1. Sugarcane Crops in Brazil

Currently, there are plantations of sugarcane all over Brazil; however, the most significant crops are concentrated in the northeast, southeast, and central-west regions. Regarding the leading producers, in the 2018/2019 harvest, the leading state producers in the northeast were Pernambuco and Alagoas. In the central-west, Goiás was the leader in production, and in the southeast, where the most extensive national production is located, São Paulo state had the most significant production, followed by the state of Minas Gerais [

24].

Regarding sugarcane production, in the 2018/2019 harvest, the amount of sugarcane produced was 625,963 thousand tons, representing a 1.2% decrease compared to the previous harvest [

25]. To understand the reasons for this decrease, it is vital to analyze the factors influencing the production, i.e., productivity and harvested area.

In the sugarcane area harvested in 2018/2019, there was a reduction of 1.3% compared to the harvest in 2017/2018. This was the second decrease in a row considering the area cultivated. Moreover, this situation has been occurring since the 2016/2017 harvest, and it is due to a number of factors [

25]. First, there has been a shortage cultivation area. The expansion of a specific crop depends on the willingness of farmers [

24], and to decide a crops’ expansion it is necessary to choose between two different crops [

26]. Such a decision is complicated because it involves risks and costs. Specifically, for sugarcane, the investments and costs related to producing this plant are 2.5 higher than those required to produce soybean [

26].

Secondly, in some regions, contracts between sugarcane mills and farmers were not renewed due to the significant distance between the farms and processing areas, or the low profitability of these contracts. Difficulties in using machines to harvest sugarcane are another reason to end contracts [

25]. Moreover, a risk related to these contracts is the non-payment or delay in the payment to farmers [

27,

28]. Another reason for the decrease in the area of sugarcane harvested in Brazil is the necessity to renew the crops, with more areas for new seeds [

25]. Financial issues also have motivated the decrease in the sugarcane cultivation area [

29]. Many factors have contributed to worsening these issues, such as lack of rain, governmental policies to control gasoline prices, low sugar prices, the necessity for imported products, and an increase in the dollar exchange rate.

The average productivity for sugarcane crops all over Brazil in the 2018/2019 harvest was 72,671 kg per hectare. This value is similar that for harvests in 2016/2017 and 2017/2018. However, even this might seem satisfactory, since there was no reduction in the last three harvests, current productivity is lower than it was in the past. For instance, in the 2009/2010 harvest in São Paulo state, the leading state producer in Brazil, the average productivity reached almost 90,000 kg per hectare, but in the 2018/2019 harvest, the productivity was around 76,000 kg per hectare. Such a decrease from the 2009/2010 harvest to the 2018/2019 harvest almost happened in other states. For example, in Paraná, the decrease was 19,000 kg per hectare, and in Alagoas the difference was even higher at 26,000 kg per hectare [

25]. Among the reasons for the reduction in productivity are lack of investment, low renewal of crops, and rainfall reduction [

30].

In Brazil, there is a link between the economic situation and the decrease in sugarcane production. First, an economic situation in which there was an increased level of indebtedness and negative income of sugarcane mills, associated with the preference of the Brazilian banks for higher liquidity and more strict rules for borrowing financial resources, led to little chance of obtaining credit. When the sugarcane mills had fewer chances of financing their crops, farmers chose to reduce the expansion rate and not to renew or invest in the plantations. These factors contributed to a decrease in productivity and production [

11,

15,

31]. Furthermore, climate change badly affected sugarcane crops, and a decrease in rainfall may have led to less production of sugarcane [

30].

2. Products Manufactured from Sugarcane

The main products obtained from sugarcane processing are ethanol and sugar [

15,

32,

33].

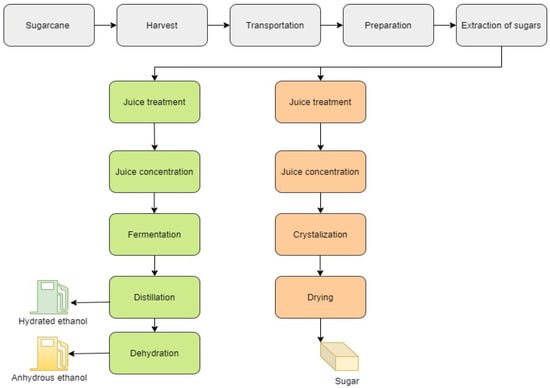

Figure 1 shows a simplified diagram outlining production of both products.

Figure 1. Production of ethanol and sugar from sugarcane.

According to

Figure 1, to obtain sugar and ethanol, some stages are shared, and companies must choose between sugar and ethanol since both are derived from the juice recovered from the sugarcane. This is interesting because it indicates competition between ethanol and sugar production, and the decision is made according to economic factors, such as market value [

34].

In the 2013/2014 harvest, the amount of sugarcane used to produce sugar and ethanol was almost the same. However, this proportion has been changing over the years, and in the 2018/2019 harvest, the proportion was almost 40% to produce sugar and 60% to produce ethanol. It is expected that in the 2023/2024 harvest, less than 40% of Brazil’s sugarcane will be used to produce sugar [

35,

36,

37]. This is based on reducing sugar prices due to the surplus of this product in the world market.

3. Sugar-Related Health Risks

Sugar consumption in excess may lead to higher cancer risk because it causes insulin-glucose dysregulation, oxidative stress, inflammation, and body adiposity. It is necessary to advise the population to reduce sugar consumption because it may lead to obesity and affect cardiometabolic health, which are some of the factors that increase the risk of cancer [

38]. Furthermore, there is an association between sucrose intake and consumption of products such as sweet buns and cookies, leading to a higher risk of endometrial cancer [

39].

Considering the potential risk of cancer due to the consumption of sugar in excess, some regulations have been created to decrease sugar consumption. For example, in Brazil, some policies aim to promote restrictions on the sale of sugar-sweetened beverages (SSB) in schools [

40]. This restriction considers not only that SSB damages children’s health but also because children may adopt the habit of eating unhealthy food [

41]. Another restriction is related to advertisements or promotion of unhealthy food. Companies must not take advantage of children’s innocence to increase sales of these products, and must not stimulate negative habits such as consuming such unhealthy products [

40].

Besides Brazil, 13 other countries in Latin America have adopted policies to reduce sugar consumption. Other Latin American countries follow the same policies used in Brazil, but they also apply SSB taxes [

40,

42,

43]. The taxation on SSB is also present in other countries such as Finland, France, Hungary, Latvia, Fiji, Nauru, Samoa, and French Polynesia [

44,

45]. Another aspect interesting about these initiatives is their effectiveness. The taxation on SSB may be helpful to improve public health due to less consumption of SSB, and the population may tend to drink healthier beverages such as fruit juice [

46]. In addition, the income from SSB taxes may be used for the benefit of the population, for instance, to improve the health sector [

47].

4. Legal Aspects Related to Sugarcane Production

Sugarcane production in Brazil might be negatively affected because of legal factors, especially those related to its harvest. Currently, Brazil has two ways of harvesting sugarcane: the manual and the mechanical method [

48,

49,

50]. The main difference between these methods is that manual harvesting requires burning because there is the risk of cutting workers that are responsible for cutting the plant [

51]. In addition, there are several negative consequences related to burning, for example, greenhouse gas emissions, flora and fauna affected by the high temperatures and smoke, and sugar loss [

52,

53,

54].

Considering the issues caused by burning sugarcane crops, law no. 11241, established on 19 September 2002, was created to prohibit this practice [

55,

56]. According to this law, in areas where it is possible to use machines, it will be illegal to burn sugarcane crops after 2021 [

28,

57,

58]. In addition, in regions where mechanical harvest is not possible due to topography, it will be prohibited to burn sugarcane crops after 2031 [

58,

59].

Analyzing the prohibition terms of São Paulo state law, it is interesting to identify the percentage of areas using the mechanical method and the manual one. In crops, in the central-south region, only a small percentage of crops still involve manual harvesting. On the other hand, in Brazil’s north and northeast regions, the percentage of farms using manual harvesting is significant at around 80%. In addition, since the 2014/2015 harvest, the percentage of manual harvesting has not changed considerably [

25].

Two reasons for the slow reduction in manual harvesting in the north and northeast regions are the topography and the availability of workers. Due to the uneven surface, the topography makes it difficult to use machines in the sugarcane crops. Furthermore, it is essential to highlight that prior burning is not compulsory. Therefore, not every area that uses manual harvesting burns the crops. However, few workers accept harvesting a crop that is not burned, it is more difficult to harvest the sugarcane when it is not previously burned, which leads to more incidences of prior burning in areas with manual harvesting [

28,

57,

58].

Nineteen years have elapsed since the law that prohibits burning in sugarcane harvesting until 2021 was passed, and more than 70% of the producers in the north and northeast do not use mechanical harvesting. This may mean that most producers will not have changed to mechanical harvesting by the end of 2030, mainly because in most of these regions, it would be necessary to change the local topography. Even though the law mentioned is only for cities in São Paulo, it shows that producers in the north and northeast are not concerned about following trends that lead to change in this practice. In addition, it is likely that environmental laws have become more strict in terms of sustainability and therefore affect some sugarcane crops that still use the burning method in the harvest [

60].

As mentioned, greenhouse gas emissions are an important issue related to sugarcane burning. The emission avoided using mechanical harvest is 1223.6 kg CO

2eq ha

−1 yr

−1 [

61]. In addition, the Brazilian government signed an agreement during COP21 to reduce its emissions to 43%, based on the levels measured in 2005, by 2030 [

62,

63]. Two possible consequences of such a scenario may be the creation of federal laws to prohibit sugarcane crop burning, to fine producers that use this practice, or to award lesser gains from selling decarbonization credits (CBios) in the stock market. Therefore, producers may have less profitability due to the payment of fines or because they can sell fewer CBios. In the worst-case scenario, in which a federal law is created, they will not be allowed to burn the sugarcane. This situation may lead to the acquisition of expensive machines and consequently increase the sugarcane production costs. A possible outcome of this is that sugarcane producers facing difficulties may resort to other agricultural activities. This change is not attractive to the ethanol market in Brazil because the north and northeast produced almost 2 billion liters of ethanol in the 2018/2019 harvest. Even though the main producing region is the central-south area, with 28.5 billion liters in the same harvest, the north and northeast regions would undoubtedly contribute to achieving future demands [

25].

5. Alternative Feedstocks to Produce Ethanol

Considering the abovementioned issues related to sugarcane production and its negative impact on the ethanol market, it is essential to consider another alternative, for example, corn ethanol. Furthermore, since bioethanol is an exciting alternative to fossil fuels, it is essential to have more feedstock options to supply the demand [

32,

64]. Adding another source for ethanol production may increase the fuel’s relevance and create a more stable ethanol market [

65].

It is important to understand that around the world there are other sources besides corn that are used to produce ethanol; for example beet pulp, sweet sorghum, wheat, cassava, and lignocellulosic biomass [

65,

66,

67]. Even though there are other sources used to produce ethanol in other countries, in this article the suggested second feedstock to produce ethanol in Brazil is corn because corn is the second most important crop considering the area harvested, and Brazil is one of the main players in the corn world market [

11,

68,

69]. In addition, Brazil has advanced technology in agriculture, which has resulted in Brazil achieving an almost 50% average gain of productivity in grains [

11].

6. Brazilian Corn Market

The corn crop in Brazil has a unique characteristic that differs from the corn crops in other locations. Usually, corn producers grow only one crop a year; however, in Brazil, farmers can grow two [

70,

71,

72]. The first crop, which is also called the summer crop, starts with planting between September and December, and is harvested between January and April. Most of the first crop production is to supply the domestic market. The second crop, or winter crop, started in the 1980s, is planted between January and March and harvested between May and August. The winter crop mainly supplies the international market [

73].

In Brazil, corn crops are grown all over the country; however, higher production levels are found in the central-south region. The leading producer is Mato Grosso state, with 26.1 million tons of corn harvested in 2017/2018. The second-largest producer in the same harvest was Paraná state, with 13.5 tons. Considering national corn production, in the 2017/2018 harvest, 85 million tons were produced. Such production resulted from an area planted of 16.67 thousand hectares. These values represent the summer and winter crops [

74].

Corn is crucial for Brazil because the country is one of the largest corn consumers in the world. Most of this production is used for feed purposes, mainly because in recent years the population’s income has been rising; therefore, there has been a growing domestic demand for meat, such as swine and broiler meat [

11,

68,

69]. Due to the demand for corn for animal feed, the first crop is destined for animal feed and second crop is mostly for exportation [

11,

68,

69].

Part of the total corn production can be stored. For example, in the corn harvest mentioned previously, 12.7% was stored. The amount of corn stock varies from harvest to harvest. For instance, in the 2014/2015 harvest, the stocks reached 17.2 million tons, and in the 2015/2016 harvest, only around 6.8 million tons were stored [

75]. Stocks are created because production exceeds the demand for corn.

Regarding storage, related costs and commodity prices, are important. Maintaining stocks requires insurance, taxes, and the opportunity cost of the capital invested in maintaining the product stocked [

76]. Furthermore, when producers choose to keep their products in stock, aiming to sell them in the future, they are taking the risk of price variation making it difficult to know whether storage is economically viable [

77]. Besides the risk related to price, farmers also face other risks such as weather conditions and plagues [

78,

79]. Another critical aspect is transportation. Even though there have been tremendous technological improvements in Brazilian agriculture, the country faces issues with logistics, which is a limitation for this business [

80].

Considering the risks of losing money due to the price variations of corn and the costs of maintaining stock, it would be interesting for farmers to have an application for the corn stored. Therefore, an attractive product to be produced from corn might be ethanol. In addition, from corn processing to obtain ethanol, there are by-products such as Distillers Grains (DGS) with soluble compounds that are sources of proteins and fat [

81]. DGS can be used for cattle feed and have advantages such as low cost compared to other sources of protein and fat, and this product can be produced without affecting human food production [

82,

83,

84].

On aspect of DGS in cattle feed is the positive results of adding this product to the animals’ diet [

85,

86,

87]. For example, a study that included DGS in Holstein cows’ diet found an increase in milk yield [

88]. However another study concluded that the inclusion of DDGS did not influence milk yield or the milk composition [

89]. It is possible that farmers can increase their profit by selling ethanol and DGS as cattle feed.

Another possibility for corn farmers is to produce ethanol [

90,

91]. This is interesting because the ethanol market in Brazil will benefit from the RenovaBio Program [

19,

84,

92]. The RenovaBio Program was created in 2016 to incentivize biofuel production by 2030 [

19,

84,

92,

93]. In addition, this program aims to provide more stability for the biofuels market and to attain the commitments agreed upon at COP21 (21st Conference of the Parties) [

94]. From this program, biofuel producers will receive a document corresponding to a certain amount of CBios based on their efficiency in biofuel production [

19,

84,

92]. These CBios can be sold on the stock market, and be another source of income for farmers [

15,

16,

62]. This is an interesting opportunity for farmers to explore because due to incentives to reduce carbon emissions, the biofuels market has the potential for significant development and to receive investments [

95].

An interesting measure that can be taken to improve net energy balance and reduce greenhouse gas emissions in corn ethanol plants is the cogeneration of electricity [

96]. The biomass obtained after ethanol production, such as the corn stover and DGS, can be used to generate electricity, which may reduce the use of coal and lead to less greenhouse gas emissions [

97].

The production of corn ethanol is still in the beginning phases. Currently, there are five plants in operation, and another six are still projects in the final stages of conclusion [

92]. Some facilities can produce ethanol using more than one feedstock, such as sugarcane and corn.

This entry is adapted from the peer-reviewed paper 10.3390/biomass3010001