During the current post-epidemic period, hygiene requirements and health needs in the hospitality industry keep increasing, and consumers become more concerned about the cleanliness of hotels and have stronger demands for contactless services in hotels. The growth and popularity of IoT technology in China make it more accessible to a wider range of service industries and provides the basis for the application of IoT in the hospitality industry. The application of IoT devices in hotels mainly includes intelligent robots, intelligent guest control, systems, etc., which helps to realise contactless services in hotels.

1. Introduction

The Internet of Things (IoT) is a phrase that refers to the inclusion of internet connectivity in everyday devices and appliances that do not usually have such functionality. Examples of these devices may range from thermostats and energy meters to vehicles and large machines (Mercan, S. et al. 2021). In essence, the IoT is able to turn these devices or appliances into ‘smart’ objects that can send and receive data and communicate with each other. This also can improve data collection, increase automation, and allow multiple devices to be controlled or monitored from a centralized location (such as a mobile phone or tablet).

IoT hotels have recently been widely discussed in the hospitality industry. With the development of China’s communication industry and internet coverage, the smartening of hotels is an inevitable trend. The industry chain of IoT application in hotels in China is relatively distinct, with the upstream of the industry chain being raw materials for IoT devices, the midstream being hotel IoT service providers, and the downstream being hotels. In the upstream, although China’s independent research and development of chip enthusiasm is high and the chip design is developing rapidly, China’s chip market still relies heavily on overseas imports. The midstream of IoT comprehensive service providers and software service providers are mainly under a cooperation-based relationship. The downstream is mainly for hotel applications. From 2016 to 2020, the market size of IoT in hotels in China has grown from 51.74 billion RMB to 67.18 billion RMB, with a compound annual growth rate of 5.4%.

Many hospitality companies are already successfully deploying IoT applications in their hotels to improve guest satisfaction, staff productivity, and environmental sustainability, while reducing unnecessary costs and labor.

2. IoT Has Been Revolutionizing the Supply Chain of Hospitality Industry to Reduce Costs

2.1. IoT Improve the Efficiency and Reduce the Cost of the Hotels Supply Chain

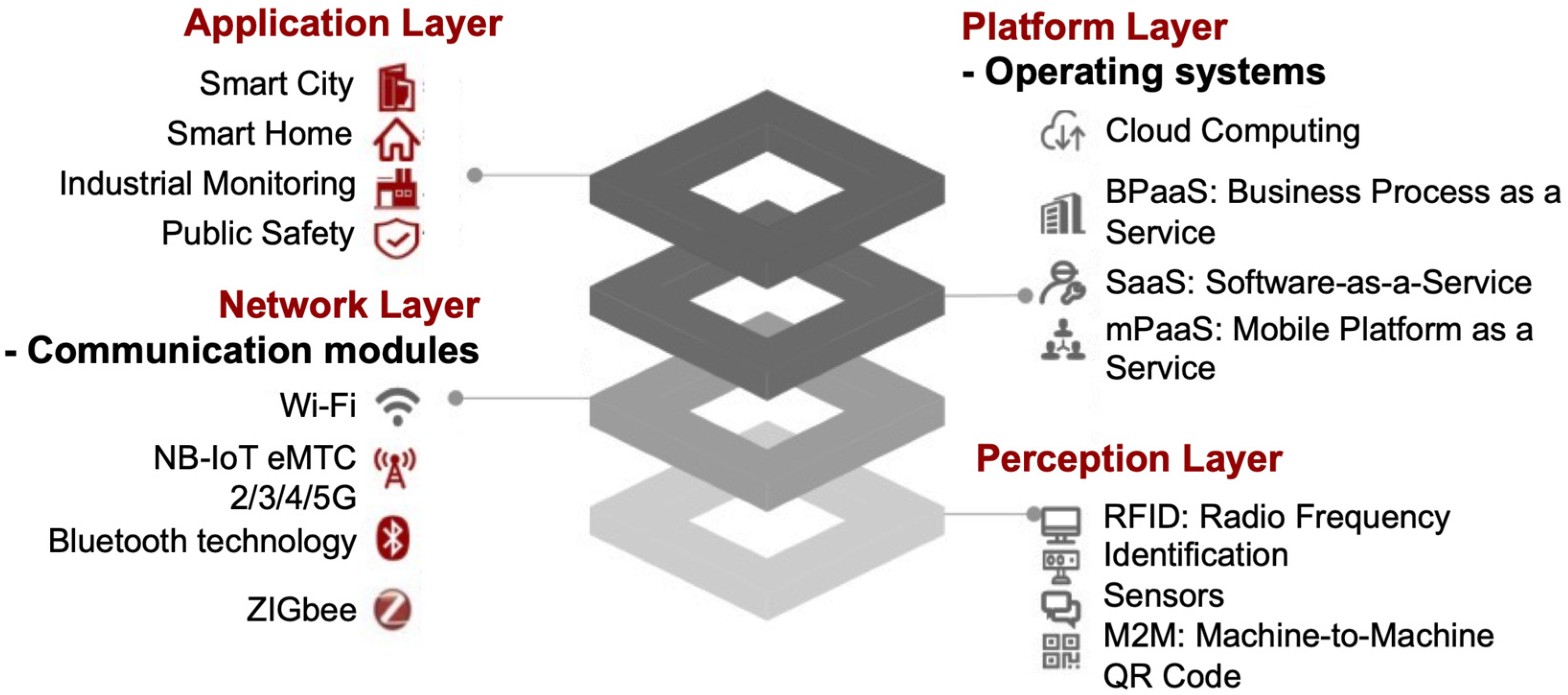

In the upstream of hotels’ supply chain (Figure 1), the IoT system records the current product data in the warehouse in real time, and the hotel grants the rights to the supplier, who can replenish the stock in time according to the stock situation. At the same time, the supplier can also change the type and quantity of the products supplied by the hotel based on the user usage data returned by the IoT system and improve the quantity of its own products to meet market demand. The IoT equipment can be used to efficiently and quickly check the logistics and goods data through sensors and RFID technology, thus making the transport and logistics more personalized and improving the operational efficiency of the hotel.

Figure 1. The use of the Internet of Things in the hotel supply chain.

In the midstream of the supply chain, enabling inventory management and flow detection through smart IoT devices may ensure the usual up-and-down of the supply chain, guarantee the quality of service and resource reserves in the hotel, and over time, will allow the business to predict seasonal highs and lows and raise or lower inventory levels accordingly.

In the downstream of the supply chain, regarding the aftermath of cleaning, once the guest leaves the hotel, the IoT device will instantly notify the third-party service procured by the hotel, which posts the task on the platform and the hotel cleaning professionals will take the order on the service side. In this way, hotels can share their service staff to save on operational costs. Regarding the maintenance and security, the hotel itself is subject to predictive maintenance through the Internet of Things. Sensors connected to the ERP system monitor the parts of the hotel that need to be replaced and automatically send alerts before breakdowns occur or before equipment runs out of critical consumables, which reduces the need to hold excess stock and helps with maintenance planning.

2.2. IoT Improvements to Hotel Costs in 2021

In terms of energy costs, IoT hotel applications use wireless controllers and sensors to detect the usage of customer rooms and adjust the control systems of air conditioning and lighting in the room according to the actual needs, so as to maximize the rational allocation of energy usage and achieve energy savings and cost reduction.

As summarized in Table 1, the IoT is effective in controlling labor costs and staff costs will be saved by 40%. According to the National Bureau of Statistics, the average salary of a service worker in China’s hospitality industry in 2020 will be RMB 48,260/year, while the rent of an intelligent robot will be RMB 24,000–36,000/year, representing an overall reduction in costs of approximately 40%. With the application of the Internet of Things in hotels, some of the work will be converted from human management to intelligent detection, the addition of intelligent robots and self-check-in machines will extend the length of hotel services, and the use of intelligent delivery machines in restaurants will improve the efficiency of hotel restaurant services. In general, energy accounts for around 6% of the hotel’s operating costs. With the use of the IoT, it is expected that energy costs will be reduced to 4% of the operating costs and the hotel’s public service expenditure will be reduced by 25%.

Table 1. IoT improvements to hotel costs in 2021.

| Major Categories |

Subdivision |

Market Costs |

Cost Breakdown |

Solutions |

Costs after Optimization |

Savings |

| Energy costs |

Energy |

6% of operating costs |

Water, electricity, gas, etc. |

Using the wireless controller |

4% of operating costs |

≈25% |

| Labor costs |

Staff |

48,260 RMB/year |

Salaries, social security, overheads |

Robotic assistance |

24,000–36,000 RMB/year |

≈40% |

| Room Distribution |

Approx. 16.8 RMB per hour |

Labor costs |

Robot-assisted delivery |

Approx. 2.7–4.2 RMB per hour |

≈80% |

| Restaurant Services |

Per 6 people |

Labor costs |

Robots instead of manual labor |

1 unit |

≈80% |

| Management costs |

Transport delivery |

Approx. 2–2.5 RMB/set |

Vehicles, drivers, fuel costs |

RFID chip implantation without handover |

Approx. 0.6–0.7 RMB/set |

≈65% |

| Stock Turnaround |

360 RMB/set |

Towel replacement cycle 1 year, bedding 1.5 years |

Scheduling of cloths via app, on demand |

250 RMB/set |

≈30% |

| Laundry |

360 RMB/set |

3 times stock availability |

Three levels of procurement based on demand |

220 RMB/set |

≈70% |

In terms of management costs, the IoT saves costs in transport and distribution, stock turnover, and laundry. Transport costs are reduced through the unmanned delivery of goods via RFID. Inventory and turnover are monitored in real-time through the IoT to rationalize the scheduling of hotel equipment and supplies.

3. Drivers of IoT Adoption in Hospitality Industry Depend on the Development of the Communications Industry and the Pandemic

3.1. Communications Development Drives IoT in the Hospitality Industry

The rapid development of mobile communications and the Internet is the basis for the development and application of the IoT. From 2014 to 2020, the number of smartphones in China has increased year after year in terms of ownership and penetration, and the number of base stations is also growing rapidly. It is the development of the Internet and communications industry that is driving the development and application of the IoT in the hospitality industry.

Smartphone ownership in China continues to rise from 800 million units in 2014 to 1.3 billion units in 2020, a compound growth rate of 7.2% over seven years. The smartphone penetration rate is also increasing, from 46.4% in 2014 to 58.7% in 2020, a 12.3% increase over seven years. The growth and popularity of smartphones as client access points for the IoT has contributed to the increase in users, making IoT applications more accessible to a wider range of people and easier and faster to operate, facilitating the application of the IoT in the hospitality industry.

The popularity of mobile networks and Wi-Fi is also an important factor in the development of IoT applications in the hospitality industry. Between 2014 and 2020, there was a rapid rise in the number of base stations in China, from 3.51 million in 2014 to 9.338 million in 2020, with a compound annual growth rate of 15% over seven years. The increase in the number of base stations is conducive to the laying of a network environment, and the full coverage of Wi-Fi in hotels and the increase in network speed provide the foundation for the use of the IoT in hotels.

3.2. Epidemic Drives the Development of IoT in Hospitality Industry

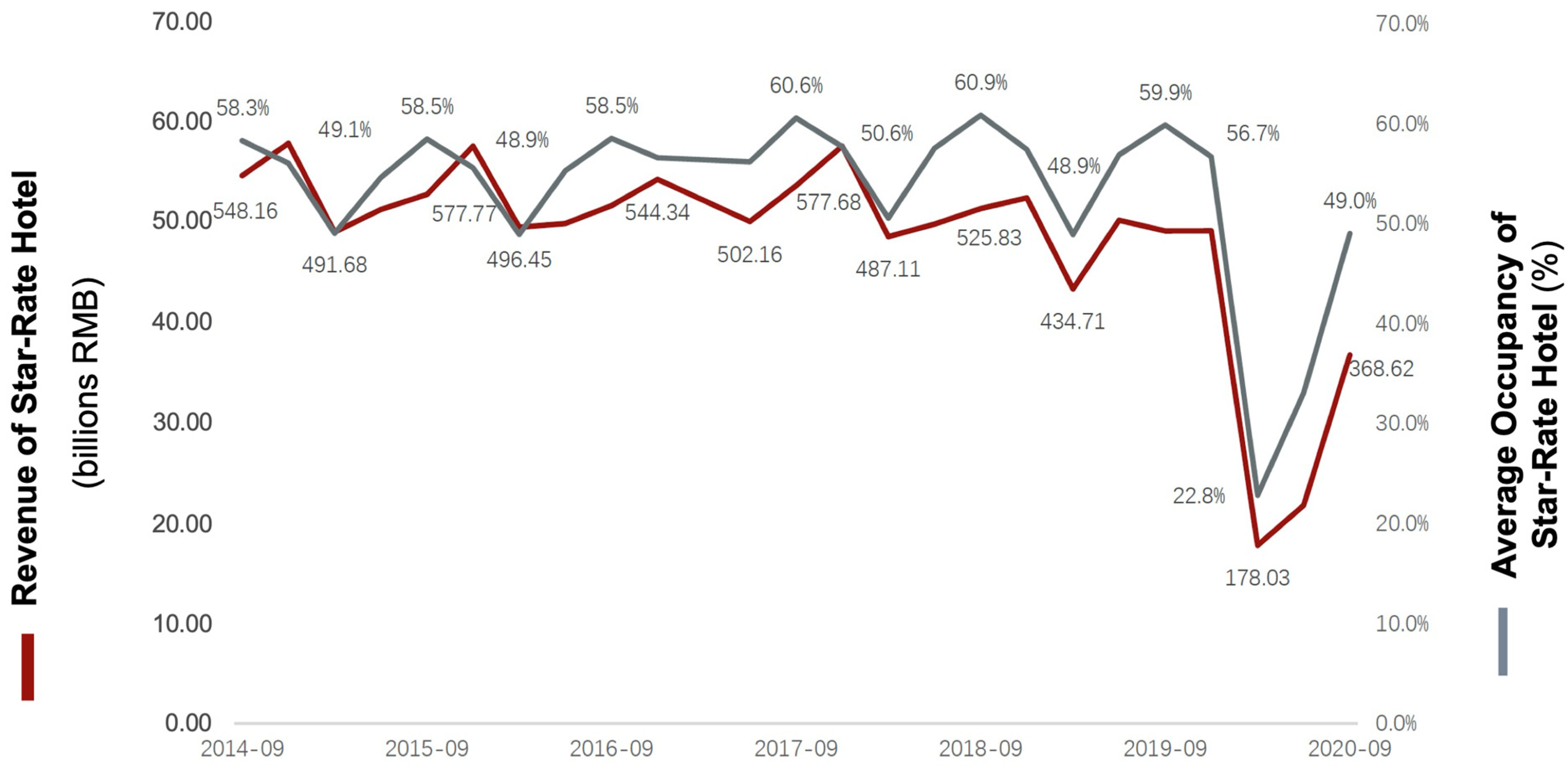

From 2014 to Q3 2019 (Figure 2), the occupancy rate of star-rated hotels in China remained between approximately 45% and 60%, but the operating income of star-rated hotels continued to decline, mainly due to (1) the impact of OTAs on traditional hotels. As a result of the impact of OTAs, traditional hotels have no advantage in terms of price and booking methods, which has led to a certain degree of decline in hotel revenue. (2) The industry is highly competitive, focusing on low-price competition, but the application of IoT in hotels will break this dilemma. On the one hand, the use of IoT in hotels no longer insists on low price competition but creates differentiation and comfort through IoT hotel systems and equipment to attract users.

Figure 2. Revenue and average occupancy of star-rated hotels in China from 2014 Q3 to 2020 Q3.

The hospitality industry in China has been hit by the impact of the Newcastle Pneumonia outbreak. In March 2020, operations in the Chinese star-rated hospitality industry hit a low point, with an overall revenue of RMB 17.8 billion and occupancy rates reaching only 22.8%. However, as the epidemic gradually came under control in China and the economy recovered, the hospitality industry’s operations quickly recovered and grew rapidly. In the aftermath of the epidemic, users became more demanding in terms of the level of epidemic prevention and the cleanliness of hotels, and demand for contactless services has increased

[1].

This entry is adapted from the peer-reviewed paper 10.3390/pr10071256