Although there is no universally accepted definition of governance, and a conceptual framework for governance statistics is still lacking, for the purpose of this article, i.e., to investigate the convergence of CEE countries as a potential result of the transfer of Western formal institutions to those countries, the latest edition of the Worldwide Governance Indicators (WGI) dataset was used. Based on a long-standing research programme by the World Bank, the Worldwide Governance Indicators (WGI) capture six key dimensions of governance (Voice and Accountability, Political Stability and Lack of Violence, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption) in the period between 1996 and 2019. Thus, in the following lines, we first analyse the institutional quality in CEECs based on the VoC approach, after which we empirically test the σ- and unconditional β-convergence in selected groups of countries.

1. Quantitative Analysis of Institutional Quality in EU Based on the VoC Approach

Institutions are recognized as a fundamental determinant of long-run growth in the literature [

55]. Additionally, there is a vast amount of literature proving that that institutional convergence is related to convergence in terms of GDP per capita (i.e., real or economic convergence), i.e., previous research shows a strong correlation between good governance and a higher level of per capita GDP. Although there are usually some issues with endogeneity in such research, and the correlation between the two variables does not reveal much information on the direction of causality, it is nonetheless generally accepted that good governance, while important in and of itself, can also help in improving a country’s economic prospects [

56], i.e., that the quality of governance matters for growth and development. However, although governance quality in general matters for growth and development, it also varies across dimensions of governance and a country’s level of prosperity. Precisely, according to the contemporary data, most indicators point out that quality of governance, or ‘good governance’, is generally higher on average within the EU-28 member states as compared with other world regions, yet there is significant variation among the countries in the EU [

57]. Moreover, recent research shows that fast reforming transition countries (i.e., countries that applied a 'shock therapy' approach) have outperformed the gradual reformers

[1]The novelty of our research is that we follow the VoC approach, based on which, taking into consideration institutional prototypes of the economic system [

13], the EU countries can be grouped into the following groups of countries: Liberal, Nordic, Continental, Mediterranean, Central and Eastern European countries with a coordinated market system, and Central and Eastern European countries with a liberal market (as presented in the

Table 2).

Table 2. EU countries grouped according to the VoC approach.

| Liberal |

Nordic |

Continental |

Mediterranean |

CEECs with a Coordinated Market System |

CEECs with a Liberal Market System |

| UK |

Finland |

Belgium |

Greece |

Hungary |

Bulgaria |

| Ireland |

Denmark |

Netherland |

Italy |

Poland |

Slovakia |

| |

Sweden |

Germany |

Portugal |

Czech Republic |

Romania |

| |

|

Austria |

Spain |

Croatia |

Latvia |

| |

|

France |

|

Slovenia |

Estonia |

| |

|

|

|

|

Lithuania |

When analysing the sources measuring some aspect of the quality of governance in European countries, WGI is considered to provide the best tools to make reliable and meaningful comparisons within the EU at the national level [

57]. Additionally, the WGI captures the main components of the EU standard of good governance: liberal democracy and governance capacity [

58]. Furthermore, based on a long-standing research program of the World Bank, the WGI captures six key dimensions of governance—Voice and Accountability, Political Stability and Lack of Violence, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption—in the period from 1996 to 2019. These indicators evaluate the quality of governance in over 200 countries, from close to 40 sources of information prepared by over 30 organizations worldwide, and have been updated on a yearly basis since 2002. Additionally, these six dimensions of governance should not be considered as being some way independent of one another. Although the main criticisms of this measure are based on the fact that they are all subjective measures, they are nonetheless the most extensive in terms of country coverage and various aspects of institutional quality [

4]. According to the WGI aggregation methodology, the six aggregate indicators are reported in two different ways: (1) in their standard normal units, ranging from approximately −2.5 to 2.5, and (2) in percentile rank terms from 0 to 100, with higher values corresponding to better outcomes. The standard normal units are used in the analysis [

59].

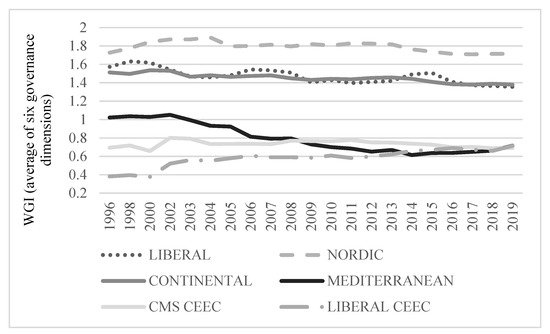

When analysing the changes in WGI (average for all six dimensions) over time (

Figure 1), data show a strong persistence in governance scores and regional rankings. We can see that there are two groups of countries from this aspect—there is a significant and consistent gap between the Nordic, Continental, and Liberal countries, on the one hand (first group), and the Mediterranean and CEE countries (second group), on the other hand. Moreover, in the observed period, the Mediterranean countries have even reduced their scores, while CEEC LME countries have improved their scores the most. In terms of policy, the results of descriptive analysis indicate that CEE countries still strive for stronger control of corruption, more operative government, better rule of law, and higher regulatory quality. Based on the trends explored, it is likely to expect the Nordic countries to remain the top performers and Liberal and Continental countries to come closer to them in the medium- or long-run. Yet, it is highly unlikely that Mediterranean and CEEC will join the three leading groups of countries anytime soon. This result is in line with the findings of the University of Gothenburg [

57], which highlight that a group of old EU members, such as Germany, Sweden, the Netherlands, Denmark, or Finland, exhibits steadily high levels of quality of government irrespective of the particular index used to capture good governance. In addition to their finding, we have shown that some of the members in that group of countries have surprisingly low levels of governance quality (i.e., Mediterranean countries). Additionally, Glawe and Wagner [

5], analysing the formation of institutional convergence clusters within the EU over the period from 2002 to 2018 by using Phillips and Sul’s log t test, pointed to the existence of multiple institutional clubs for the WGI dimensions “government effectiveness”, “regulatory quality”, “rule of law”, and “control of corruption”, as well as for the mean of these four indicators. Precisely, the authors outline a northwest-southeast divide for all indicators, where among the NMS, the Baltic States perform best, whereas the rest of NMS and Mediterranean countries are rather stuck in poor institutional traps.

Figure 1. Changes over time in WGI, 1996–2018. Source: Authors’ calculation using World Bank—Worldwide Governance Indicators (WGI) online database [

60]. Note: WGI average of six key dimensions of governance: Voice and Accountability (VA), Political Stability and Lack of Violence (PSAV), Government Effectiveness (GE), Regulatory Quality (RQ), Rule of Law (RoL), and Control of Corruption (CoC).

4.2. Sigma (σ) and Unconditional β-Convergence

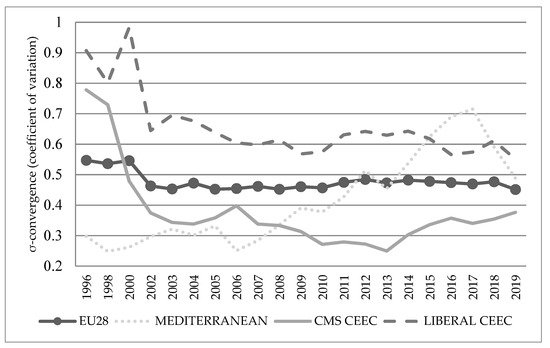

In order to grasp the causes of previously described trends, in further steps, we calculated the coefficient of variation as a measure of dispersion for selected groups of countries in order to test for the σ-convergence (in the period from 1996 to 2019) (Figure 2). The application of σ-convergence is somewhat problematic because the ‘Liberal’ cluster combines two countries only. More generally, based on the low number of observations within some clusters, the variance within clusters is sensitive to changes in one country, and differences between clusters are, hence, difficult to interpret with respect to their significance. Therefore, in the next step, we compare CEECs with the EU28 average on one side and Mediterranean countries on the other side.

Figure 2. Institutional σ-convergence in CEECs based on VoC approach. Source: Authors’ calculation using World Bank—Worldwide Governance Indicators online database [

60].

As it is assumed that σ-convergence is present when the coefficient of variation shrinks between the periods, the presented data show that the largest trend in institutional divergence is recorded in the group of Mediterranean countries.

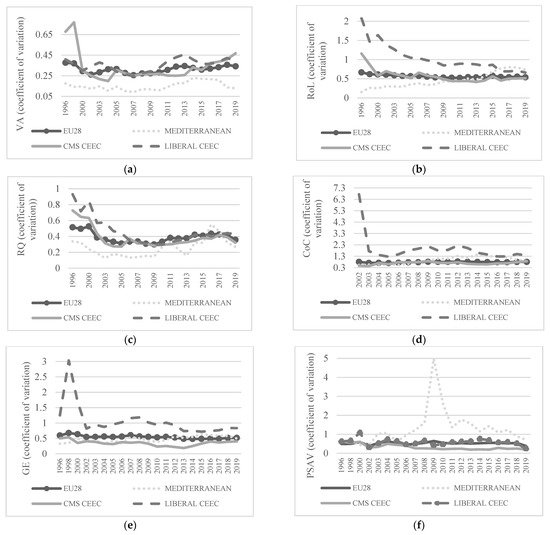

We also look at the σ-convergence for all six dimensions contained in the WGI: Voice and Accountability (VA), Rule of Law (RoL), Regulatory Quality (RQ), Control of Corruption (CoC), Government Effectiveness (GE), and Political Stability and Absence of Violence (PSAV) (Figure 3).

Figure 3. Institutional σ-convergence: specific dimensions of WGI. Source: Authors’ calculation using World Bank—Worldwide Governance Indicators online database [

60]. Notes: (

a) VA (Voice and Accountability), (

b) RoL (Rule of Law), (

c) RQ (Regulatory Quality), (

d) CoC (Control of Cor-ruption), (

e) GE (Government Effectiveness), and (

f) PSAV (Political Stability and Absence of Violence).

We see differences within various dimensions of WGI, as well as across time, especially before and after the 2008 crisis. In the group of Mediterranean countries, there is an evident trend of divergence in all dimensions, except in Government Effectiveness. In the Liberal CEEC group, there is evident convergence in the Rule of Law dimension for the whole period observed and in the pre-crisis period within the Regulatory Quality dimension. Within the CMS CEEC group, we can see the convergence trends in all dimensions.

In the next step, we test the unconditional beta (β) convergence, performing a cross-section regression analysis in which the change of institutional quality

g in the 1996–2019 period is regressed on the initial level of institutional quality

I0,i:

where the parameter

β shows the speed of convergence towards a unique steady state. The negative and significant coefficient implies convergence. Generally, β-convergence models stem from economic growth theories. The models capture the relationship between initial per capita income and subsequent growth. Two models can be used: unconditional β-convergence or conditional β-convergence, which controls for other growth factors. The β-convergence occurs when the parameter

β is negative and statistically significant, whereas a positive value of

β implies the presence of divergence. Finally, if the parameter

β is not statistically significant, we conclude that there is neither convergence nor divergence [

3].

We test the convergence for an average of all six dimensions of governance contained in the WGI (IQ

avg) and the following specific dimensions: rule of law (RoL), regulatory quality (RQ), government effectiveness (GE), and control of corruption (CoC). We selected these four dimensions in accordance with claims of Savoia and Sen [

4] who pointed out that these are a very good proxy for all aspects of legal and administrative institutional quality. We also calculate β-convergence for Mediterranean countries and for the EU25 (Cyprus, Malta, and Luxemburg are excluded from the analysis) average, in order to compare their convergence paths to the one of the CEECs.

As one of the contributions of our paper is in introducing the VoC approach into the discussion, we obtained interesting results for countries divided according to this classification (Table 3). At the average level of institutional quality (IQavg), the results show convergence at the level of CMS CEECs and the level of EU25, while in the Mediterranean group of countries, we observe divergence. The results for CMS CEECs show convergence in the dimensions Rule of Law, Regulatory Quality, and Control of Corruption, while the model with the Government Effectiveness dimension is not significant. Next, concerning the Liberal CEECs, the results point to convergence in the Regulatory Quality dimension and divergence in the Rule of Law and Government Effectiveness dimensions. The other models are not significant.

Table 3. Regression analysis results.

Countries’ Group

Dimension

of Institutional Quality |

Liberal CEECs |

CMS CEECs |

Mediterranean |

EU25 |

| RoL |

β 0.3274 ** |

β −0.6889 * |

Model not significant |

β −0.3386 *** |

| (0.0717) |

(0.2330) |

(0.1092) |

| R2 0.27 |

R2 0.74 |

R2 0.29 |

| RQ |

β −0.2902 ** |

β −0.6281 * |

Model not significant |

β −0.3422 *** |

| (0.1057) |

(0.2357) |

(0.0815) |

| R2 0.65 |

R2 0.70 |

R2 0.43 |

| GE |

β 0.4852 * |

Model not significant |

Model not significant |

β −0.2945 *** |

| (0.2108) |

(0.0958) |

| R2 0.57 |

R2 0.29 |

| CoC |

Model not significant |

β −0.6357 * |

Model not significant |

β −0.2116 ** |

| (0.2557) |

(0.0835) |

| R2 0.67 |

R2 0.22 |

| IQavg |

Model not significant |

β −0.7091 ** |

β 0.1259 * |

β −0.3110 *** |

| (0.2218) |

(0.0393) |

(0.0799) |

| R2 0.77 |

R2 0.83 |

R2 0.39 |

This entry is adapted from the peer-reviewed paper 10.3390/su132413822