Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Mohammad Hashemi-Tabatabaei | -- | 8159 | 2023-05-30 11:40:46 | | | |

| 2 | Alfred Zheng | Meta information modification | 8159 | 2023-05-31 04:53:10 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Amiri, M.; Hashemi-Tabatabaei, M.; Keshavarz-Ghorabaee, M.; Antucheviciene, J.; Šaparauskas, J.; Keramatpanah, M. Digital Banking Implementation Indicators in Industry 4.0. Encyclopedia. Available online: https://encyclopedia.pub/entry/45003 (accessed on 07 February 2026).

Amiri M, Hashemi-Tabatabaei M, Keshavarz-Ghorabaee M, Antucheviciene J, Šaparauskas J, Keramatpanah M. Digital Banking Implementation Indicators in Industry 4.0. Encyclopedia. Available at: https://encyclopedia.pub/entry/45003. Accessed February 07, 2026.

Amiri, Maghsoud, Mohammad Hashemi-Tabatabaei, Mehdi Keshavarz-Ghorabaee, Jurgita Antucheviciene, Jonas Šaparauskas, Mohsen Keramatpanah. "Digital Banking Implementation Indicators in Industry 4.0" Encyclopedia, https://encyclopedia.pub/entry/45003 (accessed February 07, 2026).

Amiri, M., Hashemi-Tabatabaei, M., Keshavarz-Ghorabaee, M., Antucheviciene, J., Šaparauskas, J., & Keramatpanah, M. (2023, May 30). Digital Banking Implementation Indicators in Industry 4.0. In Encyclopedia. https://encyclopedia.pub/entry/45003

Amiri, Maghsoud, et al. "Digital Banking Implementation Indicators in Industry 4.0." Encyclopedia. Web. 30 May, 2023.

Copy Citation

Extensive technological changes brought about by Industry 4.0 have changed the behaviors and attitudes of customers and created new needs for them. The digital transformation of banking encompasses a wide range of services, such as document digitization, electronic signatures for transactions, e-learning, teleconferencing, online trading platforms, digital stores, e-statements, and mobile payments. Adopting new business models through the digital transformation of banking operations is the most appropriate approach for banking institutions in today’s economic environment.

multi-criteria decision-making (MCDM)

best–worst method (BWM)

Industry 4.0

digital banking

Banking 4.0

service quality (SERVQUAL)

1. Introduction

Extensive technological changes brought about by Industry 4.0 have changed the behaviors and attitudes of customers and created new needs for them. Due to the emergence of technologies such as the Internet, broadband, social networks, data processing solutions, cloud computing, and digital transformations, these new customers have higher expectations of their bank and are looking for convenience, personalized products, and coverage of their daily needs [1]. With the widespread use of new digital technologies and the emergence of new malicious threats, service-oriented business models and processes have been evolved in all sectors and business rules have changed [2]. Digitalization does not necessarily mean that all companies must have high-level technologies, although it conveys the message that in the not-so-distant future, businesses that invest efficiently in digital services that create value for customers and improve the operational agility of customer services will be market leaders [3].

On the other hand, with the increase in the activities of banks, the emergence of new competitors in the industry, and the increase in the complexity of economic variables and society’s needs, the importance of defining goals and developing new banking programs has increased. Banks are customer-oriented organizations and deal with the general public, so they must have a comprehensive understanding of customers and adjust their business models accordingly. Digitalization of banking in the new era is very necessary in order to transform and adapt banks to environmental changes and the new requirements of the banking industry [4]. Considering the undeniable effects of new technologies, such as the development of the web and high-speed Internet, social networks, smart phones, and user-oriented platforms, and the emergence of a generation of customers with new needs and desires who want to carry out banking affairs, including payments, investment management, loans and the like, on new technological platforms, it is necessary to examine the impact of digitalization of the banking industry on the quality of its services [3]. The advent of digitalization, innovation, and new technologies is transforming conventional business models and processes. As a consequence, banks must modify their business models to alter their customer interactions, manage their middle- and back-office operations, enhance competitiveness, and prepare for the future [5].

The digital transformation of banking encompasses a wide range of services, such as document digitization, electronic signatures for transactions, e-learning, teleconferencing, online trading platforms, digital stores, e-statements, and mobile payments. As customers increasingly adopt these digital operations, new solutions are emerging in this sector. Consequently, the banking industry must develop new business models to emphasize all the major banking processes [6]. As many service sectors are driven to explore innovative technological methods to enhance customer service and streamline internal processes, adopting new business models through the digital transformation of banking operations is the most appropriate approach for banking institutions in today’s economic environment [7].

Adoption of digital banking (DB) is necessary and inevitable. Considering the fact that DB will become the dominant service-oriented business model in the future in this sector, banks should try to identify the necessary infrastructure and mechanisms for the design and implementation of this new business model. As technology becomes more widely available, people are increasingly using DB for their everyday transactions. While some may see this as beneficial, it disrupts the usual way of banking that customers are used to.

The best–worst method (BWM) is one of the newest and most accurate criteria evaluation methods, which provides more acceptable results than previous methods, including the analytical hierarchy process (AHP). The BWM is one of the multi-criteria decision-making (MCDM) techniques, and it was introduced by Rezaei [8]. With this method, the best and worst indicators are selected and the rest of the options are compared with them in a pairwise comparison. Then, a maximum–minimum problem is formulated and solved to obtain the weights of the indicators. With this method, the degree of consistency of decisions can be calculated with a specified formula. In this research, in order to evaluate the effective indicators for the implementation of DB, a new fuzzy decision-making model based on the BWM and α-cut analysis using TFNs is presented. With the proposed approach, the decision-maker is able to choose different values of the α parameter between 0.1 and 0.9 and to make decisions with high reliability by determining the level of uncertainty. The higher the value of the α parameter, the lower the level of uncertainty in the decision-making environment, and the lower the value of the α parameter, the higher the level of uncertainty in the decision-making environment. Some of the advantages of the proposed method include the possibility of making a definite decision in a fuzzy environment, taking into account more uncertainty compared to previous similar models, and the increased robustness of the results.

DB, like classical banking, has been formed with the aim of providing services to customers; however, in DB, people seek to improve processes and increase the efficiency and effectiveness of services provided to customers by using new technologies and concepts. To provide high-quality services and the integrated development of service delivery systems in the banking industry, it is essential to understand the customer’s attitudes and pay attention to their needs [9]. In addition, DB service quality dimensions, such as ease of use, efficiency, privacy/security and reliability, impact customers’ satisfaction and retention intentions [10]. The successful implementation of DB depends on the acceptance of DB by customers, and the mechanisms for persuading them to use DB are important. Therefore, when evaluating the DB implementation indicators, special attention should be paid to the quality of electronic services provided to customers.

Regarding the identification and prioritization of appropriate criteria for the successful implementation of DB, many research gaps remain. Indicators that take into account various aspects of DB, from customer behavior to technological infrastructure, require a comprehensive literature review, past practical experiences, emerging trends affected by Industry 4.0, expert opinions, and the like. For example, many efforts have been made in India, such as digital marketing campaigns and customer education, to drive customers toward DB, but due to the lack of identification of appropriate criteria for DB implementation and their accurate evaluation, these programs have failed [11]. It is worth noting that the responsibility for implementing DB lies with banks, financial institutions, and policymakers, while the adoption of DB lies with customers and users. While numerous studies have focused on evaluating users’ acceptance of DB, limited research has been conducted to identify and evaluate appropriate criteria for successful DB implementation. To ensure that banks can switch to the DB business model, it is necessary to study the factors affecting the implementation of DB [12].

2. Evaluation of Digital Banking Implementation Indicators and Models in the Context of Industry 4.0

2.1. Theoretical Background

Banks are basically service organizations, and their final outputs are the services they provide to customers. DB tries to increase the quality of the services provided by banks and thus increase the efficiency and effectiveness of the banking industry.

The theory of service quality examines customer satisfaction and states that the quality level of services provided to customers affects their satisfaction and has a direct relationship with the company’s profit. Service quality is considered a leading factor in the service industry that affects consumer satisfaction [13]. A comprehensive and widely used approach to measure service quality in various industries is the service quality (SERVQUAL) model [14]. The SERVQUAL model is a framework that records and measures the quality of services provided to customers and evaluates customers’ experience of receiving services. In other words, the SERVQUAL model measures the difference between the actual services provided and the services expected by customers. The five main dimensions of the service quality model are tangibility (the physical appearance of the service and the customer’s understanding of the service delivery environment), reliability (reliability of service results and performance), empathy (willingness and enthusiasm to provide services), responsiveness (willingness to address appropriate and timely feedback), and assurance (specialized skills and increasing trust and confidence) [15]. On the other hand, measuring the quality of electronic services has become an important issue in relation to understanding the value of customers in the context of online service transactions. Service quality plays an important role in customer satisfaction, which can be directly evaluated and managed [13]. Service quality has different results regarding user satisfaction. If the service provided to customers is less than their expectations, customers will be dissatisfied; if the service provided is equal to the expectations of customers, they will be satisfied; and if the service provided exceeds the expectations of customers, they will be highly satisfied [16]. Banking services are moving from an interactive and traditional approach to a digital approach, and the concept of electronic service quality in DB is used to measure and manage digital services such as online shopping, delivery, and ordering. From the user’s point of view, the quality of electronic services is defined as how online systems and various electronic portals can improve the efficiency of transactions and activities and meet the customer’s needs [17][18]. Electronic service quality is classified into two categories: technical performance quality and service performance quality. Technical performance quality refers to websites and systems that provide electronic services to users, and service performance quality refers to the efficiency and effectiveness of electronic service delivery processes [19].

Considering predictions of the future of banking in the world, it becomes clear that it is necessary to improve the quality of DB services, especially in the field of retail banking [20]. Parasuraman et al. [21] believed that service quality is an externally perceived attitude based on the customer’s experience of the service. Parasuraman et al. [22] used a factor analysis to correct the service quality model provided in the past and named it the SERQUAL model, which includes 5 measurement aspects and 22 evaluation indicators. The quality of service is examined from two perspectives as follows [23]:

-

Interaction perspective: Service quality is a sign of the inherent excellence of services and the fulfillment of high-level standards in providing services. This view is often used in performing and visual arts. It is argued that people perceive quality only through repeated experience.

-

User-centered view: This view is based on the hypothesis that the quality of a service depends on the user’s opinion about it. This definition considers the level of service quality to be equivalent to the level of user satisfaction. This mental perspective and demand-oriented perspective specifies that every customer has different and unique demands and needs.

In the following, some of the studies conducted in the field of service quality are reviewed, along with the theories used in them, so that the variety of theories used in the field of service quality becomes more palpable.

Omarini [24] investigated the transformation of banking from traditional to digital and, finally, open banking. He pointed to the opportunities and possibilities of creating value through the use of new banking approaches in the form of open banking. Bouwman et al. [25] examined the effect of digitalization, the internal capabilities of the organization and the ecosystem, and the external environment of the organization as influential factors in the use of new business models in the digital era and Industry 4.0. Sousa and Rocha [26] examined the skills needed by employees to use and manage emerging technologies such as artificial intelligence, Internet of things, etc., in an organization.

Liu et al. [27] investigated the experiences of the CBC e-banking project and how to integrate two important management theories, namely resource-based theory and resource-fit, in order to exploit e-banking. They developed a framework with four main dimensions: external resource fit, internal resource fit, external capability fit, and internal capability fit. Additionally, they examined the eight critical factors necessary for the successful implementation of an electronic banking project through a real case study. Mbama and Ezepue [28] examined the components of the customer experience of digital services in VK Bank. In their research, they proposed 15 hypotheses about the relationship between the quality of bank services and the experience, satisfaction, and loyalty of customers and the positive effects of DB on them. Khanboubi and Boulmakoul [29] investigated the effects of DB on various aspects of people’s personal and professional lives. They showed that digital transformations have dramatic effects on lifestyles. They suggested some ways to improve organizations in the digital era. Kumar et al. [30] investigated the challenges of creating ethical and sustainable operations in Indian manufacturing units using soft operational research methods, especially the decision-making trial and evaluation laboratory (DEMATEL). They first identified 15 challenges to sustainability in operations in manufacturing industries, and they then investigated the cause-and-effect relationships between them. A summary of research related to the theories and concepts used in DB can be seen in Table 1.

Table 1. Research related to theories and concepts used in DB.

| Concept | Reference | Theory Used | Purpose of the Study |

|---|---|---|---|

| Open digital banking | [24] | Open innovation | Review of the evolution of new banking models and open banking platforms |

| Maturity of digital banking | [25] | Theory of corporate strategy | Examining the impacts of digital trends on business models |

| Digital banking project | [27] | Concept of resource fit and resource-based view | Developing a combined view of organizational theories in digital banking |

| Customer experience in digital banking | [28] | Customer perceptions | Designing a conceptual model of customer satisfaction, experience, loyalty and performance of digital banking |

| Digital transformation and meta-model banking | [29] | Meta-model and ontology | Proposing a digitalization road map for financial organizations |

| Sustainable and ethical operations in the era of Industry 4.0 | [30] | Theory of social responsibility and sustainability | Determining the challenges of sustainable and ethical operations of production organizations and determining the relationships between them |

| Digital learning in banking | [31] | Organizational learning | Strategic redesign of new digital organization skills |

2.2. Survey of Service Quality and Digital Banking

Various aspects of the service quality theory in different industries are examined. In addition, some studies related to the quality of services will be reviewed from the perspective of Industry 4.0 and its drivers, and finally, various trends in DB will be described by reviewing the studies conducted in this field.

Büyüközkan et al. [32] argued that today, transformation is an important factor for the competitiveness and performance of organizations. Using integrated MCDM approaches, they investigated companies’ sustainability components in the aviation industry and the effects of digital transformation in the era of Industry 4.0. Büyüközkan et al. [33] debated that since air transportation is one of the most important modes of transportation, customers are constantly looking for the best quality of airline services. By using fuzzy models based on cognitive maps, they tried to reconstruct the structure and scenario according to the uncertainties in order to improve the airline service quality.

Li et al. [34] investigated the inflight service quality perceived by customers using the integrated approach of fuzzy blind and fuzzy AHP. They finally identified five criteria and eighteen sub-criteria and evaluated them using MCDM approaches. Aydemir and Gerni [35] investigated the service quality in export credit agencies in Turkey. By sending a questionnaire to 127 companies, they analyzed the gap between the perceived service quality and their expectations in the field of exports. Using statistical tests, they showed that the perceived and expected quality in these agencies were higher than the average values. Al-Neyadi et al. [36] assessed the quality of health sector services in UAE. They examined the components of reassurance, empathy, accountability, and tangible structures among 127 patients and, using statistical models, showed that the quality of the services was appropriate. Kargari [37] studied the dimensions of service quality of the hotel industry using hybrid models by combining the DEMATEL and an analytic network process (ANP). The dimensions he studied in his research were accountability, empathy, and confidence.

Jun and Cai [38] investigated service quality in Internet banking. They investigated 17 components of service quality in 4 clusters, namely online banking system quality, perceived customer service quality, product quality, and banking packages, using the content analysis method. Sari et al. [39] investigated service quality in boat and small ship services. Using statistical modelling approaches, they investigated the opinions of fishermen and yachtsmen regarding the quality of services provided in marinas. Ten hypotheses were tested to calculate the final satisfaction of customers with these services. Caro and Garcia [40] proposed a comprehensive model of service quality in the travel industry. Agents were surveyed using a qualitative approach and in-depth interviews. Then, a model with three components (performance, physical environment, interactions between people) and seven sub-components was tested. Finally, the level of customer satisfaction was determined by surveying users of travel agencies. Miranda et al. [41] investigated the impacts of different components of service quality on customer satisfaction. By developing a basic model of service quality and by adding the three dimensions of convenience, comfort, and connection, which are specific to the railway industry, they examined the correlation between these dimensions and finally modelled a multiple regression. Table 2 provides a summary of the research conducted in the field of service quality in various service-oriented industries.

Table 2. Some applications of service quality theory in different industries.

| Business Field | Reference | Approaches/Methods | Information Form |

|---|---|---|---|

| Aviation | [32] | IFAHP/IFVIKOR | Triangular fuzzy numbers |

| Transportation | [33] | Intuitionistic fuzzy cognitive mapping | Triangular fuzzy numbers |

| Communication | [34] | Fuzzy AHP/2-tuple fuzzy linguistic method | Triangular fuzzy numbers |

| Financial | [35] | Structural equation modeling | Crisp values |

| Health | [36] | Quantitative approach | Descriptive data |

| Tourism | [37] | Fuzzy ANP | Triangular fuzzy numbers |

| Internet banking | [38] | Content analysis | Qualitative data |

| Boat and small ship | [39] | Multiple regression analysis | Crisp values |

| Travel agency | [40] | Structural equation modeling | Crisp values |

| Railroad transportation | [41] | Multiple regression analysis/fsQCA | Crisp values |

The service quality theory has been expanded due to emerging trends under the influence of Industry 4.0. A number of studies have been conducted on the theory of service quality and the impacts of the emerging trends of Industry 4.0. In the following, some of them will be reviewed, and a summary of these studies can be seen in Table 3.

Table 3. Service-quality-based studies considering the emerging trends of Industry 4.0.

| Field of Study | Reference | Uncertainty | Type of Research |

|---|---|---|---|

| Virtual service quality | [42] | Exploratory study | |

| Service quality in digital government | [43] | Exploratory study | |

| Evaluation of the quality of digital services | [44] | Systematic literature review | |

| Quality of service based on SaaS | [45] | √ | Exploratory study |

| Quality of online banking services | [46] | √ | Exploratory study |

| Service quality of Internet of Things | [47] | Exploratory study | |

| Quality of services on the platform of cloud computing | [48] | √ | Exploratory study |

| Digital library service quality | [49] | Exploratory study | |

| Service quality in the smart city | [50] | Exploratory study | |

| Service quality in the digital age | [51] | Critical study | |

| Service quality in the evolution of Industry 4.0 | [52] | Illustrative case study |

Santos [42] examined service quality in e-commerce and its implementation on the Internet. A service quality model was proposed based on the determinants of service quality in the Internet world. Corradini [43] examined the quality of services in public administrations in Italy. The author introduced a comprehensive model using effective components of government service quality and, finally, implemented a mathematical model. Hartwig and Billert [44] examined the impact of digital transformation on industry, society and services. They reviewed various studies, and by reviewing the literature presented on this topic, they investigated the differences and gaps among the presented models. Benlian et al. [45] investigated customers’ views about software-as-a-service solutions through the lens of perceived quality and the decision to adopt and use them. They extracted and ranked the effective factors by reviewing the literature. At the end, they presented a conceptual model of SaaS. Wu et al. [46] investigated the development of service quality in e-banking according to the cultural requirements of Taiwan. They proposed a new model based on the scale-development approach and the opinions of managers and evaluations made by customers.

Hizam and Ahmed [47] examined the emerging trends of the digital world as an important element of providing Internet of Things services by considering the four dimensions of privacy, efficiency, functionality, and infrastructure in order to empower the organization in evaluating the opinions of customers regarding the service provided on the Internet of Things platform. Ardagna et al. [48] investigated the application of cloud computing in service quality management. After reviewing the literature on the subject and formulating effective components to improve the quality of services based on cloud computing, they provided recommendations for the efficient allocation of resources. Ahmad and Abawajy [49] examined service quality in digital libraries. Instead of paying attention to users’ perception of service quality, they examined this issue through the lens of providers. At the end, they tested the service quality evaluation model based on two clusters (internal and external) and five hypotheses. Al-Hader et al. [50] investigated the service quality and smart city architecture in various dimensions of daily urban life. By proposing some models, they examined how to design a smart city to increase the quality of services and reduce costs. Tate et al. [51] reviewed the concepts of service quality provided in various articles and studies. With a critical view, they proposed a new research method to understand the concept of digital service quality. Tam and Van Thuy [52] examined the service quality of Vietnamese banks in the Industry 4.0 era. Through structured and semi-structured interviews, they formulated assumptions regarding the problem and evaluated the impacts of the components of Industry 4.0 on the service quality of Vietnamese banks using statistical tests.

Due to the increasing growth of technological tools and digital transformation, various digital payment methods and, subsequently, DB have led to various changes in the banking and financial industry [53]. Therefore, various types of DB approaches and various methods derived from them have emerged in the banking industry. These approaches cover digital payment methods, including wallets, mobile banking, Internet banking, and payment using cryptocurrencies, and they are based on technology brought about by Industry 4.0, i.e., DB [54].

According to the high growth rate of DB and the types of digital payment approaches, the focus on providing quality services and the optimal use of these trends has attracted the attention of researchers and managers of financial organizations.

In the following, some studies in the field of new banking trends are mentioned.

Behbood et al. [55] examined the speed of digital transformation and its effects on DB. They assessed one of the most important new trends in banking, namely machine learning. Finally, using fuzzy expert system approaches, they proposed an algorithm for data-driven forecasting in DB. Mahdiraji et al. [56] discussed the evolution of the digital world and one of its important aspects, i.e., big data. Using decision approaches, they clustered the influential and important components of big data in banking, and finally, by examining the proposed clusters, they proposed a strategic document for the development of DB. Zhao et al. [57] identified and ranked the components related to the evaluation of financial service innovation strategies using decision-making approaches, considering the developments in DB and the cooperation of banks with fin-techs and start-ups. Kahveci and Wolfs [58] investigated DB in the Turkish banking industry. Using the DEA approach, they analyzed the effects of DB services on the performance and efficiency of the Turkish banking industry. After examining seven banks, they showed that DB had positive effects in five banks and had no special effect in two banks. Sharma et al. [59] investigated the barriers to adopting mobile banking in the Omani banking industry. Using the structural modelling approach, they determined the relationships and effects of each of the barriers on other components and, finally, presented a model of the key components effective in accepting the mobile wallet approach. Veríssimo [60] examined the barriers to using mobile banking. He first identified the important barriers and then ranked them using fuzzy set methodology. Ondrus et al. [61] discussed the rapid changes in the digital world and the willingness of users to adapt their needs to those changes. By identifying the input components, they evaluated alternatives based on integrated FSS and MCDM approaches.

Ali and Kaur [62] investigated various business models to face the challenges of using mobile banking. First, they created a hierarchical structure for the criteria based on the factors related to the organization and the factors related to the service. Then, using MCDM approaches, they ranked the business models based on the obtained priorities. Hu and Liao [63] investigated the quality of internet banking services. First, they identified the main criteria using the literature and then extracted the relevant sub-criteria by reviewing different articles. Finally, by applying MCDM approaches, they weighted the criteria and sub-criteria. Liang et al. [64] examined the quality of internet banking in Ghana. They first identified criteria and alternatives. They considered five criteria and, finally, ranked five options or alternatives, which were internet banking providers. Sayyadi Tooranloo and Ayatollah [65] focused on identifying and evaluating the important factors for success in Internet banking. They first identified the factors of Internet banking failure and then ranked and weighted the factors using fuzzy decision-making approaches. Arias-Oliva et al. [66] investigated and identified the effective variables in the development of cryptocurrency banking. They first identified the key variables and then ranked the variables using fuzzy approaches. Gupta et al. [67] investigated the reasons and motives behind the decision to use cryptocurrencies in banking and investment. They first identified different factors and then prioritized them using fuzzy analysis frameworks. Chen et al. [68] evaluated blockchain-based businesses in the banking sector by using a hybrid approach, including BWM and modified VIKOR methods. Their findings indicated that due to the importance of policy and regulations, a circumspect government should lay an adaptable foundation for fostering fin-tech innovations. In Table 4, the trends mentioned above and the papers related to them are summarized.

Table 4. Studies of emerging trends of Industry 4.0 in the field of banking.

| Trend | Brief Definition | Related Paper |

Approaches/Methods | Information Form | Uncertainty |

|---|---|---|---|---|---|

| Digital banking | Refers to using different types of technology, including internet banking, mobile banking and other technological trends, in the form of open banking, etc. [54] | [56] | BWM–COPRAS | Crisp values | |

| [55] | Fuzzy expert system | Triangular fuzzy sets | √ | ||

| [69] | DEMATEL-based analytic network process (DANP) and VIKOR | Crisp values | |||

| [58] | DEA | Crisp values | |||

| Mobile banking | Refers to the execution of transactions on the basis of mobile and Internet-based technology [70] | [60] | A fuzzy set qualitative comparative analysis (fsQCA) | Linguistic data | √ |

| [59] | ISM | Crisp values | |||

| [61] | MCDM methods | Crisp values | |||

| [62] | MCDM methods | Crisp values | |||

| E-banking | Refers to conducting transactions remotely on the Internet [71] | [72] | Fuzzy MCDM | Triangular fuzzy numbers | √ |

| [73] | Fuzzy MCDM | Triangular fuzzy numbers | √ | ||

| Internet banking | Refers to conducting financial transactions on banking websites through the Internet [74] | [63] | AHP–ELECTRE method | Crisp values | |

| [64] | Pythagorean fuzzy VIKOR | Pythagorean fuzzy numbers | √ | ||

| [65] | Fuzzy MCDM | Triangular fuzzy numbers | √ | ||

| Cryptocurrency; Bitcoin banking | Refers to secure financial transactions using cryptocurrencies [75] | [66] | A fuzzy set qualitative comparative analysis (fsQCA) | Linguistic data | √ |

| [67] | Fuzzy AHP | Triangular fuzzy numbers | √ | ||

| [68] | BWM and modified VIKOR | Triangular fuzzy numbers | √ |

As can be seen from the results, several theories have contributed to the development and implementation of DB. Open innovation, the resource-based view, corporate strategy, organizational learning, and social responsibility are the advantageous theories used in the development of DB. On the other hand, service quality and electronic service quality theories have made a major contribution to the development of DB, and since banks are inherently service organizations, key indicators of the development, implementation, and evaluation of DB are derived from these theories. A review of studies related to the application of service quality theory showed that this theory has been used in various service fields and industries, such as transportation, financial institutions, travel agencies, and similar cases. Most of the studies in this field have evaluated and measured the quality of services provided to customers by considering the basic service quality model or its expanded models using specific indicators and MCDM approaches. Additionally, the review of studies related to the application of service quality theory in relation to the emerging trends of Industry 4.0 showed the wide application of this theory in innovative and modern concepts. In addition, the review of related works on the development of the banking industry affected by the drivers of Industry 4.0 showed that the digital, mobile, electronic, internet, and cryptocurrency banking models are prominent models, and researchers mostly used MCDM approaches to evaluate models and indicators in this field. In this research, by reviewing the literature on DB in various dimensions, comprehensive indicators of DB implementation and evaluation were identified according to the emerging trends and drivers of Industry 4.0. Moreover, in this study, a new fuzzy MCDM approach was proposed to prioritize the indicators and alternatives for DB implementation. DB services have become the main trend in the financial industry in today’s modern era [76]. Due to the novelty of concepts related to DB development, there is limited practical experience in the field, leading researchers to encounter uncertainty in the decision-making process. To address this, the proposed approach in this study utilizes TFNs to effectively handle a significant portion of the uncertainty in the decision-making environment. This enables decision-makers to express their preferences more reliably.

2.3. Digital Banking Implementation Criteria

2.3.1. Human Resources

It refers to selection, training, performance evaluation, providing rewards and financial and non-financial benefits, increasing productivity, and taking care of intra- and extra-organizational relations [77]. Human resources are among the main resources of the organization that empower the organization in developing the skills, capabilities, behaviors and attitudes of its employees to achieve its goals [78]. This component includes a workforce familiar with the characteristics of the era of the Industry 4.0. This workforce has characteristics such as collaboration and participation anywhere and anytime, instant feedback, an open and innovative culture, and data-driven decisions [79].

Compensation

This refers to promotions and rewards to employees according to the evaluation of their participation in key performance components and without relying solely on their position and seniority [79]. Of course, benefits include different types, such as benefits that are paid in cash and non-cash. In addition, the design of benefit systems according to different levels of performance is one of the most important components in e-HR departments [80].

HR Technical Qualification

Having a workforce familiar with IT knowledge and skills, IT management, professional computer coding and programming, ability to analyze data, and ability in security topics and the like is an important prerequisite for entering the digital age [81]. Additionally, the workforce of the digital age needs to have general knowledge about new technologies [82]. Another required technical condition is the familiarization of the workforce with the new interfaces of the digital age in order to exploit a variety of emerging technological trends [83].

Training

Hiring and training a highly capable workforce is very important when facing the new trends of Industry 4.0, including artificial intelligence, social networks, and cognitive systems [79]. Therefore, human resource training is a necessity for the digital ecosystem and various organizational levels, and planned and documented training is a key component of the workforce improvement cycle [84]. As a result, education in the era of Industry 4.0 will be different from the past, and due to the rapid development of technologies in this era, continuous education is very important for organizations [85].

Personal Skills

Due to the growing technological changes in Industry 4.0, human resources need skills such as teamwork, social communication, as well as continuous improvement and long-term learning [81]. Long-term learning ability in the face of emerging technologies and adaptability are significant individual skills in Industry 4.0 [82]. Having a workforce with effective and talented skills will lead to increased productivity and competitive advantages for the organization [86].

2.3.2. Digital Strategy

Digital strategy refers to how to use digital technology as a tool to achieve the organization’s goals [2]. Digital strategy is not a separate tool from other business processes but rather helps to rebuild all kinds of organizational relationships with business agents, including personnel, customers, and the ecosystem. Digitization by itself does not lead to digital transformation, although digital strategy is the core of this transformation [87].

Digital Preparation

This refers to the level of the organization’s expectations of the workforce to prepare for the transformational changes related to the new processes of Industry 4.0 era. In addition, the redesign of tasks in this era is one of the key factors. Reaching the end point of the value chain requires preparation and provision of effective conditions and a road map [88]. One approach to digital preparation is to involve all stakeholders (shareholders, managers, etc.). Paying attention and focusing on services and their efficient provision has a significant role in achieving organizational goals [89].

Agility

Agility refers to quick and easy movement and quick and intelligent thinking [90]. In the digital age, it is critical to respond in a timely manner to customer feedback [33]. In the era of digital transformation, the integration and redesign of technological trends for setting contracts, managing assets, obtaining licenses and ensuring transparent financial transactions will lead to advantages such as high agility and increased data security [91]. Technological changes and smart services require organizational agility and especially operational agility. This agility will lead to the effective regulation of processes related to data and interfaces, which will consequently facilitate data exchange and improve the efficiency of the value chain [92].

Digital Culturalization

It refers to the cultural changes of Industry 4.0 era and the changes in training needed to face those changes, as well as providing general information about the benefits of the new generation of Banking 4.0 to customers [93]. A suitable organizational culture can lead to the effective sharing of knowledge in the organization’s environment [94]. Moreover, in the organizations of Industry 4.0 era, choosing the right type of culture for the organization to properly implement the trends related to this era and digital transformation is of great importance [95].

Partnership with Third-Party

It refers to cooperation and partnership with start-ups and fin-techs and other technology-based financial companies in order to improve organizational performance [96]. Resource sharing and asset exchange can lead to effective service development. Today, companies are increasingly forming coalitions for a specific purpose and service [97]. As a result, due to the rapid changes in technologies, the creation of alliances in order to meet the needs of customers and exploit the capabilities of technology-based financial companies leads to an increase in organizational agility [98]. The assessment of third-party providers can be considered an MCDM issue. In this evaluation procedure, the experts usually express their judgments with uncertainty [99]. In addition, by outsourcing activities to third-party providers, organizations can focus on their core functions to improve competitive advantages [100].

Investment

It refers to the development of future banks by investing in new digital transformation trends such as artificial intelligence, blockchain, cyberspace security and robotics [101]. In the future, companies will invest in new digital trends to redesign processes, optimize distribution, reduce costs through tracking the transport fleet and the like [102]. Reducing costs and increasing revenues can be achieved by making the right decisions in relation to digital investment. Therefore, determining investment priorities and the components of the digitization of banks is of great importance [103].

Strategic Management

It refers to the redesign of business according to digital transformation trends in order to gain competitive advantages [104]. By applying the strategic management approach, companies seek to create opportunities through the development of new business models [105]. By properly applying digital transformation and organizational resources and capabilities, competitive advantages will be achieved [27].

Leadership

Leadership qualities in the age of Industry 4.0 include cognitive ability, interpersonal skills, business skills, strategic skills, agile leadership, ability to analyze data and functions, ability to identify problems, and intelligent leadership [106]. Paying attention to cultural changes and having a creative and learning spirit are the requirements of Leadership 4.0 [79]. Therefore, the way of leadership in the era of Industry 4.0 plays an important role in the intelligent behavior and success of the organization [107].

2.3.3. Regulations and Rules

Regulations related to technologies facilitate the appropriate response of the organization to the changes and trends of the digital world. Therefore, technology regulation is an essential tool to adapt to changes [108]. Overall, the purpose of regulation is to protect investors, consumers, competitions, innovations, and transactions in the digital age [109].

Third-Party Operational Law

In the Banking 4.0 environment, third-party service providers are continuously growing and developing through partnerships with various companies; therefore, creating standard rules and regulations for third-party service providers is important, especially in the fields of cloud computing and data services in affiliated companies [109].

Cooperative Regulation

In the Banking 4.0 environment, each banking method and process requires its own regulations. Therefore, the cooperation of technology-oriented companies in the financial area and legislators and the use of others’ experiences result in reduced divergence and island activities (independent activities without considering the beneficiaries) in this industry [109]. Additionally, the coordination of regulations and cooperation between the parties and the agreement of all countries regarding a set of common standards is one of the vital requirements of cooperative regulation [110].

Updated Regulation

In the Banking 4.0 era, the regulators should be able to modify the regulations related to each banking method in an agile way if needed and quickly react to changes in the financial business environment. Governments are facing increasing challenges in establishing and amending regulations in this changing environment. These challenges exist not only in managing the issues caused by disruptive digital trends but also in the methods of guaranteeing, identifying and distributing the opportunities and benefits of digital marketing [111].

2.3.4. Technologies

It refers to all technological facilities and infrastructures and related processes and their performances [14]. In the era of Industry 4.0, interfaces are embedded in the form of codes and computing kits in artifacts and other objects so that it is possible to display and present information to users in different digital forms [112].

Functional Ability

It refers to the suitability and quality of digital channels and their services [113]. What is important from the viewpoint of functional ability is that customers or other stakeholders should be efficiently guided from one process to another or from one stage to the next [114]. Customers and users have expectations of any service. It is important to fulfill their needs at each stage and to pay attention to their behaviors in order to improve the functional ability of the service [115].

Efficiency

It refers to responding to several users in the shortest time and with the most appropriate product and experience. When inputs and data are effectively converted into reliable outputs, efficiency approaches its ideal state [116]. Therefore, the efficient use of organizational resources, such as human resources and infrastructure, can ultimately lead to financial and non-financial advantages for service providers [117].

Technology Architecture

It refers to processes and continuous sequences of new technological trends. Its improvement and coordination can lead to better service delivery to stakeholders and the workforce of the organization. Therefore, the convenience for customers of using digital services and the appropriate and agile implementation of technology by the organization are characteristics of efficient technology architecture [33].

Service-Providing Platforms

It refers to the delivery of services to customers and users and their interactions with the organization through new platforms [33]. Today, banks provide services to their customers using their own APIs. Instead of developing their own APIs, many banks collaborate with third parties and provide them with their customer data to improve the bank’s platforms [118].

Suitability

It refers to the operationality and compatibility of service processes with service channels and platforms. One of the important components that organizations should pay attention to when providing services is correct and appropriate responses to users’ needs. The organization should focus on the suitability of its services. If customers think that their needs are met by the service provided by the platform or application, they will find it suitable [119].

Usability

It refers to the easy performance of transactions through channels and platforms by the user [113]. A service has usability when it is efficient, satisfactory, easily learnable, and has minimal errors. When the perceived satisfaction of the user reaches a high level, he interacts with the content and service to fulfill his goals and needs. Therefore, usability is very important for user satisfaction with the platform and application, and it allows users to easily fulfill their needs through the channel or platform provided [120].

2.3.5. Trust

It refers to providing services based on transparency, respecting privacy and focusing on secure transactions. In general, trust is dependent on confidence in the other party to the transaction, and when the customer is transacting online, factors such as expected performance and competence and availability lead to an increase in trust [121].

Virtual Security

It indicates that the system or platform is reliable and efficient to the extent that it has the ability to deal with virtual threats and the transaction data of customers are securely protected [33]. Therefore, privacy, strict control over financial transactions and people’s assets, and finally, increasing security should be considered when applying the new trends of digital transformation in every industry [122].

Privacy

It refers to the protection of the privacy and non-distributable data of customers [33]. In the era of digital transformation, providers encrypt data. This approach is performed by using the specific architecture and rules and policies of each of the digital trends. Therefore, in the era of digital transformation, each platform needs a special mechanism to apply privacy policies. By improving privacy in financial transactions, security will be strengthened [123].

Recognizability

It refers to the possibility of identifying and recognizing a service provider, whether it is an internal provider or a third party [122]. In addition, by focusing on privacy and security, it is possible to create platforms with embedded recognizability. As a result, everyone can perform their transactions with confidence in the digital environment. This means that there is no need to refer to the central core, there is no need to monitor the transaction and ensure the identity of the participants and there is no need for third-party intervention [124].

2.3.6. Customer Satisfaction

Customers always have needs, and meeting those needs with efficient online services will lead to their satisfaction. Customer satisfaction depends a lot on the performance of the organization and the usefulness of the service provided. The structure of the service and the way the service is provided are among the factors that make the user inclined to use the service [125].

Access

It refers to the possibility of continuous provision of the service without any technical problems and under suitable and efficient technical conditions. Accessibility is affected by various factors, including the technology and network architecture, platform design, servers and processes [126]. Therefore, before designing any service or platform, it is necessary to check the composition of the platform or service in detail and determine the availability [127].

Accountability

It refers to the responsibility of the service provider to solve the problems and take corrective actions on the information and services provided to the customers [128].

Availability

It refers to the ability of the customers to communicate with the organization at any time and in any place, and in addition, the ability to choose any of the service provider channels by the customers according to their interests [33]. Therefore, the digital service provider should make it possible for users to have equal access to their favorite services. Since the users of the service are from different spectrums of society in terms of education and age, and they may even have physical disabilities, it is very important to pay attention to the functionality and usability of the service delivery channels [129].

Self-Service Capability

It refers to the possibility of using and installing new applications and platforms without the need for an IT specialist. Nowadays, due to the increasing growth of technology trends, banks are seriously trying to provide self-service applications so that customers can easily perform their transactions at any time and in any place using the capabilities of banking channels. Therefore, paying attention to remote self-service capabilities can lead to the increased satisfaction and trust of customers and users [130].

Customer Participation

It refers to the participation of customers in promoting the organization’s services and recommending it to other users on social networks, the web, etc. [131]. It is also possible to track users’ opinions on the web and social media and use them in decisions related to the organization’s marketing.

Customer Insight

It refers to the organization’s ability to use the data obtained from the analysis of customers and users in the virtual space and the online world in order to provide its services and products based on their preferences and interests. Such information and data are very important for designing services and products. Therefore, due to the rapid growth and development of the digital world and information technology as well as the large volume of customer data, paying attention to customer opinions, interests, and reactions can greatly help designers to better meet customer expectations and requirements [132]. As a result, the application of information obtained from customer analysis in products and services is the value that companies and organizations will gain through paying attention to customer insight.

2.4. Digital Banking Implementation: Key Trends and Alternatives

After identifying appropriate criteria, appropriate alternatives were also determined according to the experts’ opinions, research literature, and existing infrastructure, which are presented in Table 5. These alternatives will be ranked using the proposed approach and the results will be analyzed. When identifying and evaluating DB models, it is necessary to pay attention to the technologies required in DB. In addition to identifying and evaluating the criteria for the implementation of DB, the technologies required for the implementation, growth, and development of DB should also be considered. Digital electronic technologies are widely used to switch classical banks to modern digital banks, some of which are computers, computer networks, digital communications, the Internet, and information and communication technologies with the appropriate software. Fin-techs, cloud computing, big data, and APIs have been considered facilitating technologies in relation to DB. The use of such technologies increases the speed, security and efficiency of all banking operations and services [133].

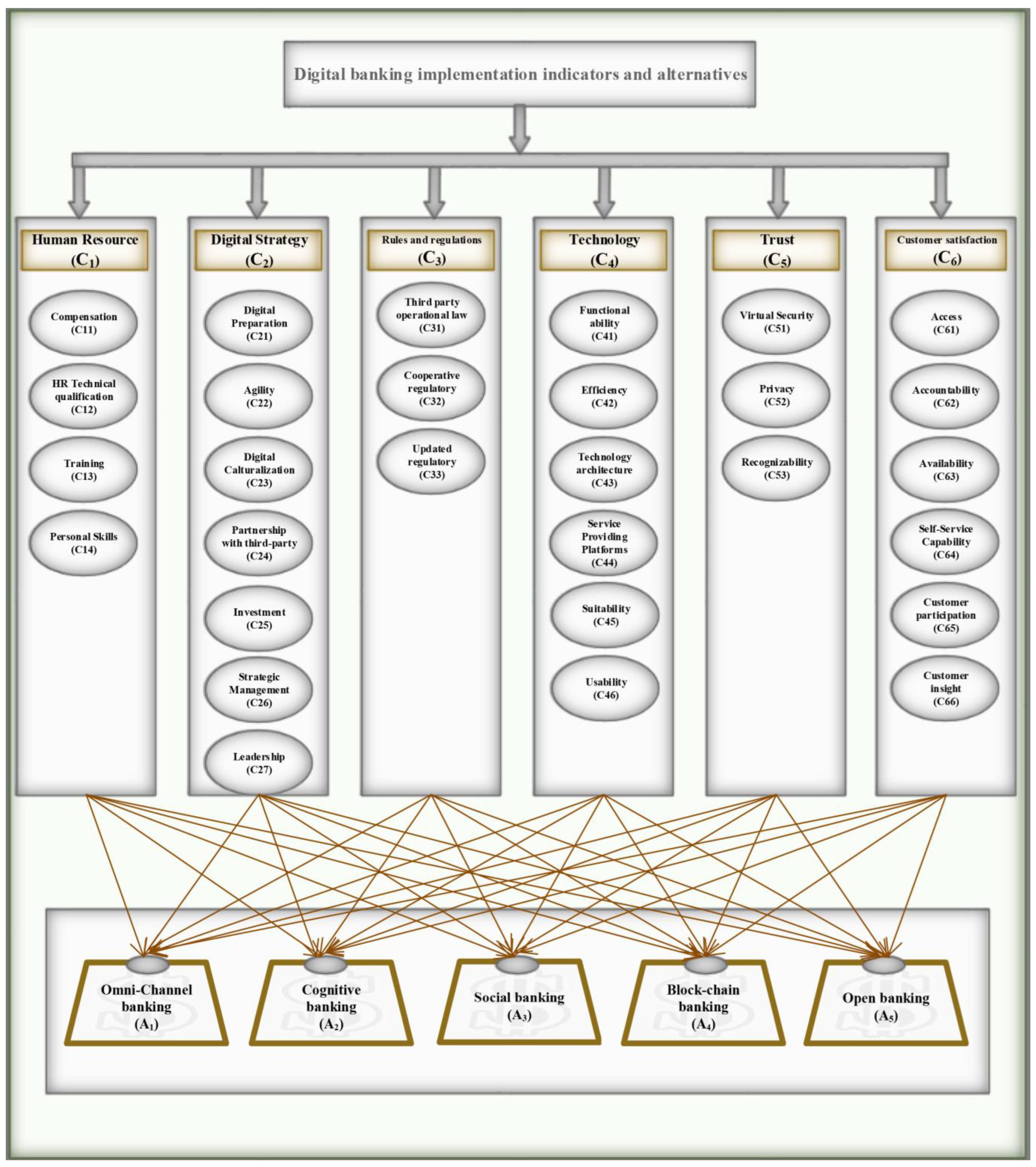

Melnychenko et al. [134] reviewed the important technological trends used in DB. According to the field of application of these technologies in the analysis of customer behavior, supervision of financial transactions, fraud management, and other areas related to modern banking services, they consider four technological trends, namely big data, artificial intelligence, biometrics and blockchain, as effective technologies in DB. In another study, the destructive trends affecting the increasing growth of DB were investigated. The results of the research showed that the important and vital infrastructures for the effective use of DB that lead to customer satisfaction are data protection regulation, APIs, data sharing, artificial intelligence, big data and fin-techs [135]. Managers and policymakers in the banking industry should pay special attention to the existing infrastructure and widely used concepts in Industry 4.0, such as artificial intelligence, in line with the implementation of DB [136]. Before evaluating the implementation criteria for DB, it is necessary to examine the existing infrastructures and the possibility of their development to drive the transformation from classical banking to DB. The hierarchical structure of the research, including the decision criteria and alternatives, can be seen in Figure 1.

Table 5. Digital banking alternatives.

| Alternative | Explanation | Source |

|---|---|---|

| Omni-channel banking | In omni-channel banking, communication with the customer is conducted uniformly at any time, in any place and on all channels. The customer and the activities he performs are the focus of how to provide the services that are provided to him. Accordingly, the way of serving each customer is personalized based on the activities performed in all portals. With this method, not only the explicit requests of the customer are answered but also his implicit interests and needs are guessed. | [137] |

| Cognitive banking | Cognitive banking begins with the development of the big data platform by collecting, integrating, and extracting structured and unstructured customer data and other useful data, and it incorporates artificial intelligence and advanced data-based analytics. It is worth noting that with the maturity of systems and algorithms based on artificial intelligence, cognitive banking, as a new generation of advanced analytics with learning capabilities, will replace smart banking. | [138] |

| Social banking | Social networks can be used as one of the important platforms for promoting and even selling the products and services of various businesses. This platform creates a good opportunity for banks to, on the one hand, be on the path to transition to a social business model and coordinate with emerging markets, and on the other hand, by analyzing large volumes of customer data and measuring customer behavior, provide better, personalized and new products and services. | [139] |

| Blockchain banking | Due to its nature, blockchain technology can provide the financial system with the tools needed to develop and improve services and products and to facilitate and accelerate the process of DB. Therefore, the use of this technology in the country’s banking industry has advantages such as transparency, security and control, no need for intermediaries, uncertainty of the system, integration and immutability, and reduced costs. According to an international analysis of emerging technologies, disrupting technologies such as blockchain technology are moving beyond unrealistic expectations and gradually entering a large implementation phase. | [140] |

| Open banking | In this model, banking data and information are shared through APIs between different members of the banking ecosystem with the customer’s permission according to specific standards, and this creates various opportunities and threats for the traditional banking system. Based on the transformation caused by the open banking model, banks transfer part of their activities in the banking value chain to other actors and change the situation from the position of bank management to the position of ecosystem management. | [141] |

Figure 1. Hierarchical structure of decision criteria and alternatives.

References

- Skinner, C. Digital Bank: Strategies to Launch or Become a Digital Bank; Marshall Cavendish International Asia Pte Ltd.: Singapore, 2014; ISBN 9814561800.

- Rogers, D. The Digital Transformation Playbook Rethink Your Business for the Digital Age; Columbia University Press: New York, NY, USA, 2016.

- Buvat, J.; KVG, S. Doing Business the Digital Way: How Capital One Fundamentally Disrupted the Financial Services Industry; Capgemini Consulting: Vienna, Austria, 2014; Available online: https://www.capgemini.com (accessed on 8 March 2023).

- Pourebrahimi, N.; Kordnaeij, A.; Hosseini, H.K.; Azar, A. Developing a Digital Banking Framework in the Iranian Banks: Prerequisites and Facilitators. Int. J. E-Bus. Res. (IJEBR) 2018, 14, 65–77.

- Cziesla, T. A literature review on digital transformation in the financial service industry. In Proceedings of the 27th Bled eConference eEcosystems, Bled, Slovenia, 1–5 June 2014.

- Yip, A.W.H.; Bocken, N.M.P. Sustainable business model archetypes for the banking industry. J. Clean. Prod. 2018, 174, 150–169.

- Kitsios, F.; Giatsidis, I.; Kamariotou, M. Digital Transformation and Strategy in the Banking Sector: Evaluating the Acceptance Rate of E-Services. J. Open Innov. Technol. Mark. Complex. 2021, 7, 204.

- Rezaei, J. Best-worst multi-criteria decision-making method. Omega 2015, 53, 49–57.

- Pakurár, M.; Haddad, H.; Nagy, J.; Popp, J.; Oláh, J. The service quality dimensions that affect customer satisfaction in the Jordanian banking sector. Sustainability 2019, 11, 1113.

- Egala, S.B.; Boateng, D.; Mensah, S.A. To leave or retain? An interplay between quality digital banking services and customer satisfaction. Int. J. Bank Mark. 2021, 39, 1420–1445.

- Patel, K.J.; Patel, H.J. Adoption of internet banking services in Gujarat: An extension of TAM with perceived security and social influence. Int. J. Bank Mark. 2018, 36, 147–169.

- Nguyen, O.T. Factors affecting the intention to use digital banking in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 303–310.

- Kim, H.-S.; Shim, J.-H. The effects of quality factors on customer satisfaction, trust and behavioral intention in chicken restaurants. J. Ind. Distrib. Bus. 2019, 10, 43–56.

- Parasuraman, A.; Zeithaml, V.A.; Berry, L.L. A conceptual model of service quality and its implications for future research. J. Mark. 1985, 49, 41–50.

- Kim, J. Platform quality factors influencing content providers’ loyalty. J. Retail. Consum. Serv. 2021, 60, 102510.

- Uzir, M.U.H.; Hamid, A.B.A.; Latiff, A.S.A. Does customer satisfaction exist in purchasing and usage of electronic home appliances in Bangladesh through interaction effects of social media? Int. J. Bus. Excell. 2021, 23, 113–137.

- Tan, C.-W.; Benbasat, I.; Cenfetelli, R.T. IT-mediated customer service content and delivery in electronic governments: An empirical investigation of the antecedents of service quality. MIS Q. 2013, 37, 77–109.

- Blut, M. E-service quality: Development of a hierarchical model. J. Retail. 2016, 92, 500–517.

- Li, Y.; Shang, H. Service quality, perceived value, and citizens’ continuous-use intention regarding e-government: Empirical evidence from China. Inf. Manag. 2020, 57, 103197.

- Westerman, G.; Bonnet, D.; McAfee, A. Leading Digital: Turning Technology into Business Transformation; Harvard Business Press: Boston, MA, USA, 2014; ISBN 1625272472.

- Parasuraman, A.; Berry, L.L.; Zeithaml, V.A. Perceived service quality as a customer-based performance measure: An empirical examination of organizational barriers using an extended service quality model. Hum. Resour. Manag. 1991, 30, 335–364.

- Parasuraman, A.P.; Zeithaml, V.; Berry, L. SERVQUAL: A multiple-Item Scale for measuring consumer perceptions of service quality. J. Retail. 1988, 64, 12–40.

- Lovelock, C.H.; Wirtz, J. Services Marketing: People, Technology, Strategy; Pearson Education: London, UK, 2004.

- Omarini, A.E. Banks and FinTechs: How to develop a digital open banking approach for the bank’s future. Int. Bus. Res. 2018, 11, 23–36.

- Bouwman, H.; Nikou, S.; Molina-Castillo, F.J.; de Reuver, M. The impact of digitalization on business models. Digit. Policy Regul. Gov. 2018, 20, 105–124.

- Sousa, M.J.; Rocha, Á. Digital learning: Developing skills for digital transformation of organizations. Future Gener. Comput. Syst. 2019, 91, 327–334.

- Liu, D.; Chen, S.; Chou, T. Resource fit in digital transformation. Manag. Decis. 2011, 49, 1728–1742.

- Mbama, C.I.; Ezepue, P.O. Digital banking, customer experience and bank financial performance: UK customers’ perceptions. Int. J. Bank Mark. 2018, 2, 230–255.

- Khanboubi, F.; Boulmakoul, A. Digital Transformation Metamodel in Banking. INTIS 2019, 2019, 8.

- Kumar, R.; Singh, R.K.; Dwivedi, Y.K. Application of industry 4.0 technologies in SMEs for ethical and sustainable operations: Analysis of challenges. J. Clean. Prod. 2020, 275, 124063.

- Avelar-Sosa, L.; García-Alcaraz, J.L.; Castrellón-Torres, J.P. The effects of some risk factors in the supply chains performance: A case of study. J. Appl. Res. Technol. 2014, 12, 958–968.

- Büyüközkan, G.; Feyzioğlu, O.; Havle, C.A. Analysis of success factors in aviation 4.0 using integrated intuitionistic fuzzy MCDM methods. In Proceedings of the International Conference on Intelligent and Fuzzy Systems, Istanbul, Turkey, 23–25 July 2019; Springer: Berlin/Heidelberg, Germany, 2019; pp. 598–606.

- Büyüközkan, G.; Havle, C.A.; Feyzioğlu, O.; Göçer, F. A combined group decision making based IFCM and SERVQUAL approach for strategic analysis of airline service quality. J. Intell. Fuzzy Syst. 2020, 38, 859–872.

- Li, W.; Yu, S.; Pei, H.; Zhao, C.; Tian, B. A hybrid approach based on fuzzy AHP and 2-tuple fuzzy linguistic method for evaluation in-flight service quality. J. Air Transp. Manag. 2017, 60, 49–64.

- Aydemir, S.D.; Gerni, C. Measuring service quality of export credit agency in Turkey by using Servqual. Procedia-Soc. Behav. Sci. 2011, 24, 1663–1670.

- Al-Neyadi, H.S.; Abdallah, S.; Malik, M. Measuring patient’s satisfaction of healthcare services in the UAE hospitals: Using SERVQUAL. Int. J. Healthc. Manag. 2018, 11, 96–105.

- Kargari, M. Ranking of performance assessment measures at tehran hotel by combining DEMATEL, ANP, and SERVQUAL models under fuzzy condition. Math. Probl. Eng. 2018, 2018, 5701923.

- Jun, M.; Cai, S. The key determinants of internet banking service quality: A content analysis. Int. J. Bank Mark. 2001, 19, 276–291.

- Sari, F.O.; Bulut, C.; Pirnar, I. Adaptation of hospitality service quality scales for marina services. Int. J. Hosp. Manag. 2016, 54, 95–103.

- Caro, L.M.; Garcia, J.A.M. Developing a multidimensional and hierarchical service quality model for the travel agency industry. Tour. Manag. 2008, 29, 706–720.

- Miranda, S.; Tavares, P.; Queiró, R. Perceived service quality and customer satisfaction: A fuzzy set QCA approach in the railway sector. J. Bus. Res. 2018, 89, 371–377.

- Santos, J. E-service quality: A model of virtual service quality dimensions. Manag. Serv. Qual. Int. J. 2003, 13, 233–246.

- Corradini, F. Quality assessment of digital services in E-government with a case study in an Italian region. In Electronic Services: Concepts, Methodologies, Tools and Applications; IGI Global: Hershey, PA, USA, 2010; pp. 1100–1118.

- Hartwig, K.; Billert, M.S. Measuring service quality: A systematic literature review. In Proceedings of the Twenty-Sixth European Conference on Information Systems (ECIS2018), Portsmouth, UK, 23–28 June 2018.

- Benlian, A.; Koufaris, M.; Hess, T. Service quality in software-as-a-service: Developing the SaaS-Qual measure and examining its role in usage continuance. J. Manag. Inf. Syst. 2011, 28, 85–126.

- Wu, Y.-L.; Tao, Y.-H.; Yang, P.-C. Learning from the past and present: Measuring Internet banking service quality. Serv. Ind. J. 2012, 32, 477–497.

- Hizam, S.M.; Ahmed, W. A conceptual paper on SERVQUAL-framework for assessing quality of Internet of Things (IoT) services. arXiv 2020, arXiv:2001.01840.

- Ardagna, D.; Casale, G.; Ciavotta, M.; Pérez, J.F.; Wang, W. Quality-of-service in cloud computing: Modeling techniques and their applications. J. Internet Serv. Appl. 2014, 5, 1–17.

- Ahmad, M.; Abawajy, J.H. Digital library service quality assessment model. Procedia-Soc. Behav. Sci. 2014, 129, 571–580.

- Al-Hader, M.; Rodzi, A.; Sharif, A.R.; Ahmad, N. Smart city components architicture. In Proceedings of the 2009 International Conference on Computational Intelligence, Modelling and Simulation, Brno, Czech Republic, 7–9 September 2009; IEEE: New York, NY, USA, 2009; pp. 93–97.

- Tate, M.; Furtmueller, E.; Gao, H.; Gable, G. Reconceptualizing digital service quality: A call-to-action and research approach. In Proceedings of the 18th Pacific Asia Conference on Information Systems (PACIS), Chengdu, China, 24–28 June 2014; Association for Information Systems (AIS): Atlanta, GA, USA, 2014; pp. 1–11.

- Tam, P.T.; Van Thuy, M.B. The Industry 4.0 Factor Affecting the Service Quality of Commercial Banks in Dong Nai Province. Eur. J. Account. Audit. Financ. Res. 2017, 5, 81–91.

- Leong, L.-Y.; Hew, T.-S.; Ooi, K.-B.; Wei, J. Predicting mobile wallet resistance: A two-staged structural equation modeling-artificial neural network approach. Int. J. Inf. Manag. 2020, 51, 102047.

- Sardana, V.; Singhania, S. Digital technology in the realm of banking: A review of literature. Int. J. Res. Financ. Manag. 2018, 1, 28–32.

- Behbood, V.; Lu, J.; Zhang, G. Fuzzy refinement domain adaptation for long term prediction in banking ecosystem. IEEE Trans. Ind. Inform. 2013, 10, 1637–1646.

- Mahdiraji, H.A.; Zavadskas, E.K.; Kazeminia, A.; Kamardi, A.A. Marketing strategies evaluation based on big data analysis: A CLUSTERING-MCDM approach. Econ. Res. Ekon. Istraživanja 2019, 32, 2882–2892.

- Zhao, Q.; Tsai, P.-H.; Wang, J.-L. Improving financial service innovation strategies for enhancing china’s banking industry competitive advantage during the fintech revolution: A Hybrid MCDM model. Sustainability 2019, 11, 1419.

- Kahveci, E.; Wolfs, B. Digital banking impact on Turkish deposit banks performance. Banks Bank Syst. 2018, 13, 48–57.

- Sharma, S.K.; Mangla, S.K.; Luthra, S.; Al-Salti, Z. Mobile wallet inhibitors: Developing a comprehensive theory using an integrated model. J. Retail. Consum. Serv. 2018, 45, 52–63.

- Veríssimo, J.M.C. Enablers and restrictors of mobile banking app use: A fuzzy set qualitative comparative analysis (fsQCA). J. Bus. Res. 2016, 69, 5456–5460.

- Ondrus, J.; Bui, T.; Pigneur, Y. A foresight support system using MCDM methods. Group Decis. Negot. 2015, 24, 333–358.

- Ali, S.S.; Kaur, R. An empirical approach to customer perception of mobile banking in Indian scenario. Int. J. Bus. Innov. Res. 2015, 9, 272–294.

- Hu, Y.-C.; Liao, P.-C. Finding critical criteria of evaluating electronic service quality of Internet banking using fuzzy multiple-criteria decision making. Appl. Soft Comput. 2011, 11, 3764–3770.

- Liang, D.; Zhang, Y.; Xu, Z.; Jamaldeen, A. Pythagorean fuzzy VIKOR approaches based on TODIM for evaluating internet banking website quality of Ghanaian banking industry. Appl. Soft Comput. 2019, 78, 583–594.

- Tooranloo, H.S.; Ayatollah, A.S. Pathology the internet banking service quality using failure mode and effect analysis in interval-valued intuitionistic fuzzy environment. Int. J. Fuzzy Syst. 2017, 19, 109–123.

- Arias-Oliva, M.; de Andrés-Sánchez, J.; Pelegrín-Borondo, J. Fuzzy set qualitative comparative analysis of factors influencing the use of cryptocurrencies in Spanish households. Mathematics 2021, 9, 324.

- Gupta, S.; Gupta, S.; Mathew, M.; Sama, H.R. Prioritizing intentions behind investment in cryptocurrency: A fuzzy analytical framework. J. Econ. Stud. 2020, 48, 1442–1459.

- Chen, N.-P.; Shen, K.-Y.; Liang, C.-J. Hybrid Decision Model for Evaluating Blockchain Business Strategy: A Bank’s Perspective. Sustainability 2021, 13, 5809.

- Wibowo, S.; Grandhi, L.; Grandhi, S.; Wells, M. A Fuzzy Multicriteria Group Decision Making Approach for Evaluating and Selecting Fintech Projects. Mathematics 2022, 10, 225.

- Chong, A.Y.-L. Predicting m-commerce adoption determinants: A neural network approach. Expert Syst. Appl. 2013, 40, 523–530.

- Siam, A.Z. Role of the electronic banking services on the profits of Jordanian banks. Am. J. Appl. Sci. 2006, 3, 1999–2004.

- Syamsuddin, I.; Hwang, J. A new fuzzy MCDM framework to evaluate e-government security strategy. In Proceedings of the 2010 4th International Conference on Application of Information and Communication Technologies, Kochi, India, 7–9 September 2010; IEEE: New York, NY, USA, 2010; pp. 1–5.

- Kaya, T.; Kahraman, C. A fuzzy approach to e-banking website quality assessment based on an integrated AHP-ELECTRE method. Technol. Econ. Dev. Econ. 2011, 17, 313–334.

- Thulani, D.; Tofara, C.; Langton, R. Adoption and use of internet banking in Zimbabwe: An exploratory study. J. Internet Bank. Commer. 1970, 14, 1–13.

- Almarashdeh, I.; Bouzkraoui, H.; Azouaoui, A.; Youssef, H.; Niharmine, L.; Rahman, A.A.; Yahaya, S.S.S.; Atta, A.M.A.; Egbe, D.A.; Murimo, B.M. An overview of technology evolution: Investigating the factors influencing non-bitcoins users to adopt bitcoins as online payment transaction method. J. Theor. Appl. Inf. Technol. 2018, 96, 3984–3993.

- Wadesango, N.; Magaya, B. The impact of digital banking services on performance of commercial banks. J. Manag. Inf. Decis. Sci. 2020, 23, 343–353.

- Kambiz, S.; Saeed, Y.; Mohsen, K. A Mathematical Model Designing to Achieve Cost Management in Value Chain with Combinational Approach of AHP & GP (Case Study: Home Appliance Industries). SOCRATES Int. Multi-Ling. Multi-Discip. Ref. (Peer-Rev.) Index. Sch. J. 2016, 4, 30–51.

- Collins, C.J.; Clark, K.D. Strategic human resource practices, top management team social networks, and firm performance: The role of human resource practices in creating organizational competitive advantage. Acad. Manag. J. 2003, 46, 740–751.

- Sivathanu, B.; Pillai, R. Smart HR 4.0–how industry 4.0 is disrupting HR. Hum. Resour. Manag. Int. Dig. 2018, 26, 7–11.

- Carlson, D.S.; Upton, N.; Seaman, S. The impact of human resource practices and compensation design on performance: An analysis of family-owned SMEs. J. Small Bus. Manag. 2006, 44, 531–543.

- Bayraktar, O.; Ataç, C. The effects of Industry 4.0 on Human resources management. In Globalization, Institutions and Socio-Economic Performance; Yıldırım, E., Çeştepe, H., Eds.; Peter Lang Group AG: Lausanne, Switzerland, 2018; pp. 337–359.

- Gehrke, L.; Kühn, A.T.; Rule, D.; Moore, P.; Bellmann, C.; Siemes, S.; Dawood, D.; Lakshmi, S.; Kulik, J.; Standley, M. A discussion of qualifications and skills in the factory of the future: A German and American perspective. VDI/ASME Ind. 2015, 4, 1–28.

- Hecklau, F.; Galeitzke, M.; Flachs, S.; Kohl, H. Holistic approach for human resource management in Industry 4.0. Procedia Cirp 2016, 54, 1–6.

- Stachová, K.; Papula, J.; Stacho, Z.; Kohnová, L. External partnerships in employee education and development as the key to facing industry 4.0 challenges. Sustainability 2019, 11, 345.

- Sony, M.; Naik, S. Critical factors for the successful implementation of Industry 4.0: A review and future research direction. Prod. Plan. Control 2020, 31, 799–815.

- Chryssolouris, G.; Mavrikios, D.; Mourtzis, D. Manufacturing systems: Skills & competencies for the future. Procedia CIRp 2013, 7, 17–24.

- Gobble, M.M. Digital strategy and digital transformation. Res. Technol. Manag. 2018, 61, 66–71.

- Porter, M.E.; Heppelmann, J.E. How smart, connected products are transforming competition. Harv. Bus. Rev. 2014, 92, 64–88.

- De Carolis, A.; Macchi, M.; Negri, E.; Terzi, S. A maturity model for assessing the digital readiness of manufacturing companies. In Proceedings of the IFIP International Conference on Advances in Production Management Systems, Hamburg, Germany, 3–7 September 2017; Springer: Berlin/Heidelberg, Germany, 2017; pp. 13–20.

- Rajabzadeh, A.; Keramatpanah, M.; Keramatpanah, A. Comparative Modeling of Supply Chain Using Interpretive Structural Modeling and DEMATEL. Organ. Resour. Manag. Res. 2015, 5, 49–71.

- Rane, S.B.; Narvel, Y.A.M. Re-designing the business organization using disruptive innovations based on blockchain-IoT integrated architecture for improving agility in future Industry 4.0. Benchmarking Int. J. 2021, 28, 1883–1908.

- Matthiae, M.; Richter, J. Industry 4.0-Induced Change Factors and the Role of Organizational Agility. Universität zu Köln. 28 November 2018. Available online: https://aisel.aisnet.org/ecis2018_rp/53 (accessed on 17 March 2023).

- Dastranj, N.; Ghazinoory, S.; Gholami, A.A. Technology roadmap for social banking. J. Sci. Technol. Policy Manag. 2017, 9, 102–122.

- Okatan, K.; Alankuş, O.B. Effect of organizational culture on internal innovation capacity. J. Organ. Stud. Innov. 2017, 4, 18–50.

- Ziaei Nafchi, M.; Mohelská, H. Organizational culture as an indication of readiness to implement industry 4.0. Information 2020, 11, 174.

- Bömer, M.; Maxin, H. Why fintechs cooperate with banks—Evidence from germany. Z. Für Die Gesamte Versicher. 2018, 107, 359–386.

- Dushnitsky, G. Corporate Venture Capital: Past. In The Oxford Handbook of Entrepreneurship; Oxford University Press: Oxford, UK, 2006; p. 387.

- Klus, M.F.; Lohwasser, T.S.; Holotiuk, F.; Moormann, J. Strategic alliances between banks and fintechs for digital innovation: Motives to collaborate and types of interaction. J. Entrep. Financ. 2019, 21, 1.

- Pamucar, D.; Chatterjee, K.; Zavadskas, E.K. Assessment of third-party logistics provider using multi-criteria decision-making approach based on interval rough numbers. Comput. Ind. Eng. 2019, 127, 383–407.

- Qian, X.; Fang, S.-C.; Yin, M.; Huang, M.; Li, X. Selecting green third party logistics providers for a loss-averse fourth party logistics provider in a multiattribute reverse auction. Inf. Sci. 2021, 548, 357–377.

- Lee, I.; Shin, Y.J. Fintech: Ecosystem, business models, investment decisions, and challenges. Bus. Horiz. 2018, 61, 35–46.

- Lee, I.; Lee, K. The Internet of Things (IoT): Applications, investments, and challenges for enterprises. Bus. Horiz. 2015, 58, 431–440.

- Cuesta, C.; Ruesta, M.; Tuesta, D.; Urbiola, P. The digital transformation of the banking industry. BBVA Res. 2015, 1, 1–10.