Global energy transition trends are reflected not only in oil and gas market dynamics, but also in the development of related sectors. They influence the demand for various types of metals and minerals. It is well-known that clean technologies require far more metals than their counterparts relying on fossil fuels. Nowadays, rare-earth metals (REMs) have become part and parcel of green technologies as they are widely used in wind turbine generators, motors for electric vehicles, and permanent magnet generators, and there are no materials to substitute them. Consequently, growth in demand for this group of metals can be projected in the near future.

1. Introduction

Modern economic conditions are characterized by high rates of development, entailing increasing uncertainty in terms of strategic decision-making. Priorities change, while market dynamics and such processes as the internationalization and globalization of global economic systems are intensifying. Recent events related to the global COVID-19 pandemic have also influenced the perceptions of how the world will be structured. Markets for raw materials are also undergoing transformations: demand patterns, needs, the structure of the critical materials market, the applications of some minerals, and their role for the global economy are gradually changing [

1,

2,

3].

The global energy sector is gradually transforming in favor of the use of alternative energy sources, which is indicated by not only the opinion of the scientific community, but also statistics showing an increase in the share of renewable energy sources in the pattern of primary energy consumption [

4,

5].

New trends associated with the energy transition are also creating new challenges. Researchers all over the world are discussing issues related to how to make this transition, what tools to use, and how to create the necessary institutional conditions, with a particularly large number of studies being devoted to the question of what resources and materials will be needed to make a transition to low-carbon development and commitment in the context of climate change mitigation [

6,

7,

8]. All the results of these studies boil down to the fact that one of the integral components of the energy transition will be metals, and, in particular, rare-earth metals, which are actively used in the creation of clean technologies due to their unique properties [

9,

10,

11,

12,

13,

14]. Today, the properties of rare-earth metals, the conditions of the global REM market (market monopoly), the difficulties of implementing REM projects, and the problems of their being inefficient under the current conditions are widely studied [

15,

16,

17].

A large and growing body of literature has investigated the role of rare-earth metals in the modern economy and assessed their contribution to scientific and technological progress [

18,

19,

20]. They are considered to be critical and strategic types of raw materials, sometimes being called “vitamins of modern society” [

16,

19,

21]. It is discussed in the publicistic works that in the future the competition for access to these metals will be comparable to the competition in the global oil and gas market [

22,

23]. The comparison with the oil market in this context is not accidental. Estimates of the future development of the rare-earth metal industry are increasingly interconnected with the trends in the global energy sector, the structural parameters of which are constantly changing.

Rare-earth elements (REEs) are classified as critically important types of raw materials by many countries of the world (Japan, the USA, Australia, European countries, etc.) [

24,

25,

26]. Of greatest interest in the context of this research are studies in which the degree of criticality of rare-earth metals is studied from the standpoint of their contribution to the green energy sector. An example is a study conducted in 2013 by the U.S. Department of Energy in order to determine the required raw material potential for sustainable development of areas related to green energy. Two key indicators were calculated: significance for green energy and supply risk. When analyzing the former, such indicators as the demand for green technologies and the possibility of replacing certain raw materials were taken into account. Supply risk was assessed based on the political, social, and economic factors existing in the world. According to the results obtained, the highest level of critical importance is possessed by such rare-earth elements as dysprosium, neodymium, terbium, europium, and yttrium, which are characterized by both high importance for the development of green energy (namely production of components for electric vehicles and wind turbines) and a high probability of supply risks [

27].

A number of scientific works have developed predictive estimates of future needs in REMs, taking into account the emerging trends in the field of low-carbon development [

11,

12,

28,

29]. It can be noted that, despite the difference in the applied methods and approaches to calculating the volume of demand, research results show that the demand for these metals in the future will increase. Another issue is that not all experts see the intensification of the use of rare-earth metals as a process that brings only advantages. Those who also discuss disadvantages critically assess how an increase in metal extraction and processing can affect the environment and whether an energy transition based on technologies containing dirty metals can reduce environmental damage, hydrocarbon emissions, and the emissions of other harmful substances [

30].

Paradoxically, rare-earth metals, on the one hand, contribute to the achievement of the global sustainable development goals (SDGs)—Agenda 2030, and, on the other hand, their extraction and processing can produce a negative impact on environmental parameters [

31,

32]. In Russian literature, the issue of the SD in case of REM industry has not been reflected either in scientific sources or in government strategies and programs. However, in foreign sources, this topic has been widely discussed [

32]. Thus, McLellan et al. reflects the relationship between the stages of production of REM products and social, as well as environmental parameters [

33]. In a study by Liang et al. a whole system of factors has been developed, which are necessary for analysis in assessing the sustainability of REM projects. They include social, environmental, economic factors, current technological and logical capabilities of production and processing of REM products [

34]. Nevertheless, this only stimulates interest in this topic, dividing the scientific community into those who believe in the power of rare-earth metals in the context of the energy transition and those who prove the opposite effect from their use.

In one way or another, today’s global energy transition trends affect the economies of all countries of the world, regardless of what kind of contribution a particular state makes to the solution of global environmental problems: the structure of the energy mix is changing, new requirements for technologies are being formed, and so forth. The emphasis in this study is placed on Russia, a country which both has a significant resource potential and strives to shift the focus of its economy from raw materials to low-carbon development and green principles. Despite the relevance of the research topic under consideration for the country, very little research has been devoted to the study of the problem of resource provision for an energy transition. There is a problem of REM deficiency in the country, which is widely covered in Russian scientific and publicistic papers [

35,

36,

37]. There is an opinion that the development of national high-tech industries is impossible without providing domestic industries with the required REEs [

38]. In works by Russian researchers, even an attempt was made to correlate the trend of growing demand for rare-earth metals with the shift of the domestic industry to a «green» development [

39].

2. The Russian REM Industry: In Search of New Development Drivers

Russia, which possesses significant reserves of rare-earth metals, may not consider the factor of resource availability as critical in contrast to European countries, Japan, and South Korea [

60,

61,

62]. Another issue is that at the moment, REM deposits in the country are not actually being developed, which is due to a number of systemic problems at the level of the national industry—a low level of adoption of multipurpose resource use practices, issues associated with the replenishment of mineral deposits, imperfection of current institutional and economic mechanisms, technological limits, and lack of production capacities to manufacture high value-added products, to name a few [

63,

64,

65,

66,

67,

68,

69].

The Lovozero deposit remains the only source of rare-earth elements despite the fact that the country ranks fourth in terms of REM reserves in the world [

62]. The future potential in the context of the REM industry is associated with new projects. However, even despite the availability of technologies, new projects are not being implemented.

Table 1 contains information about the most promising Russian projects for the development of rare-earth metals and their basic data (products, investments, and estimated launch dates) [

62,

70].

Table 1. The key characteristics of prospective REM projects in Russia.

| Deposit/Company |

Products |

Annual Production Capacity for Rare-Earth Metals |

Investments Required |

Estimated Implementation Time |

| Tomtor Deposit/IST Group |

REEs, ferroniobium, didymium |

2.4 thousand tons of REEs |

RUB 53 billion |

2025–2026 |

| Zashikhinskoye Deposit/Technoinvest Alliance |

Ferroniobium, niobium, tantalum, zirconium, rare-earth metals |

240 tons of concentrates of REE oxides |

RUB 27.6 billion |

2024–2025 |

| Afrikanda Deposit /SGK Arkmineral LLC |

Niobium, tantalum, titanium dioxide, rare-earth metals |

400 tons of mixed REE concentrate |

About RUB 70 billion (taking into account the cost of technology) |

2020–2039 |

| Seligdar Deposit |

Apatite concentrate, rare-earth metals |

100 tons of REE concentrate |

RUB 46 billion |

No data available |

According to 2018 data, the level of Russia’s dependency on the supply of rare-earth metals was 81% [

71]. In 2019, the growth in consumption of REMs was accompanied by an increase in imports reaching 1260 tons (in terms of oxides). At the same time, the domestic market for rare-earth metals is incomparable with markets in China, the USA, and Japan in terms of capacity and consumption. This is viewed as an obstacle to the development of the national rare-earth metal industry due to the lack of effective incentives that can give impetus to the implementation of market approaches.

The country’s high import dependency on the supply of rare-earth metals and their compounds jeopardizes chances for developing domestic high-tech industries and improving the economic security of the country under the conditions of increased geopolitical risks and the absence of effective mechanisms for boosting the development of manufacturing capacities required for extracting the necessary elements [

36,

38].

In modern conditions, solving the problems of providing the economy and industry with the necessary rare-earth elements is a challenge greatly affecting the country’s scientific and technological progress in such sectors as green energy, low-carbon development, and so forth [

72]. Speaking of potential growth, the question immediately arises as to whether the Russian economy will be able to provide a sufficient level of demand for rare-earth metals. Despite the global upward trend in the demand for these metals, the Russian market can be classified as poorly developed. While the growth rate of the global REM market is estimated at 10–13%, the same indicator for the national market is only 3–5% [

73]. In global REM production, the share of Russia does not exceed 1.1% [

60].

REM consumption figures in Russia can be called insignificant, despite the fact that the role of high-tech industries is becoming increasingly important for the sustainable development of the Russian economy, especially in the context of the government’s intentions to develop on par with other economically developed countries and move along with the fifth and sixth waves of innovation [

38].

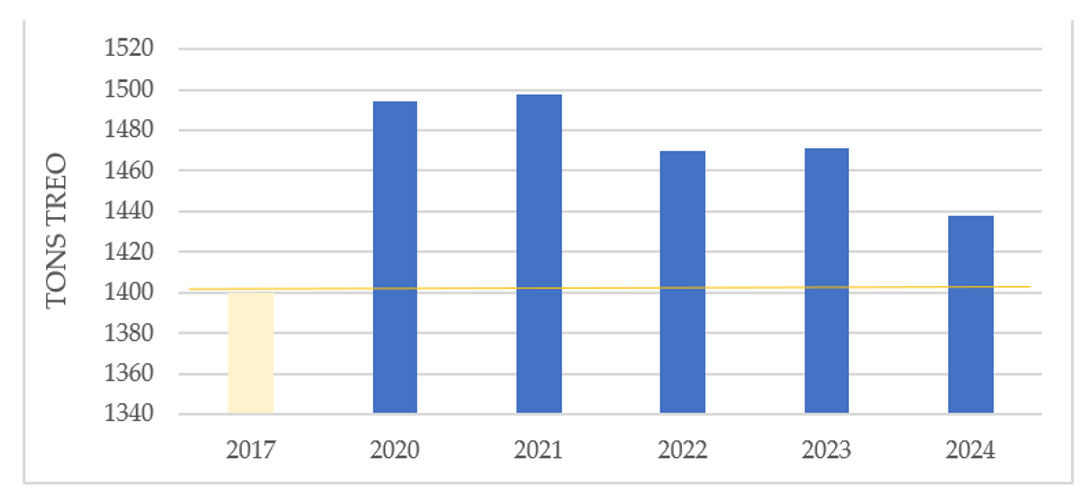

As of 2020, the consumption of rare-earth products did not exceed 1400 tons of TREO. However, as it was established earlier, the demand for rare-earth metals in the world is growing, with one of the factors being the pressure of emerging green trends [

56,

57,

58]. Here, the question arises as to whether this is valid for Russia.

3. Global Energy Transition Trends: The Case of Russia

For the Russian economy, which is exclusively focused on raw materials, the departure from the model based on the sale of hydrocarbon resources should be accompanied by a transition to a low-carbon type of development [

74,

75]. Plans, scenarios, and strategies based on such a development model have become widespread all over the world, and they are becoming adopted in Russia, albeit not on a wide scale [

76].

The trends discussed in the first section of the article gave impetus to discussing paths towards energy transition that the country can take [

77,

78,

79]. There is such a concept as the oil curse (sometimes called “oil needle”), which is characteristic of the Russian economy. However, in the context of the current and projected trends, it becomes unclear how the country can maintain its advantages as a producer of hydrocarbons if they lose their positions in the global market [

47,

75]. Not only are the prices changing, but also the attitude of investors and consumers (ESG concept) [

80]. All this shape a fundamentally new environment in which the existing national economic model may turn out to be unviable.

The first initiatives related to the transition to alternative energy sources in Russia emerged back in 2009, which was associated with the adoption of a government decree defining the priority directions of state policy in the field of developing renewable energy sources. It was planned that by 2015, the scale of the introduction of clean energy technologies would increase significantly, and the share of alternative sources in the national energy mix would reach at least 4.5%. In 2013, special rules were developed for determining the price of capacity for facilities using renewable energy sources in the wholesale market, which allowed the country to join the existing system of capacity supply agreements (CSA) [

47,

81].

At the One Hundred Years of Energy International Forum, Petr Bobylev, Director of the Competition, Energy Efficiency and Ecology Department of the Russian Ministry of Economic Development, said that Russia was building its own energy system, focusing on the strategic goal associated with the transition to low-carbon energy. At the same time, as it was clarified, the country was trying to avoid the “mistakes” of the accelerated transition witnessed in the EU and the United States. Therefore, one should not expect from Russia a rapid pace of development in this direction.

According to IRENA, Russia’s installed renewable energy amounted to 55,000 MW in 2019, demonstrating an increase of 10% from the year before. When compared with other countries, these figures seem insignificant. For example, China has a capacity of 759 thousand MW of renewable power (according to 2019 data). As for Russia, most renewable energy is produced by hydroelectric power plants that were built back in the Soviet era. An overwhelming majority of investments (about 90%) in renewable energy are channeled into solar panels and wind turbines. As of 2019, more than 1.7 GW of renewable energy capacity was commissioned in Russia, most of which is accounted for by solar generation. However, wind power facilities are also being actively built [

42].

On 23 September 2019, Russia ratified the Paris Agreement. The experience of other countries indicates that it is necessary to develop plans to be able to fulfill long-term commitments under this agreement. In particular, for a successful transition to a low-carbon type of development, necessary facilities need to be created [

82]. In January 2020, the Government of the Russian Federation approved the National Action Plan for the first stage of adaptation to climate change for the period up to 2025.

In April 2020, against the background of a high level of instability in the global energy sector, the Energy Strategy of the Russian Federation for the period up to 2035 was approved, according to which the main goal of modern energy development in the country is to move its resource-based energy sector towards a resource-innovative path [

83]. However, it is not clarified how it should be done. It is unclear whether the transition to a resource-innovative energy sector is equivalent to the priorities that countries set themselves in the framework of the global energy transition. In Russian scientific literature, there are different understandings of this term. Some associate it with an increase in investment in the energy sector, the creation of new jobs, and the transition to the production of finished products with higher value added while others interpret it as a synonym of low-carbon development. The said strategy identifies reducing the negative impact of the energy sector on the environment and adapting to climate change as its key goals. At the same time, an increase in coal production is predicted, which goes against these goals [

83,

84].

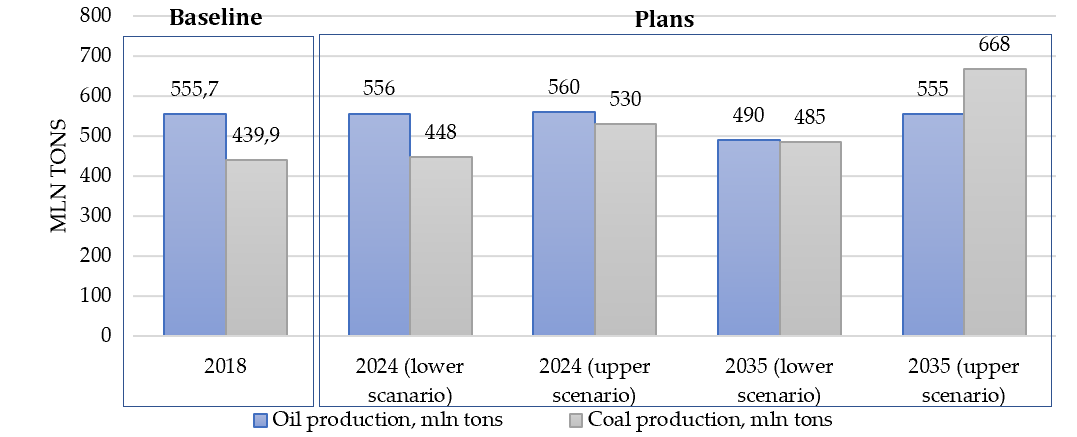

Figure 1 shows forecasts for coal and oil production in Russia until 2035.

Figure 1. Oil and coal production scenarios according to the Energy Strategy of the Russian Federation for the period up to 2035. Source: compiled by the authors based on [

83,

84].

The figure presents so-called lower and upper production scenarios. The former involves the development of the national energy sector while ensuring sustainability and energy security of the country. It is based on the assumption that the growth rate of the national economy will be moderate in the context of a conservative forecast regarding global demand and prices for energy sources. As for the upper scenario, it implies a high rate of economic growth. It assumes that prices for energy sources will grow while the external and internal conditions influencing the energy sector will be favorable (macroeconomic stability, low inflation) [

83,

84]. However, as mentioned earlier, forecasts by international analytical agencies regarding future oil prices suggest the opposite.

Despite the fact that energy transition trends are not reflected in the scenarios described above, the Energy Strategy of the Russian Federation for the period up to 2035 considers the following to be breakthrough technologies for the development of the national energy sector [

83]:

- -Renewable energy sources and energy storage;

- -Hybrid vehicles and electric vehicles, including cars;

- -Hydrogen fuel;

- -Unmanned vehicles and intelligent transport systems; and

- -Network technologies in the electric power industry.

At the same time, it is emphasized that scaling-up these technologies will entail significant technological and organizational changes in the management and operation of electric power systems. It is also noted that these technologies will become the foundation for Russia’s transition to green energy. However, the strategy itself does not provide any specific plans regarding these technologies in terms of the timing of implementation, their output, or consumption, which creates uncertainty as to when exactly the transition mechanisms will be launched in Russia and whether they will be launched at all.

The National Security Strategy of the Russian Federation, which was adopted in July 2021, indicates that two key factors should become priorities in the context of the transformation of the global economy: (1) human capital and (2) environment. The development of low-carbon energy is viewed as one of the key goals of ensuring the country’s economic security [

85].

It can be concluded that Russia has plans to transform the national energy sector. After all, the need for the development of clean energy technologies is reflected in the Energy Strategy of the Russian Federation for the period up to 2035, a legal document [

83]. However, can it be argued that real steps are being taken in this direction?

4. The Way to Green Technologies and Forecasting Demand for Rare-Earth Metals

According to the Energy Transition Index 2020, Russia ranks 80th out of 115 countries with a score of 50.5% (which is 1% higher than in 2019) [

86]. For comparison, Sweden tops the ranking with a score of 74.2%. Russia’s energy transition readiness is estimated at 39% (it did not change from 2019 to 2020). This indicator is based on the analysis of institutional and economic conditions, contribution to the energy transition, the volume of investments, the pattern of the energy mix, and the legal regulation of this area. Also, energy system performance is assessed based on such criteria as energy security, sustainable development, and economic growth. In 2020, Russia’s system performance was estimated at 63%, an improvement of 3.3% compared to 2019. Based on these indicators, we can conclude that the Russian economy demonstrates some shifts towards the energy transition, but in comparison with other countries, the pace of movement is not very high.

4.1. Electric Vehicles

As for specific green technologies, it should be noted that Russia still does not have its own production of electric vehicles. The internal market for electric vehicles is constrained by many factors associated with both the high cost of environmentally friendly vehicles and the lack of the necessary infrastructure [

87,

88]. All electric vehicles sold in Russia are imported, which makes it is surprising that despite the current crisis, sales of new electric vehicles in the country by the end of 2020 increased by 95% compared to 2019.

The Strategy for the Development of the Automotive Industry in the Russian Federation for the period up to 2025 notes that REMs, along with composite materials and electronic components, are irreplaceable materials for the creation of domestic production [

89]. Obviously, as the volume of production of electric vehicles expands, the demand for key components will also increase.

Russia plans to introduce facilities for the production of electric vehicles, which is confirmed by the Concept for the Development of Electric Transportation adopted in 2021. While information about the prospects for creating facilities for the production of electric vehicles used to be fragmentary, now all developments in this direction are becoming systematic. This segment is currently showing some positive results. In 2018, 2383 electric vehicles were sold, including new and used models (0.14% of the total domestic passenger car market). According to PwC forecasts, sales of electric cars in the country will increase in the period from 2019 to 2025 with an average annual growth rate of up to 30% resulting from government support measures [

90]. All this will ultimately stimulate the creation of production facilities for the manufacturing of electric vehicles.

The

Table 2 provides information on the key models of electric vehicles that are planned to be launched on the market in Russia in some future. An interesting fact is that the ZETTA model, which was designed by Russian scientists, does not require rare-earth elements [

91]. Manufacturers replaced electric motors with wheel motors that do not need the use of rare-earth metals. It can be stated that domestic manufacturers, along with European researchers, are looking for material substitutes in order to (a) reduce production costs and (b) minimize the risks of supply disruption.

Table 2. Types of electric vehicles in Russia (preparations for launching production are in progress).

| Name |

Estimated Costs |

Needs for REMs |

| ZETTA (Zero Emission Terra Transport Asset) |

550 thousand rubles |

REMs are not used (this explains the relatively low cost of the proposed vehicles) |

| GAZelle e-NN |

NA |

The first cars will be equipped with Chinese motors and batteries. But over time, manufacturers plan to switch to REM components of domestic production. |

| Cama-1 (St. Petersburg Polytechnic University) |

About 1 million rubles |

Requirements for rare-earth metals were not disclosed |

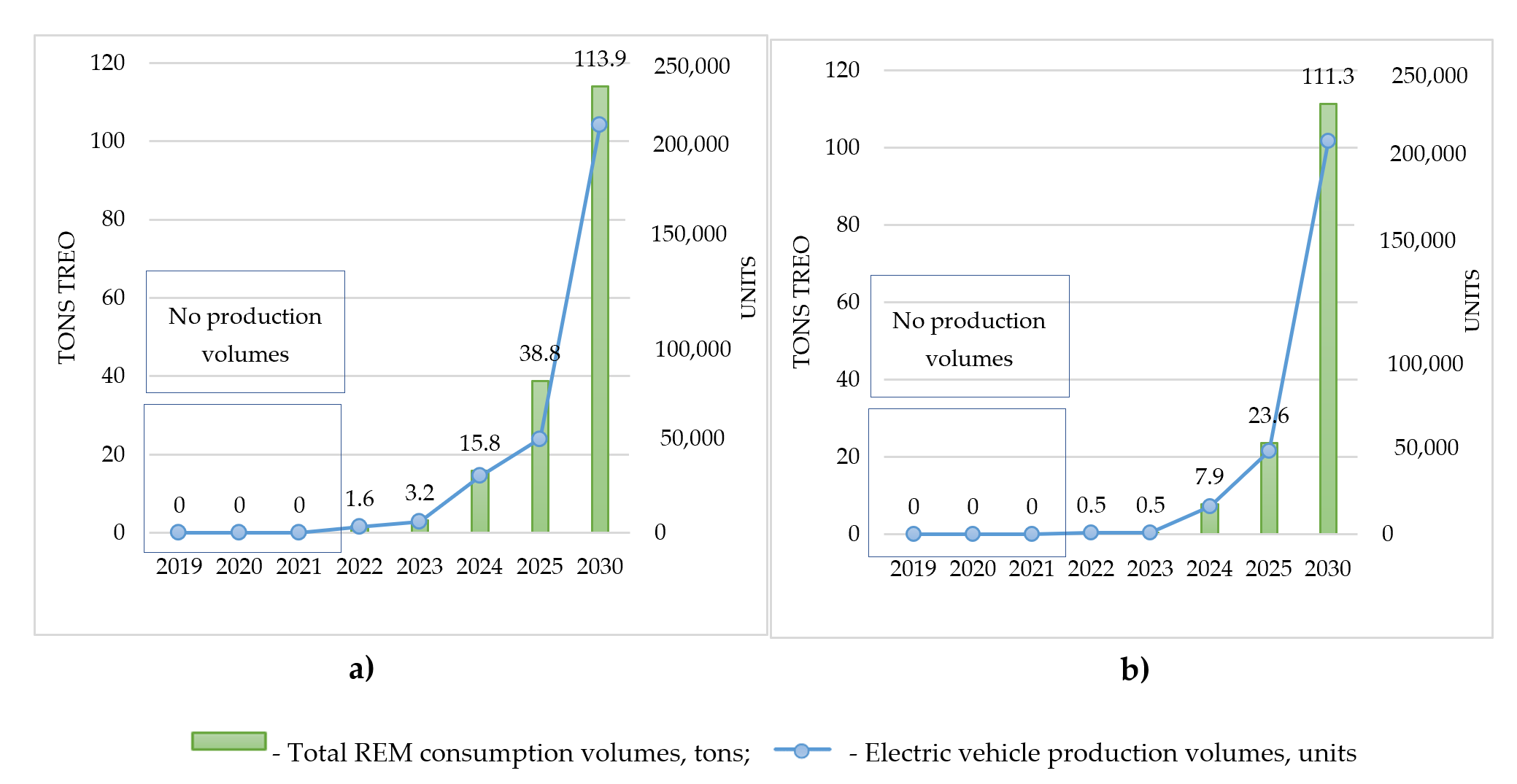

In accordance with the Concept for the Development of Electric Transportation, the first facilities for the production of electric vehicles in Russia should be launched already in 2022 (with an annual production of 5000 electric vehicles). By 2025, this value will grow to 50,000 units (10 times more than in 2022), reaching 217,000 units by 2030. Figure 2a shows the projected REM consumption in the implementation of the plans announced by the state for the production of electric vehicles.

Figure 2. Forecasted REM consumption (a) in the implementation of the plans announced by the state for the production of electric vehicles; (b) in the implementation of the plans announced by the state for the production of electric vehicles without taking into account the ZETTA electric vehicle that does not require REMs.

If we take into account that the projected production volumes (according to the Concept for the Development of Electric Transportation) include electric vehicles produced by ZETTA that do not require components made of rare-earth elements, the demand for metals will be as follows (see Figure 2b). According to production plans, in the first years of production, the volume of production will not exceed 3000 units, and the maximum capacity will be 15,000 units.

The main REM components in the production of electric vehicles are neodymium and dysprosium oxides, which belong to the heavy group of metals [

11]. Their peculiarity is their relatively high cost and relatively low availability (the balance problem). A total of 86% of the required rare-earth metals are neodymium oxides, and 14% are dysprosium oxides.

4.2. Wind Turbines

The capacity of the Russian wind energy market is small and amounts to no more than 1% in the global market. It is believed that Russia is the only major economy in the world in which wind energy is only beginning to take its first steps [

93,

94].

The main obstacle to the development of wind energy in Russia is the insignificant volume of the domestic market guaranteed by the government support program, which is due to the absence of a climate and environmental agenda in the country. At the same time, global energy trends cannot help but influence the national market. The introduction of carbon border tax by the European Union raises concerns not only at the level of the corporate sector, but also at the government level. The availability of the necessary competencies and capacities in the field of wind energy can reduce the economic losses that Russian exporters are likely to bear from the introduction of this type of tax [

93,

94].

It is believed that it is the global challenges that can become the impetus for the development of the wind energy market in Russia. According to IEA, in 2020, renewable energy sources accounted for about 90% of the total volume of newly installed capacities. During the year, 200 GW of new green generation was added globally, with 65 GW being accounted for by wind farms (an increase of 8% compared to 2019) [

95].

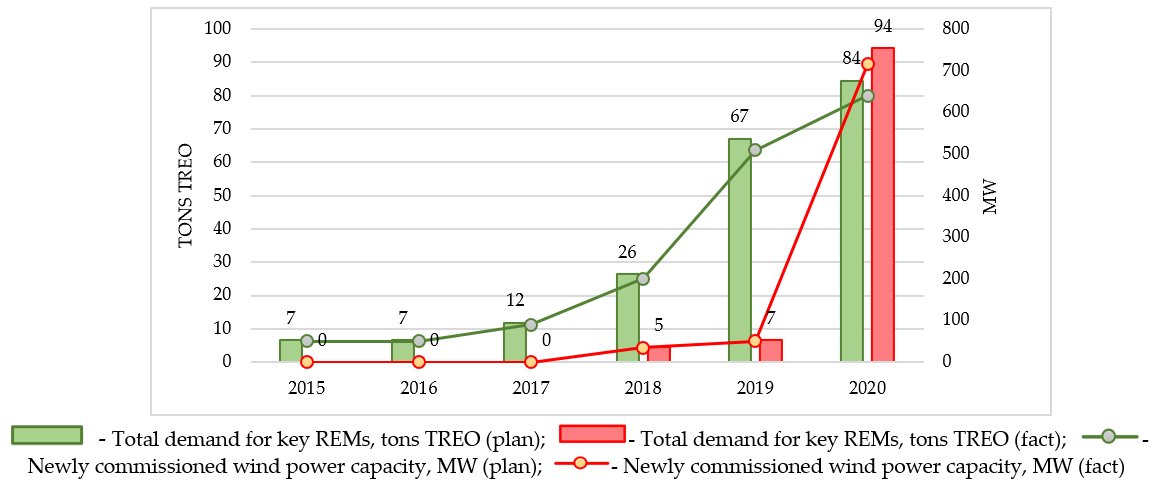

The analysis showed that Russia has plans to commission new wind energy capacities, which are reflected in the Order of the Government of the Russian Federation of January 8, 2009 No. 1-r titled “On Approval of the Main Directions of State Policy in the Field of Increasing the Energy Efficiency of Electric Power Generated on the Basis of Renewable Energy Sources for the Period up to 2035”. However, when comparing the real and planned indicators, it turned out that in the period from 2015 to 2017, the announced plans were not fulfilled. It was planned to commission 51, 50, and 90 MW of energy capacity in 2015, 2016, and 2017, respectively. The failure to meet these plans can be associated with two key factors:

- (1)Excessive requirements for equipment localization;

- (2)Sharp change in the ruble exchange rate in 2014.

Consequently, the approved plans began to be implemented only in 2018. Figure 3 shows data comparing the planned and real values for the commissioning of new wind power capacity in Russia with an assessment of the needs for dysprosium and neodymium (based on average values).

Figure 3. Comparison of planned and actual indicators of wind production capacities in Russia with an assessment of potential requirements for rare-earth materials.

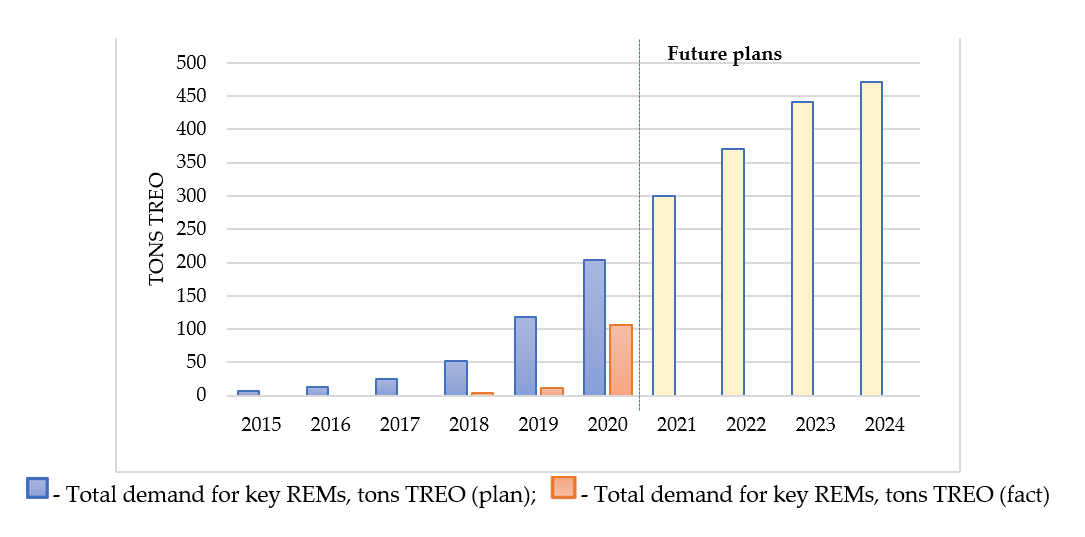

Figure 4 shows the total demand for key REMs in the planned and real commissioning of wind power capacity. Based on the data obtained, it can be seen that in 2020, the planned demand for rare-earth metals was 92% lower than the real demand. At the beginning of 2021, wind farms with a total capacity of about 1 GW operated in Russia, 700 MW of which were commissioned in 2020 despite the existing difficulties and restrictions caused by the COVID-19 pandemic. According to the approved plans, 530, 532.7, and 228.75 MW will be commissioned in 2020, 2023, and 2024, respectively. Based on the data above, the forecasts presented in the figure were made. By 2024, the total demand for REM products will amount to 500 tons of TREO.

Figure 4. Total demand for key REMs (cumulative total).

The demand pattern for specific types of rare-earth metals is similar to that for the production of electric vehicles: up to 90% are neodymium oxides and less than 10% are dysprosium oxides.

5. Prospects for the Development of Russia’s REM Industry in View of Current Trends

According to the previously presented conceptual framework for the development of the rare-earth metal industry, the prospects will largely be determined by the future demand for advanced technologies, including green ones, which influence trends in the global energy transition. Today, the total demand on the national rare-earth metal market varies from 1200 to 1400 tons of TREO, more than 85% of which is imported from other countries (China, the United Arab Emirates, Estonia, etc.).

It was revealed that there is yet no demand for rare-earth metals to be used in electric vehicle production since there is currently no such industry in Russia. As for the wind power sector, the current demand does not exceed 100 tons of TREO, which is no more than 5–7% of the country’s total needs. However, the approved plans indicate that the creation of new production facilities in Russia is not only possible, but will also be implemented in practice in the medium term.

Table 3 presents the results of the analysis of the prospects for the development of the rare-earth metal industry in Russia in the context of the production of green technologies. In addition to the key factors (T1, T2, and M), government regulation and resource availability are also included. In the context of Russia, we believe that additional factors will not become an obstacle to the implementation of the plans for the development of the industry due to (a) the availability of rare-earth metal reserves and (b) the readiness of the government to support the development of the industry: initiatives have been launched, tax measures are being introduced, and there are opportunities to use modern support mechanisms.

Table 3. Analysis of the prospects for the development of the rare-earth metal industry in Russia in the context of green technology production.

| Pillars |

Factors |

| Present |

| Technology Pillar #1 (T1) |

Electric vehicles |

Wind turbines |

| No production |

There are production capacities; a plan for the introduction of new capacities has been developed and approved |

| Market Pillar (M) |

No demand for REMs from this sector |

The annual demand for rare-earth metals does not exceed 100 tons of TREO |

| Technology Pillar #2 (T2) |

Lack of incentives to develop technologies for obtaining REM products |

Technologies for producing neodymium and dysprosium oxides (heavy group of metals) |

| Future (2021 to 2030) |

| Technology Pillar #1 (T1) |

Electric vehicles |

Wind turbines |

| The launch of the first production facilities is planned by 2022 with subsequent growth in production volumes |

Further implementation of the developed plan for the introduction of new wind power capacities until 2024 |

| Market Pillar (M) |

By 2025, the annual demand for rare-earth metals will amount to 7–15 tons of TREO (depending on the models launched into production). By 2030, the demand for REM products will exceed 100 tons of TREO per year |

The annual demand for rare-earth metals will vary between 60 and 70 tons of TREO. By 2024, the total demand for REM products will reach 470 tons of TREO |

| Technology Pillar #2 (T2) |

Technologies for producing neodymium and dysprosium oxides (heavy group of metals) |

Technologies for producing neodymium and dysprosium oxides (heavy group of metals) |

| Additional factors |

| Government regulation |

Government initiatives are aimed at intensifying the development of the national industry of rare-earth metals (fiscal mechanisms are being implemented; there are opportunities to attract additional funding to REM projects) |

| Resource Pillar |

Russia possesses significant REM reserves, ranking fourth in the world |

Figure 5 shows the forecasts of how the demand for REM products in Russia may change in the implementation of plans for the production of electric vehicles and the commissioning of new wind power capacities in 2020–2024.

Figure 5. Forecasts for the increase in demand compared to the baseline indicator (if the plans associated with wind farms and electric vehicles are fulfilled), tons TREO.

This entry is adapted from the peer-reviewed paper 10.3390/en15010387