In recent years, fashion brands and retailers have been advancing rapidly to provide U.S. consumers more seamless omni-channel shopping experiences. The pandemic has further accelerated the growth of omni-channel shopping. This study aimed to explore the effects of channel integration in six aspects (i.e., promotion, product and price, transaction information, information access, order fulfillment, and customer service) on the U.S. consumers’ intentions to use three omni-channel shopping methods: buy online pick-up in-store (BOPI), buy online curbside pickup (BOCP), and buy in-store home delivery (BIHD). We proposed a mediation model to test the effects through consumer perceived values (hedonic value, utilitarian value), perceived risk, and perceived behavioral control. Furthermore, this study explored the moderating effect of perceived COVID-19 vulnerability on the relationships between consumers’ internal evaluations of channel integration and their shopping method selection intentions. A total of 516 eligible responses were gathered through a survey of U.S. consumers. Multiple regressions were applied to test the hypotheses. Six types of channel integration showed significant effects on the U.S. consumers’ internal evaluations, which in turn influence their intentions to use certain types of omni-channel shopping methods. Overall, the proposed model exhibits a satisfactory explanatory power.

- omni-channel retailing

- fashion

- shopping method selection

- COVID-19

- U.S. consumers

1. Introduction

The outbreak of COVID-19 in 2020 has changed consumers’ shopping behaviors and brought retailers challenges in many ways. Before the hit of the pandemic, traditional retailers relying on brick-and-mortar channel had already suffered intense competition from emerging online retailers. In 2019, over 9,300 retail stores in the U.S. were closed because they failed to change or embrace new retail strategies to meet new consumer needs, adapt digital innovation, and compete with online retailers [1]. In the meantime, share of e-commerce transactions by total U.S. retail transactions has grown from 4.2% in 2010 to 15.7% in 2020 [2]. Now, the pandemic is further forcing traditional retailers to adopt new retail strategies to stay competitive or just survive the retail disaster. Many scholars and market research companies predicted that, with the impact of the COVID-19 pandemic, online and digital formats would become the dominant shopping channels for consumers to obtain products and services and this trend would continue even in the era of post pandemic [3,4].

A majority of fashion retailers have severely suffered from the COVID-19 pandemic because they had to temporarily close their physical stores in compliance with the government order because fashion products were not categorized as "essential" goods and services like food, pharmacy products, etc. According to Business Insider, twenty-eight major retailers filed for bankruptcy or liquidation in 2020 due to the impact of COVID-19, among which, twelve were fashion companies owning famous brands such as J. Crew, Men’s Wearhouse, and Ann Taylor, or department stores such as Neiman Marcus and JC Penny [5]. Taylor [6] indicated there has been a prominent movement in the retail industry that retailers are shifting their investment from the physical store channel to digital channel and channel integration. For example, Zara’s parent company, Inditex, recently announced that they planned to close around 1,200 stores in 2020 and 2021, and believed that the revenue loss due to store closures would be offset by online sales and enhanced inventory management through effective channel integration [7].

Many marketers and researchers asserted that flexible marketing strategies, such as omnichannel retailing, can help retailers deal with the challenges they face during the pandemic and the uncertainties post the pandemic [4,6,8–10]. Prior to the pandemic, many retailers hesitated to implement omni-channel retailing services (e.g., purchase online pick-up in-store or subsidy pickup) because of the concern on potential decline in store traffic, but the pandemic has accelerated retailers’ adoption of these new shopping methods [6]. Beck and Rygl [11] defined omni-channel retailing as “the set of activities involved in selling merchandise or services through all widespread channels, whereby the customer can trigger full channel interaction and/or the retailer controls full channel integration” (p. 175). With the continuous advancement of digital and communication technologies, more retailers are becoming capable of providing additional channels besides physical store channel for consumers to explore such as online websites and mobile apps [12,13]. The core of omni-channel retailing is to provide consumers seamless and synchronized shopping experiences [12–16]. To reach the goal, a true channel integration is essential [16–19]. Therefore, omni-channel retailing is a business strategy offered by retailers for consumers to gain seamless shopping experiences, and consumers have the freedom to choose various shopping methods and channels at each stage of the shopping process from searching information to obtaining products [10].

Although the advantages of omni-channel retailing and the need of channel integration have been repeatedly emphasized in prior studies, there lacks research devoted to theoretical advancement and empirical investigation in how channel integration may affect consumers’ selection of omni-channel shopping methods [8,10,11]. In particular, our knowledge on the COVID-19 impact on consumer behavior towards omni-channel shopping is very limited [8]. Therefore, this study aimed to fill the gap in the literature by identifying the effects of channel integration in six aspects (i.e., promotion, product and price, transaction information, information access, order fulfillment, and customer service) on the U.S. consumers’ intentions to use three omni-channel shopping methods: buy online pick-up in-store (BOPI), buy online curbside pickup (BOCP), and buy in-store home delivery (BIHD). We proposed a mediation model to test the effects through consumer perceived values (i.e., hedonic value, utilitarian value), perceived risk, and perceived behavioral control. Moreover, this study explored the moderating effect of consumer perceived COVID-19 vulnerability on the relationships between consumers’ internal evaluations of channel integration and their shopping method selection intentions. The findings from this study provide the valuable insights to fashion retailers on the determinants of consumers’ selection of omni-channel shopping methods and the impact of the COVID-19 pandemic. This information may guide the corporate strategic investment in omni-channel retailing and contribute to maximizing the benefits of channel integration.

2. Theoretical Background and Hypotheses Development

2.1. Omni-channel Shopping Methods

Fashion retail industry mainly has three types of channels: store channel, online channel, and other non-store channel [12]. Online channel contains two subcategories: (1) traditional internet channel via computer or laptop, and (2) mobile channel via smartphone or tablet. Online channel also has a fast-growing subset, named social commerce, defined as e-commerce activities and transactions through social media sites [20]. Thus, retail online channels could be identified through two dimensions, hardware (e.g., computer, smartphone) and software (e.g., social media sites, brands’ or retailers’ websites). Other non-store channels include catalog, direct selling, and automated machines (e.g., vending machines). Large retailers often sell their products through various channels and allow consumers to flexibly choose the appropriate channel meeting their needs. Moreover, consumers can use multiple channels throughout their shopping process from information search, order placement, order pick-up, to post-purchase activities.

Bell [21] proposed an information and fulfillment matrix of four shopping modes: 1) traditional retail (obtain information and product offline), 2) shopping and delivery hybrid (obtain information online and pickup product offline), 3) online retail plus showrooms (obtain information offline and deliver product to home), and 4) pure-play e-commerce (obtain information online and deliver product to home). The first and the fourth kinds are single-channel shopping modes where product information and fulfillment happens within either offline or online channel, while the second and the third shopping modes are examples of integrated omni-channel retailing, which combines both online and offline channels.

In 2013, Macy’s launched an omni-channel program named “click-and-collect”, which integrates its digital wallet into both the Macy’s app and website [22]. No matter where and how consumers shops, either in Macy’s store or online, they have access to the consistent services or benefits Macy’s offers, such as the retailer’s loyalty program, special coupons, and the assorted payment methods [22]. This omni-channel strategy successfully meets the needs of Macy’s target consumers who have busy lifestyles and look for simple and convenient shopping methods. Researchers defined this “click and collect” service offered by many retailers (e.g., Walmart, Target, Kohl’s, Nordstrom, etc.) as buy-online-pickup-in-store (BOPS) or reserve-online-pickup-and-pay-in-store (ROPS) [23–25]. BOPS and ROPS belong to the same category in Bell’s [21] matrix, which is shopping and delivery hybrid, although BOPS is a more widely known shopping mode in the retail field. A recent study discovered that BOPS fulfillment operation could improve retail supply chain’s performance when it is offered under a centralized scenario (retailer and manufacturer work together to serve an integrated supply chain) [26].

Under the pandemic, retailers began offering many contactless shopping options to reduce the number of customers inside of stores and maintain social distance. Instead of having customers pick up their orders inside of stores, retailers slightly modified BOPS and began offering a similar omni-channel shopping method, called buy online pickup at curbside (BOPC) or just curbside pickup [27,28]. Shoppers could park their cars at designated curbside pickup area and shop assistants would walk outside to put their orders in the trunk or backseat. Business Insider recently highlighted sixteen retailers’ BOPS and BOPC options, which include famous fashion retailers such as Bloomingdale’s, JCPenney, L.L.Bean, Macy’s, Neiman Marcus, Nordstrom, and REI [29]. According to 2021 Omnichannel Report by Digital Commerce 360, at the beginning of 2021, 68.7% of U.S. retailers provided BOPS while 50.7% of retail chains provided BOPC [30].

Many Once-Online-Only retailers (e.g., Amazon, Warby Parker, Adore Me, Bonobos, and BaubleBar) opened physical stores because they realized that opening physical stores or showrooms can help increase sales across all channels and decrease the operational costs of shipping products that often do not meet customers’ expectations [31]. Temporary showrooms (“pop-up” shops or movable stores) are anticipated to have the similar advantages of boosting awareness and total demand [21]. An example for physical stores with minimum inventory but high level of customer service is “Nordstrom Local”. Those shops are identified as neighborhood service hubs with no dedicated inventory but offering a variety of services in small spaces with around 3,000 sq.ft [32]. When a physical store serves the role as a showroom, customers often choose the shopping mode of buy in-store home delivery (BIHD) [33], which is consistent with the shopping mode, reserve-online-pickup-and-pay-in-store (ROPS) that Bell [21] identified.

2.2. S-O-R Model

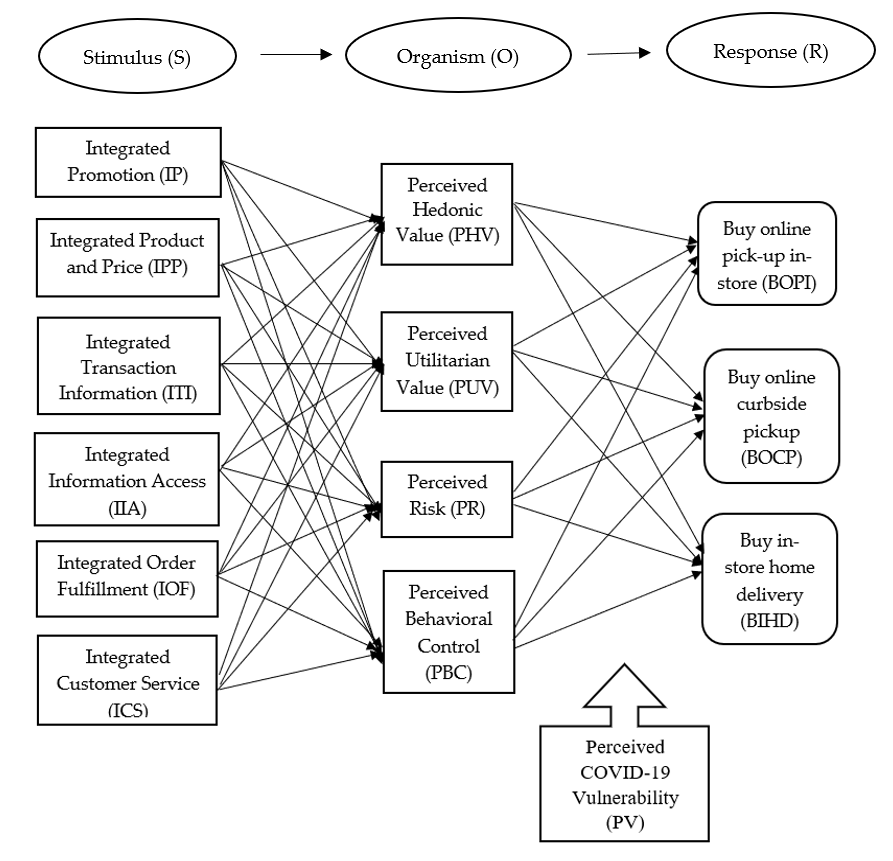

To investigate fashion consumers’ decision-making process for choosing omni-channel shopping methods, this study employed the Stimulus-Organism-Response (S-O-R) model by Mehrabiana and Russel [34]. This model successfully linked the three dimensions together: environmental incentive (stimulus), individuals’ internal states (organism), and consequent behavior (response) (see Figure 1). In other words, external factors or catalysts impact subjects’ actions through intermediaries of individuals’ judgements or intuitions. Thus, many marketing researchers were able to use this model to explore the impact of retailing environment on consumers’ actions through mediators of consumers’ internal evaluations such as consumer empowerment, perceived values, perceived risk, trust, etc. [35–38].

In the retail field, researchers often considered the stimulus as marketing-associated influences (e.g., sensory marketing and service characteristics) [37,39] or environmental attributes (e.g., store environment and website attributes) [40,41]. Previous studies have explored the effects of channel availability or channel integration as the stimuli on consumers’ cognitive and affective states [38,42,43]. For instance, by following the S-O-R model, researchers found that channel integration could significantly affect consumers’ empowerment, which in turn enhanced their trust and satisfaction as well as increased their patronage intention [35]. This study chose to investigate the influence of channel integration as the stimulus on consumer selection of omni-channel shopping methods as the response through the mediators of consumer internal evaluations as the organism.

Consumers’ internal states (organism) mainly include two aspects: pleasure and arousal [44]. Pleasure–displeasure is a condition of feeling that is either positive or negative, while arousal is a feeling condition with a certain degree of awakeness going from slumber to furious excitement. According to Bakker et al. [45], pleasure could be considered as affect while arousal could be considered as cognition. Prior studies demonstrated that cognitive and affective internal evaluations could significantly mediate the effect of environmental stimuli on consumers’ responses [45–49]. Researchers also found that consumer perceived value is a key organism factor bridging the environmental stimuli and consumers’ responses [36,50,51]. Consumer perceived value (both hedonic and utilitarian value) along with perceived risk and perceived behavioral control (PBC) were repeatedly reported as the significant factors influencing consumers’ adoption behaviors toward new technologies or new shopping channels [52–54].

Regarding the response, this study examined consumers’ selection intentions toward three omni-channel shopping methods: buy online pick-up in-store (BOPI), buy online curbside pickup (BOCP), and buy in-store home delivery (BIHD). In addition to these shopping methods, prior studies also discussed buy-online-return-in-store and reserve-online-pickup-in-store [55,56]. Current research focused on the stage of purchasing and receiving products during the shopping process. Since the returning and the reserving methods were not closely related to the interest of this study, they were excluded from the options of responses. Therefore, this study included and tested BOPI, BOCP, and BIHD as the three responses in the S-O-R model.

2.3. Stimulus: Channel Integration

Channel integration is one of the key success factors of omni-channel retailing implementation. For retailers being able to effectively apply the omni-channel strategy, they should integrate all channels seamlessly, and the integration needs to be implemented at all levels of logistics and marketing, and even internal business operations [57–60]. When online and offline channels are successfully integrated, businesses are able to maxmize the benefits of each channel, reduce cannibalization, and promote synergy, and as a result, businesses would reach better performance [61,62]. Channel integration is essential for retailers to provide the seamless shopping experience in the omni-channel environment [35,63,64]. According to Sousa and Voss [64], channel integration quality was assessed through two dimensions: channel–service configuration and integrated interactions. Channel–service configuration is defined as how good service quality is for each channel as well as the quality of the combined services across different channels [64]. In other words, channel–service configuration is the scope of channel choice and flexibility of the combinations of different services and channels. Integrated interactions involve the consistency and standardization of both content (e.g., response to a question or information across different channels) and process (e.g., process features such as service’s experience, appearance, waiting times, and employee power levels).

Instead of identifying channel integration from the perspective of service quality like Sousa and Voss did [64], more recently, Oh, Teo and Sambamurthy [62] defined channel integration by analyzing all possible retail activities in three regular phases of the buying procedure: pre-purchase, purchase, and post-purchase. They proposed six dimensions of retail channel integration (i.e., integrated promotion, integrated transaction information management, integrated product and pricing information management, integrated information access, integrated order fulfillment, and integrated customer service). After testing the impact of these dimensions on multichannel retailers’ performance, Oh et al. [62] discovered that channel integration enabled by information technologies improves firms’ competencies in delivering both existing resources and future innovative contributions, which in turn enhances the overall performance of the firms. Lately, Zhang et al. [35] refined the six channel integration dimensions to accommodate the emerging omni-channel retail trend and from the perspective of consumers.

In line with prior researchers’ definitions and measurement of channel integration, this study considered channel integration as the extent to which a retailer synchronizes all available channels and all levels of the organization to boost synergy for the business and offer consumers seamless and flexible shopping experiences. The dimensions of retail channel integration focused in this study are: (1) integrated promotion (IP), (2) integrated product and price (IPP), (3) integrated transaction information (ITI), (4) integrated information access (IIA), (5) integrated order fulfillment (IOF), and (6) integrated customer service (ICS). Table 1 summarizes the definitions of the six dimensions as below. These definitions were used to guide the development of the constructs of the six channel integration dimensions.

Table 1. Channel integration dimensions in the omni-channel environment.

|

Dimensions |

Definitions |

|

|

Integrated Promotion (IP) |

The degree to which a consumer can find one channel’s advertisements or promotional information in another channel. |

|

|

Integrated Product and Price (IPP) |

The degree to which a consumer has access to consistent product and price information across all available channels. |

|

|

Integrated Transaction Information (ITI) |

The degree to which a consumer can use the same account to manage all the purchase records in all available channels. |

|

|

Integrated Information Access (IIA) |

The degree to which a consumer has consistent access to the information across all available channels. |

|

|

Integrated Order Fulfillment (IOF) |

The degree to which a consumer can finish the whole shopping process (order placement, payment, delivery, and return) through one or more channels. |

|

|

Integrated Customer Service (ICS) |

The degree to which a consumer has access to standard and consistent customer service across all available channels, including after-sales services. |

|

2.4. Organism: Consumer Perceived Value

Perceived value evolves from the means-end theory, which demonstrates that values consumers perceive are the ends from the products’ attributes representing the means [65]. Prior studies discovered that perceived value was the key for understanding consumer behavior in the marketplace [66,67]. Thaler [68] defined value as a trade-off which is the net benefits of the difference between consumers’ perceived gains and losses. Zeithaml [69] further developed the meaning of perceived value as “the consumer's overall assessment of the utility of a product based on perceptions of what is received and what is given” (p.14). As stated by Babin et al. [70], perceived shopping value mainly contains two dimensions: hedonic and utilitarian values. When consumers make purchase decisions, they take all the decision factors (both hedonic and utilitarian values) into consideration and mentally calculate if it is worth the price and cost of the deal [71]. Current research examined the impact of both hedonic and utilitarian values as the mediators connecting channel integration and consumers’ shopping method selection intentions.

Prior studies discovered that consumers chose to use multi-channel or omni-channel integration while shopping because they perceived both hedonic and utilitarian values of this type of shopping method [72–75]. Pragmatic consumers liked to use multi-channel integration because they perceived utilitarian values (e.g., money, time, and effort saving) of this shopping process while shopping beginners are more likely to shop for the hedonic reasons (e.g., enjoyment and pleasure) than multi-channel shopping experts [72]. For example, researchers found significant relationships between online promotion and both functional and emotional value among e-commerce shoppers in China [51]. Price promotions often stimulate consumers’ shopping intentions because consumers often perceive functional value in a deal for its cheaper price [76]. Moreover, consumers also get excited and pleasant (perceive hedonic value) when seeing and noticing a favorite product is on sale or promotion. When promotion information is provided in an omni-channel environment, the effect might be even stronger because integrated channels could offer consumers more convenient and fun shopping experiences [73,77,78].

Prior findings showed that cross-channel integration dimensions (e.g., information consistency, freedom of channel selection, strong customer services, channel reciprocity) were positively related to consumers’ hedonic and utilitarian shopping purposes [75]. These dimensions are similar to the channel integration dimensions examined in this study. According to Wu and Chang [77], in a multi-channel retail environment, consumers generate more trust toward the businesses who provide coherent information and shopping process across all the channels. With higher trust, consumers would probably generate more favorable assessments (e.g., monetary savings, convenience, and hedonic value) toward products, information and services [77]. Thus, coherent information (i.e., IP, IPP, ITI) and consistent shopping process (i.e., IIA, IOF, ICS) across different channels may induce consumers to perceive higher functional and hedonic values [79]. Therefore, hypotheses 1a–f and 2a–f were proposed as follows.

Hypothesis 1. (a) Integrated promotion (IP), (b) integrated product and price (IPP), (c) integrated transaction information (ITI), (d) integrated information access (IIA), (e) integrated order fulfillment (IOF), and (f) integrated customer service (ICS) have positive impact on consumer-perceived hedonic value in the omni-channel retail shopping context.

Hypothesis 2. (a) Integrated promotion (IP), (b) integrated product and price (IPP), (c) integrated transaction information (ITI), (d) integrated information access (IIA), (e) integrated order fulfillment (IOF), and (f) integrated customer service (ICS) have positive impact on consumer-perceived utilitarian value in the omni-channel retail shopping context.

2.5. Organism: Perceived Risk and Perceived Behavioral Control

In addition to consumer perceived values, consumers may generate other evaluations (perceived risk and perceived behavioral control) when utilizing integrated channels in the omni-channel retail setting. Morgan and Hunt’s commitment–trust theory demonstrated the importance of trust in business relationships and the negative relationship between trust and uncertainty [80]. Trust could decrease consumers’ perceived risks in the shopping procedure, such as transaction risks [81]. Perceived risk (PR) refers to the level of uncertainty consumers perceive regarding using omni-channel shopping method for purchasing apparel products [82,83]. Perceived behavioral control (PBC) is a key concept in the theory of planned behavior (TPB), a popular ethological theory extended from the theory of reasoned action [84]. TPB is often utilized as the theoretical foundation to explain technology adoption [85]. According to Chen [86], PBC includes two aspects: perceived control and perceived difficulty. In this study, PBC is identified as the level of reorganized simplicity or difficulty of executing the action, using omni-channel shopping methods [87].

Prior studies showed that channel integration in the retail setting, especially, integrated product and price cross channels could help reduce the risk consumers perceived when purchasing products online [77,83]. Other studies also demonstrated the impact of channel synergy on reduction of perceived risk of online channel [79,83,88]. Xu and Jackson [83] investigated three important features of successful omni-channel retailers (i.e., channel transparency, channel convenience, and channel uniformity, and discovered that these features were negatively related to consumers’ perceived risk. In a recent study, IP, IPP, and ITI were determined as moderators impacting the relationships between online channel media richness (OCMR), and two risk-related variables, information privacy concern and perceived deception toward website channel [79]. The results showed that all three moderators (IP, IPP, and ITI) could improve the negative relationships between OCMR and consumers’ concerns toward an online channel because adding an offline channel could mitigate some of the concerns consumers hold toward transaction and privacy risks in a pure online setting.

Although some aspects of channel integration (e.g., integrated promotion, integrated product and price) seem to be able to reduce uncertainties in the online channel, some consumers still have concerns on their personal information security in the omni-channel retail environment when big data and other information integration technologies are used. Piotrowicz and Cuthbertson [89] stated that the balance between personalization and privacy was a key issue in the omni-channel retail environment, especially when consumers’ information was overused for marketing purposes. Furthermore, many researchers asserted that the application of big data and predictive systems in the retail setting would cause consumer backlash because many consumers had concerns for personal data breaches [89–92]. According to Bradlow et al. [90], if retailers practice some information protection techniques (e.g., opt-in policy), consumers would have less concerns for the information privacy issue and generate more favor toward the information services provided by omni-channel retailers. Since the current study did not limit respondents’ omni-channel shopping experiences to those retailers engaged in information protection practices, the respondents might still hold unfavorable attitude toward the two information-related integration involved in consumers’ personal information: integrated transaction information (ITI) and integrated information access (IIA). Therefore, this study proposed four negative relationships (3a, 3b, 3e, and 3f), and two positive relationships (3c and 3d) with perceived risk as follows.

Hypothesis 3 Integrated promotion (IP) (a), Integrated product and price (IPP) (b), Integrated order fulfillment (IOF) (e) and Integrated customer service (ICS) (f) negatively affect perceived risk in the omni-channel retail context while Integrated transaction information (ITI) (c) and Integrated information access (IIA) (d) positively affect perceived risk in the omni-channel retail context.

In addition to perceived risk, researchers also demonstrated the connections between channel integration and perceived behavioral control (PBC). Xu et al [83] revealed that the three omni-channel characteristics, namely, channel transparency, channel convenience, and channel uniformity, had significantly positive influence on PBC of using omni-channel shopping methods. Some researchers explored the impact of channel integration on consumer empowerment, a similar concept to PBC, and found the significant relationship [38,42]. The relationship between channel integration and PBC was justified as that when all the information and services were well integrated across different channels, consumers would become more confident and certain about their capability of purchasing products whenever, wherever, and however when using omni-channel services [38,42]. Therefore, we proposed that when the six dimensions of channel integration achieved a higher level, consumers would perceive higher behavioral control of using the omni-channel shopping methods. The hypotheses 4a–f were proposed below.

Hypothesis 4. (a) Integrated promotion (IP), (b) integrated product and price (IPP), (c) integrated transaction information (ITI), (d) integrated information access (IIA), (e) integrated order fulfillment (IOF), and (f) integrated customer service (ICS) have positive impact on perceived behavioral control (PBC) in the omni-channel retail context.

2.6. Behavioral Responses and Moderating Effect of Perceived COVID-19 Vulnerability

This study examined U.S. consumers’ selection intentions of the three popular omni-channel shopping methods (i.e., BOPI, BOCP, and BIHD), and proposed that the four mediators (i.e., PHV, PUV, PR, and PBC) would directly influence the intentions of choosing the omni-channel shopping methods. Prior studies showed the connections between these mediators and consumers’ behavioral responses, such as purchase intention, repatronage intention, channel selection intention, and channel switching intention [23,74,77,78,83,93]. Kim et al. [16] found that hedonic motivation positively impacted consumers’ behavioral intentions toward using BOPI. Other studies revealed that utilitarian value (e.g., save time, money, and effort) was the primary determinant of consumer selection BOPI method [94,95].

According to Lee et al. [94], PBC positively influenced consumers’ intentions toward using BOPI because when an order was placed online for in-store pickup, consumers could pick up the order within a short time and check the quality of the product in person. This process makes consumers feel that they have control over the whole shopping process and they are able to reach their goals [94]. Moreover, BOPI service may help reduce the risks of getting defective or wrong products since consumers could reject the products in the store, save shipping cost and waiting time, and receive immediate gratification [87]. All the effects explained above should have the same effects on BOCP because BOPI and BOCP are two similar services. The only difference is, when using BOCP, consumers could wait in their car for their order instead of walking inside of the store. BOCP has become a popular shopping method during the pandemic for the safety consideration.

Rather than purchasing product online and picking up order offline like BOPI and BOCP, consumers can purchase products in store and receive their orders through shipment when using the BIHD service. Similar to BOPI and BOCP, BIHD also allows customers to see and touch products in person, which may reduce their concerns and uncertainties about products’ fit and performance [96,97]. Under this circumstance, customers can not only receive joy and happiness of browsing and trying on products in the physical store channel, but also receive the convenience of the shipping service if the products they purchase are too many or large to carry with them. Moreover, air travelers may also avoid extra charges for their overweight luggage by having the retailers ship the orders directly to home. Thus, BIHD service can also provide consumers hedonic and utilitarian values, as well as reduce perceived risks. If they see an omni-channel shopping method as easy or less difficult to practice, they will be more likely to use the method for shopping fashion products. Therefore, we proposed that perceived hedonic and utilitarian values and perceived behavioral control could positively affect consumers’ selection intentions toward the three omni-channel shopping methods (i.e., BOPI, BOCP, and BIHD) while perceived risk could negatively affect consumers’ shopping method selection. Hypotheses 5a–d, 6a–d, and 7a–d were proposed as follows.

Hypothesis 5. (a) Perceived hedonic value (PHV), (b) perceived utilitarian value (PUV), (c) perceived risk (PR), and (d) perceived behavioral control (PBC) significantly affect the consumers’ intention to use buy online pick-up in-store (BOPI).

Hypothesis 6. (a) Perceived hedonic value (PHV), (b) perceived utilitarian value (PUV), (c) perceived risk (PR), and (d) perceived behavioral control (PBC) significantly affect the consumers’ intention to use buy online curbside pickup (BOCP).

Hypothesis 7. (a) Perceived hedonic value (PHV), (b) perceived utilitarian value (PUV), (c) perceived risk (PR), and (d) perceived behavioral control (PBC) significantly affect the consumers’ intention to use buy in-store home delivery (BIHD).

Consumer behaviors changed under different stages of the pandemic, across different countries and areas, and under different governmental policies. Individual differences influenced consumers’ channel selections [98]. In a recent study, researchers investigated apparel consumers’ channel shifting intentions during the COVID-19 pandemic and discovered that perceived vulnerability (PV) affected consumers’ attitude toward shifting to online channel from physical channel [53]. In other words, when consumers held stronger belief toward that if they got sick from COVID-19, the situation would be serious, they would be more likely to switch to online channel to purchase fashion products. Perceived vulnerability is the key concept in the protection motivation theory for measuring threat appraisals (the degree of risk of perilous actions) [99]. Moon et al. [98] revealed that perceived vulnerability and offline-channel use intention were negatively correlated. BOPI and BOCP services could help reduce the searching and browsing time consumers might spend in physical stores or even skip the offline channel (walk-ins) to receive orders. However, BIHD service requires consumers to shop inside of stores, which might seem to be riskier under COVID-19. Thus, we proposed that PV might enhance the relationships between the four mediators (i.e., PHV, PUV, PR, and PBC) and the selection intentions toward BOPI and BOCP, but weaken the relationships between the four mediators and the intention to use BIHD. Therefore, the hypotheses 5e–g, 6e–g, and 7e–g were proposed as follows.

Hypothesis 5. Under the omni-channel retail context, the higher the perceived COVID-19 vulnerability, the greater the impact of (e) perceived hedonic value (PHV), (f) perceived utilitarian value (PUV), (g) perceived risk (PR), and (h) perceived behavioral control (PBC) on the intentions to use buy online pick-up in-store (BOPI).

Hypothesis 6. Under the omni-channel retail context, the higher the perceived COVID-19 vulnerability, the greater the impact of (e) perceived hedonic value (PHV), (f) perceived utilitarian value (PUV), (g) perceived risk (PR), and (h) perceived behavioral control (PBC) on the intentions to use buy online curbside pickup (BOCP).

Hypothesis 7. Under the omni-channel retail context, the higher the perceived COVID-19 vulnerability, the weaker the impact of (e) perceived hedonic value (PHV), (f) perceived utilitarian value (PUV), (g) perceived risk (PR), and (h) perceived behavioral control (PBC) on the intentions to use buy in-store home delivery (BIHD).

3. Proposed Research Model and Developed Survey Instrument

According to the literature review above, an integrative S-O-R model for fashion omni-channel retailing covering all the proposed relationships (48 hypotheses) is delineated in Figure 1. Integrated promotion (IP), integrated product and price (IPP), integrated transaction information (ITI), integrated information access (IIA), integrated order fulfillment (IOF), and integrated customer service (ICS) may affect U.S. consumers’ perceived value (perceived hedonic value (PHV) and perceived utilitarian value (PUV)), perceived risk (PR), and perceived behavioral control (PBC) toward apparel omni-channel retailing. Consequently, the U.S. consumer’s perceived value, perceived risk, and perceived behavioral control may affect their omni-channel shopping method selection including buy online pick-up in-store (BOPI), buy online curbside pickup (BOCP), and buy in-store home delivery (BIHD). Perceived COVID-19 vulnerability (PV) may moderate the correlations between perceived value, perceived risk, and perceived behavioral control and U.S. consumers’ shopping method selection. The demographic variables including age, gender, income level, and education level were treated as control factors.

Figure 1. Proposed research model.

The six dimensions of channel integration (i.e., IP, IPP, ITI, IIA, IOF, and ICS) were adapted from Oh et al. [62] and Zhang et al [42]. Perceived hedonic value (PHV) and perceived utilitarian value (PUV) were adapted from Babin et al. [70] and Picot-Coupey et al. [100]. The scales for perceived risk (PR) and perceived behavioral control (PBC) were adapted from Xu et al. [83]. The scales for the selection intentions of the three omni-channel shopping methods, buy online pick-up in-store (BOPI), buy online curbside pickup (BOCP), and buy in-store home delivery (BIHD), were also adapted from Xu et al. [83]. The scale for the moderator, perceived COVID-19 vulnerability (PV), was adapted from Youn et al. [53]. For the selection intentions of the three omni-channel shopping methods, the authors applied a seven-point Likert scale (1 = extremely unlikely, 2 = moderately unlikely, 3 = slightly unlikely, 4 = neither likely nor unlikely, 5 = slightly likely, 6 = moderately likely, and 7 = extremely likely). For the rest of the variables, a seven-point Likert scale (1 = strongly disagree, 2 = disagree, 3 = somewhat disagree, 4 = neither agree nor disagree, 5 = somewhat agree, 6 = agree, and 7 = strongly agree) was applied.

4. Methodology

4.1. Research Design and Data Collection

4.2. Data Analysis Methods

Multiple regression is applied to predict the value of a variable based on the value of two or more other variables [111]. Thus, multiple regression analysis was selected as an appropriate method for this study to test the hypotheses. SPSS 27 software was used for statistical assumption tests, model adequacy examinations, and multiple regression analysis.

5. Results and Discussions

Twenty-one hypotheses were statistically significant at a p < 0.05 level. Perceived COVID-19 vulnerability did not show any significant moderating effect. Demographic variables (i.e., age, gender, education level, and income level) did not directly affect the U.S. consumers’ omni-channel shopping method selection but did significantly affect some perceived value, risk, and behavior control.

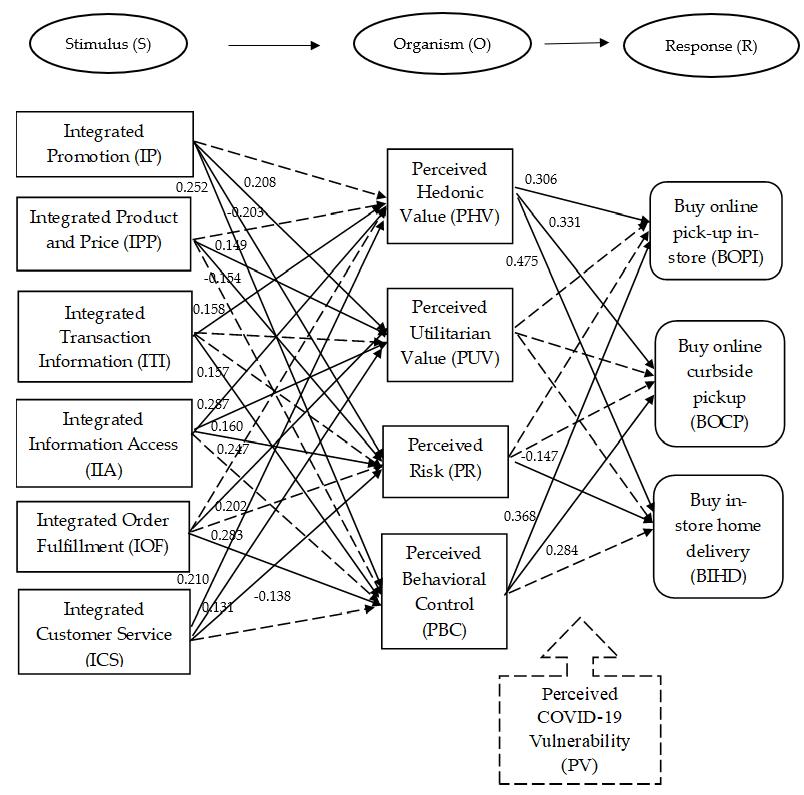

Figure 2 illustrates the identified relationships in the proposed research model. The proposed model shows a satisfactory explanatory power. Stimuli including integrated promotion (IP), integrated product and price (IPP), integrated transaction information (ITI), integrated information access (IIA), integrated order fulfillment (IOF), and integrated customer service (ICS) play a critical role in forming an individual's internal state (perceived hedonic value (PHV), perceived utilitarian value (PUV), perceived risk (PR), and perceived behavioral control (PBC)) toward fashion omni-channel retailing, which subsequently derives the individual's behavioral response (fashion omni-channel shopping method selection). The variances in adoption of BOPI, BOCP, BIHD are accounted for at 31%, 26.4%, and 30.3%, respectively. Perceived COVID-19 vulnerability (PV) does not moderate any relationships investigated.

Figure 2. Identified relationships in the proposed research model.

6. Conclusions

In recent years, fashion brands and retailers are moving quickly to provide U.S. consumers more seamless omni-channel shopping experiences. The pandemic has further accelerated the growth of omni-channel shopping and promoted certain safety-oriented methods such as buy online curbside pickup (BOCP). Omni-channel shopping is becoming the new norm for the U.S. consumers [112]. Omni-channel consumers are hungry for innovation and are more likely to experiment with new technologies and engaging shopping methods [113]. As the number of omni-channel consumers continue to grow, the degree and pace of innovation and integration will need to grow to serve them. To better understand the fashion omni-channel retailing, as one of very first efforts, this study provides the valuable insights to fashion brands and retailers on the determinants of consumers’ selection of omni-channel shopping methods and the impact of the COVID-19 pandemic.

Overall, this study contributes to the existing literature in four ways. First, based on the Stimulus-Organism-Response (S-O-R) model, this study proposed an omni-channel retailing model linking six types of channel integration (stimulus) to consumers’ intentions to use three omni-channel shopping methods (response) through the mediators of consumer perceived value, risk, and behavioral control (organism). The moderating effects of COVID-19 vulnerability on the relationships between consumers’ internal evaluations of channel integration and their shopping method selection intentions were also included in the proposed model. The variances in U.S. consumers’ intentions to use Buy Online Pick-up In-store (BOPI), Buy Online Curbside Pickup (BOCP), or Buy In-store Home Delivery (BIHD) were well accounted for by the model.

Second, the mediating effects played by consumer’s internal state (i.e., perceived hedonic value (PHV), perceived utilitarian value (PUV), perceived risk (PR), and perceived behavioral control (PBC)) were identified. PHV and PBC played a significant role in U.S. consumers’ selection shopping methods of BOPI and BOCP. The intention to use BIHD is positively affected by PHV but decreases when PR is greater. In contrast, PR is not significantly associated with BOPI and BOCP, which corroborates the popularity of these shopping methods. In addition, utilitarian value seems to be an essential but not a winning value for consumers to use omni-channel shopping methods.

Third, the moderating effects played by perceived COVID-19 vulnerability (PV) were all insignificant. Although the COVID-19 pandemic has profoundly changed the way we have been living and working since Spring 2020, with the rapid nationwide vaccination, the U.S. becomes one of the early major economies returning to normal. The COVID-19 safety measures have started being phased out when this study was conducted. The consumers do not necessarily feel their use of omni-channel shopping methods is due to COVID-19 but has been a long-term shift of lifestyle. This supports the general view that digital transformation will continue to be a top priority among retailers in years to come.

Finally, although there were no significant differences in consumers’ omni-channel shopping method selection between consumer segments, some demographic variables did significantly affect perceived utilitarian value, risk, and behavior control. U.S. consumers with lower education level or higher income level perceived more utilitarian value from omni-channel shopping. U.S. consumers with higher education level or lower income level perceived greater level of risk from omni-channel shopping. In comparison, males perceived less risk than female consumers. Education level is positively associated with perceived behavioral control towards omni-channel shopping.

References

- Mascitto, D. Omnichannel Retail Rebel: Breaking the Rules to Save the Industry. Available online: https://infohub.tecsys.com/omnichannel-retail-rebel-breaking-the-rules-to-save-the-industry (accessed on 28 April 2021).

- Statista. Quarterly Share of E-Commerce Sales of Total U.S. Retail Sales. Available online: https://www.statista.com/statistics/187439/share-of-e-commerce-sales-in-total-us-retail-sales-in-2010/ (accessed on 7 June 2021).

- Craven, M.; Liu, L.; Mysore, M.; Wilson, M. Covid-19: Implications for Business. Available online: http://www.amcham-egypt.org/bic/pdf/corona1/McKinsey_Co%20-%20COVID-19-Implications%20For%20Business.pdf (accessed on 8 May 2021).

- Nguyen, H.V.; Tran, H.X.; Van Huy, L.; Nguyen, X.N.; Do, M.T.; Nguyen, N. Online book shopping in Vietnam: The impact of the Covid-19 pandemic situation. Publ. Res. Q. 2020, 36, 437–445.

- Cain, A.; Stone, M. These 28 Retailers, Including Lord & Taylor and Men’s Wearhouse Owner, Have Filed for Bankruptcy or Liquidation in 2020. Available online: https://www.businessinsider.com/retailers-filed-bankruptcy-liquidation-closing-stores-2020-2 (accessed on 3 August 2020).

- Taylor, G. Covid Forced Ominichannel into Overdrive- but Few Are Measuring It Right. Available online: https://sourcingjournal.com/topics/retail/omnichannel-retail-fulfillment-forrester-bloomreach-aptos-bopis-mobile-215215/ (accessed on 28 April 2021).

- Donaldson, T. Zara Owner Inditex to Close Up to 1,200 Stores. Available online: https://sourcingjournal.com/topics/retail/zara-inditex-close-1200-stores-first-quarterly-loss-coronavirus-215385/ (accessed on 28 March 2021).

- Knowles, J.; Ettenson, R.; Lynch, P.; Dollens, J. Growth opportunities for brands during the Covid-19 crisis. MIT Sloan Manag. Rev. 2020, 61, 2–6.

- Pani, A.; Mishra, S.; Golias, M.; Figliozzi, M. Evaluating public acceptance of autonomous delivery robots during Covid-19 pandemic. Transp. Res. Part D Transp. Environ. 2020, 89, 102600.

- Chen, Y.; Chi, T. Omni-Channel Retailing in the Fashion Industry: A Literature Review of Empirical Evidences. Available online: https://www.iastatedigitalpress.com/itaa/article/id/8256/ (accessed on 28 October 2020).

- Beck, N.; Rygl, D. Categorization of multiple channel retailing in multi-, cross-, and omni-channel retailing for retailers and retailing. J. Retail. Consum. Serv. 2015, 27, 170–178.

- Levy, M.; Weitz, B.A.; Grewal, D. Retailing Management; Weitz, B.A., Grewal, D., Eds.; McGraw-Hill Education: Dubuque, IA, USA, 2019.

- Dorf, D. Highlights from Our Recent Webinar with Forrester. Available online: https://www.infor.com/blog/mastering-the-art-of-omni-channel-retailing (accessed on 27 June 2021).

- Byrnjolfsson, E.; Hu, Y.J.; Rahman, M.S. Competing in the age of omnichannel retailing. MIT Sloan Manag. Rev. 2013, 54, 23–29.

- Park, S.; Lee, D. An Empirical study on consumer online shopping channel choice behavior in omni-channel environment. Telemat. Inform. 2017, 34, 1398–1407.

- Jocevski, M.; Arvidsson, N.; Miragliotta, G.; Ghezzi, A.; Mangiaracina, R. Transitions Towards omni-channel retailing strategies: A business model perspective. Int. J. Retail. Distrib. Manag. 2019, 47, 78–93.

- Trenz, M.; Veit, D.J.; Chee-Wee, T. Disentangling the impact of omni channel integration on consumer behavior in integrated sales channels. MIS Q. 2020, 44, 1207–1258.

- Frasquet, M.; Miquel, M.J. Do channel integration efforts pay-off in terms of online and offline customer loyalty? Int. J. Retail. Distrib. Manag. 2017, 45, 859–873.

- Verhoef, P.C.; Kannan, P.K.; Inman, J. From Multi-channel retailing to omni-channel retailing: Introduction to the special issue on multi-channel retailing. J. Retail. 2015, 91, 174–181.

- Liang, T.-P.; Turban, E. Introduction to the special issue social commerce: A research framework for social commerce. Int. J. Electron. Commer. 2011, 16, 5–14.

- Bell, D.; Gallino, S.; Moreno, A. How to win in an omnichannel world. MIT Sloan Manag. Rev. 2014, 56, 45–53.

- Waldron, J. Is Macy’s Guiding the Future of Retail? Available online: https://etaileast.wbresearch.com/blog/macy-future-of-retail (accessed on 7 June 2021).

- Kim, K.; Han, S.-L.; Jang, Y.-Y.; Shin, Y.-C. The Effects of the antecedents of “Buy-Online-Pick-up-in-Store” service on consumer’s bopis choice behaviour. Sustainability 2020, 12, 9989.

- Jin, M.; Li, G.; Cheng, T. Buy Online and Pick up in-Store: Design of the service area. Eur. J. Oper. Res. 2018, 268, 613–623.

- MacCarthy, B.L.; Zhang, L.; Muyldermans, L. Best performance frontiers for Buy-Online-Pickup-in-Store order fulfilment. Int. J. Prod. Econ. 2019, 211, 251–264.

- Jiang, Y.; Liu, L.; Lim, A. Optimal Pricing decisions for an omni-channel supply chain with retail service. Int. Trans. Oper. Res. 2020, 27, 2927–2948.

- Kim, N.L.; Im, H. Do Liberals Want Curbside Pickup More than Conservatives? Contactless Shopping as a Protectionary Action against the Covid-19 Pandemic. Available online: https://onlinelibrary.wiley.com/doi/full/10.1111/ijcs.12714?casa_token=-rsJu3qA3VYAAAAA%3AzZwAgaLLWR68KH678Irl-d6I91qtMGuEHoKcxxjBK2GMjPNgDq24oQJD-afuDMfJDlyMocFR3WH-I5nF (accessed on 1 June 2021).

- Adhi, P.; Davis, A.; Jayakumar, J.; Touse, S. Reimagining Stores for Retail’s Next Normal. Available online: https://www.mckinsey.com/industries/retail/our-insights/reimagining-stores-for-retails-next-normal (accessed on 28 April 2021).

- Saril, S. 16 Online Retailers that Offer Fast and Free in-Store and Curbside Pickup—Including Target, Walmart, Best Buy, Neiman Marcus, and More. Available online: https://www.businessinsider.com/buy-online-pickup-in-store-same-day (accessed on 1 June 2021).

- 2021 Omnichannel Report. Available online: https://www.digitalcommerce360.com/product/omnichannel-report/?utm_source=Web&utm_campaign=2020-Article&cmp=1&utm_medium=Article (accessed on 9 June 2021).

- Bell, D.; Gallino, S.; Moreno, A. Offline Showrooms in omnichannel retail: Demand and operational benefits. Manag. Sci. 2017, 64, 1629–1651.

- Schmidt, I. Shop Talk: Nordstrom’s Merch-Free Concept Store Coming Soon. Madonna’s Skincare Line Is Here. Available online: https://www.hollywoodreporter.com/lists/nordstroms-merch-free-concept-store-coming-soon-madonnas-skincare-line-is-1044165 (accessed on 28 April 2021).

- Murfield, M.; Boone, C.A.; Rutner, P.; Thomas, R. Investigating logistics service quality in omni-channel retailing. Int. J. Phys. Distrib. Logist. Manag. 2017, 47, 263–296.

- Mehrabian, A.; Russell, J.A. An Approach to Environmental Psychology; MIT Press: Cambridge, MA, USA, 1974.

- Zhang, M.; Ren, C.; Wang, G.A.; He, Z. The Impact of channel integration on consumer responses in omni-channel retailing: The mediating effect of consumer empowerment. Electron. Commer. Res. Appl. 2018, 28, 181–193.

- Chi, T.; Chen, Y. A Study of Lifestyle Fashion Retailing in China. Mark. Intell. Plan. 2019, 38, 46–60.

- Pantano, E.; Viassone, M. Engaging consumers on new integrated multichannel retail settings: Challenges for retailers. J. Retail. Consum. Serv. 2015, 25, 106–114.

- Cheah, J.-H.; Lim, X.-J.; Ting, H.; Liu, Y.; Quach, S. Are privacy concerns still relevant? revisiting consumer behaviour in omnichannel retailing. J. Retail. Consum. Serv. 2020, 102242, doi:10.1016/j.jretconser.2020.102242.

- Perumal, S.; Ali, J.; Shaarih, H. Exploring Nexus among Sensory Marketing and Repurchase Intention: Application of Sor Model. Manag. Sci. Lett. 2021, 11, 1527–1536.

- Watts, L.; Chi, T. Key factors influencing the purchase intention of activewear: An empirical study of US consumers. Int. J. Fash. Des. Technol. Educ. 2019, 12, 46–55.

- Chi, T. Mobile commerce website success: Antecedents of consumer satisfaction and purchase intention. J. Internet Commer. 2018, 17, 189–215.

- Zimmerman, J. Using the Sor Model to Understand the Impact of Website Attributes on the Online Shopping Experience; University of North Texas: Denton, TX, USA. Avaialble online https://digital.library.unt.edu/ark:/67531/metadc149694/ (accessed on 1 June 2021)..

- Lim, X.-J.; Cheah, J.-H.; Cham, T.H.; Ting, H.; Memon, M.A. Compulsive buying of branded apparel, its antecedents, and the mediating role of brand attachment. Asia Pac. J. Mark. Logist. 2020, 32, 1539–1563.

- Baker, J.; Levy, M.; Grewal, D. An experimental approach to making retail store environmental decisions. J. Retail. 1992, 68, 445.

- Bakker, I.; Van Der Voordt, T.; Vink, P.; De Boon, J. Pleasure, Arousal, Dominance: Mehrabian and Russell Revisited. Curr Psychol . 2014, 33, 405–421.

- Hyllegard, K.H.; Ogle, J.P.; Yan, R.-N.; Kissell, K. Consumer Response to exterior atmospherics at a university-branded merchandise store. Fash. Text. 2016, 3, 1–17.

- Russell, J.A. Core affect and the psychological construction of emotion. Psychol. Rev. 2003, 110, 145.

- Kumar, A.; Kim, Y.-K. The Store-as-a-Brand Strategy: The effect of store environment on customer responses. J. Retail. Consum. Serv. 2014, 21, 685–695.

- Ladhari, R.; Souiden, N.; Dufour, B. The Role of emotions in utilitarian service settings: The effects of emotional satisfaction on product perception and behavioral intentions. J. Retail. Consum. Serv. 2017, 34, 10–18.

- Chopdar, P.K.; Balakrishnan, J. Consumers Response Towards Mobile Commerce Applications: Sor Approach. Int. J. Inf. Manag. 2020, 53, 102106.

- Xiao, L.; Guo, F.; Yu, F.; Liu, S. The Effects of online shopping context cues on consumers’ purchase intention for cross-border e-commerce sustainability. Sustainability 2019, 11, 2777.

- Chi, T., Ganak, J., Summers, L., Adesanya, O., McCoy, L., Liu, H., Tai, Y. Understanding perceived value and purchase intention toward eco-friendly athleisure apparel: insights from US millennials. Sustain. 2021, 13, 7946.

- Youn, S.-y.; Lee, J.E.; Ha-Brookshire, J. Fashion consumers’ channel switching behavior during the Covid-19: Protection motivation theory in the extended planned behavior framework. Cloth. Text. Res. J. 2021, 39, 139–156.

- Hsin Chang, H.; Wen Chen, S. The Impact of online store environment cues on purchase intention: Trust and perceived risk as a mediator. Online Inf. Rev. 2008, 32, 818–841.

- Bigcommerce. Bopis: How Buy Online, Pick-Up in Store Is Catering to Consumers’ Needs and Boosting Retailers’ Bottom Lines. Available online: https://www.bigcommerce.com/articles/offline-to-online/bopis/#faq (accessed on 28 July 2021).

- Saghiri, S.S.; Bourlakis, M. Guest editorial: Omni-Channel evolution: Confronting the whats and hows. Int. J. Phys. Distrib. Logist. Manag. 2020, 50, 505–508.

- Agnihotri, A. Can Brick-and-Mortar Retailers successfully become multichannel retailers? J. Mark. Channels 2015, 22, 62–73.

- Jeanpert, S.; Paché, G. Successful multi-channel strategy: Mixing marketing and logistical issues. J. Bus. Strategy 2016, 37, 12–19.

- Sousa, P.R.d.; Barbosa, M.W.; Oliveira, L.K.d.; Resende, P.T.V.d.; Rodrigues, R.R.; Moura, M.T.; Matoso, D. Challenges, Opportunities, and lessons learned: Sustainability in Brazilian omnichannel retail. Sustainability 2021, 13, 666.

- Ye, Y.; Lau, K.H.; Teo, L.K.Y. Drivers and barriers of omni-channel retailing in China. Int. J. Retail. Distrib. Manag. 2018, 46, 657–689.

- Neslin, S.A.; Grewal, D.; Leghorn, R.; Shankar, V.; Teerling, M.L.; Thomas, J.S.; Verhoef, P.C. Challenges and opportunities in multichannel customer management. J. Serv. Res. 2006, 9, 95–112.

- Oh, L.-B.; Teo, H.-H.; Sambamurthy, V. The effects of retail channel integration through the use of information technologies on firm performance. J. Oper. Manag. 2012, 30, 368–381.

- Le, A.N.H.; Nguyen-Le, X.-D. A Moderated Mediating mechanism of omnichannel customer experiences. Int. J. Retail. Distrib. Manag. 2020, 49, 595–615.

- Sousa, R.; Voss, C.A. Service quality in multichannel services employing virtual channels. J. Serv. Res. 2006, 8, 356–371.

- Gutman, J. A Means-End chain model based on consumer categorization processes. J. Mark. 1982, 46, 60–72.

- Chi, T.; Kilduff, P.P. Understanding consumer perceived value of casual sportswear: An empirical study. J. Retail. Consum. Serv. 2011, 18, 422–429.

- Ganak, J.; Chen, Y.; Liang, D.; Liu, H.; Chi, T. Understanding US millennials' perceived values of denim apparel recycling: Insights for brands and retailers. Int. J. Sustain. Soc. 2020, 12, 267–290.

- Thaler, R. Mental accounting and consumer choice. Mark. Sci. 1985, 4, 199–214.

- Zeithaml, V.A. Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. J. Mark. 1988, 52, 2–22.

- Babin, B.J.; Darden, W.R.; Griffin, M. Work and/or fun: Measuring hedonic and utilitarian shopping value. J. Consum. Res. 1994, 20, 644–656.

- Gupta, S.; Kim, H.W. Value-Driven Internet shopping: The mental accounting theory perspective. Psychol. Mark. 2010, 27, 13–35.

- Hsiao, C.C.; Yen, H.J.R.; Li, E.Y. Exploring consumer value of multi-channel shopping: A perspective of means-end theory. Internet Res. 2012, 22, 318–339.

- Kokku, R. Omni and multi-channel: Relationship with utilitarian/hedonic benefits, shopping value and channel patronage. Int. Rev. Manag. Mark. 2021, 11, 11.

- Pookulangara, S.; Hawley, J.; Xiao, G. Explaining Consumers’ Channel-Switching Behavior Using the Theory of Planned Behavior. J. Retail. Consum. Serv. 2011, 18, 311–321.

- Lee, H.-H.; Kim, J. Investigating dimensionality of multichannel retailer's cross-channel integration practices and effectiveness: Shopping orientation and loyalty intention. J. Mark. Channels 2010, 17, 281–312.

- Raghubir, P.; Corfman, K. When Do Price Promotions Affect Pretrial Brand Evaluations? J. Mark. Res. 1999, 36, 211–222.

- Wu, J.-F.; Chang, Y.P. Multichannel integration quality, online perceived value and online purchase intention. Internet Res. 2016, 26, 1228–1248.

- Savastano, M.; Bellini, F.; D’ascenzo, F.; De Marco, M. Technology adoption for the integration of online–offline purchasing. Int. J. Retail. Distrib. Manag. 2019, 47, 474–492.

- Li, Y.; Liu, H.; Lee, M.; Huang, Q. Information privacy concern and deception in online retailing: The moderating effect of online–offline information integration. Internet Res. 2019, 30, 511–537.

- Morgan, R.M.; Hunt, S.D. The commitment-trust theory of relationship marketing. J. Mark. 1994, 58, 20–38.

- Mukherjee, A.; Nath, P. Role of electronic trust in online retailing: A re-examination of the commitment-trust theory. Eur. J. Mark. 2007, 41, 1173–1202.

- Peter, J.P.; Ryan, M.J. An investigation of perceived risk at the brand level. J. Mark. Res. 1976, 13, 184–188.

- Xu, X.; Jackson, J.E. Examining customer channel selection intention in the omni-channel retail environment. Int. J. Prod. Econ. 2019, 208, 434–445.

- Sheppard, B.H.; Hartwick, J.; Warshaw, P.R. The Theory of reasoned action: A meta-analysis of past research with recommendations for modifications and future research. J. Consum. Res. 1988, 15, 325–343.

- Koul, S.; Eydgahi, A. A systematic review of technology adoption frameworks and their applications. J. Technol. Manag. Innov. 2017, 12, 106–113.

- Chen, M.-F. Consumer Attitudes and Purchase Intentions in Relation to Organic Foods in Taiwan: Moderating Effects of Food-Related Personality Traits. Food Qual Prefer. 2007, 18, 1008–1021.

- Ajzen, I. perceived behavioral control, self-efficacy, locus of control, and the theory of planned behavior. J. Appl. Soc. Psychol. 2002, 32, 665–683.

- Herhausen, D.; Binder, J.; Schoegel, M.; Herrmann, A. integrating bricks with clicks: Retailer-level and channel-level outcomes of online–offline channel integration. J. Retail. 2015, 91, 309–325.

- Piotrowicz, W.; Cuthbertson, R. Introduction to the Special Issue Information Technology in Retail: Toward Omnichannel Retailing. Int. J. Electron. Commer. 2014, 18, 5–16.

- Bradlow, E.T.; Gangwar, M.; Kopalle, P.; Voleti, S. The Role of Big Data and Predictive Analytics in Retailing. J. Retail. 2017, 93, 79–95.

- Chi, T. Understanding Chinese consumer adoption of apparel mobile commerce: An extended tam approach. J. Retail. Consum. Serv. 2018, 44, 274–284.

- Sharma, M.; Gupta, M.; Joshi, S. Adoption Barriers in engaging young consumers in the omni-channel retailing. Young Consum. 2019, 21, 193–210.

- Juaneda-Ayensa, E.; Mosquera, A.; Murillo, Y.S. Omnichannel Customer behavior: Key drivers of technology acceptance and use and their effects on purchase intention. Front. Psychol. 2016, 7, 1117.

- Lee, Y.; Choi, S.; Field, J.M. Development and Validation of the pick-up service quality scale of the Buy-Online-Pick-up-in-Store Service. Oper. Manag. Res. 2020, 13, 218–232.

- Kim, E.; Park, M.-C.; Lee, J. Determinants of the intention to use Buy-Online, Pickup in-Store (Bops): The moderating effects of situational factors and product type. Telemat. Inform. 2017, 34, 1721–1735.

- Li, G.; Zhang, T.; Tayi, G.K. Inroad into omni-channel retailing: Physical showroom deployment of an online retailer. Eur. J. Oper. Res. 2020, 283, 676–691.

- Daunt, K.L.; Harris, L.C. Consumer Showrooming: value co-destruction. J. Retail. Consum. Serv. 2017, 38, 166-76.

- Moon, J.; Choe, Y.; Song, H. Determinants of consumers’ online/offline shopping behaviours during the Covid-19 pandemic. Int. J. Environ. Res. 2021, 18, 1593.

- Rogers, R.W. Cognitive and psychological processes in fear appeals and attitude change: a revised theory of protection motivation. Social Psychophysiology: A Sourcebook; Guilford: New York, NY, USA, 1983.

- Picot-Coupey, K.; Krey, N.; Huré, E.; Ackermann, C.-L. Still work and/or fun? corroboration of the hedonic and utilitarian shopping value scale. J. Bus. Res. 2021, 126, 578-90.

- Goodman, J.K.; Cryder, C.E.; Cheema, A. Data collection in a flat world: The strengths and weaknesses of Mechanical Turk samples. J. Behav. Decis. Mak. 2013, 26, 213–224.

- George, D.; Mallery, P. IBM SPSS Statistics 26 Step by Step: A Simple Guide and Reference; Routledge: London, UK, 2019.

- Ott, L.; Longnecker, M.; Ott, R.L. An Introduction to Statistical Methods and Data Analysis; Cengage Learning: Boston, MA, USA, 2001.

- Chi, T.; Gerard, J.; Dephillips, A.; Liu, H.; Sun, J. Why U.S. Consumers Buy Sustainable Cotton Made Collegiate Apparel? A Study of the Key Determinants. Sustainability 2019, 11, 3126.

- Chi, T.; Sun, Y. Development of firm export market oriented behavior: Evidence from an emerging economy. Int. Bus. Rev. 2013, 22, 339–350.

- Morgan, N.A.; Vorhies, D.W.; Mason, C.H. Market orientation, marketing capabilities, and firm performance. Strateg. Manag.J. 2009, 30, 909–920.

- Ping, R.A., Jr. A parsimonious estimating technique for interaction and quadratic latent variables. J. Mark. Res. 1995, 32, 336–347.

- Mariadoss, B.J.; Chi, T.; Tansuhaj, P.; Pomirleanu, N. Influences of firm orientations on sustainable supply chain management. J. Bus. Res. 2016, 69, 3406–3414.

- Byrne, B.M. Structural Equation Modeling with LISREL, PRELIS, and SIMPLIS; Lawrence Erlbaum Associates Inc.: London, UK, 1998.

- Nunnally, J.C.; Bernstein, I.H. Psychometric Theory, 2nd ed.; McGraw-Hill: New York, NY, USA, 1978.

- Cohen, J.; Cohen, P.; West, S.G.; Aiken, L.S. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences; Abingdon: Routledge, UK, 2013.

- Briedis, H.; Harris, T.; Pacchia, M.; Ungerman, K. Ready to ‘Where’: Getting Sharp on Apparel Omnichannel Excellence. Available online: https://www.mckinsey.com/industries/retail/our-insights/ready-to-where-getting-sharp-on-apparel-omnichannel-excellence (accessed on 1 May 2021).

- Holmes, N. Omnichannel Retail Trends for 2021. Available online: https://www.widen.com/blog/omnichannel-retail-trends (accessed on 7 May 2021).