Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Management

In response to changes taking place in the global environment, seaport terminal operators constantly search for lines of development in their operations, choosing i.a. a strategy of diversification or specialisation.

- seaport

- stevedore

- diversification strategy

1. Introduction

With the development of technology and increased competition in the business environment, enterprises started to diversify their activity first and foremost to reduce the risk [1]. The turbulent competitive environment in which seaports now operate determines the way of strategic development of transshipment terminal operators (also referred to as stevedoring companies or stevedores) and inclines them to adopt an appropriate development strategy. Such a strategy should consider both the turbulent changes in the port’s environment (such as the COVID-19 pandemic and the war in Ukraine) and the specific conditions ensuing from the port’s position in the global market of port services (hub ports and secondary ports). Specialisation and diversification are the two fundamental dimensions of development for a contemporary seaport [2], mainly identified with the types of cargoes handled.

Previous research studies regarding terminal operators’ strategies focused predominantly on the activities and strategies of container terminals that operate in large seaports, i.e., specialisation strategies. There are few studies addressing diversification strategies in business models followed by operators of multipurpose terminals, operating in multipurpose, small and medium ports or secondary ports [3,4]. Secondary ports function in a highly competitive environment of large hub ports, also providing complementary functions for them [5]. This has a significant effect on the directions of strategic development of terminal operators in secondary ports. Compared to hub ports, secondary ports to a larger extent experience the effects of structural changes taking place in the world economy, maritime trade and transport, which are also stimulated by the increasingly strict climate policy [6,7,8]. The impact of those changes on the operations of seaports is manifested by the gradual decrease in trading of traditional bulk cargo groups (coal, ores) or general cargo. The competitiveness of this category of ports is also limited by their technical parameters, which prevent the ports from handling increasingly large vessels that are put in operation. Consequently, secondary ports are under strong pressure as they need to attract new cargo groups to replace those on the decline. This justifies implementation of diversification measures by terminal operators, focusing on the search for new cargo groups, new cargo flow directions and expanding the range of offered services.

2. Ports’ Strategies Diversification

In the literature on strategic management, it is underlined that a diversification strategy refers predominantly to an increase in heterogeneity of the enterprise’s products market [11]; therefore, it is a business strategy aimed at the development of new markets with new products. However, diversification is manifested not only by an increased number and diversity of finished products, but also by horizontal and vertical integration of enterprises [1,12,13]. Two main types (levels) of diversification strategy are distinguished: related diversification and non-related diversification (related or unrelated to the firm’s primary activity) [1,13]. The related diversification is also referred to as concentric diversification, which relates to choosing the enterprise’s new product or market area based on its previous business activity or market. In comparison with the unrelated diversification, also referred to as centrifugal diversification, related diversification fosters full utilisation of the original knowledge held by the firm, own skills, marketing channels and other advantages, and the integration risk is small. The major reasons for choosing a diversification strategy by enterprises are as follows [1,11]: (1) to improve competitiveness (through economies of scale, scope and market influence), (2) to diversify a non-systemic risk (through diversified business portfolio), (3) to utilise the resources to the maximum (advantages of utilising them in various industries).

However, the hitherto-completed studies have shown that there is still no final answer to the question of whether or not a diversification strategy is advantageous in terms of the enterprise’s financial results. There is no homogeneous consensus about a relationship between a diversification strategy and a company’s financial results. Based on a literature review, Le (2019) [1] analysed the relationship between an enterprise’s diversification strategy and the enterprise’s financial results, and found that there are four different relationships: positive correlation, negative correlation, lack of significant correlation and non-linear correlation. Nevertheless, the author stressed that the core competences of an enterprise constitute a fundamental support for diversified business operations and a deeply rooted factor in formulation and implementation of diversified business strategies. Differentiation of diversification strategy effects is connected with the specific nature of the industry and the market in which the enterprise operates, particularly in the context of the influence of external factors.

Over the recent decades, the development of the maritime logistics has been considerably influenced by business environment factors whose impact is reflected by the changing role of seaports in supply chains and logistics [14]. The hitherto-completed studies underline that ports operate in a multi-stakeholder environment, which should be taken into account when measuring the performance, monitoring and planning the operations of ports and terminals. This in particular pertains to stimulating the cooperation and joint activities of port stakeholders in order to achieve common goals in the ports [15].

To plan their development, seaport authorities and operators of terminals located within the ports devise and regularly verify their development strategies. The strategies may cover various operation areas of ports and terminals, and they take into account not only the impact of external (e.g., import, export, investments) [16], but also internal factors (e.g., competition and performance may be diverse in various port sectors) [17]. The literature presents numerous analyses of seaport strategies which cover measures in the areas of infrastructure development, natural environment protection, automation and digitalisation, improved quality and scope of services provided, partnership, pricing, and other [18,19]. The current trend is to make ports more sustainable and smarter [20]. It is pointed out that there is a need for comprehensive improvement in the way ports are managed [21].

Nevertheless, one of the key areas of strategic decisions made by port authorities and terminal operators is figuring out the scope of cargoes to be handled in the port. The specialisation strategy is followed by single-function terminals, such as container terminals, ferry/ro-ro terminals or homogeneous bulk cargo (e.g., grain, fuel) terminals, whereas the diversification strategy is adopted by multipurpose terminals that handle cargoes from various cargo groups and provide services that are complementary to transshipment and storage.

Ducruet (2010) [2] pointed out that diversification of cargo traffic in a port is the most common, though costly, diversification strategy (investing in new facilities and equipment), whereas striving for specialisation corresponds to enhancement of the existing potential of the technical facilities (e.g., expanding the terminal). The authors indicated in particular that two major factors influence the diversity of cargo traffic in a port: continental hinterland and local economy. Ports with a large and diversified hinterland may handle a greater variety of cargoes than ports with a narrow and specialised hinterland (e.g., mines or forest produce). Ports may also compete for the same cargo in a shared hinterland, and the competitiveness factor may be the quality of access from the land side (by road, rail, or inland waterway). It was pointed out that, from the perspective of the particular nature of a local economy, ports may develop into specific industrial clusters (e.g., refinery, petroleum) using the economies of scale and creating synergy effects between selected activities. The size and diversification of the economic structure of a port city also has an impact on the volume and variety of traffic in the port. Larger ports are also more diverse due to playing the role of a gate to a large hinterland or agglomeration (of port cities and regions). Smaller, local ports rely on a limited assortment of the local hinterland.

Ducruet (2010) [2] also indicated that concentration of containers in larger ports is detrimental to the development of secondary ports. Furthermore, Schubert (2012) [22] noticed that it is the changes in logistics and globalisation in the case of a large group of British ports that led i.a. to changes in the land use of former port areas and their re-use for residential and office development. In addition, the studies conducted in major ports on the east and west coasts of the USA have shown that some ports evolved from their traditional revenue flows connected with cargoes towards real property rental and related services [23]. Various factors inclined many ports to diversify their business models in order to ensure an alternative to their traditional activity. The mentioned factors included: long- and short-term trends in consumers’ requirements, shipping trends, environmental restrictions, real property value, stakeholders’ support, and governmental policy. In the latest study, [24], the authors focused on the model of the port life cycle and port entities’ strategies followed in order to prevent deterioration of the port’s competitiveness when the port experiences geographical or economic limitations. The authors analysed a conflict situation with regard to port management at a national and local level, and the division of the management between the neighbouring municipalities, which led to a situation where old and new ports appeared to compete with one another rather than become complementary transport and logistics nodes.

The identified problems regard in particular secondary ports threatened with ageing and negligence, ensuing from i.a. the ongoing transformation of port grounds to serve municipal and tourist functions, at the same time departing from the traditional port activity. Nonetheless, many secondary ports still intensively carry on the core, traditional function connected with ship handling, utilising their competitive potential such as the multipurpose type of activity and increasing the diversity of cargo groups handled. After all, the studies completed so far have indicated, for all ports, that a key requirement for commercial and economic viability is to retain the business of the ships served by them and to remain accessible to those ships [25].

The ports’ ability to develop the core transshipment and storage function and selection of the type of cargo to be handled in the port to a large extent depend on the access to the dedicated port infrastructure and the indispensable equipment. It is believed that there is a significant relationship between port infrastructure development and foreign trade [16]. In [26], it is indicated that changes in imports and exports of selected cargo groups (e.g., raw materials) have a significant impact on ports’ strategic decisions, while decreased dependence on raw materials and diversification of cargo flows may be decisive for the long-term stability of ports. It was also found that when the environment is unstable, any inappropriate, capital-intensive, large-scale port construction projects should be avoided. Instead, it is reasonable to save and focus on maximal utilisation of the current potential, upgrading of the existing infrastructure, increasing the ports competitiveness i.a. via the application of modern technologies, searching for opportunities and replacing some cargo groups with other cargoes. The relationship between implemented investment projects and the economic growth rate is also underlined.

As part of the scenario analysis, there were also studies comparing the port services prices, demand for port services and ports’ profits in various combinations of competition and cooperation [27]. In addition, simulation models are developed to make forecasts and evaluations of the ability to implement changes in the activities of ports and terminals [28]. Such models are based on selected criteria that take into account i.a. the global and regional economic situation, development of ports or terminals, competition growth, possible limitations due to the neighbouring countries, logistics platform functioning, and other factors.

The hitherto-completed studies have confirmed that the diversification strategy is particularly common in secondary port activity, and it is, among other things, an answer to their limited transport accessibility from the foreland and hinterland, and the risk of excessive financial dependence on the changing or vanishing cargo groups (financially fluctuating commodities) [29,30]. On the other hand, the other studies [2] have shown that large hub ports are better adapted to maintaining and expanding their cargo portfolio—i.e., to diversification based on effective integration of strong connections with the hinterland and foreland. The smaller ports, in turn, are constrained by the activity of hub ports when they attempt to achieve a better competitive position. At the same time, the research studies have proved that strategies of specialisation and diversification of port activities are co-existing, and both may contribute to development of seaports.

The evaluation of the effectiveness of 27 Spanish ports carried out by (Pérez, González, and Trujillo (2020) [31] has shown that the larger and more specialised ports are more efficient. It would be recommended to encourage port specialisation and cooperation between ports with different specialisations, and between smaller ports. That would enable the development of strategic planning that would facilitate coordination between ports, joint development of infrastructure and avoidance of service replication. In turn, Hidalgo-Gallego et al. (2020) [32] analysed the impact of cargo specialisation on the Spanish port authorities’ technical efficiency. Port specialisation was examined on various levels. The research results have shown that the increasing specialisation in general cargo transport improves the technical efficiency. Nevertheless, it is not recommended to be specialised in liquid or solid bulk cargoes—these cargoes should preferably be transshipped together with other kinds of cargoes. Finally, full specialisation is not recommended in terms of an increase in technical efficiency.

Moreover, the studies completed so far have shown that even though specialisation has a positive effect on the results of seaport activity [33], excessive specialisation, understood as strong dependence on several kinds of cargoes, may be detrimental not only to the ports, but also to the local economy dependent on the port [34]. In turn, diversity of port activity unambiguously stimulates the port’s growth and development [35]. On the other hand, according to some studies [34], the global shipping network is strongly dependent on the more diversified transport nodes which in turn take over the greatest traffic and show higher connectivity.

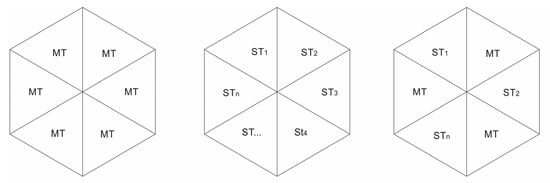

However, a diversified service offer at the seaport level does not have to translate into a diversified service range offered by operators of terminals operating in the seaport. The hitherto completed studies on diversification strategies were taken up mainly from the perspective of a seaport rather than from the level of individual stevedoring companies. Importantly, there are considerable differences in understanding ‘a diversification strategy’ in both research perspectives. From the point of view of a seaport, it may be said that the port offers a diversified range of services when, within its area, there are: (1) multipurpose terminal operators, handling various cargoes, (2) terminal operators specialised in handling one cargo type, but as a group handling several cargo types, (3) combination of multipurpose and specialised terminal operators (the mixed solution) (Figure 1).

Figure 1. Types of multipurpose seaports. Key: MT—multipurpose terminal; ST—specialised terminal; 1,2,3,…,n—type of cargo.

From the point of view of a terminal operator, a multipurpose enterprise will be the one that is ready to handle several cargo types, whereas a specialised enterprise will handle only one.

Studies of diversification strategies from the perspective of terminal operators are rarely carried out. The studies published to date mainly address specialisation strategies of terminal operators handling one cargo or freight unit type. In those studies (particularly the earlier ones), the focus was predominantly on analysing the operations of leading container terminal operators and their relations with shipping lines. They also underlined the issues of the increasing and aggressive engagement of shipping lines in stowage activities and development of dedicated container terminals in seaports [36,37]. Later studies also referred to the phenomenon of intensive competition between shipping lines and terminal operators, and to measures taken by the terminal operators in response to the aggressive strategies of container ship operators. The studies showed that the terminal operators started to expand their activity on the international level, developing extensive networks of terminals in various regions of the world [38].

However, it was only to a small extent that these studies analysed diversification strategies implemented by operators of multipurpose terminals that offer handling several different cargo types. The strategies are implemented in multipurpose terminals and in terminals being transformed from specialised ones towards diversified ones and/or expanding the range of handled cargo groups. One of few studies in this area, authored by Parola, Satta, and Panayides (2015) [39] has shown a positive relationship between diversification and terminal operators’ financial results, but only in the case of the related diversification strategy, strongly relying on the core activity. This was also confirmed by later studies showing that a diversification strategy developed by terminal operators proved to be an effective strategy in coping with the effects of economic slowdown and disruptions ensuing from the COVID-19 pandemic [40,41]. In particular, flexibility of terminal operators’ activities and ability to react quickly to disruptions in supply chains during the COVID-19 pandemic made it possible to maintain and even increase the transshipment level, and thus also business growth.

This entry is adapted from the peer-reviewed paper 10.3390/su15075644

This entry is offline, you can click here to edit this entry!