Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Lauri Holappa | -- | 2691 | 2022-04-18 10:14:31 | | | |

| 2 | Conner Chen | + 2 word(s) | 2693 | 2022-04-18 10:53:26 | | | | |

| 3 | Conner Chen | Meta information modification | 2693 | 2022-04-22 03:54:39 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Holappa, L. Trends and Challenges in the Indian Steel Industry. Encyclopedia. Available online: https://encyclopedia.pub/entry/21865 (accessed on 07 February 2026).

Holappa L. Trends and Challenges in the Indian Steel Industry. Encyclopedia. Available at: https://encyclopedia.pub/entry/21865. Accessed February 07, 2026.

Holappa, Lauri. "Trends and Challenges in the Indian Steel Industry" Encyclopedia, https://encyclopedia.pub/entry/21865 (accessed February 07, 2026).

Holappa, L. (2022, April 18). Trends and Challenges in the Indian Steel Industry. In Encyclopedia. https://encyclopedia.pub/entry/21865

Holappa, Lauri. "Trends and Challenges in the Indian Steel Industry." Encyclopedia. Web. 18 April, 2022.

Copy Citation

India is the 4th largest iron ore producer and the 3rd largest coal producer in the world. Coal is also identified as one of the major sectors of “Make in India”, which is an initiative by the Government of India launched by the prime minister. India is also the world’s largest producer of sponge iron: about 37 million tons per annum.

India

steel

1. Raw Materials

India is the 4th largest iron ore producer and the 3rd largest coal producer in the world. Coal is also identified as one of the major sectors of “Make in India”, which is an initiative by the Government of India launched by the prime minister [1]. India is also the world’s largest producer of sponge iron: about 37 million tons per annum.

1.1. Iron Ore

Proven hematite resources in India are around 29 billion ton, of which only 13% is high grade (>65% Fe), 47% are medium grade (62–65% Fe), and the remaining are low-grade ores [2]. During mining, lumps (−40 + 10 mm), fines (−10 + 0.15 mm), and slimes (<0.15 mm) are generated. For the efficient use of all these size ranges of ores, suitable ore agglomeration techniques are followed across the country. Over a while, sinter and pellet processes have improved and gained a significant place. Ore fines, −6 to 100 mm mesh size are being used for making sinter, and below 100 mesh fines are used for manufacturing pellets.

Indian iron ores have a major problem with high alumina and phosphorus. Highly friable hematite ore generates a huge quantity of fines during mining and crushing, which are rich in Al2O3. These fines are generally in the form of goethite (hydrated iron oxide) in which alumina is present in the matrix. Alumina exists in the form of gibbsite and kaolinite [3]. The high alumina content in these fines make them less amenable to physical separation and creates a problem in getting the final concentrate grade. In addition to magnetic and gravity separation, there is a need to explore the possibility of efficient beneficiation through froth flotation and selective dispersion with chemical aids. Some research efforts in this direction are being conducted at the National Metallurgical Laboratory, Jamshedpur, and Institute of Minerals and Materials Technology, Bhubaneswar.

As a result of the highly reducing atmosphere at the ironmaking stage, all the phosphorus in iron ore ends up in hot metal. Furthermore, if phosphorous is not removed in subsequent processes, it causes cold brittleness in steel. Efforts to remove phosphorous during mineral processing techniques are being explored using techniques such as thermal treatment, bioleaching, froth flotation, etc. [4]. The high P content in hot metal results in high P-containing slag in the steelmaking process and further poses difficulty in recycling this steelmaking slag back into the ironmaking process.

Blue dust is fine, powdery, soft, and friable ore rich in Fe content (65–67%) present in mines. Due to its fineness, it is not used directly in the furnaces. An estimated reserve of around 550 million ton of blue dust is available in India. India needs to find an appropriate technology to utilize this high-grade fine iron ore.

1.2. Coal

Although India is the third-largest coal producer after China and the USA, coking coal is only 15% out of the total coal mined [5]. In addition, Indian coking coal is not suitable for blast furnace due to its high ash content and hence requires extensive crushing and washing. About 85% of the coking coal requirements of Indian steel industries are met through imports [6]. Nevertheless, it invariably increases the coke rate in Indian blast furnaces compared to other countries. The cost of coke in the international market is expected to remain high in the foreseeable future and has forced the Indian manufacturers to go toward decreasing coke consumption by injecting pulverized coal. Increased usage of these injectants also paves the way for high production rates resulting from more oxygen input but decreases permeability, resulting in a larger pressure drop in blast furnaces [7]. Unfortunately, coal grades available in India are also found to be mostly not suitable for pulverized coal injection due to its high ash content. Thus, both for coke making as well as pulverized coal injection, Indian steel industries rely primarily on imported coal. Manufacturers in the electric route who use a rotary kiln process for the production of DRI/sponge iron also use primarily imported coal for their processes.

In summary, India has almost no reserves of coal that can be used in blast furnaces as well as other DRI-making units. This is one of the major issues that will shape the future of Indian steel industries and also should encourage efforts to decarbonize the Indian steel industry.

1.3. Alternative Fuels

Natural gas is the cleanest of fossil fuels, causing smallest CO2 emissions. It is available in oil and gas fields located at the Hazira basin, Assam, Tripura, and Mumbai offshore regions [8]. A total of 90 Million Metric Standard Cubic Meters Per Day (MMSCMDs) of domestic gas production was achieved in FY 2018–2019. Apart from this, India imports Liquified Natural Gas (LNG) through six operational LNG regasification terminals with a combined capacity of ≈140 MMSCMD. Utilizing hydrogen-rich tuyere injectant such as natural gas helps to decrease the coke quantity as well as CO2 emission of the blast furnace.

Other hydrocarbons such as waste plastics when heated up in the absence of oxygen, produce CO and hydrogen, which can be utilized in blast furnaces. However, before the injection of plastics through tuyeres, it needs to be crushed and pelletized (if necessary). Not all types of plastics can be injected; they should be segregated and sized. Indian manufacturers have yet to explore these advantages from plastics. Plastics can also be used in a coke oven as chemical feedstock [9].

1.4. Scrap

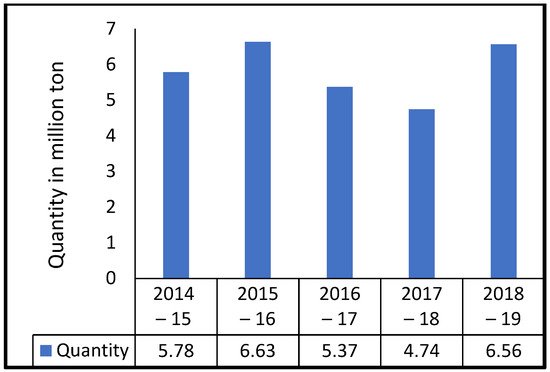

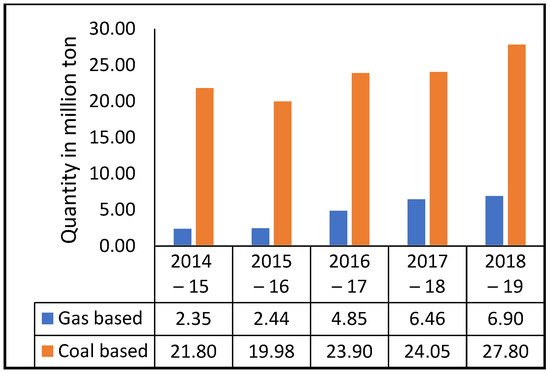

Major raw materials for electric route manufacturers are steel scrap and DRI. The import quantity of scrap and DRI production in India are shown in Figure 1 and Figure 2. Domestic scrap supply from unorganized industry is around 25 MT (around 78% of the demand) in the year 2017–2018. [10]. However, the gap is expected to be reduced due to the increased production foreseen in the future, and it is likely to increase the scrap quantity considerably. In addition, the national scrap policy of 2017 envisages setting up a system that improves the processing and recycling of ferrous scraps through organized and scientific metal scrapping centers to minimize imports as well as to become self-sufficient in availability. In recent years, there has been an increasing trend in manufacturing steel through the scrap route, as it reduces greenhouse gas (GHG) emissions. Every ton of scrap utilized for steel production avoids the emission of 1.5 tons of CO2 and the consumption of 1.4 tons of iron ore, 740 kg of coal, and 120 kg of limestone [11]. As of March 2019, 47 electric arc furnaces and 1128 induction furnaces are in operation across the country, and their main source of raw material is scrap.

Figure 1. Steel scrap import over the years(Graph plotted using data from: Ministry of Steel).

Figure 2. DRI Production (Graph plotted using data from: Ministry of Steel).

2. Processes

From the viewpoint of blast furnace operation, sinters and pellets in burden material give better bed permeability, decreasing the thickness of the cohesive zone due to narrower softening and melting ranges compared to lump ore. They also save energy since the calcination of limestone is avoided by making fluxed pellets/sinters, and the alkali content in the blast furnace has been reduced. As a result of these advantages, the use of lump ore is drastically reduced to around 10% [12].

The high alumina content in the iron ore poses a major challenge in blast furnace operation. To maintain appropriate slag viscosity, plants practice the addition of quartz and correspondingly the addition of lime to take care of basicity [13]. This results in a significant increase in the slag rate for Indian blast furnaces (375–420 kg/ton of hot metal as compared to 350–375 kg/ton of hot metal in China). High slag rates demanding more heat also result in higher coke rates. It also poses challenges toward increased pulverized coal injection in Indian blast furnaces.

High phosphorus in ore directly results in higher P% in the hot metal. To remove P, an excessive quantity of flux is necessitated in the converter process, resulting in significant temperature loss. If an external pre-treatment for hot metal dephosphorization is used, the process should be fast enough to match the BOF sequence.

Rotary kiln processes employ non-coking coal for converting iron ore to metallic iron and have the advantage of low investment cost. The energy balance of rotary kiln with theoretical and actual consumption showed only about 55% energy efficiency. A significant factor is that the waste gas liberated during the process remains unutilized at the moment [14]. It decreases the efficiency of the rotary kiln process. In addition, the utilization of this waste gas by waste heat recovery boiler experiences difficulty due to the accretion formation in the kiln and dust particles in the gas. These conditions make the rotary kiln highly inefficient compared to gas-based processes.

Typically, electric route manufacturers in India work with capacity less than 1 million tons per annum with the DRI-EAF/Induction Furnace route. Over the years, such small units have evolved closer to the market. It is also interesting to note that the electric route industries that are located in the western parts of the country use a higher proportion of scrap due to the accessibility of imported scrap by the sea route. On the other hand, on the eastern parts where ore reserves are abundant, they use rotary kiln units in combination with an induction or an electric arc furnace. Among electric arc furnace and induction furnace routes, the induction furnace is preferred because of its high yield (95–96% for IF and 92–93% for EAF), better electrical efficiency, and low investment cost [15][16]. The IF also has the characteristic of not using other forms of energy than electricity (O2, fuel, carbon injection). However, unlike electric arc furnaces, at present, the maximum induction furnace capacity available in India is 50 tons only.

Although gas-based DRI is an environmentally effective process, the final carbon in the DRI is high compared to coal-based DRI from Indian plants (gas based 1.5–1.8%, coal based 0.2–0.25%). Thus, it makes it difficult for electric route manufacturers to reduce carbon in the product to the required range, especially when they use Induction Furnaces with acidic lining. However, manufacturers who use EAF prefer DRI from gas-based units, as the higher carbon content gives higher energy efficiency [17]. In addition, the high porosity, the low thermal, and the electrical conductivity of DRI are some of the other problems faced by electric route manufacturers. The proper selection of scrap and separation is much needed to have control over tramp elements in the final steel. Since most of the electric route manufacturers do not have extensive ladle-refining facilities, control over the nitrogen, hydrogen, and total oxygen contents are not present. These shortcomings are the reason why most of the induction-based manufacturers are making rebars and construction-quality steel rather than engineering and automotive-grade steel. In addition, the furnace lining of induction-based electric route industries is generally silica-based, and it results in ineffective dephosphorization compared to oxygen route products. The typical furnace lining life is 18 to 20 heats.

As the production is increasing, the demand for making clean steel is also increasing. It is the steelmaker’s responsibility to fulfill the stringent quality requirements of the end-user. For example, the fatigue life of bearing steel greatly depends on the non-metallic inclusions. Bearing customers would want to have an inclusion size as low as possible (hard aluminum oxide and other oxide inclusions larger than 30 μm should be avoided). In that regard, reducing the total oxygen content in the steel becomes a necessary criterion. Reducing the total oxygen level from 15 ppm to less than 10 ppm would reduce the non-metallic inclusions as well. Achieving the low level of oxygen requires stringent control of the secondary steelmaking practice.

Steel manufacturers with large capacity and that have blast furnaces produce a versatile range of steel grades right from construction-quality steel grades to automobile, defense, railways, and aerospace grades. Larger capacity manufacturers have their rolling mills inbuilt in their facilities, and they produce a plethora of products in the form of bars, flats, wire rods, hexagon bars, etc.

Steel manufacturers with induction and arc furnaces produce mostly construction-quality grades in the form of rebars due to the factors mentioned earlier. Some manufacturers have a vacuum degassing facility and argon oxygen decarburization facility (AOD) and produce high-quality alloy steels for automotive applications and stainless steel grades with a smaller heat size. In Indian steel market conditions, highly critical steel grades for applications in space and aerospace equipment are imported. India needs to grow in terms of high-value niche special steels.

3. Environment and Energy

Steel industries generate around 30% of the total CO2 emissions from all industrial sectors on the planet. The reason for this huge quantity is due to the usage of coke and the high consumption of energy factory-wide. Nearly 65% of the emissions of oxygen route industries come from ironmaking processes, out of which 90% is contributed by coke and coal. Steel industries all around the world are striving hard to improve the energy efficiency of blast furnaces by approaching the theoretical limits of production and carbon consumption.

The iron and steel industry is one of the major energy consumers in India as well. By using the best available technologies (BAT), the specific energy consumptions are BF-BOF route-16.4 GJ/TCS (ton of crude steel), COREX-BOF-19.3 GJ/TCS, DRI-EAF (coal-based) route-19 GJ/TCS, and DRI-EAF (gas-based)-15.9 GJ/TCS [10]. However, major steel plants in India have a specific energy consumption of 27.3 GJ/TCS [10]. Although there exists a substantial potential to save energy by adopting the best practices and newest innovations for reducing energy consumption, reaching this target can be quite challenging considering the quality of raw materials in India. Thus, the authors opine that arriving at a target-specific energy consumption considering the local raw material quality can be quite fruitful in defining the road map for steel technology for India.

A major challenge for the electric route with arc furnaces or induction furnaces is the electrical energy consumption. The melting process starts from room temperature, and there is no heat recovery from off-gases. Typically, Indian manufacturers have electricity consumption 600 kWh/T compared to the world average of 416 kWh/T. However, DRI-EAF based routes generally consume less energy than companies that use EAF alone. The specific energy consumption of gas-based DRI is 10.46 to 14.43 GJ/T, and coal-based plants have 15.9 to 20.9 GJ/T [18].

Waste disposal and treatment is a big challenge for steel manufacturers. The steel industry generates solid, liquid, and gaseous wastes, and the most common are iron and steel slag, scrap, sludge, effluent, flue gases, etc. Approximately 0.4 to 0.8 tons of solid waste is generated for a ton of liquid steel (also, 0.5 tons of effluent water and 8 tons of moist laden gases) [18]. The waste management systems practiced by steel industries involve processing the wastes for a recycling in-plant process or disposing by appropriate methods. Ironmaking slag such as BF or COREX slag is used as a raw material for slag cement making and for producing slag sand, which can replace river sand. Due to the presence of free lime, BOF slag is not used in construction applications and generally goes for landfilling. Steel plants are developing and adopting methods for accelerated weathering of the steel slag and use it in construction activities, tide breakers in the coastal areas, and soil ameliorants. Some of the other applications for weathered BOF slag are rail ballast, cement making, road and paver blocks, and brick and tiles manufacturing [19].

On the contrary, electric arc slag is granulated and used as agglomerates in road construction and similar applications. Fine granulated EAF slag is also used in shot blasting and industrial water filter applications. Ladle-refining slags have high CaO, MgO, and SiO2 contents and could be used as a raw material in cement production [20]. However, the powdery nature of the LF slag makes it difficult to handle. In addition, the presence of high sulfur, heavy metals such as Cr, V should be avoided and thus necessitates proper screening and care. One of the important solid wastes to be recycled is the slag from BOF, as it cannot be dumped due to its high phosphorus content.

References

- Make in India. Available online: https://en.wikipedia.org/wiki/Make_in_India (accessed on 20 April 2021).

- Ministry of Mines, Government of India. Indian Minerals Year Book-2014. Available online: https://ibm.gov.in/?c=pages&m=index&id=513 (accessed on 20 April 2021).

- Lu, L.; Holmes, R.J.; Manuel, J.R. Effects of alumina on sintering performance of Hematite Iron ores. ISIJ Int. 2007, 47, 349–358.

- Quast, K. A review on the characterisation and processing of oolitic iron ores. Miner. Eng. 2018, 126, 89–100.

- Government of India. Coal Statistics, Ministry of Coal. Available online: https://coal.gov.in/public-information/reports/annual-reports (accessed on 20 April 2021).

- Indian Steel Ministry. Draft of National Steel Policy. 2017. Available online: https://steel.gov.in/sites/default/files/draft-national-steel-policy-2017.pdf (accessed on 20 April 2021).

- Ballal, N.B. Some challenges and opportunities in blast furnace operations. Trans. Indian Inst. Met. 2013, 66, 483–489.

- Ministry of Petroleum and Natural Gas. Natural Gas Scenario in India. Available online: http://petroleum.nic.in/natural-gas/about-natural-gas (accessed on 20 April 2021).

- Nomura, S. Use of waste plastics in coke oven: A review. J. Sustain. Met. 2015, 1, 85–93.

- Government of India. National Steel Scrap Policy–2017, Ministry of Steel. Available online: https://pib.gov.in/newsite/PrintRelease.aspx?relid=194359 (accessed on 20 April 2021).

- Raw Materials. Maximising Scrap Use Helps Reduce CO2 Emissions. Available online: https://www.worldsteel.org/steel-by-topic/raw-materials.html (accessed on 26 August 2021).

- Mandal, A.K.; Sinha, O.P. Technological changes in Blast furnace iron making in India since last few decades. Int. J. Sci. Res. 2013, 2, 211–219.

- Agrawal, A.; Das, K.; Singh, B.K.; Singh, R.S.; Tripathi, V.R.; Kundu, S.; Ramna, P.R.V.; Singh, M.K. Means to cope with the higher alumina burden in the blast furnace. Ironmak. Steelmak. 2020, 47, 238–245.

- Biswas, D.K.; Asthana, S.R.; Rau, V.G. Some studies on energy savings in sponge iron plant. J. Energy Resour. Technol. 2003, 125, 228–237.

- Dutta, S.K.; Lele, A.B.; Pancholi, N.K. Studies on direct reduced iron melting in induction furnace. Trans. Indian Inst. Met. 2004, 57, 467–473.

- Bedarkar, S.S.; Dalal, N.B. Energy balance in induction furnace and arc furnace steelmaking. Int. J. Eng. Res. Appl. 2020, 10, 57–61.

- Jones, J.A.; Bowman, B.; Lefrank, P.A. Electric furnace steelmaking. Making Shaping and Treating of Steel; The AISE Steel Foundation: Pittsburgh, PA, USA, 1998.

- Krishnan, S.S.; Vunnam, V.; Sunder, P.S.; Sunil, J.V.; Ramakrishnan, M.A. A Study of Energy Efficiency in the Iron and Steel Industry; Centre for Science and Technology and Policy: Bangalore, India, 2013.

- Ambasta, D.K.; Pandey, B.; Saha, N. Utilization of Solid Waste from Steel Melting Shop; MECON Ltd.: Ranchi, India, 2016.

- Sharma, N.; Nurni, V.N.; Tathavadkar, V.; Basu, S. A review on the generation of solid wastes and their utilization in Indian steel industries. Miner. Process. Extr. Met. 2017, 126, 54–61.

More

Information

Subjects:

Metallurgy & Metallurgical Engineering

Contributor

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

1.1K

Revisions:

3 times

(View History)

Update Date:

22 Apr 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No