Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Business

Start-up accelerators are units supporting entrepreneurs (substantively, financially, legally, and organizationally) in establishing and running young and innovative companies such as start-ups. The commencing energy crisis has led to the need for energy savings, as well as the need to change energy policies and implement energy transformation, creating a wide field for start-ups and start-up accelerators. Making full use of potentially innovative solutions developed by start-ups is, in turn, essential for energy giants and related accelerators in the market.

- corporate accelerator

- energy accelerator

- acceleration program

- start-up

- sustainability

1. Introduction

A well-defined business model, human resources, and financial means are crucial for the survival and growth of start-ups. Attracting capital investment and winning business contracts is not an easy task, especially for young innovative companies that lack market traction or the business foundations to develop a start-up and its product in compliance with market expectations. In many cases, companies at an early stage of development do not have a precise business model or correctly defined revenue streams, and the business knowledge of start-up managers is not at a high level. In this context, start-up accelerators, which operate within the market, are considered an appropriate choice in the context of development, the finetuning of solutions, and the acquisition of customers and capital investors. The first accelerators and acceleration programs were established in the USA in 2005–2006 (Y Commbinator, Techstars). Accelerators provide intensive support for start-ups in their rapid development. Accelerator programs usually last several months, during which a start-up’s product or service is intensively developed with the support of resources, mentors, experts (both technical and business), partners’ infrastructure, a workspace, networking, and promotional activities. Depending on the operational model adopted, the accelerator program may be share-based, i.e., the accelerator charges the start-up a price ranging from a few to several percent of its shares for its participation. Another model is an equity-free accelerator program, in which no fees or shares for participation are charged. Another solution found on the market is the performance-based model, in which the accelerator can take up shares once the acceleration program in selected companies has been completed if the start-up has achieved certain business objectives.

Energy transitions have entered an era characterized by accelerated technological innovation. The World Energy Council highlighted the significance of new measures related to the humanization of the energy transition. The activities bring together actors such as start-ups, large energy companies, and investors [1]. Companies follow two distinct external and internal growth strategies. The external growth strategy is based on mergers and acquisitions (M&S), whereas the internal strategy aims at the expansion of the utilization of available internal resources [2]. Companies adapt their strategies in order to survive and thrive in rapidly changing environments [3]. During the implementation of an external growth strategy, barriers emerge due to a lack of a shared vision for the organization’s development and business externalities. The acquisition of start-ups minimizes the risk of failure due to the risk of evaluating the young company’s previous activities. The integration of acquired start-ups, as well as the acquisition of features, patents, research work, qualified personnel, and innovation in regard to start-ups, is much easier than developing them from scratch within the structures of a large business [4].

Sustainable development has become a major priority for the modern economy, so decision makers are taking steps to improve its operation in connection with the growing demand for greater diversity, the need for innovative solutions, and the diversification of energy sources. The fundamental improvement drivers include innovation and entrepreneurship [5]. Start-ups are considered to be the major driving force of change and innovation [6,7]. During the sustainable transformation of industries, start-ups play an essential role; therefore, the transformation cannot be carried out by industry tycoons alone. The interaction of these two market players is key for success [5,8,9]. Start-ups are more inclined to test innovative approaches and are characterized by creative thinking [10], speed, flexibility, and risk-taking approaches [11]. The above-mentioned factors are the main reasons that corporations establish business relationships with innovative start-ups, as it enables large companies to obtain access to innovations, new technologies, and the entrepreneurial thinking specific to teams in young companies. The energy sector identified innovation as a key driver of survival in the rapidly changing market environment caused, for instance, by the war between Russia and Ukraine or by ongoing climate change. However, in order to establish such business relationships, both energy companies and start-ups need to plan carefully and manage the change process. In order to ensure the desirable effect of such cooperation, both sides have increasingly noted the need to cooperate with start-up accelerators.

Despite the variety of support offered, the popularity of business environment institutions such as accelerators is constantly growing. The rapid growth in the last 10 years of start-up ecosystems with accelerators operating within them raised the need for in-depth studies to be conducted in this area [12,13,14]. The current resources in the scientific literature do not provide a broad analysis of this topic; there is a lack of structured knowledge collected in one place. Given their significance, it is surprising to find only a few studies focusing on the operations of start-up accelerators [15,16,17]. This issue is relatively new; thus, a lack of a structured studies on the current state-of-the-art research in relation to this topic is perceptible, as signalled by many authors in their scientific articles [18,19,20,21,22]. For instance, A.C. Carvalho et al. focused on structuring the knowledge on the types and kinds of entrepreneurial support [18]. T. Gutmann, in his study, attempts to structure the issue of corporate venturing [19]. In 2019, M. Guijarro-García et al. conducted an analysis of 21 articles to approximate the current state-of-the-art research regarding start-up accelerators and noticeable trends [20]. In turn, authors such as U. Gür or E.L. Crișan et al. focused their research on technology transfer solutions in corporate accelerators [22] and their role in supporting entrepreneurship [21]. There is a particularly noticeable gap in the reviewed literature regarding the operation of accelerators and acceleration programs focused on start-ups offering innovative solutions to the energy sector. This is all the more puzzling given the significant acceleration of the pace of change in this sector due to initiatives taken at least at the European Commission level.

2. Start-Up Acceleration in the Energy Sector

Due to a perceived gap in the literature related to the lack of analysis of the functioning of the offered support for the acceleration of solutions in the energy sector, the authors decided to examine this question by presenting main forms support offered on the market in this area. They compared models of accelerator operation on the example of case studies of large players in the energy market in Europe.

Start-ups in the energy sector work closely with investors, technology providers, and funding agencies [97]. Large energy market players recognise the increasing value of external innovation projects to improve innovation processes within the organisation [11,98]. Consequently, in recent years, energy sector giants engaged in activities to support start-ups by creating their own accelerator programs or joining as a partner of existing accelerator programs. The acceleration program is a form of support that plays an Important role in the initial stage of a start-up’s development. Investments are characterised by a limited duration [99]. The purpose of the program is to accelerate the creation process, the implementation of products, and to increase the sustainability of the start-up [78]. Most acceleration programs guarantee start-ups: intensive mentoring, the possibility to cooperate with corporations, and a shorter time to raise capital from investors [41,99].

In contrast, a hackathon is a short, intensive event where participants develop innovative products, services, and solutions. Participants develop innovations in interdisciplinary teams [100]. A hackathon is a type of competition [101]. The event lasts from one day to even a week [102]. A hackathon refers to the implementation of a project from the concept phase to a working prototype that meets the key objectives and expectations of future technology adopters. The creators develop an innovative business model for the solution and have an opportunity to test the innovation using start-up working methods [100].

Another type of support is corporate venture capital (CVC), which is an equity investment by corporations in start-ups and is treated as a corporate investment vehicle in companies. Corporations allocate funds for investment and are entities that indirectly influence investment decisions [103,104]. The purpose of CVCs is financial returns on investment [105] and “exposure to new technologies and markets”, according to managers of CVC programs [106].

Meanwhile, corporate venture building (CVB) is an alternative solution for large corporations interested in bringing innovation to the organisation. Compared to corporate venture capital, CVB involves building a solution from scratch [107]. Venture building involves the establishment of an independent entity by a corporation to act as an innovation centre. The CVB allows the start-up to leverage speed, flexibility, and agility [108]. In turn, the management team has large corporate resources at its disposal, which guarantees fast and agile decision-making (without the barriers of corporate hierarchy) [109].

2.1. Model of Cooperation between an Energy Corporation and a Third Party Independent Accelerator

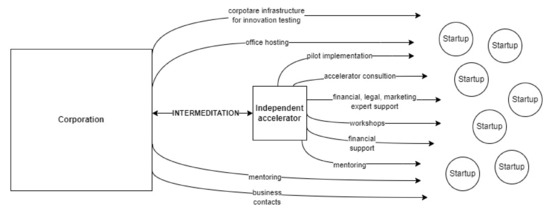

In this model, the corporation cooperates with an accelerator, for which its aim is to support start-ups by providing conditions for the rapid development of the designed or offered solution and its testing in conditions similar to real ones (e.g., in a test environment or on a small sample of consumers, e.g., retail buyers of electricity). Accelerators under this model provide multifaceted support and mediation between start-ups and corporations (Figure 8). Accelerators are the link between corporations and start-ups because of the differences between corporations and start-ups. Accelerators create space to reduce and/or eliminate barriers to cooperation with corporations. Organisations are specialised in acceleration processes and have proprietary start-up support programs. Many energy corporations lack experience in acceleration activities and knowledge about start-ups, which is why they choose to cooperate with an external accelerator [66]. The cooperation of the corporation is mainly focused on facilitating the development of the solution offered by the start-up by providing their own industry experts and possibly providing test infrastructure. On behalf of corporations, accelerators recruit start-ups from the market, usually according to the expectations and challenges defining the needs of the corporation [110]. The acceleration program lasts for a set period of time and additionally provides workshops, pilot implementation, funding, and support from accelerator mentors at each stage of the acceleration process [111].

Figure 8. A model for commercial collaboration between a corporation and an external accelerator.

An external accelerator has its own board and team dedicated to working with start-ups [112], and it has its own leaders experienced in launching, funding, and scaling a start-up.

An example of such cooperation is the involvement of the Tauron Group (a key player in the energy sector and an important link in Poland’s energy security system) in an external acceleration program operated by the Kraków Technology Park (KPT ScaleUp). KPT ScaleUp is a program that supports start-ups from the area of Industry 4.0. The program guarantees support, mentoring, pilot implementation, financing up to EUR 50K, and the possibility of cooperation with a large energy company. Start-ups that want to take advantage of the offer must have at least a prototype solution and has not been on the market for more than 5 years [110].

The Equinor & Techstars Energy Accelerator, on the other hand, is a global, 13-week accelerator program operating in the energy sector. The program combines support from the international consultancy company Capgemini and a partnership with Equinor (a broad energy company with more than 21,000 colleagues committed to providing affordable energy for societies worldwide and taking a leading role in the energy transition). Equinor’s corporate partnership with Capgemini and Techstars aims to streamline start-up development by providing access to more than 100 mentors and energy-sector experts from around the world, and this is hosted at the Equinor office and supported by Capgemini consultants. The program supports companies with solutions that contribute to helping the energy transition. The program focuses on four thematic areas: energy generation, net zero future, digital and operational enablers, and disruptors [113].

2.2. A Model for Setting up an In-House Structure in an Energy Company as a Corporate Accelerator (Model In-House Accelerator)

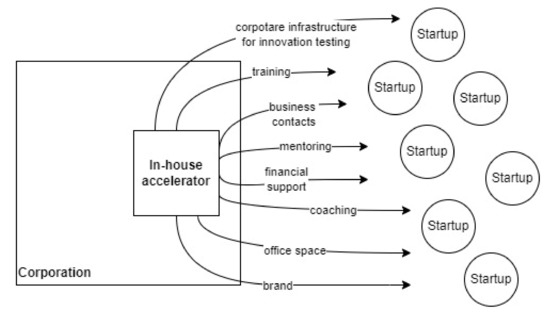

Corporate accelerators (Figure 9) can take different forms of operation, the most common being a dedicated innovation centre. The common feature in this model is the direct use of corporate assets to influence the faster implementation of start-up innovations in the corporation [112]. The priority of the corporate accelerator in this case is not profit but more importantly the development of innovation in the corporation and the added value for the portfolio companies from the supported start-ups [12].

Figure 9. Operational model of a corporate accelerator, established within the structure of an energy company.

Corporate accelerators differ from accelerators developed by private investors, universities, or public institutions [114]. Corporate accelerators are programs characterised by a limited duration and selective collaboration with start-ups. The programs are created and run as part of a corporate entrepreneurship strategy. Corporate accelerators, in addition to providing direct and indirect financial support, strive for self-development and support the energy and digital transformation of corporations [26]. Via acceleration, corporations strive to realise strategic objectives related to corporate rejuvenation and the acquisition of innovative solutions, sometimes including start-up employees [74]. What corporations have to offer, inter alia, is direct access to the resources of the energy company, including the organisation’s financial resources, a strong brand and market recognition, sales channels, and a large customer and supplier base, often numbering in the tens of thousands of energy consumers [112]. A corporate accelerator involves corporate stakeholders in its activities. Executives (e.g., directors of business units interested in new technologies) are involved in the selection process of start-ups. The involvement of executives involves the selection of projects that should contribute to the improvement of the corporation in different spheres of activity, e.g., customer service, sales, research. Corporate experts offer intensive support for start-ups in product development [12]. In a corporate accelerator, one can notice a barrier in the form of the mentoring offered. This is due to the fact that experts are usually experienced corporate employees who do not necessarily have experience in scaling a start-up’s solution [112].

A market example of such a model is the ORLEN Skylight accelerator, which is a program run by Polski Koncern Naftowy Orlen Spółka Akcyjna (integrated multi-utility company that operates in Central Europe and Canada: provider of energy and fuel to over 100 million of recipients). The acceleration process lasts approximately 6 months and consists of three phases: the recruitment and selection of projects for the accelerator, signing a contract, and piloting [115]. The accelerator offers benefits such as: funding for technology development, pilot implementation (testing and scaling the innovation on the company’s infrastructure), and expert support. Orlen offers knowledge exchanges within business lines of the PKN Group and provides networking with relevant employees. The biggest advantage of the accelerator is the possibility of further commercial cooperation after the end of the acceleration with the business units of the corporation [116]. The company aims to accelerate start-ups that respond to current business challenges. It seeks solutions from start-ups that link their activities to Industry 4.0, methods for removing pollutants from industrial wastewater, automating gas station services with robots, and using sustainable packaging methods [117].

Meanwhile, the Enel Start-up Supports accelerator was developed to drive energy transformation through open collaboration with start-ups, investors, industry leaders, researchers, and internal and external experts [118]. Enel (Italy’s national entity for electricity) offers the scaling of an innovative solution on an international scale using a global corporate network after the testing phase. Enel leverages the Enel Open Innovability team and global centres and laboratories. Enel Open Innovability is integrated into all business lines in the Enel Group. In order to identify the best projects, managers systematically search for new business solutions. The centres and labs work with start-ups and the SME sector. The cooperation results in new technological solutions and pilot projects. Access to the corporation’s centres, labs, mentoring, database, and customers influences the start-up’s development throughout the acceleration process. In order to accelerate a start-up’s development path, Enel uses a simplified qualification, a standard and flexible contract, upfront funding (30% down payment upon signing the contract), reduced payment times, and further support after a successful PoC at the corporation [119].

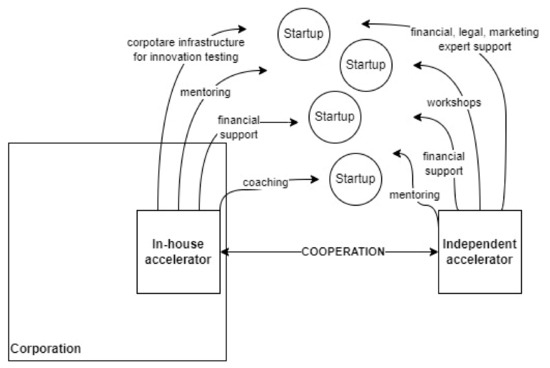

2.3. Mixed Model of Cooperation between Energy Companies and Start-ups (MIX Accelerator Model)

The MIX accelerator model (Figure 10) is characterised by a combination of the energy company’s management of its own acceleration program according to the model described in Section 4.2 and, in addition, its involvement in collaboration with independent, external accelerators. The model aims to combine development activities for the start-up and to provide a relationship between the corporate accelerator and the collaborating external accelerator. An external accelerator provides a proven acceleration program with a defined structure, leaving freedom for the corporation to adjust its own preferences. The tasks of the external accelerator include screening and scouting activities, while the corporation usually decides on the selection of the start-up for acceleration and takes over the main cooperation with the start-up on the development of the innovative solution. The MIX model is perceived by energy corporations as increasing the chance of acquiring a larger number of valuable projects that fit the needs of the technology recipient. Thus, cooperation under the mixed model is perceived as supporting innovative activities of corporations.

Figure 10. Mixed model between energy company and start-ups.

The Polish Oil and Gas Company (Polish acronym PGNiG) is a leader in the Polish natural gas market, operating in the exploration for and production of natural gas and crude oil. The company offers cooperation to small- and medium-sized enterprises, including start-ups, through its own corporate acceleration program InnVento. The aim of this program is to connect established multinational corporations with start-ups by offering support to micro-companies and small companies. The accelerator guarantees support from external mentors and its own experts and provides office space and access to databases and business units of the corporation. In addition, support is offered in the areas of law, accounting, and obtaining financing [120]. The accelerator program targets projects that demonstrate a competitive advantage over current solutions on the market. The solution submitted by the start-up must have at least a fabricated prototype of the solution and an implementation potential in the corporation. The corporation focuses on the following topics: new RES technologies and systems, digital technologies, natural gas extraction materials and technologies, and new energy sources and environmental protection in the energy sector [121]. The Polish Oil and Gas Company, in order to support small- and medium-sized companies, and previously mentioned InVento additionally cooperate with external accelerators such as Space3ac and IDEA Global—Huge Tech [122]. The joint program under the model aims to provide funding for the pilot, as well as testing using the infrastructure of a major energy company [123]. In the mixed model, the corporation also interacts with an external accelerator managed by the Kraków Technology Park. The organisations create a joint program that is geared towards helping start-ups in the areas of IoT, AR/VR, artificial intelligence, robotics and automation, and energy efficiency. Start-ups can benefit from funding, workshops, and mentoring [124].

2.4. Classification of Energy Accelerator Models

In relation to the noticed gap in the literature of the presented models of operation of acceleration programs in the energy sector, in the Table 3 below, the authors discussed the advantages and disadvantages of start-up acceleration models. The presented overview of the model will help the management of the energy company to make an informed decision on choosing the right model of accelerator operations. Three different corporate accelerator models were identified.

Table 3. Comparison of corporate accelerator models in the energy sector.

| Independent Accelerator Model | In-House Accelerator Model | Hybrid Accelerator Model | |

|---|---|---|---|

| Advantages |

|

|

|

| Disadvantages |

|

|

|

As the above tabular overview shows, there are not only many similarities but also significant differences between the described models. There are noticeable differences in the number of projects filed under the accelerator programs, the management structure of accelerators and the influence of corporations on ongoing programs, the pace of starting-up, and the provision of financial and organisational resources. The above findings provide practical implications for managers in terms of a deliberate decision on choosing the model of cooperation between a large energy company and start-ups.

This entry is adapted from the peer-reviewed paper 10.3390/su142013397

This entry is offline, you can click here to edit this entry!