Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Management

COVID-19 pandemic has brought significant and multiple challenges for small and medium enterprises (SMEs). While SMEs have traditionally faced financial and non-financial crises, the pandemic has brought about additional uncertainties on how to maintain business continuity.

- SMEs

- COVID-19

- rapid review

- resilience

- technological advancements

1. Introduction

The COVID-19 pandemic continues to hit the profitability and sustainability of small and medium enterprises (SMEs) in an unprecedented way. This paper addresses the question ‘how do SMEs mitigate against their challenges and develop resilience capability when faced with a crisis such as COVID-19?’ by examining the literature on SME challenges in the context of the COVID-19 pandemic. The study covers both developed and developing countries to see what role, if any, has been played by individuals and organisations alike in developing creativity and resilience characteristics that might help SMEs in sailing through the toughest crisis of their lives.

The outbreak of the COVID-19 pandemic led to a number of new contexts for studying the SMEs, including the need to be agile to boost a lag in performance [1][2], to increase productivity [3] in order to mitigate against financial difficulties [4]. Some early studies highlighted the need for SMEs to be dynamic if they are to resolve the COVID-19 crisis, without actually showing the aspects wherein such dynamism might help. For instance, Ba et al. [5] highlighted the challenges faced by such enterprises but falls short on providing a set of recommendations that can help them survive and develop during and post-COVID-19.

Some of the emerging literature studying SMEs in the context of the COVID-19 pandemic suggests that a strategic set of responses are required to enhance their chances of survival [6][7][8]. Most recently, Musa and Aifuwa [9] have identified how technology can help SMEs address their growing challenges through the use of social media to help with budgetary, business transactions, and cash flow problems. However, the extent to which these recommendations have facilitated resilience capacity in financial areas such as accounts monitoring, the promotion of a firm’s products and services and the proper maintenance of cash flow for the affected SMEs has not been investigated and articulated in the scholarship on SMEs.

2. From Crises to Creativity: Enhancing SMEs’ Resilience

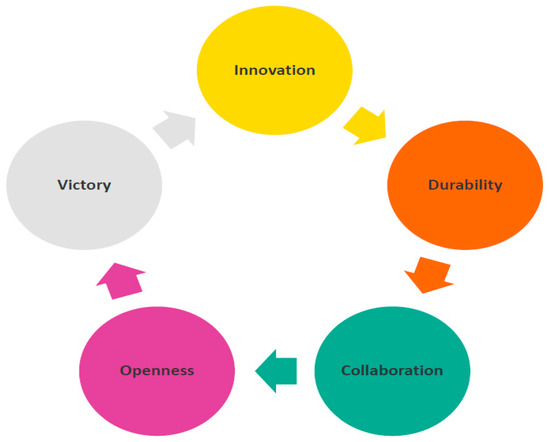

The literature underscores that SMEs are a source of economic viability but the COVID-19 pandemic has brought such viability under question. This section outlines recommendations on how SMEs can recover and rejuvenate from the past, and the ongoing impact of COVID-19—to survive in such a manner as to reduce (if not avoid) detrimental impact on their resources. The start of the year and COVID-19 brought with itself confusion fear of the unknown, lack of acceptance, and lots of what-if questions, which varied based on the country and even regional context. A stage of acceptance and adaptability seems to have been reached (see Figure 1) amidst fantastic examples of creativity and innovation. The authors propose viewing lessons learnt to date from COVID-19 from a different and new lens (see Figure 2), which were further delved into from practical and policy perspectives next.

Figure 1. COVID-19 to creativity.

Figure 2. Enhancing SMEs’ resilience.

2.1. Collaboration

This first step includes partnerships with all stakeholders and focussing on win–win outcomes. One should not forget the support system (friends, neighbours, and relatives) during this process and identify their skills and expertise to facilitate collaborations and positive contributions towards business survival. Some of the measures suggested as part of this resilient approach include:

- (i)

-

Focus on local: SMEs in partnership with other business and local councils (or equivalent) should enhance advertising to attract and encourage customers to buy local. Sectors such as groceries and hospitality lend themselves to market themselves and focus on local customers.

- (ii)

-

Regulatory bodies: The human and financial resource constraints on the SME sector make it extremely cumbersome to comply with the government policies and rules. Regulatory agencies should work with the businesses, and vice versa, in a collaborative manner and keep the bureaucratic and thus administrative costs to a minimum. For the current environment where SMEs are working amidst and post-COVID-19 period, the exemplar suggested by [5], centre around Thanh Hoa province of Vietnam, can be followed. This policy model incorporates factors from all governmental levels and acts to build SMEs endurance and growth. The payment of interest and employees’ salary, as well as static records and cost of rent during the pandemic period, need to be supported, especially if the SMEs are operating at a partial capacity, due to the limited resource availability. The business operating restrictions are enforced by the government and can have a long-lasting and detrimental impact on SMEs. SMEs had requested governments to assist by providing relief in taxes, finances, and subsidies relating to employment and operations [10]. There was, however, limited demand and uptake of government services beyond those of financial nature.

2.2. Openness

This step involves being transparent with the stakeholders by keeping the communication channels open and allowing for two-way input and feedback process [2]. This pairing of transparency and communication can contribute towards preserving the organisations’ relationships with internal and external stakeholders. The crux of openness is founded on using different communication strategies (e.g., verbal, written, visual, social media, print, etc.) to inform stakeholders of the potential challenges being experienced and constructively discussing resolutions (including being receptive to ideas from the stakeholders). The level of digitization in contemporary times lends much exclusivity to the challenges thrown by COVID-19, ensuing strategies knitted around digital adoption and integration [11]:

- (i)

-

Social media: The rise of the new techno-centric paradigm can be a requisite ingredient for SMEs’ coping ability. This could also influence the promotion of products or businesses via the increasing use and adoption of social media and information technologies, especially beyond the lockdown restrictions. The increasingly sophisticated tools of connectivity and networking mechanisms used in digital technologies can enhance the modes of communication for SMEs.

- (ii)

-

Digital technologies (DT) and innovation: Strategic adoption can lead to enhanced competitiveness, productivity, performance, and embracing of new skills and digital opportunities [12]. Such characteristics can enhance SMEs’ competitive advantage and resilience when faced with their larger counterparts [13][14]. Although there appears to be an increase in the SME literature in relation to their use of digital technologies in improving competitive advantage, there is a lack of empirical evidence demonstrating the effectiveness of the use of digital technologies in both developed as well as developing countries. It should be noted that these digital advancements alone are not capable of resolving the diverse range of socio-political and legal barriers that pose limitations to the performance and resilience of SMEs.

- (iii)

-

Flexibility and agility on the part of suppliers: Whether a business is classified as a supplier or is accepting raw material for a supplier, there needs to be openness of a kind that has never witnessed earlier. The closing of state (depending on the country) and international borders has brought forth the spotlight of overreliance on a few suppliers. Long-term relationships are invaluable for any operational business transactions. What has been overlooked, nevertheless, is the lack of contingency planning in the absence of these trusted partners. With the landscape of changing restriction, flexibility and agility on the part of suppliers have become non-negotiable. This is also the time for a business to audit all their suppliers and if required, replace their inflexible suppliers with new partners.

2.3. Victory

Accepting the external environmental threats while identifying and taking advantage of opportunities will lead to victory for all involved. This again is predicated on collaboration with different stakeholders and thinking creatively such as:

- (i)

-

Government initiatives: Ref. [13] found that SMEs/firms with a long history, huge employee size, and a strategy of formal disaster mitigation can recover within 4 months after the eruption of the crisis in comparison to organizations without any strategy and fewer resources. To encourage policy responses of SMEs finances during the COVID-19 pandemic, the United Kingdom and other OECD economies have been granting debt finances such as loan guarantees and direct subsidised loans [15]. An analysis by [16] proposed additional measures including wage support and loans. During disasters, the government needs to invest more in technology because there is heavy dependence on technology and telecommunication, which help local SMEs become accustomed to environmental changes. It seems as if a few of the pandemic winners could be in highly technical and digitally enabled sectors such as life sciences, medical equipment, online delivery-based organizations, software organizations, and application-based organizations [15].

- (ii)

-

Streamlining policies in line with the regulations: It is imperative for policymakers to work with and streamline existing legal and regulatory infrastructure (even accounting for variances for it to deal with sudden shocks such as pandemics) to ensure that businesses are viewed to be supporting businesses than increasing bureaucratic hurdles. Simultaneously, businesses need to be agile and adapt their policies in line with the government regulations to improve their business performance.

- (iii)

-

Variations of employment contracts and recruitment: Temporary closures of firms can lead to permanent employment loss, and reduced job openings could provide businesses with heterogeneity. Under such conditions, SMEs can experience unprecedented challenges such as changing business, curtailed ability to repay the loans, shunting of employees, and inadequate gain to resources [17]. Bartik et al. [18] found that many firms in the United States have closed temporarily or have decreased the number of workers as compared to January 2020. The organizations researched were not positive about the federal government’s effectiveness of the fiscal stimulus (CARES Act loan program). Brown et al. [19] recommended schemes such as the Scottish Jobs Guarantee Scheme to assist younger employees in the labour market. Brown et al. [19] also suggested a sequence of peculiar policy such as the takeover of failing organizations by the Scottish Government.

- (iv)

-

Economic structure flexibility: The economic crisis resulting from the COVID-19 will impact financial institutions from the state to the global level [7]. During uncertain times, small scale financial assistance can bring about important variations in SMEs behaviour [19]. Exemplars of this include forgivable loans, for instance, permitting existing businesses to continue and developing policies that provide stimulus packages for current and budding entrepreneurs [20]. There is also a need for digital skills training and web-based marketing [21]. This can be evident in the actions of firms who were gradually familiarizing themselves with electronic and social media and other marketing plans that require sales sub-agents in every state [22]. Optimum digitalization plans are required to attain business goals and develop SME products or services of higher quality [7]. Collective flexibility as a response is required both by governments and SMEs to develop new and creative business platforms [8][23][22]. The digital economic ecosystem comprises SMEs and calls for changes and creativity in digital skills for business sustainability [9]. Government policies and the village officials of Yogyakarta city in Indonesia are supported to speed up such changes post-COVID-19 [2].

2.4. Innovation

This involves putting different pieces of the jigsaw puzzle together and learning about and investing in transferable skills and resources from individual to organisational levels. The potential options here include:

- (i)

-

Business transactions support: The economically affected sector of SMEs is dependent on the money transactions in the sale and purchase of products. In the research conducted by [21], it was found that there is a requirement to support services to avoid SMEs from closing business before the end of this year. There is also a need for cash grants and similar kinds of support. Many European governments quickly protected SMEs’ employees by providing plans relating to jobs retention and wages support. Tsilika et al. [24] highlighted that policymakers need to assist organizations in responding to harmful environmental conditions caused because of disasters (e.g., COVID-19) and examine entrepreneurial bricolage and its particularities. These innovative alternatives can contribute towards invigorating human creativity. Policymakers need to have conversations besides providing financial aid and discuss regulations and methods to manage organizations cropping from human creativity.

- (ii)

-

Circular economy: Countries and businesses alike have started to have conversations around the circular economy (CE). It is still early days, nevertheless, the fundamentals of CE can be implemented now to ensure more efficient and effective use of resources (human, financial, infrastructure, etc.). CE is founded on the principles of refusing, reducing, reusing, reforming, and recycling (5R) materials (raw and end product) so that overall waste can be reduced, in turn, positively contributing towards the ecological environment. In the current COVID-19 environment, with scarce resources and a continually changing landscape, these 5R principles can be adopted by businesses of all sizes (including micro) and sectors. It also needs to be acknowledged that some individuals and businesses alike will face hurdles during their journey. The main hurdle is changing the mindset and behaviours from a ‘throw-away’ and ‘make-or-break’ economic system to a ‘make-to keep’ one. The authors contend that a number of households have already embarked on their CE journey, an example being creative with available food ingredients and avoiding food (and money) wastage during the COVID-19 environment. As uncertainty around employment looms, individuals have restricted spending their disposable incomes on such areas as take-aways while simultaneously cooking at home with limited groceries due to supply chain shortages.

2.5. Durability

The SMEs need to adopt a resilient approach comprising unorthodox thinking and mindful execution. While being mentioned last, following the circular process, this could also be the first step—for resilience (and hence durability) being established at the individual level before being transferred to other (e.g., departmental) levels and the entire organisation. The spectrum of initiatives includes:

- (i)

-

SWOT of the owner/manager/decision maker: What is the business strategy? What are its capabilities and available resources? These phrases are commonplace when referring to a business (irrespective of its size). Authors view that these same principles need to be responded at the individual level. Each owner/manager need to undertake the SWOT (strengths, weaknesses, opportunities, and threats) of themselves, and, ideally, of the people around them (both personally and professionally). This evaluation will tie back to the earlier point about collaborating with their support system. An objective SWOT process will also contribute in the long term with enhanced relationships as the decision maker is likely to better understand other stakeholders’ perspectives, making them overall competitive. This process will also assist in the identification of transferable skills, which can be deployed at a time of need.

- (ii)

-

Balance in life dimensions: All work and no play can have a detrimental impact on the physical and mental health and wellbeing. COVID-19 has reignited and reminded everyone of the significance of health and the need to enjoy small pleasures in the light of unexpected events, loss, and uncertainties. Without good and stable health, one cannot commit to the hard work required for the survival and subsequent success of a business. The authors posit that ‘self-care’ should be the utmost priority for everyone, especially. within the COVID-19 situation we have found ourselves in, notwithstanding their role and responsibilities.

This entry is adapted from the peer-reviewed paper 10.3390/su13126542

References

- Gerald, E.; Obianuju, A.; Chukwunonso, N. Strategic agility and performance of small and medium enterprises in the phase of Covid-19 pandemic. Int. J. Financ. Account. Manag. 2020, 2, 41–50.

- Hadi, S. Revitalization Strategy for Small and Medium Enterprises after Corona Virus Disease Pandemic (Covid-19) in Yogyakarta. J. Xi’an Univ. Archit. Technol. 2020, XII, 4068–4076.

- Nyanga, T.; Zirima, H. Reactions of Small to Medium Enterprises in Masvingo, Zimbabwe To Covid 19: Implications on Productivity. Bus. Excell. Manag. 2020, 10, 22–32.

- McGeever, N.; McQuinn, J.; Myers, S. SME Liquidity Needs during the COVID-19 Shock; Financial Stability Notes; Central Bank of Ireland: Dublin, Ireland, 2020.

- Ba, H.; Le, H.; Loan, T.; Thanh, C.; Bich, T.; Pham, T.; Binh, T. Policy related factors affecting the survival and development of SMEs in the context of Covid 19 pandemic. Manag. Sci. Lett. 2020, 10, 3683–3692.

- Ratnasingam, J.; Khoo, A.; Jegathesan, N.; Wei, L.C.; Latib, H.A.; Thanasegaran, G.; Liat, L.C.; Yi, L.Y.; Othman, K. How are Small and Medium Enterprises in Malaysia’s Early Evidences from a Survey and Recommendations. BioResources 2020, 15, 5951–5964.

- Liguori, E.W.; Pittz, T.G. Strategies for small business: Surviving and thriving in the era of COVID-19. J. Int. Counc. Small Bus. 2020, 1–5.

- Fitriasari, F. How do Small and Medium-sized Enterprises (SME) survive the COVID-19 outbreak? J. Inov. Ekon. 2020, 5, 53–62.

- Musa, S.; Aifuwa, H.O. Coronavirus pandemic in Nigeria: How can Small and Medium Enterprises (SMEs) cope and flatten the curve? Eur. J. Account. Financ. Invest. 2020, 6, 56–61.

- Lu, Y.; Wu, J.; Peng, J.; Lu, L. The perceived impact of the Covid-19 epidemic: Evidence from a sample of 4807 SMEs in Sichuan Province, China. Environ. Hazards 2020.

- Haider Syed, M.; Khan, S.; Raza Rabbani, M.; Thalassinos, Y.E. An Artificial Intelligence and NLP based Islamic FinTech Model Combining Zakat and Qardh-Al-Hasan for Countering the Adverse Impact of COVID 19 on SMEs and Individuals. Int. J. Econ. Bus. Adm. 2020, VIII, 351–364.

- Mazzarol, T. SMEs engagement with e-commerce, e-business and e-marketing. Small Enterp. Res. 2015, 22, 79–90.

- Jain, M.; Sharma, G.D.; Mahendru, M. Can I sustain my happiness? A review, critique and research agenda for economics of happiness. Sustainability 2019, 11, 6375.

- MacGregor, R.; Vrazalic, L. A Profile of Australian Regional SME Non-Adopters of E-commerce. Small Enterp. Res. 2008, 16, 27–46.

- Brown, R.; Rocha, A.; Cowling, M. Financing entrepreneurship in times of crisis: Exploring the impact of COVID-19 on the market for entrepreneurial finance in the United Kingdom. Int. Small Bus. J. Res. Entrep. 2020.

- Brülhart, M.; Lalive, R.; Lehmann, T.; Siegenthaler, M. COVID-19 financial support to small businesses in Switzerland: Evaluation and outlook. Swiss J. Econ. Stat. 2020, 156, 1–13.

- Beraha, I.; Đuričin, S. The Impact of COVID-19 Crisis on Medium-sized Enterprises in Serbia. Econ. Anal. 2020, 53, 14–27.

- Bartik, A.W.; Bertrand, M.; Cullen, Z.B.; Glaeser, E.L.; Luca, M.; Stanton, C.T. How Are Small Businesses Adjusting to COVID-19? Early Evidence from A Survey; NBER Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2020.

- Keogh-Brown, M.R.; Jensen, H.T.; Edmunds, W.J.; Smith, R.D. The impact of Covid-19, associated behaviours and policies on the UK economy: A computable general equilibrium model. SSM Popul. Health 2020, 12, 100651.

- Morgan, T.; Anokhin, S.; Ofstein, L.; Friske, W. SME response to major exogenous shocks: The bright and dark sides of business model pivoting. Int. Small Bus. J. Res. Entrep. 2020.

- Hoorens, S.; Hocking, L.; Fays, C. How Small Businesses Are Coping with the Impact of COVID-19; Rand Europe: Cambridge, MA, USA, 2020.

- Che Omar, A.R.; Ishak, S.; Jusoh, M.A. The impact of Covid-19 Movement Control Order on SMEs’ businesses and survival strategies. Malays. J. Soc. Space 2020, 16, 139–150.

- Papadopoulos, T.; Baltas, K.N.; Balta, M.E. The use of digital technologies by small and medium enterprises during COVID-19: Implications for theory and practice. Int. J. Inf. Manag. 2020, 102192.

- Tsilika, T.; Kakouris, A.; Apostolopoulos, N.; Dermatis, Z. Entrepreneurial bricolage in the aftermath of a shock. Insights from Greek SMEs. J. Small Bus. Entrep. 2020, 1–18.

This entry is offline, you can click here to edit this entry!