Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Platform enterprises have emerged as one of the most popular business models in the era of knowledge economy. The success of platform enterprises relies on continuous value creation by constructing an efficient platform and attracting more users to participate in order to create more value for the users and by the users. Different factors make unique contributions to the process of value creation in China's platform enterprises.

- platform enterprise

- emerging markets

- value creation

- configurational framework

- the efficiency logic of value creation

- the innovation logic of value creation

1. Introduction

Along with the booming knowledge economy, platform enterprises as knowledge-based entrepreneurial ventures have become a symbol of emerging business models that are spearheading the development of global business theories and practices [1][2][3]. Among the first one hundred unicorn enterprises in the world, more than sixty of them are actually making profits, mainly from a platform business model, such as Apple, Intel, Amazon, Alibaba, JD.com, Facebook, and others. In addition, as the newly emerged knowledge-based business model, platform businesses are also more vital than traditional industry models [3]. For example, when Apple’s iPhone entered the mobile market in 2007, the global mobile phone market was dominated by five giants: Nokia, Samsung, Motorola, Sony Ericsson, and LG. But after just eight years, Apple defeated them all by building an interconnected ecosystem—a platform business—to connect consumers and producers and became the global leader in smartphones [3]. Platform enterprises have also achieved amazing success in China, the most important emerging economy. Given the impressive success of a large number of platform enterprises, it is essential to better understand which factors have helped platform enterprises create a sustainable ecosystem and how platform enterprises create value to maintain their competitiveness in China and other emerging markets [1][2][3][4].

The current research on platform businesses focuses on two-sided markets [2], network effects in an ecosystem [4], platform supervision and governance [5], and platform enterprise strategic management [6]. More recent research has realized that the competitive advantages of platform enterprises as knowledge-intensive entrepreneurial ventures lie in their value creation process in an interconnected ecosystem. For instance, empirical research has shown that platform openness is a key success factor for a platform enterprise’s ecosystem, and opening up platform interface leads to positive effects in platform enterprises’ knowledge sharing and value creation [7]. Research also indicates that the modularity of a platform architecture is a key force in value-creating and advantages-building, which further improves the scalability of the platform system in ensuring the versatility of the platform interface [5]. Based on the notion that value creation cannot be separated from platform users, studies on platform businesses have contended that user interaction is a basic embodiment of platform value creation [8], and, consequently, a good platform ecosystem should promote positive interactions (“cumulative” interaction) and avoid negative interactions (“consumption” interaction) to ensure continuous knowledge sharing and value creation within the platform enterprises’ ecosystem. However, although this line of research on platform enterprises has produced impressive literature, more studies are needed on what are the driving factors of value creation in a platform enterprise and what is the dominant logic for platform enterprises to build competitive advantages in emerging markets. The answers to these questions are not only important for developing more robust theories on platform strategies but are also essential for providing insightful guidance on platform enterprises’ value creation and a more sustainable development in emerging markets.

2.Value Creation in Platform Enterprises

Platform is a value-generating business model that allows interdependent parties to exchange information, products, or services [1][2][3][5][6][7][8]. To facilitate these transactions, platform enterprises leverage and create large, scalable networks of end-users and services that can be accessed on-demand. The last two decades have seen increasing research interests in platform enterprises [1][2][3][5][6][7][8][9] and more recent research on platform enterprises has focused on creating value in the platforms and on how they manage interactions with platform users and other stakeholders to survive in the competition. Unlike traditional value chain production or one-sided market exchanges, platform enterprises connect at least two markets with different needs and provide interfaces and venues to facilitate trade and interaction between suppliers and buyers [2][3][6]. Platform enterprises do not directly produce products or sell products to consumers. Instead, they provide trading spaces for buyers and sellers to form an interconnected ecosystem, and the value created by platform enterprises is often reflected in the platform usage fee rather than sales revenue [1][3][5][6][7][8]. Therefore, platform enterprises must be central and impartial to ensure that platform enterprises can manage and constrain every platform user in an impartial way. In essence, with the fast development of information technology and internet-based technology, platform enterprises use online resources to achieve real-time communications across regions and time zones, reducing the geographical and time constraints on platform users, which further promotes the rapid interactions among platform users [5][6].

Scholars have explored different value creation approaches to building sustainable competitive advantages in various platforms [9][10][11][12][13][14][15][16][17][18]. The traditional competitive strategy contends that business advantages can be enhanced by competitive analysis and market segmentation [13]. The resource-based view (RBV) argues that the key element of value creation is to obtain or control resources that are valuable, scarce, difficult to imitate, and irreplaceable [9][10][17]. The knowledge-based view and dynamic capability theory extends the resource-based view to consider knowledge and capability as specific and cumulative rare resources and further advocates for the flexible use of them to create value [11][14][15][16][18]. Classic organization economics has also conducted in-depth investigation into value creation. Take the transaction cost economics (TCE) as an example, it considers transaction fees as an important market parameter and thus advocates for the reduction of transaction costs through internalizing transactions as an important part of value creation [19][20]. Different from the theories discussed above, Schumpeter’s innovation theory attaches more importance to the positive role of entrepreneurs and argues that innovation is to constantly break the old order and market equilibrium and inject new vitality into the market through creative destruction in order to create new value [21][22]. Based on the innovation theory, Teece has proposed and developed the Profiting from Innovation (PFI) theory to emphasize that firms can create value through innovation, based on two basic conditions: whether a firm has a strong appropriation regime to protect the innovation value from being imitated or stolen; and whether a firm has or can obtain complementary assets to ensure successful commercialization [22][23]. The resulting literature from these studies has provided a solid foundation for research on platform enterprises’ knowledge management and value creation.

Research shows that internet-based platform enterprises have unique characteristics in their value creation. First, platform enterprises are not directly involved in manufacturing or production but provide necessary spaces and basic services to create value for platform users or interactive trading parties [3]. Second, platform enterprises do not use the traditional industrial value chain to connect producers and consumers. Consequently, the traditional value creation and capture logic for traditional enterprises, such as the Long-linked Technologies and value chain configuration [24][25], do not apply to platform enterprises. Third, platform enterprises are two-sided markets. The two-sided markets, different from the traditional one-sided market, have two groups of supply and demand at the same time, and, thus, traditional pricing and business rules in the one-sided market do not work [2]. Fourth, platform enterprises as interconnected ecosystems have significant network effects [4]. Positive network effects produce a “snowball-effect” feedback mechanism that constantly attracts more users (of supply, demand, and other sides) to the platform and continues to increase the overall value within the ecosystem [26]. Fifth, platform enterprises are an open system and thus have higher openness than that of traditional enterprises. Open systems pose new challenges for platform enterprises to build sustainable competitive advantages. Platform users may participate in multiple similar platforms at the same time, a multi-homing phenomenon [27]. Because users can enter or exit the platform freely, thus changing the competition strategy of platform enterprises, how to enhance users’ participation and value perception is not the only the focus of value creation in platform enterprises; it is also pivotal for platform enterprises to build a sustainable ecosystem to attract users.

Sixth, the value creation and capture process in platform enterprises is also different from that of traditional enterprises. In the age of the Internet of Things, the long tail economy has become more attractive, and emerging technologies such as Operational Technologies, Data Technologies, and Artificial Intelligence have drastically reduced the cost of the long tail market. Human-friendly and experience-oriented interactions have become essential to increasing consumers’ willingness to pay [27]. As information asymmetry decreases, the willingness and urgency of users to participate in the platform becomes more important. As a result, new value creation elements such as user participation, continuous commitment, and knowledge sharing become more important for the creation of an efficient ecosystem. Seventh, the key elements that drive the value creation and capture in platform enterprises are different from those of traditional enterprises. While resources, capabilities, knowledge, and other factors still play an important role in the value creation of platform enterprises [28], knowledge-based value-creation activities such as innovative platform construction/improvement and platform launch have become an important part of value creation. Due to the particularity of the two-sided markets in platform enterprises, the launch of a platform is often a problem of “chicken and eggs”. It is more difficult for enterprises to enter the platform market than traditional enterprises [29] and thus more difficult for new platform enterprises to create value and build an ecosystem.

These unique characteristics of platform enterprises have suggested that the construction of a platform ecosystem and the management of user participation are pivotal for value creation within the platform enterprises. Meanwhile, since platform users are multi-homing and thus can easily migrate to different platforms, it is of upmost importance for platform enterprises to actively create values to improve users’ satisfaction, the core of user-participation and building sustainable ecosystems. With increased user participation, platform users are more willing to share their knowledge and provide positive user feedback, which attracts more users to participate, a self-enhancing knowledge-generating process. In addition, research on platform enterprises also examines the relationship between value creation and the platform evolution stage. In the emergence stage, platform enterprises focus on platform construction and improvement, and platform enterprises stimulate network effects through platform service innovation. In the expansion stage, platform enterprises rely on value creation to stimulate more network effects for a most sustainable ecosystem [30].

3. Driving Factors in Value Creation in Platform Enterprises

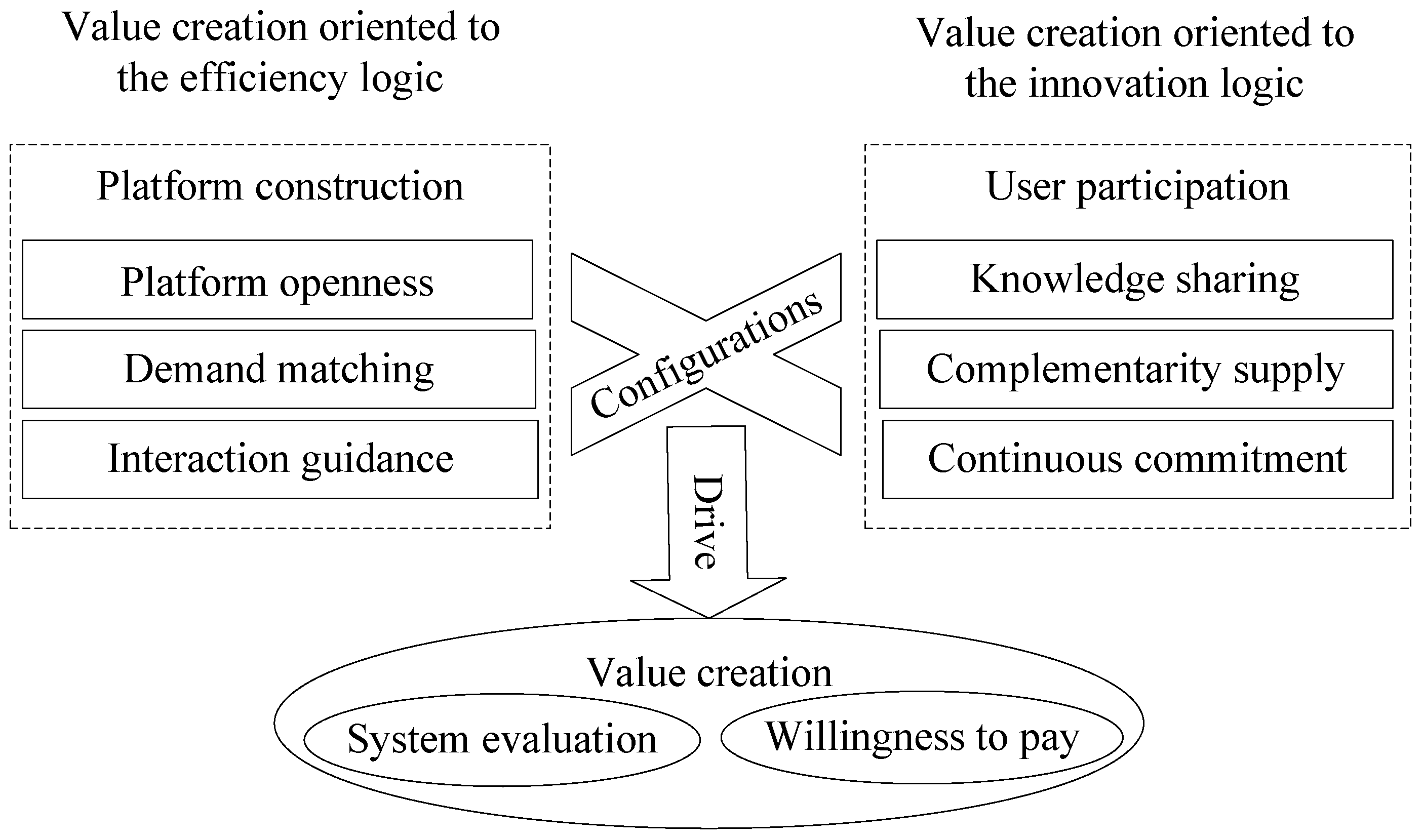

While research on platform enterprises may have different views on what constitutes key factors of value creation, and further for an innovative ecosystem in platform enterprises, previous studies has identified two sets of antecedent conditions for value creation in platform enterprises: platform construction and user participation [2][6][31][32][33][34][35][36], which correspond to two different logics of value creation: the transaction-cost based efficiency logic [20] and the profit-from-innovation based innovation logic [22].

4. Configurational Framework

The dual value creation logic—efficiency logic and innovation logic—based the conceptual model of the platform enterprise is presented in Figure 1. Although contemporary research agrees that value creation in platform enterprises is an outcome of platform construction and user participation, existing studies are limited in exploring the combined effects of each set of factors, i.e., past research has largely ignored the complex combinations of different factors from both platform construction and user participation. At the same time, the existing research is not clear as to whether there is a difference in antecedent configurations (asymmetric causality) between platform enterprises with high levels of value creation (presence of value creation results) and platform enterprises with non-high levels of value creation (absence of value creation results). A configurational framework of various factors that contribute to the process of value creation in China's platform enterprises helps bridge this research gap. Therefore, researchers introduce this configurational framework and argue that platform enterprise value creation does not depend on a single factor but rather on the complex combinations of platform construction and user participation.

Figure 1. A Model of Value Creation in Platform Enterprises.

This entry is adapted from the peer-reviewed paper 10.3390/su14095331

References

- Rochet, J.C.; Tirole, J. Platform competition in two-sided markets. J. Eur. Econ. Assoc. 2003, 1, 990–1029.

- Rochet, J.C.; Tirole, J. Two-sided markets: A progress report. Rand J. Econ. 2006, 37, 645–667.

- Van Alstyne, M.W.; Parker, G.G.; Choudary, S.P. Pipelines, platforms, and the new rules of strategy. Harv. Bus. Rev. 2016, 94, 54–60,62.

- Katz, M.L.; Shapiro, C. Network externalities, competition and compatibility. Am. Econ. Rev. 1985, 75, 424–440.

- Tiwana, A. Platform desertion by App developers. J. Manag. Inf. Syst. 2015, 32, 40–77.

- Eisenmann, T.; Parker, G.; Van Alstyne, M. Platform envelopment. Strateg. Manag. J. 2011, 32, 1270–1285.

- West, J. How open is open enough? Melding proprietary and open source platform strategies. Res. Policy 2003, 32, 1259–1285.

- Parker, G.G.; Van Alstyne, M. Innovation, openness, and platform control. Manag. Sci. 2018, 64, 3015–3032.

- Barney, J.B. Why resource-based theory’s model of profit appropriation must incorporate a stakeholder perspective. Strateg. Manag. J. 2018, 39, 3305–3325.

- Barney, J.; Wright, M.; Ketchen, D.J. The resource-based view of the firm: Ten years after 1991. J. Manag. 2001, 27, 625–641.

- Ma, Z.; Huang, Y.; Wu, J.; Dong, W.; Qi, L. What matters for knowledge sharing in collectivistic cultures? Empirical evidence from China. J. Knowl. Manag. 2014, 18, 1004–1019.

- Ma, Z.; Yu, K. Research paradigms of contemporary knowledge management studies: 1998–2007. J. Knowl. Manag. 2010, 14, 175–189.

- Porter, M.E. From competitive advantage to corporate strategy. Harv. Bus. Rev. 1987, 65, 43–59.

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533.

- Yin, J.; Ma, Z.; Yu, H.; Jia, M.; Liao, G. Transformational leadership and employee knowledge sharing: Explore the mediating roles of psychological safety and team efficacy. J. Knowl. Manag. 2019, 24, 150–171.

- Yu, H.; Shang, Y.; Wang, N.; Ma, Z. The mediating effect of decision quality on knowledge management and firm performance for Chinese entrepreneurs: An empirical study. Sustainability 2019, 11, 3660.

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180.

- Zahra, S.A.; Sapienza, H.J.; Davidsson, P. Entrepreneurship and dynamic capabilities: A review, model and research agenda. J. Manag. Stud. 2006, 43, 917–955.

- Williamson, O.E. Markets and Hierarchies; Free Press: New York, NY, USA, 1975.

- Williamson, O.E. Comparative economic organization: The analysis of discrete structural alternatives. Adm. Sci. Q. 1991, 36, 269–296.

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1943.

- Teece, D.J. Profiting from innovation in the digital economy: Standards, complementary assets, and business models in the wire-less world. Res. Policy 2018, 47, 1367–1387.

- Teece, D.J. Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Res. Policy 1986, 15, 285–305.

- Thompson, J.D. Organizations in Action; McGraw-Hill: New York, NY, USA, 1967.

- Stabell, C.; Fjeldstad, Ø.D. Configuring value for competitive advantage: On chains, shops, and networks. Strateg. Manag. J. 1998, 19, 413–437.

- Li, Z.X.; Agarwal, A. Platform integration and demand spillovers in complementary markets: Evidence from Facebook’s integration of Instagram. Manag. Sci. 2017, 63, 3438–3458.

- Armstrong, M. Competition in two-sided markets. RAND J. Econ. 2006, 37, 668–691.

- Shang, Y.; Yu, H.; Ma, Z. Venture investor’s monitoring and product innovation performance in serial crowdfunding projects: An empirical test. Chin. Econ. 2020, 53, 300–314.

- Caillaud, B.; Jullien, B. Chicken and egg: Competition among intermediation service providers. RAND J. Econ. 2003, 34, 309–328.

- Fu, W.H.; Wang, Q.; Zhao, X.D. The influence of platform service innovation on value co-creation activities and the network effect. J. Serv. Manag. 2017, 28, 348–388.

- Gawer, A.; Cusumano, M.A. Industry platforms and ecosystem innovation. J. Prod. Innov. Manag. 2014, 31, 417–433.

- Gawer, A.; Cusumano, M. Platform Leadership; Harvard Business School Press: Boston, MA, USA, 2002.

- Alexy, O.; West, J.; Klapper, H.; Reitzig, M. Surrendering control to gain advantage: Reconciling openness and the resource-based view of the firm. Strateg. Manag. J. 2018, 39, 1704–1727.

- Ondrus, J.; Gannamaneni, A.; Lyytinen, K. The impact of openness on the market potential of multi-sided platforms: A case study of mobile payment platforms. J. Inf. Technol. 2015, 30, 260–275.

- Gawer, A. Bridging differing perspectives on technological platforms: Toward an integrative framework. Res. Policy 2014, 43, 1239–1249.

- Pasche, M.; Magnusson, M. Continuous innovation and improvement of product platforms. Int. J. Technol. Manag. 2011, 56, 256–271.

This entry is offline, you can click here to edit this entry!