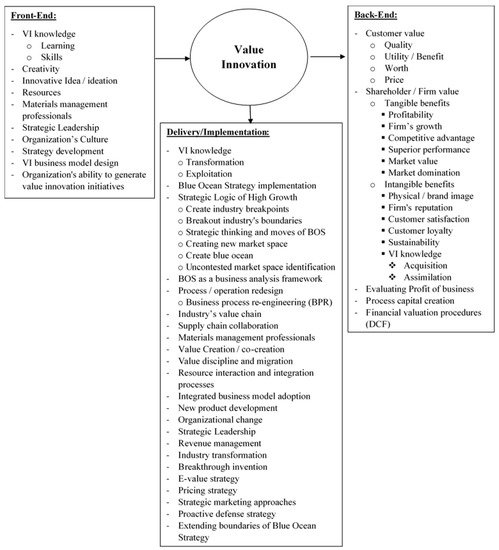

As shown in

Figure 1, value innovation front-end comprises the inputs or the pre-implementation process of value innovation. In this stage, reviewed articles focused on the capabilities and competencies of organizations to adopt value innovation strategies. This systematic review study highlighted ten value innovation inputs (

Figure 1), namely, value innovation knowledge, creativity, ideation, resources, material management professional, strategic leadership, strategy development, business model design, organization’s culture, and organizations’ ability to generate value innovation initiatives. For example, in [

8,

14,

22,

25,

39], the authors emphasized the importance of organizational knowledge competencies to develop and create value innovation. Kim and Mauborgne [

22] considered knowledge and ideas as major inputs of value innovation; they are physical and fiscal assets that fill in the gap between a firm’s market value and its tangible asset value, which can generate increasing returns through their systematic use. Mele [

25] indicated that developing value innovation begins by generating new knowledge through an effective learning system within the firm. The author linked knowledge learning, skills, and creativity by a threefold structure (know why, know how, and know what) of learning to value innovation.

Figure 1. Integrated Framework for Value Innovation.

Creativity was emphasized in Mele [

25], Tang and Tong [

62], Yang [

10], and Aboujafari, Farhadnejad [

63] works as the basis of idea generation and as significant in developing and implementing value innovation and BOS. Knowledge, creativity, and idea generation are interrelated and linked with the integration of capabilities and competencies into any value innovation development. Mele [

25], Dillon, Lee [

58], and Kulkarni and Sivaraman [

64] presented the creativity and ideation process by combining multiple resources and building on core competencies to generate new value propositions. The authors considered knowledge, creativity, and the ideation process as part of companies’ norms, in which organizational culture plays an important role.

Resources have been discussed widely in the value innovation field concerning many perspectives. Mele, Russo Spena [

26], and Kachouie and Mavondo [

12] presented value innovation as a process of resource integration to build new competencies for a new value proposition. Liao and Kuo [

65] investigated the internal and external types of resources and their role in facilitating supply chain activities, whereas tangible and intangible resources in value innovation systems were highlighted in [

53]. Moreover, many of the reviewed articles, such as [

11,

26,

31,

53,

54,

55,

63,

65,

66,

67], adopted RBV as the theoretical approach to resource combination and integration and hence value innovation.

Tang and Tong [

62] denoted organizations’ culture as the innovative spirit that infused surprises in their work. The corporate innovative culture was also reported in [

8,

10,

11,

24,

25,

39,

53,

58] as an important driver of successful value innovation that may appear in firms’ everyday activities through, for example, leadership and business strategy development [

10,

39]; imposing learning and creativity processes [

25]; behavioral change [

58]; management practices that facilitate discussion, information sharing, and experimentation [

30]. The reviewed articles also emphasized the strategy development step to configure targets and determine how to reach them. Kim and Mauborgne [

68] identified value innovation as a strategy that embraces the entire system of company activities [

27,

29]. On this basis, Kim and Mauborgne [

68] proposed the BOS, which was enhanced with analytical tools and frameworks to reframe business strategies and design value frontier. Kim and Mauborgne [

21] indicated that the difference between high-growth companies and their less successful competitors is not the analytical tool or planning model but their approach to strategy. Yang and Yang [

9], Wollmann and Tortato [

13], Xi, and Zhang [

66] emphasized business model design that integrated value innovation approach into other management, decision-making and marketing approaches to achieve their value innovation goals. Such business model integrations are advantageous to the value innovation domain because they link the field with quality management and marketing perspectives. Berghman and Matthyssens [

31], Dillon and Lee [

58] focused on evaluating companies’ ability to generate value innovation initiatives for depicting current value proposition and capture further activities.

3. Value Innovation Implementation

The majority of value innovation researchers have focused on the implementation techniques, methods, and processes of value innovation. As highlighted in

Figure 2, scholars discussed various perspectives to approach value innovation. In the implementation stage, value innovation researchers usually concentrate on transforming and using value innovation knowledge to make industrial changes to obtain value innovation and create a blue ocean [

4,

8,

22,

57,

60,

61,

69]. BOS and its analytical tools and frameworks are the most commonly used in implementing value innovation [

6,

23,

38,

59,

70,

71,

72,

73,

74]. BOS aids in developing the strategic logic of high growth by creating an industry breakpoint [

8,

24,

64], breaking out industries’ boundaries [

75], adopting strategic thinking and approach of BOS [

21,

74,

76], creating a new market space [

23,

35,

60,

73], creating blue ocean [

61,

71,

77], and identifying uncongested market space [

72]. BOS has also been used as a business analysis and evaluation framework [

6] by utilizing its strategy canvas, four actions framework, and six paths framework tools to monitor and evaluate the value curve, reconstruct buyer value elements in crafting the new value curve, and reconstruct market boundaries, respectively [

68]. Agnihotri [

27] studied the means of extending the boundaries of BOS and suggested strategy canvas to be the source of all innovation types and not only value innovation.

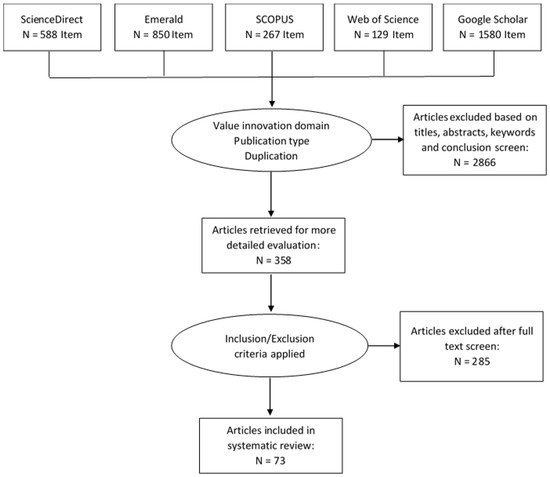

Figure 2. Systematic Review Flow Diagram.

Another method used to approach value innovation is by implementing BPR [

50,

51,

52]. Such strategy aids to redesign operation processes within organizations and restructure firms’ resources to obtain superior customer value, cost reduction, high productivity, and thus value innovation. Some value innovation scholars have focused on optimizing industries’ value chains to utilize opportunities for superior customer value at low producer cost [

4,

7,

75]. Coughlan and Fergus [

75] added value discipline and migration as combined steps with the value chain to define the path to value innovation. Accordingly, Coughlan and Fergus [

75] suggested three methods to enhance the value chain industrially: declining value added in manufacturing processes and techniques, increasing value-added in customization and customer services, and increasing value-added in product development and design. Other scholars, such as [

30,

31,

55,

65], emphasized supply chain relation and collaboration approach for value innovation. They determined that supply chain collaboration is significant to develop firms’ resources and capabilities, thereby improving their performance. In other words, the authors explored the capability of supply chain collaboration in maintaining a sustainable competitive advantage by transferring external materials, knowledge, skills, and experiences and integrate them with internal resources and capabilities to create value innovation [

30,

31,

55,

56,

64,

65].

Value creation/co-creation is a broad field that is interrelated with many domains in the management literature. In value innovation, value creation and co-creation concepts have been highlighted in association with several perspectives. In [

26], value co-creation was viewed via resource interaction and integration process, whereas the authors in [

9,

66,

78] suggested business model development to drive new value creation by value innovation. Some scholars have expressed value innovation as a combination of two different concepts of value creation and innovation [

39,

58].

In addition, new product development strategies have contributed to implementing value innovation [

6,

9,

25,

28,

79]. To approach value innovation, new product development needs to offer unprecedented value to customers that can break through the competition and create an uncontested market space. Product development has been associated with pricing strategy as an important factor for value innovation success [

21,

28,

35,

40,

61,

68]. BOS emphasized on strategic pricing to create a leap in buyers’ value and companies’ value itself in the form of profit [

68]. Therefore, the sequence of BOS of utility, price, cost, and adoption, and buyer utility map tools was built in [

68] to help firms determine their strategic price, capture the mass of target buyers, and maintain their blue ocean. Yang [

40] empirically showed that value innovation could optimize profitability by connecting value, price, and customer-perceived fairness.

Furthermore, the implementation process of value innovation is not exclusive to a particular pattern; rather, it depends on firms’ creativity and innovativeness. Reviewed articles highlighted many other approaches that seek value innovation, such as organizational change [

10,

59], leadership [

10,

24,

39,

80], revenue management [

40], industry transformation [

60,

69], breakthrough invention [

5], e-value strategy [

62], strategic marketing [

7,

12,

69,

81], strategic decision-making process [

13,

82], and proactive defense strategy [

76].

3.1. Value Innovation Back-End

The value innovation back-end is the outcomes or the fruitage that organizations aim to achieve from implementing value innovation. Although the majority of articles focused on developing customer value, it returns beneficially to a value for shareholders in general. Indeed, the core of BOS is to create a leap in value for customers and shareholders themselves [

68].

As shown in Figure 7, tThe reviewed articles emphasized on many outcomes of value innovation. During the synthesis of this systematic review, outcomes were classified into two categories, namely, customer and shareholder values [

58]. Value innovation literature has focused on customer value with regard to four dimensions of quality, utility, worth, and price [

9,

21,

25,

28,

49,

58,

74,

83]. Value innovation and its BOS apply exceptional attention on customer value, in which they seek to target the mass of customers not only by acquiring new customers but also by retaining existing customers. Thus, value innovation strives to offer an entirely new experience to customers by breaking the tradeoff between differentiation, low cost, and creating a new value curve by challenging an industry’s strategic logic and business model [

49]. Kim and Mauborgne [

49] stated that value innovation cannot be achieved only when companies can align innovation with utility, price, and cost position. Value innovation literature has also emphasized on understanding customers’ needs and willingness and developing a close relationship with them. Rabino, Gabay [

28] and Tseng, Lim [

82] demonstrated value innovation-pricing processes under various competitive conditions with regard to perceived value, customers’ expectations, and willingness to pay an additional amount of money for product usefulness. In [

9,

25,

65,

84], the authors went beyond by linking value innovation and customer value with customer satisfaction and customer loyalty; meanwhile, the authors in [

6,

81,

85] suggested a close relationship with customers by importing customer-oriented approach to value innovation.

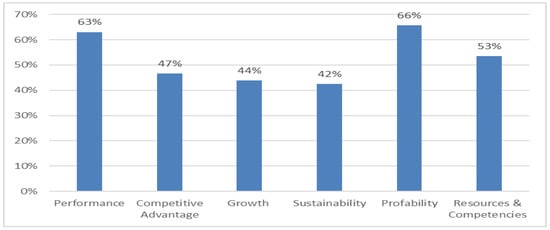

Shareholder or organization value does not only come in terms of financial returns but also in terms of building intangible resources for the firm. As highlighted in

Figure 1, shareholder value is classified into tangible and intangible values. The tangible value represents the short-term quantifiable and measurable returns of value innovation, such as profitability, firms’ growth, competitive advantage, superior performance, market value, and market domination. Profitable growth is the most popular benefit discussed in value innovation literature (

Figure 3) [

21,

35,

49,

69,

73,

75,

86,

87]. Such growth relies on two main attributes of value innovation, namely, cost process reduction and process elimination strategies; this growth aims to create a leap in shareholder value in the form of profit and create superior customer value to attract the mass of customers, generate new demand, and achieve high growth [

35]. Another attribute that scholars focused on is creating a new market space to dominate fundamentally the market by imposing the idea of blue ocean and head-to-head competition avoidance [

23,

33,

87].

Figure 3. Research Focus of Value Innovation Outcomes. The sum of data collection methods is more than 100% because some articles focused on more than one outcome.

Intangible shareholder values are interrelated with tangible benefits, which may be considered to be the root for developing any long-term intangible value. This systematic review identified several strategic intangible resources, namely, brand image, firms’ reputation, customer satisfaction and loyalty, sustainability, and knowledge (acquisition, assimilation;

Figure 1). As highlighted in the former sections, reviewed articles discussed various approaches to obtain shareholder values. Scholars, including [

26,

30,

55,

59], followed the integration of resources and capabilities to obtain a competitive advantage, whereas others [

4,

62,

86] implemented electronic value strategies to achieve sustainable competitive advantages through performance efficiency and customer satisfaction. The context of RBV has been employed to apply uniqueness and achieve a sustainable competitive advantage, market dominance, and brand image [

54,

55,

63,

66]. Integrated business models of value innovation with TQM and marketing approaches have been used to enhance customer satisfaction and loyalty [

9,

11,

39], and BPR strategy has been implemented to improve performance efficiency, thereby developing intangible values, such as physical image, reputation, and customer satisfaction and loyalty. In other words, scholars have examined many perspectives to obtain particular goals within the value innovation approach; for example, sustainability has been discussed via developing a competitive advantage, customer satisfaction and loyalty, superior performance, and firms’ reputation. In [

8,

14,

31], the authors highlighted the importance of the acquisition and assimilation of value innovation knowledge in improving firms’ experience and competency for generating value innovation initiatives.

Furthermore, value innovation has been implemented for secondary objectives, such as evaluating the profit of a business, process capital creation, and financial valuation procedure. Mina and Mohseni [

70] utilized BOS tools for assessing business profit for industrial firms. Mohanty and Deshmukh [

52] enhanced process capital creation through process redesign and BPR approach implementation. Carter and Diro Ejara [

84] demonstrated financial valuation procedures for value innovation by using DCF tools.