Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 1 by Atis Verdenhofs and Version 2 by Catherine Yang.

Green bond investments have a positive impact on carbon reduction and renewable energy supply in the EU OECD countries, and cluster analysis of the European OECD countries indicated a positive relationship between economic performance and overall social and governance (ESG) risk.

- green finance

- green bonds

- benefits

- challenges

1. Introduction

Green finance plays a vital role in achieving the Sustainable Development Goals (SDGs), especially SDG 7, in accordance with the UN Agenda 2030 [1]. Green finance projects comply with the framework of the 2015 Paris Climate Agreement, which focuses on mitigating global warming and is an important basis for the development of the global green bond market [1].

Bibliometric analysis reveals that while the previous articles are mainly related to green finance for developing countries, especially China, the latest ones are related to the risks of climate finance, green bonds and the inclusion of financial issues in the wider regions of energy emissions; these studies provide useful insights for researchers, investors, and policymakers on the importance of environmental investments in promoting economic sustainability [2][3][4][5][6][7][8][9][2,3,4,5,6,7,8,9].

Due to the growing interest and massive European movement towards a greener society and business, the term green finance is used to describe the different types of products created to support both public and private green investments, as well as initiatives and policies to endorse the execution of environmental mitigation or adaptation projects.

The task of green finance is to strategically include the financial sector in the transition to minimal carbon emissions and to solve climate problems, as well as to increase economic well-being; therefore, it mainly focuses on the environmental aspect of sustainable development [10][11][12][13][14][10,11,12,13,14].

The popularity of green finance stems from the consideration of preventing potential climate crises, making it a priority within each country’s policies and global formats for their cooperation. At the same time, the broader and more organic integration of green finance in the context of economic activity results from the awareness of economics consistency in a given time perspective, if the climate impact of economic activities is ignored, and the risks associated with climate change are not mitigated.

Between 1980 and 2021, weather and climate-related extremes caused economic losses estimated at EUR 560 billion in the EU Member States, of which EUR 56.6 billion is from 2021 alone [15].

Extensive research has been conducted analyzing the relationships between higher spending on human resources, green energy research and development, and the growth of the green economy, emphasizing the intermediary role of green finance. However, the impact of the growth of the green economy on GDP per capita differs between countries with different starting points of economic development, which has not been sufficiently studied [16][17][16,17].

Recent studies prove that green finance promotes the use of renewable energy, with incremental positive effects. However, this effect can be observed in developed countries or emerging economies with strict environmental protection and high influence of green finance [18][19][18,19]. The development of capital markets and bond markets affects the use of renewable energy [20][21][20,21]. However, in general, in recent years, green finance studies have mostly been conducted in developing countries; only a few thorough studies on European countries can be found [19][22][23][24][25][19,22,23,24,25].

2. Benefits of Green Finance

Definitions of green finance can be found in several publications—[26][45] indicates that there are very large differences between the definitions of green finance, as well as different types of organizations, economic sectors define their own indices and definitions of what is described as green finance. According to a 2016 publication by the World Bank Group [27][46], green finance could be broadly defined as “the financing of investments that provide environmental benefits”. Other researchers [28][47], while studying the evolution of green finance and its enablers, concluded that the enablers can be classified under a number of wide-ranging factors, for example, economic indicators, expansion of supervisory and governing framework, possibilities and support for investments, commitment of the governmental and other authorities to provide help and support, scientific and technological progresses, development and regulation of financial and capital market products. As mentioned in the field of investment and green financing, one of the most important green financial instruments is green bonds. Green bonds appeared in current years as a response to the severe need to assemble capital to reinforce the United Nations’ Sustainable Development Goals, as well as the objectives of the Paris Agreement. Hence, nations are proceeding towards a low-carbon and climate-resilient future, and, as a result, there is a growing need for financing solutions. Green bonds are supposed to generate and transfer capital from capital markets for various projects, including climate change mitigation and adaptation, renewable energy projects, and others [29][48]. Green bonds are built like traditional bonds—fixed-income debt instruments. An additional tendency in the market is the speeding up of sovereign green bond issuances as governments wish to advance sustainable policies and fulfil their national sustainability agendas [30][31][32][49,50,51]. The success of a green bond issue is determined by the issuer’s reputation, sufficiently good credit rating and environmental, social and governance performance [33][52]. The authors summarized the main benefits of the development of green finance and the issue of green bonds in Table 12.Table 12.

Benefits of the development of green finance and the release of green bonds.

| Issue | Benefit | Reference |

|---|---|---|

| Society (solve issues related to the environment) | Lower carbon emissions | Sangiorgi and Schopohl [24], Gianfrate and Peri [34][53], Fatica et al. [35][54], Al Mamun et al. [36][55], Huang and Zhang [37][56], Chang et al. [38][57], Koval et al. [39][58], Koziol at al. [40][59], Umar and Safi [41][60] |

| Fosters renewable energy production, utilization | Anton and Nucu [20], Huang et al. [22], Cheng et al. [42][61], Wang and Taghizadeh-Hersay [43][62] | |

| Regional development | Hou et al. [18], Huang and Zhang [37][56], Mejia-Escobar et al. [44][63] | |

| Issuers | Access to capital at lower costs | Teti et al. [45][64] |

| Stimulate technological innovations | Madaleno et al. [9] | |

| Stimulate financial performance | Du et al. [46][65] |

Table 23.

Challenges for green finance and green bond development.

| Issue | Challenges | Reference |

|---|---|---|

| Market | Macroeconomic environment | Anh Tu et al. [61][80], Torvanger et al. [62][81] |

| Investors | ||

| Diversification of investments | ||

| Liaw | [ | 7], Orzechowski and Bombol [23], Sangiorgi and Schopohl [24], Bužinskė and Stankevičienė [33][52], Gianfrate and Peri [34][53], Ferrer et al. [47][66], Hadaś-Dyduch et al. [48][67], Chopra and Mehta [49][68] |

3. Challenges of Green Finance

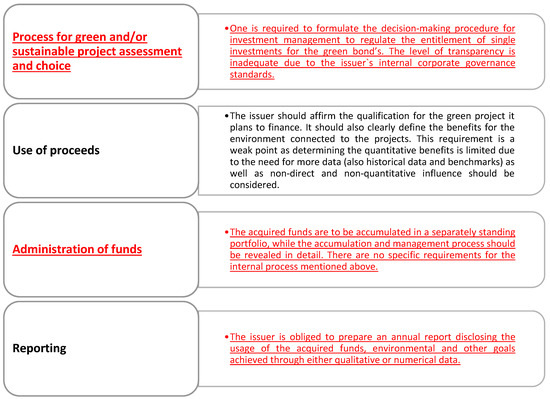

Green bonds are an essential element in achieving sustainability goals. Nevertheless, there are no common rules or standards for green bonds, bringing to life the discussion about greenwashing. The European Union (EU) Commission’s action plan on funding sustainable growth includes the framework of an EU green bond standard, methodologies for low-carbon indices, and metrics for climate-related disclosure [29][48]. In addition, the International Capital Market Association’s Green Bond Principles [59][78] and the Climate Bonds Initiative’s Climate Bond Standards [60][79] clarify whether a bond qualifies as green. As shown in Figure 13, there are four main principles that define a bond as green. Nevertheless, no specific legal requirements for issuing green bonds exist, which would hinder the transparency and market participants’ interest in such a product. Further, the authors summarize the challenges for green finance and green bonds development by splitting them into four different groups: market-, issue-, investor-, and law-related ones.

| , Ejaz et al. | ||

| [ | 63 | ][82], Doğan et al. [64][83] |

| General bond market development | Du et al. [46][65], Deschryver and De Mariz [57][76], Elsayed et al. [58][77], Torvanger et al. [62][81], Ge et al. [65][84] | |

| Greenwashing | Bužinskė and Stankevičienė [33][52], Deschryver and De Mariz [57][76] | |

| Issuers | Costs of meeting requirements | Deschryver and De Mariz [57][76], Alsmadi et al. [66][85] |

| Investors | Insufficient financial and economic benefits | Maltais and Nykvist [3], Bužinskė and Stankevičienė [33][52], Wu (2022) [68][87] |

| Lack of labelled green bond | Li et al. [56][75], Deschryver and De Mariz [57][76] | |

| Lack of green bond project impact information | Deschryver and De Mariz [57][76], Jankovic et al. [69][88] | |

| Law | Lack of regulation | Peng et al. [54][73], Pyka (2023) [67][86] |