A private equity fund is a collective investment scheme used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with private equity. Private equity funds are typically limited partnerships with a fixed term of 10 years (often with annual extensions). At inception, institutional investors make an unfunded commitment to the limited partnership, which is then drawn over the term of the fund. From the investors' point of view, funds can be traditional (where all the investors invest with equal terms) or asymmetric (where different investors have different terms). A private equity fund is raised and managed by investment professionals of a specific private equity firm (the general partner and investment advisor). Typically, a single private equity firm will manage a series of distinct private equity funds and will attempt to raise a new fund every 3 to 5 years as the previous fund is fully invested.

- private equity fund

- private equity

- institutional investors

1. Legal Structure and Terms

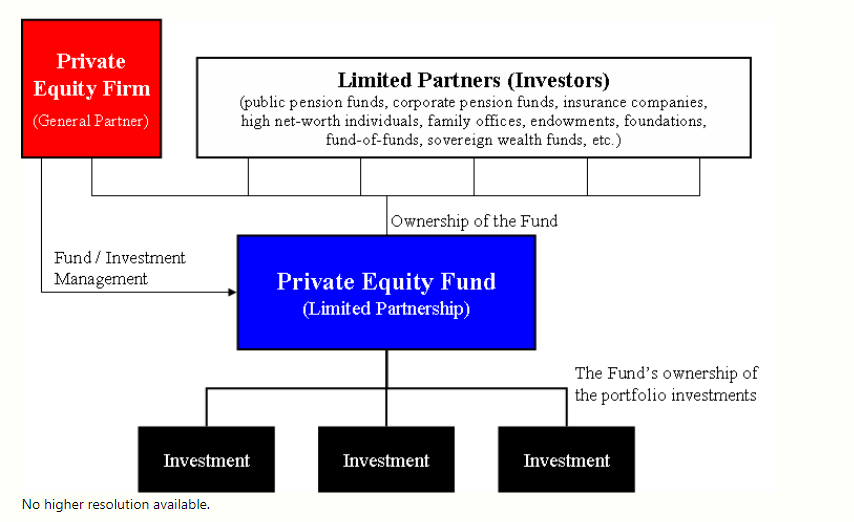

Most private equity funds are structured as limited partnerships and are governed by the terms set forth in the limited partnership agreement or LPA.[1] Such funds have a general partner (GP), which raises capital from cash-rich institutional investors, such as pension plans, universities, insurance companies, foundations, endowments, and high-net-worth individuals, which invest as limited partners (LPs) in the fund. Among the terms set forth in the limited partnership agreement are the following:[2][3]

- Term of the partnership: The partnership is usually a fixed-life investment vehicle that is typically 10 years plus some number of extensions.

- Management fees: An annual payment made by the investors in the fund to the fund's manager to pay for the private equity firm's investment operations (typically 1 to 2% of the committed capital of the fund.[4]

- Distribution Waterfall : The process by which the returned capital will be distributed to the investor, and allocated between Limited and General Partner. This waterfall includes the preferred return : a minimum rate of return (e.g. 8%) which must be achieved before the General Partner can receive any carried interest, and the Carried interest, the share of the profits paid the General Partner above the preferred return (e.g. 20%).[4]

- Transfer of an interest in the fund: Private equity funds are not intended to be transferred or traded; however, they can be transferred to another investor. Typically, such a transfer must receive the consent of and is at the discretion of the fund's manager.[5]

- Restrictions on the General Partner: The fund's manager has significant discretion to make investments and control the affairs of the fund. However, the LPA does have certain restrictions and controls and is often limited in the type, size, or geographic focus of investments permitted, and how long the manager is permitted to make new investments.[6]

The following is an illustration of the difference between a private equity fund and a private equity firm:

| Private equity firm | Private equity fund | Private equity portfolio investments (partial list) |

|---|---|---|

| Kohlberg Kravis Roberts & Co. (KKR) | KKR 2006 Fund, L.P. ($17.6 billion of commitments) |

Alliance Boots |

| Dollar General | ||

| Energy Future Holdings Corporation | ||

| First Data Corp | ||

| Hospital Corporation of America (HCA) | ||

| Nielsen Company | ||

| NXP Semiconductors |

2. Investments and Financing

A private equity fund typically makes investments in companies (known as portfolio companies). These portfolio company investments are funded with the capital raised from LPs, and may be partially or substantially financed by debt. Some private equity investment transactions can be highly leveraged with debt financing—hence the acronym LBO for "leveraged buy-out". The cash flow from the portfolio company usually provides the source for the repayment of such debt. While billion dollar private equity investments make the headlines, private equity funds also play a large role in middle market businesses.[7]

Such LBO financing most often comes from commercial banks, although other financial institutions, such as hedge funds and mezzanine funds, may also provide financing. Since mid-2007, debt financing has become much more difficult to obtain for private equity funds than in previous years.[8][9]

LBO funds commonly acquire most of the equity interests or assets of the portfolio company through a newly created special purpose acquisition subsidiary controlled by the fund, and sometimes as a consortium of several like-minded funds.[10][11]

2.1. Multiples and Prices

The acquisition price of a portfolio company is usually based on a multiple of the company's historical income, most often based on the measure of earnings before interest, taxes, depreciation, and amortization (EBITDA). Private equity multiples are highly dependent on the portfolio company's industry, the size of the company, and the availability of LBO financing.[12]

2.2. Portfolio Company Sales (exits)

A private equity fund's ultimate goal is to sell or exit its investments in portfolio companies for a return, known as internal rate of return (IRR) in excess of the price paid. These exit scenarios historically have been an IPO of the portfolio company or a sale of the company to a strategic acquirer through a merger or acquisition (M&A), also known as a trade sale.[13] A sale of the portfolio company to another private equity firm, also known as a secondary, has become common feature of developed private equity markets.[12]

In prior years, another exit strategy has been a preferred dividend by the portfolio company to the private equity fund to repay the capital investment, sometimes financed with additional debt.[14][15]

3. Investment Features and Considerations

Considerations for investing in private equity funds relative to other forms of investment include:

- Substantial entry requirements: With most private equity funds requiring significant initial commitment (usually upwards of $1,000,000), which can be drawn at the manager's discretion over the first few years of the fund.[16]

- Limited liquidity: Investments in limited partnership interests (the dominant legal form of private equity investments) are referred to as "illiquid" investments, which should earn a premium over traditional securities, such as stocks and bonds. Once invested, liquidity of invested funds may be very difficult to achieve before the manager realizes the investments in the portfolio because an investor's capital may be locked-up in long-term investments for as long as twelve years. Distributions may be made only as investments are converted to cash with limited partners typically having no right to demand that sales be made.[17]

- Investment Control: Nearly all investors in private equity are passive and rely on the manager to make investments and generate liquidity from those investments. Typically, governance rights for limited partners in private equity funds are minimal. However, in some cases, Limited Partners with substantial investment enjoy special rights and terms of investment.[18]

- Unfunded Commitments: An investor's commitment to a private equity fund is satisfied over time as the general partner makes capital calls on the investor. If a private equity firm cannot find suitable investment opportunities, it will not draw on an investor's commitment, and an investor may potentially invest less than expected or committed.[2][8]

- Investment Risks: Given the risks associated with private equity investments, an investor can lose all of its investment. The risk of loss of capital is typically higher in venture capital funds, which invest in companies during the earliest phases of their development or in companies with high amounts of financial leverage. By their nature, investments in privately held companies tend to be riskier than investments in publicly traded companies.[19]

- High returns: Consistent with the risks outlined above, private equity can provide high returns, with the best private equity managers significantly outperforming the public markets.[20]

For the above-mentioned reasons, private equity fund investment is for investors who can afford to have capital locked up for long periods and who can risk losing significant amounts of money. These disadvantages are offset by the potential benefits of annual returns, which may range up to 30% per annum for successful funds.[21]

The content is sourced from: https://handwiki.org/wiki/Finance:Private_equity_fund

References

- Kaplan, Steven N., and Antoinette Schoar. "Private equity performance: Returns, persistence, and capital flows." The Journal of Finance 60.4 (2005): 1791-1823.

- James M. Schell (1 January 1999). Private Equity Funds: Business Structure and Operations. Law Journal Press. pp. 3–. ISBN 978-1-58852-088-3. https://books.google.com/books?id=9CXLWwVGDbQC&pg=SA3-PA7.

- Kay Müller (17 June 2008). Investing in Private Equity Partnerships: The Role of Monitoring and Reporting. Springer Science & Business Media. pp. 99–. ISBN 978-3-8349-9745-6. https://books.google.com/books?id=JTFK7AWepyIC&pg=PA99.

- Private equity industry dictionary . CalPERS Alternative Investment Program http://www.calpers.ca.gov/index.jsp?bc=/investments/assets/equities/aim/pe-glossary.xml

- Douglas J. Cumming; Sofia A. Johan (21 August 2013). Venture Capital and Private Equity Contracting: An International Perspective. Academic Press. pp. 145–. ISBN 978-0-12-409596-0. https://books.google.com/books?id=EXWMHie6IxsC&pg=PA145.

- Metrick, Andrew; Yasuda, Ayako (2010). "The Economics of Private Equity Funds". Review of Financial Studies 23 (6): 2303–2341. doi:10.1093/rfs/hhq020. ISSN 0893-9454. https://dx.doi.org/10.1093%2Frfs%2Fhhq020

- Davis, Eva; Robinson, Monique; Birenbaum, Joshua. "Selling Your Business: Why Private Equity Can Be The Best Buyer". Transaction Advisors. https://www.transactionadvisors.com/insights/selling-your-business-why-private-equity-can-be-best-buyer.

- David Stowell (19 March 2010). An Introduction to Investment Banks, Hedge Funds, and Private Equity. Academic Press. pp. 347–. ISBN 978-0-08-092289-8. https://books.google.com/books?id=5G5pj7SRIwMC&pg=PA347.

- David P. Stowell (2012). Investment Banks, Hedge Funds, and Private Equity. Academic Press. pp. 205–. ISBN 978-0-12-415820-7. https://books.google.com/books?id=HThWziP0X08C&pg=PA205.

- Spencer J. Fritz (2009). Private Equity and Its Impact. Nova Science Publishers. ISBN 978-1-60692-682-6. https://books.google.com/books?id=q90JAQAAMAAJ.

- Walter Jurek (2006). Merger and Acquisition Sourcebook. The Company. https://books.google.com/books?id=8dgbAQAAMAAJ.

- Eli Talmor; Florin Vasvari (24 June 2011). International Private Equity. John Wiley & Sons. pp. 4–. ISBN 978-1-119-97388-1. https://books.google.com/books?id=glAqLXXKsaAC&pg=RA4-PT87.

- Stefan Povaly (21 March 2007). Private Equity Exits: Divestment Process Management for Leveraged Buyouts. Springer Science & Business Media. pp. 184–. ISBN 978-3-540-70954-1. https://books.google.com/books?id=FLwUz93RgoAC&pg=PA184.

- Thomas Kirchner (1 July 2009). Merger Arbitrage: How to Profit from Event-Driven Arbitrage. John Wiley & Sons. pp. 189–. ISBN 978-0-470-50811-4. https://books.google.com/books?id=VYCYMZwFmgkC&pg=PA189.

- Stefano Caselli (20 November 2009). Private Equity and Venture Capital in Europe: Markets, Techniques, and Deals. Academic Press. pp. 310–. ISBN 978-0-08-096294-8. https://books.google.com/books?id=d2S2k4pioZsC&pg=PA310.

- Niamh Moloney (21 January 2010). How to Protect Investors: Lessons from the EC and the UK. Cambridge University Press. pp. 187–. ISBN 978-0-521-88870-7. https://books.google.com/books?id=T4IbuAk1QhQC&pg=PA187.

- Cyril Demaria (1 May 2015). Private Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and Forecasting. Palgrave Macmillan. pp. 114–. ISBN 978-1-137-40039-0. https://books.google.com/books?id=ZEATBwAAQBAJ&pg=PA114.

- Pratt's Guide to Private Equity Sources. Thomson Venture Economics. 2003. ISBN 978-0-914470-09-0. https://books.google.com/books?id=nQFbAAAAYAAJ.

- Phoebus Athanassiou (1 January 2012). Research Handbook on Hedge Funds, Private Equity and Alternative Investments. Edward Elgar Publishing. pp. 113–. ISBN 978-1-84980-608-4. https://books.google.com/books?id=zcgH-EBCa48C&pg=PA113.

- Michael S. Long & Thomas A. Bryant (2007) Valuing the Closely Held Firm New York: Oxford University Press. ISBN:978-0-19-530146-5 [1]

- Keith Arundale (3 April 2007). Raising Venture Capital Finance in Europe: A Practical Guide for Business Owners, Entrepreneurs and Investors. Kogan Page Publishers. pp. 216–. ISBN 978-0-7494-5202-5. https://books.google.com/books?id=cfRBoYM78pMC&pg=PA216.