This entry provides a review of economic models of professional sports leagues with and without revenue sharing. These include models that assume profit-maximizing and win-maximizing (sportsmen) club owners. Both approaches predict that revenue sharing will reduce the demand for player talent, depress player salaries, and transfer revenue from large-market to small-market clubs, but they differ on league parity effects. Empirical work has been sparse due to financial data limitations and has not yielded definitive results on the parity issue. Despite the growing awareness of sports economics in the sports industry, the lack of consensus from theoretical models has resulted in sports leagues searching for an optimal revenue sharing policy. The difficulty in providing consistent policy prescriptions in models that incorporate revenue sharing, salary caps, and other league policies has made economic modeling of sports leagues very difficult and complex. While revenue sharing remains an interesting theoretical modeling issue, it has not bridged the gap to real-world league policies.

Revenue sharing is a business tool used by North American professional sports leagues to redistribute revenues from wealthy large-market clubs to less wealthy small-market clubs. The intention of revenue sharing is to ensure survival of the league by having enough clubs that are financially viable. The nature of professional team sports requires an opposing club at each match to produce an output, defined here as ticket sales from attendees. Neale [

1] referred to this joint production as the “peculiar economics of professional sports”: while competition is encouraged on the field, clubs participate in a joint venture to maximize league revenue. Fan interest could dwindle if a league shrinks to only a few clubs. Revenue sharing is one of several tools a league can use to reach its optimal size, where it achieves its highest revenue and profitability. The purpose of this paper is to discuss the mechanics of different revenue sharing schemes, the development of theoretical models in sports economics that incorporate revenue sharing, and summarizing empirical work that test their predictions, particularly regarding league parity.

The sharing of league revenues that fall outside of the contests played is commonplace in professional sports leagues around the world. These revenues include national television, streaming, licensing, apparel, and other revenue sources that are negotiated and collected by the league offices. In most cases, these revenues are shared equally among the member clubs. Major League Baseball (MLB) clubs each received USD 60.1 million from the national revenue pool in 2023 [

2]. The National Football League (NFL) clubs each received USD 372 million from the national revenue pool in 2022 [

3]. One notable exception is the English Premier League (EPL), that shares 50% of these revenues equally among its member clubs, assigning 25% based progressively on order of finish in the 20-team league (higher finishing clubs earning a larger share), and the remaining 25% as a facilities fee for televised matches [

4]. This could be a sensible policy to encourage greater competition in football leagues that feature promotion and relegation with lower leagues. However, North American leagues do not feature promotion and relegation systems, so an equal split of national revenues is sensible.

North American professional sports leagues have utilized two different types of systems to share local revenues that include gate revenue (not including suite revenue), some parking and concession revenue, and some local advertising revenue (signage and media). These revenues are commonly referred to as “baseball-related income” or “basketball-related income” depending upon the sport. The revenues included in these categories differ slightly among the four major leagues (MLB, NFL, National Basketball Association (NBA), and National Hockey League (NHL)). Gate revenue sharing requires that the home and visiting club split the revenue from each contest unequally. The NFL used a 60–40 split (home and visitor) for decades. MLB adopted a 50–50 split early in its history, moving to a roughly 95–5 split (the National League paid 50 cents to the visiting team for every ticket sold, which works out to a roughly 95–5 split over several decades) and 80–20 split (American League) until the mid-1990s. Gate revenue sharing resulted in disproportionate effects on club revenue since the system is sensitive to the playing schedule. A small-market club prefers being placed in a league division (or conference) that contains many large-market clubs to garner more revenue from the gate split. A large-market club would suffer a loss in potential revenue by being placed in a division with only small-market clubs. The result could be a “revenue reversal” [

5], where a club changes position in the league revenue hierarchy due to the gate sharing system. Incentives for club owners to be competitive in matches and at the business table could become distorted. This premise relies on the property that clubs will move towards business decisions (player acquisitions, ticket pricing, etc.) that maximize league revenue in the absence of any restrictions (where marginal revenues are equated between clubs), which is a standard result of economic models of sports leagues [

6].

Gate revenue sharing in North American sports leagues has been replaced with a pooled revenue sharing system in which each club contributes a common, fixed percentage of its local revenue to a central pool administered by the league office. Each club then receives an equal share of the revenue pool at the end of each playing season. These percentages are negotiated in the collective bargaining agreements of each league with the players since revenue sharing has the potential to depress player salaries if it is extensive (Fort and Quirk 1995). The 2023 contribution rates were 48% in MLB, 34% in the NFL, and 50% in the NBA. The NBA redistributes an amount to each club equal to the average club payroll. Small-market clubs must earn at least 70% of the average club local revenue to qualify to receive a share. The NHL revenue sharing system is more complex, with contributions to the league revenue pool made only by the top ten revenue teams (with some concessions to several U.S. teams) and an unequal split of pooled revenue based on local market size. NFL clubs equally shared a total revenue pool of approximately USD 12.3 billion in 2022 [

7]; MLB clubs equally shared approximately USD 3.3 billion in 2022 [

8]. A total of USD 404 million was redistributed among clubs in the NBA in 2022 [

9]. Pool revenue sharing does not suffer from the potential of revenue reversals [

5] and could be one of the reasons for its adoption by North American leagues.

In a pool revenue sharing system, clubs whose local revenue falls below the league average receive a net positive revenue transfer, while those clubs who fall above the league average are net payers. There is no change in the average club revenue; however, the distribution of club revenues becomes more compact, reflected in a smaller standard deviation. All clubs maintain their ranking in the local revenue hierarchy after revenue sharing.

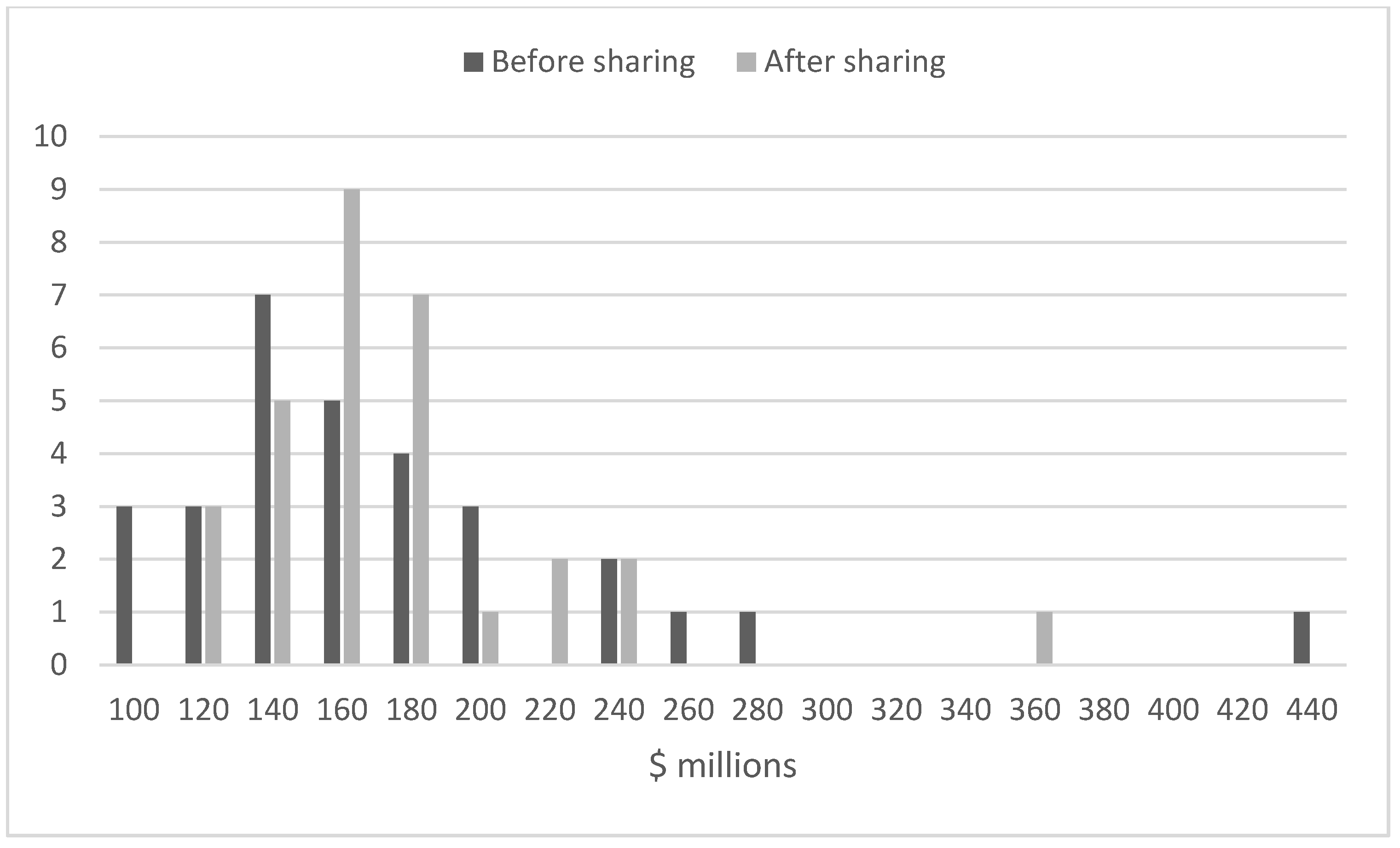

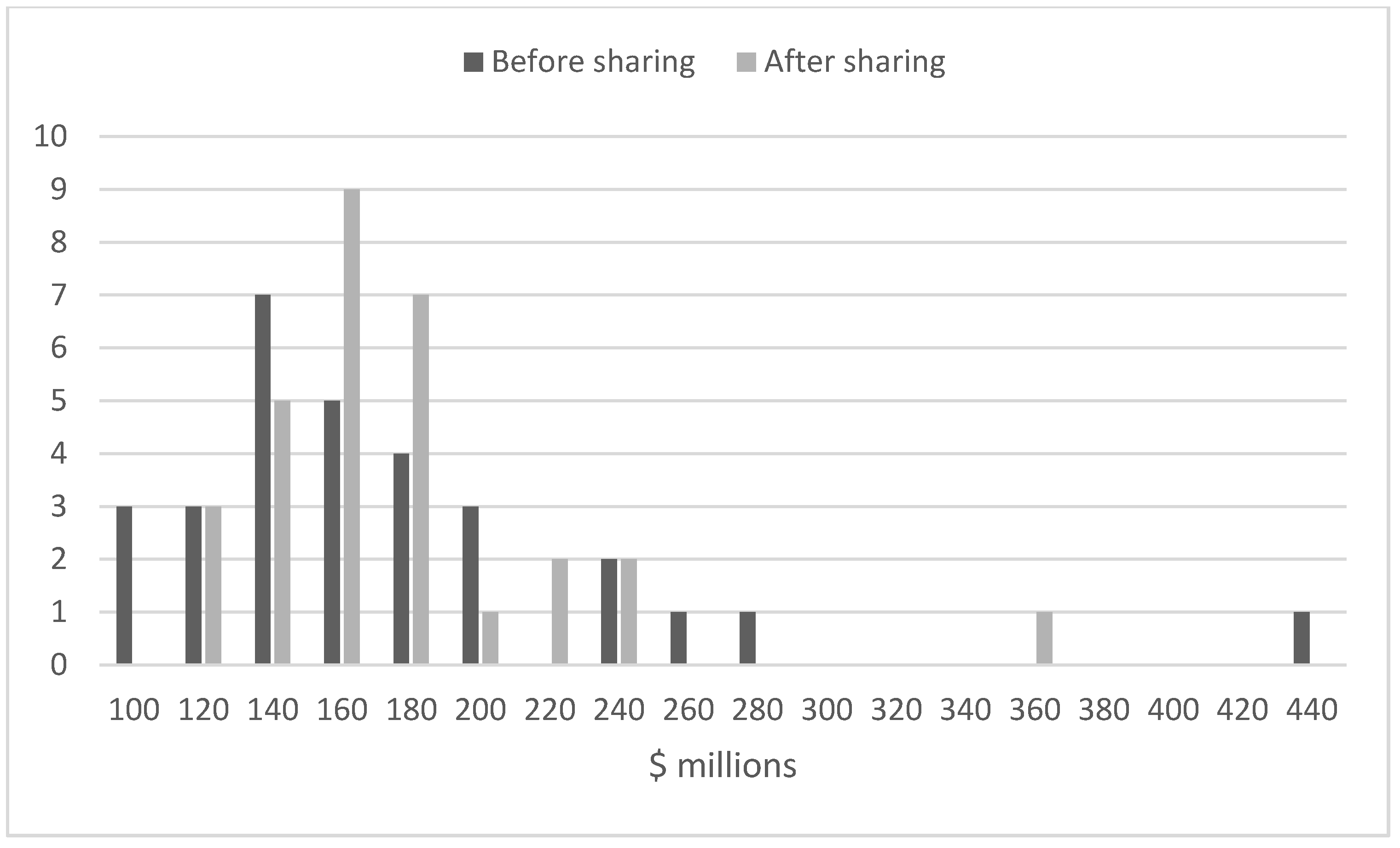

Figure 1 demonstrates this effect for the 2008 MLB season, when the contribution rate was 31%. Estimates of local club revenue after revenue sharing are produced each season by Forbes magazine and catalogued at a website [

10]. The standard deviation of local club revenue fell from USD 67.1 million before revenue sharing to USD 46.3 million after revenue sharing, with a significant decrease in skewness.

Figure 1.

Figure 1. Histogram of local club revenues before and after revenue sharing in MLB in 2008. Data from Forbes magazine estimates catalogued at [

10].

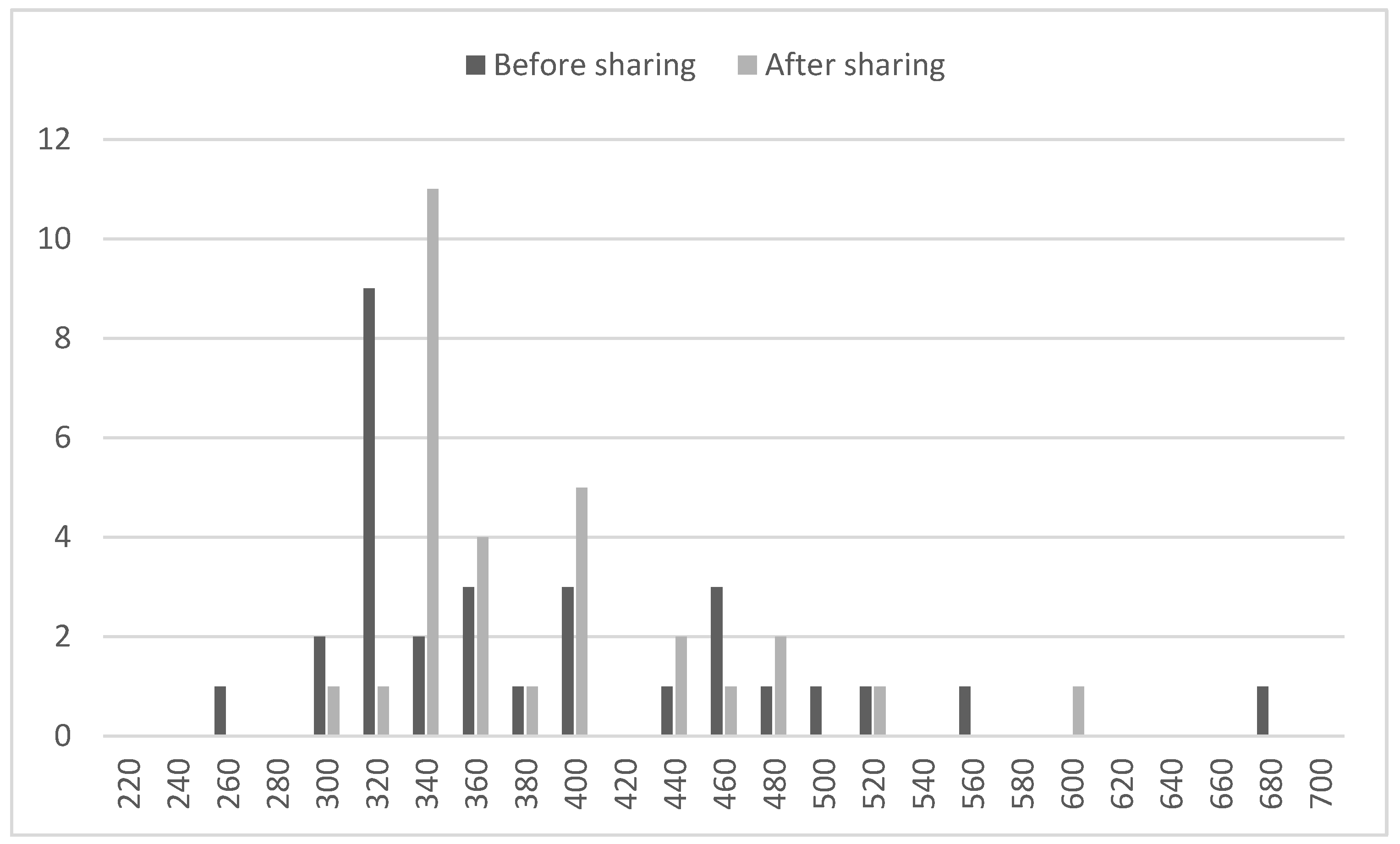

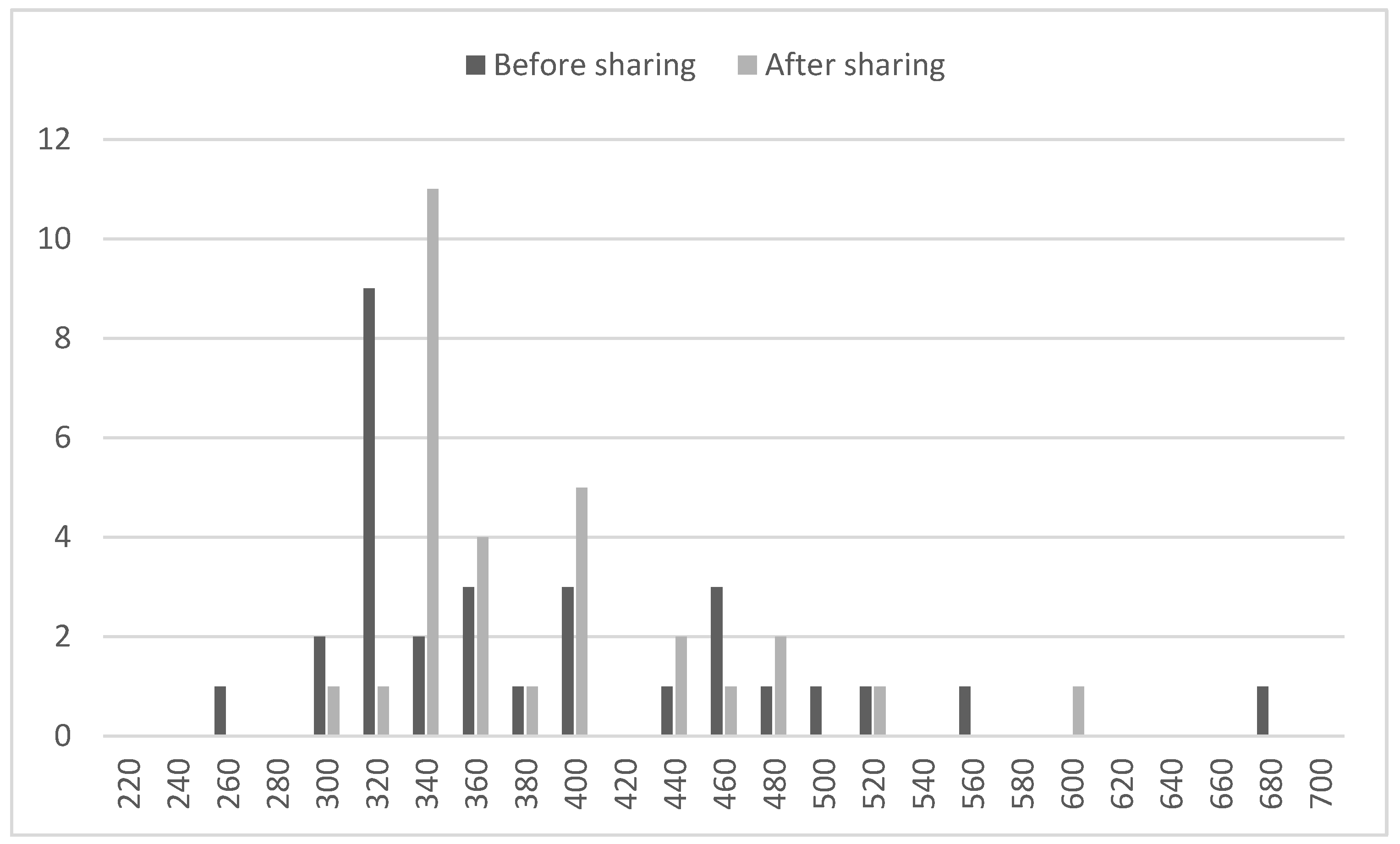

The compression effect of revenue sharing on team revenues was more pronounced for the 2023 season in Figure 2 when the contribution was 48%. The standard deviation of local club revenue fell from USD 93.3 million before revenue sharing to USD 65.5 million after revenue sharing, again with a significant decrease in skewness.

Figure 2.

Figure 2. Histogram of local club revenues before and after revenue sharing in MLB in 2023. Data from Forbes magazine estimates catalogued at [

10].

There is no doubt that pool revenue sharing supports the survival of small-market clubs by transferring revenue to them from large-market clubs. Economists debate whether this is necessary or if it is better to simply let small-market clubs fail if they cannot survive without revenue sharing. The so-called invariance principle [

11] states that the distribution of player talent among clubs will be the same over time whether club owners or players own the property rights to player talent. It is a precursor to the famous Coase theorem [

12] that applied the invariance principle to problems of social cost, including pollution, crime, and other negative externalities. The invariance principle has been extended to consider whether league policies to affect parity do so. A lack of evidence that such policies affect parity is considered support for the invariance principle even though it was originally applied to only free agency and the reserve clause. If the invariance principle holds, clubs will pursue business behaviors that maximize total league revenue, even if that requires letting small-market clubs fail. This result requires very strict conditions that are not likely to hold and do not hold in the standard theoretical model of a sports league. It could be profit-maximizing to use revenue sharing to ensure the survival of small-market clubs if the resulting decrease in player salaries is large and the effects on league parity are small [

13].

There are other motivations for a professional sports league to use revenue sharing in addition to supporting small-market clubs. The welfare of all the member clubs can be improved by reducing the volatility of club revenues after revenue sharing [

14]. Leagues whose member clubs are in different countries can use revenue sharing to help mitigate the effects of exchange rate fluctuations [

15] since revenues are garnered in local currency, but players are often paid in a single standard currency (such as U.S. dollars). Revenue sharing can increase social welfare and club profits under certain conditions [

16] and it can facilitate collusion among club owners when bidding for new talent, resulting in lower player salaries [

17].

Professional sports leagues employ other policies to promote parity in play and ensure the survival of small-market clubs. The EPL, NFL, NBA, and NHL use a salary cap system to limit the growth in player salaries to maintain profit stability. The North American leagues use similar systems, allocating a percentage of the anticipated sport-related league revenue to the players (48% in the NFL, 50% in the NBA, and 57% in the NHL) that is shared evenly among all clubs. Penalties for exceeding the club salary cap are severe in the NFL and NHL. The salary cap rules are negotiated in each league’s collective bargaining agreement. The EPL limits the amount of losses that clubs can accrue over a three-year period (profit sustainability rule or PSR), currently GBP 105 million, effectively tying the club payroll to its revenue over this period [

18]. Unlike the North American system, the EPL allows clubs to increase their payrolls if revenue growth is sufficient. Violations can result in fines and points deductions. Restrictions on the abilities of clubs to generate revenue and subsequently afford higher payrolls make it difficult to predict the effects of revenue sharing alone in an economic model of a sports league. We restrict the analysis that follows to a league that uses revenue sharing only; however, we make note of research that has attempted to use revenue sharing and salary caps.

This entry is adapted from the peer-reviewed paper 10.3390/encyclopedia4030076

Figure 1. Histogram of local club revenues before and after revenue sharing in MLB in 2008. Data from Forbes magazine estimates catalogued at [10].

Figure 1. Histogram of local club revenues before and after revenue sharing in MLB in 2008. Data from Forbes magazine estimates catalogued at [10]. Figure 2. Histogram of local club revenues before and after revenue sharing in MLB in 2023. Data from Forbes magazine estimates catalogued at [10].

Figure 2. Histogram of local club revenues before and after revenue sharing in MLB in 2023. Data from Forbes magazine estimates catalogued at [10].