Market power is a multidisciplinary concept, bringing together aspects from law and economics, which are necessary to be understood in order to assess market situations with a global dimension. Globalization is an economic and social phenomenon which comes together with enhanced market power for global actors. Factors influencing or limiting market power, such as corporate social responsibility, are important to understand in order to assess market power situations. According to European Union Law, the concept of market power is reflected in abuse of dominance, which is an anti-competitive behavior prohibited in the Common Market of the EU, as defined in Article—102 of the Treaty on the Functioning of the EU. An interdisciplinary approach based on elements of law and economics is thus necessary when assessing market power of global actors.

Market power is a dynamic concept with a development influenced by perspectives from law and economics, based on which the assessment of market situations occurs. This aspect is of growing importance due to the fact that nowadays market actors are global players. In global markets with an oligopoly structure, as most of the markets nowadays are, market power becomes an extremely important issue. Global actors do have market power. The question of whether they abuse this market power is relevant due to its effects on consumers and as well on the structure of the market. Competition law, or antitrust law as it is known in the United States of America, addresses major issues of multinational market actors. In this perspective, dealing with this topic is interesting and useful at the same time. This aspect is validated by the fact that market power is also approached by EU Competition Law and by US Antitrust Law, as due to globalization, there are domino effects between economies and between the interactions of global acting companies. Globalization is an economic phenomenon that can be defined as an integration of economies and even of societies worldwide

[1].

Assessed in a multidisciplinary manner, market power is ambivalent. On the one hand, gaining market power validates the fact that a company is competitive and that it is an important actor in its sector. On the other hand, it opens the question of whether an abuse of dominance is likely to occur. Exactly this type of anti-competitive conduct is severely sanctioned by EU Competition Law, which is very strict when assessing abuse of dominance. This aspect is reflected in the practice of the European Commission and in the case-law of the Court of Justice of the EU. Unlike for Article 101 from the Treaty on the Functioning of the EU referring to cartels and other anti-competitive agreements, for which some exceptions and exemptions from applying competition law provisions are provided, for Article 102 from the Treaty on the Functioning of the EU, no exceptions are tolerated. Abuse of dominance cannot find any justification and is not acceptable in the view of EU Competition Law. The US Antitrust Law approach does not encourage abuse of market power either, but it states that this is also a market issue which will be eventually regulated by the market itself. What is not tolerated in any circumstances by the US Antitrust Law are cartels, which are worse than abuse of market power, as is reflected in US Antitrust Law. Given this international and comparative perspective, an assessment of the concept of market power in the context of globalization and of enhanced digitalization is important when dealing with market power situations. This is the objective of the present entry paper.

The context of digitalization might generate a change of paradigm in the assessment of market power, which is analyzed in the present paper. This change of paradigm is reflected in the new dimension of market power and its evaluation. The developments regarding the measurement of market power are assessed, considering the transition from well-established views based on market share to new perspectives of market power in the digital global environment and in the era of delocalization. The financial sector with relevant case studies is being considered as it is a sector where moral hazard occurred, triggering changes at global level, such as the financial crisis in 2008–2009. Linked with the idea of market power, the principle “too big to fail” proved at that time to be false. In order to avoid similar situations, an ethics-based approach has been put in place. Corporate social responsibility became a value that gains increasing importance and that has to be considered by actors with market power. Rating agencies might as well have a role in this assessment. These aspects reflect the developments of the concept of market power and how the perception of influencing factors has changed over time.

The current state of research reveals the concept of market power and its dimensions. According to the studied literature, the economic view defines market power as the ability to set a price “above short-run marginal costs”

[2]. This definition, though, is not very useful for policy formulation or for a legal interpretation according to EU Competition Law. Regarding pricing matters, companies focus not on “short-run marginal costs”, as knowing these costs is quite difficult, so that they rather focus on average costs, which are easier to be determined. Market power is reflected in the fact that a company is able to raise prices above the level that would exist in a competitive environment. This way, the company having market power increases its profit

[2]. According to Bishop & Walker, three elements define market power. By increasing prices, the company is ready to renounce at some output.

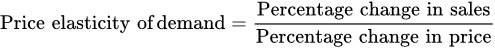

The next element to consider when assessing market power is the fact that the price increase must have an increase in profitability as a consequence. After the price raise, demand is likely to fall, according to the demand curve that slopes downwards. In order to predict the fall, a company may use the indicator of price elasticity of demand, which is the percentage change in sales divided by the percentage change in price

[2]:

By using this indicator, the company with market power will predict which would be the response of consumers to a given percentage increase in price and it might calculate if the price increase will have consequences on profitability or not. The indicator that is relevant for market power is, according to the studied literature, the own-price elasticity and not the cross-price elasticity. The cross-price elasticity shows the response to a change in the price of some other product, which is a substitute offered by competitors

[2]. It is less relevant as an indicator for market power than the own-price elasticity. The elasticity of demand might be analyzed with econometric methods, by means of the multiple regression analysis

[2].

It is important to mention in this context that real elasticity of demand for the products of oligopolists depends not only on changes in own prices, but also on the reaction of competitors to changes in prices or output volumes of the firm that initiated the changes. It also depends on many other factors: geographic accessibility (transport costs), climatic conditions, and others.

The third element illustrating market power is the fact that the price increase is above the price that would exist in a competitive environment. The economic literature uses in this comparison the short-run marginal cost as a benchmark or as a comparative parameter. If this situation is just singular, it represents only an isolated, episodical behavior of the company and it does not necessarily indicate market power. In order to indicate market power, the situation should occur on a constant basis. This would indeed indicate market power

[2] as it indicates that the company with market power simply ignores its competitors, and it has the market power to do so. The correct assessment of market power would therefore be on a dynamic basis, considering the dynamics of the company and of its behavior.

This entry is adapted from the peer-reviewed paper 10.3390/encyclopedia2040115