| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Rim Abdallah | -- | 2209 | 2024-01-22 10:25:04 | | | |

| 2 | Catherine Yang | + 4 word(s) | 2213 | 2024-01-23 02:07:53 | | | | |

| 3 | Catherine Yang | + 1 word(s) | 2214 | 2024-01-23 02:08:34 | | |

Video Upload Options

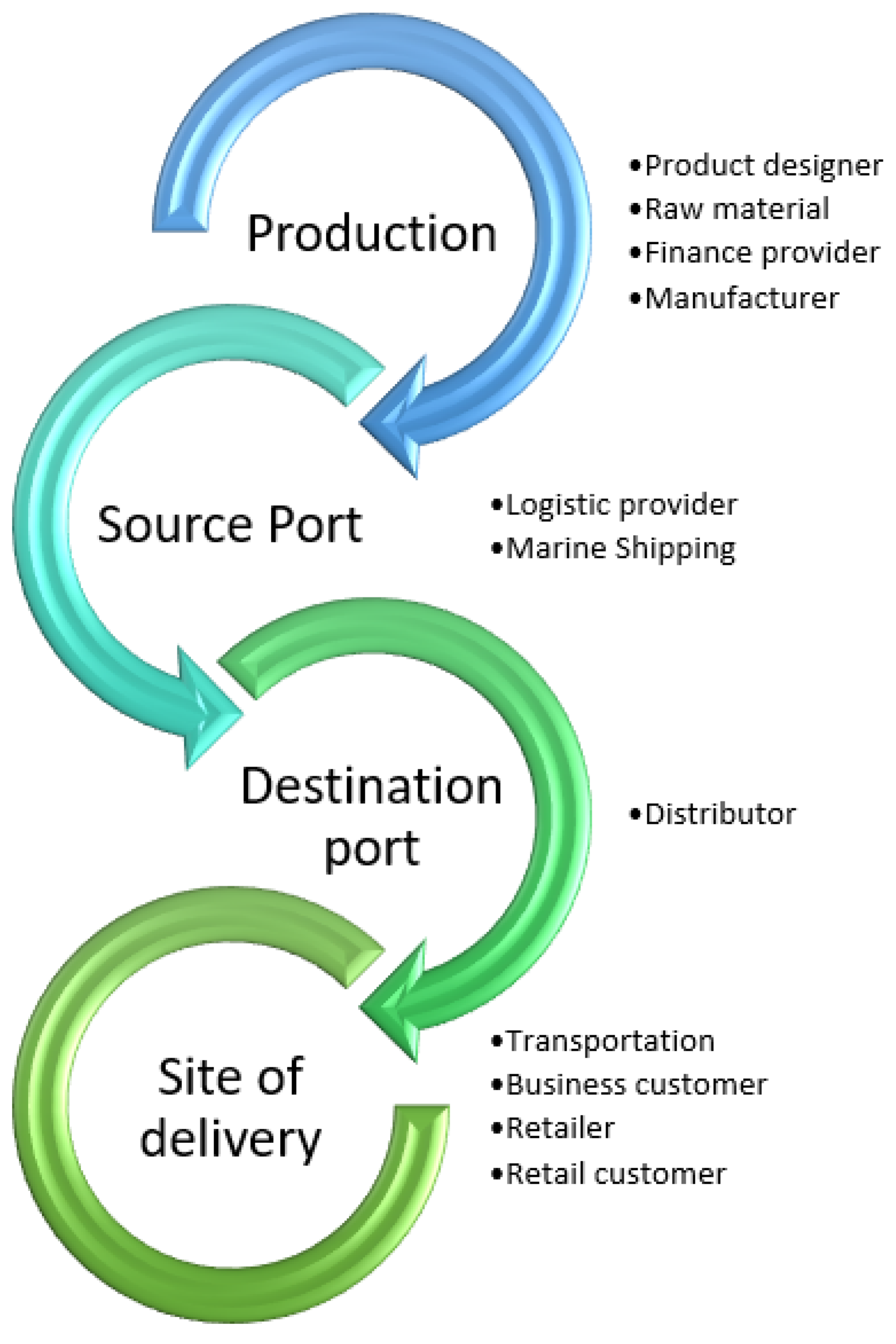

The nautical sector is progressively transitioning towards a digital framework, aiming to harness collective benefits. This evolution involves integrating disparate existing systems into more unified, scalable platforms. Yet, this shift encounters several obstacles. In response, it is proposed to employ cutting-edge technologies like blockchain, which resonate well with the industry's requisites. The study adopts a comprehensive approach, intertwining an array of sources including scholarly literature, online data, practical applications, and industry projects, to illuminate blockchain's contributions and its potential applications. It further investigate its applicability, drawing parallels and projections from other industries. Moreover, the research delves into the challenges and proposes viable solutions. This inquiry serves as an initial exploration into blockchain's integration in the maritime realm, endorsing its transformative potential. The outcomes of this study are anticipated to be valuable for academics, policy strategists, and industry professionals in the maritime field.

1. Blockchain: A maritime link

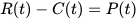

The attempts to establish new evolutionary approaches in the maritime sector retained findings and objectives set by the “industry 4.0” concepts. They aimed to achieve global interoperability by utilizing innovative technologies while maintaining a competitive edge for businesses. This was also evidenced in the new shipping business model which revolved around value.

2. A Profitable Argument

3. About Blockchain

4. Partial Recognition and Early Adopters

| Usecase | Project | Owner/Proposer | Blockchain Used | Documentation |

|---|---|---|---|---|

| Fuel quality and traceability | BunkerTrace | Blockchain labs for open collaborative and Main Blockchain Labs |

Ethereum | https://bunkertrace.co/ |

| Shipment Tracking | TradeLens | Maersk and IBM | Hyperledger Fabric | https://www.tradelens.com/ |

| GSBN | Oracle, Microsoft, AntChain and Alibaba Cloud |

AntChain | https://www.gsbn.trade/ | |

| Silsal | Abu Dhabi Port | Hyperledger Fabric | https://www.adports.ae/abu-dhabi-ports-collaborating-with-msc-mediterranean-shipping-company-on-international-blockchain-solution-silsal/ | |

| Calista | PSA International, and Global eTrade Services (GeTS) |

Not a blockchain but an intensive API delivering end-to-end data (based on blockchain concepts) |

https://calistalogistics.com/ | |

| Track and Trace hazardous goods |

(pilot project) | BLOC and Lloyd’s register foundation and rainmaking consortium project |

– | https://www.lr.org/en/latest-news/lr-foundation-bloc-establish-maritime-blockchain-lab/ |

| Smart Bill of Lading | CargoX | CargoX | Ethereum | https://cargox.io/ |

| TradeLens | Maersk and IBM | Hyperledger Fabric | https://www.tradelens.com/ | |

| Bolero’s digital trade platform |

Bolero | Volton Corda based | https://www.bolero.net/ | |

| Easy Trading Connect | Blue Water Shipping Louis Dreyfus |

Ethereum Quorum | https://www.ldc.com/press-releases/louis-dreyfus-company-ing-societe-generale-and-abn-amro-complete-the-first-agricultural-commodity-trade-through-blockchain/ | |

| (proof of concept) | Pacific International Lines ,and PSA International and IBM Singapore |

Hyperledger Fabric | https://www.globalpsa.com/psa-pil-and-ibm-conclude-a-successful-blockchain-trial-along-the-southern-trade-corridor-stc/ | |

| WAVEBL | https://wavebl.com/about/ | private blockchain | https://wavebl.com/ | |

| Tokio Marine | Tokio Marine Holdings | Corda | https://www.gtreview.com/news/fintech/insurance-blockchain-alliance-leaves-ibm-hyperledger-for-r3s-corda/ | |

| Digitization | (storage on blockchain) | DNV GL | Vechain Thor | https://www.dnv.com/assurance/certificates-in-the-blockchain.html |

| Smart Contracts | Blockconnect | 300Cubits | Ethereum | https://www.300cubits.tech/ |

| ShipChain | ShipChain | Ethereum | https://www.freightwaves.com/news/logistics-provider-shipchain-which-built-on-blockchain-shutting-down-after-big-payment-to-sec | |

| Insurance and finances | (proof of concept: maritime insurance platform) |

A.P.Møller-Maersk, Willis Towers Waston, MS Amilin, and XL Catlin |

Corda | https://www.wtwco.com/en-GB/news/2018/06/willis-towers-watson-at-the-forefront-of-blockchain-technology |

| (proof of concept: Blockchain Insurance Industry Initiative ) |

B3i Services AG | Corda | https://b3i.tech/ | |

| (enterprise-level blockchain consortium) |

RiskStream Collaborativ | Corda | https://web.theinstitutes.org/institutes-riskstream-collaborative-launches-canopy-risk-management-and-insurance-industrys-first | |

| Shipowners | Shipowner.io | Ethereum | https://shipowner.io/ | |

| Skuchain | Founded by Srinivasan Sriram | Hyperledger Fabric | https://www.skuchain.com/ | |

| Provenance | Owned by Morgan McKenney | Ethereum | https://www.provenance.io/ | |

| Tallysticks | Co-founded by Kush Patel | https://www.f6s.com/tallysticks | ||

| VGM Portal | SOLASVGM | Kuehne + Nagel Group | Hyperledger Fabric | https://newsroom.kuehne-nagel.com/kuehne–nagel-deploys-blockchain-technology-for-vgm-portal/ |

Moreover, Blockchain is still often described in the literature as a novel technology. The term novel represents the recency degree of the technology. The more recent the technology is, the more it is important to dissect it and explore not only its potential but also to understand the challenges it may face. Once challenges are known, the technology can be introduced to the ecosystem levitating the ambiguity it faces. However, the full potential of a decentralized technology such as the blockchain cannot be exploited without efforts being made in the ecosystem to ensure total coordination and widespread adoption. Therefore, the researchers re-addressed some of the challenges and brought forth additional challenges with a deeper analysis using the triangulation approach to confirm hypothetical challenges probe for solutions and analyze them. Hence, the deployment of blockchain technology will become less ambiguous as solutions are identified, listed, and analyzed for suitability.

References

- Kaplan, R.S.; Norton, D.P. The strategy map: Guide to aligning intangible assets. Strategy Leadersh. 2004, 32, 10–17.

- Ekström, L. Estimating Fuel Consumption Using Regression and Machine Learning. 2018. Available online: https://www.diva-portal.org/smash/record.jsf?pid=diva2%3A1255660&dswid=2012 (accessed on 2 October 2022).

- Abdallah, R.; Bertelle, C.; Duvallet, C.; Besancenot, J.; Gilletta, F. Blockchain Potentials in the Maritime Sector: A Survey. In Proceedings of the ICR’22 International Conference on Innovations in Computing Research, Athens, Greece, 29–31 August 2022; Springer: Berlin/Heidelberg, Germany, 2022; pp. 293–309.

- Li, Z.; Xu, M.; Shi, Y. Centrality in global shipping network basing on worldwide shipping areas. GeoJournal 2014, 80, 47–60.

- Ganne, E. Can Blockchain Revolutionize International Trade; World Trade Organization: Geneva, Switzerland, 2018.

- Botton, N. Blockchain and trade: Not a fix for Brexit, but could revolutionise global value chains (if governments let it). In ECIPE Policy Brief 1/2018; European Centre for International Political Economy: Brussels, Belgium, 2018.

- Dib, O.; Toumi, K. Decentralized identity systems: Architecture, challenges, solutions and future directions. Ann. Emerg. Technol. Comput. AETiC 2020, 4, 2516-0281.

- Abdallah, R.; Besancenot, J.; Bertelle, C.; Duvallet, C.; Gilletta, F. Assessing Blockchain Challenges in the Maritime Sector. In Proceedings of the Blockchain and Applications, 4th International Congress, L’Aquila, Italy, 12–14 July 2022; Springer: Berlin/Heidelberg, Germany, 2023; pp. 13–22.