The adoption of plug-in electric vehicles in Germany is actively supported by the German Federal Government. Under its National Plattform for Electric Mobility, Chancellor Angela Merkel set an initial goal in 2010 to deploy one million electric vehicles on German roads by 2020. Initially, the government did not provide subsidies to promote sales of plug-in electric vehicles, however, by the end of 2014 it was recognized that the country was well behind the set sales targets. A purchase bonus scheme was approved in 2016, but premium cars were not eligible to the incentive. In order to meet the climate targets for the transport sector, in 2016 the government set the goal to have from 7 to 10 million plug-in electric cars on the road by 2030, and 1 million charging points deployed by 2030. In June 2020, and as a result of the economic impact of the COVID-19 pandemic, the government approved a recovery plan which included €8 billion to promote electric vehicle adoption and deployment of charging infrastructure. The purchase bonus for all-electric cars was raised temporarily from €6,000 to €9,000 for cars costing less than €40,000. There are lower bonuses for the purchase of plug-in hybrids, used cars and for leasing. The additional bonus will be available until the end of 2025. The initial one million goal was achieved in July 2021. The stock of plug-in electric vehicles in Germany is the largest in Europe, and (As of July 2021), there were 1 million plug-in electric vehicles on the road, including buses and commercial vehicles. The German fleet in use consists of 54% all-electric vehicles and 46% plug-in hybrids. (As of December 2019), Germany had a stock of 21,890 light-duty electric commercial vehicles, the second largest in Europe after France. (As of March 2020), the country had 27,730 public charging stations. The plug-in electric car segment market share was 1.58% in 2017 and 1.9% in 2018. The segment market share rose to 3.10% in 2019, and despite the global strong decline in car sales brought by the COVID-19 pandemic, the uptake rate achieved a record 13.6% in 2020. (As of January 2021), the stock of German plug-in electric cars on the road totaled 588,944 units, representing 1.2% of all registered passenger cars, up from 0.5% the previous year. In 2019, Germany surpassed Norway as Europe's top selling country market in terms of annual sales, and with a record volume of 394,632 plug-in passenger cars registered in 2020, up 263% from 2019, Germany listed for a second year running as the best selling European plug-in market. Both years, the German market led both the fully electric and plug-in hybrid segments. The only country that outsold Germany in 2020 was China.

- plug-in hybrid

- electric car

- electric vehicle

1. Government Incentives

In May 2010, under its National Platform for Electric Mobility, Chancellor Angela Merkel set the goal to bring one million electric vehicles on German roads by 2020.[1][2] However, the government also announced that it would not provide subsidies to the sales of plug-in electric cars but instead it would only fund research in the area of electric mobility.[1] (As of April 2016), electric vehicles and plug-ins in Germany are exempt from the annual circulation tax for a period of five years from the date of their first registration.[3][4] In 2016, the annual circulation tax exemption was extended from five to ten years, backdated to 1 January 2016.[5]

The private use of a company car is treated as taxable income in Germany and measured at a flat monthly rate of 1% of the vehicle's gross list price. So plug-in electric cars have been at a disadvantage since their price tag can be as much as double that of a car using a conventional internal combustion engine due to the high cost of the battery. In June 2013 German legislators approved a law that ends the tax disadvantage for corporate plug-in electric cars. The law, backdated to 1 January 2013, allows private users to offset the list price with €500 per unit of battery size, expressed in kilowatt hours (kWh). The maximum offset was set at €10,000 corresponding to a 20 kWh battery. the amount one can offset will sink annually by €50 per kilowatt hour.[6] As part of the package of financial incentives approved in 2016, private owners of plug-in electric vehicles that charge their cars in their employer premises are exempted from declaring this perk as a cash benefit in their income tax return. Employers who provide this perk are allowed to discount from their income tax a 25% of the lump sum value of the cash benefit. These two fiscal benefits apply only from 1 January 2017 until the end of 2020.[7]

In August 2014, the federal government announced its plan to introduce non-monetary incentives through new legislation to be effective by early 2015. The proposed user benefits include measures to privilege battery-powered cars, fuel cell vehicles and some plug-in hybrids, just like Norway does, by granting local governments the authority to allow these vehicles into bus lanes, and to offer free parking and reserved parking spaces in locations with charging points.[8][9] Not all plug-in hybrids will qualify for the benefits, only those with CO

2 emissions of no more than 50 g/km or an all-electric range of over 30 km (19 mi) are eligible.[10] The range criteria will rise to 40 km (25 mi) starting in 2018.[11] The Bundestag passed the Electric Mobility Act in March 2015 authorizing local government to grant these non-monetary incentives, which are not mandatory. The law also provides issuing special license plates for electric vehicles to allow proper identification to avoid abuses of these privileges. (As of March 2015), just 12 municipalities are considering to allow electric vehicles in the bus lanes in their jurisdiction. Most cities, including Hamburg and Munich, are not willing to allow electric cars in their bus lanes.[12][13]

The special license plate authorized by the 2015 Electric Mobility Act adds the letter "E" at the end of the license number. Owners of all-electric cars and plug-in hybrids with a minimum all-electric range of 30 km (19 mi) can apply for the special license. The minimum range for eligible plug-in hybrids goes up to 40 km (25 mi) from January 1, 2018.[14][15]

According to the fourth progress report of the German National Platform for Electric Mobility, only about 24,000 plug-in electric cars are on German roads by the end of November 2014, well behind the target of 100,000 unit goal set for 2014. As a result, Chancellor Angela Merkel recognized in December 2014 that the government has to provide more incentives to meet the goal of having one million electric cars on the country's roads by 2020. Among others, the federal government is considering to offer a tax break for zero-emission company cars, more subsidies to expand charging infrastructure, particularly to deploy more public fast chargers, and more public funding for research and development of the next generation of rechargeable batteries.[16][17]

1.1. Purchase Incentives

2016-2019

At the beginning of 2016, German politicians from the three parties in Mrs. Merkel's ruling coalition and auto executives began talks to introduce a subsidy for green car buyers worth up to €5000 (US$5,500) to boost sales of electric and plug-in hybrid cars.[18] (As of February 2016), the German government proposal is for the auto industry to cover 40% of the cost of the purchase subsidy. Private buyers would get the full €5000 subsidy, while corporate buyers would receive €3000 for each electric car, and the program is expected to run until 2020, the deadline set to achieve the goal of 1 million electric cars on German roads. Incentives will fall by €500 each year.[19] In March 2016, Nissan Europe announced its support to the green car incentive and its commitment to double the government's E-premium incentive when buying a Nissan electric car, with a reduction of the purchase price of the same amount of the subsidy. Nissan Center Europe CEO said "we remain convinced that the goal of one million electric cars by 2020 is still achievable." According to Nissan if from now on electric car sales double every year until 2020, it is still possible to achieve the government goal.[20]

An incentive scheme to promote plug-in electric vehicle adoption was approved in April 2016 with a budget of €1 billion (US$1.13 billion). A total of €600 million (US$678 million) is reserved for the purchase subsidies, which are expected to run until all the money is disbursed, estimated to last until 2019 at the latest. Another €300 million (US$339 million) are budgeted to finance the deployment of charging stations in cities and on autobahn highway stops. And another €100 million (US$113 million) would go toward purchasing electric cars for federal government fleets. The program is aimed to promote the sale of 400,000 electric vehicles. The cost of the purchase incentive is shared equally between the government and automakers. Electric car buyers get a €4000 (US$4,520) discount while buyers of plug-in hybrid vehicles get a discount of €3000 (US$3,390). Premium cars, such as the Tesla Model S and BMW i8, are not eligible to the incentive because there is a cap of €60,000 (US$67,800) for the purchase price.[21][22][23] Only electric vehicles purchased after 18 May 2016 are eligible for the bonus and the owner must keep the new electric car at least nine months. The same rule applies for leasing.[5]

(As of September 2016), BMW, Citroën, Daimler, Ford, Hyundai, Kia, Mitsubishi, Nissan, Peugeot, Renault, Toyota, Volkswagen, and Volvo had signed up to participate in the scheme.[5][24] In May 2016, Nissan announced the company decided to raise the bonus with an additional €1000 (US$1,130) to €5000 (US$5,650) for customers of its all-electric Leaf car and e-NV200 utility van.[25] The online application system to claim the bonus went into effect on 2 July 2016.[26] (As of September 2016), a total of 26 plug-in electric cars and vans were eligible for the purchase bonus.[24] According to the Federal Office of Economics and Export Control (BAFA), a total of 4,451 applications have been made for the government subsidy for the purchase of a plug-in electric model (As of September 2016), consisting of 2,650 all-electrics and 1,801 plug-in hybrids.[24] (As of September 2016), the federal states with the most claims are Bayern (1,130), Baden-Württemberg (873), and Nordrhein-Westfalen (726).[24]

(As of September 2016), the following 26 plug-in electric cars and vans were eligible for the purchase bonus: Audi A3 e-tron, BMW 225xe, BMW 330e, BMW i3, Citroën Berlingo Electric, Citroën C-Zero, Ford Focus Electric, Kia Soul EV, Mercedes-Benz B-Class Electric Drive (B 250e), Mercedes-Benz C350 e, Mitsubishi i-MiEV, Mitsubishi Outlander P-HEV, Nissan e-NV200 5- and 7-seater Combi, Nissan Leaf, Peugeot iOn, Peugeot Partner Electric, Renault Kangoo Z.E., Renault Zoe, Smart Fortwo electric drive, Toyota Prius Plug-in Hybrid, Volkswagen e-Golf, Volkswagen e-Up!, Volkswagen Golf GTE, Volkswagen Passat GTE, and Volvo V60 Plug-in Hybrid.[24] (As of September 2016), the models with the most applications are the Renault Zoe (876), BMW i3 (766), Audi A3 e-tron (462), BMW 225xe (440), and Mitsubishi Outlander P-HEV (353).[24]

In order to meet the climate targets for the transport sector, in 2016 the government set the goal to have from 7 to 10 million plug-in electric cars on the road by 2030, and 1 million charging points available in Germany also by 2030.[27][28]

2020-2025

As a result of the economic impact of the COVID-19 pandemic, the government approved in June 2020 an economic recovery plan with a budget of €130 billion, which included €8 billion to promote electric vehicle adoption and deployment of charging infrastructure.[29]

As part of the stimulus plan, the purchase bonus for plug-in electric cars was raised by temporarily doubling the federal contribution of the environmental bonus until the end of 2021. The so-called "innovation bonus" increased the subsidy for new cars costing less than €40,000 from €6,000 to €9,000 for fully electric cars, and for plug-in hybrids from €4,500 to €6,750. This became the highest economic incentive granted in any European country, but there is a holding period, the vehicle must be registered in Germany for at least six months.[28][29][30]

There are also lower bonuses available for leasing; new cars costing between €40,000 and €65,000; and also for used cars, provided no environmental bonus was granted in a previous purchase. In addition, other tax incentives for electric vehicles were introduced. In November 2020 the government decided to keep the innovation bonus until the end of 2025, but for plug-in hybrid cars to be eligible they must have a minimum electric range of 60 km (37 mi) from 2022 and at least 80 km (50 mi) from 2025.[30] The initial one million goal was achieved with a six months delay in July 2021.[31]

1.2. Controversies

- Loophole to EU regulations

According to Der Spiegel, by the early fourth quarter of 2015 the Kia Soul EV ranked as the top selling plug-in electric car in Germany during 2015 with 2,459 units sold, with almost 1,000 registered in October, nevertheless, there were actually only a few of them on German roads. At the time, about 1,400 Soul EVs had been shipped to Norway and sold as used cars, where availability of new Soul EVs was limited. According to the magazine, Kia Motors is registering the electric cars in Germany and then shipping them to Norway, which does not belong to the European Union, as a strategy to reduce the average CO

2 fleet emissions of the entire Hyundai-Kia Group. This strategy allows the carmaker to comply with European Union regulations that mandate 130 grams of CO

2 emission per km in 2015, and so they avoid to pay a fine of €70 million per year for each gram above the established average limit. According to German authorities this loophole is legal.[33] A total of 2,044 Kia Soul EVs were exported to Norway as used cars during 2015.[32][34]

1.3. National Platform for Electric Mobility

The German National Platform for Electric Mobility ("Nationale Plattform Elektromobilität") is an advisory council of the German Federal Government for electric vehicle introduction. It consists of the top representatives of industry (10 Members), politics (6), science (3), associations (3) and unions (1). It was officially established on 3 May 2010 during a meeting with German chancellor Angela Merkel. Its task is to push on the National Development Plan for Electric Mobility ("Nationaler Entwicklungsplan Elektromobilität"). The goal for 2020 of the NPE is to develop Germany to the leading supplier and lead market for electric mobility and to gain employment in the country.[35]

2. Charging Infrastructure

By November 2014, Germany had 4,800 public charging stations.[16] (As of March 2020), the country had 27,730 charging stations.[36] By June 2020, The German government is considering to mandate all petrol stations to offer electric car charging as part of its economic recovery plan due to the effects of the COVID-19 pandemic. The government expects to spend €2.5 billion euros on battery cell production and charging infrastructure as part of the national stimulus package.[36]

Several pilot projects have been implemented based on partnerships of carmakers and utility companies. Daimler AG and utility RWE AG run a joint electric car and charging station test project in the German capital, Berlin, called "E-Mobility Berlin." They have set up 60 charging stations in Berlin (September 2009) and planned to expand the system to include 500 charging stations.[37] Daimler has provided for 100 Smart electric drive cars to the project. The second phase started in November 2010. The RWE subsidiary "RWE Mobility"[38] created cooperations with the automobilist club ADAC, car rental service Sixt and car park provider APCOA to equip all locations with charging stations.[39] since mid of 2009. Renault joined the RWE Mobility program in September 2009 whereby the project goals of erecting charging stations were enlarged to mid of 2011[40] Renault's partner Nissan has joined the RWE-mobility program in June 2010 announcing that RWE will create a network of 1,000 charging stations until the end of the year 2010 focusing on the Berlin and Rhein-Ruhr region.[41] In August 2010 a cooperation with fuel retailer PKN Orlen was announced – they planned to equip 30 gas stations in Hamburg with charging points for electric vehicles.[42]

Carmaker BMW and utility Vattenfall run a joint electric car and charging test project with Mini E electric cars.[43] A total of 100 trial vehicles were assigned.[44] Testing in Berlin began in June 2009, and for the second phase, a total of 70 vehicles were delivered in March 2011 to private customers and fleet users.[45] Field testing began in Munich in September 2010, for a leasing fee of €400 (approx. US$517) per month.[46][47] Up to June 2011 there were 42 public charge points by Vattenfall in Berlin and the company is in the process of building 50 public charge points in Hamburg.[48]

Carmaker VW and utility E.ON run a joint electric car and charging station test project in the German capital, Berlin and in Wolfsburg.[49] The "Electric Mobility Fleet Test"[50] was started as a research project with mostly partners in German universities using the VW hybrid cars (to be tested in 2010). E.ON has later joined also in the MINI E project providing the infrastructure in Munich which was started in July 2009.[51] erecting an initial series of 11 charging stations (May 2010) enlarging it continuously (21 locations in December 2010).[52] The region test in Munich has been extended with BMW i prototypes (BMW i3 and BMW i8) as well as Audi e-tron models (project eflott) in 2011. E.ON has announced to provide the eflott project with 200 public charging stations the Munich region.[53]

Carmaker Daimler, the utility EnBW and the government of Baden-Württemberg announced in June 2010 to expand the "Landesinitiative Elektromobilität" program with the "e-mobility Baden-Württemberg" project that includes erecting 700 charging stations in the state until the end of 2011.[54] Additionally there will be 200 electric vehicles added to the test including some electric trucks.[54] The government of Baden-Württemberg has assigned €28.5 million to support EV research up to 2014.[54] Meanwhile, EnBW has sponsored 500 E-Bikes in the Elektronauten project in 2010 which can use 13 charging stations in the Stuttgart region.[55] EnBW has claimed to offer 250 charging stations for the Elektronauten 500 project in May 2011 although the map has not been updated.[56][57] Bosch has developed a new charging station type for EnBW that is capable for 63A – the station was certified on 11. April 2011 by DEKRA[58] and EnBW has announced to install 260 charge stations in the following weeks for MeRegioMobil project in Stuttgart and Karlsruhe.[59] In November 2011 the Car2Go carsharing service announced plans to operate in Stuttgart in 2012 – EnBW reassured to have 500 charging spots ready in time with the roll out of the Car2Go vehicles in the second half of 2012.[60]

3. Sales

(As of September 2021), cumulative registrations in Germany totaled 1,178,178 plug-in electric passenger cars since 2010, consisting of 599,254 all-electric cars and 578,924 plug-in hybrids.[61][62][63][64][65][66][67] In addition, Germany had a stock of 21,890 light-duty electric commercial vehicles in 2019, the second largest in Europe after France.[68]

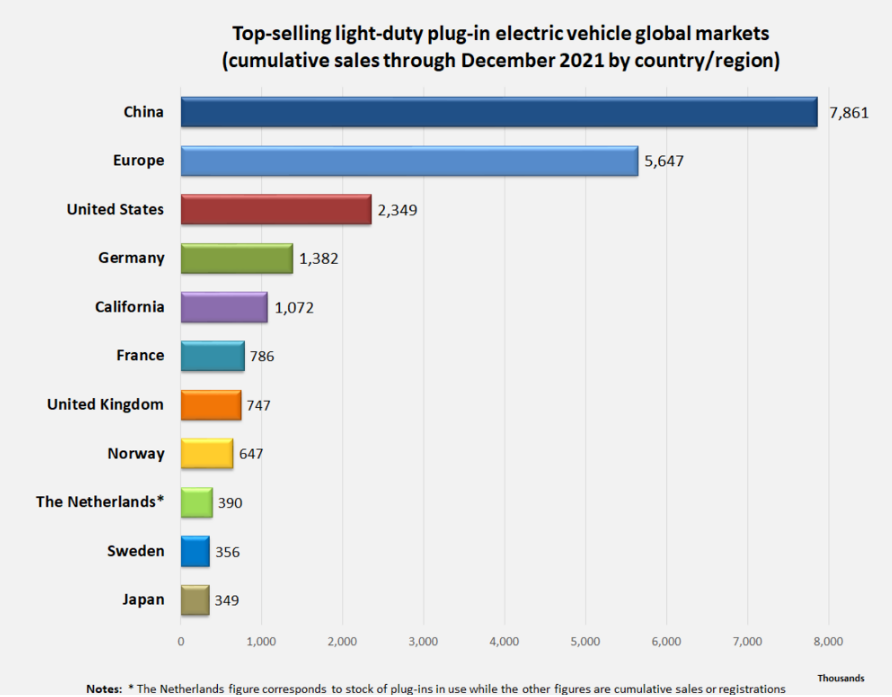

Germany listed as Europe's second best selling plug-in market in 2017, overtaking the French and the British markets for the first time, and again in 2018, ranked second after Norway.[69] Germany topped plug-in car sales in the European continent in 2019,[70] and with a record volume of 394,632 plug-in passenger cars registered in 2020, up 263% from 2019, Germany listed for a second year in-a-row as the best selling European country market.[64][71] The German market topped both the fully electric and plug-in hybrid segments.[71] By the end of 2020, Germany had the world's third largest plug-in car stock after China and the U.S.[68][72]

The plug-in electric car segment market share was 1.58% in 2017 and 1.9% in 2018.[61][62] The segment market share rose to 3.10% in 2019,[63] and despite the global strong decline in car sales brought by the COVID-19 pandemic, the uptake rate achieved a record 13.6% in 2020.[64]

The official German definition of electric vehicles changed at the beginning of 2013, before that, official statistics only registered all-electric vehicles because plug-in hybrids were accounted together with conventional hybrids. As a result, the registrations figures for 2012 and older do not account for total new plug-in electric car registrations.[73]

3.1. 2011-2012

During 2011, a total of 2,154 pure electric cars were registered in the country, up from 541 units in 2010.[75] All-electric car sales for 2011 were led by the Mitsubishi i-MiEV family with 683 i-MiEVs, 208 Peugeot iOns and 200 Citroën C-Zeros, representing 50.6% of all electric car registrations in 2011.[75] Plug-in hybrid registrations totaled 266 units in 2011, 241 Opel Amperas and 25 Chevrolet Volts, for a total of 2,420 plug-in electric vehicles registered in 2011.[76]

A total of 2,956 all-electric vehicles were registered in Germany during 2012, a 37.2% increase over 2011.[77] When 901 registered plug-in hybrids are accounted for, 2012 registrations climb to 3,857 units,[77][78] and sales of plug-in electric car represented a 0.12% market share of new passenger vehicles sold in the country in 2012.[79] Most sales in the country were made by corporate and fleet customers and 1,493 all-electric vehicles were registered by the automobile industry, as demonstration or research vehicles.[77] Registrations of plug-in electric-drive vehicles were led by the Opel Ampera extended-range electric car with 828 units, followed by the Smart electric drive with 734 units.[78][80] In addition, a total of 2,413 Renault Twizys were sold during 2012, making Germany the top selling European market for the electric quadricycle.[81][82]

3.2. 2013-2015

A total of 7,436 new plug-in electric cars were registered in Germany in 2013, consisting of 6,051 all-electric cars and 1,385 plug-in hybrids.[83] Total registrations at the end of 2013 reached 12,156 units.[74] The market share of plug-in electric passenger cars increased to 0.25% in 2013 from 0.12% in 2012.[79][83] The Smart electric drive led new plug-in car registrations in 2013 with 2,146 units, followed by Renault Zoe with 1,019, the Nissan Leaf with 855 units, and the BMW i3 with 559.[84][85]

Registrations of plug-in electric cars totaled 13,049 units in 2014, consisting of 8,522 all-electric cars and 4,527 plug-in hybrids. The plug-in segment achieved a market share of 0.4% of new car sales that year.[88] The BMW i3 ended 2014 as the top selling plug-in electric car with 2,233 units registered, followed by the Smart Fortwo ED with 1,589, and the Renault Zoe with 1,498.[86][89] Accounting for registrations of plug-in electric cars between January 2010 and June 2014, the leading model was the Smart electric drive with 3,959 units, with a significant number in use by carsharing services, followed by the BMW i3 with 1,937 units, Nissan Leaf with 1,693 units, Renault Zoe with 1,532, and Opel Ampera with 1,450 units.[75][76][77][78][84][85][89][90][91]

Plug-in hybrid registrations totaled 11,101 units in 2015, up 145% from 2014, and all-electric cars totaled 12,363 units registered, up 45% from 2014. Combined sales of the two segments totaled 23,464 units. The plug-in segment achieved a market share of 0.7% of new car sales that year, up from 0.4% in 2014.[88][92] Registrations totaled 3,176 plug-in cars in December 2015, achieving both, the highest monthly sales volume ever and a record market share of 1.28% of new car registrations that month.[92][93] The top selling models in 2015 were the Kia Soul EV with 3,839 units, followed by the BMW i3 with 2,271, the Mitsubishi Outlander P-HEV with 2,128, the Volkswagen Golf GTE with 2,109 and the Audi A3 e-tron with 1,839.[94]

The magazine Der Spiegel questioned whether the Kia Soul EV was actually the top selling plug-in electric car in the country, as about 2,000 electric cars were registered in Germany and then imported to Norway as used cars, as part of a strategy of the Hyundai-Kia Group to comply with European Union CO

2 regulations.[33][34] (see Controversies section above). There were about 50,000 plug-in electric cars registered in Germany by the end of 2015.[95]

3.3. 2016-2017

During the first three quarters of 2016, sales of plug-in hybrids surpassed sales of all-electric cars for the first time in the country with a total of 17,074 units were registered.[98] The introduction of the purchase bonus did not produce immediate effect on plug-in car sales until September 2016, when registrations peaked to 3,061 units.[98][99] Combined registrations of both type of plug-in accounted for 1.1% of new car registrations, allowing the German plug-in market share to pass the 1% mark for the first time during 2016.[99][100]

A total of 25,254 plug-in cars were registered in 2016 consisting of 13,744 plug-in hybrids and 11,410 all-electric cars, representing a market share of 0.72% of new car registrations that year.[101] The top selling models in 2016 were the BMW i3 (2,863), Renault Zoe (2,805), Audi A3 e-tron (1,615), Tesla Model S (1,474), and Mitsubishi Outlander P-HEV (1,436).[87]

A record of 54,492 plug-in cars were registered in 2017, up 217% the previous year, and consisting of 29,436 plug-in hybrids and 25,056 all-electric cars.[61] The top selling models in 2017 were the Audi A3 e-tron (4,454), Renault Zoe (4,322), and BMW i3 (4,319).[102][103] Registrations achieved a record market share of 1.58% in 2017.[61]

3.4. 2019

A total of 108,629 plug-in electric passenger cars were sold in Germany in 2019, consisting of 45,348 plug-in hybrids and 63,321 all-electric cars. The plug-in segment market share achieved a record 3.1% of new car sales in 2019, with all-electric cars representing 1.8%, and plug-in hybrids 1.3%.[63] In 2019, Germany surpassed Norway as the best selling plug-in market in terms of annual sales, leading both the all-electric and the plug-in hybrid segments.[104]

- Sales, Electric Vehicles, Germany, January to October 2019[105]

| Manufacturer | Pieces | |

|---|---|---|

| 1 | Tesla | 9301 |

| 2 | Renault | 8330 |

| 3 | BMW | 7957 |

| 4 | VW | 6208 |

| 5 | Smart | 5862 |

| 6 | Hyundai | 4497 |

| 7 | Audi | 3204 |

| 8 | Nissan | 2747 |

| 9 | Kia | 1751 |

| 10 | Jaguar | 789 |

3.5. 2020

Despite the global strong decline in car sales brought by the COVID-19 pandemic, new plug-in electric car sales in Germany between January and September 2020 achieved record registrations with a total of 204,251 units sold, consisting of 105,882 plug-in hybrids and 98,369 all-electric cars. The plug-in market share achieved a record of 15.6% of new car sales, and the global market share for the first nine months of 2020 attained 10%, 5.2% for plug-in hybrids and 4.8% for batery electric cars.[106]

The top selling electric models in 2020 were the Renault Zoe (30,376), VW e-Golf (17,438), the Tesla Model 3 (15,202), the new VW ID.3 (14,493), and the Hyundai Kona (14,008).[107]

3.6. 2021

(As of January 2021), there were 588,944 plug-in electric cars in circulation on January 1, 2021, representing 1.2% of all cars on the road in Germany, up from 0.5% the previous year.[27][108] The stock of plug-in cars in use consisted of 309,083 fully electric cars and 279,861 plug-in hybrids.[108]

4. Top Selling Models by Year

The following table presents registrations of the top selling highway-capable plug-in electric cars available for retail customers by year between 2010 and June 2014.

Registration of highway-capable plug-in electric cars by model in Germany between 2010 and June 2014[75][76][77][78][84][85][89][90][91] |

||||||

|---|---|---|---|---|---|---|

| Model | Total 2010-2014(1) |

2Q 2014 |

2013 | 2012 | 2011 | 2010 |

| Smart electric drive | 3,959 | 645 | 2,146 | 734 | 328 | 106 |

| BMW i3 | 1,937 | 1,378 | 559 | |||

| Nissan Leaf | 1,693 | 380 | 855 | 451 | 7 | |

| Renault Zoe | 1,532 | 513 | 1,019 | |||

| Opel Ampera | 1,450 | 46 | 335 | 828 | 241 | |

| Volkswagen e-Up! | 1,034 | 884 | 150 | |||

| Citroën C-Zero | 950 | 17 | 276 | 454 | 200 | 3 |

| Mitsubishi i MiEV | 910 | 56 | 89 | 71 | 683 | 11 |

| Tesla Model S | 637 | 446 | 191 | |||

| Peugeot iOn | 520 | 0 | 48 | 263 | 208 | 1 |

| Mitsubishi Outlander P-HEV | 507 | 507 | ||||

| Volvo V60 Plug-in Hybrid | 316 | 243 | 73 | |||

| Renault Fluence Z.E. | 273 | 0 | 60 | 213 | ||

| Volkswagen e-Golf | 231 | 231 | ||||

| Tesla Roadster | 190 | 67 | 100 | 23 | ||

| BMW ActiveE | 124 | 11 | 113 | |||

| Chevrolet Volt | 73 | 0 | 25 | 23 | 25 | |

| Porsche Panamera S E-Hybrid | 63 | 51 | 12 | |||

| BMW i8 | 55 | 55 | ||||

| Ford Focus Electric | 51 | 16 | 35 | |||

| Fisker Karma | 50 | 50 | ||||

| Tazzari Zero | 50 | 50 | ||||

| Volvo C30 Electric | 21 | 9 | 0 | 12 | ||

| Total and registrations by year[73][74][75][77][83] | 17,919(2) | 5,763 | 7,436 | 2,956(2) | 2,154(2) | 541(2) |

| Notes: (1) CYTD: current year-to-date sales through June 2014. (2) The official KBA registration numbers only registered all-electric vehicles before 2013 (plug-in hybrids were accounted together with conventional hybrids). As a result, these figures do not include plug-in hybrids, and the cumulative total does not reflect actual all new plug-in electric car registrations before 2013.[73] |

||||||

The content is sourced from: https://handwiki.org/wiki/Engineering:Plug-in_electric_vehicles_in_Germany

References

- John Blau (2010-05-03). "Berlin plugs in electric mobility strategy". Deutsche Welle. http://www.dw-world.de/dw/article/0,,5533192,00.html.

- Barbara Praetorius (2011). "E-Mobility in Germany: A research agenda for studying the diffusion of innovative mobility concepts". ECEEE. http://proceedings.eceee.org/papers/proceedings2011/4-174_Praetorius.pdf?returnurl=http%3A%2F%2Fproceedings.eceee.org%2Fvisabstrakt.php%3Fevent%3D1%26doc%3D4-174-11.

- "Overview of Tax Incentives for Electric Vehicles in the EU". European Automobile Manufacturers Association. 2010-04-20. http://www.acea.be/images/uploads/files/20100420_EV_tax_overview.pdf.

- ACEA (February 2010). "Policy support for electrically chargeable vehicles". rai vereniging (RAI Association - Dutch Association of Bicycle and Automobile Industry). http://www.raivereniging.nl/dossiers/elektrische-voertuigen.aspx. Click under "Overzicht stimuleringsprogrammas elektrische voertuigen (Overview incentive programs electric vehicles) to download the report in pdf format (website in Dutch).

- "Prämie für E-Autos beschlossenWie komme ich jetzt an den Bonus?" (in de). Bild. 2016-05-18. http://www.bild.de/politik/inland/elektroauto/kabinett-beschliesst-umweltbonus-45858838.bild.html.

- "Germany ends tax disadvantage for corporate electric cars". Reuters. 2013-06-07. https://www.reuters.com/article/germany-electricvehicles-tax-idUSL5N0EJ1Y320130607.

- Staff (2016-08-09). "E-Auto-Prämie: Diese Voraussetzungen müssen erfüllt sein: Gibt es auch Formen von Steuervergünstigungen oder Steuerbefreiungen?" (in de). KFZ-betrieb. http://www.kfz-betrieb.vogel.de/e-auto-praemie-diese-voraussetzungen-muessen-erfuellt-sein-a-545197/index6.html.

- Staff (2014-08-04). "Förderung von Elektroautos kommt ins Rollen" (in de). KFZ-betrieb. http://www.kfz-betrieb.vogel.de/neuwagen/handel/articles/454644/?cmp=nl-125.

- Faye Sunderland (2014-08-15). "Germany plans new EV incentives to spur uptake". The Green Car Website UK. http://www.thegreencarwebsite.co.uk/blog/index.php/2014/08/15/germany-plans-new-ev-incentives-to-spur-uptake/.

- Stefan Nicola (2014-09-24). "Germany Proposes Free Parking to Spur Electric-Car Sales". Bloomberg Businessweek. http://www.businessweek.com/news/2014-09-24/germany-proposes-free-parking-to-spur-electric-car-sales.

- Daniel Tost (2014-09-25). "Berlin approves new incentives for electric car drivers". EurActiv.com. http://www.euractiv.com/sections/transport/berlin-approves-new-incentives-electric-car-drivers-308700.

- Staff (2015-03-06). "Elektromobilitätsgesetz:Bundestag beschließt Vorfahrt für E-Autos" (in de). Spiegel Online. http://www.spiegel.de/auto/aktuell/bundestag-beschliesst-elektromobilitaetsgesetz-a-1022098.html.

- Staff (2015-03-05). "Bundestag will Vorfahrt für E-Autos" (in de). KFZ-betrieb. http://www.kfz-betrieb.vogel.de/verbaendeundpolitik/politik/articles/479501/?cmp=nl-125.

- Staff (2015-09-29). ""E" wie Elektroauto" (in de). Autobild. http://www.autobild.de/artikel/e-kennzeichen-autokennzeichen-fuer-elektroautos-5642890.html.

- Viehmann, Sebastian (2016-06-03). "E-Kennzeichen und ElektromobilitätsgesetzMit diesem Nummernschild parken Sie jetzt umsonst" (in de). Focus (German magazine). http://www.focus.de/auto/elektroauto/e-kennzeichen-elektroautos-mit-diesem-nummernschild-parken-sie-jetzt-umsonst_id_5592119.html.

- Brian Parkin; Dorothee Tschampa (2014-12-02). "Merkel Backs Incentives in Push for a Million Electric Cars". Bloomberg Businessweek. https://www.bloomberg.com/news/articles/2014-12-02/merkel-backs-incentives-in-1-million-electric-cars-push.

- Sabine Kinkartz (2014-12-03). "The future is electric - or is it?". Deutsche Welle. http://www.dw.de/the-future-is-electric-or-is-it/a-18108847.

- "Germany considers $5,500 incentive for electric cars". Reuters. Automotive News Europe. 2016-01-29. http://europe.autonews.com/article/20160129/ANE/160129831/germany-will-mull-5000-euro-incentive-for-ev-plug-in-hybrid-sales.

- Bellon, Tina; Wacket, Markus (2016-02-26). "Automakers would share German electric car incentive plan cost". Reuters. https://www.reuters.com/article/us-autos-electric-germany-idUSKCN0VZ251.

- Grimm, Andreas (2016-03-18). "Nissan will zusätzliche E-Prämie zahlen" (in de). KFZ-betrieb. http://www.kfz-betrieb.vogel.de/wirtschaft/articles/526724/?cmp=nl-125&uuid=B225CA8F-E6F9-464D-9839-BAB0E10881B8.

- Cremer, Andreas (2016-04-27). "Germany to launch 1 billion-euro discount scheme for electric car buyers". Reuters. http://in.reuters.com/article/autos-electric-germany-discount-idINKCN0XO1Y4.

- Agence France-Presse (2016-04-28). "Germany to give €1bn subsidy to boost electric car sales". The Guardian. https://www.theguardian.com/world/2016/apr/28/germany-subsidy-boost-electric-car-sales.

- Staff (2016-04-27). "Bis zu 4.000 Euro Förderung für Elektroautos" (in de). KFZ-betrieb. http://www.kfz-betrieb.vogel.de/wirtschaft/articles/531213/?cmp=nl-125&uuid=B225CA8F-E6F9-464D-9839-BAB0E10881B8.

- Bundesamt für Wirtschaft und Ausfuhrkontrolle (BAFA) (2016-09-30). "Elektromobilität (Umweltbonus) Zwischenbilanz zum Antragstand vom 30. September 2016" (in de). BAFA. http://www.bafa.de/bafa/de/wirtschaftsfoerderung/elektromobilitaet/publikationen/emob_zwischenbilanz.pdf.

- "Nissan sparks interest in electric vehicles with an added bonus for customers". Nissan Press Release (Automotive World). 2016-05-12. http://www.automotiveworld.com/news-releases/nissan-sparks-interest-electric-vehicles-added-bonus-customers/.

- Staff (2016-07-04). "Bislang 175 Anträge für Elektroauto-Prämie" (in de). KFZ-betrieb. http://www.kfz-betrieb.vogel.de/wirtschaft/articles/540876/?cmp=nl-125&uuid=B225CA8F-E6F9-464D-9839-BAB0E10881B8.

- Kraftfahrt-Bundesamtes (KBA) (2021-01-06). "Pressemitteilung Nr. 01/2021 - Elektromobilität in Deutschland auf der Überholspur" (in de). KBA. https://www.kba.de/DE/Presse/Pressemitteilungen/2021/Allgemein/pm01_2021_E_Antrieb.html?nn=646300. "In the case of cars with electric drive, this positive development was even more pronounced at +147.1 percent - here the share of the total stock rose from 0.5 percent to 1.2 percent (Translated from the original)" The term electric drive used by KBA includes battery-electric, plug-in and fuel-cell cars.

- Die Bundesregierung (The Federal Government) (2020-09-22). "Climate-friendly transport: Promoting the conversion to electric mobility". Cabinet of Germany. https://www.bundesregierung.de/breg-en/issues/climate-action/klimaschonender-verkehr-1795842.

- Laura Millan Lombrana and Akshat Rathi (2020-06-05). "Germany Just Unveiled the World's Greenest Stimulus Plan". Bloomberg Green. https://www.bloomberg.com/news/articles/2020-06-05/germany-s-recovery-fund-gets-green-hue-with-its-focus-on-climate.

- Funding for electric cars: there is money here https://www.adac.de/rund-ums-fahrzeug/elektromobilitaet/kaufen/foerderung-elektroautos/#:~:text=Am%2017.11.,von%20bis%20zu%206750%20Euro.

- "Germany reaches one-million electric vehicles target with half a year delay". Clean Energy Wire. 2021-08-02. https://www.cleanenergywire.org/news/germany-reaches-one-million-electric-vehicles-target-half-year-delay.

- Moberg, Knut (2016-01-16). "Bilsalget i 2015: Tidenes bronseplass" (in no). Dinside.com. http://www.dinside.no/935706/bilsalget-i-2015-tidenes-bronseplass. See table: "Topp 5 bruktimport i 2015" A total of 2,088 Leafs and 2,044 Soul EVs were imported to Norway in 2015 from neighboring countries.

- Nils-Viktor Sorge; Wilfried Eckl-Dorna (2015-11-26). "Dubiose Zulassungs-Strategie:Dieser Ladenhüter trickst Kias Umweltbilanz schön" (in de). Der Spiegel. http://www.spiegel.de/auto/aktuell/hyundai-poliert-co2-flottenverbrauch-mit-kia-soul-ev-export-a-1064766.html.

- Breitinger, Matthias (2016-01-27). "Elektroautos: Deutschland rollt ohne Strom" (in de). Die Zeit. http://www.zeit.de/mobilitaet/2016-01/elektroauto-deutschland-leitmarkt-china.

- "Nationale Plattform Elektromobilität: Background". http://nationale-plattform-elektromobilitaet.de/en/background/the-approach/.

- Steitz, Christoph; Taylor, Edward (2020-06-04). "Germany will require all petrol stations to provide electric car charging". Reuters. https://www.reuters.com/article/us-health-coronavirus-germany-autos/germany-will-require-all-petrol-stations-to-provide-electric-car-charging-idUSKBN23B1WU.

- Pressemeldung vom 25.11.2008 "Nationale Strategiekonferenz Elektromobilität" "... schon ab 2009 den Einsatz von mehr als 100 Elektrofahrzeugen der Marken smart und Mercedes-Benz in der Bundeshauptstadt. ... RWE stellt dafür rund 500 Ladestationen im Stadtgebiet Berlins auf." http://www.rwe-mobility.com/web/cms/de/236840/236692/rwemobility/presse-news/pressemitteilungen/nationale-strategiekonferenz-elektromobilitaet/

- http://rwe-mobility.com

- Pressemeldung vom 26.10.2009 "Startschuss für Elektromobilität in Mainz" " Partner des Projekts sind der Automobilclub ADAC, der Autovermieter Sixt, Siemens und Deutschlands größter Parkraumanbieter APCOA" .. "Langfristiges Branchenziel ist ein flächendeckendes Netz mit Ladepunkten – und zwar in ganz Europa." http://www.rwe-mobility.com/web/cms/de/236840/338340/rwemobility/presse-news/pressemitteilungen/rwe-mobility-presse/

- Pressemeldung vom 15.09.2009 "Renault und RWE unterzeichnen Abkommen für Stromtankstellen" "Bis Ende Juni 2011 werden weitere Stromtankstellen in deutschen Großstädten errichtet. Ab Ende 2010 werden die ersten 100 Vorserien-Elektrofahrzeuge von Renault die neue Infrastruktur nutzen." http://www.rwe-mobility.com/web/cms/de/236840/322482/rwemobility/presse-news/pressemitteilungen/rwe-mobility-presse/

- "RWE und Nissan kooperieren bei der Elektromobilität", press release, 21. June 2010 http://www.heise.de/autos/artikel/RWE-und-Nissan-kooperieren-bei-der-Elektromobilitaet-1026141.html

- "RWE-Autostrom künftig an Star-Tankstellen in Hamburg und NRW" , press release, RWE E-Mobility, Elmshorn/Dortmund, 18. August 2010 http://www.e-mobility-21.de/related-e-auto-7-tage-news-detai/artikel/45541-rwe-autostrom-kuenftig-an-star-tankstellen-in-hamburg-und-nrw/189/

- MINI E FAQ, "Wie viele Säulen werden in Berlin aufgestellt? Vattenfall plant die Bereitstellung von bis zu 50 Ladestationen an öffentlich zugänglichen Plätzen." http://www.vattenfall.de/www/vf/vf_de/225583xberx/228797innov/228917wasse/1550203minix/1565379frage/index.jsp#faq_6

- Tom Murphy (2010-05-19). "Mini E Only Beginning of BMW EV Strategy". Wards Auto. http://wardsauto.com/ar/mini_bmw_ev_100519/.

- "BMW Group and Vattenfall Europe begin second phase of MINI E fleet test in Berlin". Green Car Congress. 2011-03-31. http://www.greencarcongress.com/2011/03/bmw-20110331.html.

- "BMW Group Taking Applications for MINI-E Trial Drivers in Munich". Green Car Congress. 2010-05-10. http://www.greencarcongress.com/2010/05/munchen-20100510.html.

- Zaher Karp (May 2010). "Upcoming Munich MIni E Trial". PluginCars.com. http://www.plugincars.com/upcoming-munich-mini-e-trial.html.

- "FAQ Green eMobility by Vattenfall". Vattenfall. http://www.vattenfall.de/de/innovation-minie-berlin-fragen-und-antworten.htm.

- Volkswagen 2008 VW Golf Twin Drive Plug-in Hybrid Prototype – Volkswagen cars specifications review http://www.auto-power-girl.com/cars-2008/volkswagen-specifications/vw_golf_twin_drive_plugin_hybrid_prototype-2709

- Flottenversuch Elektromobilität http://www.eon-energie.com/pages/eea_de/Innovation/Innovation/E-Mobilitaet/VW-Flottenversuch/index.htm

- "Grüner Strom auf Münchens Straßen" "Seit Juli 2009 rollen MINI E mit E.ON-Strom durch die bayerische Landeshauptstadt und die angrenzenden Landkreise. E.ON konnte hierbei eine Infrastruktur aus öffentlichen Ladestationen aufbauen." http://www.eon-energie.com/pages/eea_de/Innovation/Innovation/E-Mobilitaet/MINI_E_Projekt/index.htm

- "Map of Charging Stations in Munich", E.ON, accessed 6. March 2011 http://www.eon-energie.com/pages/eea_de/Innovation/Innovation/E-Mobilitaet/Ladestationen_in_Muenchen/Alle_Ladestationen/

- "Pilotprojekt eflott". http://www.eon-energie.com/pages/eea_de/Innovation/Innovation/E-Mobilitaet/Pilotprojekt_eflott/index.htm. until September 2011

- "e-mobility Baden-Württemberg" startet: Daimler und EnBW Vorreiter für emissionsfreie Mobilität , press release, EnBW, 18. June 2010 http://www.enbw.com/content/de/presse/pressemitteilungen/2010/06/PM_20100618_emobility_cu_mw01/index.jsp;jsessionid=EF5FAB013B27DFC1A4AD936C1D8A8835.nbw184

- "Elektronauten project", EnBW, 2010 http://www.enbw.com/content/de/privatkunden/e_mobility/elektronauten/index.jsp

- "Eine neue Bewegung: die E-Mobilität". 2011-05-06. http://www.enbw.com/content/de/privatkunden/e_mobility/unser_beitrag/index.jsp.

- "Ladestationenkarte". EnBW. http://www.enbw.com/content/de/privatkunden/e_mobility/elektronauten/ladestation/index.jsp.

- "DEKRA gibt grünes Licht für Stromtankstellen". DEKRA. 2011-04-11. press release. http://www.dekra.de/de/pressemitteilung?p_p_lifecycle=0&p_p_id=ArticleDisplay_WAR_ArticleDisplay&_ArticleDisplay_WAR_ArticleDisplay_articleID=5356052.

- "Erste "intelligente" Ladestation von EnBW und Bosch erhält Flughafen Stuttgart" (in de). EnBW. 2011-04-11. press release. http://www.enbw.com/content/de/presse/pressemitteilungen/2011/04/PM_20110411_Ladesaeule_Flughafen_cu_ys_01/20110411_Lades__ule-Flughafen.pdf. "Das Projekt MeRegioMobil wird vom Bundesministerium für Wirtschaft und Technologie (BMWi) gefördert. In den nächsten Wochen werden rund 260 weitere Ladepunkte in Karlsruhe und Stuttgart installiert."

- "www.enbw.com/content/de/_media/_pdf/pdf_pressemeldungen/20111110Stuttgart_wird_Living-Lab_f__r_die_Zukunft_urbaner_Mobilit__t.pdf". EnBW. 2011-11-10. http://www.enbw.com/content/de/_media/_pdf/pdf_pressemeldungen/20111110Stuttgart_wird_Living-Lab_f__r_die_Zukunft_urbaner_Mobilit__t.pdf.

- Kraftfahrt-Bundesamtes (KBA) (2018-01-12). "Neuzulassungsbarometer im Dezember 2017" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2017/201712_GV1monatlich/201712_nzbarometer/201712_n_barometer.html?nn=1841712. A total of 29,436 plug-in hybrids and 25,056 all-electric cars were registered in Germany in 2017.

- Kraftfahrt-Bundesamt (KBA) (January 2019). "Neuzulassungsbarometer im Dezember 2018" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2018/201812_GV1monatlich/201812_nzbarometer/201812_n_barometer.html?nn=2146326. Click on the tab Kraftstoffarten for the market shares by fuel: Electric was 1.0% in 2018, and plug-in hybrid was 0.9%

- Kraftfahrt-Bundesamtes (KBA) (January 2020). "Neuzulassungsbarometer im Dezember 2019" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2019/201912_GImonatlich/201912_nzbarometer/201912_n_barometer.html?nn=2607426. See the tab Kraftsoffarten: A total of 45,348 plug-in hybrids (market share 1.3%) and 63,321 all-electric cars (market share 1.8%) were registered in Germany in 2019.

- Kraftfahrt-Bundesamtes (KBA) (2021-01-08). "Pressemitteilung Nr. 02/2021 - Fahrzeugzulassungen im Dezember 2020 - Jahresbilanz" (in de). KBA. https://www.kba.de/DE/Presse/Pressemitteilungen/2021/Fahrzeugzulassungen/pm02_2021_n_12_20_pm_komplett.html?. A total of 394,632 plug-in electric passenger cars were registered in Germany in 2021, consisting of 200,469 plug-in hybrids (6.9% market share) and 194,163 all-electric cars (6.7% market share).

- Cobb, Jeff (2017-01-17). "Top 10 Plug-in Vehicle Adopting Countries of 2016". HybridCars.com. http://www.hybridcars.com/top-10-plug-in-vehicle-adopting-countries-of-2016/.

- New registrations of vehicles with an alternative drive between January-August 2021 (FZ 28)XLSX, 1MB https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/Umwelt/n_umwelt_node.html

- Fahrzeugzulassungen im September 2021 https://www.kba.de/DE/Presse/Pressemitteilungen/Fahrzeugzulassungen/2021/pm40_2021_n_09_21_pm_komplett.html?fromStatistic=3504038&fromStatistic=3536106&yearFilter=2021&yearFilter=2021&monthFilter=09_September&monthFilter=09_September

- International Energy Agency (IEA), Clean Energy Ministerial, and Electric Vehicles Initiative (EVI) (June 2020). "Global EV Outlook 2020: Enterign the decade of electric drive?". IEA Publications. https://www.iea.org/reports/global-ev-outlook-2020. See Statistical annex, pp. 247–252 (See Tables A.1 and A.12).

- Bekker, Henk (2018-01-17). "2017 (Full Year) Europe: Car Sales per EU and EFTA Country". Car Sales Statistics. https://www.best-selling-cars.com/europe/2017-full-year-europe-car-sales-per-eu-efta-country/.

- European Automobile Manufacturers Association (ACEA) (2020-02-06). "New Passenger Car Registrations By Alternative Fuel Type In The European Union: Quarter 4 2019". ACEA. https://www.acea.be/uploads/press_releases_files/20200206_PRPC_fuel_Q4_2019_FINAL.pdf. See table New Passenger Car Registrations By Market In The EU + EFTA - Total Electric Rechargeable Vehicles: Total EU + EFTA in Q1-Q4 2018 and 2019.

- France Mobilité Électrique - AVERE France (2021-01-08). "Baromètre des immatriculations - En décembre 2020, les véhicules électriques et hybrides rechargeables ont représenté plus de 16 % du marché français : du jamais vu !" (in French). AVERE France. http://www.avere-france.org/Site/Article/?article_id=7950&from_espace_adherent=0. See infographic

- Irle, Roland (2021-01-19). "Global Plug-in Vehicle Sales Reached over 3,2 Million in 2020". EV-volumes.com. http://www.ev-volumes.com/news/86364/. Plug-in sales totaled 3.24 million in 2020, up from 2.26 million in 2019.

- Kraftfahrt-Bundesamtes (KBA). "Monatliche Neuzulassungen - Neuzulassungsbarometer im Juni 2014" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2014/201406GV1monatlich/201406_n_barometer_teil2_tabelle.html. A total of 1,575 plug-in hybrids and 4,188 electric cars were registered during the first six months of 2014.

- Henk Bekker (2014-03-29). "2014 Germany: Total Number of Electric Cars". BestSellingCars.com. http://www.best-selling-cars.com/germany/2014-germany-total-number-electric-cars/. Cumulative number of registered electric cars was 12,156 as of January 1, 2014.

- Autobild (2012-01-12). "2011 Full Year Best-Selling Electric Cars in Germany in 2011". BestSellingCars.com. http://www.best-selling-cars.com/germany/2011-full-year-best-selling-electric-cars-in-germany-in-2011/. Cumulative number of registered electric cars was 4,541 as of January 1, 2012. All-electric car and van registrations in 2010 totaled 541 units and 2,154 in 2011.

- Kraftfahrt-Bundesamtes (KBA). "Neuzulassungen von Personenkraftwagen im Dezember 2011 nach Segmenten und Modellreihen" (in de). KBA. http://www.kfz-betrieb.vogel.de/fileserver/vogelonline/issues/kfz/sonst/2011/3699.pdf. A total of 241 Amperas and 25 Volts were sold through December 2011.

- Kraftfahrt-Bundesamtes (KBA) (2013-01-31). "Neuzulassungen E-Mobilität 2012-Kaum Zuwachs wegen Twizy" (in de). Auto Bild. http://www.autobild.de/artikel/neuzulassungen-e-mobilitaet-2012-3793952.html. A total of 2,956 all-electric cars were registered in Germany during 2012.

- Kraftfahrt-Bundesamtes (KBA) (January 2013). "Neuzulassungen von Personenkraftwagen im Dezember 2012 nach Marken und Modellreihen" (in de). KBA. http://www.kfz-betrieb.vogel.de/fileserver/vogelonline/issues/kfz/sonst/2012/4378.pdf.

- Hans Håvard Kvisle (2013-02-12). "Europeisk salg av elbiler 2012" (in no). Norsk Elbilforening (Norwegian Electric Vehicle Association). http://www.elbil.no/elbiler/920-europeisk-salg-av-elbiler-2012.

- BestSellingCars.com (2013-05-03). "2012 (Full Year) Germany: Best-Selling Electric Car Models". BestSellingCars.com. http://www.best-selling-cars.com/germany/2012-full-year-germany-best-selling-electric-car-models/.

- Renault (2013-01-18). "Ventes Mensuelles" (in fr). Renault.com. http://www.renault.com/fr/finance/chiffres-cles/pages/ventes-mensuelles.aspx. Click on "Ventes mensuelles (décembre 2012) (xls, 294 Ko)" to download the file, and open the tab TWIZY.

- Mat Gasnier (2012-09-27). "Europe: Renault Twizy sales update". Best Selling Car Blog. http://bestsellingcarsblog.com/2012/09/27/europe-renault-twizy-sales-update/.

- Kraftfahrt-Bundesamtes (KBA). "Monatliche Neuzulassungen - Neuzulassungsbarometer im Dezember 2013" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2013/201312GV1monatlich/201312_n_barometer_teil2_tabelle.html?nn=791842. A total of 1,385 plug-in hybrids and 6,051 all-electric cars were registered during 2013.

- Kraftfahrt-Bundesamtes (KBA) (January 2014). "Neuzulassungen von Personenkraftwagen im Dezember 2013 nach Segmenten und Modellreihen" (in de). KBA. http://files.vogel.de/vogelonline/vogelonline/issues/kfz/sonst/2013/4963.pdf.

- Jose Pontes (2014-01-20). "Germany December 2013". EVSales.com. http://www.ev-sales.blogspot.ca/2014/01/germany-december-2013.html.

- Kane, Mark (2015-01-26). "Electric Car Sales In Germany Hit New High In December 2014". InsideEVs.com. https://insideevs.com/electric-car-sales-germany-hit-new-high-december-2014/.

- Pontes, Jose (2017-01-16). "Germany December 2016 (Updated)". EVSales.com. http://ev-sales.blogspot.ca/search/label/Germany?updated-max=2017-02-13T16:39:00Z&max-results=20&start=13&by-date=false.

- Kraftfahrt-Bundesamtes (KBA) (January 2015). "Neuzulassungsbarometer im Dezember 2014" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2014/201412GV1monatlich/201412_n_barometer_teil2_tabelle.html?nn=653844. A total of 13,049 plug-in electric cars registered in Germany during 2014, consisting of 8,522 all-electric cars and 4,527 plug-in hybrids.

- Pontes, Jose (2015-01-19). "Germany December 2014". EVSales.com. http://ev-sales.blogspot.com.br/2015/01/germany-december-2014.html.

- Kraftfahrt-Bundesamtes (KBA) (July 2014). "Neuzulassungen von Personenkraftwagen im Juni 2014 nach Segmenten und Modellreihen" (in de). KBA. https://www.kba.de/SharedDocs/Publikationen/DE/Statistik/Fahrzeuge/FZ/2014_monatlich/FZ11/fz11_2014_06_pdf.pdf?__blob=publicationFile&v=4.

- Justin Aschard (2012-11-30). "Inmatriculations VP et VUL Allemagne à fin Oct. (2010-2012) 2012" (in fr). France Mobilité Électrique. http://www.france-mobilite-electrique.org/IMG/pdf/12_ALLEMAGNE.pdf. Full 2010 and 2011 sales by model.

- Kraftfahrt-Bundesamtes (KBA) (January 2016). "Neuzulassungsbarometer im Dezember 2015" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2015/201512GV1monatlich/201512_nzbarometer/201512_n_barometer.html?nn=1129994. A total of 23,464 plug-in electric cars registered in Germany during 2015, consisting of 12,363 all-electric cars and 11,101 plug-in hybrids.

- Kane, Mark (2016-02-16). "Germany Plug-In Electric Car Registrations Exceeded 23,000 In 2015". http://insideevs.com/germany-plug-in-electric-car-registrations-exceeded-23000-in-2015/.

- Pontes, Jose (2016-01-25). "Germany December 2015". EVSales.com. http://ev-sales.blogspot.com.br/2016/01/germany-december-2015.html.

- Taylor, Edward (2016-02-03). "UPDATE 2-German car industry urges Merkel to help promote electric cars". Reuters. https://www.reuters.com/article/autos-electric-idUSL8N15I1LH. About 50,000 plug-in electric vehicles were registered in Germany by the end of 2015.

- Kraftfahrt-Bundesamt (KBA) (January 2016). "Neuzulassungen von Personenkraftwagen nach Segmenten und Modellreihen im Dezember 2015" (in de). KBA. https://www.kba.de/DE/Presse/Presseportal/N_Segmente_Modellreihen_FZ11/n_seg_12_15_pdf.pdf?__blob=publicationFile&v=3. A total of 2,271 i3s and 393 i8s were registered in Germany in 2015.

- Kraftfahrt-Bundesamt (KBA) (September 2016). "Neuzulassungen von Personenkraftwagen im August 2016 nach Segmenten und Modellreihen" (in de). KBA. https://www.kba.de/SharedDocs/Publikationen/DE/Statistik/Fahrzeuge/FZ/2016_monatlich/FZ11/fz11_2016_08_pdf.pdf?__blob=publicationFile&v=2. A total of 1,237 i3s and 179 i8s were registered in Germany during the first eight months of 2016.

- Kraftfahrt-Bundesamtes (KBA) (October 2016). "Neuzulassungsbarometer im September 2016" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2016/201609GV1monatlich/201609_nzbarometer/201609_n_barometer.html?nn=653844. A total of 17,074 plug-in electric cars were registered in Germany between January and September 2016, consisting of 7,678 all-electric cars and 9,396 plug-in hybrids.

- Hall, Larry E. (2016-10-07). "German Plug-in Car Sales Surge Past 1 Percent For First Time in September". HybridCars.com. http://www.hybridcars.com/german-plug-in-car-sales-surge-past-1-percent-for-first-time-in-september/.

- Agence France-Presse (2016-10-05). "Cheap financing deals push Germans to buy more cars". Yahoo News. https://www.yahoo.com/news/german-car-sales-see-big-jump-september-105351149.html.

- Kraftfahrt-Bundesamtes (KBA) (January 2017). "Neuzulassungsbarometer im Dezember 2016" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2016/201612GV1monatlich/201612_nzbarometer/201612_n_barometer.html?nn=653844. A total of 25,154 plug-in electric cars were registered in Germany in 2016, consisting of 11,410 all-electric cars and 13,744 plug-in hybrids.

- Kraftfahrt-Bundesamt (KBA) (January 2018). "Neuzulassungen von Personenkraftwagen nach Marken und Modellreihen im Dezember 2017 (FZ 10) (XLS, 153 KB, Datei ist nicht barrierefrei)" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/2017/2017_node.html. Click on the link Neuzulassungen von Personenkraftwagen nach Marken und Modellreihen im Dezember 2017 (FZ 10) (XLS, 153 KB, Datei ist nicht barrierefrei) to download the file with registrations figures.

- Bekker, Henk (2018-01-09). "2017 (Full Year) Germany: Best-Selling Electric Car Brands and Models". best-selling-cars.com. https://www.best-selling-cars.com/electric/2017-full-year-germany-best-selling-electric-car-brands-models/.

- France Mobilité Électrique - AVERE France (2020-02-11). "En Europe, les ventes de voitures électriques en hausse de 80 % en 2019" (in fr). AVERE. http://www.avere-france.org/Site/Article/?article_id=7788.

- "Elektroautos: Tesla führt Ranking in Deutschland an". https://t3n.de/news/elektroautos-tesla-fuehrt-1220465/.

- Kraftfahrt-Bundesamtes (KBA) (October 2020). "Neuzulassungsbarometer im September 2020" (in de). KBA. https://www.kba.de/DE/Statistik/Fahrzeuge/Neuzulassungen/MonatlicheNeuzulassungen/fz_n_MonatlicheNeuzulassungen_archiv/2020/202009_GImonatlich/202009_nzbarometer/202009_n_barometer.html?nn=2592390. See the tab Kraftsoffarten: A total of 105,882 plug-in hybrids (market share 5.2%) and 98,369 all-electric cars (market share 4.8%) were registered in Germany during the first nine months of 2020.

- Bekker, Henk (2021-01-08). "Best-Selling Electric Car Models in Germany in 2020". Best Selling Cars (Car Sales Statistics). https://www.best-selling-cars.com/germany/2020-full-year-germany-best-selling-electric-cars-by-brand-and-model/.

- Kraftfahrt-Bundesamtes (KBA) (2021-03-02). "Pressemitteilung Nr. 8/2021 - Der Fahrzeugbestand am 1. Januar 2021" (in de). KBA. https://www.kba.de/DE/Presse/Pressemitteilungen/2021/Fahrzeugbestand/pm08_fz_bestand_pm_komplett.html. "The share of electric cars (BEV ) rose from 0.3 percent (136,617) on January 1, 2020 to 0.6 percent (309,083) and that of hybrid cars from 1.1 percent (539,383) to 2.1 percent (1.004.089). The number of plug-in hybrid vehicles grew from 102,175 to 279,861 (+ 173.9%). Their share tripled to 0.6 percent. (Translated from the original)"