Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | John Ormerod | -- | 2538 | 2023-10-28 13:53:37 | | | |

| 2 | Rita Xu | -8 word(s) | 2530 | 2023-10-30 02:46:30 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Ormerod, J.; Karati, A.; Baghel, A.P.S.; Prodius, D.; Nlebedim, I.C. Rare-Earth Magnets. Encyclopedia. Available online: https://encyclopedia.pub/entry/50899 (accessed on 01 March 2026).

Ormerod J, Karati A, Baghel APS, Prodius D, Nlebedim IC. Rare-Earth Magnets. Encyclopedia. Available at: https://encyclopedia.pub/entry/50899. Accessed March 01, 2026.

Ormerod, John, Anirudha Karati, Ajay Pal Singh Baghel, Denis Prodius, Ikenna C. Nlebedim. "Rare-Earth Magnets" Encyclopedia, https://encyclopedia.pub/entry/50899 (accessed March 01, 2026).

Ormerod, J., Karati, A., Baghel, A.P.S., Prodius, D., & Nlebedim, I.C. (2023, October 28). Rare-Earth Magnets. In Encyclopedia. https://encyclopedia.pub/entry/50899

Ormerod, John, et al. "Rare-Earth Magnets." Encyclopedia. Web. 28 October, 2023.

Copy Citation

Permanent magnets today are used in a wide range of transportation, industrial, residential/commercial, consumer electronics, defense, domestic, data storage, wind energy, and medical markets and applications.

rare earth elements

magnets

Nd-Fe-B

1. Rare-Earth Elements (REE): Sources, Classification, Concentration, and Refinement

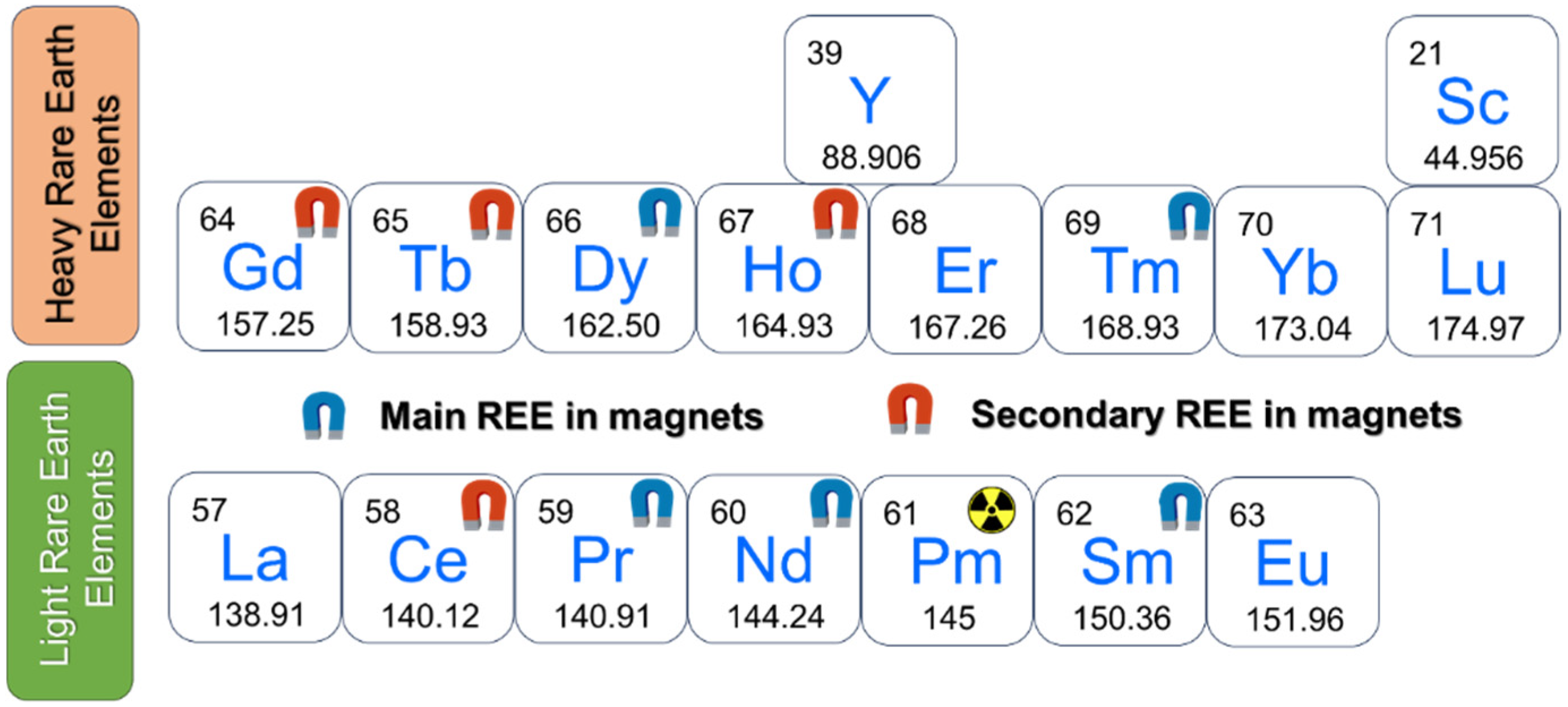

Rare-earth elements (REEs) are a group of 15 elements in the periodic table, ranging from lanthanum to lutetium, also known as lanthanides, plus scandium and yttrium. Depending on their atomic numbers, REEs can be separated into light rare-earth elements (LREEs) and heavy rare-earth elements (HREEs). LREEs include lanthanum, cerium, praseodymium, neodymium, samarium, and europium, and HREEs are defined by the suite of lanthanides that include gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium, with those elements most used in high-performance permanent magnet applications highlighted with horseshoe magnet symbols in Figure 1 [1][2][3][4][5].

Figure 1. Classification of REEs based on their application in magnets.

The REE resources can be broadly classified into primary and secondary sources. Primary REE sources are predominantly mineral ores produced by magmatic, hydrothermal, or metamorphic processes [6]. Commercial extraction of REEs is dominated by a few mineralogies, including bastnaesite, ion-adsorption clays, monazite, and xenotime, which account for over 95% of economic production. The LREEs are predominantly recovered from mineral concentrates of monazite and bastnaesite sourced from operations in China, the USA, Australia, India, and Madagascar, and to a lesser extent from the mineral loparite extracted in Russia. Most HREEs are produced from ion-adsorption clays and xenotime mineralization in Southern China, Myanmar, and Australia. Though xenotime is less abundant than other minerals, it is a primary source of HREEs, particularly dysprosium. Apatite has also been mined in its non-weathered state for REEs [1]. Table 1 shows a list of naturally occurring REE-containing ores. Bastnaesite, iimoriite, monazite, parisite, and xenotime are the ones that contain the maximum fraction of REEs [7].

Table 1. REEs containing natural ores [7].

| Mineral | Formula | REO (wt. %) |

|---|---|---|

| Allanite | (Y,Ln,Ca)2(Al,Fe3+)3(SiO4)3(OH) | 39 |

| Apatite | (Ca,Ln)5(PO4)3(F,Cl,OH) | 19 |

| Bastnaesite | (Ln,Y)(CO3)F | 75 |

| Eudialyte | Na4(Ca,Ln)2(Fe2+,Mn2+,Y)ZrSi8O22(OH,Cl)2 | 9 |

| Fergusonite | (Ln, Y)NbO4 | 53 |

| Iimoriite | Y2(SiO4)(CO3) | 68 |

| Kainosite | Ca2(Y,Ln)2Si4O12(CO3).H2O | 38 |

| Loparite | (Ln,Na,Ca)(Ti,Nb)O3 | 30 |

| Monazite | (Ln,Th)PO4 | 65 |

| Mosandrite | (Na,Ca)3Ca3Ln(Ti,Nb,Zr)(Si2O7)2(O,OH,F)4 | 33 |

| Parisite | Ca(Ln)2(CO3)3F2 | 61 |

| Rinkite | (Ca,Ln)4Na(Na,Ca)2Ti(Si2O7)2(O,F)2 | 20 |

| Steenstrupine | Na14Ln6Mn2Fe2(Zr,Th)(Si6O18)2(PO4)7.3H2O | 31 |

| Synchysite | Ca(Ln)(CO3)2F | 51 |

| Xenotime | YPO4 | 61 |

| Zircon | (Zr,Ln)SiO4 | 4 |

Secondary REE sources, on the other hand, originate from industry byproducts that otherwise end up in landfills owing to their dilute concentrations [8][9]. Furthermore, secondary sources of REEs also include electronic wastes and several other useful commercial commodities. Thus, while the idea of primary REE sources is clear, the definition of secondary sources must be clarified for consistent referencing. Researchers thus broadly classify the secondary REE sources into two major categories, namely: (a) unprocessed and (b) processed sources. The unprocessed sources are REE-containing materials without any prior commercial use. They include mine tailings, coal ash, phosphogypsum, red mud, and marine sediments [10]. Conversely, the processed sources relate to REEs that have already been used for certain applications. These include REEs in catalysts, permanent magnets, polishing materials, fluorescent and LED lamps, metal hydride batteries, and electrical appliances and other applications [11].

REE sources are also categorized based on conventional and unconventional sources. While ores containing REEs have been strictly categorized as conventional sources, mine tailings and byproducts from coal ash, apatite, and phosphates have been labeled unconventional REE sources [12]. E-waste generation, continually rising over the years, is also seen as an unconventional REE source. However, with the fast depletion of conventional REE sources, unconventional sources may become the conventional and primary sources.

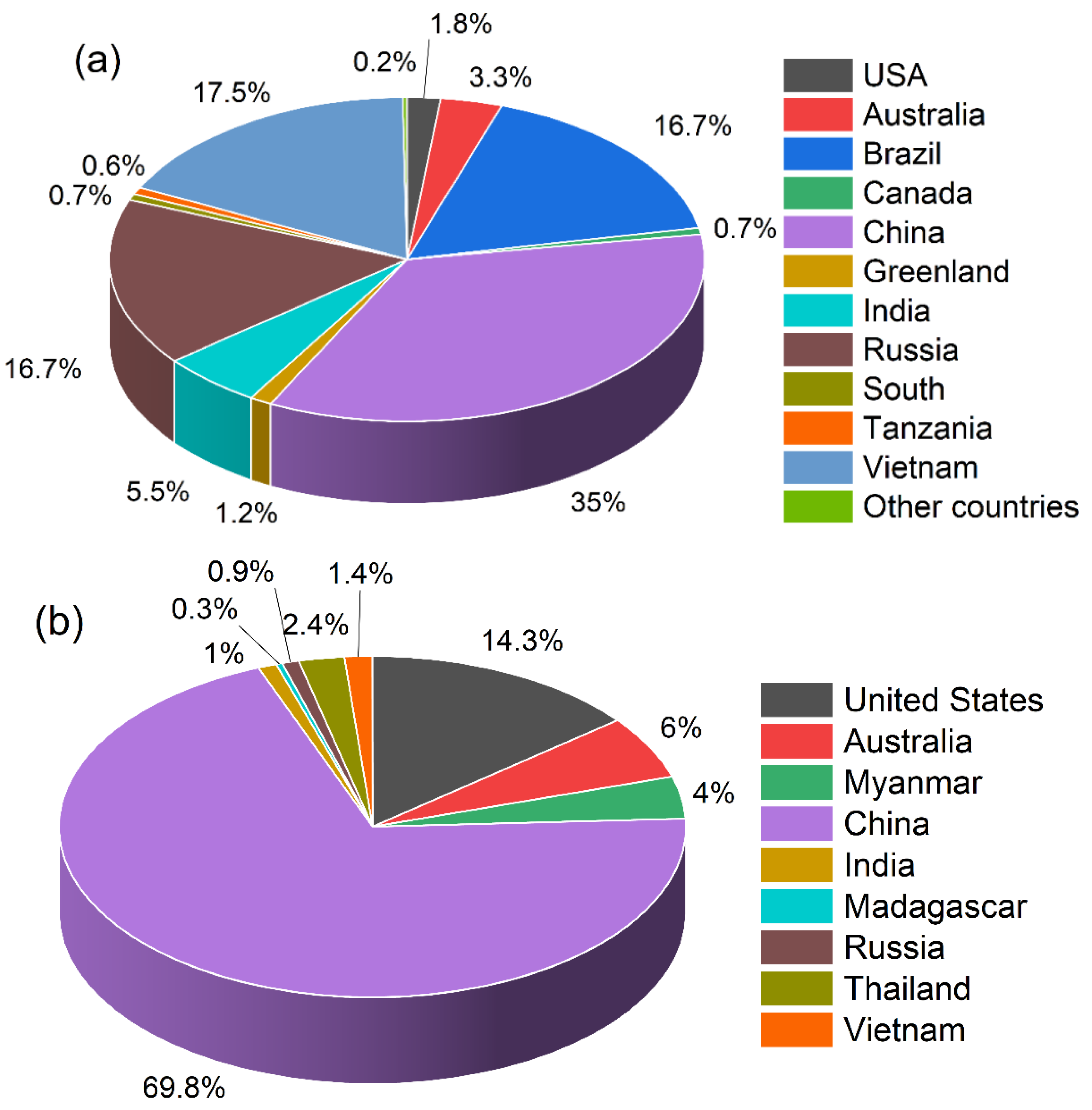

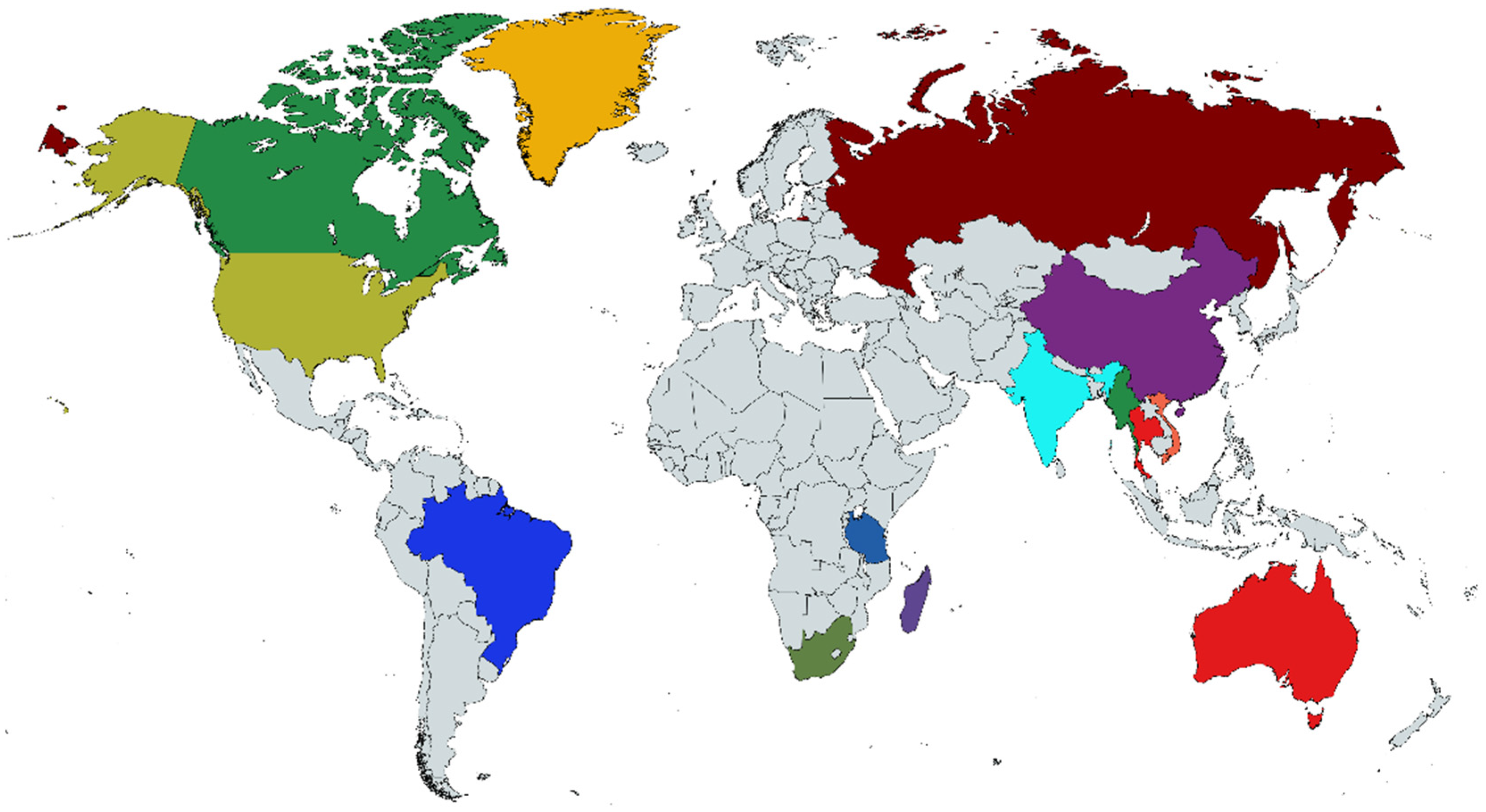

Furthermore, the primary REE sources are sparsely dispersed worldwide. A recent US Geological Survey report suggests that four countries possess more than 85% of the world’s natural REE resources [13] (Figure 2, Table 2). Figure 3 shows a global map of countries with REE reserves. Countries such as the United States are already mining their REEs at an unprecedented rate, which might bring forth the REE crisis in the coming decades [13] (Figure 2, Table 2). This has thus brought forth the idea of urban mining, which looks at recycling e-wastes to recover rare-earth resources as an alternative approach [14]. “Mining” REE from e-wastes can be more environmentally friendly than mining from virgin resources [15]. Researchers suggest demarcating REE reserves into two categories: primary and non-primary. The non-primary resources would include all the secondary and unconventional REE resources.

Figure 2. Share of (a) REE reserves and (b) mined REE worldwide.

Figure 3. World map showing countries with REE reserves as of 2023. Non-grayscale colors have no other significance than to highlight the countries indicated.

Table 2. REE reserves for different countries as of 2022 [13].

| Country | Mine Production (Tons) |

Total Reserves (Tons) |

% of Reserves Mined |

Share of World Reserves |

|---|---|---|---|---|

| United States | 43,000 | 2,300,000 | 1.87 | 1.83 |

| Australia | 18,000 | 4,200,000 | 0.43 | 3.34 |

| Brazil | 80 | 21,000,000 | 0.0004 | 16.71 |

| Myanmar | 12,000 | - | - | - |

| Canada | - | 830,000 | - | 0.66 |

| China | 210,000 | 44,000,000 | 0.48 | 35.01 |

| Greenland | - | 1,500,000 | - | 1.19 |

| India | 2900 | 6,900,000 | 0.04 | 5.49 |

| Madagascar | 960 | - | - | - |

| Russia | 2600 | 21,000,000 | 0.01 | 16.71 |

| South Africa | - | 790,000 | - | 0.63 |

| Tanzania | - | 890,000 | - | 0.71 |

| Thailand | 7100 | - | - | - |

| Vietnam | 4300 | 22,000,000 | 0.02 | 17.50 |

| Other countries | 80 | 280,000 | 0.03 | 0.22 |

Several projects are currently assessing REE from various unconventional sources that will propel countries into more self-reliance and help alleviate their need to rely on imports of such materials. Table 3 briefly lists key activities from coal byproducts and acid mine drainage to extract REEs.

Table 3. Key activities investigating the extraction of REE from coal-based products and acid mine drainage.

| S. No. | Institution | Key Goals and Findings | |

|---|---|---|---|

| 1 | University of Illinois, USA | A database of carbon ore, rare earth, and critical minerals (CORE-CM) has been developed by collecting datasets from several thousand samples along the Illinois Basin. Development of technology to aid in separating RE materials operating at or near the mine-face. |

[16] |

| 2 | University of Kansas Center for Research, USA | The commissioning of a Geotek core scanner will assess CMs in the Cherokee forest City Basin. This includes regions of Kansas, Iowa, Missouri, Nebraska, and Oklahoma, and Osage Nation. | [17] |

| 3 | Collaborative Composite Solutions Corporation, USA | Revitalize the coal production for CM assessment in the Southern Appalachian Basin. Parameters needed to determine REE security costs for the US in the coming years have been investigated. |

[18] |

| 4 | University of Texas, Austin, USA | Investigation of REE from coal mines and power plants in the US Gulf Coast Basin. Investigations found significant REE in Gibbons Creek mine (TREE: 1000–8000 ppm) and San Miguel mine (TREE: 300–900 ppm). |

[19] |

| 5 | NETL, USA | Investigation of CORE-CM in Usibelli Coal Mine and Graphite Creek in Alaska. Preliminary studies have indicated an encouraging amount of REE minerals in coal samples from the mines. |

[20] |

| 6 | LANL, USA | Quantitative investigation of REEs in coal samples using laser-induced breakdown spectroscopy (LIBS). Construction of LIBS in a backpack to quantitatively analyze the presence of REE in coal. |

[21] |

| 7 | West Virginia University, USA | Development of pilot-scale plant for treating acid mine drainage to produce RE and CMs. Extracted and separated samples demonstrate the presence of >67% HREE+CM. 807 tons of TREE production per year waste product is non-hazardous and can be disposed of on-site. |

[22] |

| 8 | Florida Polytechnic University, USA | Extract REE from phosphoric acid sludge. Demonstrated extraction of 90% REE and 100% heavy REEs. Planned production capacity of 900 to 1100 tons of REM per year. |

[23] |

| 9 | Institute of Environmental Assessment and Water Research, Spain | 7.9 and 3.5 mg/L REE and Y concentrations obtained from Monte Romero and Almagrera acid mine drainage. REE includes predominantly La and Ce. |

[24] |

| 10 | Institute of Earth Sciences, Germany | 1.8 and 2.5 mg/L concentrations of REE detected in Giessenbach Creek. Higher concentrations of middle and heavy REEs were detected. |

[25] |

| 11 | Universidade de Aveiro, Portugal | 110, 120, and 124 mg/kg of REE located in Lousal mine area in the Iberian Pyrite Belt, Portugal. 14–20 mg/kg of HREE detected. |

[26] |

| 12 | IIT Kharagpur, India | 0.71 mg/L of REE detected in mine drainage from Jaintia Hills coalfields, India. | [27] |

| 13 | University of Huelva, Spain | Origin of REE traced in acid mine drainage from the Iberian Pyrite Belt (SW Spain). 20–30 mg/kg of REE detected in Felsic volcanic from Poderosa mine. 20–30 mg/kg of REE detected in Shales from the Perrunal mine. |

[28] |

Concentrates of REE minerals are exclusively processed into refined products, either as mixed/semi-separated compounds or individual rare-earth compounds. Most refining occurs within China, Malaysia, Russia, and India, with small amounts separated in Vietnam, Norway, and Australia. Refined REEs have a range of end uses, but increasingly, high-powered permanent magnet applications dominate the sales value of REEs. Today, the REEs used in permanent magnets (Nd, Pr, Dy, and Tb) account for over 90% of the value of all REEs processed [6].

Over 50% of REE demand has historically come from China, other Asian countries, Australia, and North America. Under this context, global demand for REEs increased from below 157 kt of rare-earth oxide (REO) in 2017 to 256 kt REO in 2020, expecting to reach 305 kt REO by 2025 [29]. Due to the 2019 COVID-19 pandemic and its effects, the REE market contracted by 1% in 2020; however, its overall increase in demand has seen REE consumption reach record highs, enhanced mainly by rapid growth in permanent magnet applications [30][31]. In 2022 and early 2023, China still accounted for 70% of REE production and 90% of processing [32]. In general, REEs’ demand will be increasingly driven by their use in permanent magnets for the electrification of transport and the transition to renewable energy generation. This is evident from the more than 40% increase in refined REEs for permanent magnets between 2020 and early 2023 [32]. Simultaneously, the transitioning away from fossil fuels in transport and energy generation will reduce the REE demand from catalyst applications in both petroleum processing and emissions control systems for passenger and commercial vehicles [33].

Permanent magnet applications play a critical role in supporting the energy transition. Transport, energy-efficient equipment, and energy generation applications will cause significant growth in the demand for key magnet elements, with Nd and Pr being the most impacted, as they are the main rare-earth constituents of Nd-Fe-B alloys by volume. Short-term demand growth for Tb and Dy will accelerate in the period to 2030 before slowing, as the development of new magnet designs and production methods reduce the required HREE intensity in high-performance magnets. Replacement of some Nd-Pr by La and Ce tends to reduce the performance of the magnets, which may be unsuitable for the highest growth markets, such as automotive drivetrains. Using La and Ce in such mid- to low-quality magnets can increase their demand in the future.

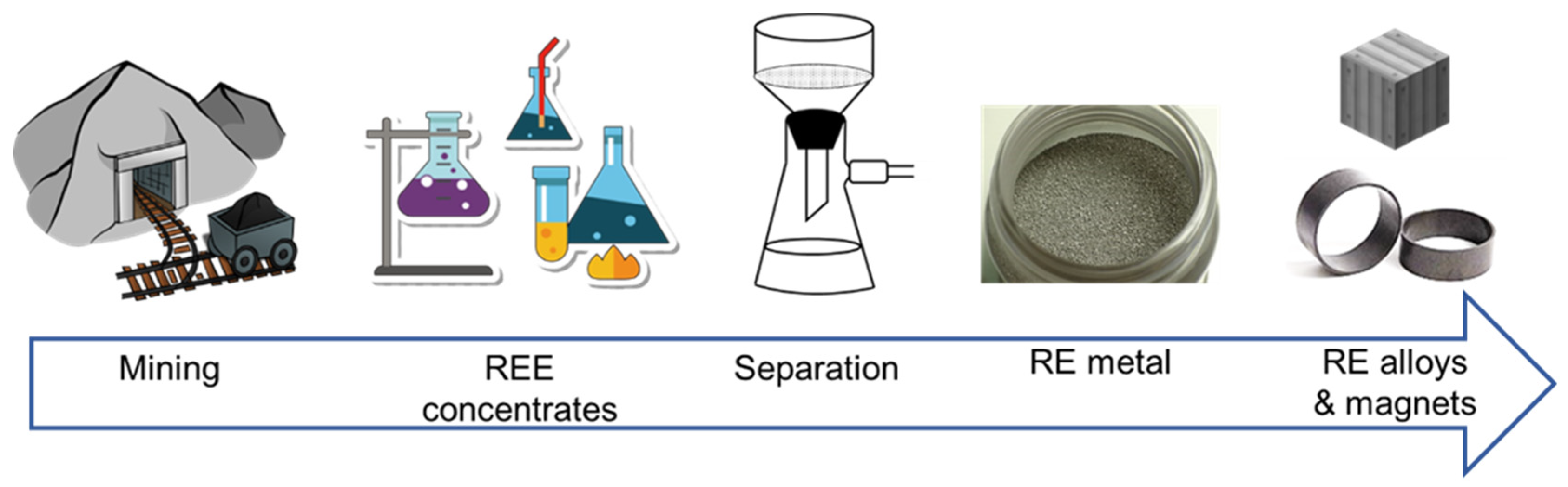

Once mined, RE minerals are processed into concentrates containing multiple REEs, which need to be separated from each other (Figure 4), typically by solvent extraction. REEs are chemically very similar, so separation often requires a series of extractions using multiple solvents to separate desired individual or compound REEs. This step in the process involves large amounts of acid, water, and radioactive byproducts, so obtaining adequate solvents and treatment of waste are significant cost drivers. REOs must be further refined or reduced to metal before they can be used for magnet production (Figure 4). Electrowinning is the most common process for converting REOs into their metallic state, while ensuring low-impurity contents, particularly oxygen, nitrogen, and carbon [33][34].

Figure 4. Steps in the processing and refinement of REEs.

2. Rare-Earth Permanent Magnets and Applications

The special technological importance of permanent magnets derives from their ability to produce a magnetic field, making them suitable for various transportation, industrial, residential/commercial, consumer electronics, defense, information technology, power generation, and medical applications. Unlike electromagnets that require a continuous electrical current to be supplied to generate a magnetic field and function as a source of magnetic flux [31][35][36], permanent magnets provide a magnetic flux with no external energy input.

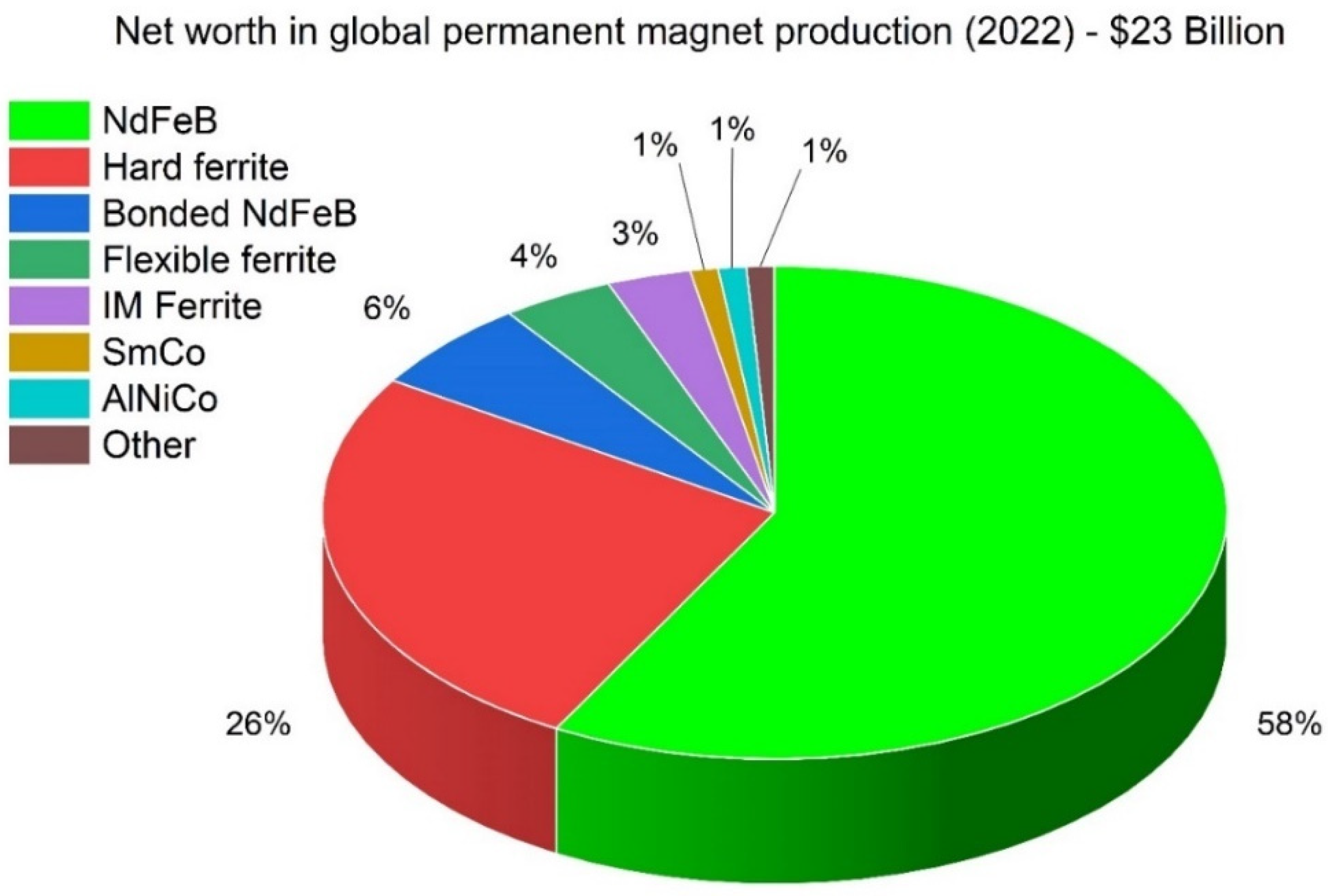

Not all permanent magnets utilize REEs. There are four general classifications of permanent magnets, each with a range of performance metrics and typical end-uses, and these include ferrite, alnico, samarium-cobalt (Sm-Co), and neodymium-iron-boron (Nd-Fe-B). Nd-Fe-B-based magnets are the backbone of expansion in alternative energies, although their performance at high operating temperatures is limited. This limitation is typically overcome by adding Dy or Tb, which increases the coercivity and performance at higher temperatures. Several extensive reviews are available that cover the history of REE permanent magnet development [37][38][39][40][41][42][43]. Nd-Fe-B magnets typically contain around 32 wt.% of REEs, principally, Nd and Pr, plus Dy and Tb for higher-temperature performance. Figure 5 shows the estimated global production of permanent magnets by material type [31].

Figure 5. Global permanent magnet production by value in 2022.

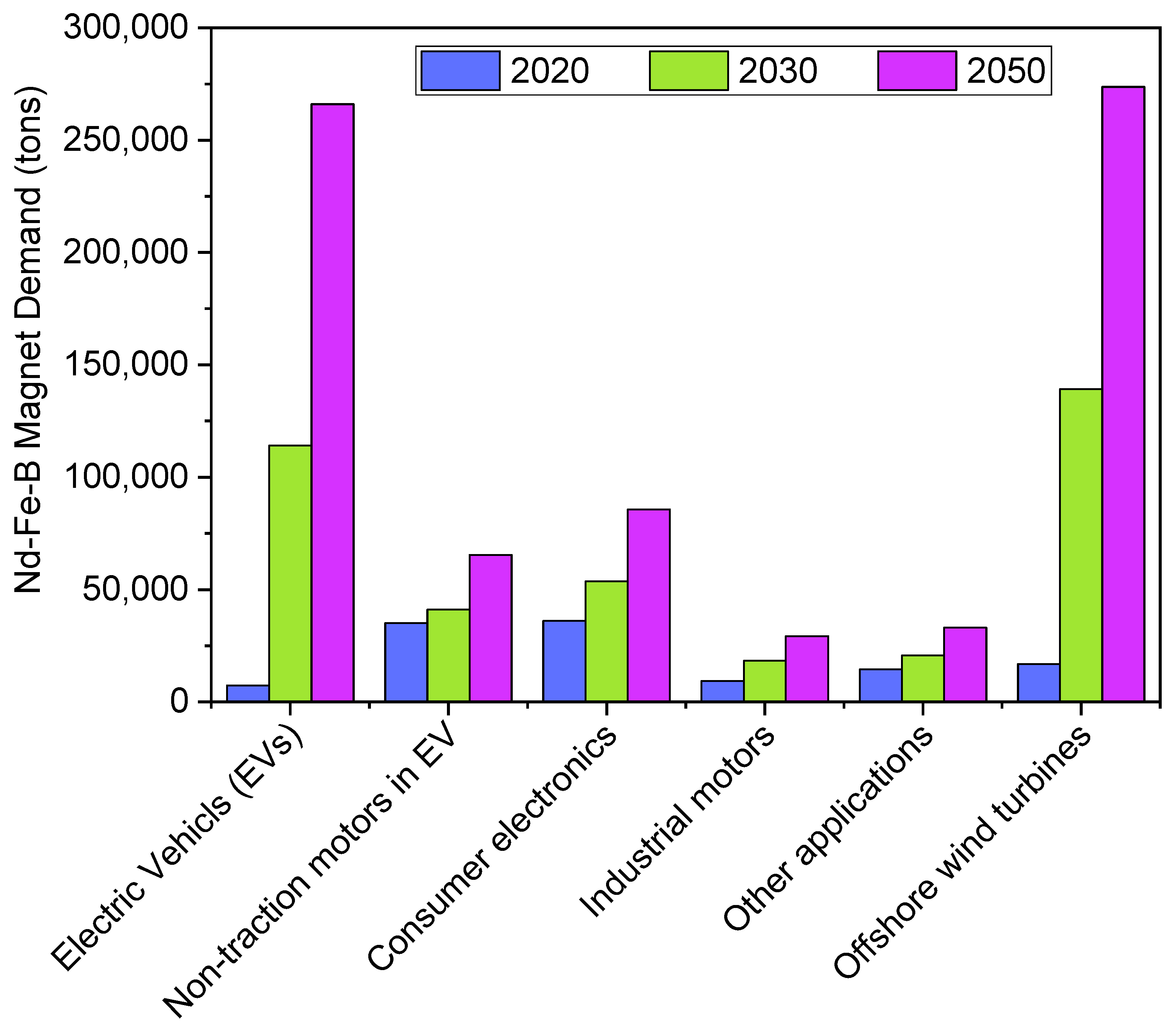

Together, the ferrite- and Nd-Fe-B-based magnets account for over 90% of the global production of permanent magnets. Despite the significant difference in magnetic performance between the two materials, their respective price-to-magnetic performance ratio is extremely favorable compared to all other material options. The high energy density of Nd-Fe-B makes them the magnet of choice for many energy-efficient and renewable energy applications, e.g., EV drivetrain motors, wind power generators, and HVAC (heating, ventilation, and air conditioning) units. Consequently, the market for these magnets is forecast to grow from 200,000 tons per year in 2022 to 450,000 tons in 2030 [31]. The details, by major markets, are shown below in Figure 6.

As can be seen, the growth in demand is largely driven by renewable energy applications. Unfortunately, the major REEs used, namely Nd and Pr, and for higher-temperature applications, Dy and Tb, are forecast to be in short supply, considering these aggressive demand forecasts. For example, the Adamas Intelligence forecast indicates that by 2040, the undersupplies of Nd-Pr, Dy, and Tb oxides will reach 90 kt, 1.8 kt, and 0.45 kt, respectively [44]. Nd-Fe-B magnets are forecast to grow at a CAGR of over 10% throughout this decade, largely driven by the growth in electric vehicles of all types. Several market studies are predicting that combined production of electric vehicles and hybrid electric vehicles (EVs/HEVs) will be in the range of 50 to 100 million units produced annually by 2030. Current EV/HEV motors contain, on average, 1.8 kg of Nd-Fe-B-based magnet material per vehicle [45]. This equates to over 90,000 mt of Nd-Fe-B magnet material at the low end of the forecast consumption for this one application in 2030. The preferred motor type used in EV traction drives is the interior permanent magnet (IPM) design. In this design, the magnets are installed into slots in the laminated rotor [45].

Figure 6. Major growth markets for Nd-Fe-B magnets through 2030.

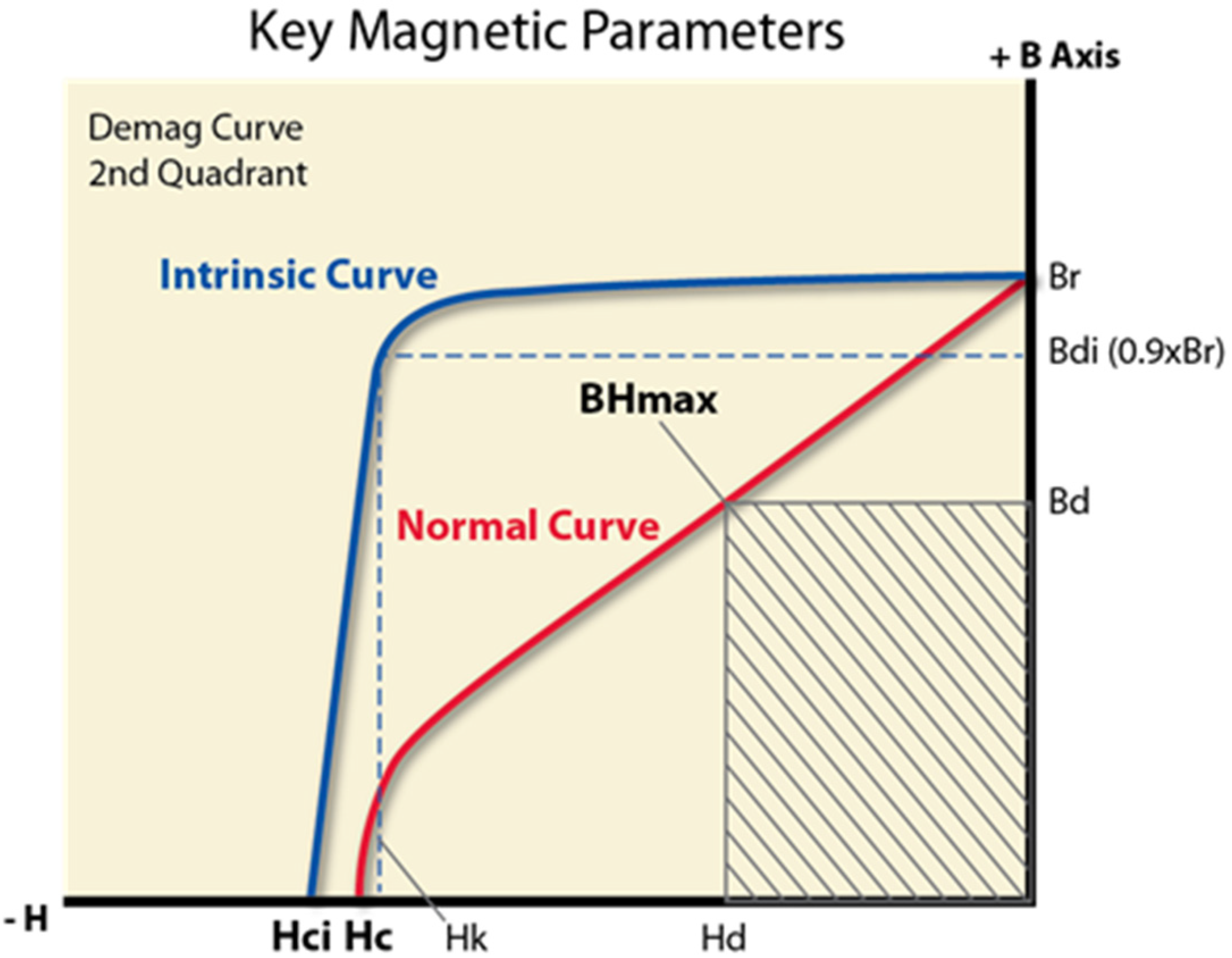

It is generally accepted that the magnetic parameter, maximum-energy product (BH)max, is the best all-round single indicator of permanent magnet performance. From the first principles, it can be shown that for a magnetic circuit containing an airgap, the energy stored in the field in the air gap is directly proportional to the product of flux density, B, and the corresponding field strength, H, at any point on the second-quadrant normal demagnetization curve, as shown in Figure 7 below [46]. The maximum value of this product, i.e., (BH)max, or the maximum-energy product, can be directly related to the maximum energy that can be generated with a permanent magnet [47].

Figure 7. Second−quadrant demagnetization curves.

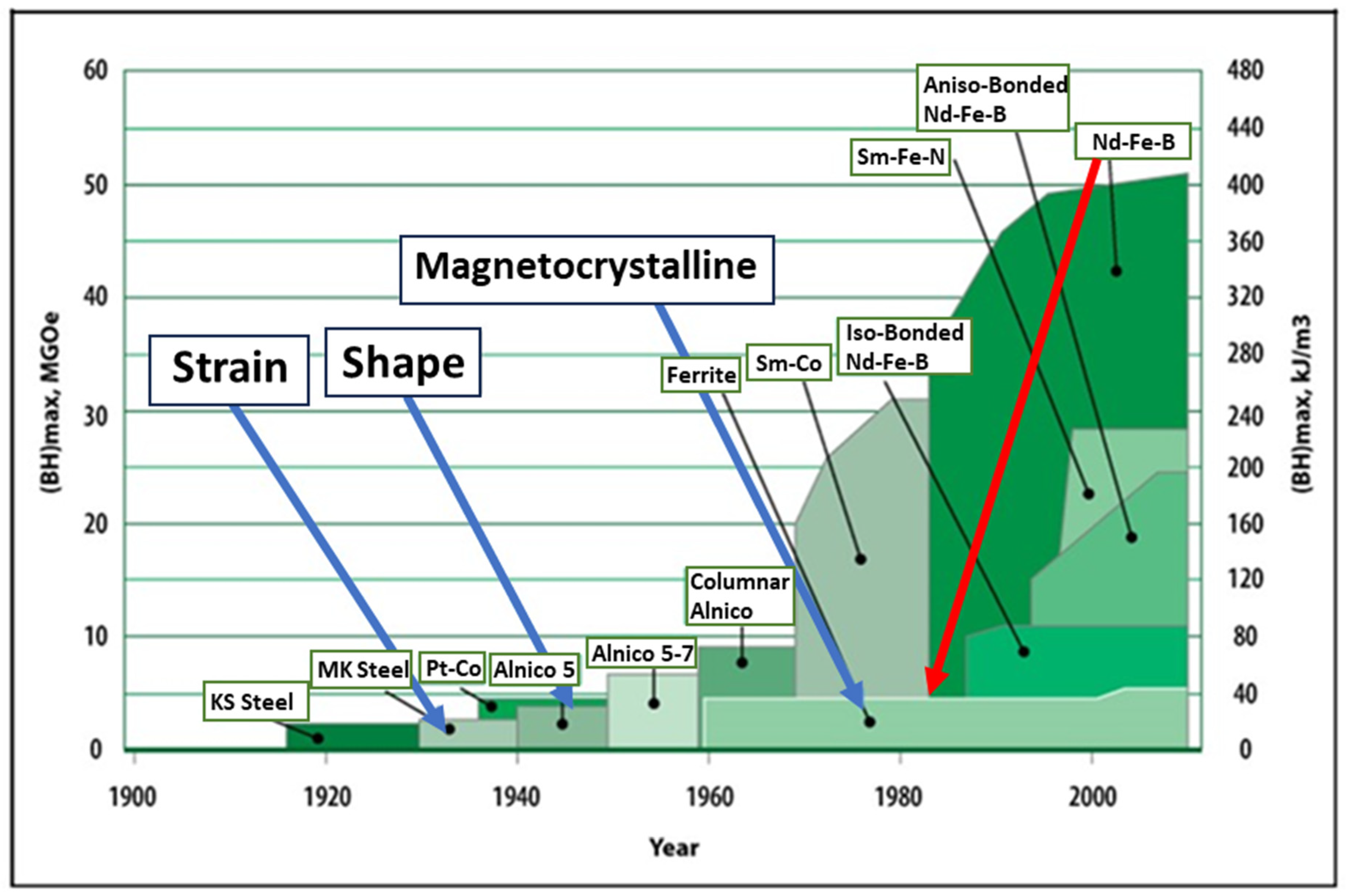

The following chart (Figure 8) shows the historical development and commercialization of permanent magnets based on their maximum-energy product, (BH)max. This chart clearly demonstrates the improvement in magnetic performance, beginning with magnet steels in the early 1900s, to alnico’s, and finally, hard ferrites and rare-earth magnets. It is now over 40 years since the US announcement of Nd-Fe-B magnets at the 29th MMM conference held in Pittsburgh, PA, in November 1983 [22]. It is interesting to note that since the discovery and introduction of Nd-Fe-B magnets, no major new sintered permanent magnet material has been introduced.

Figure 8. Historical development of permanent magnets.

References

- Rare Earth Elements: Frequently Asked Questions. Available online: https://www.woodmac.com/news/editorial/rare-earth-elements-frequently-asked-questions/ (accessed on 6 July 2023).

- Securing America’s Clean Energy Supply Chain. Available online: https://www.energy.gov/policy/securing-americas-clean-energy-supply-chain (accessed on 6 July 2023).

- Critical Materials for The Energy Transition: Rare Earth Elements. Available online: https://www.irena.org/Technical-Papers/Critical-Materials-For-The-Energy-Transition-Rare-Earth-elements (accessed on 6 July 2023).

- Binnemans, K.; Jones, P.T.; Müller, T.; Yurramendi, L. Rare Earths and the Balance Problem: How to Deal with Changing Markets? J. Sustain. Metall. 2018, 4, 126–146.

- Rare Earth Elements. Available online: https://web.mit.edu/12.000/www/m2016/finalwebsite/elements/ree.html (accessed on 23 July 2023).

- Balaram, V. Rare Earth Elements: A Review of Applications, Occurrence, Exploration, Analysis, Recycling, and Environmental Impact. Geosci. Front. 2019, 10, 1285–1303.

- Dostal, J. Rare Earth Element Deposits of Alkaline Igneous Rocks. Resources 2017, 6, 34.

- Reck, B.K.; Graedel, T.E. Challenges in Metal Recycling. Science 2012, 337, 690–695.

- Du, X.; Graedel, T.E. Uncovering the Global Life Cycles of the Rare Earth Elements. Sci. Rep. 2011, 1, 145.

- Balaram, V. Potential Future Alternative Resources for Rare Earth Elements: Opportunities and Challenges. Minerals 2023, 13, 425.

- Gaustad, G.; Williams, E.; Leader, A. Rare Earth Metals from Secondary Sources: Review of Potential Supply from Waste and Byproducts. Resour. Conserv. Recycl. 2021, 167, 105213.

- Peiravi, M.; Dehghani, F.; Ackah, L.; Baharlouei, A.; Godbold, J.; Liu, J.; Mohanty, M.; Ghosh, T. A Review of Rare-Earth Elements Extraction with Emphasis on Non-Conventional Sources: Coal and Coal Byproducts, Iron Ore Tailings, Apatite, and Phosphate Byproducts. Min. Metall. Explor. 2021, 38, 1–26.

- Mineral Commodity Summaries 2023. Available online: https://pubs.usgs.gov/publication/mcs2023 (accessed on 8 September 2023).

- Javed, A.; Singh, J. Process Intensification for Sustainable Extraction of Metals from E-Waste: Challenges and Opportunities. Environ. Sci. Pollut. Res. 2023, 1–34.

- Zeng, X.; Mathews, J.A.; Li, J. Urban Mining of E-Waste Is Becoming More Cost-Effective Than Virgin Mining. Environ. Sci. Technol. 2018, 52, 4835–4841.

- Illinois Basin Carbon Ore, Rare Earth, and Critical Minerals Initiative. Available online: https://netl.doe.gov/node/11905 (accessed on 6 July 2023).

- Critical Minerals in Coaly Strata of the Cherokee-Forest City Basin. Available online: https://netl.doe.gov/node/11894 (accessed on 6 July 2023).

- Manufacturing Valuable Coal-Derived Products in Southern Appalachia. Available online: https://netl.doe.gov/node/11892 (accessed on 6 July 2023).

- Assessment of Rare Earth Elements and Critical Minerals in Coal and Coal Ash in the U.S. Gulf Coast. Available online: https://netl.doe.gov/node/11895 (accessed on 6 July 2023).

- Bringing Alaska’s CORE-CM Potential into Perspective. Available online: https://netl.doe.gov/node/11890 (accessed on 6 July 2023).

- Clegg, S.M.; Alamos, L. Evaluation of Laser-Based Analysis of Rare Earth Elements in Coal-Related Materials. Available online: https://netl.doe.gov/sites/default/files/netl-file/20VPRREE_Clegg.pdf (accessed on 7 July 2023).

- Ziemkiewicz, P.; Noble, A.; Tech, V.; Quaranta, J.; Lian, W.; Lin, S.; Finklea, H. Development and Testing of an Integrated AMD/REE-CM Plant. Available online: https://netl.doe.gov/sites/default/files/netl-file/20VPRREE_Ziemkiewicz.pdf (accessed on 6 July 2023).

- Zhang, P. Technology Development, and Integration for Volume Production of High Purity Rare Earth Metals from Phosphate Processing DE-FE0032123. Available online: https://netl.doe.gov/sites/default/files/netl-file/22RS-26_Zhang.pdf (accessed on 7 July 2023).

- Ayora, C.; Macías, F.; Torres, E.; Lozano, A.; Carrero, S.; Nieto, J.M.; Pérez-López, R.; Fernández-Martínez, A.; Castillo-Michel, H. Recovery of Rare Earth Elements and Yttrium from Passive-Remediation Systems of Acid Mine Drainage. Environ. Sci. Technol. 2016, 50, 8255–8262.

- Merten, D.; Geletneky, J.; Bergmann, H.; Haferburg, G.; Kothe, E.; Büchel, G. Rare Earth Element Patterns: A Tool for Understanding Processes in Remediation of Acid Mine Drainage. Geochemistry 2005, 65, 97–114.

- Ferreira da Silva, E.; Bobos, I.; Xavier Matos, J.; Patinha, C.; Reis, A.P.; Cardoso Fonseca, E. Mineralogy and Geochemistry of Trace Metals and REE in Volcanic Massive Sulfide Host Rocks, Stream Sediments, Stream Waters and Acid Mine Drainage from the Lousal Mine Area (Iberian Pyrite Belt, Portugal). J. Appl. Geochem. 2009, 24, 383–401.

- Sahoo, P.K.; Tripathy, S.; Equeenuddin, S.M.; Panigrahi, M.K. Geochemical Characteristics of Coal Mine Discharge Vis-à-Vis Behavior of Rare Earth Elements at Jaintia Hills Coalfield, Northeastern India. J. Geochem. Explor. 2012, 112, 235–243.

- León, R.; Macías, F.; Cánovas, C.R.; Millán-Becerro, R.; Pérez-López, R.; Ayora, C.; Nieto, J.M. Evidence of Rare Earth Elements Origin in Acid Mine Drainage from the Iberian Pyrite Belt (SW Spain). Ore Geol. Rev. 2023, 154, 105336.

- Rare Earth Oxide Demand Worldwide 2025. Available online: https://www.statista.com/statistics/1114638/global-rare-earth-oxide-demand/ (accessed on 6 September 2023).

- Rare Earth Magnet Market Outlook to 2035—Adamas Intelligence. Available online: https://www.adamasintel.com/rare-earth-magnet-market-outlook-to-2035/ (accessed on 6 July 2023).

- Global Permanent Magnet Industry Report. Available online: https://www.magnetreport.com/ (accessed on 6 July 2023).

- Critical Minerals Market Review 2023. Available online: https://www.iea.org/reports/critical-minerals-market-review-2023 (accessed on 6 September 2023).

- Metal Production by Salt Electrolysis. Available online: https://www.eurare.org/technologies/REE-metal-production.html (accessed on 6 July 2023).

- World Energy Transitions Outlook 2022. Available online: https://www.irena.org/Digital-Report/World-Energy-Transitions-Outlook-2022 (accessed on 6 July 2023).

- Croat, J.J.; Ormerod, J.G. Modern Permanent Magnets; Woodhead Publishing: Sawston, UK, 2022; ISBN 9780323886581/9780323886406.

- Rare Earth Magnets: Yesterday, Today and Tomorrow. Available online: https://www.slideshare.net/JohnOrmerod/2019-01-17-magnetics-2019 (accessed on 6 July 2023).

- Dushyantha, N.; Batapola, N.; Ilankoon, I.M.S.K.; Rohitha, S.; Premasiri, R.; Abeysinghe, B.; Ratnayake, N.; Dissanayake, K. The Story of Rare Earth Elements (REEs): Occurrences, Global Distribution, Genesis, Geology, Mineralogy and Global Production. Ore Geol. Rev. 2020, 122, 103521.

- Nesbitt, E.A.; Wernick, J.H. Rare Earth Permanent Magnets; Academic Press: New York, NY, USA, 1973.

- Strnat, K.J.; Strnat, R.M.W. Rare Earth-Cobalt Permanent Magnets. J. Magn. Magn. Mater. 1991, 100, 38–56.

- Menth, A.; Nagel, H.; Perkins, R.S. New high-performance permanent magnets based on rare earth-transition metal compounds. Annu. Rev. Mater. Res. 1978, 8, 21–47.

- Livingston, J.D. Chalmers Anniversary Volume, 1st ed.; Christian, J.W., Haasen, P., Massalski, T.B., Eds.; Pergamon Press: Oxford, UK, 1981; pp. 243–268.

- Ormerod, J. The Physical Metallurgy and Processing of Sintered Rare Earth Permanent Magnets. J. Less-Common Met. 1985, 111, 49–69.

- Strnat, K.J. Modern permanent magnets for applications in electro-technology. Proc. IEEE 1990, 78, 923–946.

- Rare Earth Magnet Market Outlook to 2040. Available online: https://www.adamasintel.com/rare-earth-magnet-market-outlook-to-2040/ (accessed on 6 September 2023).

- Smith, B.J.; Riddle, M.E.; Earlam, M.R.; Iloeje, C.; Diamond, D. Rare Earth Permanent Magnets: Supply Chain Deep Dive Assessment; USDOE Office of Policy: Washington, DC, USA, 2022.

- Cullity, B.D. Introduction to Magnetic Materials; Addison-Wesley Pub. Co.: Reading, MA, USA, 1972.

- Additive Manufacturing of Permanent Magnets. Available online: https://www.sigmaaldrich.com/US/en/technical-documents/technical-article/materials-science-and-engineering/nanoparticle-and-microparticle-synthesis/additive-manufacturing-of-permanent-magnets (accessed on 6 September 2023).

More

Information

Subjects:

Metallurgy & Metallurgical Engineering

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

2.1K

Revisions:

2 times

(View History)

Update Date:

30 Oct 2023

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No