Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Business, Finance

|

Environmental Sciences

Environmental, Social and Governance (ESG) is currently one of the main focus areas for policy makers worldwide.

- European Union

- corporate governance

- sustainable finance

- Environmental

- ESG

- Environmental Social Governance

1. Introduction

In December 2016, the European Commission formed a high-level expert group (HLEG) to develop an overarching and detailed EU sustainable finance strategy. On 31 January 2018, the HLEG released its final report [1]. This report presented an holistic view of European sustainable finance and established two financial system imperatives. The first is to increase finance’s commitment to long-term, inclusive development. The second goal is to improve financial stability by fostering the awareness about environmental, social and governance (ESG) issues while making investment decisions. The United Nations-backed Principles for Responsible Investment Directive 2016/234 incorporates ESG considerations into the EU legislative framework. The increased attention by policy makers toward this topic has also been followed by an improved appetite of financial investors for ESG funds. According to the ECB’s Financial Stability Review, the Asset Under Management (AUM) of these funds has increased by 170%, soaring from 500 billion USD in 2015 to more than 1.3 trillion USD in 2020 [2].

As suggested by the United Nations Environment Programme (UNEP) Inquiry and the Principles for Responsible Investment (PRI), we can refer to ESG as the following: (i) Environmental (E) issues are related to the natural environment and natural systems; (ii) Social (S) issues refer to the rights of people and communities; and (iii) Governance (G) issues pertain to corporate governance of firms.

2. Current European Regulatory Framework for Banking Institutions with Reference to the ESG Principles

Specific disclosure requirements have been introduced in the current European regulatory framework for industrial companies and for banks alike in order to support the implementation of the so-called European Green Deal [3].

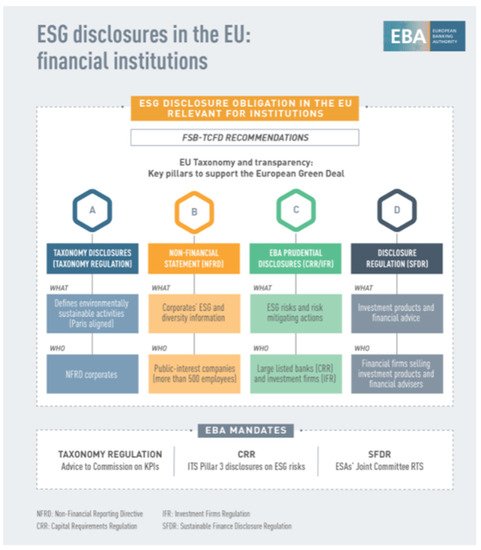

Figure 1 summarises the disclosure requirements for banks under the current European regulatory framework.

Figure 1. Relevant disclosure rules in the EU. Source: European Banking Authority [4].

As shown in Figure 1, the Taxonomy Regulation, that came into force in 2020, introduces some criteria for the classification of the activities performed by industrial companies based on their environmental sustainability (in line with the provisions of the Paris Climate Agreement). The definition of specific criteria for the classification of the activities performed by industrial companies provides more clarity regarding the environmental sustainability of the firms’ businesses.

The Non-Financial Reporting Directive (NFRD) imposes additional disclosure requirements on listed industrial companies with more than 500 employees. The aim of this directive is to improve the quality of data available to banks and investors to direct financial resources toward sustainable investments.

Furthermore, following the introduction of the so-called CRR2 (i.e., Capital Requirements Regulation) the European significant banks are expected to disclose in the information provided to investors the risks related to ESG factors to which they are exposed, and the related mitigating actions being undertaken to reduce their severity.

Finally, in 2021, the Financial Services Sustainability Disclosure Regulation (SFDR) also came into force. This regulation introduces a new set of rules that is aimed at making the sustainability profile of funds and financial products more comparable and easier for investors to understand. The new rules will lead to the classification of financial products in specific types by including metrics to assess their environmental, social and governance (ESG) impacts.

It has also been noticed that the EBA has been given three specific mandates to further enforce the introduction of the ESG principles in the European banking regulation. Under the taxonomy regulation, the EBA has been requested to propose to the European Commission a number of key performance indicators (KPIs), together with the related methodology for the disclosure by credit institutions and by investment firms, on how and to what extent their activities qualify as environmentally sustainable. In its opinion released in March 2021 [5], the EBA underlined the importance of the green asset ratio (GAR) as a key means to understand how institutions are financing sustainable activities and meeting the Paris agreement targets.

In March 2021, the EBA also published a consultation paper on draft implementing technical standard (ITS) [6] on Pillar 3 disclosures on environmental, social and governance risks as a response to the second mandate highlighted in Figure 1. In line with the requirements laid down in the Capital Requirements Regulation (CRR), the draft ITS proposes comparable quantitative disclosures on climate-change related transition and physical risks, including information on exposures towards carbon related assets and assets subject to chronic and acute climate change events. They also include quantitative disclosures on institutions’ mitigating actions supporting their counterparties in the transition to a carbon neutral economy and in the adaptation to climate change. In addition, they request significant banks to disclose their GAR. The green asset GAR identifies the institutions’ assets financing activities that are environmentally sustainable according to the EU taxonomy, such as those consistent with the European Green Deal and the Paris agreement goals. Finally, the draft ITS provides qualitative information on how institutions are embedding ESG considerations in their governance, business model and strategy and risk management framework.

The new banking regulation package, CRR2 and CRDV (i.e., Capital Requirements Directive), has also provided a number of mandates to the European Banking Authority (EBA) to issue specific regulations and guidelines for banks and supervisory authorities with regards to the sustainable finance.

Figure 2 summarises the main mandates that have been provided to the EBA through the new banking regulatory package.

Figure 2. EBA mandates concerning sustainable finance legislation. Source: European Banking Authority [7].

The first mandate (also mentioned in Figure 1), stemming from the introduction of the SFDR, that was given to the European Banking Authority (EBA) and the other two authorities that are part of the European Supervisory Authorities (ESMA and EIOPA) led to the introduction of a binding technical standard that provides detailed indications on how financial investors must communicate the potential negative impacts of their investment choices (through the disclosure of specific indicators) on sustainability factors [8]. Furthermore, the technical standard also provides detailed indications on the pre-contractual information on sustainability issues to be provided when placing financial products on the market.

The second mandate entrusts the EBA with the task of exploring the possibility of introducing ESG risk factors within the Supervisory Review and Evaluation Process (SREP) and the regulatory stress tests.

Indeed, the EBA sees a need to strengthen institutions’ integration of ESG risks into their business objectives and procedures, as well as to include ESG risks appropriately into their internal governance frameworks. Adapting an institution’s business plan to include ESG risks as drivers of prudential risks might be regarded as a progressive risk management method for mitigating the potential impact of ESG risks. Additionally, the EBA sees a need to gradually develop methodology and approaches for conducting a climate risk stress test, while taking methodological and data constraints into account. The purpose of a climate risk stress test should be to inform institutions about their own business models and investment strategies’ resilience. However, supervisors’ current assessment of credit institutions under the Supervisory Review and Evaluation Process (SREP) may not be sufficient to enable them to comprehend the longer-term impact of ESG risks, their breadth and magnitude, on future financial positions and associated long-term vulnerabilities. In this context, the EBA believes that a new area of analysis should be added to supervisory assessment: determining whether credit institutions adequately test the long-term resilience of their business models against the time horizons of relevant public policies or broader transition trends, i.e., beyond commonly used timeframes of 3–5 years or potentially even the 10-year horizon already applied in some jurisdictions [9].

Finally, another mandate requires the EBA to support the work of the group of experts (set up by the European Commission) on sustainable finance. EBA is expected to provide its technical support on issues, such as the update of the taxonomy of sustainable assets, the definition of binding standards for the identification of so-called “Green Bonds” and the issuance of guidelines on the disclosure of information relating to climate risk.

In addition to the mandates specifically received by the European Commission, the EBA has recently updated its guidelines on loan origination and monitoring targeted to banks [10]. In these guidelines, it is explicitly requested that banks incorporate ESG risk factors in the definition of their credit risk appetite and in their credit risk management practices.

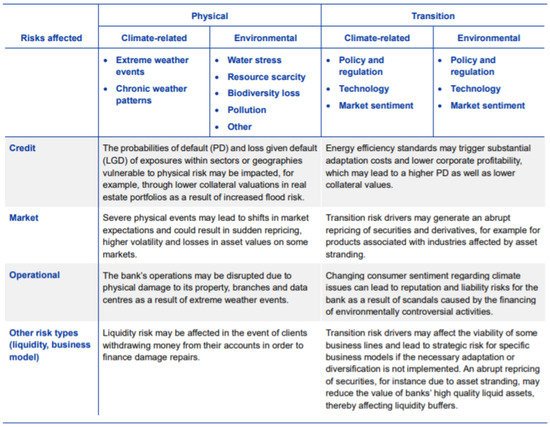

Furthermore, the Single Supervisory Mechanism (European Central Bank), the supervisory authority of the significant banks of the 19 Eurozone countries, has issued its own guide on climate and environmental risks in which it sets out the expectations with regard to the management of such risks and the related disclosure to investors [11]. The table below (Figure 3) shows the main impacts on the various risk categories highlighted in the guide issued by the European Central Bank.

Figure 3. Examples of climatic and environmental risk factors. Source: European Central Bank [11].

As reported in the table above, the credit risk area might be negatively impacted by the physical risk through the lower collateral valuations in real estate portfolios in areas that are highly exposed to flood risk. This, in turn, may negatively affect the PDs and LGDs of these portfolios. Similarly, severe climate events might lead to shifts in the market sentiment that could trigger a market crash. Extreme climate events might also have a negative impact on operational risk as they could entail physical damages to the credit institutions’ premises and properties causing disruptions in the provision of services.

Moreover, the EBA recognizes that the qualitative and quantitative indicators, metrics, and procedures available to institutions for risk assessment may be more sophisticated for environmental hazards than for social and governance concerns. Thus, institutional management of ESG risks, as well as the incorporation of ESG risks into monitoring, may first prioritize environmental issues. Nonetheless, developments in this policy area, especially the further development of the EU Taxonomy Regulation, will progressively enable institutions and regulators to use and incorporate social and governance indicators into the management and supervision of ESG risks [9].

This entry is adapted from the peer-reviewed paper 10.3390/su132212641

References

- European Commission. Financing a Sustainable Economy. Final Report by the High-Level Expert Group on Sustainable Finance; European Commission: Brussels, Belgium, 2018; pp. 6–8.

- European Central Bank. Financial Stability Review; European Central Bank: Frankfurt am Main, Germany, 2020; p. 94.

- A European Green Deal. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en (accessed on 14 October 2021).

- EBA. EBA Acknowledges Adoption by the European Commission of Standards on Institutions’ Public Disclosures. Available online: https://www.eba.europa.eu/eba-acknowledges-adoption-european-commission-standards-institutions%E2%80%99-public-disclosures (accessed on 14 October 2021).

- EBA. Call for Advice to the European Supervisory Authorities on Key Performance Indicators and Methodology on the Disclosure of How and to What Extent the Activities of Undertakings under the NFRD Qualify as Environmentally Sustainable as Per the EU Taxonomy. Available online: https://www.eba.europa.eu/sites/default/documents/files/document_library/About%20Us/Missions%20and%20tasks/Call%20for%20Advice/2021/CfA%20on%20KPIs%20and%20methodology%20for%20disclosures%20under%20Article%208%20of%20the%20Taxonomy%20Regulation/963620/Letter%20to%20EC%20-%20CfA%20Article%208%20Taxonomy%20Regulation.pdf (accessed on 14 October 2021).

- Consultation Paper on Draft ITS on Pillar 3 Disclosures on ESG Risks. Available online: https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Consultations/2021/Consultation%20on%20draft%20ITS%20on%20Pillar%20disclosures%20on%20ESG%20risk/963621/Consultation%20paper%20on%20draft%20ITS%20on%20Pillar%203%20disclosures%20on%20ESG%20risks.pdf (accessed on 14 October 2021).

- Sustainable Finance. Available online: https://www.eba.europa.eu/financial-innovation-and-fintech/sustainable-finance (accessed on 14 October 2021).

- JC 2021 03-Joint ESAs Final Report on RTS under SFDR. Available online: https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Draft%20Technical%20Standards/2021/962778/JC%202021%2003%20-%20Joint%20ESAs%20Final%20Report%20on%20RTS%20under%20SFDR.pdf (accessed on 14 October 2021).

- 2020-10-15 BoS-ESG report MASTER FILEcl. Available online: https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Discussions/2021/Discussion%20Paper%20on%20management%20and%20supervision%20of%20ESG%20risks%20for%20credit%20institutions%20and%20investment%20firms/935496/2020-11-02%20%20ESG%20Discussion%20Paper.pdf (accessed on 14 October 2021).

- Guidelines on Loan Origination and Monitoring. Available online: https://www.eba.europa.eu/regulation-and-policy/credit-risk/guidelines-on-loan-origination-and-monitoring (accessed on 14 October 2021).

- ECB. ECB Publishes Final Guide on Climate-Related and Environmental Risks for Banks. Available online: https://www.bankingsupervision.europa.eu/press/pr/date/2020/html/ssm.pr201127~5642b6e68d.en.html (accessed on 14 October 2021).

This entry is offline, you can click here to edit this entry!