The concept of externalities in the production of goods and services by Arthur Pigou became part of economics with the publication of “The Economics of welfare”. GHG emissions became a negative global externality from production activities causing global warming and climate change. Society needs to adapt to the catastrophic consequences if governments across the globe delay in taking any unprecedented policy corrections.

A price on GHG emissions determined from climate economic modelling is called Social Cost of Carbon (SCC) or carbon price. SCC is defined as the net present value of climate damages from one more tonne of carbon dioxide (CO2) or equivalent, conditional on a global emissions trajectory over time . Among others, setting a price on greenhouse gas emissions is one of the effective policy instruments to address the negative externalities of anthropogenic greenhouse gas emissions. Carbon pricing is implemented in almost 61 jurisdictions around the world covering 22% of global GHG emissions based on a report by the World Bank in 2020. According to this report, the range of carbon prices starts from 1 USD/tCO2e to 119 USD/tCO2e. However, the percentage coverage of global GHG emissions has almost doubled from 13% in 2016 with only 40 jurisdictions . The year 2016 was selected to compare the state of the global carbon pricing in the post-Paris Agreement in 2015. This is evidence by the adoption of carbon pricing which is expected to build its pace following this growing trend.

1. An Overview of Global Efforts in Climate Economic Modelling

Energy economics models were widely used to estimate the cost of GHG abatement prior to the advent of integrated climate economics models in the 1990s [

20,

21,

22,

23]. Nordhaus used an optimization model to determine the balance between the abatement cost and the cost of avoided damages from the physical impacts of climate change [

24]. More climate-economic models such as DICE, PAGE & FUND are developed in the past two decades to determine carbon pricing to correct the market failure [

25,

26].

There was a surge in climate economic models since the early 1990s. This was motivated by the release of the first IPCC assessment report in 1990 [

27] and the establishment of UNFCCC in 1992. Below is the description of three key climate economic models often quoted in IPCC assessment reports.

Dynamic Integrated Climate and Economy or commonly known as DICE model evolved from previous works on energy models developed by William Nordhaus and gained more popularity during the early 1990s [

21]. Regional Integrated Assessment Model or commonly known as the RICE model was developed during the mid-1990s to downscale the DICE to a regional-based analysis by William Nordhaus [

28]. Both models are top-down assessment models often quoted in IPCC reports. DICE analyses at the global scale and RICE has the capability of analyzing at the regional scale [

29].

- 2.

-

Policy Analysis of Greenhouse Effect

Policy Analysis of Greenhouse Effect or commonly known as PAGE, was a model initiated to serve European Union decision-makers and was developed by Chris Hope in 1991 [

30,

31]. This is a top-down model used in various publications such as “The Stern Review” by Cambridge University. PAGE model is also used at the regional level [

32]. This model analyzed climate economics at national levels as the non-market impacts vary widely between countries [

33].

- 3.

-

Climate Framework for Uncertainty, Negotiation, and Distribution

FUND or “Climate Framework for Uncertainty, Negotiation, and Distribution” was developed by Richard Tol in the early 1990s. This is to study the impact of climate policy on international capital transfers by clustering the worldwide economy into nine economic regions [

34]. After version 2.5, the model subdivided the world into 16 regions (

http://www.fund-model.org). Subsequently, FUND was widely referred to for climate policy discussions [

35].

The economic models range from basic models incorporating principles of general equilibrium to complex algorithms, integrating climate science to determine the carbon price required to correct the externalities [

36,

37].

The carbon price is also sometimes referred to as the Social Cost of Carbon (SCC) which is the marginal benefit of GHG reduction by one tonne [

38]. In other words, it is also an economic measurement of the impact of adding one more tonne of carbon dioxide equivalent (CO

2e) commonly called GHGs. From the definition above, the unit of measurement for SCC can be both in tonnes of carbon dioxide (CO

2) or carbon dioxide equivalent (CO

2e) depending on the framework and coverage of the model.

SCC is a function of climate damages quantified as global Gross Domestic Product (GDP) loss by IPCC reports [

39,

40]. The highest GDP impact was 3.5% in IPCC 1996 compared to 20% in IPCC 2007. The estimates of the GDP impact of climate change in the second assessment report by IPCC are far lower than the fourth assessment report due to the early stage of climate economics modelling which only accounted for a gradual change in climate conditions on the market sectors of an economy. Catastrophic impacts such as abrupt changes in the frequency and intensity of extreme weather events and climate shocks (i.e., system change) or even non-market factors such as human health and environment were not factored [

41]. The developing countries already suffer a higher degree of climate damage compared to the developed countries in the form of a market. Hence, including damage from climate shocks and non-market impact will make it worst [

42,

43,

44]. The “Stern Review” run climate economic modelling using “Monte-Carlo” simulation technique indicates that the mean cost of climate change in developing countries such as India as well as South East Asia is approximately 6% of regional GDP by 2100 compared to global average GDP of 2.6% [

5].

The latest IPCC Fifth Assessment Report reiterated that the impacts of climate change are real and strengthen the evidence that developing countries are more vulnerable to the impacts of climate change [

6]. Since the cost of climate damages could be higher in developing countries, climate economic modelling will give value to the SCC. There is a need to downscale the climate economic models to understand the regional or even country-level impacts due to high uncertainty in global models [

45]. The climate economic model will enable nations to determine appropriate SCC to correct the externalities of GHG emissions [

42]. Many countries have introduced carbon pricing based on decades of negotiations and research findings (World Bank et al., 2016). Malaysia needs a comprehensive climate economic modelling to comprehend the short- and long-term impacts and make sound policies to build resilience and sustainability.

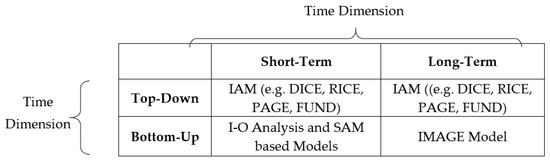

2. Identification of the Key Dimensions and a Framework to Classify Climate Economic Models

Climate economic modelling can be viewed in two key dimensions namely “level of details” and “time”. The first dimension can be from an economic or spatial details perspective modelling as a “top-down” or “bottom-up” approach [

44]. Nordhaus [

46] and Hope [

47] worked on top-down models that include global or regional climate damage functions and they don’t include spatial or economic structural details. However, the bottom-up models such as “IMAGE 2.0” [

48] have good sectoral and spatial details but fail to capture aspects of adaptation and related welfare. Such bottom-up climate economics models contain too much information and it is difficult to interpret [

44]. IMAGE models have been used widely to study the land use, agriculture economy, natural vegetation, hydrology, and other climate impacts closely linked to spatial parameters [

49].

The second dimension is based on time. Climate models can be classified to fit the objectives of the short-term and long-term analysis. Input-Output (I-O) tables and Social Accounting Matrix (SAM) [

50] models are generally short term [

51]. These models are valid when the fundamental structure of the economy remains constant and assume advancement in low carbon technologies do not cause any change to economic structure. Most of these models took the carbon price as exogenous and analyze the impact on the current state of the economy in the short run [

52]. They are also good for studies on tax neutrality which redistributes the collected carbon tax for social welfare [

53].

Long term climate economics model incorporates the impact of climate change and its associated damage costs. The long-term models also factor in the possibility of changing economic structure due to the advancement of low carbon technology in terms of estimated cost reduction [

54]. Such models integrating climate science and economy are called Integrated Assessment Models (IAMs) and they were studied from an aggregated view and mostly top-down models [

51]. The IAM framework commonly includes the following common elements in the modelling:

-

Projections of global and local temperatures

-

Bounded scenarios with respect to changes in precipitation and storms

-

Large scale systemic or surprise shocks to climate systems such as the shift of oceans circulation or sudden reversal of carbon sink in the biosphere

Comparatively, I-O and SAM based models are matured, however since their nature is to serve short term analysis, climate feedback loops that will be in long horizons cannot fit in. Thus, the carbon price is usually exogenous making the largest limitations for I-O or SAM based models. IAM based models are mostly top-down and the limitation is that they are not suitable for a bottom-up analysis looking into economic impacts by sectors in a region or country.

Hence, climate economic models from both dimensions of level and detail and time are required to complete the puzzle of SCC and its impact on the economy. IAM can cover both short-term and long-term analysis. However, these models have disadvantages, whereby they are unable to study in detail the economic impacts of different sectors within the economy [

55]. The “bottom-up” models such as I-O or SAM can fulfill this gap, where they can give granularity to sectorial impact with less uncertainty which is suitable for short-term analysis. provides a framework to group the climate economics models into four quadrants for an easy understanding.

Figure 3. Framework to Group Climate Economics Models.

Based on the above framework and analysis key models are identified as I-O tables, SAM, and IAM. These three models can be used to classify and review climate economic modelling in Malaysia. The following section will analyze the key literature on the origin of climate economics in Malaysia.

3. Trends and Developments of Climate Economic Modelling in Malaysia

Climate change discussions have been a global debate since the establishment of IPCC in 1988. However, the involvement of the Malaysian government in global climate negotiations only started after Malaysia ratified the UNFCCC treaty on 13 July 1994. Malaysia subsequently ratified the Kyoto Protocol in Sept 2002 and the Paris Agreement in Nov 2016 respectively.

Research in climate-related to CGE modelling picked up momentum globally from 2002–2008 [

73]. The published papers increase fivefold during 2009–2015 [

73]. This concurs with Period 1 and 2 in this review.

The above analysis indicates that the discussion on climate economics in Malaysia gained momentum in Period 2 (2005–2012) after the introduction of the National Climate Policy in 2009. The initial work was in the academic circles. The carbon price was introduced as an exogenous parameter into modelling approach build based on I-O table by the academia [

57]. However, the momentum in academia was not translated into actual GHG reductions. It was reported that Malaysia has not reduced its CO

2 intensity per unit of GDP from 1991 to 2013 [

74].

Climate economics modelling work was further explored in Period 3 by using SAM as well as IAMs as shown in . However, this work was not at the centre stage for decision making during the ratification of the Paris Agreement in 2016. The reflection is seen from a modest Malaysia National Determined Contribution (NDC) which was not too ambitious. It is also important to note that, Malaysia’s modest ambition is also a reflection of collective global NDC submissions [

75].

In the post-Paris Agreement in Period 4, many jurisdictions and countries around the world have implemented or scheduled to implement carbon pricing initiatives [

72]. However, carbon price is still at the level of academic discussion, proposals, and plans at various levels of civil society and government departments in Malaysia. No firm date for the implementation is seen in Malaysia.

4. Classification of Climate Economic Modelling in Malaysia

A review was conducted to classify climate economics-related papers in Malaysia from Period 2 to Period 4. A total of 31 papers related to climate economics discussion in Malaysia were reviewed. Discussion on climate economics in Malaysia varies from sectorial energy modelling focusing on renewables [

76,

77], transport [

78], agriculture [

79,

80,

81], and urbanisation [

82]. Some literature discussed Malaysia in general but focusing on ASEAN [

83,

84].

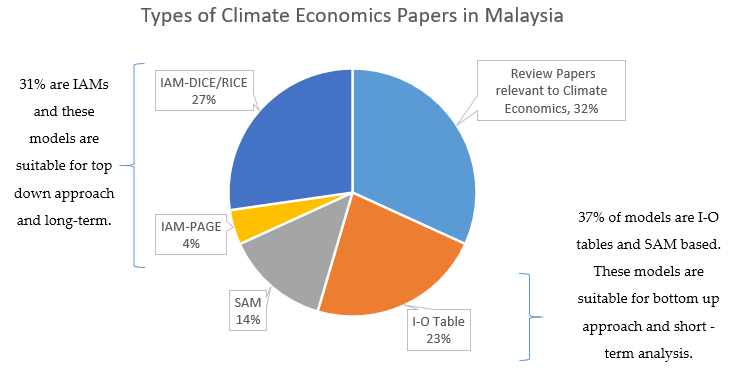

A total of 22 papers that discussed climate economics or carbon pricing in Malaysia were filtered. The remaining 9 papers were filtered out as they do not discuss carbon pricing or specific on Malaysia. The selected papers are summarized in

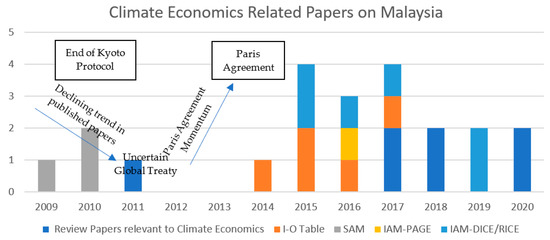

Appendix A. These papers include those that used models of I-O tables, SAM, IAMs, and some review papers or policy discussions on carbon pricing. None of the papers employed IMAGE modelling in Malaysia. An additional category of review papers was included in this study due to several review or policy papers related to climate economics published in Malaysia during the period of study. shows the distribution of papers from 2009–2020.

Figure 4. Climate Economics Related Papers in Malaysia.

The first paper on climate economics modelling in Malaysia was published in 2009 [

85]. The authors employed SAM modelling to investigate the short-term analysis of carbon tax injection into Malaysian economy. The authors conclude that the introduction of carbon price in the form of tax will reduce CO

2 emissions but at the same time will have a negative impact on the GDP. Two similar studies were published in 2010 based on the SAM modelling by the same authors with updated data. The studies inferred that imposing a price on carbon will have a negative impact on GDP. In 2011, a policy review paper by Al-Amin was motivated by National Climate Change Policy and Malaysia voluntary pledge at the Copenhagen conference to reduce GHG intensity [

86]. There were no published papers on Malaysian climate economics modelling in 2012 and 2013. Malaysia actively participated in Kyoto Protocol Clean Development Mechanism (CDM) during the first commitment period of 2008–2012 [

86,

87]. The declining trend of published papers on climate economics modelling in Malaysia could be largely attributed to the uncertainty on the second phase of Kyoto Protocol and a new global treaty on climate change. An increasing trend in published papers related to climate economics modelling in Malaysia was observed after 2014. This can be attributed to the momentum of securing a global deal on climate change which was a reality with a landmark Paris Agreement in 2015 [

88]. More steady publications are seen in , post INDC announcement by Malaysia government in 2015 [

65] as well as the IPCC 1.5 degrees special report [

89] on the need for unprecedented action to get to net-zero by 2050. More climate economics modeling is needed in Malaysia to meet the global goals of climate change. The previous works on climate economics in Malaysia need to be properly categorized for further analysis.

Thus, the published papers were categorized into five broad groups according to their objective of the paper and their modelling approach which can be grouped into four quadrants as discussed in this paper before. The five broad groups are as follows:

Modelling could be linear using block equations and good for short term analysis assuming no major change to the current economic structure in the form of I-O tables for economy-wide or sector-specific. Suitable to study the impact on current GDP impact of introducing carbon tax.

Modelling papers used Social Accounting Matrices to study the impact of carbon tax in the short run as well to economy-wide or sector-specific in a non-linear approach.

- 3.

-

Group 3: IAM-PAGE Models

Models integrate climate science and economy for the long run in a nonlinear approach as used in the Stern Review [

33]. Long term climate feedbacks are considered in models to optimize the goal of GHG reduction and limiting temperature increase. Good for an economy-wide impact study. This model is often quoted in IPCC literature for climate economics.

- 4.

-

Group 4: IAM- DICE/RICE Models

Models integrate climate science and economy for long-run analysis in a nonlinear approach as used by Nordhaus [

90]. Have the same advantages as IAM-PAGE model. This model is also often quoted in IPCC literature for climate economics.

- 5.

-

Group 5: Policy review papers with no modelling

No modelling was done and mostly discuss the policy and simple analysis. Provides current state of policy overview and clearer problem statement for future work on climate economics modelling.

Almost one-third of the papers over the past decade were based on I-O and SAM models accounting for 23% and 14%, respectively. DICE/RICE models accounted for 27% and IAM-PAGE models accounted for 4%. Review papers accounted for the remaining 32% of climate economics modelling papers. Collectively, 68% of the papers were based on climate economics modelling as shown in .

Figure 5. Types of Climate Economics Papers on Malaysia.

This entry is adapted from the peer-reviewed paper 10.3390/su13010325