2. Background to LEMs and MGs

The concept of P2P is not entirely new and has been used in a wide variety of applications, ranging from computer networks to energy management. In the context of MG systems, P2P energy trading allows each individual MG to share its resources and trade energy with other neighboring peers (i.e., other MGs or any producer and prosumer) in order to ensure the security of supply. Depending on the installed capacity and location, certain peers may be able to support and supply the loads of neighboring peers with deficit energy by exchanging their excess energy [

8,

14]. A LEM can facilitate this energy trade among individual MGs and offer transparency to each transaction between sellers and buyers. This can be particularly important for the concept of smart city to achieve a complete connection among the distinct city entities by allowing them to interact and share their resources with each other [

24]. Implementing a LEM can provide numerous benefits to both the participant and the power system, being considered by IRENA as one of the 30 innovative solutions to enhance power system flexibility, grant increased access to renewable energy, empower consumers, and allow for a higher availability and more cost-effective use of RES [

25].

A well-known and successful implementation of a LEM is the real-world case of the Brooklyn MG part of the TransActive Grid project, which uses blockchain technology to allow local P2P energy trading among the participants without relying on a central entity to manage the transactions [

12,

14]. Besides this case, several regional and national projects have been developed for P2P energy trading with some of the most relevant ones being Piclo in the United Kingdom, Vandebron in the Netherlands, and Yeloha and Masaic in the United States [

14,

15]. In a smaller scale, other projects have been developed for P2P energy trading in MG systems, including PeerEnergyCloud in Germany and TransActive Grid in the United States. The PeerEnergyCloud project was developed using a cloud-based trading platform for the local transaction of excess energy within a MG [

12,

14].

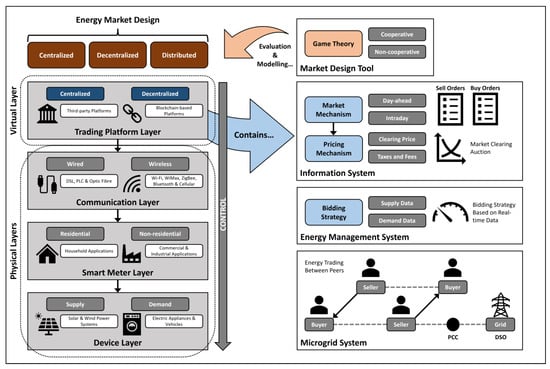

As represented in

Figure 1, the market design, trading platform, and physical infrastructure are some of the key aspects of P2P energy trading in LEMs. In any of the designs, each upper layer is responsible for the control of the lower layer. The use of game theory, namely cooperative and non-cooperative games, is also an important aspect to consider when designing a P2P energy market to model the decision-making behaviors among market participants, being reflected in the sheer number of publications proposing game-theoretic approaches [

16,

17,

18,

19,

20,

21,

22]. The heterogenous and dynamic nature of SGs and MG systems motivates the adoption of game-theoretic approaches due to the existence of various players with distinct goals or preferences, which often seek to maximize their own profits [

119]. Game theory is proven to be effective in analyzing decision-making behaviors, allowing us to properly justify, in a mathematical way, the strategic interactions among multiple independent players in a highly competitive environment and help predicting the outcome for their interactions. More importantly, this enables the easy integration of pricing mechanisms and incentive designs that can adapt to the heterogenous and dynamic nature of SGs and MG systems by modelling the behaviors of players and stimulate interaction between them [

105,

119].

The energy trading platform is part of the virtual layer and contains an information system that interacts with the energy management system [

12]. Trading platforms, categorized as either centralized or decentralized, are seen as the interface that houses the necessary market mechanisms and enables the P2P transactions based on gathered data and information. They need to ensure that participants follow the market regulations and pay any fees associated with the use of the power distribution grid. An effective and reliable information system is also required for the operation of the energy trading platform and provide access to the energy market, enabling participants to connect and transact energy with each other as well as with retail and wholesale markets [

12,

16]. As shown in

Figure 1, the information system allocates two important mechanisms, namely the market mechanism and pricing mechanism. Then, an energy management system is responsible for managing the amount of traded energy from sellers to buyers with a bidding strategy based on real-time supply and demand data of each market participant [

12].

Figure 1. Diagram of the typical structure of LEMs for P2P energy trading in MGs and its distinct virtual and physical layers.

The physical layer mainly includes the physical infrastructure responsible for the power flow and data communication between peers or devices. Depending on the communication requirements and type of network (e.g., WAN, NAN, and HAN), the communication between the trading platform and smart meters and devices can be achieved through various communication protocols and standards using wired technologies (e.g., DSL, PLC, and optic fiber) or wireless technologies (e.g., Wi-Fi, WiMax, ZigBee, Bluetooth, and Cellular 3G/4G/5G) [

26]. Many works have been specifically proposed for SGs and MG systems, but even the ones proposed for other applications such as electric vehicles (EV) and battery energy storage systems (BESS) can be effectively integrated into MG applications.

2.1. Relationship between LEMs and MGs

LEMs can be seen as local energy communities, which are considered and treated as legal entities consisted of local system operators, generators, and consumers. Such communities aggregate distributed energy resources (DERs) in a local area, allowing us to mitigate forecast errors of renewable energy generation and turn community members into active market players [

63]. This is facilitated through consumer-centric schemes for P2P energy trading to enable the concept of P2P economy also known as sharing economy [

64]. The active engagement from community members can lead to the provision of ancillary services to distribution system operators (DSOs) and reduction of additional costs associated with grid usage and expansion, extending the charging network for EVs in MGs and facilitating the transition to smarter, cleaner, and more flexible grid systems [

63,

65].

There is a close relationship between the concept of local energy community and the concept of MG or SG. According to [

65], the definitions of local energy community available in the literature do not concern technology, unlike the definitions of MG. The concept of local energy community focuses solely on the community as space, as stakeholder, and as shared interest. It mainly concerns the area affected, who develops and runs the project, and who benefits from the project in socio-economic terms. MGs can be owned by a utility or any other private or public company, but in certain cases, the community can act as a stakeholder by implementing and operating an MG itself. In either case, the local energy community is electrically served by the MG, independently of the ownership [

65].

MGs interact with the LEM or community as well as with the upper wholesale market layer in order to provide various ancillary services to both DSOs and transmission system operators (TSOs) [

66]. These services can include black start capability, congestion management, reactive power and voltage control support, harmonics compensation, frequency regulation, load following, and spinning, non-spinning, and replacement reserves [

67]. Depending on local or regional regulation, SGs and MGs can provide increased flexibility to TSOs as they can be treated as effective means of grid expansion. This has the potential to increase reliability and effectively extend the power supply to remote and isolated locations [

66,

68].

2.2. Barriers Associated with MGs

While MGs can provide various benefits and services to facilitate the implementation of LEMs [

66], there are technical, social, institutional, economic, and regulatory challenges that constitute potential barriers to their widespread adoption [

69,

70].

Technical challenges may involve developments in control of MGs with meshed topology, improvements in islanding detection techniques, changes in fault currents by location and operation mode, lack of grounding systems for DC MGs, and difficulties in implementing controllers for plug-and-play capabilities and in managing, exchanging, and processing large amounts of data [

64,

69]. The islanded operation of MGs is associated with some challenges which may include the ability of DERs to locally change power output according to the frequency and voltage of the MG or the capability of grid-forming power inverters to provide synthetic inertia and regulation of frequency and voltage [

71]. Another potential technical barrier can be related to the lack of conformity with communication protocols and standards or the inappropriate design of energy resources, energy market, infrastructure, and various systems, which can diminish the overall efficiency, reliability, and lifespan of SGs and MGs [

69,

70]. In particularly, user privacy and cybersecurity has received a lot of attention to ensure the privacy of users and the integrity and security of data [

64]. The availability of secure and anonymous data is important to estimate grid constraints, determine the need for consumer-centric services, and guarantee a healthy growth of competition among market players in local flexibility markets [

64,

72].

Social challenges often include the ability of community members to be persuaded in being actively engaged in MG projects during the planning stage and accept the integration of various RES and smart devices, as well as the lack of qualified and experienced community members with adequate knowledge regarding energy management or system maintenance [

69,

70]. Moreover, other social challenges can be related to the identification of potential triggers for behavioral changes via incentives and the lack of mutual agreements or cooperation among all involved parties (e.g., community members, investors, or system planners and developers) [

64,

69,

70]. The lack of engagement in MG projects and market activities is often a result of the lack of interest on the part of consumers or the lack of understanding and willingness to understand [

64].

Institutional challenges are generally related to inertia in changing the structure of power systems and difficulties in decision-making and coordination among stakeholders. These challenges also encompass some economic barriers associated with lack of incentives, financial capacity, or capital to make significant high-risk investments in MG projects and uncertainty regarding future revenues and hidden costs [

69,

70]. From an economic perspective, it is important to overcome the challenge of defining common frameworks for profitable business models and identifying, evaluating, and comparing new or existing business models applicable to SGs and MGs from on-going project demonstrations [

64].

Regulatory challenges include the assurance of user privacy and cybersecurity, lack of incentive for community members to provide flexibility, and uncertain contractual agreements between market players [

69,

73]. In certain cases, the existence of ineffective initiatives or lack of proper policy and frameworks may discourage stakeholders and players, preventing them from being interested in MG projects. This constitutes a potential barrier to the development of mechanisms and schemes (e.g., feed-in tariffs, net metering, net billing, and tax incentives), which are needed to promote and facilitate the integration of RES and trade of excess energy between community members in a SG or MG [

70]. According to [

64], some of the regulatory challenges in SGs and MGs can be associated with the provision of incentives for smart metering data, demand response (DR), and commercial arrangements, as well as the need to provide clear rules and set responsibilities regarding competition, ownership, and technical and financial conditions [

64]. Regulation also plays a key role on allowing the use of blockchain technology for automated transactions between parties and increasing its potential in existing SG and MG applications [

64].

Several European projects have been developing approaches to address some of these challenges. The proposed projects are mainly focused on upgrading the existing architecture (e.g., SmartNet and IDE4L projects) or based on introducing essential changes to the architecture through decentralized systems with local autonomy in the optimal management of resources (e.g., Web of Cells and LINK-Solution projects) [

72].

3. Energy Market Design

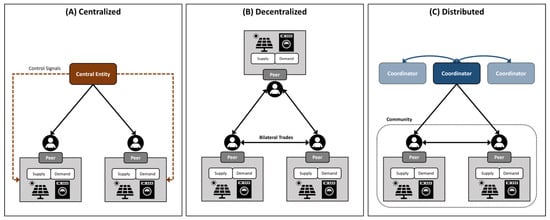

The implementation and operation of P2P energy trading in LEMs requires a market design capable of dealing with the increased penetration of RES and effectively enable participants to share their resources with other peers in the same network. Depending on how they are structured, these energy market designs can be categorized as centralized, decentralized, and distributed markets [

16,

17,

18,

19,

20,

21,

22], as briefly represented in

Figure 2.

Figure 2. Diagrams of market designs for P2P energy trading: (A) Centralized; (B) Decentralized; (C) Distributed.

3.1. Centralized Market Designs

A centralized market design relies on pool market trading and involves a central entity to manage and coordinate the energy transactions between the participants [

16,

17], as represented in

Figure 2A. The central entity is responsible for making decisions regarding prices and for directly managing the amount of energy exported and imported based on data collected from each peer [

16,

19,

20].

Some works available in the literature have addressed the implementation of centralized market designs, mainly focusing on the optimization and reduction of energy costs. Alam et al. in [

27] proposed a near-optimal cost algorithm, called “Energy Cost Optimization via Trade” (ECO-Trade), for the optimization of the energy trade and to avoid unfair cost distribution in a centralized market design by coordinating the P2P energy trade in smart homes with demand-side management (DSM) system. In [

28], two centralized market designs, called “Flexi User” and “Pool Hub”, are proposed for P2P energy trading in a LEM incorporated with BESS to achieve energy cost savings. Long et al. in [

29] proposed a two-stage aggregated control for P2P energy trading in community MGs by simply using one-way communication links and measurements at the PCC. The energy resources of each individual prosumer were controlled and managed using a central entity or third-party entity known as the energy sharing coordinator (ESC), being able to reduce the energy bills and costs of the community.

3.1.1. Advantages of Centralized Markets

This market design allows the central entity to maximize the social welfare of the entire P2P energy market and increase the overall market efficiency [

21,

78,

79]. The study in [

22] found that decentralized energy markets result in a small welfare loss of around 4.25% when compared to centralized energy markets, which can be a significant difference considering the annual trade volume occurring in large-scale markets. There is also less uncertainty of power generation and consumption patterns with a centralized market design, given the increased direct control of the central entity over the device operation of peers [

16,

21,

80].

Ahlqvist et al. in [

81] addresses and discusses wholesale electricity markets, providing a detailed comparison of the main advantages and disadvantages of adopting centralized and decentralized market designs. In wholesale electricity markets, a centralized design can ensure the technical and economic feasibility of the day-ahead dispatch by relying on the central entity to manage and coordinate electricity production. This coordination and decision making is achieved by taking into consideration several network aspects such as power plant location, costs, and ramp rates, which are submitted to the central entity as part of the bid [

81]. Because centralized electricity markets use marginal or uniform pricing based on the variable costs of the marginal generation unit or power plant, they can set a clear and well-defined market price for all transactions at a specified location [

78,

81]. These well-defined market prices are only possible if there are no uplift payments or other form of compensation to help finance start-up and no-load costs, which often provide producers an incentive to exaggerate or overstate their variable costs [

81]. Due to increased coordination, these markets can also help providing various grid services and delivery of high-quality energy [

19].

3.1.2. Disadvantages of Centralized Markets

A centralized market design raises a few autonomy and privacy concerns because of the amount of data each peer sends to the central entity and its ability to directly influence their decisions and outcomes of deals [

16]. Privacy can become a concern for market participants because sensitive information regarding personal preferences, load properties, and daily habits can easily be disclosed during the bidding processes [

80]. In addition, the existence of a single central entity to manage the entire market makes it unable to scale and vulnerable to a single-point failure [

78].

Another disadvantage of the centralized market design is the high computational and communication burden [

17], especially in P2P energy markets with many DERs and peers participating simultaneously in the energy trade [

16,

21,

66]. This large number of market assets is likely to cause severe problems related to data collection and communication faults for the central entity, reducing the scalability of the centralized network [

80]. More specifically, the presence of various dynamic costs, as well as network and production constraints in the bidding process, prevents the separation of the market clearing of adjacent supply periods in the optimization of day-ahead dispatch. This contributes to a significant increase of the computational burden required for a fast and transparent market clearing procedure free of faults, especially if the day-ahead market needs to be cleared within a short time frame (i.e., from 5 min to 1 h). For large-scale markets, the scalability of the network can be substantially reduced as the clearing procedure becomes more complex and challenging to perform in short time frames [

80,

81]. This constitutes a challenge to attain an optimal dispatch within such a short time frame in the day-ahead market, thus having to rely on approximations determined by an opaque iterative procedure which reduces market transparency and forces participants to place their trust on the central entity [

81].

The response to grid events such as uncertain generation from RES, power outages, and network disturbances is usually slow in day-ahead markets with a centralized market design. This is a result of producers or prosumers being forced to wait for the real-time or hour-ahead market in order to correct or adjust their day-ahead dispatch [

78,

81]. Centralized markets are often rigid and offer low day-ahead dispatch flexibility, making intra-day market trading a difficult task for producers with day-ahead unit commitment and tailored-made contracts. In certain cases, penalties can be issued to prevent producers from revising and optimally adjusting their day-ahead dispatch. This inflexibility is also reflected in the ability to develop new bidding strategies to properly integrate ESS and DR programs, which require high costs and long periods of time [

81].

3.2. Decentralized Market Designs

A decentralized market design discards the central entity and allows energy to be directly traded between the participants through bilateral trading [

16,

17], as represented in

Figure 2B. Because there is no central entity to manage and coordinate the transactions, this market design is operated in a less organized and structured manner with lower market efficiency [

16,

19,

20]. According to the literature, decentralized market designs are often considered as pure and full P2P networks.

There have been several works being proposed in the literature regarding decentralized market designs, being mostly focused on satisfying the preferences of participants and on maximizing social welfare. Sorin et al. in [

30] introduced a P2P market structure based on a multi-bilateral economic dispatch (MBED) formulation in a fully decentralized manner. This allowed for a more pro-active participant behavior and enabled multi-bilateral trading with product differentiation in respect to participant preferences while maximizing social welfare. Morstyn et al. in [

31] presented a new scalable decentralized market design for P2P energy trading using forward and real-time bilateral contract networks to satisfy full substitutability conditions and obtain a stable outcome. Khorasany et al. in [

32] proposed a fully decentralized market design for P2P energy markets with high penetration of DERs. By using bilateral trading with product differentiation, the proposed design respected the preferences of participants and enabled them to trade energy while maximizing the social welfare and reducing the amount of data exchanged in the system. Antal et al. in [

33] presented a blockchain-based decentralized market to enable prosumers to trade their energy profile flexibility in a fully P2P manner. The results of this decentralized market showed complete self-consumption of renewable energy generated in a small-scale urban MG, which facilitated the P2P transactions of DSM among prosumers. Khorasany et al. in [

34] proposed an energy trading optimization framework for a decentralized market containing smart buildings with BESS and aggregated EVs. This framework was focused on maximizing social welfare through P2P energy cooperation among participants. Hu et al. in [

35] relied on game theory to develop a decentralized energy trading framework for an oceanic islanded MG. This framework was able to maximize the revenue of the aggregator and minimize the energy costs for each participant.

3.2.1. Advantages of Decentralized Markets

This type of market provides a high level of autonomy and privacy for participants, because no data is sent to a central entity and each peer is directly responsible for their own decisions and has control over the outcomes of deals [

79]. The absence of a central entity increases reliability as it eliminates problems associated with single-point failures [

16,

17]. This also offers high scalability, flexibility, and plug-and-play capability to the network, allowing peers to easily enter or leave the energy trading market if they so desire [

16,

21]. The fewer number of communication links compared to centralized energy markets is an important factor that contributes to the increased scalability [

30].

As addressed by [

81] in the context of wholesale electricity markets, a decentralized market design provides a more transparent and straightforward way to facilitate hedging and simplify market clearing, which can also increase the scalability of the network. This is achieved by performing a decoupling of supply periods in the day-ahead market. Market prices received by producers and paid by consumers are dependent on the respective zonal spot prices, being advantageous for investments and facilitating the hedge of profits for prosumers and optimal dispatch based on estimates [

78,

81].

3.2.2. Disadvantages of Decentralized Markets

The lack of a central entity to optimally manage and control each transaction deteriorates the social welfare of the P2P energy market and reduces its efficiency [

21,

22,

78,

79]. The reduction of social welfare is a result of producers and prosumers avoiding losses due to non-convexities by offering their electricity at a price higher than their marginal cost [

78,

81]. Moreover, the management of a decentralized market network is known to be relatively complex due to several hidden constraints (e.g., participant interests and device operation) that are difficult for the DSO to visualize and predict, which also contributes to the low overall efficiency of the market [

16].

Decentralized market designs often rely on block orders, which can increase the complexity of the bidding process due to the large number of different block types or combinations of supply hours [

81,

82], although this complexity can be mitigated by applying block type restrictions on block orders [

82]. While the increased complexity can be a drawback, block orders also provide additional flexibility in intra-day markets, allowing producers to increase their generation output during a certain period by simply selling more for that period in the intra-day market [

78,

81]. In addition, continuous intra-day trading in decentralized markets may suffer from problems related to the lack of full consideration for grid transmission constraints due to the fast and overwhelming market clearing process. Such problems cause zonal pricing inefficiencies in large networks, favoring fast traders rather than network owners. There is an incentive for automated high-frequency trading in continuous intra-day trading, resulting in a problematic large number of orders needed to be clearer in a short time frame [

81]. This type of energy market can also induce a level of competition among participants, but without a central entity to coordinate the energy trade, it may be unable to provide or guarantee the delivery of high-quality energy to the consumers [

19].

3.3. Distributed Market Designs

A distributed market design can be seen as a combination of the centralized and decentralized market designs, in which various central entities, in this case called coordinators or agents, are used to coordinate the transactions but participants can trade energy with each other without their direct influence [

16,

17], as represented in

Figure 2C. The role of central entities or coordinators in a distributed market design is relatively limited compared to their role in centralized market designs because they cannot manage the amount of energy each peer exports or imports [

16,

19,

20].

The works available in the literature encompassing distributed market designs are mainly focused on the development of pricing mechanisms to enable and facilitate P2P energy trading in SGs and MG systems. For instance, Long et al. in [

36] proposed three distinct pricing mechanisms for P2P energy trading in a community MG to increase income for producers and reduce energy costs for consumers. These pricing mechanisms included bill sharing, mid-market rate, and auction-based pricing with specified detailed business models, energy trading prices, and individual participant energy costs. Liu et al. in [

37] proposed a P2P energy trading model with price-based DR for MGs. This was achieved by using an equivalent cost model based on the energy consumption flexibility of prosumers and a dynamic internal pricing model based on the supply and demand ratio of PV energy traded. Furthermore, Nunna and Srinivasan in [

38] proposed an agent-based transactive energy management framework for distribution systems with multiple MGs, enabling each MG to buy or sell energy in the internal auction-based market. In the context of social welfare in distributed market designs, Kang et al. in [

39] proposed a P2P energy trading model to enable local electricity trading among plug-in hybrid electric vehicles (PHEVs) in SGs. This was achieved by using an iterative double-auction mechanism to determine the price and amount of electricity traded and thus maximize social welfare. Concerns associated with the security and privacy of the PHEVs are also considered in the proposed model, showing a relative improvement of the protection level. Wang et al. in [

40] presented a model for a distributed energy trading market using game theory to study the cooperative benefits between several EV charging stations and integrated energy systems. This model was able to reduce energy costs for the integrated energy systems and increase profits for the EV charging stations by considering individual participant interests and various uncertainties associated with market prices, renewable energy generation, and DR. Khorasany et al. in [

41] proposed a hybrid energy trading scheme for distributed energy trading markets, in which market participants could transact in different LEMs, neighborhood areas, or even transact with the grid. Each LEM relied on a central entity known as the community manager (CM) to facilitate the process of energy trading and negotiate with the other CMs for energy trading between distinct markets. Finally, Yao et al. in [

85] proposed a strategy for distributed energy trading markets to determine the optimal trading decisions of competitive prosumers and enable successful transactions between them using prospect theory and adaptive learning process.

3.3.1. Advantages of Distributed Markets

Like decentralized designs, a distributed market design can enable a certain level of autonomy and privacy for participants by limiting the amount of data sent to the central entities and by not directly controlling the operation of devices. This allows peers to autonomously maximize their own individual benefits [

16,

70]. Distributed market designs can also provide increased network scalability for the ICT infrastructures and easier integration in existing infrastructure [

17,

20]. According to [

40], distributed or hybrid market designs can provide a level of network scalability higher than centralized market design because the number of market participants is decreased as they are divided into groups or communities, which reduces the overall computational and communication requirement.

The existence of various coordinators encourages or promotes the development of these various groups or cooperative communities of like-minded peers with common interests and preferences, which form around each coordinator and contain their own market clearing price [

19,

40]. This could be referred to as an organized prosumer group, in which a group of prosumers share and combine their resources as denoted in [

19]. Each coordinator can be a non-profit entity that interacts with the DSO and solely focused on serving and benefiting the members of its community by increasing the social welfare and optimizing prices for sellers and buyers [

84]. Distributed market designs can also take into consideration network constraints to avoid congestion in distribution branches. As suggested in [

40], this can be achieved by introducing a network utilization charge to integrate operating conditions of the network into each energy transaction and generate a local price signal based on the network constraints. Like centralized designs, a distributed energy market can also help providing various grid services and delivery of high-quality energy [

19].

3.3.2. Disadvantages of Distributed Markets

The pricing mechanisms used in distributed market designs can be relatively complex due to the existence of multiple simultaneous markets and may require further development to be effective for P2P energy trading [

16,

17]. Moreover, this type of market design encompasses a challenge related to the high difficulty in integrating and managing data sets from the various prosumer groups or communities [

17,

19,

20].