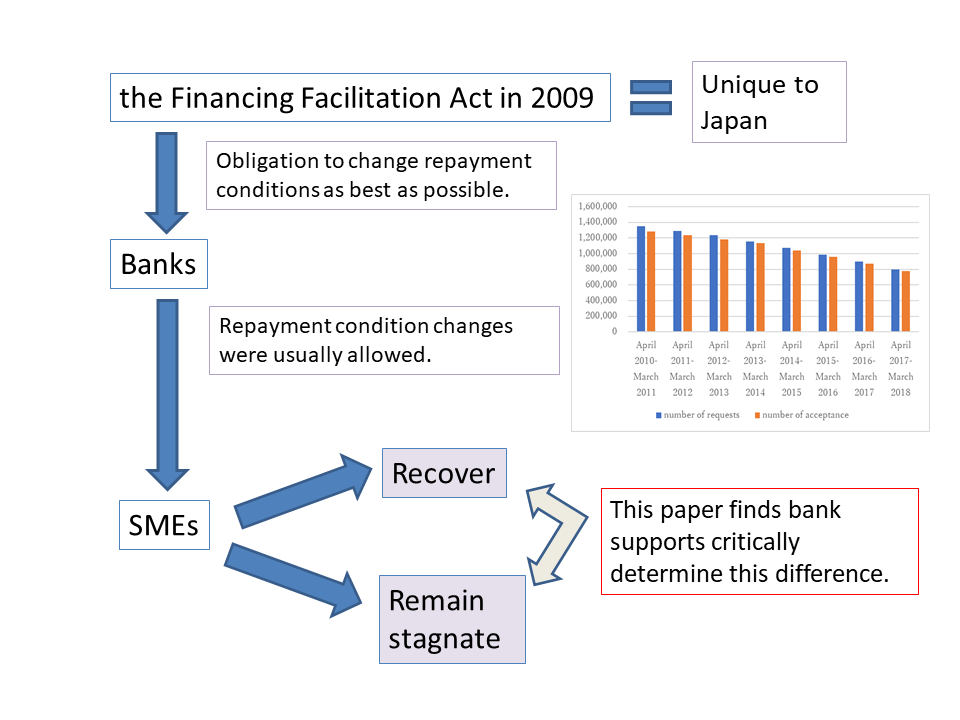

After the global financial crisis, the Japanese government enacted the Financing Facilitation Act in 2009 to help small and medium-sized enterprises (SMEs) that had fallen into unprofitable conditions. Under this law, when troubled debtors asked financial institutions to ease repayment conditions (e.g., extend repayment periods or bring down interest rates), the institution would have the obligation to meet such needs as best as possible. Afterward, the changing of loan conditions began to be utilized often in Japan as a means for supporting underperforming companies. Although many countries employed various countermeasures against the global financial crisis, the Financing Facilitation Act was unique to Japan. However, there is criticism that it did not become an opportunity for companies to substantially reform their businesses, and that there was a moral hazard on the company’s side. This paper analyses whether the easing of repayment conditions revived underperforming firms and who were likely to recover, by using the “Financial Field Study After the End of the Financing Facilitation Act”, carried out by the Research Institute of Economy, Trade and Industry (RIETI) in Oct 2014. We found that the act was successful in that about 60% of companies whose loan conditions were changed recovered their performance after the loan condition changed, and the attitude that financial institutions had towards support was an important factor in whether performance recovered or not. In sum, the act might be effectual when financial institutions properly support firms, although previous studies tend to emphasize its problems.

- financing facilitation act

- business improvement

- business support

- regional financial institutions

- business revitalization

Contents of the paper

2.1. Impacts of the global financial crisis on Japanese SMEs. 2

2.2 The SME Financing Facilitation Act 4

3.1 Impacts of the global financial crisis on SMEs. 6

3.2 Literature relating to the Financing Facilitation Act 6

- An outline of the Financial Field Study After the End of the Financing Facilitation Act 7

- Results. 8

5.1. Changes in loan condition changes after the Financing Facilitation Act 8

5.2. Changes in business performance from the first changes in loan conditions to the present 9

5.3. An overview of companies which had their loan conditions changed. 10

5.3.2. The current business states. 10

5.3.3. Changes in the debt balance from financial institutions. 11

5.3.4. The details of payment condition changes. 12

5.4. Relations with main banks. 12

5.5. The changes in attitude of financial institutions after condition changes. 14

5.6. Self-evaluation on the reasons for the improvement 15