Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Considering the turbulence existent in the entrepreneurial process of creation, survival, the management of new technology based ventures, and the increasingly important role played by both business incubators (BI) and business accelerators (BA), there is a need to better understand the portfolio of services supplied by this type of support structures and the needs of the companies that demand for a set of diversified services, which are not easily represented and typified in the reference literature.

- accelerators

- business development

- firm growth

- incubators

- start-ups

1. Introduction

Business incubation is the most effective way of assisting entrepreneurs in their new venture creation [1]. BI are oftentimes viewed as drivers of job creation and thus regional economic development as they provide several facilities [2] ranging from office space and capital to management support and knowledge [3]. BI have evolved in terms of types, variety, stakeholders, sponsors, location, goals, and services offered [4]. BI constitute an important dimension in the innovation system [3] and have become part of modern entrepreneurial ecosystems [5]. They are, as a result, sprouting everywhere in developed as well as rapidly developing countries [6]. The success of BI depend on them attracting the best incubated ventures, and their ability to produce new firms, with high growth potential, spurring from R&D developed in universities and research institutions [7].

BA can be defined as organizations that help nascent ventures get a jumpstart by providing them with funds and resources [8], seed capital and sometimes even working space; helping ventures to define and build their own products/services; arranging for customers; and securing capital, investors, and employees [9]. BA programs can be more effective, and even avoid failure when the teams are willing to have an open innovation attitude [10].

A startup is a new venture that entails the development and validation of a business model [11]. Startup performance can be affected by material capital, human capital, knowledge, and entrepreneurial capital [12]. Startup performance can also be affected by the access to multiple networks, resources and knowledge [10]. Furthermore, open innovation practices facilitate network creation, relationships for collaborative work and knowledge flow, partnerships and external links to other networks and firms [13]. In terms of the research gap found in the literature, it remains to be understood how BI and BA structures can be facilitators for the adoption of open innovation practices.

2. Theoretical Framework and Research Questions

BI appeared in the late 1950s, and from then on there have been innumerous definitions for the term [14][15][16][17][18], whereas BA appeared latter (in 2005). The definitions for BA are fewer, but nonetheless various exist [8][9][19].

BI can be defined as organizations that provide support to new businesses during a period of time, either through tangible assets (for example, space and administrative services), or through intangible ones (for example, knowledge and access to networks) [5].

The majority of the literature regarding BI mainly discuss incubators that do not restrict to specific sectors. A study from Germany found that from 1999 to 2008, a third of all new incubators created were specialized incubators, specializing in one or a few complementary sectors [19]. Not all requirements of a BI and specialized BI differ, nonetheless, emerging from a sector specific focus can have its benefits, mainly the potential availability of specialized equipment and structures, sector specific knowledge of the specialized BI staff, fruitful networking and availability for synergies between the incubatees [19].

The entrepreneurship education offered by universities has the capacity to motivate and attract graduates to engage in entrepreneurial ventures, and these graduates can be a source of nascent entrepreneurship [20]. BI associated with universities, enable technology transfer and empower the networks that allow for technology to be materialized into new ventures [21].

By virtue of the success of BI, later came business accelerators (BA) as an evolution of the BI models [22]. BA were idealized as an arrangement of five main features: (1) standardized seed funding packages; (2) cohort-based entry and exit; (3) a structured capacity development programme; (4) mentoring; and (5) physical co-location [23]. BA can be defined as cohort-based programs of fixed duration for startups. These programs can entail educational components, as well as mentorship moments, which come to a conclusion in a final event [24]. Most BA offer an initial seed investment in exchange for services and space [23] and target a specific sector, such as manufacturing, health care, IT [25], biotechnology, or telecommunications [26], while others have a horizontal perspective focusing instead on the region [27].

Y Combinator, the first accelerator, was launched in 2005. Since then, the popularity of BA has been boosted mainly thanks to participants such as Dropbox, Reddit, and Airbnb. Another pioneer BA, Techstars was founded in 2007, the two BA combined have accelerated over 2000 startups [24]. Currently there are at least two hundred accelerators worldwide and their portfolio companies have raised more than $14.5 billion in funding [28].

Both BI and BA are important resources that aid the growth of entrepreneurial endeavors. Nonetheless, looking at the various definitions for the two, there are some factors that distinguish them. One of the factors of distinction between the two structures is that BI provide space for the company to grow, while BA either do not provide space, or provide some type of co-working space or desk space [24]. Another key distinguishing aspect is that BA assign funding to their participants, while BI do not. Duration of the program is also another distinguishing factor, as BI programs last for varying timeframes and include forms of mentorship and support which serve as aids for the business to get off the ground, what sometimes can take years. On the other hand, a BA program usually lasts from three to six months. BA programs focus on rapid growth, and strategies for organizational and operational difficulties which the business might be facing or will face.

BI and BA both aim to create entrepreneurial ecosystems. The term “ecosystem” was introduced to describe the community in Silicon Valley, showing that entrepreneurship oftentimes depends on a nurturing environment for emerging businesses [29]. An entrepreneurial ecosystem mainly refers to a group of interacting firms that depend on each other’s activities [30]. A better understanding of the boundaries of the ecosystem is essential in order to evaluate the performance, outputs, and impact of that ecosystem [31].

Through an extensive SLR on entrepreneurial ecosystems, the terms: “innovation”, “clusters”, and “open innovation”; were identified as the three most relevant characteristics for entrepreneurial ecosystems, influencing a new definition for this complex concept, where these are identified as an environment where entrepreneurship can flourish, aided by an ensemble of various independent players and factors [32]. In a “closed innovation” model, a company does not search for ideas and knowledge form outside its boundaries, but instead the company generates, develops, and markets its own knowledge [33]. However, a startup’s success can depend on external knowledge flows [10]. That gave rise to a shift in the paradigm [34], from closed to “open innovation”, being the sharing of ideas and knowledge from outside a firm into the inside [33] and this type of practice should be endorsed in entrepreneurial ecosystems [13].

Structures such as incubators and accelerators provide opportunities for knowledge transfer, experience sharing, and cooperation, as the different incubated ventures share a common physical location [35]. These structures play a critical role in fostering the economic development of the regions [36], as these structures can host entrepreneurial ecosystems [37]. A recent study found that open innovation practices with the goal of developing an entrepreneurial ecosystem facilitate network creation, relationships for collaborative work and knowledge flow, and partnerships and external links to other networks and firms [13]. Since the introduction of this concept, the organizations have opened their research and development processes [38]. There are two pathways for open innovation practices: inbound–integrating into the organization, and outbound–transferring from the organization to the outside.

The literature concerning BI and BA has been evolving. Nonetheless, the question of how these structures can facilitate network creation, foster partnerships and knowledge flow, thus acting as facilitators for open innovation practices, still remains unanswered. It is expected that these structures play a role in the stage of open innovation, but very few information is available [39]. Moreover, another question arises: what services provided by BI and BA are oriented for open innovation practices in the two pathways (inbound (from the university to an external environment) and outbound (from an external environment to the university)? In line with the open debate [34], new review studies are needed in order to broaden the literature covering this subject.

3. Research Questions: Contrasting Literature and Findings

Recovering the MRQ: “How incubation and acceleration ecosystems foster the adoption of open innovation practices influencing the performance of technology-based ventures along their life cycle?”, the researchers analysed the literature pertaining to BA and BI, their actions as facilitators of open innocation practices, and their influence over the performance of startups.

The process of incubation can provide a number of contributions to the development of high-technology firms [40], providing resources, capabilities, knowledge, and social capital, however, the influence of these intermediary benefits on startup performance is ambiguous [41]. Nevertheless, the image effect of a BI (e.g., media presence, word-of-mouth), seems to be an enormous advantage [19]. This can imply that BIs should update their service portfolio while simultaneously imposing stricter selection criteria and introducing exit policies [42].

Incubation and acceleration ecosystems serve as facilitators for open innovation practices as these practices allow the companies to foster alliances [34].

It is also noticeable that younger firms value the credibility that they get through the acceptance into an incubator [43]. As the firms matured, belonging to a BI could be associated with newness, vulnerability and inexperience [43], and could be perceived as less disadvantageous. Younger firms are more available to be open organizations, as they are necessarily involved in the innovation process [39].

The success of a BI depends on the performance of ventures in its portfolio [44] and thus a BI benefits from limiting the tenant failure rate [3]. BA companies learn to cut losses earlier and shut down accordingly. Even though BA companies raise less money on average, the funding ratio is lower, meaning that more money is invested in companies that eventually get acquired than in companies that eventually close [28].

BI do not increase the likelihood of firm survival, innovativeness, and growth [45]. Conversely, some studies found that BI are, on their own, insufficient to exert an influence on business survival [46][47][48][49], and therefore raising some doubts regarding the impacts of incubation on long-term firm survival.

In contrast with the aforementioned, university incubators give credibility to a firm, as they can offer a professional image and valuable social networks [21]. The support provided by a BI or a science park is proven to be of key importance, not only since it provides mentoring and facilities but it is also a guarantee of reliability in front of potential clients, suppliers, employees and in front of banks that are more inclined to give loans to firms positively evaluated by a university incubator [21][50].

Previous research reveals that the association of BI with local universities provide incubated ventures with knowledge, skills, and R&D facilities [51], being the mentorship provided, and are of extreme importance in the cases where the startups lack business competences [50]. Moreover, incubating in a university incubator enhances the firms’ sustainability, offering a big opportunity for future growth [21].

BA are undoubtedly becoming increasingly visible across a large number of entrepreneurial ecosystems. BA play a central role in shaping entrepreneurial activity and act as powerful enablers of transnational entrepreneurship [52].

Concerning the SRQ1: Does the specialization of incubation and acceleration ecosystems facilitates the adoption of open innovation practices influencing the performance of technology-based ventures along their life cycle?; the researchers analyzed the effect of the specialization of the ecosystem on the performance of startups.

A specialized BI is a BI with focus on a specific sector or a limited number of sectors [3]. An increasing number of BI focus their activities on one specific sector, however the benefits arising from this specialization have not been explored in great detail [19]. For example, a previous work of the authors details a Portuguese incubator focused in the bio health sector, being this specialization highly praised in instances as the provided facilities and the specialized staff [37].

Importantly, it was found that the sharing of technical resources is only profitable in the case of a specialized incubator [14]. It is impossible to provide sector-specific knowledge and business support for a plethora of heterogeneous sectors with the same quality [45]. Thus, if the incubator is specialized on a defined sector, it increases the expertise of the management team [3] and also the incubator’s value to the incubated startups [19]. The major determinant factors to the decision to locate at a BI is access to research facilities and laboratories [53], business support, grants and potential financial investors. [54].

There is no positive or negative effects of being incubated in a specialized BI regarding the promotion of networking between the incubates and academic institutions, they found that the specialization of the incubator brings no added value compared to a generic incubator [55].

However, the specialization of the incubator can bring about some disadvantages, namely the increased vulnerability of the incubator, if the sector of specialization suffers, the incubator will consequently suffer [3].

It is noteworthy to mention the lack of literature in what pertains to specialized BI, and even more in what pertains to open innovation practices in specialized BI.

In what relates to the SRQ2: What are the types of capital related with the adoption of open innovation practices influencing the performance of technology-based ventures along their life cycle?; the researchers analysed the types of capital that influence the performance of startups.

On one hand, human and social capital, structures and systems and networks influence learning and growth [56]; on the other human capital is said to have a negative influence on innovative capability, this implies that individual expertise is not encouraging of innovation [57]. Conversely, social capital has an important positive influence on knowledge transfer [58].

Relating to organizational capital, it was found to positively influence innovative capability [57] whereas social capital is described to be the foundation of innovative capabilities.

Concerning intellectual capital, the dimensions considered as critical for the success of the entrepreneurial ecosystem are the structural capital and the relational capital (although human capital is perceived as a basic prerequisite for fostering the entrepreneurial ecosystem’s performance) [37].

It has been pointed out that the skills of the incubator’s staff positively affect the incubator activity, and thus the formation of new technology-based ventures [59]. It is also worth mentioning that the relationship between the incubator manager/director and the incubated ventures has a significant role in performance [40].

Regarding the SRQ3: What are the research gaps in the literature concerning incubation and acceleration ecosystems, facilitators of open innovation practices, and technology-based ventures performance?; the researchers identified some gaps in the literature that suggest the need for further research.

The benefits of BI specialization have not been fully studied and identified [19]. The existing research revolving around BA is fragmented and sparse, as a literature gap remains regarding the understanding of how BA impact and interact with their local ecosystem [24]. Also, there is a need for further research regarding the BI and BA’s regional impact.

There is also a literature gap relating to the process of incubation itself [60], for instance the finer aspects of what type of knowledge to accumulate/incentivize by the management teams, or regarding what pertains to the efficiency of incubation initiatives that best benefit the incubated ventures [61].

4. Taxonomy Proposal

Taxonomy is best known for being used as a classification system for the plant and animal kingdom. Nonetheless, taxonomy can be defined as a means of organizing knowledge, providing a structure of concepts, using terms that aid in knowledge sharing [62]. Based on the research questions of this SLR, mainly related to the specialization and the various different types of capital, a taxonomy for BI and BA was proposed, in order to allow for the advancement of this field of research.

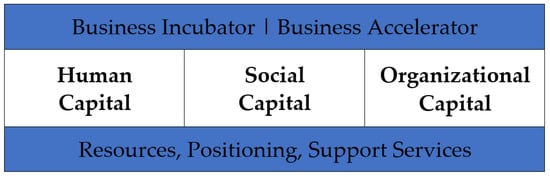

Based on the empirical findings of this SLR, the main contribution resides in the presentation of a new taxonomy (see Figure 1) for the classification of BI and BA, according to three pillars: human capital, social capital, and organizational capital. This taxonomy will allow for the unequivocal classification of BI and BA, targeted to facilitating the adoption of open innovation practices.

Figure 1. Taxonomy of the capitals that support the facilitators of open innovation of BI and BA (Source: Own elaboration).

Bearing in mind the first pillar, human capital, it should be fostered, as it encompasses the staff, their expertise.

The second pillar, social capital, is related with the creation of networks, but also relates with the corporate social performance.

The third pillar, organizational capital, encompasses the physical structure of the BI, meaning the building and its components, for instance, structures such as laboratories, re-search facilities, auditoriums, conference rooms, etc.

This entry is adapted from the peer-reviewed paper 10.3390/joitmc8010046

This entry is offline, you can click here to edit this entry!