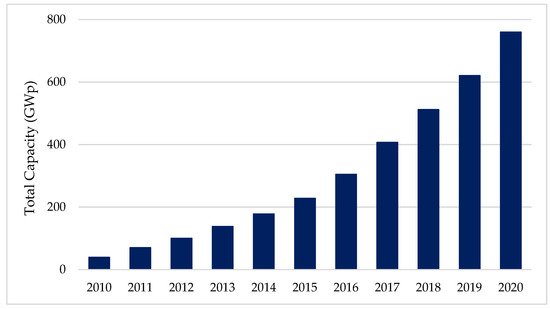

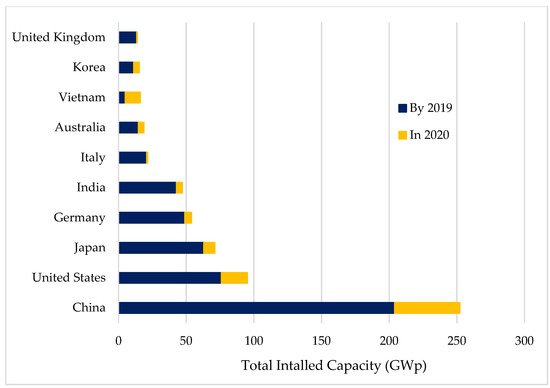

In recent years, solar photovoltaics (PV) has grown rapidly and strongly worldwide. By 2020, the worldwide installed capacity of solar PV reached 760 GWp, with major three markets in China, the United States, and Vietnam.

Vietnam became the world’s third-largest market for solar PV energy in 2020. Especially after the Vietnamese government issued feed-in tariffs for grid-connected solar PV systems, the installed capacity of solar PV applications exploded in 2019. From studies in the relevant literature, it can be said that support policies are highly important for the initial development of the renewable energy industry in most countries, especially in emerging countries like Vietnam.

- solar policy

- photovoltaic

- Vietnam

1. Introduction

2. Policy Development for Solar PV in Vietnam

| Year | RTS (UScents/kWh) |

SPP (UScents/kWh) | Tariff Duration (Years) | Max. Cap (MWp) | Others | |

|---|---|---|---|---|---|---|

| Floating | Ground | |||||

| 2017 | 9.35 | 9.35 | 20 | |||

| 2019 | 9.35 | 9.35 | 9.35 | 20 | ||

| 2020 | 8.38 | 7.69 | 7.09 | 20 | <1 (RTS) | |

| 9.35 | 9.35 | 9.35 | 20 | <2000 | Ninh Thuan | |

3. Conclusions

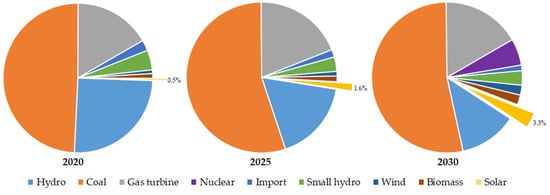

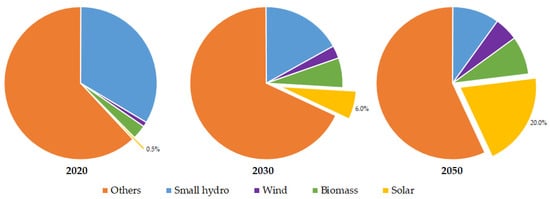

This paper addressed the question of the FIT mechanisms and related support policies for solar PV in Vietnam. It also has summarized the policies and regulations related to solar PV of the Vietnamese government from the 2000s up to now, as well as the process of developing them in practice.

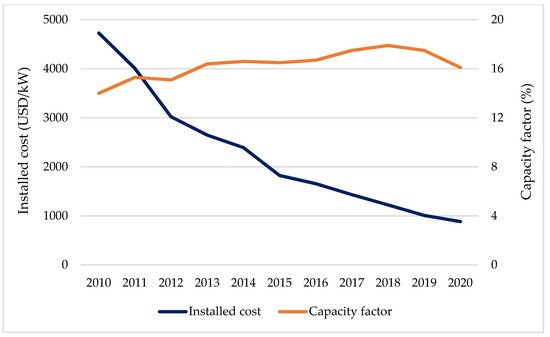

In the future, the government should build a solar PV roadmap based on the cost trend of demand, technology type, installed capacity, and/or project location. The roadmap should provide vision, target identification, and identify specific actions, especially the stability of policy frameworks. Policy changes should be made in a deliberate and predictable manner. The process of developing and implementing a roadmap is also important and needs to involve stakeholders.

This entry is adapted from the peer-reviewed paper 10.3390/en15020556

References

- Jäger-Waldau, A. PV Status Report 2019; Publications Office of the European Union: Luxembourg, 2019; ISBN 978-92-76-12608-9.

- REN21. Renewables 2020. Global Status Report; REN21 Secretariat: Paris, France, 2020; ISBN 978-3-9818911-7-1.

- REN21. Renewables 2021. Global Status Report; REN21 Secretariat: Paris, France, 2021; ISBN 9783948393038.

- Riva Sanseverino, E.; Le Thi Thuy, H.; Pham, M.-H.; Di Silvestre, M.L.; Nguyen Quang, N.; Favuzza, S. Review of Potential and Actual Penetration of Solar Power in Vietnam. Energies 2020, 13, 2529.

- Tvaronaciene, M.; Slusarczyk, B. Energy Transformation towards Sustainability; Elsevier Inc.: Amsterdam, The Netherlands, 2019; ISBN 9780128176887.

- UN. Report of the Conference of the Parties on its Third Session, Held at Kyoto from 1 to 11 December 1997; United Nations: Kyoto, Japan, 1998.

- COP21. Paris Agreement under the United Nations Framework Convention on Climate Change; United Nations: Paris, France, 2015.

- COP26. Glasgow Agreement under the United Nations Framework Convention on Climate Change; United Nations: Glasgow, Scotland, 2021.

- IRENA. Renewable Power Generation Costs in 2020; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021; ISBN 978-92-9260-348-9.

- IRENA. Renewable Power Generation Costs in 2019; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020; ISBN 9789292602444.

- Taylor, B.Y.M. Energy Subsidies: Evolution in the Global Energy Transformation to 2050; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020; ISBN 9789292601256.

- Lazard Lazard’s Levelized Cost of Energy Analysis—Version 14.0. Available online: https://www.lazard.com/perspective/levelized-cost-of-energy-and-levelized-cost-of-storage-2020/ (accessed on 19 October 2020).

- Gray, M.; Ljungwaldh, S.; Watson, L.; Kok, I. Powering Down Coal—Navigating the Economic and Financial Risks in the Last Years of Coal Power; Carbon Tracker Initiative: London, UK, 2018.

- Perez-Arriaga, I.J.; Batlle, C. Impacts of Intermittent Renewables on Electricity Generation System Operation. Econ. Energy Environ. Policy 2012, 1, 3–18.

- Hart, E.K.; Stoutenburg, E.D.; Jacobson, M.Z. The Potential of Intermittent Renewables to Meet Electric Power Demand: Current Methods and Emerging Analytical Techniques. Proc. IEEE 2012, 100, 322–334.

- Milanés-Montero, P.; Arroyo-Farrona, A.; Pérez-Calderón, E. Assessment of the Influence of Feed-In Tariffs on the Profitability of European Photovoltaic Companies. Sustainability 2018, 10, 3427.

- Ye, L.-C.; Rodrigues, J.F.D.; Lin, H.X. Analysis of feed-in tariff policies for solar photovoltaic in China 2011–2016. Appl. Energy 2017, 203, 496–505.

- Dusonchet, L.; Telaretti, E. Economic analysis of different supporting policies for the production of electrical energy by solar photovoltaics in eastern European Union countries. Energy Policy 2010, 38, 4011–4020.

- Dusonchet, L.; Telaretti, E. Economic analysis of different supporting policies for the production of electrical energy by solar photovoltaics in western European Union countries. Energy Policy 2010, 38, 3297–3308.

- Abolhosseini, S.; Heshmati, A. The main support mechanisms to finance renewable energy development. Renew. Sustain. Energy Rev. 2014, 40, 876–885.

- Johnstone, N.; Haščič, I.; Popp, D. Renewable Energy Policies and Technological Innovation: Evidence Based on Patent Counts. Environ. Resour. Econ. 2010, 45, 133–155.

- Haas, R.; Panzer, C.; Resch, G.; Ragwitz, M.; Reece, G.; Held, A. A historical review of promotion strategies for electricity from renewable energy sources in EU countries. Renew. Sustain. Energy Rev. 2011, 15, 1003–1034.

- Lüthi, S.; Wüstenhagen, R. The price of policy risk—Empirical insights from choice experiments with European photovoltaic project developers. Energy Econ. 2012, 34, 1001–1011.

- Couture, T.; Gagnon, Y. An analysis of feed-in tariff remuneration models: Implications for renewable energy investment. Energy Policy 2010, 38, 955–965.

- Muhammad-Sukki, F.; Abu-Bakar, S.H.; Munir, A.B.; Mohd Yasin, S.H.; Ramirez-Iniguez, R.; McMeekin, S.G.; Stewart, B.G.; Sarmah, N.; Mallick, T.K.; Abdul Rahim, R.; et al. Feed-in tariff for solar photovoltaic: The rise of Japan. Renew. Energy 2014, 68, 636–643.

- Arias, J. Solar Energy, Energy Storage and Virtual Power Plants in Japan—Potential Opportunities of Collaboration between Japanese and European Firms; EU-Japan Centre for Industrial Cooperation: Tokyo, Japan, 2018.

- Lüthi, S. Effective deployment of photovoltaics in the Mediterranean countries: Balancing policy risk and return. Solar Energy 2010, 84, 1059–1071.

- FMENCNS. Act on Granting Priority to Renewable Energy Sources (Renewable Energy Sources Act, Germany, 2000). Solar Energy 2001, 70, 489–504.

- Grau, T. Responsive feed-in tariff adjustment to dynamic technology development. Energy Econ. 2014, 44, 36–46.

- Di Dio, V.; Favuzza, S.; La Cascia, D.; Massaro, F.; Zizzo, G. Critical assessment of support for the evolution of photovoltaics and feed-in tariff(s) in Italy. Sustain. Energy Technol. Assess. 2015, 9, 95–104.

- Homma, T.; Akimoto, K. Analysis of Japan’s energy and environment strategy after the Fukushima nuclear plant accident. Energy Policy 2013, 62, 1216–1225.

- METI. Act on Purchase of Renewable Energy Sourced Electricity by Electric Utilities; Japan Ministry of Economy Trade and Industry: Tokyo, Japan, 2011.

- CEERP. BP Statistical Review of World Energy 2019; BP International Limited: London, UK, 2019.

- EREA&DEA. Vietnam Energy Outlook Report 2019; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- Zissler, R. Renewable Energy to Replace Coal Power in Southeast Asia. Pragmatism to Deliver a Sustainable Bright Future; Renewable Energy Institute: Tokyo, Japan, 2019.

- Prime Minister. Decision 02/2019/QD-TTg on Amendments and Supplements to Certain Articles of Decision No. 11/2017/QD-TTG on the Mechanism for Encouragement of Development of Solar Power in Vietnam; Vietnam Government: Hanoi, Vietnam, 2019.

- Prime Minister. Decision 11/2017/QD-TTg on Mechanism for Encouragement of the Development of Solar Power Projects in Vietnam; Vietnam Government: Hanoi, Vietnam, 2017.

- Prime Minister. Decision 13/2020/QD-TTg on Mechanism for Encouragement of the Development of Solar Power in Vietnam; Vietnam Government: Hanoi, Vietnam, 2020.

- VGO. Notice 402/TB-VPCP of Prime Minister’s Conclusions on the Draft of Solar Power Promotion Mechanism in Vietnam, Applied from July 1, 2019, Following Decision 11/2017/QD-TTg; Vietnam Goverment Office: Hanoi, Vietnam, 2019.

- MoIT. Dispatch 9608/BCT-DL on Suspension of Proposal and Agreement for Solar Power Projects under FIT Price Mechanism; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- MoIT. Dispatch 89/BCT-DL on on Implementation of Agreements with Rooftop Solar Power; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2020.

- MoIT. Proposal 10170/TTr-BCT of a New Draft Decision on the Mechanism for Developing Solar Power Projects in Vietnam; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- VEPG. Vietnam Factsheet on Rooftop Solar Development 2019; Viet Nam Energy Partnership Group: Hanoi, Vietnam, 2019.

- EVN. Press Release on Capacity Release of Renewable Energy Sources of Vietnam Electricity. Available online: https://www.evn.com.vn/d6/news/Den-3062019-Tren-4460-MW-dien-mat-troi-da-hoa-luoi-6-12-23925.aspx (accessed on 10 September 2020).

- MoIT&DEA. Vietnam Energy Outlook 2017; Danish Energy Agency: Hanoi, Vietnam, 2017.

- WB Group. Solar Resource Maps for More Than 200 Countries on the World. Available online: https://solargis.com/maps-and-gis-data/download (accessed on 8 May 2021).

- IEA. Southeast Asia Energy Outlook 2017; OECD: Bangkok, Thailand, 2017; ISBN 9789264285576.

- Prime Minister. Decision 1855/QD-TTg of Approving Vietnam’s National Energy Development Strategy up to 2020, with Vision to 2050; Vietnam Government: Hanoi, Vietnam, 2007.

- Prime Minister. Decision 1208/QD-TTg Dated 21 July 2011 of Approving the National Master Plan for Power Development in the 2011–2020 Period, with Considerations to 2030; Vietnam Government: Hanoi, Vietnam, 2011.

- Prime Minister. Decision 2081/QD-TTg of Approving the Program on Electricity Supply in Rural, Mountainous and Island Areas in Period of 2013–2020; Vietnam Government: Hanoi, Vietnam, 2013.

- Prime Minister. Decision 2068/QD-TTg of Approving the Viet Nam’s Renewable Energy Development Strategy up to 2030 with an Outlook to 2050; Vietnam Government: Hanoi, Vietnam, 2015.

- Prime Minister. Decision 428/QD-TTg of Approval of the Revised National Power Development Master Plan for the 2011–2020 Period with the vision to 2030; Vietnam Government: Hanoi, Vietnam, 2016.

- Prime Minister. Decision 37/2011/QD-TTg on the Mechanism Supporting the Development of wind Power Project in Vietnam; Vietnam Government: Hanoi, Vietnam, 2011.

- Sinh, T.D.; Long, N.H.; Dung, N.T.M. Report on Rural Electrification Policies and Supporting Mechanisms for Off-Grid Community; Green Innovation and Development Centre: Hanoi, Vietnam, 2017.

- MoIT. Decision 2023/QD-BCT of Approving the Program to Promote the Development of Rooftop Solar Power in Vietnam in Period of 2019–2025; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.

- MoIT. Circular 16/2017/TT-BCT on Project Development and Model Power Purchase Agreements Applied to Solar Power Projects; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2017.

- MoIT. Circular 18/2020/TT-BCT on Project Development and Model Power Purchase Agreements Applied to Solar Power Projects; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2020.

- MoIT. Circular 05/2019/TT-BCT of Amendments to Circular 16/2017/TT-BCT on Development of Solar Power Projects and Standard form Power Purchase Agreement; Vietnam Ministry of Industry and Trade: Hanoi, Vietnam, 2019.