It is important that the strategic mine plan makes optimum use of available resources and provides continuous quality ore to drive sustainable mining and profitability. This requires the development of a well-integrated strategy of mining options for surface and/or underground mining and their interactions. Understanding the current tools and methodologies used in the mining industry for surface and underground mining options and transitions planning are essential to dealing with complex and deep-seated deposits that are amenable to both surface and underground mining.

- strategic mining options optimization

- mathematical programming models

- transition depth

- open pit-underground mining

- resource development planning

1. Classification of Mining Methods (Mining Options)

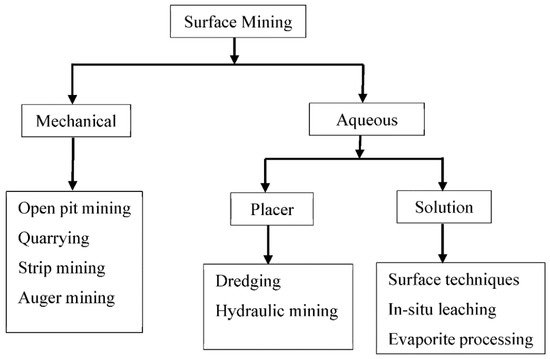

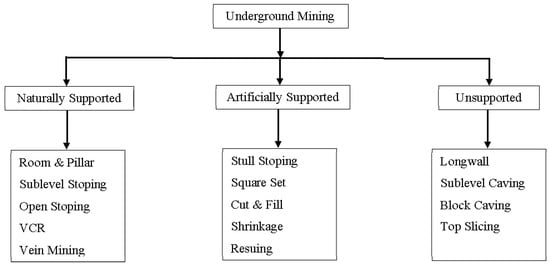

Mining is defined as the process of exploiting a valuable mineral resource naturally occurring in the earth crust [1][2]. The extraction of mineral resources from the earth crust is classified broadly into two; surface mining and underground (UG) mining. In surface mining, all the extraction operations are exposed to the atmosphere while in UG mining, all the operations are conducted in the bosom of the earth crust. The main objective of a mineral project development is the maximization of investment returns; the “golden rule” of mining or the investor’s “law of conservation” [3]. Therefore, adopting the best mining option that maximizes the project’s value is a requirement to the establishment of a successful mine. Planning a surface mine is often simpler compared to an underground mine because there are broad similarities between different variations of surface mining as opposed to the variations of underground mining. Thus, planning an underground mine is necessarily complicated by the availability of many different types and variations of mining systems [4]. These surface and underground mining variations are also generally referred to as classes of mining methods. The classification of surface mining methods and underground mining methods are respectively illustrated in Figure 1 and Figure 2.

Surface mining methods are broadly classified into mechanical and aqueous extraction methods (Figure 2). Mechanical surface mining methods include open pit mining, quarrying, strip mining, and auger mining, while aqueous surface mining methods include placer mining and solution mining. Placer mining includes dredging and hydraulic mining while solution mining includes surface techniques such as in-situ leaching and evaporite processing. Based on the rock formation strength, UG mining methods are broadly classified into naturally supported methods, artificially supported methods, and unsupported methods (Figure 3). Naturally supported mining methods include room and pillar, sublevel stoping, open stoping, vertical crater retreat (VCR), and vein mining. Artificially supported mining methods include stull stoping, square set, cut and fill, shrinkage, and resuing while unsupported methods include longwall, sublevel caving, block caving, and top slicing. According to Nelson [5], some of the factors that must be considered when choosing between surface or underground mining methods include:

-

Extent, shape, and depth of the deposit;

-

Geological formation and geomechanical conditions;

-

Productivities and equipment capacities;

-

Availability of skilled labor;

-

Capital and operating costs requirements;

-

Ore processing recoveries and revenues;

-

Safety and injuries;

-

Environmental impacts, during and after mining;

-

Reclamation and restoration requirements and costs;

-

Societal and cultural requirements.

2. Evaluation Techniques for Mining Options and Transitions Planning

The outcome of an evaluation study for a mineral deposit amenable to open pit (OP) and underground (OPUG) mining includes the optimal mining option, strategic extraction plan, and a transition depth or location. The variations of the mining option are independent OP mining, independent UG mining, concurrent OP and UG mining, OP mining followed by UG mining, and UG mining followed by OP mining. The strategic extraction plan includes the sequences of rock extraction and the determination of life of mine and transition depth. The transition depth defines the location or position of the crown pillar. The extraction strategy when OPUG mining is preferred could either be sequential mining or parallel mining or both [6]. Respectively, other researchers used the terms simultaneous or non-simultaneous or combined OPUG mining to refer to these same mining options [7].

Sequential mining is when the mineral deposit is continuously extracted by an independent OP mining method(s) until the pit limit is completely mined out before being followed by UG mining method(s), while parallel mining is when the mineral deposit is simultaneously or concurrently extracted by OP and UG mining in the same period or time. Transitioning is the main challenge for OPUG mining projects due to the complexity and implications of where and when to position the crown pillar (or identify the transition depth) [8] in the presence of various mining constraints. Over the years, five fundamental approaches have been used to determine the transition point or location of the crown pillar [9][6][10][11]. These techniques are (1) biggest economic pit, (2) incremental undiscounted cash flow, (3) automated scenario, (4) stripping ratio, and (5) opportunity cost analyses.

For the biggest economic pit approach, the mineral resource is primarily evaluated for OP mining. When the OP mining limit is obtained, the portion of the mineral resource falling outside the OP outline is evaluated for UG mining. The biggest economic pit is the simplest and most commonly used traditional approach for evaluating a mineral resource amenable to OPUG mining options. For the biggest economic pit, the pit usually terminates when the marginal cost of waste stripping outweighs the marginal revenue obtained from processing additional amounts of ore.

In the case of the incremental undiscounted cash flow approach, the marginal OP profit from the mineral project per depth is evaluated and compared to the marginal UG profit. Due to increasing cost of stripping waste per depth, there is a point where the marginal OP profit is lower than the marginal UG profit. This depth is the transition point which then acts as the crown pillar during transition. This transition depth is typically shallower compared to the largest economic pit [6]. This method assumes that UG mining profits do not depend on the depth of operation, therefore, there will be a point where the marginal profits from UG mining operation will exceed that from OP mining operation.

The automated scenario analysis approach accounts for discounting unlike the incremental undiscounted cash flow approach. It is based on the premise that, per an equivalent unit of throughput, UG mines are characterized by high cut-off grades and therefore have higher cash flow compared to OP mines for the same throughput. The approach is implemented by compiling schedules for OP and UG mining and comparing the computed NPV for each potential transition point. Thus, a set of transition points are evaluated and the OPUG mining arrangements that offers the highest NPV is selected for further analysis and design [6]. This method is time consuming and complex.

The stripping ratio analysis features the use of allowable stripping ratio (ASR) planned by mine management for the OP mine and overall stripping ratio (OSR) computed per depth for the OP mine to determine the transition depth [10][11]. The stripping ratio is expressed by this relation with emphasis on exploitation cost of 1 tonne of ore in UG mining and in OP mining, as well as, removal cost of waste in relation to 1 tonne of ore extracted by OP mining. As OP mining deepens, the stripping ratio usually increases, increasing the overall mining cost. An OSR is calculated and used to determine the breakeven point of the OP mine relative to its depth. The OP mine transitions to UG mine when OSR is equal to the ASR established by management of the mining project.

The opportunity cost technique is an extension of the LG algorithm that optimizes the OP ultimal pit while considering the value of the next best alternative UG mining option. This approach also employs the strength of the undiscounted cashflow technique and assumes that rock materal in the transition zone will be mined by UG method if not mined by OP method [9]. The methodology ensures that a minimum opportunity cost is achieved for the selected optimal mining option at the expense of the unselected mining option.

An evaluation technique that seeks to leverage the advantages of all these five fundamental approaches were recently introduced by Afum and Ben-Awuah [12]. This approach is referred to as the competitive economic evaluation (CEE) technique. The CEE process evaluates each block of the mineral deposit and economically decides: (a) blocks suitable for OP mining, (b) blocks suitable for UG mining, (c) unmined blocks, and (d) unmined crown pillar simultaneously. The CEE optimization strategy is an unbiased approach that provides fair opportunity to each mining block for selection by a mining option

This entry is adapted from the peer-reviewed paper 10.3390/mining1010008

References

- Caro, R.; Epstein, R.; Santibañez, P.; Weintraub, A. An integrated approach to the long-term planning process in the copper mining industry. In Handbook of Operations Research in Natural Resources; Springer: New York, NY, USA, 2007; Volume 99, pp. 595–609.

- Newman, A.M.; Rubio, E.; Weintraub, A.; Eurek, K. A review of operations research in mine planning. Interfaces 2010, 40, 222–245.

- Bohnet, E. Comparison of surface mining methods. In SME Mining Engineering Handbook, 3rd ed.; Darling, P., Ed.; Society for Mining, Metallurgy, and Exploration: Englewood, CO, USA, 2011; Volume 1, pp. 405–413.

- Yardimci, A.G.; Tutluoglu, L.; Karpuz, C. Crown pillar optimization for surface to underground mine transition in Erzincan/Bizmisen Iron Mine. In Proceedings of the 50th US Rock Mechanics/Geomechanics Symposium, Houston, TX, USA, 26–29 June 2016; pp. 1–10.

- Nelson, G.M. Evaluation of mining methods and systems. In SME Mining Engineering Handbook, 3rd ed.; Darling, P., Ed.; Society for Mining, Metallurgy and Exploration: Englewood, CO, USA, 2011; Volume 1, pp. 341–348.

- Finch, A. Open pit to underground. Int. Min. January 2012, 88–90.

- Bakhtavar, E.; Abdollahisharif, J.; Aminzadeh, A. A stochastic mathematical model for determination of transition time in the non-simultaneous case of surface and underground. J. South. Afr. Inst. Min. Metall. 2017, 117, 1145–1153.

- Opoku, S.; Musingwini, C. Stochastic modelling of the open pit to underground transition interface for gold mines. Int. J. Min. Reclam. Environ. 2013, 27, 407–424.

- Whittle, D.; Brazil, M.; Grossman, P.A.; Rubinstein, J.H.; Thomas, D.A. Combined optimisation of an open-pit mine outline and the transition depth to underground mining. Eur. J. Opt. Res. 2018, 268, 624–634.

- Chen, J.; Guo, D.; Li, J. Optimization principle of combined surface and underground mining and its applications. J. Central South Univ. Technol. 2003, 10, 222–225.

- Chen, J.; Li, J.; Luo, Z.; Guo, D. Development and application of optimum open-pit software for the combined mining of surface and underground. In Proceedings of the Computer Applications in the Mineral Industries (CAMI) Symposium, Beijing, China, 25–27 April 2001; pp. 303–306.

- Nhleko, A.S.; Tholana, T.; Neingo, P.N. A review of underground stope boundary optimization algorithms. Resour. Policy 2018, 56, 59–69.