The given research paper examines the characteristics of German private investors regarding the probability of using robo-advisory-services. The used data set was gathered for this purpose (N = 305) to address the research question by using a logistic regression approach. The presented logit regression model results indicate that the awareness of sustainable aspects make a significant difference in the probability of using a sustainable robo-service. Additionally, our findings show that being male and cost-aware are positively associated with the use of a sustainable robo-advisor. Furthermore, the probability of use is 1.53 times higher among young and experienced investors. The findings in this paper provide relevant research findings for banks, asset managers, FinTechs, policy makers and financial practitioners to increase the adoption rate of robo-advice by introducing a sustainable offering.

- robo-advisory

- sustainability

- innovation

- financial services

- asset management

1. Introduction

1.1. Sustainability Preferences in Personnel Finance of Private Investors

1.2. Robo-Advisory as Financial Innovation

2. Materials and Methods

2.1. Research Hypotheses

| Hypothesis | |

|---|---|

| H1 | The likelihood of using a sustainable robo-advisor is higher among male investors. |

| H2 | The higher the age, the higher the likelihood to use a sustainable robo-advisor. |

| H3 | The likelihood of using a sustainable robo-advisor is higher among academics. |

| H4 | The likelihood of using a sustainable robo-advisor is higher among investors with investment experience. |

| H5 | If the reason for investing is long-term oriented, the likelihood of using a sustainable robo-advisor is higher. |

| H6 | The likelihood of using a sustainable robo-advisor is higher among investors preferring professional finance advice. |

| H7 | The higher the risk appetite, the higher the likelihood of using a sustainable robo-advisor. |

| H8 | The higher the demand for investment transparency, the higher the likelihood of using a sustainable robo-advisor. |

| H9 | The higher the cost-awareness, the higher the likelihood of using a sustainable robo-advisor. |

| H10 | The higher the importance for ecological aspects, the higher the likelihood of using a sustainable robo-advisor. |

| H11 | The higher the importance for social aspects, the higher the likelihood of using a sustainable robo-advisor. |

| H12 | The higher the importance for governance aspects, the higher the likelihood of using a sustainable robo-advisor. |

2.2. Main Procedures & Statistical Analysis

3. Results

| Coefficient | Std. Error | z | p-Value | ||

|---|---|---|---|---|---|

| const | −8.69691 | 1.78710 | −4.867 | <0.0001 | *** |

| MALE | 0.741439 | 0.301207 | 2.462 | 0.0138 | ** |

| AGE | 0.0914433 | 0.0361638 | 2.529 | 0.0115 | ** |

| EDUC_DUMMY | 0.671967 | 0.303410 | 2.215 | 0.0268 | ** |

| INVESTED_ALREADY | −0.284926 | 0.492762 | −0.5782 | 0.5631 | |

| REASONS_INVESTING | 0.0630840 | 0.377005 | 0.1673 | 0.8671 | |

| ADVISING_INVESTMENTS | 0.931415 | 0.279045 | 3.338 | 0.0008 | *** |

| RISK | 0.0928086 | 0.171748 | 0.5404 | 0.5889 | |

| TRANSPARENCY | −0.118239 | 0.244411 | −0.4838 | 0.6285 | |

| COST_AWARENESS | 0.371011 | 0.181503 | 2.044 | 0.0409 | ** |

| ECOLOGICAL | 0.743656 | 0.193921 | 3.835 | 0.0001 | *** |

| SOCIAL | 0.00317336 | 0.211120 | 0.01503 | 0.9880 | |

| GOVERNANCE | 0.200450 | 0.144973 | 1.383 | 0.1668 | |

| Mean dependent var | 0.455738 | S.D. dependent var | 0.498855 | ||

| McFadden R-squared | 0.209759 | Adjusted R-squared | 0.147917 | ||

| Log-likelihood | −166.1191 | Akaike criterion | 358.2381 | ||

| Schwarz criterion | 406.6022 | Hannan-Quinn | 377.5828 | ||

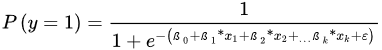

with

- P(y=1): Observing probability of an analyzed event, that y = 1;

- e: Base of the natural logarithm (Euler’s number);

- xk: Independent variables;

- ßk: Regression coefficients of independent variables;

- ε:Error value.

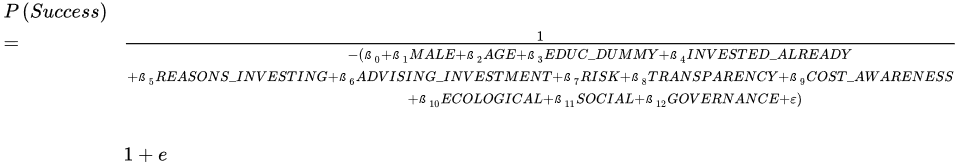

With regards to the final model presented in Table 2, the adjusted logistic regression model is given by:

| Independent Variable | Variance Inflation Factor |

|---|---|

| MALE | 1194 |

| AGE | 1100 |

| EDUC_DUMMY | 1110 |

| REASONS_INVESTING | 1097 |

| ADVISING_INVESTMENTS | 1092 |

| RISK | 1392 |

| TRANSPARENCY | 1469 |

| COST_AWARENESS | 1332 |

| ECOLOGICAL | 2580 |

| SOCIAL | 2611 |

| GOVERNANCE | 1473 |

| Significant Independent Variable | Coefficient | Odds Ratio |

|---|---|---|

| MALE | 0.741439 | 2.098953737 |

| AGE | 0.0914433 | 1.095754646 |

| EDUC_DUMMY | 0.671967 | 1.958085088 |

| ADVISING_INVESTMENTS | 0.931415 | 2.538098047 |

| COST_AWARENESS | 0.371011 | 1.449199014 |

| ECOLOGICAL | 0.743656 | 2.103612279 |

| Hypothesis | Testing Result | |

|---|---|---|

| H1 | The likelihood of using a sustainable robo-advisor is higher among male investors. | Fail to reject |

| H2 | The higher the age, the higher the likelihood to use a sustainable robo-advisor. | Fail to reject |

| H3 | The likelihood of using a sustainable robo-advisor is higher among academics. | Fail to reject |

| H4 | The likelihood of using a sustainable robo-advisor is higher among investors with investment experience. | Fail to reject |

| H5 | If the reason for investing is long-term oriented, the likelihood of using a sustainable robo-advisor is higher. | Rejected |

| H6 | The likelihood of using a sustainable robo-advisor is higher among investors preferring professional finance advice. | Fail to reject |

| H7 | The higher the risk appetite, the higher the likelihood of using a sustainable robo-advisor. | Rejected |

| H8 | The higher the demand for investment transparency, the higher the likelihood of using a sustainable robo-advisor. | Rejected |

| H9 | The higher the cost-awareness, the higher the likelihood of using a sustainable robo-advisor. | Fail to reject |

| H10 | The higher the importance for ecological aspects, the higher the likelihood of using a sustainable robo-advisor. | Fail to reject |

| H11 | The higher the importance for social aspects, the higher the likelihood of using a sustainable robo-advisor. | Rejected |

| H12 | The higher the importance for governance aspects, the higher the likelihood of using a sustainable robo-advisor. | Rejected |

-

Practical implications

-

Regarding H1: the collected data set consists of 47.2% (144 respondents) male online participants with an average age of 28, which is also the average age of the whole population. The findings indicate that a primary focus on male investors may have the highest chance of winning new clients for the robo-advisory-service. Strategic marketing operations could target young and male clients, who have typically finished their studies in that life period and started to earn money from employment.

-

Regarding H2: the higher the age, the higher the probability to use a sustainable robo-advisor. This may refer to various factors, which are not subject to this study. Some hypotheses may be eligible to state, that there is a positive correlation between the age and the available household income. Furthermore, another valid hypothesis could be that there is a positive correlation between the age and the interest in sustainable investment matters. Robo-advisors should consider that a profitable foundation is grounded on a healthy balance between young clients (e.g., as stated in H1) and older clients with a more beneficial financial status. The sole emphasis on young clients with an average age of 28 may not be sufficient to cover business expenses and to lead to a positive annual result.

-

Regarding H3: academics are more likely to use a sustainable robo-offering. This indicates that robo-advisors should make use of their big data departments to identify the partial number of existing clients with an academic degree. Furthermore, strategic marketing measures may focus on the establishment of an academic clientele. This could be a concise marketing strategy at universities or other research institutes to attract the desired target group.

-

Regarding H4: experienced investment clients show higher acceptance towards the use of a sustainable robo-advisor. Besides the already mentioned facts, another strategic approach is to focus on experienced clients and provide them with marketing information to create awareness for the robo-offering.

-

Regarding H6: the results of this hypothesis test is surprising because robo-advisory is a digital service, which originally seeks to substitute human advisory by using algorithms. Nonetheless, the gathered data prove that clients who are loyal to their advisors may also be a strategic target group for the sustainable offering. However, this may be of secondary priority because businesses seek to create new revenue streams by winning new clients with the digital alternative. Human advisory services still are more profitable due to the higher pricing.

-

Regarding H9: cost-aware clients are more likely to use the robo-offering. Banks or robo-advisors often do not have data regarding the cost-awareness of clients. In that case, traditional banks may use the existing relationship of the advisors with their clients to manually assess the partial number of cost-aware clients. In doing so, it provides a promising approach to identify high-potential prospects for the digital service alternative.

4. Conclusions and Discussion

This entry is adapted from the peer-reviewed paper 10.3390/su132313009