While blockchain and distributed ledger technology offer immense potential for applications in transparency, security, efficiency, censorship resistance, and more, they have been criticized due to the energy-intensive nature of the proof of work consensus algorithm, particularly in the context of Bitcoin mining. Bitcoin’s environmental impact has been portrayed in comparison to countries (Netherlands, Ireland, Argentina) and to industries (steel, aluminum, gold, banking, Christmas lights, aviation, tumble dryers, and even the global monetary system). The former is usually preferred by critics, as it gives a sense of the scale of Bitcoin energy consumption. In contrast, the latter is usually preferred by advocates, who highlight that many industries surpass individual countries in energy consumption and this is not usually seen as a problem. Bitcoin’s environmental impact are not confined to GHG emissions but also encompass issues such as e-waste and noise pollution.

1. Introduction

The energy consumption of the Bitcoin blockchain has raised concerns about its greenhouse gas (GHG) emissions and “social license to operate”

[1][2][3][4][5][1,2,3,4,5]. In turn, this has sparked debate. While advocates argue that a higher energy consumption is associated with enhanced protocol security

[3], critics express concern over the significant carbon footprint, and a fear that it may grow further with additional Bitcoin adoption.

Nevertheless, Bitcoin (BTC) proponents make a series of claims in defense of the protocol, arguing that not only is its carbon footprint overestimated, but furthermore that the cryptocurrency could provide an environmental service through flexible load response capabilities and methane onsite neutralization

[6][7][6,7]. This could support renewable energy (RE) profitability and penetration, as well as decrease Bitcoin’s carbon footprint, and could theoretically result in

net decarbonizing additions of load.

2. Bitcoin’s Environmental Impact

Bitcoin’s energy consumption and Scope 2 carbon intensity are undeniably high compared to other systems, e.g., proof of stake (PoS)

[4][5][8][9][10][11][4,5,16,17,18,19]. However, there is disagreement regarding the most suitable data sources, metrics, and projections to account for this.

Estimates of the magnitude of Bitcoin’s energy consumption and carbon footprint vary widely. The White House Office of Science and Technology Policy

[8][16] suggests that the former ranges between 72 and 185 billion kWh per year. This is because the exact hardware used and the carbon intensity of its energy sources are hard to ascertain. On the first front, one may resort to a “top-down” approach, estimating the share of miners’ revenue spent on electricity, or a “bottom-up” approach, which estimates energy consumption based on the hash rate. The latter method is usually preferred

[12][13][20,21]. On the second front, one may calculate carbon intensity based on the grid mix corresponding to mining pools’ IP addresses, or based on first-hand data from the miners. The first method overlooks behind-the-meter (BTM), RE-based mining, and the second is vulnerable to the limitations due to self-reporting and inconsistency of accounting methods.

Bitcoin’s environmental impact has been portrayed in comparison to countries (Netherlands, Ireland, Argentina)

[8][16] and to industries (steel, aluminum, gold, banking, Christmas lights, aviation, tumble dryers, and even the global monetary system)

[2][3][14][2,3,14]. The former is usually preferred by critics, as it gives a sense of the scale of Bitcoin energy consumption. In contrast, the latter is usually preferred by advocates, who highlight that many industries surpass individual countries in energy consumption and this is not usually seen as a problem.

In addition, different denominators are used to depict Bitcoin’s share of a global magnitude. Against a share of global

electricity consumption

[2], some argue for a metric of global

energy consumption, to avoid obscuring conversion efficiencies between different energy sources in a context where Bitcoin uses an energy mix different from the grid average

[2][3][15][2,3,12]. For the same reason, denominators of global CO

2 and GHG

emissions are proposed

[8][15][12,16], also considering that climate change is a function of the latter, not the former.

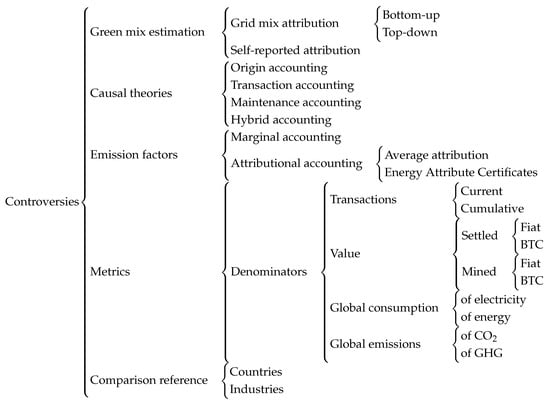

Various denominators are used to contrast carbon emissions and energy consumption with the return on value. This has led to the introduction of measuring energy consumption “per transaction”, known as “transaction accounting”. However, as Table 1 illustrates, alternatives to transaction accounting have also been developed.

For carbon accounting in particular, alternatives to transaction accounting include

origin accounting (a genealogical analysis of the historically necessary carbon emissions to produce each block),

maintenance accounting (attributing carbon footprint to the

holding of a coin, as demand for the coin incentivizes mining), and

hybrid accounting (a combination of transaction accounting, applied to emissions from the pursuit of transaction fees, and maintenance accounting, applied to emissions from the pursuit of block rewards)

[16][17][18][22,23,24].

There is also a divide between marginal accounting and attributional accounting, with the usage of each often implicitly entailing the usage of different theories of causality to Bitcoin’s impact on the energy grid and the environment

[16][19][22,25]. Marginal accounting matches before-and-after energy consumption with before-and-after carbon emissions, respectively. It succeeds at assigning additional energy consumption of the latest consumer to the additional carbon emissions subsequent to the addition of the new demand source, but may illegitimately prioritize older energy consumers over younger ones, leading to problematic conclusions in the long term, as well as failing to preserve compositionality

[16][22]. Attributional accounting, in turn, takes the totality of a grid’s (or group’s) emissions and attributes it to all its members based on some criterion—average emissions, purchase of Energy Attribute Certificates or others—thus preserving compositionality but failing to provide a before-and-after perspective.

Table 1. Various alternatives for denominators to illustrate the magnitude of Bitcoin’s energy consumption or carbon emissions, with corresponding criticisms.

Whichever theory of causality is preferred, it is crucial to apply it consistently. Claims that the introduction of miners in a grid leads to high marginal emissions are inconsistent with worldwide figures of the carbon footprint of the Bitcoin network based on attributional accounting. Similarly, if it is not legitimate for a miner to claim the average grid mix if there is a market for Energy Attribute Certificates and none have been purchased (a frequent scenario when the grid mix is highly renewable), it is not legitimate for journal articles, press, and activists to take mining pools’ IP addresses and assign to them the average emissions of the corresponding area.

The multiplicity of ways of looking at Bitcoin’s environmental impact (see

Figure 1) should always be considered, as the choice of any given methodology might significantly impact the reader’s conclusions. The upcoming introduction of carbon accounting requirements

[22][27] may provide additional insight into these debates.

Figure 1.

Different approaches to ascertaining the environmental impact of Bitcoin mining.

In addition, Bitcoin critics express concern about the potentially increasing energy requirements as Bitcoin becomes more mainstream. In short, if the demand for Bitcoin (for hoarding or for transaction settlement) increases, its price rises together with the incentive to mine. On the other hand, advocates argue that Bitcoin leads to a higher standard of living, which in turn may result in lower emissions through the environmental Kuznets curve

[3][8][3,16]. They also highlight the effect of

halvings in their projections

[2][3][15][2,3,12], which will reduce the incentive to mine. This, together with the bans in carbon-intensive countries and the expectation of efficiency gains in mining hardware is used to argue that mining emissions will peak at 1% of global emissions at worst

[3]. However, one should note that Bitcoin’s peak as a share of global emissions may proceed Bitcoin’s peak in terms of absolute energy consumption, especially if the latter peaks before the global electrification rates.

3. Net-decarbonizing Bitcoin Mining

Bitcoin mining is a flexible energy buyer however, because of its electricity price sensitivity, the interruptibility of the mining process, the portability of the infrastructure, and other characteristics that make miners a good fit to consume energy only when there is excess energy. In consequence, despite its high energy consumption, mining holds potential to drive grid decarbonization, because it could help increase the share of renewables in the grid by overcoming issues generated by variable renewable energy fluctuations in supply. The income effect suggests that mining can incentivize renewable energy expansion by purchasing excess energy, offering an additional income source, and aiding in demand-side energy grid management. The composition effect implies that low-carbon energy sources become more profitable, displacing high-carbon ones, while strategic placement of miners can alleviate grid congestion, enhancing resilience and adaptability to disruptions.

Mining can also counteract issues arising from renewable energy promotion schemes, such as subsidies, by acting as a market-based mechanism that preserves price signals. For significant support in renewable energy deployment, Bitcoin loads need to exhibit flexibility. It's crucial to continue research and implement regulatory measures to harness the strengths of Bitcoin mining in alignment with global decarbonization goals.

Encyclopedia

Encyclopedia