Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Management

Digitalisation of unorganised retail (UR) businesses in emerging markets have a positive socio-economic impact on the lives of the subsistence consumer–merchants who perform the dual role of being, not only consumers providing for themselves and their families, but also the managers of micro-UR businesses.

- unorganised retailers

- sustainable business model innovation

- resource constraints

- UN Sustainable Development Goals

1. Introduction

Herein developed a theoretical framework exploring the impact of digitisation on unorganised retail (UR) businesses and the implications for sustainable business model innovations at the base of the pyramid. A business model constitutes ‘what a firm is and does’ [1][2]. Increasingly, the business model literature has focused on integrating sustainability aspects into business design and implementation [3][4]. Simultaneously, changes in the global economy owing to overall economic downturns, technological disruptions, climate change, resource scarcity [3] and the resultant sustainable development agenda has given rise to a stream of sustainable business model innovation literature. Recent literature [1][5] has explored the role of technological interventions in business consolidation. There is also burgeoning literature [6][7] exploring the impact of app-based technological intervention in improving the economic performance of UR firms in emerging markets. Within this context, Gupta and Ramachandran [8] highlight the scope for exploring how technological intervention can improve efficiencies in UR business operations reliant largely on traditional supply chains, manual records of credit and in-store inventory and lack websites or online services. The UR retail context is particularly relevant to the emerging literature on sustainable base of pyramid business model innovation because large sections of the base of pyramid population (with daily earnings of USD 1.90–3.20) manage these businesses in emerging markets [9]. The majority of the existing research on sustainable business model innovation has studied business model design in relatively mature and stable institutional environments with sufficient infrastructure and access to resources [10]. In contrast, the literature on sustainable business model evolution at the base of pyramid, which is characterised by chronic resource and infrastructural constraints, has very few studies focusing on the economic [6][7] and social transformation [11] resulting from technological intervention.

2. Unorganised Retail Businesses in Emerging Markets

Unorganised Retailers (URs), comprising open kiosks and stalls, family-owned small stores and mom and pop stores [12], dominate the retail landscape across emerging markets, particularly in Asia [6][13]. According to Euromonitor [14], retail goods and services worth is an incredibly important component of the ASEAN economy, with some 27.8% of the population employed in the sector across the region. A key feature of the retail sector in emerging Asian and ASEAN countries is the co-existence of organised and URs, with the latter being the most prevalent retail format in these markets [8][13]. Several key studies [8][13][15][16] highlight the fact that URs have continued to remain the dominant retail format in emerging markets despite the significant inroads made by modern retailers. A number of factors, including the convenience of time, location, the personalised relation with customers and high service levels [16][17], provide a unique market opportunity for URs despite competitive pressures from larger retailers. Despite them being operationally inefficient, with limited procurement, inventory, supply chain, sales and store operations [8], URs provide essential goods and services to their base of pyramid (consumer) communities who lack access to transportation and other consumption alternatives [8][18][19][20][21]. More fundamentally, these URs operate in an environment characterised by chronic shortage of infrastructural resources, including a shortage of physical storage space, a sporadic supply of electricity and water, as well as a fragmented supply of raw materials, all of which result in significant diseconomies of scale. These shortages create financial and infrastructural barriers to the adoption of technology [8][10][22].

Despite a chronic resource shortage [22] in recent years, URs have undergone a technological evolution in the form of digital payments, comprising M-wallets, card-based payment technologies, account-based technologies and social security-based technologies [7][23]. According to the World Payments Report [24], published by Cap Gemini and BNP Paribas, the bulk of the digital payment technology growth has been in emerging markets. These consulting reports suggest that digital payment technologies will penetrate emerging markets by almost 19.6% per annum. It is also inevitable that this digitisation trend will accelerate in a post-COVID-19 world, as retailers seek to overcome the procurement and social distancing challenges posed by the virus [25]. Barring Adhikary et al. [6] and Kumar et al. [7], research into the impact of technological adoption on URs is scant [26]. The academic literature [6][8][10][22] and consulting reports [27] reiterate the fact that the competitiveness and resilience of URs will be key to supporting dynamic, inclusive and sustainable forms of growth because of the significant economic and societal role they play in emerging markets.

3. Framework for the Impact of App-based Digitisation on UR Businesses and Resultant Economic and Social Transformation

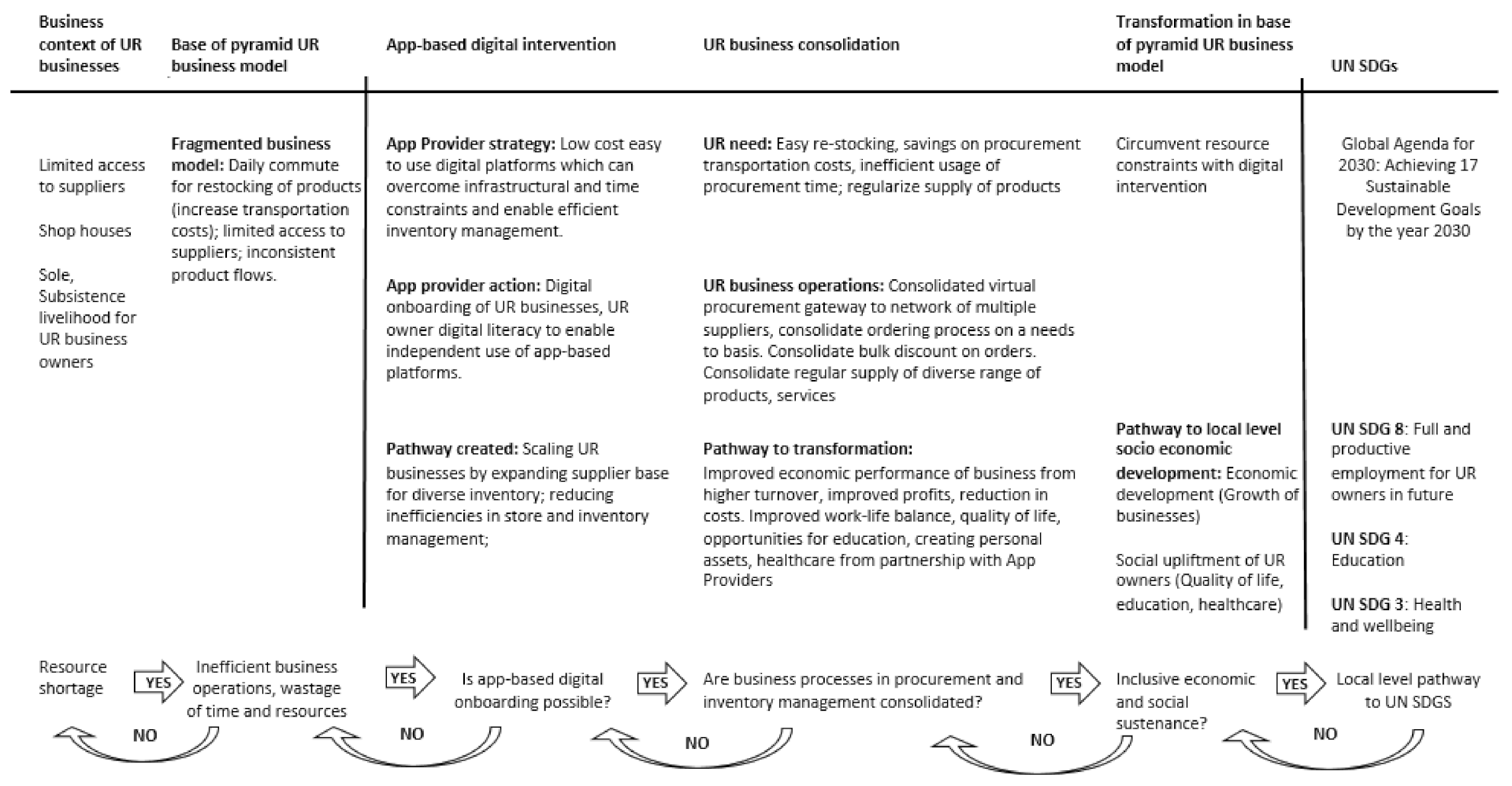

The consolidation of business operations enables the UR businesses to overcome fundamental inefficiencies in daily business operations enabling economies of scale and scope. Thus, improving the performance of UR businesses and the overall socio-economic situation of UR business owners which creates a local level pathway for the realisation of the UN SDGs [28]. What emerges from thee analysis of UR digitisation in four South East Asian countries is a grounded process framework (Figure 1) which explains how digitisation enables UR businesses to circumvent resource shortage, consolidate procurement and inventory management, resulting in overall economic and social transformation for the UR businesses and their owners.

Figure 1. Framework for the impact of app-based digitisation on UR businesses and resultant economic and social transformation.

Figure 1. Framework for the impact of app-based digitisation on UR businesses and resultant economic and social transformation.The initial analysis of UR business contexts highlighted that the inherent inefficiencies arise from the daily (transportation and purchase) costs of procuring products from suppliers, inconsistent product availability due to limited supplier access and time-consuming manual bookkeeping of transactions and inventory management. Gupta and Ramachandran [8] draw similar conclusions about the operating business model of URs from their review of the UR business context. The limited budgets on which the subsistence UR business owners manage the business are prohibitive of any future expansion or development. Our theoretical framework suggests that the app-based platforms are designed to transform UR businesses into quasi-digitised retailers who can overcome the inherent inefficiencies of their fragmented business models.

The framework highlights that the app providers’ overall strategic intent is to provide low-cost digital platforms, enabling a simple and easy onboarding of UR businesses. The UR owners are provided digital training and have access to service personnel for subsequent trouble shooting. Digital onboarding and digital literacy create a pathway for long term local level economic development in three ways. First, virtual onboarding scales up the UR businesses by opening a virtual gateway to multiple product suppliers. As a result, the previously time consuming and cost inefficient procurement processes are consolidated into digital platforms offering demand based, real time ordering facilities from a variety of suppliers at competitive prices. Over time, repeat usage of the platforms create opportunities for bulk discounts and scope for further reduction in procurement costs. Second, digital onboarding and the consolidation of inventory management and daily transactions in a singular digital platform reduce inefficiencies of manual operations and cumulatively reduce daily operating costs. Third, digital intervention also creates economies of scope by consolidating access to a wider portfolio of products and services for UR businesses to offer to their end consumers. Diversifying product and service offerings to end consumers therefore creates new opportunities for long-term growth of these businesses. The cumulative impact of consolidated procurement, automated consolidation of in-store transaction and inventory management and diversification of product/service offerings create a pathway of economic transformation from increased turnover and profits. The spill over effects of digitalisation are reflected in the improved work–life balance of UR business owners who transform into digitally empowered, well-informed, proactive participants in the marketplace for goods procurement. Overall improvement in the financial situation of UR business owners makes education affordable for younger family members, gives access to healthcare (depending on terms of partnership with app providers) and improves overall security and stability in the lives of the UR business owners. Accordingly, our framework highlights that the socio-economic impact of UR business transformation and resultant opportunities for long term employability, education and well-being create local level pathways for attainment of the UN SDGs 3, 4 and 8 within economies where these businesses dominate the retail landscape.

The framework extends the work from Adhikary et al. [6] and Gupta and Ramachandran [8] on economic benefits of digitisation for UR businesses by responding to their call for research into the impact of digitisation on upstream activities of UR businesses. Adhikary et al. [6] and Kumar et al. [7] show the positive relationship between UR’s adoption of digital payment technologies and their economic performance. In essence, their study focuses on the impact of digitisation on the downstream value chain activities in relation to efficient handling of payments from customers. Herein supplements the work by Adhikary et al. [6], Gupta and Ramachandran [8] and Kumar et al. [7] by showing the economic and social benefits URs can gain by adopting app-based digitalisation to consolidate their upstream procurement functions, in-store inventory management and diversifying their product, service offerings. Accordingly, our framework highlights that the consolidation of procurement on app-based digital platforms enable UR businesses to realise economies of scale and scope while reducing inefficiencies in in-store management. The subsequent improvements in business performance create future growth opportunities for the UR businesses and make healthcare and educational opportunities more accessible to the UR owners.

4. Practical Implications

The findings have at least three practical ramifications which we outline in the following section. First, digital transformation of the widely present URs in the South East Asian markets [6][13][14] has the potential to contribute to the UN SDGs 3, 4 and 8 [28] through the local level pathways of socio-economic development of UR businesses and their owners. This pathway for achieving the UN SDGs [28] can create an opportunity for local level entrepreneurs and policy makers to collaborate on innovative initiatives for inclusive and transformative development of subsistence and rural communities. While the onus continues to be on governments to devise and implement policies for attainment of the UN SDGs [28], nurturing the talent and entrepreneurial spirit of the subsistence communities can be a practical, effective and parallel pathway for achieving these goals.

Second, the consolidation of URs also has implications for local procurement strategies, especially in times of crisis, such as the ongoing pandemic. As the new normal of the post pandemic world evolves in the near future, local procurement strategies will become integral to the continuance of businesses and livelihoods while catering to the basic needs of consumers. The findings of this research bring to the fore the significant role URs can play in contributing to resilient South East Asian economies in the future.

Third, digitisation can cut across local boundaries and percolate regional economies, thereby opening new trade channels across regional countries. Connecting the subsistence market UR businesses to vendors and last mile consumers in regional ASEAN markets can open up new markets for URs. This can create a parallel regional trade channel between the widely prevalent URs operating in resource-constrained environments. These trade channels could also act as buffers to support economic and regional growth in a post pandemic world as economies focus on their own recovery, prioritising local and regional trade over international trade.

This entry is adapted from the peer-reviewed paper 10.3390/su132112031

References

- Holtström, J. Business model innovation under strategic transformation. Technol. Anal. Strateg. Manag. 2021.

- Hamel, G.; Prahalad, C.K. Leading the Revolution; Harvard Business School Press: Boston, MA, USA, 2000; pp. 343–354.

- Sinkovics, N.; Gunaratne, D.; Sinkovics, R.; Molina-Castillo, F.-J. Sustainable Business Model Innovation: An Umbrella Review. Sustainability 2021, 13, 7266.

- Shakeel, J.; Mardani, A.; Chofreh, A.G.; Goni, F.A.; Klemeš, J.J. Anatomy of sustainable business model innovation. J. Clean. Prod. 2020, 261, 121201.

- Langley, P.; Leyshon, A. The Platform Political Economy of FinTech: Reintermediation, Consolidation and Capitalisation. New Politi-Econ. 2021, 26, 376–388.

- Adhikary, A.; Diatha, K.S.; Borah, S.B.; Sharma, A. How does the adoption of digital payment technologies influence unorganized retailers’ performance? An investigation in an emerging market. J. Acad. Mark. Sci. 2021, 49, 882–902.

- Kumar, V.; Nim, N.; Sharma, A. Driving growth of Mwallets in emerging markets: A retailer’s perspective. J. Acad. Mark. Sci. 2019, 47, 747–769.

- Gupta, S.; Ramachandran, D. Emerging Market Retail: Transitioning from a Product-Centric to a Customer-Centric Approach. J. Retail. 2021.

- Viswanathan, M.; Rosa, J.A.; Ruth, J.A. Exchanges in marketing systems: The case of subsistence consumer–merchants in Chennai, India. J. Mark. 2010, 74, 1–17.

- Peprah, A.A.; Giachetti, C.; Larsen, M.M.; Rajwani, T.S. How Business Models Evolve in Weak Institutional Environments: The Case of Jumia, the Amazon.Com of Africa. Organ. Sci. 2021.

- Mortazavi, S.; Eslami, M.H.; Hajikhani, A.; Väätänen, J. Mapping inclusive innovation: A bibliometric study and literature review. J. Bus. Res. 2021, 122, 736–750.

- Raghavendra, R.H. An Overview of Unorganised Retail Sector in India. ELK Asia Pac. J. Mark. Retail. Manag. 2004, 5, 5.

- Mukherjee, M.; Cuthbertson, R. Applying the scenarios method to capture uncertainties of retail development in emerging markets. Int. Rev. Retail. Distrib. Consum. Res. 2015, 26, 323–346.

- Euromonitor. Top 100 Retailers in Asia 2021. Available online: https://go.euromonitor.com/white-paper-retailing-210525-top_100_retailers_in_asia_2021.html?utm_source=Top_100_Retailers_Asia_2021&utm_medium=press%20release&utm_campaign=CT_WP_21_05_25_Top%20100%20Retailers%20Asia#download-link (accessed on 29 June 2021).

- Bronnenberg, B.J.; Ellickson, P.B. Adolescence and the Path to Maturity in Global Retail. J. Econ. Perspect. 2015, 29, 113–134.

- Reinartz, W.; Dellaert, B.; Krafft, M.; Kumar, V.; Varadarajan, R. Retailing Innovations in a Globalizing Retail Market Environment. J. Retail. 2011, 87, S53–S66.

- Sinha, P.K.; Gokhale, S.; Rawal, S. Online Retailing Paired with Kirana—A Formidable Combination for Emerging Markets. Cust. Needs Solut. 2015, 2, 317–324.

- Bijmolt, T.H.; Broekhuis, M.; De Leeuw, S.; Hirche, C.; Rooderkerk, R.P.; Sousa, R.; Zhu, S.X. Challenges at the marketing–operations interface in omni-channel retail environments. J. Bus. Res. 2021, 122, 864–874.

- Viswanathan, M.; Rosa, J.A. Product and market development for subsistence marketplaces: Consumption and entrepreneurship beyond literacy and resource barriers. In Product and Market Development for Subsistence Marketplaces; Jose, R., Madhu, V., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2007; pp. 1–17.

- Hammond, A.L.; Kramer, W.J.; Katz, R.S.; Tran, J.T.; Walker, C. The Next 4 Billion. Innov. Technol. Gov. Glob. 2007, 2, 147–158.

- Ruth, J.A.; Hsiung, R.O. A family systems interpretation of how subsistence consumers manage: The case of South Africa. In Product and Market Development for Subsistence Marketplaces; Jose, R., Madhu, V., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2007; pp. 59–87.

- Sheth, J.N. Impact of Emerging Markets on Marketing: Rethinking Existing Perspectives and Practices. J. Mark. 2011, 75, 166–182.

- Yu, H.-C.; Hsi, K.-H.; Kuo, P.-J. Electronic payment systems: An analysis and comparison of types. Technol. Soc. 2002, 24, 331–347.

- Worlds Payments Report. Cap Gemini and BNP Paribas. Available online: https://worldpaymentsreport.com/wp-content/uploads/sites/5/2018/10/World-Payments-Report-2018.pdf (accessed on 2 July 2018).

- Ernst and Young. Covid-19: How to Build Supply Chains Resilient to Disruption. Available online: https://www.ey.com/en_sg/consulting/how-to-build-a-supply-chain-thats-resilient-to-global-disruption (accessed on 2 July 2021).

- Risselada, H.; Verhoef, P.; Bijmolt, T.H. Dynamic Effects of Social Influence and Direct Marketing on the Adoption of High-Technology Products. J. Mark. 2014, 78, 52–68.

- Ernst and Young. SMEs in Southeast Asia: Redesigning for the Digital Economy. Available online: https://www.ey.com/en_sg/growth/growth-markets-services/ey-smes-in-southeast-asia-redesigning-for-the-digital-economy (accessed on 2 July 2021).

- United Nations Sustainable Development Goals. Available online: https://www.un.org/sustainabledevelopment/ (accessed on 7 July 2021).

This entry is offline, you can click here to edit this entry!