Qatar’s agricultural sector has expanded in recent years due to the country’s increased food demands caused by its rapid population growth and economic development. The number of active and operational farms has increased by 12.8% from 822 in 2010 to 916 in 2017 (see ), although the number of registered farms in the country shows a small increase of 2.7% during the same period. Thus, farms that were previously registered in the Ministry of Municipality and Environment increased production. Active farms include plant production from both open field and greenhouse cultivation and also include animal farms.

Small-scale farms (<20 ha) are usually oriented towards local market demand, whereas medium (20–100 ha) and large farms (>100 ha) also export produce like dates, cereals, eggs, milk, and milk products [

13] to neighboring countries and other markets like Europe. The total arable area that could potentially be cultivated in Qatar is 65,000 ha and this area has been constant over the past few years [

13]. However, the actual cultivated land area, which includes green fodder, date palms, fruits, vegetables, and cereals has increased by approximately 23% from 2010 to 2019 (). In 2019, the agricultural and fisheries labor force was composed of 0% of Qatari and 1.4% of non-Qatari males of the total national labor force [

14].

Table 1. Cultivated land area (ha), number of registered farms, number of active farms and food self-sufficiency index (self-sufficiency = local production/available for consumption %) in Qatar (2010–2019) [

13,

15,

16].

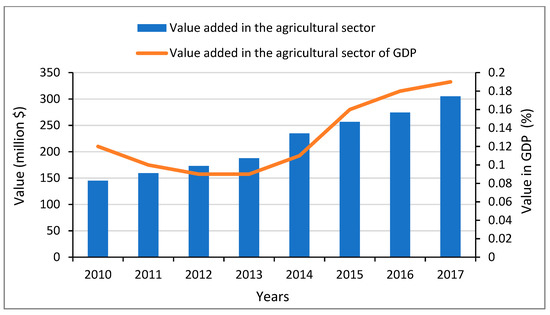

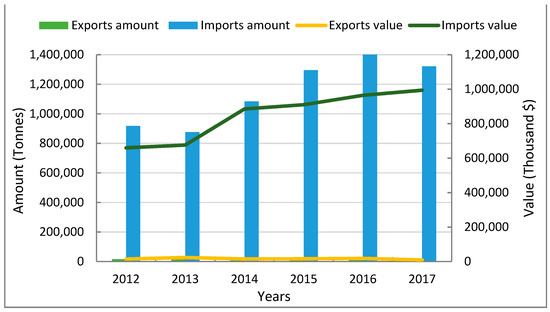

Although agriculture is an emerging economic activity in Qatar, contributing to just 0.2% of GDP in 2017, the value-added as a contribution to GDP from the agriculture, forestry, and fisheries sector, increased from 145 million United States Dollars ($) in 2010 to 305 million $ in 2017, an increase of 110% over these seven years (see ). However, to put this trend in context, in 2017 the country imported 1.3 million tonnes of agricultural products with a value of approximately 1 billion $ and exported 14,157 tonnes of produce from the sector with a value of 9.5 million $ as shown in . Agricultural produce dominates the share in quantity (tonnes) and consequent, value ($) among fisheries and forestry products (please note there is no forestry activity in the country). Fisheries accounted for 33,841 tonnes out of 1.3 million tonnes of total agricultural product imports and 773 tons out of 14,157 tonnes of total exports in 2017. The remaining share is agricultural production which includes plant, meat, dairy products, and eggs [

17]. Agricultural product imports increased by 43.9% in tonnes and 50% in value over the 5 years from 2012 to 2017 and follow Qatar’s population increasing trend over this period, which was 24% from 2.2 million to 2.7 million [

9].

Figure 1. Value added (million $) and value added of GDP (%) of agriculture, forestry and fishery sector for the Qatari economy Qatar (1 QR = 0.27$) (2010–2017) [

16,

17].

Figure 2. Exports and imports amount (tonnes) and exports and imports value ($) of agricultural products in Qatar (1 QR = 0.27$) (2012–2017) [

17].

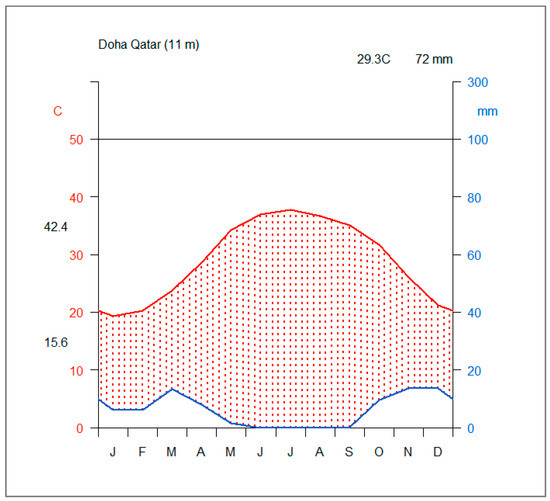

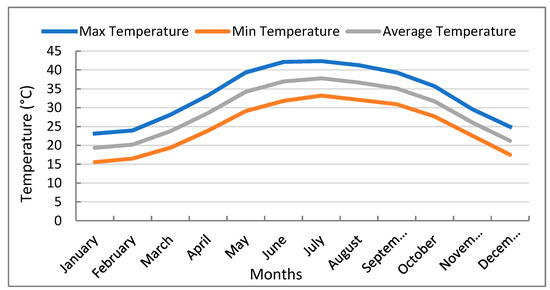

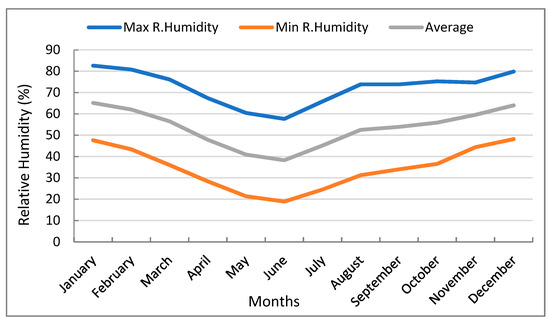

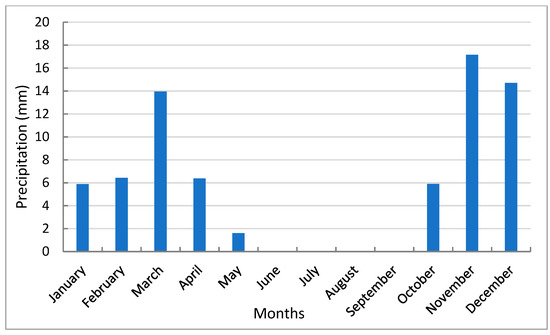

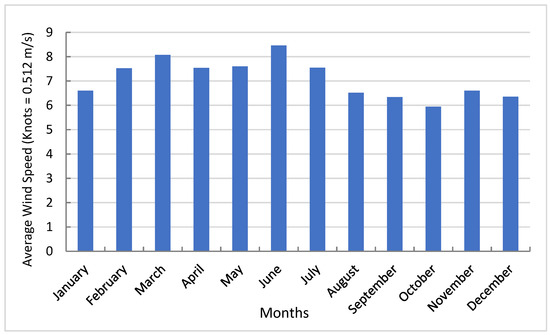

Because of Qatar’s limited resources and harsh climate, it has traditionally imported more than 90% of food requirements from more than 100 countries, e.g. the Netherlands, Kenya, South Africa, New Zealand, India, etc. [

11]. Consequently, Qatar has always been sensitive to the issue of food security and set up a National Food Security Program (QNFSP) in 2008 to reduce the state’s reliance on food imports through self-sufficiency and domestic production [

18]. Since the 2017 air and sea blockade imposed on Qatar by the same neighboring countries and their allies within the MENA region who supplied the bulk of Qatar’s food requirement [

11,

19], the issue of food security has understandably become an acute national concern.

On 5 June 2017, Saudi Arabia, the United Arab Emirates (UAE), Egypt, and Bahrain, all of which are neighboring countries and allies in the region, cut diplomatic and trade ties with Qatar and imposed a land, sea, and air blockade. The four countries claimed Qatar supported “terrorism”, had close tights to Iran, and interfered in the internal affairs of their nations. Before 2017, 27.4% of Qatar’s food imports came from Saudi Arabia and the UAE as well as 60% of dairy products. Moreover, 40% of food imports passed through Saudi Arabia [

20,

21] before entering Qatar.

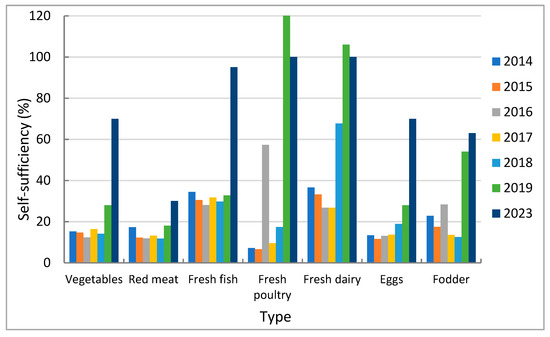

Although the blockade ended on 4 January 2021, during the blockade period Qatar rapidly developed relationships with many new food product suppliers. However, local food production was also rapidly prioritized, and the percentage of food produced within Qatar went up from 10.7% in 2016 to 11.5% in 2017 the same year as the blockade (). This was particularly true of perishable products such as vegetables and milk, which has nearly tripled [

15,

22] since 2017. Self-sufficiency in many food products like meat, dairy products, and vegetables has increased from 15.2% in 2014 to 28% for vegetables in 2019 with a growth of 16 local varieties, while the Ministry of Municipality and Environment (MME) has targeted ambitious goals for 2023, reaching 70% self-sufficiency in vegetables, as shown at . It is noteworthy that Qatar was greater than 100% self-sufficient for fresh dairy products and poultry in 2019 with 106% and 124%, respectively ().

Figure 3. Self-sufficiency (self-sufficiency = local production/available for consumption%) of major food groups (vegetables, red meat, fresh fish, fresh poultry, fresh dairy, eggs, fodder) in Qatar (2014-2023) [

13,

23,

24].

Using modern production methods applied to both outdoor and indoor cultivation, local farms are making considerable efforts to improve their agricultural production. This also includes the rapid development of equipment and practices suitable for use in hot arid climates such as:

These efforts have been remarkably successful, achieving high yields and meeting the goals for food security [

23,

25] set by MME. As a result, the greenhouse market in Qatar is growing, reaching a value of $97.9 million in 2018; the market value is further expected to reach $216 million by 2024 [

26]. Greenhouse crop production uses both soil cultivation and hydroponic techniques, as the soilless cultivation systems have been developed as a sustainable solution to food production and food security.

Hydroponic farming is considered more sustainable than traditional farming as it maximizes overall output and minimizes the use of space, soil, water, and other resources. More specifically, hydroponic crop production

- reduces the quantity of agricultural land-take;

- minimizes the use of chemicals needed as fertilizer;

- uses approximately 70% less water, and

- produces a greater yield of fruits and vegetables in a shorter time [27].

Also, combining hydroponics with aquaculture has the potential to tackle both Qatar's sustainability issues and contribute to Qatar attaining its food security targets [28].

Several local companies are following organic farming principles as the demand for organic products is increasing with consumers becoming more aware of the benefits of locally grown organic produce and follow a healthier lifestyle. Moreover, some companies like Agrico Agricultural Development, in addition to their current use of sustainable farming methods, are applying circular economy principles. Their aim is to transform business processes into sustainable, closed-loop resource systems [

29], e.g. of their waste management by composting and reusing the organic waste generated on their farms.

Qatar’s organic product market is growing and organic packaged food and beverage consumption reached approximately $14.4 million in 2020 [

30]. The number of organic farms and farmers’ markets is also increasing in Qatar [

31] and the key farms are shown in . Some farms hold international organic certifications like USDA Certification by Agrico Agricultural Development and IFOAM Certification by Al Safwa Farms. Although there are national legislation standards for the organic agricultural sector in Qatar, there is no national certification body to certify the organic farms.

Table 2. Key farms following organic farming methods, year of establishment, and location in Qatar [

32,

33,

34,

35,

36,

37,

38].