1. Introduction

After achieving a separation process from other elements, hydrogen can become an adaptable fuel, commonly referred to as an energy vector or carrier that can be moved, stored, and delivered. Accordingly, its manufacturing process determines if it can be considered a non-polluting carrier in all its meaning. As a fuel, hydrogen has good potential to reduce carbon emissions in hard-to-decarbonize sectors, such as the transport sector, by avoiding dependence on petroleum oil. Another target market will be heavy industries such as steel and chemical production. Its high energetic yield and efficiency, far greater than the ones achieved by hydrocarbon fuels, makes it an asset in the transportation sector

[1]. The global demand for hydrogen in its pure form has been increasing since the new millennia by up to 50%, reaching values in 2020 of 90 Mt. The driving industries have been the chemical industry, with values of up to 45 Mt, and refining (oil and its byproducts), with up to 37 Mt. Conversely, one of the lowest demands is in the transportation sector, with less than 20 kt (0.02% of global demand), the one that should make the strongest effort to embrace this new technology to attain the pathways pledged by governments

[2].

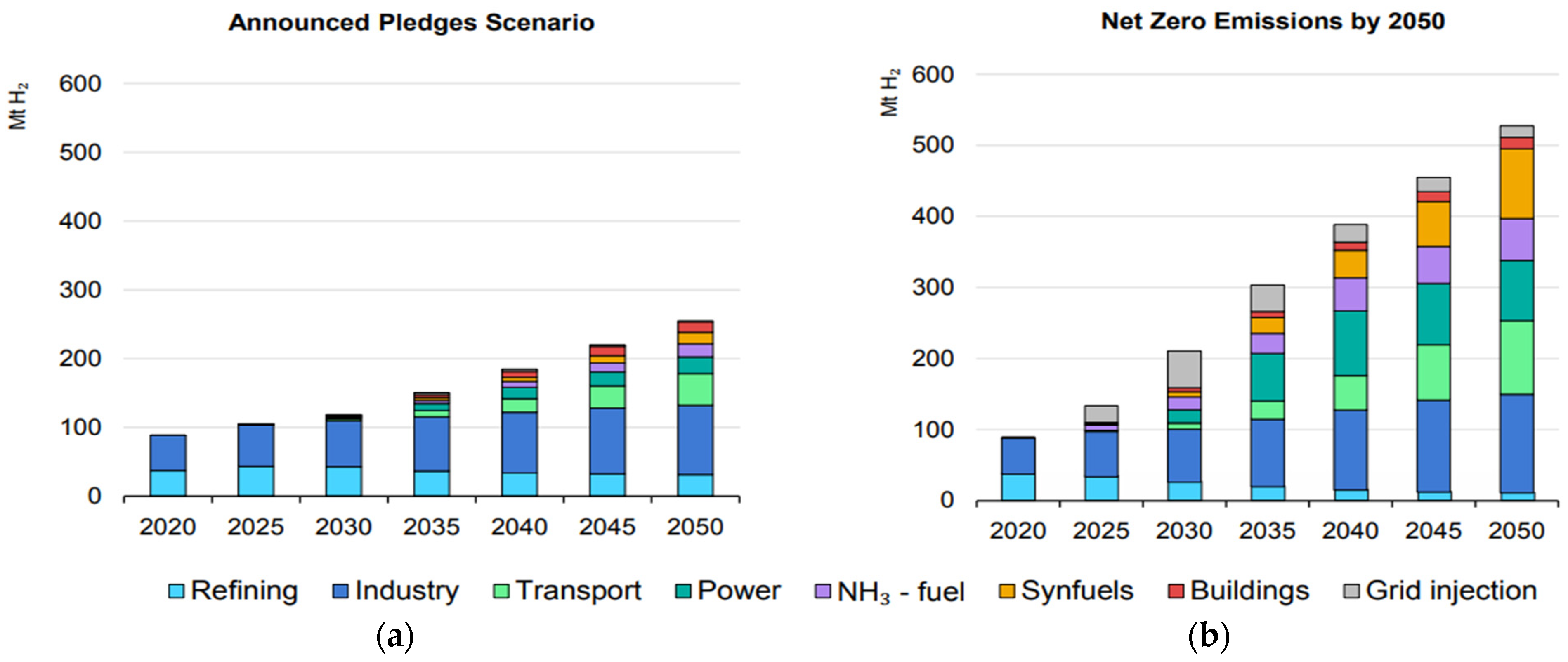

Projections state that hydrogen demand will keep increasing in the coming years, depending on the pathway chosen. If governments follow the announced pledge scenarios, 250 Mt could be the global demand in 2050. Instead, if the net-zero emission (NZE) scenario is the one pursued, more than 500 Mt would be the future demand in 2050, as shown in

Figure 1 [2]. In any of them, researchers can see that the transportation sector has a big market potential, with values of up to 20% of the total demand. Fuel cell electric vehicles should represent the largest deployment due to their early commercial availability, but the quantity will always depend on price reductions and refueling stations.

Figure 1. Hydrogen demand by sectors in 2 different scenarios listed as (

a) announced pledge scenarios stated by governments and (

b) net-zero emission scenario by 2050

[2].

Although the path towards the hydrogen economy is being led by Europe, the United States, and some Asian countries, South American governments have started giving the first steps in the same direction. Since the 2015 Paris agreement, Colombia has set goals such as stopping deforestation in the Amazonian region and reducing its emissions in the next 15 years. In 2020, more challenging goals were set to reduce emissions by 51% before 2030. To achieve this, the country began the energy transition path by starting the operation of 20 MW of onshore wind and 700 MW of photovoltaic (PV) installed capacity by the end of 2021. Roadmaps for offshore wind and hydrogen were published by the Mines and Energy Ministry, providing some insights into how the next projects will be developed in the energetic field of Colombia

[3].

The hydrogen roadmap considers emissions reduction in the energy and industry sectors (currently >75 Mt CO

2), its tentative demand, and production capacity in Colombia. It considers the country’s privileges in natural resources, such as ca. 19% and 60% of CF in solar PV and wind power, respectively, and coal and gas reserves that can be used to produce hydrogen. The 2030 goals for green hydrogen are set to be between 1 and 3 GW of electrolyzer installed capacity, for a Levelized Cost of Hydrogen (LCOH) of $1.7/kgH

2, and an annual production of 50 kt of blue hydrogen, with a LCOH of $2.4/kgH

2. During the first semester of 2022, Colombia started two pilots of green hydrogen production by using solar energy as the preferred method of powering the electrolyzers

[3].

2. Feasible Deployment Pathway of Blue Hydrogen Production in Colombia

The Mines and Energy Ministry published a hydrogen roadmap as part of the energy transition plan Colombia is about to follow, aiming for a 51% emissions reduction by 2030 and eventually a net zero by 2050. In this, an amount of 50 kt of blue hydrogen production is one of the objectives for 2030

[3]. This section intends to give a superficial overview of how the country could start the production of that hydrogen technique, its probable location, and policies to consider. To start, it is good to acknowledge that a new president has been elected for the 2022–2026 period, Gustavo Petro. During his term, it is expected that energy transition and climate change will take a major role, while fossil fuels, which are currently the spine of the Colombian economy, end up with a plan that strives for its reduction in the long term.

Colombia is a privileged country in the availability of natural resources, which will probably cover its energy needs in the mid-term and possibly in the long term if more exploration is done. The reserves of fossil fuels, such as coal and gas, could be used to produce hydrogen. Still, carbon capture, storage, and/or utilization should accompany this methodology to prevent an increase in emissions while accomplishing the net-zero plan.

The proven gas reserves, the least contaminant approach to producing hydrogen from fossil fuels, are about 7.5 years of consumption (2.95 trillion standard cubic feet, Tcf)

[4]. That amount could grow to 39.6 Tcf if the government approves the fracking practice. However, the upcoming presidential administration will most likely refuse this environmentally harmful technique, and the extraction will be limited to a maximum of 3 Tcf (8 years) if all the reserves are successfully extracted

[5]. Most of the reserves are situated in the center-east part of Colombia, in the Casanare region, and today, while new regasification plants are under construction, some imports are being made. Without gas exploration developments, the country could face difficulties in energy security because of the dependence on gas imports.

On the other hand, Colombia has one of the biggest coal reserves in Latin America, with potentially 16,500 million tons, of which 6648 Mt have been measured

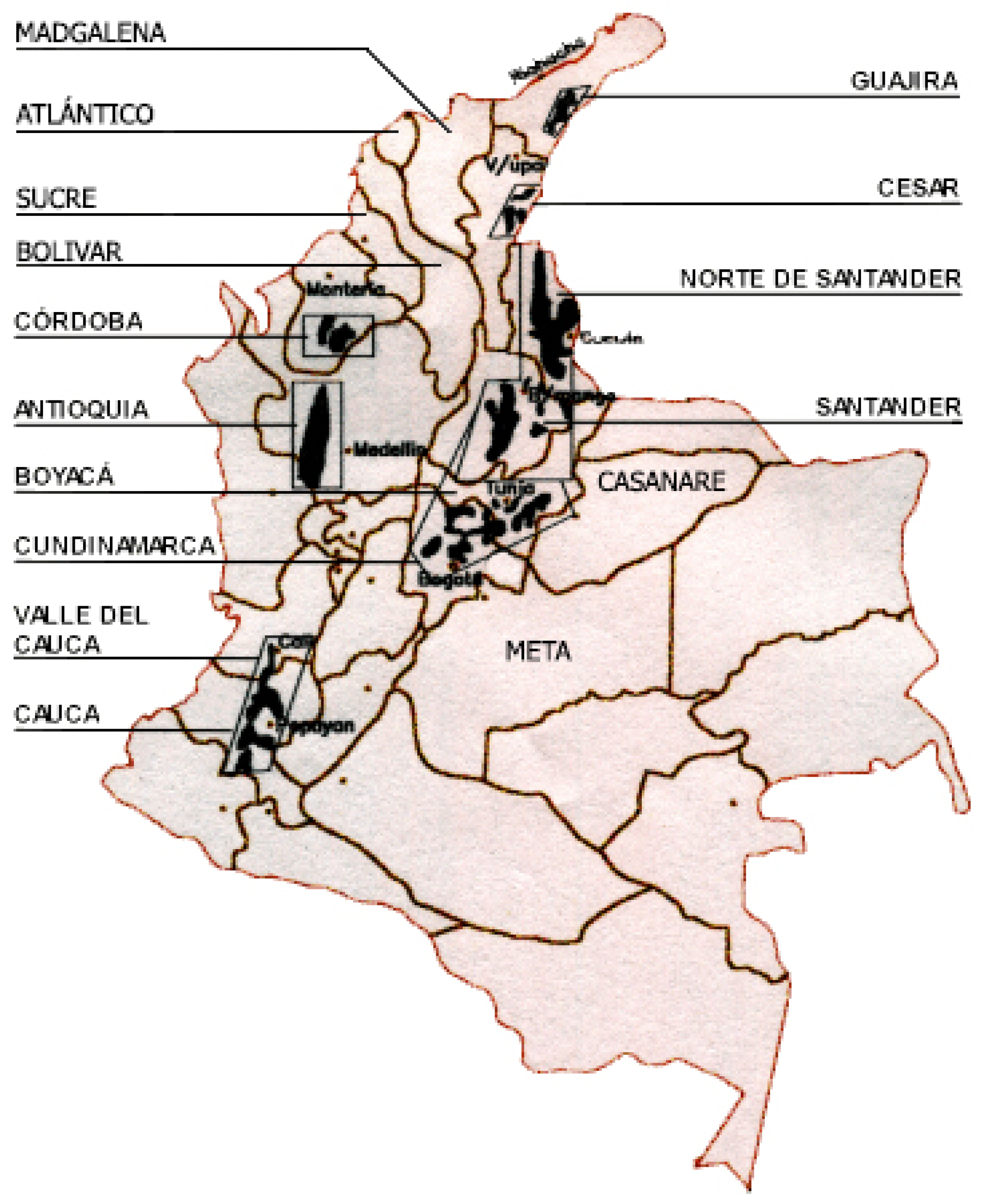

[6]. Being in the top 10 in the export of this resource, and with supply for more than 100 years of consumption, this fossil fuel could be the most feasible option to create a Blue Hydrogen production industry. The most important coal reservoir, with almost 50% of the country’s reserves, is in the Guajira and Cesar regions (

Figure 2), in the northern part of the territory

[7]. Most of the coal extracted from the opencast mining sites is exported (up to 80%) to the metallurgy industry, partially because of the calorific specifications and low sulfuric content. Usually, despite being one of the most CO

2-emitting methods, if carbon capture is fully achieved, there is a high chance for the industry to foster.

Figure 2. Coal reservoirs map in Colombia by state (adapted from

[7]).

Colombia’s total primary energy supply in 2019 was 44 Mtoe, with oil and natural gas being the most significant, with 39% and 27%, respectively. As it is an exporter of fossil fuels, its energy production is only 0.128 Mtoe or 5330 TJ. The energy consumption is focused on transportation, with 36.2%, and industry and buildings, with 25.2% and 19.4%, just as in any other regular country. From the electricity perspective, up to 65% of the yearly consumption (75 TWh) comes from Hydro renewable energy. From the other sources, the annual emissions are 75 Mt of CO

2, i.e., 1.45 t CO

2 per capita, an amount way below the global average of ca. 4.7 t CO

2 [8].

From this information, it is inferred that Colombia will not significantly reduce its emissions without changing its exploitation of the fossil fuels industry. If a real reduction in CO2 emissions is intended, the transportation sector should be the prime focus, with the biggest share of 31 Mt. Then, it is to be said that hydrogen production could essentially benefit the economy by creating new markets for the blue hydrogen production chain and management. Since most of the oil exports go to the US, the export of this energy vector could play a bigger role if the energy transition in countries like the US is achieved, increasing the demand and Colombia its production.

By 2020, Colombia had 1.82 billion barrels of proven oil reserves, approximately 13 years of its annual consumption (including exports), was the 18th exporter of oil worldwide, and could increase even 3 more billion if exploration and investment exist

[9]. Oil price dynamics are driven by various shareholders such as OPEC nations, supply–demand, and the possible future traded by hedgers and speculators

[10]. As CCUS is mostly focused and profitable in oil extraction, the oil price will impact the investment decision and scalability for CCUS projects based on EOR, where several variables must be considered. Likewise, research applied to an oil refinery in Colombia concludes that important options for mitigating emissions are energy efficiency, CCS or CCSU as EOR, among others

[11].

CCUS projects should be optimally interconnected with the emitting flue gas plant to minimize deployment costs. The cost of CO

2 transportation could be up to 10% of the value of the project if pipelines are the chosen method or even more with other methodologies

[12]. To make the most profit from the CO

2 emissions, as stated before, implementing Enhanced Oil Recovery (EOR) in the existing and future wells would be the best option. Normally, an oil well can be extracted up to 20% through natural pressure. By waterflooding, another 20% can be recovered, and by using CO

2 injection, depending on the type of oil, deepness, and several other conditions, another 10 to 20% could be retrieved, achieving a 50–60% recovery

[13]. Therefore, oil companies could sponsor the CCUS project for their benefit in a winning image for avoiding GHG emissions.

In Latin America, only Brazil has developed a CCUS Facility and a pilot and demonstration one. The Petrobras Santos Basin Pre-Salt Oil Field CCS facility capture CO

2 from an offshore installation that processes oil and natural gas and reinjects it into three different oil fields for EOR, with a capacity of 4.6 Mt per year. As the entire process occurred in the same place, this oil company did not have to invest much in transportation, storage clusters, or more complex infrastructure; therefore, the profitability should be high

[14]. These pilots and demonstrations are critical to assess the future behavior of the CO

2 inside and outside the wells. Specific emphasis on measuring if it is any effusion or leakage to the environment should be made before scaling the methodology worldwide.

Considering the previous scenario and its feasibility (socially, environmentally, technologically, and economically), Colombia should implement the technology required to gasify the coal, preferably in a place close to the mining sites or the transportation route of the coal product. Regarding gas, there are five gasifier plants currently operating, two of them with 60% of the country’s supply, located in the Casanare region

[15]. The other three are being built on the Caribbean coast (Magdalena, Sucre, and Guajira), the northern part of the country. Geographically, hydrogen production should be done in the northern region where the feedstock can be found.

Colombia has three mountain ranges that emerge from the Andes. This makes the country’s altitude significantly vary over shorter distances. As it is in the Equator, there is no seasonal behavior, but a strong influence of the altitude over the climate, combined with the tropical weather, drives rain and droughts. Therefore, the country’s topography makes interconnection by pipes difficult, even by properly paved roads.

Surpassing the adversities, major pipelines have been built to transport oil and its derivates from the exploitation sites. Between oil and multipurpose pipelines, there are more than 6150 km interconnecting the extraction sites with different clusters and ports

[16]. Most of the Casanare, Valle del Cauca, Meta, and the central part of Colombia are interconnected to the Caribbean coast, in Magdalena and Sucre ports. Additionally, more than 4000 km of gas pipelines start in Casanare, Meta, and Cauca regions and finish in Guajira, the upper coastline of the country.

If the preferred feedstock for blue hydrogen production is gas, there could be a chance to support the CO

2 transportation infrastructure within the existing gas or oil infrastructure. Of course, gas pipelines should be repurposed, or new ones should be constructed to withstand the higher pressure of transportation of the chemical compound. Normally, the most economical way to transport CO

2 is as a supercritical fluid (high density and low viscosity), with pressures above 13 Mpa

[17]. Additionally, it should be assessed if the current gas reservoirs can support an EMR process as CCUS to make the whole system profitable. Equally, interconnection from the gas pipelines to the oil exploitation sites should be more developed to apply EOR.

The transport of coal from Guajira to the oil reservoirs in Casanare, being as long as 1500 km, is economically unfeasible because of the volumetric size of the raw material. Therefore, hydrogen production in situ could be the preferred method. Then, the transportation of CO2 products could be supported by the gas infrastructure that reaches this zone of the country. Just like the previous method, new or repurposed pipelines should be acquired.

Considering that Colombia is an agricultural country with almost 50 million inhabitants, biomass also has a high potential for blue hydrogen production. Summing up biowaste from the livestock sector, agricultural sector, and urban centers, 126 Mt are collected annually, reaching a potential energy value of 130,000 TJ, or approximately 4120 MW. This process may present large advantages if the technology keeps pushing forward and CCS are used

[18]. Therefore, biomass use must be considered, avoiding the choice of sources with higher emissions

[19].

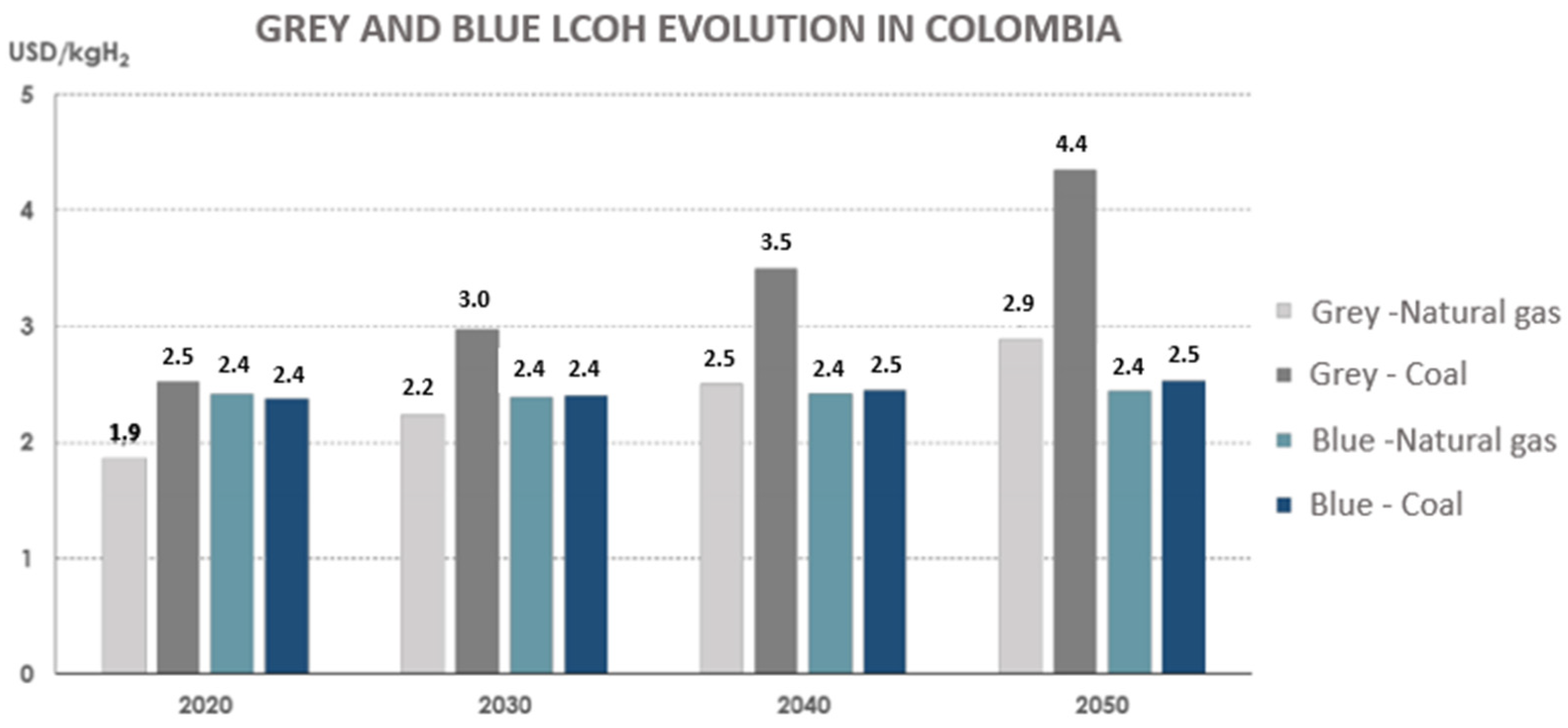

The LCOH forecast in Colombia is shown in

Figure 3, depending on the production method and considering only new projects could be developed. Grey hydrogen production by gas is currently the cheapest option, at $1.9/kgH

2, and the blue counterparts get as high as $2.4/kgH

2. The forecast is not encouraging, and more immediate actions should be taken

[3].

Figure 3. LCOH of coal and natural gas for blue and grey H

2 production

[3].

In 2021, the government implemented the 2099 policy, which funds three different institutions to foster the utilization of renewable energies and energy efficiency, and creates benefits for the people who research in these areas, as well as deducts taxes for all the parts, elements, and machines such as inverters, PVs, etc. Additionally, the 1931 policy of 2018 encompasses the development of institutions that monitor climate change and consulting organizations that help in the decisions related to emissions and sustainability. Despite the policy developments, the laws are still subtle and short-sighted if the goal is producing 50 kt of blue hydrogen at $2.4/kgH2 by 2030 and having carbon neutrality as the final goal.

The Hydrogen Roadmap for Colombia realizes the lack of normativity and proposes some steps to be considered, such as the incentive of usage of blue hydrogen, the adoption of incentives for CCUS in the market and in new technologies, the possibility of adopting the market prices of CO

2 emissions and regulate its taxation

[3]. As the previous government is ending its ruling period, timing is paramount to accomplish the goals. Only eight years are left for 2030, and just the roadmap is written, with the 2169 policy requiring a 51% emissions reduction.

From the blue hydrogen perspective, the first step should be to approve the policy to foster the adoption of CCUS and basic CO2 emissions regulation. Then, there should be a strong partnership between the oil and gas companies, such as Empresa Colombiana de Petroleos (Ecopetrol), and the government to encourage the development of Pilot and Demonstration CCUS facilities in the oil fields. In parallel, the technology for the gasification of coal–hydrogen production should be bid to an expert in the field, comprising the relationships with the raw material suppliers, e.g., Cerrejón. Likewise, the government needs to accurately write and pass the policies that push the whole blue hydrogen–CO2 emissions chain, creating new and attractive economic markets. Only after that basis is accomplished together with the deployment of a strong interconnection, clustering, CO2 storage, and required technologies, a more robust emission taxation should be passed, with a higher and more dynamic cost for the emitting industry.

3. Overview of Green Hydrogen Production in Colombia

As mentioned before, Colombia is a country privileged in its geographical location and natural resources. For example, the mountain ranges foster the coexistence of many different ecosystems at specific heights. The “Paramo” ecosystem, 50% of which is in Colombia, can collect up to 85% of the country’s drinking water. Consequently, hydroelectricity produced in Colombia corresponds to more than 70%

[12] of the entire generation, and practically there is no more chance of expansion in this type of production. At the end of 2019, the total installed capacity between hydro and thermoelectric plants was close to 17.4 GW

[20].

Just as the water flowing in the rivers was effectively used for Colombia’s electricity needs, new green resources such as the sun and the wind have been studied to support the energy transition. Once more, the outlook is positive in this aspect. In 2004, the first Onshore wind farm was installed in the Guajira region, where the winds reach velocities between 8 m/s to 10 m/s at 80 m, almost double the world average

[20]. This northern part of the country can have an installed capacity of 25 GW onshore.

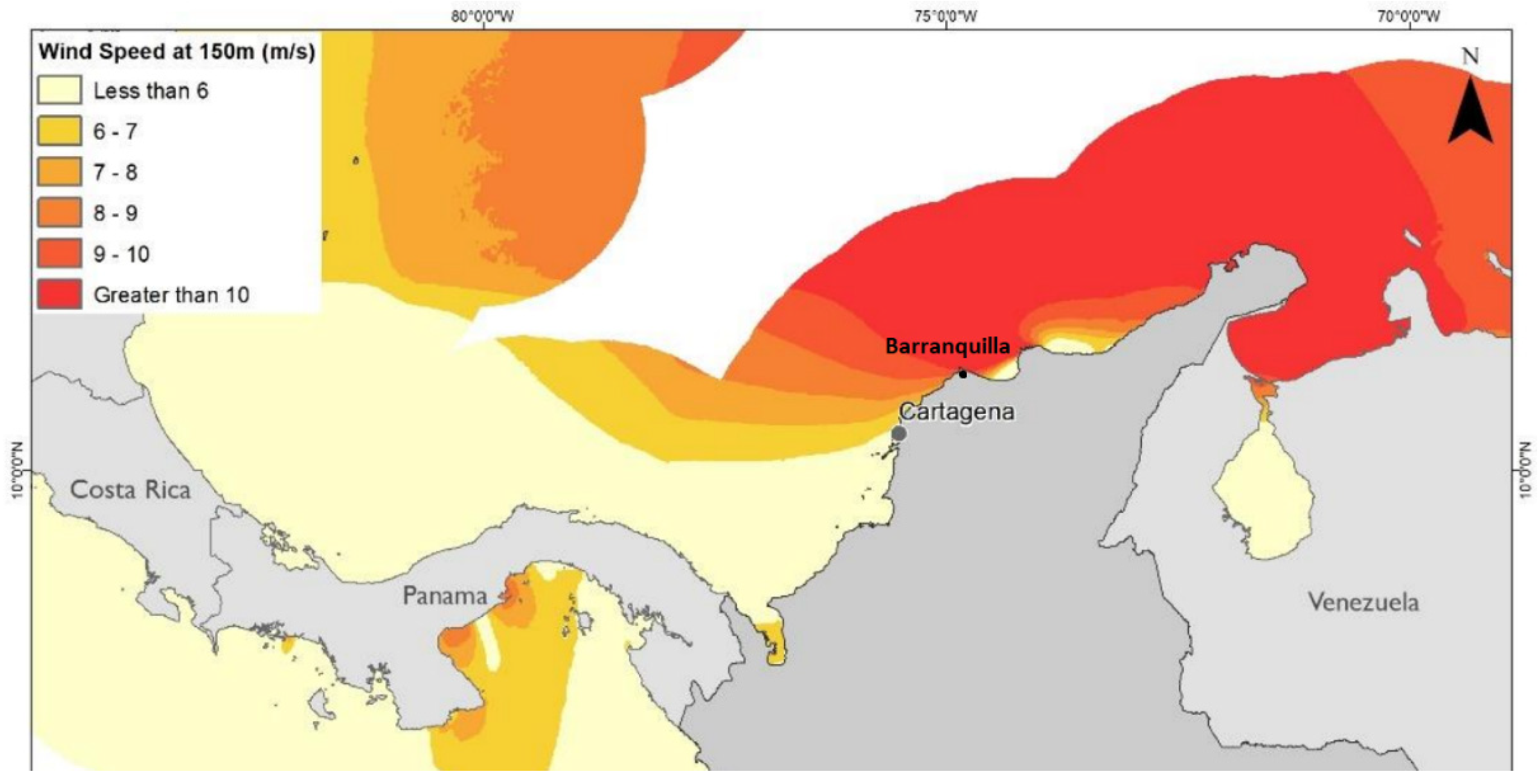

Concerning offshore wind,

Figure 4 depicts the wind speed strength on Colombia’s Caribbean coast, where winds reach values greater than 10 m/s at 150 m above sea level. The capacity factors also can achieve values up to 65–69%. On the other hand, Colombia’s west coast only reaches values up to 6 m/s with lower CFs. Likewise, the center of the country has wind resources that can come up with CFs of 60%

[20]. It must be noted that when the size of the turbines increases and the technology improves, the capacity factor can increase. For instance, 1.5 MW turbines from 2000 have a CF of 30%, and today’s turbine of 5 MW can reach 38%

[20]. Currently, only one 17.5 MW onshore farm is installed, but the plan is to increase the number of wind farms.

Being right in the equator line guarantees that solar radiation will be higher than average. Guajira region and some of the northern part have solar radiation as high as some parts of the Sahara Desert, with estimates close to 6 kWh/m

2/day. Other parts of the country reach values between 3.6 kWh/m

2/day and 4.7 kWh/m

2/day, with sun availability between 4.8 to 12 h. The irradiation map is similar to the one in

Figure 4 for the northern part of Colombia. The installed capacity is not fully clear, but it was approximately 180 MW in 2020 and is intended to keep growing

[21].

Figure 4. Wind resources in the northern part of Colombia

[22].

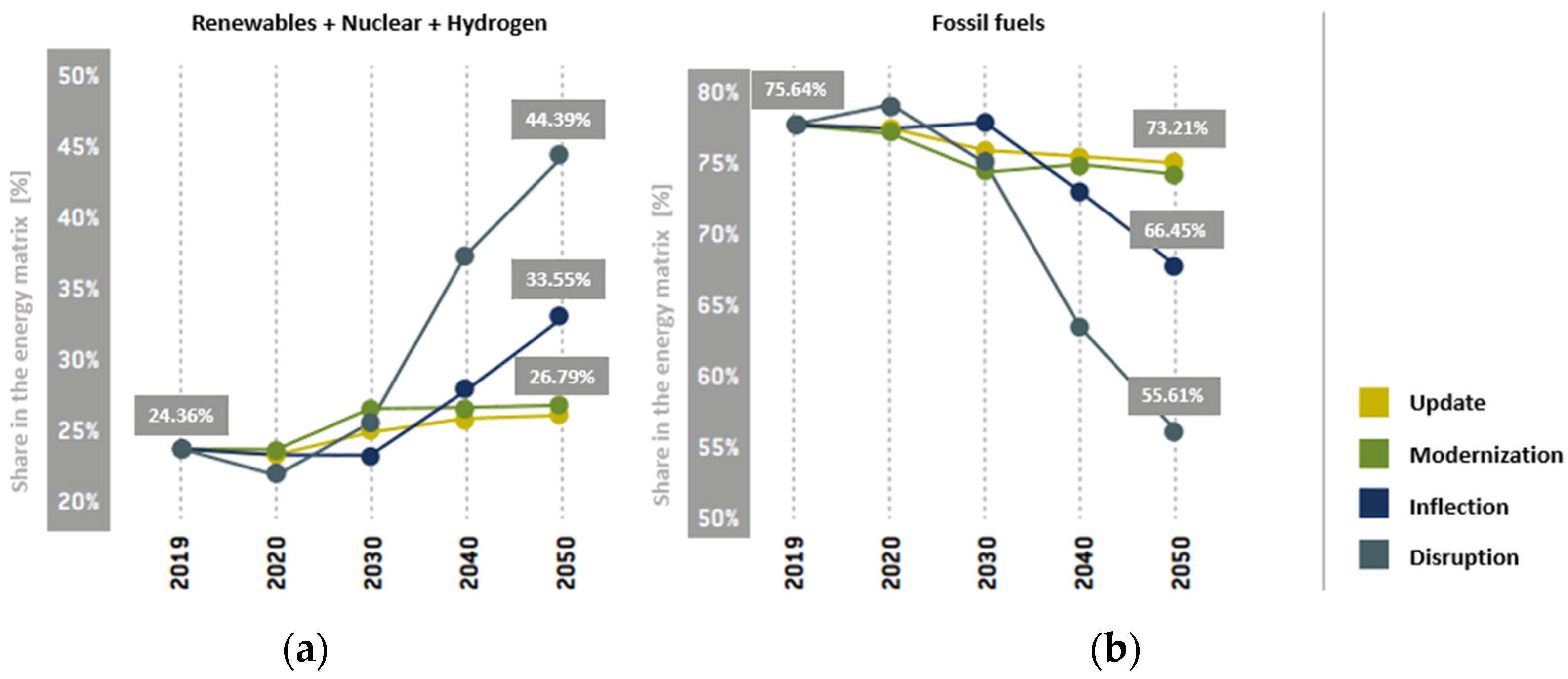

The National Energy Plan (PNE) considers four different scenarios for developing its energy transition. The most challenging and optimistic (Disruption) includes using hydrogen in transportation and some industries, green hydrogen production, a decarbonization process, using only renewable energies (even nuclear) for electricity consumption, and massive technological development. The pessimistic scenario (Update) still relies on the economic model used nowadays by extraction of fossil fuels, low growth in renewables, and not a significant decarbonization process

[23].

It must be considered that the target set in the hydrogen roadmap intends to reach values between 1 to 3 GW of electrolysis installed capacity at prices as low as $1.7/kgH

2. Then the “Update” scenario should not be the path to take if the goals of the hydrogen roadmap are the ones to attain.

Figure 5 displays the four scenarios, their participation in Colombia’s energy grid, and the share of fossil fuels vs. renewables per year

[23].

Figure 5. Evolution of the energy mix in Colombia, including (

a) the share of renewable energy, accounting for nuclear and hydrogen, and (

b) the share of fossil fuels

[23].

Today, Colombia does not have a robust electrical infrastructure that interconnects the entire country, which is a primordial challenge to overcome in the short term. Additionally, standalone hydrogen systems (off-grid) are not economically feasible yet in a country without seasons

[24]. This could discourage investment in renewables, considering that the strongest gaps of interconnection are in the north of the country, where these sources are stronger. Nevertheless, after a couple of energy auctions made in 2019, for the short term, 1390 MW were awarded for renewable energy: two PV projects of 238 MW and six onshore projects of 1160 MW, all located in the Guajira and Cesar Regions. The other auction, focused on the long-term supply, awarded eight projects (five between offshore and onshore wind and three PV) with a capacity of 1220 MW. Colombia’s first offshore project will be in Barranquilla, with a 350 MW installed capacity

[23].

Considering that between 2004 and 2018, few were Colombia’s commitments in the energy transition, it is worth highlighting the various developments that have taken place in studies, dedicated resources, and commitments in the last three years. Under the previous scenario, the country is moving forward to attain the proposed goal of 2500 MW of installed capacity for 2022; by having other projects for the future, the confidence in an energy transition increases. Regarding the price of electricity for long-term projects, it would be approximately 22 to $25/MWh, which is the lowest price with the current technologies and situation of the country

[23].

All these efforts are paving the way for green hydrogen production. Colombia realized there are optimal green resources and is heading towards its extraction. Its goal is to be the biggest Latin American exporter country of green hydrogen by 2030. This is a challenging task, considering Chile is forecasted as the strongest country in South America, with the most competitive prices. Colombia only published its Hydrogen Roadmap in the last couple of years and recently started two pilot electrolysis projects in the Magdalena and Bolivar regions

[25].

Behind these couple of projects, two oil and gas companies are investing in Colombian energy’s future. Ecopetrol, a company producing hydrogen based on gas, financed a 50 kW PEM electrolyzer system fed by 270 solar PV with the capacity of producing up to 20 kg of H

2 per day. Located in Cartagena, besides its gas refinery, this pilot will help them get insight into the system, including maintenance, scalability, and reliability for future projects. The next projects will focus on two electrolyzers feeding hydrogen to refueling stations for transportation

[26]. On the other hand, Promigas will use 324 PV panels to produce up to 4.3 kg of H

2 per day, with the possibility of expansion to 40 kg of H

2 per day. The company focuses this pilot on decentralized production, distributed generation, transportation, and blending with gas processing

[25]. Methane-hydrogen blending has proven to be efficient for several applications, including for internal combustion engines, also reducing emissions compared to the natural gas feedstock

[27].

As the oil and gas companies have the know-how of fossil fuels extraction and transportation, tied with a good financial capacity, it is expected that the companies would take advantage of the encouraging goals of the government and start building a green hydrogen economy. This could help the energy transition process and give some insight into how Colombia can replace, at least for a percentage, its economic dependence on the export of fossil fuels by using green hydrogen in the future. It is to be noted that the locations chosen by these companies are close to commercial ports, which could benefit them if exports are to be started in the mid-term.

In contrast, if green hydrogen is to be supplied to Colombia, those two locations could take advantage of the existing oil and multipurpose pipeline infrastructures for reaching the urban centers, but at a high cost. The Guajira region would have the same issue, where hydrogen pipelines should have different properties to avoid gas diffusion. Then, an on-site methodology for green hydrogen production should be studied. Hydropower supply for green hydrogen could be an easy option to spot because of its installed capacity in Colombia and the economic benefit of having hydrogen as an energy storage technology. Two options can be followed: transport the hydrogen through pipelines or use the surplus of electricity to a supply point where the electrolysis process can be carried out

[18]. The latter could be considered for the future, in parallel with the use of fuel cells for electricity supply under the existing grids.

It should be considered that subsequent processing of hydrogen could follow. Hydrogen can be transformed into energy carriers such as ammonia and e-fuels, including methane, methanol, and liquid hydrocarbons, which are usually produced from fossil fuels

[28]. These can be mixed with current fuels to ease the energy transition

[29]. In the meantime, more available fuel transportation solutions can exist under this transformation process, which is not the scope of this research, as well as different uses in the industry.

It is worth mentioning that the Colombian government will fund 10 projects as pre-investment studies in the pre-feasibility or feasibility stages for the hydrogen value chain. These projects encompass green hydrogen production, the transportation sector, and hydrogen usage

[30]. Most of the hired firms are foreign companies with a subsidiary company or partnership in Colombia, meaning that the knowledge is mostly being imported. Recognizing that Colombia needs inner R&D to succeed in the energy transition, the Science Ministry and the Renewable Energy and Energy Efficiency organization launched a call for projects on hydrogen production with low emissions and carbon capture measurement, among others, with closure in late September 2022

[31]. Similarly, Universidad Nacional de Colombia has been developing different research projects focused on the hydrogen roadmap targets

[32], but there is still a long way to go before reaching the demonstration stage. Therefore, the maturity of these technologies in Colombia, as measured by their Technology Readiness Level (TRL), is in their initial steps (1–3).

The Colombian government must continue promoting energy transition and policies to increase investment and local R & D in this area. More importantly, the market needs to be developed to have the required profits to make it a sustainable economy. On the inside, the transportation sector needs substantial investments from the government to switch the current fossil fuel fleet technology and reduce emissions.

This entry is adapted from the peer-reviewed paper 10.3390/en15238862