2. Penetration of Solar Energy

2.1. Grid-Connected Photovoltaic Power Plants

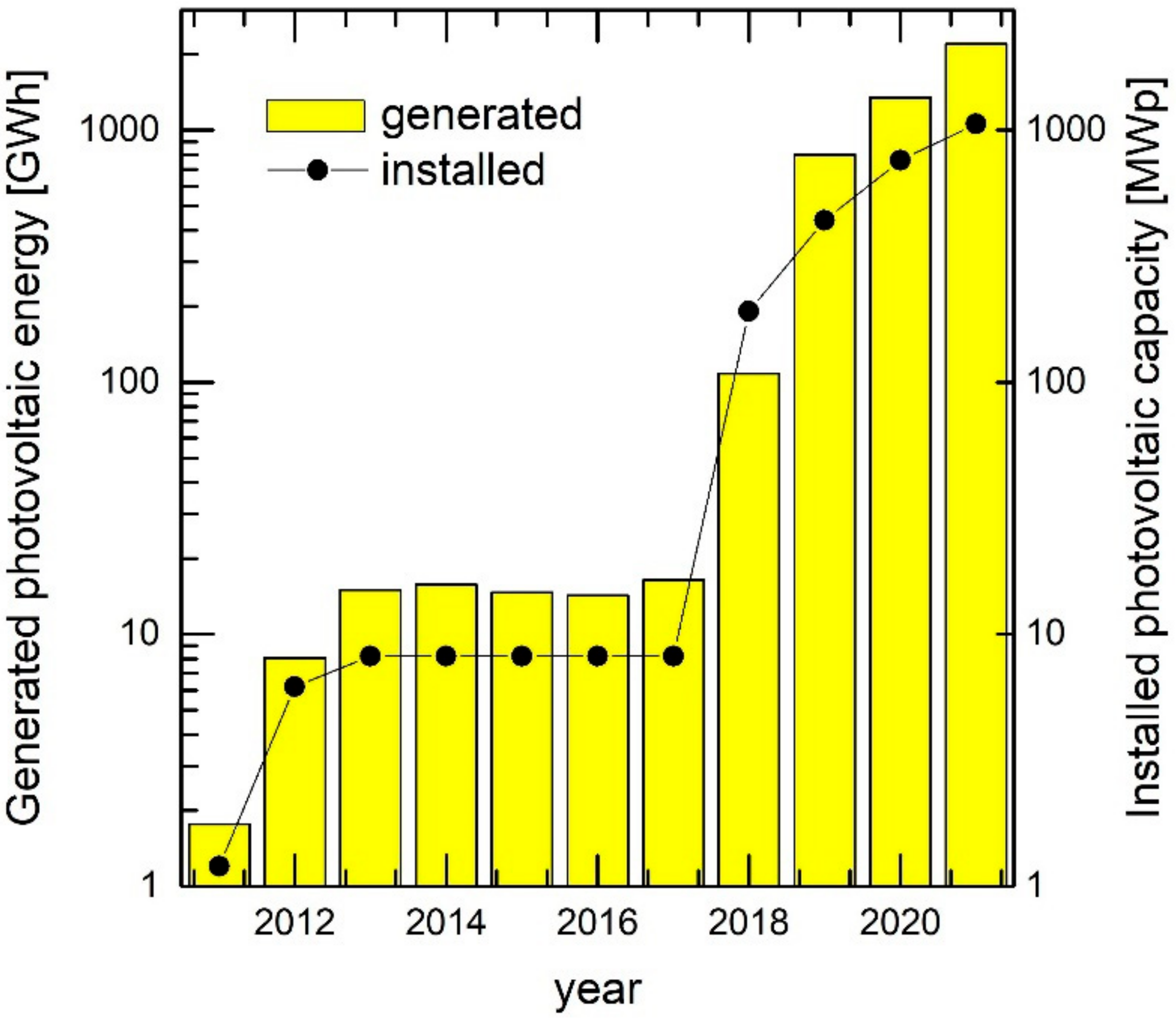

Figure 1 shows the evolution of PV´s contribution in terms of generated annual energy (yellow bars) and installed capacity (line-connected dots) in Argentina. The logarithmic y-axis reveals two waves of PV deployment: the first wave of PV installation corresponds to the GENREN program launched in 2009, while the second corresponds to the RenovAR program starting in 2016, with its successive rounds still being under execution. The 1 GW mark for installed PV capacity was reached very recently, in 2020, during the COVID-19 pandemic.

Figure 1. Evolution of yearly photovoltaic electrical energy production (yellow bars) and installed photovoltaic power (dots) since the first grid-connected PV power plant in 2011, in Argentina.

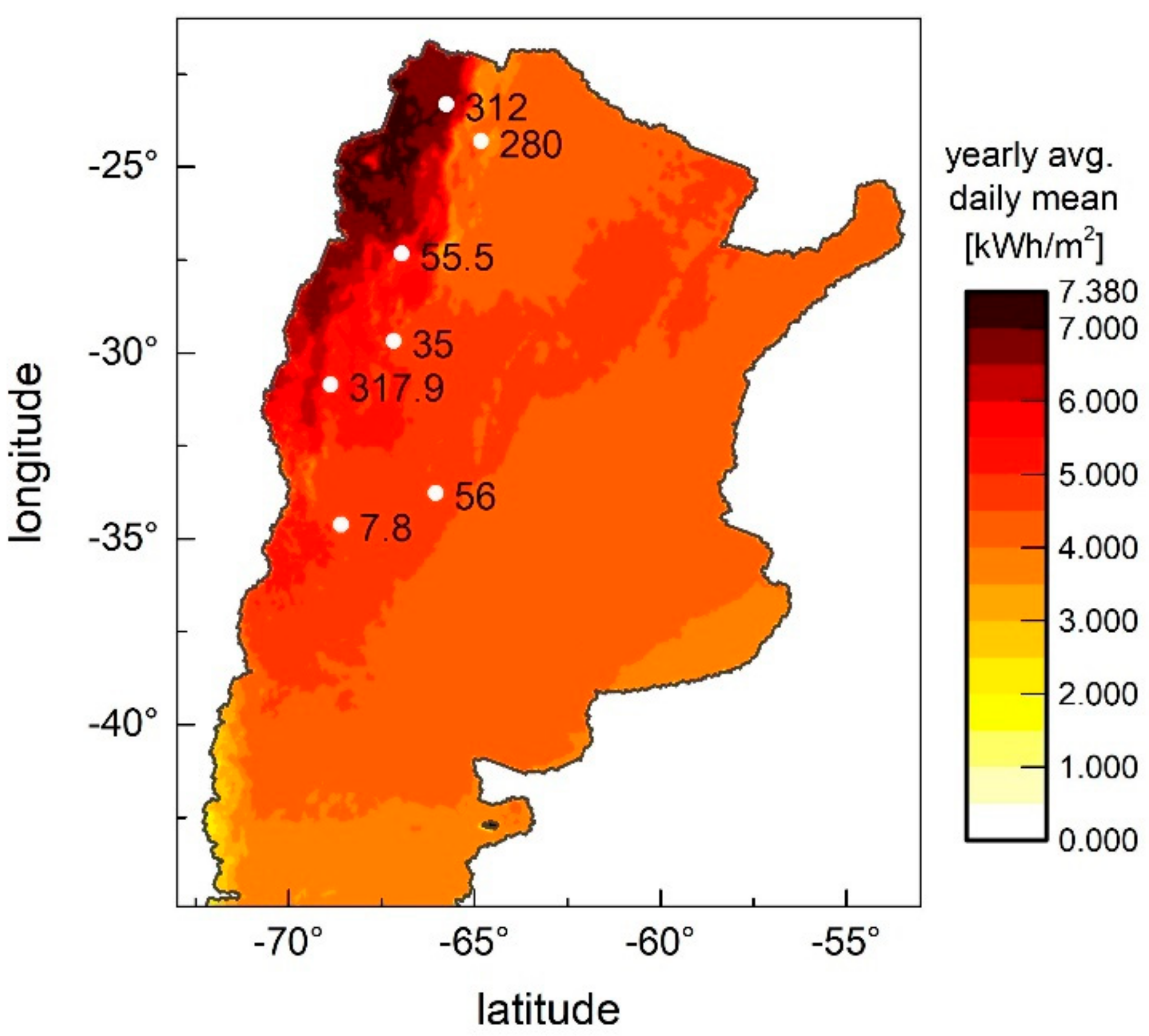

Figure 2 shows the distribution of the currently contributing PV power plants (white dots) over Argentina´s territory

[4], where each dot groups the PV plants found in each of the provinces where PV installations are operative, accompanied by the total power in MWp (the lower solar radiation, southern region of the country is omitted due to the lack of MW-sized PV installations). Comparing the location of the installations with the solar energy distribution map (the yearly average on a horizontal surface

[5]), it becomes evident that the amount of solar insolation determines, to a large extent, the profitability of each project.

Figure 2. Distribution of photovoltaic plants in Argentina, grouped by provinces (administrative divisions). The total power in MWp in each province is indicated next to each location point. The color map indicates the yearly average of daily solar radiation on a horizontal surface (see the reference bar).

Researchers briefly mention a few examples of Argentine PV power plants with different sizes and characteristics. A remarkable case is the 300 MWp Caucharí plant located at ca. 24° S 66°50′ O, i.e., in the far northwest Puna region, at 4200 m above sea level, where the daily global tilt radiation levels surpass 7.7 kWh/m

2 at an optimum tilt angle of 26°. This plant is currently the largest PV plant in South America

[6], and was acquired from PowerChina as a turnkey power plant, starting operations in late 2019. Based on fixed-mounting, crystalline silicon module technology, it is connected to the Argentine Interconnection System via a 345 kV transmission line. A recent press release announced a capacity expansion to 500 MWp, partly driven by the increased demand from lithium mining operations in the region

[7].

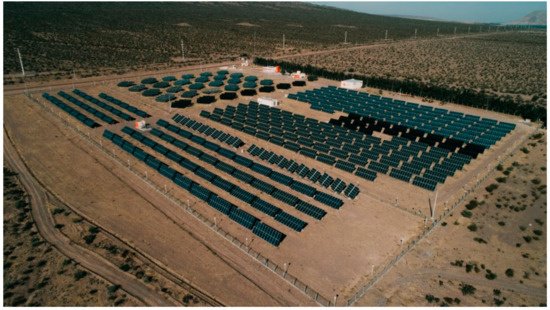

Figure 3 shows an aerial view of Ullum IV, located at 31° S 68° O in the center-western, Andean province of San Juan. This is a medium-sized solar plant with 16 MWp nominal power, which contains ca. 44,000 c-Si, fixed mounting, 365 Wp modules. The plant started to provide energy in 2019 through the national grid system using a 33 kV transmission line, which is further connected to a 132 kV grid. The photograph also shows the 1.68 MWp Solar San Juan I (far right, center), the first MW-sized plant in South America, which was connected to the grid in 2011.

Figure 3. A view of Ullum IV, a 16 MWp photovoltaic plant located in the desertic province of San Juan, which went operative in 2019. Also shown is the San Juan I PV technology testing plant (far right, center).

Figure 4 shows Anchipurac, a 3 MWp PV solar plant installed during 2021 between the pre-Andean mountain chain Sierras Azules and the city of San Juan. The multicrystalline silicon modules, with 18% efficiency and 330 Wp, are mounted on single-axis trackers. An inverter–transformer station connects the plant to a 13.2 kV grid, which provides energy to the city of San Juan.

Figure 4. Anchipurac is a small-sized 3 MWp PV solar plant provided by single-axis tracking, located in Argentina’s west-central province of San Juan. Photograph courtesy of Estrada.

Small Grid–Connected Generators

Data on distributed generation (DG), available from the Energy Secretariat of Argentina and updated monthly, reports the number of participating user-generators for different applications: residential, commercial and industrial

[8]. As of November 2021, a total of 679 DG projects have been connected to the grid, for a total of 8.6 MW, of which 1.5 MW are residential, 6.4 W are industrial and commercial, and 0.7 MW are allocated to other applications. Possible reasons for the small number of residential connections are the net billing scheme adopted in the legislation and the low, subsidized electrical tariffs which are applicable to electricity from conventional sources and large hydro plants. Additionally, there is a question as to whether all grid-connected generators report their projects to the Energy Secretariat, or only those meeting Distributed Energy Generation Incentive Scheme regulations do, which would tend to undercount DG installations.

2.2. Off-Grid Photovoltaics

Despite their much smaller size in terms of installed capacity, off-grid photovoltaic installations deserve a separate mention, as they started to appear some 10 years before the grid-connected power plants. The driving force was a government initiative: the Project for Renewable Energy in Rural Markets (or PERMER, for its Spanish acronym).

PERMER’s goal is to provide access to energy generated by renewable resources to rural populations located too far from the electric distribution networks to be cost-effectively connected. The project targets homes, rural schools, small communities and small productive initiatives, and subsidizes the equipment and installation cost for the end users

[9]. Since the beginning of the project in 1999, up to 2015, rural systems were installed, with a total PV power of over 8 MWp, providing access to electricity to rural residents

[9]. Several studies show the immediate social, health, educational and economic benefits linked to project

[10]. However, diverse factors slowed down the rate of new installations

[11], resulting in an extension of the project (PERMER II) in 2018, which aimed to provide electricity access to more rural residents. The project is currently active, and it is estimated to practically close the electricity access gap nationwide

[12].

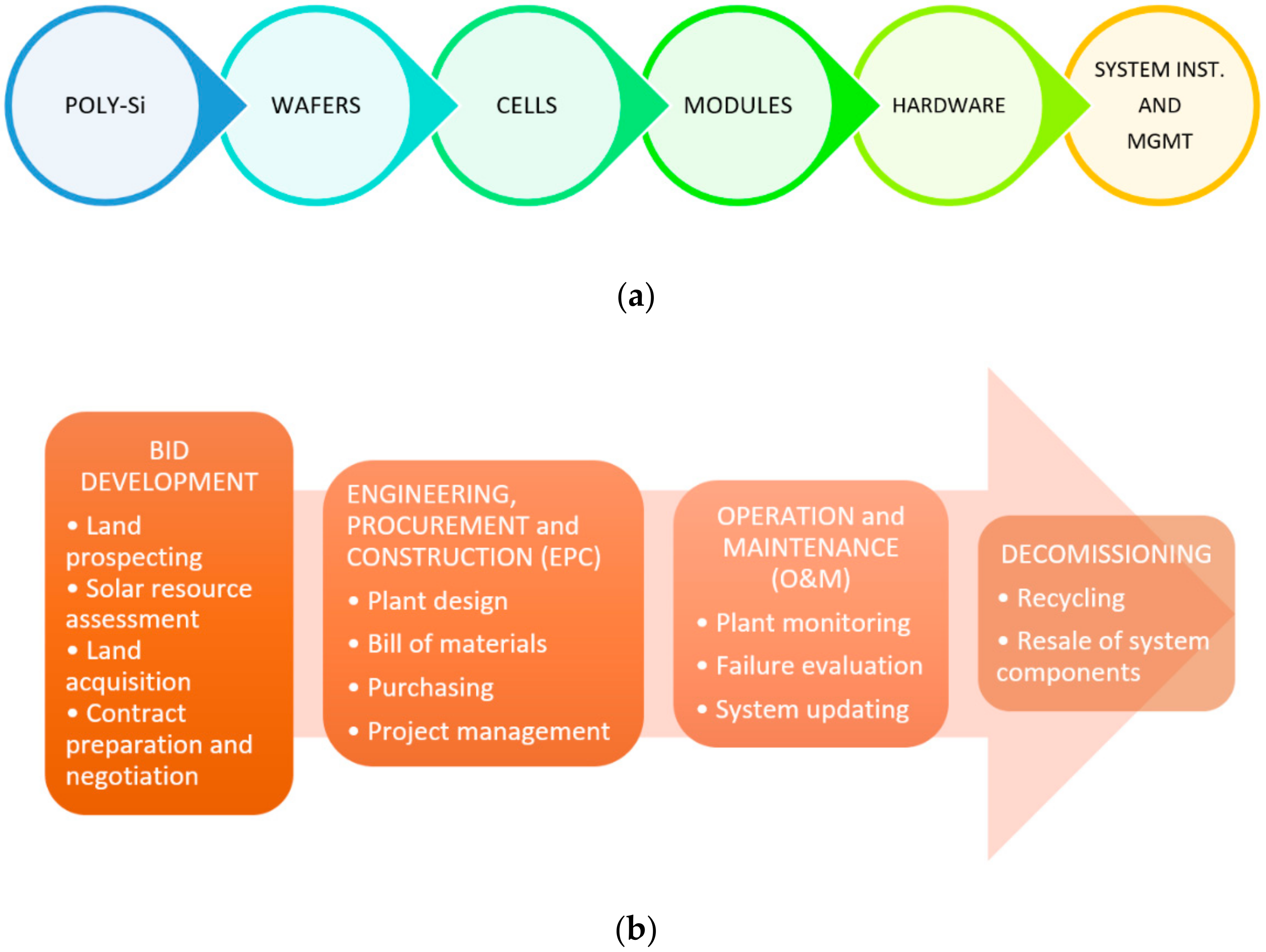

2.3. Analysis of the Local PV Value Chain

Figure 5a shows the succession of links composing the PV value chain. Argentina had a relatively late entry to the PV Industry; therefore, if somebody were to limit ourselves to the description of actors in the PV value chain only up to the module stage (as is common practice

[13]), researchers would fail to present a complete picture of Argentina’s PV industry. Therefore, the expanded view of the PV value chain includes links that are key in the delivery of PV energy to the user: ‘Hardware’ and ‘System Installation and Management’, cf.

Figure 5. Under this view, Hardware includes, e.g., electronics and module mounting components, while System Installation includes the tasks specified in

Figure 5b. According to Gomel and Rogge, data on PV and wind projects show a stated average local component content in the first RenovAR tenders which is typically between 20% and 30%

[14].

Figure 5. Value chain for crystalline silicon photovoltaic systems (part (a)), and disaggregation of the installation and management chain link (part (b)).

In the system component area, local industry contributes BOS components such as ground mounting systems, including trackers, cables, and accessories. Despite the government’s intentions to create industrial policies which are capable of providing local products and services to the local PV industry

[15], the pace at which the local industry started to offer such products lagged behind the installation of solar power plants. Imported manufactured products cover a large part of the value chain: PV modules, converters, batteries, and in many cases module support structures

[14].

The areas of services are shared between Argentine and foreign engineering companies. Local service companies offer project engineering, logistics planning, terrain preparation and installation, and the operation and maintenance of the solar power plants

[16], as well as a variety of consulting services assisting PPA contract bidders. Such services include Resource Evaluation and Prediction (RPE), involving the search for optimal land and solar resources, resource measurement, and land contract negotiation. Also offered are Engineering, Procurement and Construction (EPC) services, involving system engineering, component procurement and system construction, again typically for PPA contract bidders. Operation and Maintenance (O&M), usually the PPA contractor’s responsibility, offers opportunities for local participation.

2.3.1. Local Manufacturing

There is currently no large-scale module manufacturing in Argentina. SOLARTEC was an early participant in the industry, and operated a manual production module line beginning in 1986 with an output, which was highly dependent on the changing protection measures in the local PV market

[17]. Its market was initially in communications infrastructure and off-grid rural applications within the PERMER project, with the company eventually expanding into grid-connected applications. A relatively recent entrant, LV-Energy has operated a fully automated module plant since 2014, using solar cells as the input, offering IEC61215 and IEC61730-1/2 certified 280 Wp modules.

Regarding larger module production volumes, a key Argentine organization planning to become a high-technology PV manufacturer is EPSE (Energía Provincial Sociedad del Estado). The company, owned by the Province of San Juan, manages and distributes the conventional and alternative energy produced in its territory. In order to incorporate PV technology as a tool in the province’s future, EPSE is currently installing a fully integrated module manufacturing line with a projected yearly output of 71 MW. The semiautomatic line includes all of the processes from casting to module assembly. The German company Gebrüder Schmidt GmbH is supplying the turnkey plant

[18]. This project is sited in an area of approximately 41,000 m

2, including internal roads and raw materials storage, and includes approximately 12,000 m

2 of production and 1100 m

2 of offices. This planned line appears too small to compete in price with ‘tier one’ PV manufacturers; however, EPSE’s strategy is to selectively place its product in projects where the effect of the module cost on LCOE can be compensated by other local advantages, while developing PV technology skills and a local material supply chain. EPSE plans first to complete the module production line using imported cells, and to install 350 MW of PV in San Juan during the next five years

[19].

As an aside, that during over ten years of PV activity, EPSE has also developed valuable skills in the service side of the PV supply chain, with focus on project design and management. In 2009, EPSE built a 1.2 MW PV pilot plant Solar San Juan I in Ullum, which is shown in

Figure 6. The plant includes three silicon technologies: amorphous, multi- and single-crystal silicon, mounted on single- and two-axis trackers and adjustable fixed structures. It is equipped with data acquisition, supervision and control systems, and a state-of-the-art weather station. The data from this pilot plant contributed to a decision to adopt crystalline silicon as the basis for EPSE’s efforts in the industry. A program operated in Argentina and Europe offers training for local professionals using this plant as a tool. EPSE is also promoting other PV projects, notably the construction of a 132 kV/32 kV transformer station and a 132 kV line to connect 185 MW of PV power to the Argentine grid, as well as pilot PV irrigation plants and distributed generation plants

[20]. Recently, EPSE has been involved as an EPC contractor in a 50 MW PV plant in Neuquén province. Remarkably, with the approximate coordinates of 38° S, 69° W, this project would be the first MW-sized PV plant located in Patagonia

[21].

Figure 6. Solar San Juan I pilot solar plant, a 1.2 MW test facility using different module and mounting technologies, including fixed and single axis orientation for crystalline, multicrystalline and amorphous silicon modules. Photograph courtesy of Estrada.

2.4. De-Centralized Solar Thermal Energy

Solar thermal energy in Argentina was already considered a potential key energy source in 1975

[2], when a national R&D program for the development of solar energy and other renewables was launched, leading to numerous research programs (see next section) and the elaboration of norms and certification criteria for ST collectors

[22]. However, the deployment of this technology was hindered by the lack of long-term governmental promotion initiatives, as well as the sustained subsidies to conventional energy sources, which held until the present day

[23][24]. Hence, ST persisted for decades as a solution serving only isolated communities and schools in rural areas with reduced access to a gas supply

[25][26].

The 2001 economic crisis resulted in serious instability in the price structure, driven by frequent devaluations of the local currency. Through the Economic Emergency Law enacted on 6 January 2002, the Legislative Power temporarily delegated administrative powers to the Executive Power. In this framework, the rates of public services were frozen in the middle of the crisis in order to try to counteract the loss of the purchasing power of wages. However, after the crisis and with prices stabilized, the objective of economic policy was to maintain the new relative price structure based on a competitive (high) exchange rate and a scheme of low-cost tariffs, transport, and fuels. An explicit scheme of subsidies was established in order to maintain the low prices of public services (energy and passenger transport)

[27]. During the period of 2002 to 2015, natural gas tariffs for final-use customers were subsidized to varying degrees by as much as 100% for social tariff users

[28]. Such low prices in a growing economy did not encourage the use of ST technologies for heat generation. From 2015 to 2019, and with the aim to diminish the country’s fiscal deficit, tariff subsidies started to disappear, resulting in strong market growth for ST. As a result, local technology production was overrun by demand, international markets were open, and the importation of technology started to be a profitable option. In this period, ST equipment import grew each year

[29]. Due to the sudden rise of the market, there was a boom of ST equipment import from Asia, with no regard to equipment quality. Given the low price of equipment imports, local manufacturers started to turn from local manufacturing to equipment importation, and the remaining manufacturing organizations started the chamber of ST manufacturers (CAFEEST), which nucleates most of the manufacturers and importers in the country. As is typical of other technologies, low-quality systems are cheaper than high-quality systems; in order to address this issue, CAFEEST helped define minimum technology requirements and quality standards. After discussion with solar thermal importers, and after 9 years of regulatory updates, mandatory national quality standards were implemented in 2019 by Resolution 520/2018

[30], stating that all solar thermal systems entering the country (whether imported or fabricated) must comply with the defined regulations. Because, in Argentina, there is no accredited laboratory for solar thermal devices, reports from international labs are accepted as a proof of compliance. In 2019, the new government implemented import and currency exchange restrictions, and implemented subsidies to natural gas one more time. Although the current natural gas tariffs are still very low, solar thermal energy is growing with the momentum gained during the 2015–2019 period.

Equipment importation has become increasingly complicated due to exchange rate variability, importation permits, and recent equipment quality requisites (the Update of Resolution 520/2018). Local manufacturing has gained a renewed interest among entrepreneurs, and even importing companies. The main issue is that most of the materials needed for ST systems are either commodities or imported plastics (stainless steel, copper, thermoplastics, and polyurethane, etc.). Consequently, local manufacturing is affected by the same problems that affect equipment importation.

Additionally, manufacturing activities are highly taxed. A regular solar thermal equipment sale must pay 21% VAT, 4% for gross income tax, and 30% over the profit and municipal taxes, which can take another 10% away. A further issue is that the sale is carried out in local currency, in what is essentially a by-monetary economy, and cannot be transformed into the foreign exchange needed to purchase the input materials and devices needed for local manufacturing without large financial risk.

Solar thermal technology deployment is taking a different path from PV. Coincidentally with PV, Argentina has a huge potential for ST technologies, but in order to be competitive with imported equipment, technology transfer from academia and leveraged finance (both for manufacturers and end users) need to be in place. Currently, ST technology is mostly implemented at a household level, with very few examples in hotels and industries, with 2 m2 collectors being the typical household average. The advance of the ST market should be coupled to a progressive elimination of fuel subsidies in all sectors. Furthermore, the correct deployment of local ST technology manufacturing needs clear investment conditions, which are not likely to happen in the short–medium term. Last but not least is the equipment quality issue, which should be monitored in order to provide a fair competition among manufacturers and importers.

3. Research and Development

Scientific research around solar energy is divided into three areas: radiation assessment, solar thermal power, and photovoltaic power. The ongoing radiation assessment efforts focus on the obtention of field data

[31][32][33][34][35][36][37] and comparison with satellite estimations

[38][39][40], whilst also combining efforts with photovoltaics for the design of photovoltaic radiometers. The first solar radiation map for Argentina was published in meteorological reports in 1972, while the more detailed, digitally available solar radiation maps based on a larger number of solar measurement stations across the country appeared only after 2005

[40][41].

Research on solar thermal is mainly oriented toward finding cost-effective solutions for communities deprived of access to conventional energy, mainly in solar greenhouse and distiller design

[42][43][44], cooking

[45], drying

[40][46][47][48][49][50][51], and pasteurization

[52]. A few exceptions to this trend are larger-scale, industrial applications, where research efforts are directed towards the design of solar ponds to be applied to salt and metallurgical mining in Argentina‘s highest radiation region in the northwest

[53][54]. More recently, at INENCO (the Institute for Non-Conventional Energy), the solar thermal research division developed medium-to-large-scale concentrating systems, which led to the construction and operation of several prototypes, including a 172 m

2 linear Fresnel concentrator

[55][56][57]. Most of the research activities are oriented towards the use of locally available materials and tailored design, with some potential for technology transfer to the regional economy.

Together with INENCO, an ONG called EcoAndina has worked—since 1989—on the transfer of solar cooking and water heating developments to rural villages near the Andes, both to grant access to better sanitary conditions and to help develop a local regional economy

[58].

A key issue of research is that most of the ST research is not transferred to the market. Most national universities have little connection to the market and little experience in technology and knowledge transfer. As such, efficient mechanisms to build startups from research innovations are limited. An exception of public–private spinoff is the company Jujuy Solar, which manufactures solar thermal systems for the northwestern region of Argentina, oriented towards social housing in this high-insolation region of the country (see

[59] for a manufacturing video). Another example is the company SOLARMATE, a spinoff from the University of San Martin. The company develops portable ST devices which incorporate compound parabolic concentrators and industrial design to allow users to experiment with solar heat at a personal level.

Most of the local solar thermal manufacturers do not incorporate into their products well-known technological innovations such as selective surfaces (aerosol or sputtering deposited), or low-emissivity/textured/low-iron glass covers. This is due either to manufacturing costs or a lack of technical knowledge, with the latter being possibly due to poor know-how transfer from the academic sector. Some manufacturers have tried to import fin-tube-selective surface parts, joining them locally by means of conventional copper–silver welding, but eventually dropped the idea because market costs were lower for the imported collector than for the locally soldered collector. Others have tried to use aerosol selective coatings with very little result in the overall efficiency, and thus abandoned the original idea of using solar selective surfaces.

Given the large range of the country’s insolation and climate conditions—above 6 kWh/day and 20 °C annual average in the north, and less than 3 kWh and 10 °C annual average in the south—the market needs a variety of technologies that respond adequately to each climate. Low-efficiency collectors do not work in the south of the country, and high-efficiency collectors produce overheating in the north. Given the different technology needs, transfer from the academic sector must play and important role in the development of the solar thermal market in Argentina.

Research and development in photovoltaics followed a different path. PV research began in the early 1980s, as Argentine graduate students were trained in photovoltaics in technologically developed countries, where photovoltaics gained impulse during the 1970s and 1980s. The first published articles appeared in the early 80s, and were aimed at theoretical solar radiation assessment

[38], solar concentration studies

[60][61][62], and the optimization of silicon cell design

[63]. Thin-film solar cell research began in the early 1990s with CdTe/Cds films prepared by the chemical vapor deposition of both CdTe and CdS

[64][65][66]. These research lines were, however, isolated attempts which did not lead to long-term R&D projects, in part due to the lack of governmental policies aimed at the development of renewable energy technologies. Public funding eventually began in the mid-1090s for the development of space photovoltaic power systems for Argentine satellites. SAC-A—the first Argentine satellite mission provided with a photovoltaic array—was launched in 1988, and could be regarded as the first practical application of photovoltaic devices fabricated in Argentina. The space photovoltaics group continued to produce solar arrays for subsequent commercial satellite missions

[67], eventually switching to commercial triple-junction solar cells from Emcore, USA (later SolAero Technologies Corp.

[68]). The long-term involvement in space applications derived in the development of EDRA, a facility dedicated to radiation damage in a simulated space environment and the in-situ characterization of solar cells and materials during irradiation

[69]. In the meantime, scientific research gained some governmental attention after the economic crisis of 2001. Though modest, the increase in public research funding produced new research groups in different regions of the country. These groups focused mainly on low cost, inorganic and organic thin-film solar cells, covering modeling

[70][71][72][73][74][75][76][77], characterization techniques

[78][79][80][81][82][83], and the preparation of solar cells

[72][84][85][86][87][88][89][90][91]. In the last decade, the research focus moved to alternative chalcopyrite and perovskite solar cells, covering modeling

[92][93][94], preparation

[95][96][97][98][99][100][101][102][103] and characterization

[95][96][104][105][106].