Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

The conceptual shift, from a traditional task perspective and a managerial approach to project risks toward a value-centric view, underlines the challenge of creating different forms of value for multiple project stakeholders. This emerging theme arises the need for a new holistic framework for value creation through Project Risk Management (PRM).

- project risk management

- value creation

- theoretical framework

1. Introduction

Risk can be defined as an effect, in terms of a positive or negative deviation from expected outcomes, resulting from uncertainty [1], potentially affecting the economic performance, business continuity, reputation, environmental and social outcomes of organisations.

Therefore, risk management (RM) supports companies in achieving their goals, exploring new opportunities, and reducing potential losses in an uncertain and dynamic business environment [1][2]. Despite the range of benefits that arise from a successful RM implementation, including improved implementation of the strategy, efficient operations, and effective projects [3], its main objective consists in creating and protecting value [1].

In particular, projects can be considered vehicles of change characterised by inherent uniqueness and uncertainty [4][5]. Projects constitute the means for companies to implement their strategic objectives, particularly to innovate and grow. Consequently, projects are essential for business success and longevity, whereas project failure can be detrimental to the organisation and society [6].

The RM stream that deals with the management of project risks is called project risk management (PRM) [7]. It is a systematic process that aims at managing the intrinsic risks of any project, acting on their appearance, through the implementation of systems and procedures that identify, analyse, evaluate, and address risks [8][9]. PRM has the goal of fostering the effect of positive events (opportunities) during the project life cycle while mitigating those related to negative events (threats) [10][11]. For this reason, PRM is one of the most widely adopted approaches by companies to achieve success in their projects [12] and to foster value creation [13]. In particular, the value created through PRM is defined as the ratio between benefits and costs, which is not a quantitative quotient but only a representation [14][15][16][17]; indeed, the value generated with PRM includes both economic and intangible (not monetary) components [18][19].

However, the discrepancies between theoretical and empirical evidence on this topic represent a challenge for the current research: despite international standards that place greater relevance on value creation and protection, extending the view to potential positive effects of risks [1][20], the empirical literature reports conflicting results.

For example, normative guidelines are built around the formalisation of a PRM process, suggesting that documenting and reporting practices create value [1][21]. In this regard, many authors confirmed from empirical evidence that a formal PRM process actually increases the chance of project success [9][22][23][24][25][26]. On the contrary, other researchers suggest that disproportionate formalisation can be counterproductive [13][27][28][29][30][31].

Other conflicting results emerge on the adoption of formal reporting, which is a recommended practice to manage risk communication, support decision making, and capture risk knowledge [1][9][13][21]. In particular, empirical evidence indicates that the value of using formal risk status reports depends on the level of organisational maturity, the willingness of project stakeholders to communicate and document risks, and the type of project [13][30][32]. Furthermore, the normative guidelines promote the adoption of an open and honest communication about risk [1][21], which has been recognised as a value-adding practice through empirical results [13][25][33][34][35][36][37][38][39][40]. However, empirical results also report that high transparency can create unwanted and unproductive management attention, depending on the organisational context [13][30][32].

Further conflicting results deal with the adoption of a proactive approach to PRM [41][42], since high proactivity can be perceived as non-value-adding due to organisational culture, a high level of uncertainty, and even its cost [13][43][44].

The richness of empirical studies available in the literature offers a unique opportunity to investigate whether these discordant results can be explained.

2. Theoretical Background

Value creation through PRM has close connections with two main research streams, namely PRM and value creation in projects [13][45][46]. The current paragraph recalls the fundamental concepts, originated by these research fields, that constitute the conceptual basis of value creation through PRM.

2.1. Perspectives on Projects and Value Creation

Projects could be viewed according to different and complementary perspectives that imply a specific approach to PRM, particularly the task perspective and the organisational perspective [47].

Starting with the task perspective, according to the Project Management Institute [11], a project can be defined as a temporary effort undertaken to create a unique product, service, or result [47]. Also, a project may be a way to perform a defined, and non-repetitive task. In this view, the project goals are determined in the initial phase of the project and are expressed under three constraints, regarding the time, cost, and quality of the project output. Moreover, in the initial phase, PRM context analysis and planning are performed and (known) risks are identified. Ideally, the project is detached from the rest of the base organisation and the project team is supposed to concentrate on performing all planned tasks to meet the three objectives. If deviations are discovered, measures are taken to correct them. In this perspective, the focus of PRM tends to be on the management of threats (negative risk) rather than opportunities (positive risk) [47].

Instead, the organisational perspective defines a project as a temporary organisation established by its base organisation to perform an assignment on its own behalf [47][48][49]. In this sense, the mission of the project is directly related to the business strategy, pursuing the objective of executing the progress of the permanent organisation. The project is considered an open organisation in close contact and cooperation with the base organisation and its business environment. The overall project plan, defined in the initial phase of the project, is considered as the foundation for the following detailed plans, and the project output will be defined as the project progresses and more knowledge is acquired. If interesting opportunities arise as the project proceeds (e.g., positive risks), deadlines can be postponed, and/or the project budget can be exceeded; if the project could be completed sooner than expected or its tasks become impossible, it should be shut down earlier than planned. The project output is not necessarily delivered at the end of the project, but when it is best suited for the base organisation [50]. The main purpose of projects is the creation of value in the base organization rather than the creation of products or services [51], and PRM focuses on leveraging positive risks and managing negative risks [47]. Additionally, project leadership tends to be strongly interested in the ways in which stakeholders can contribute to value creation during the project life cycle and after the end of the project [47].

2.2. Project Risk Management Main Concepts and Methods

Different approaches to PRM have been studied in the literature and implemented in practice: the management approach, the evaluation approach, the contingency approach, the agile approach, and diverse combined approaches. All of them provide interesting indications that should be carefully considered when evaluating the value created through PRM.

According to the management approach [25][52], the PRM process consists of a preliminary phase, namely context analysis and planning, and four main phases: (1) risk identification, (2) risk analysis, (3) risk treatment, and (4) risk monitoring and control [53]. This approach focuses mainly on identifying specific project events and situations that could impact the original plan, in order to develop adequate risk responses. The PRM management approach is conceptually more related to the task perspective of projects; thus, the eventual contribution of PRM to value creation is direct.

The evaluation approach considers PRM as a process aimed at determining and addressing the risk factors from the initial stage of the project, through the collection and analysis ex post of the information about the project risks [52][54][55]. In this view, the PRM process consists of three main phases: (1) use of known risk factors in the initial phase to evaluate a new project and address known risks, (2) collection of information about project risks during all stages of the project lifecycle, and (3) analysis of new information on known or new risk factors, as input for future projects. The eventual contribution of PRM to value creation is indirect and could be seen in terms of fostering the risk knowledge management process.

Another interesting view is offered by the PRM contingency approach [25][56][57][58]. It focuses on the project capability to deal with uncertainties in the project environment [28][59] and on the fit between contingent variables (such as risk types) and the PRM system implemented. Notwithstanding the effort to predict all possible project risks, there are always residual uncertainties [56], negatively related to the project success. The contingency approach to PRM is particularly suitable when project risks are unknown, and it is difficult to fully understand all relevant variables and interactions. This approach focuses on resilience and adaptability, particularly on (1) constant environmental scanning to recognise unforeseen events when they arise, (2) having a resilient, responsive, and functioning structure at the organisational level, (3) engaging and communicating with stakeholders, and (4) having competent resources with adequate self-awareness and the ability to deal with stressful situations [25][56][58][60]. PRM techniques and tools must be selected according to the characteristics of the project context to achieve the best opportunity for value creation. For example, this includes considering the size, scope and structure of the project, the level of technological uncertainty, the level of company experience with technology, the degree of internal integration, and user participation [18][61]. The eventual contribution of PRM to value creation in projects remains unclear.

Agile methodologies have been developed to improve adaptability and responsiveness to changes [62], and are mainly applied in software development projects. Among them, the most used is Scrum, which aims to perform (1) an initial risk assessment during the pregame and (2) subsequent risk reviews during the review meetings, while reducing the threat of incorrect project output through regular communication with customers, short iterations and tests [62][63][64][65].

Finally, different combined approaches are proposed in the literature and implemented in practice. For example, some authors propose a combination of the PRM management approach and the PRM evaluation approach, in order to reuse the knowledge on risks collected in previous projects to improve PRM [52][66][67][68]. Marle (2020) [62] proposes a combination of the agile approach with complex systems methods (CST-based methods), considering that the two approaches have complementary advantages and limits. A further example is provided by the iterative seven-step PRM process for SMEs suggested by [69].

Despite the richness of the PRM literature, the contribution of the different PRM approaches to value creation in projects, which value is created, how PRM creates value, and the potential influence of the project context, remains unclear.

2.3. Value Creation through PRM

Herein, value is defined as the ratio between benefits and costs, which is not a quantitative quotient but only a representation [14][15][16][17]. Indeed, the value generated through PRM includes both economic and intangible components [18][19], it is a context-specific concept, it depends on the level of analysis, it is perceived differently by project stakeholders [14][16][45][70], and it integrates the notion of economic, social, and environmental sustainability.

Project stakeholders play a central role in the creation of value through PRM [25][45][71][72]. Indeed, stakeholders can be considered both as a target of value creation and as potential sources of risk in projects, due to their diverse behaviours, expectations, and perceptions. Several attempts have been reported in the literature to classify project stakeholders and their behaviours. For instance, it is possible to identify stakeholder groups at different levels of analysis, specifically at customer, project, company, business ecosystem, and society levels. Mendelow, (1991) [73] groups stakeholders according to their power and interest in the project, while Mitchell et al. (1997) [74] categorise them according to their power, urgency and legitimacy. Most recently, Murray-Webster e Simon, (2006) [75] suggested a classification of project stakeholders according to their (1) power, defined as the stakeholders’ ability to influence the project, which is derived from their positional or resource power in the organisation or from their credibility as leaders or experts; (2) interest in the project, measured by the extent to which stakeholders will be active or passive towards the project; and (3) attitude toward the project, measured by the extent to which stakeholders will back (support) or block (resist) the project.

3. A Theoretical Framework for Value Creation through PRM

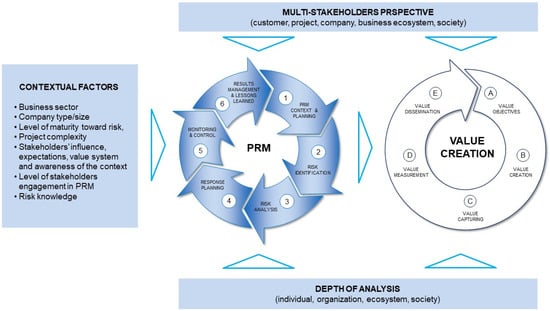

The results emerging from the SLR have been incorporated into a comprehensive theoretical framework for value creation through PRM (Figure 1).

Figure 1. The proposed framework for value creation through PRM.

The proposed framework includes five components:

-

Contextual factors: It is fundamental to identify the relevant contextual factors that influence the definition of a suitable PRM system.

-

PRM: The PRM system can be implemented at different maturity levels, in terms of the practices, activities, and tools adopted. Specifically, the PRM process is composed of the following steps: (1) PRM Context and Planning, (2) Risk Identification, (3) Risk Analysis, (4) Response Planning, (5) Monitoring and Control, (6) Results Management and Lessons Learned. The selection of PRM practices, activities, and tools is guided by the project context. Information on risks collected during each iteration of the PRM process are analysed and formalised (Step 6) to support the subsequent iterations (in the current project or in future projects). A process iteration will be started when a new project is launched or, alternatively, during the execution phase of a project, if its scope or goals are changed to take advantage of certain opportunities (positive risks), or if negative risks require reconsidering the planned approach to PRM (e.g., diverse strategies for risk responses, skills or effort, different practices and activities). The implemented PRM system influences the creation of value.

-

Value creation: The PRM value creation process is context-specific and depends on the level of analysis and on the stakeholder or stakeholders’ group considered. It includes the following steps: (A) Value Objectives: definition (or revision) and planning of value objectives, in terms of economic and intangible value for stakeholders, according to the identified risks, the levels of analysis, the type of project stakeholders and the project context; (B) Value Creation through the management of project risks and opportunities; (C) Value Capture from project stakeholders; (D) Value Measurement of economic and intangible value created for project stakeholders, compared with the defined value objectives; (E) Value dissemination (intentional or unintentional) to different project stakeholders from those who captured the PRM value in previous iterations (even after the termination of the project). The value created through PRM is defined as the ratio between benefits and costs, which is not a quantitative quotient but only a representation and includes both economic and intangible (not monetary) components.

-

Depth of analysis: A multilevel approach to value analysis is required to have a comprehensive view of the PRM value created. The levels of analysis considered influence the PRM system adopted in the project and the evaluation of the PRM value created.

-

Multi-stakeholder perspective: It is fundamental to adopt the different perspectives of the project stakeholders, considering that subjective stakeholders’ perceptions and interests influence the PRM system adopted in the project and the evaluation of the PRM value created.

It is important to note that the PRM process and the related value creation process are not synchronous. A new iteration of the PRM process could initiate (or not) a new cycle of the value creation process; it depends on whether PRM actually creates additional value for any project stakeholders in the specific iteration. Furthermore, value creation process iterations could be completed even after the completion of the project.

This entry is adapted from the peer-reviewed paper 10.3390/su16020753

References

- ISO 31000; Risk Management. ISO: Geneva, Switzerland, 2018.

- Radner, R.; Shepp, L. Risk vs. Profit Potential: A Model for Corporate Strategy. J. Econ. Dyn. Control 1996, 20, 1373–1393.

- Hopkin, P. Fundamentals of Risk Management: Understanding, Evaluating and Implementing Effective Risk Management, 5th ed.; Kogan Page: London, UK, 2018.

- Maylor, H.; Brady, T.; Cooke-Davies, T.; Hodgson, D. From Projectification to Programmification. Int. J. Proj. Manag. 2006, 24, 663–674.

- PMI. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 3rd ed.; Project Management Institute: Newtown Square, PA, USA, 2004.

- Surco-Guillen, Y.C.; Romero, J.; Rodríguez-Rivero, R.; Ortiz-Marcos, I. Success Factors in Management of Development Projects. Sustainability 2022, 14, 780.

- Verbano, C.; Venturini, K. Development Paths of Risk Management: Approaches, Methods and Fields of Application. J. Risk Res. 2011, 14, 519–550.

- Conroy, G.; Soltan, H. ConSERV, a Project Specific Risk Management Concept. Int. J. Proj. Manag. 1998, 16, 353–366.

- Raz, T.; Michael, E. Use and Benefits of Tools for Project Risk Management. Int. J. Proj. Manag. 2001, 19, 9–17.

- Borge, D. The Book of Risk; John Wiley & Sons: Hoboken, NJ, USA, 2002.

- PMI. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 5th ed.; Project Management Institute: Newtown Square, PA, USA, 2013.

- Elkington, P.; Smallman, C. Managing Project Risks: A Case Study from the Utilities Sector. Int. J. Proj. Manag. 2002, 7863, 49–57.

- Willumsen, P.; Oehmen, J.; Stingl, V.; Geraldi, J. Value Creation through Project Risk Management. Int. J. Proj. Manag. 2019, 37, 731–749.

- European Standard 12973; Value Management. British Standard Institution: London, UK, 2000.

- Laursen, M.; Svejvig, P. Taking Stock of Project Value Creation: A Structured Literature Review with Future Directions for Research and Practice. Int. J. Proj. Manag. 2016, 34, 736–747.

- Morris, P. Reconstructing Project Management; Wiley Blackwell: Chichester, UK, 2013.

- Quartermain, M. Value Engineering; Project Management Pathways; Association for Project Management: Buckinghamshire, UK, 2002; pp. 44-1–44-20.

- Shenhar, A.J.; Dvir, D.; Levy, O.; Maltz, A.C. Project Success: A Multidimensional Strategic Concept. Long. Range Plan. 2001, 34, 699–725.

- Voss, M. Impact of Customer Integration on Project Portfolio Management and Its Success-Developing a Conceptual Framework. Int. J. Proj. Manag. 2012, 30, 567–581.

- COSO. Enterprise Risk Management—Integrated Framework; Committee of Sponsoring Organizations (COSO): Englewood Cliffs, NJ, USA, 2017.

- PMI. Practice Standard for Project Risk Management; Project Management Institute: Newtown Square, PA, USA, 2009; ISBN 978-1-933890-38-8.

- Voetsch, R.J.; Cioffi, D.F.; Anbari, F.T. Project Risk Management Practices and Their Association with Reported Project Success. In Proceedings of the 6th IRNOP Project Research Conference, Turku, Finland, 25–27 August 2004; pp. 4–7.

- Rabechini, R.; de Carvalho, M.M. Understanding the Impact of Project Risk Management on Project Performance: An Empirical Study. J. Technol. Manag. Innov. 2013, 8, 64–78.

- Teller, J.; Kock, A. An Empirical Investigation on How Portfolio Risk Management Influences Project Portfolio Success. Int. J. Proj. Manag. 2013, 31, 817–829.

- Javani, B.; Rwelamila, P.M.D. Risk Management in IT Projects—A Case of the South African Public Sector. Int. J. Manag. Proj. Bus. 2016, 9, 389–413.

- Olechowski, A.; Oehmen, J.; Seering, W.; Ben-Daya, M. The Professionalization of Risk Management: What Role Can the ISO 31000 Risk Management Principles Play? Int. J. Proj. Manag. 2016, 34, 1568–1578.

- Kutsch, E. The Effect of Intervening Conditions on the Management of Project Risk. Int. J. Manag. Proj. Bus. 2008, 1, 602–610.

- Jun, L.; Qiuzhen, W.; Qingguo, M. The Effects of Project Uncertainty and Risk Management on IS Development Project Performance: A Vendor Perspective. Int. J. Proj. Manag. 2011, 29, 923–933.

- Zhao, X.; Hwang, B.G.; Phng, W. Construction Project Risk Management in Singapore: Resources, Effectiveness, Impact, and Understanding. KSCE J. Civ. Eng. 2014, 18, 27–36.

- Crispim, J.; Silva, L.H.; Rego, N. Project Risk Management Practices: The Organizational Maturity Influence. Int. J. Manag. Proj. Bus. 2019, 12, 187–210.

- Moeini, M.; Rivard, S. Sublating Tensions in the It Project Risk Management Literature: A Model of the Relative Performance of Intuition and Deliberate Analysis for Risk Assessment. J. Assoc. Inf. Syst. 2019, 20, 243–284.

- Perrenoud, A.; Lines, B.C.; Savicky, J.; Sullivan, K.T. Using Best-Value Procurement to Measure the Impact of Initial Risk-Management Capability on Qualitative Construction Performance. J. Manag. Eng. 2017, 33, 1–8.

- Liu, S. How the User Liaison’s Understanding of Development Processes Moderates the Effects of User-Related and Project Management Risks on IT Project Performance. Inf. Manag. 2016, 53, 122–134.

- De Carvalho, M.M.; Rabechini Junior, R. Impact of Risk Management on Project Performance: The Importance of Soft Skills. Int. J. Prod. Res. 2015, 53, 321–340.

- Hwang, B.G.; Zhao, X.; Ong, S.Y. Value Management in Singaporean Building Projects: Implementation Status, Critical Success Factors, and Risk Factors. J. Manag. Eng. 2015, 31, 342.

- Aven, T. Risk Assessment and Risk Management: Review of Recent Advances on Their Foundation. Eur. J. Oper. Res. 2016, 253, 1–13.

- Soares, R.A.; Chaves, M.S.; Pedron, C.D. W4RM: A Prescriptive Framework Based on a Wiki to Support Collaborative Risk Management in Information Technology Projects. Int. J. Inf. Syst. Proj. Manag. 2020, 8, 67–83.

- Doloi, H. Relational Partnerships: The Importance of Communication, Trust and Confidence and Joint Risk Management in Achieving Project Success. Constr. Manag. Econ. 2009, 27, 1099–1109.

- De Bakker, K.; Boonstra, A.; Wortmann, H. Risk Managements’ Communicative Effects Influencing IT Project Success. Int. J. Proj. Manag. 2012, 30, 444–457.

- Chih, Y.Y.; Zwikael, O.; Restubog, S.L.D. Enhancing Value Co-Creation in Professional Service Projects: The Roles of Professionals, Clients and Their Effective Interactions. Int. J. Proj. Manag. 2019, 37, 599–615.

- Thamhain, H. Managing Risks in Complex Projects. Proj. Manag. J. 2013, 44, 20–35.

- Zwikael, O.; Ahn, M. The Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and Countries. Risk Anal. 2011, 31, 25–37.

- Kutsch, E.; Hall, M. Deliberate Ignorance in Project Risk Management. Int. J. Proj. Manag. 2010, 28, 245–255.

- Shimizu, T.; Park, Y.W.; Hong, P. Project Managers for Risk Management: Case for Japan. Benchmarking 2012, 19, 532–547.

- Lepak, D.P.; Smith, K.G.; Taylor, M.S. Value Creation and Value Capture: A Multilevel Perspective. Acad. Manag. Rev. 2007, 32, 180–194.

- Winter, M.; Szczepanek, T. Projects and Programmes as Value Creation Processes: A New Perspective and Some Practical Implications. Int. J. Proj. Manag. 2008, 26, 95–103.

- Andersen, E.S. Do Project Managers Have Different Perspectives on Project Management? Int. J. Proj. Manag. 2016, 34, 58–65.

- Kenis, P.; Janowicz-Panjaitan, M.; Cambré, B. Temporary Organizations: Prevalence, Logic and Effectiveness; Elgar Publishing: Cheltenham, UK, 2009; Volume 6, ISBN 9781849802154.

- Packendorff, J. Inquiring into the Temporary Organization: New Directions for Project Management Research. Scand. J. Manag. 1995, 11, 319–333.

- Ancona, D.; Chong, C.-L. Cycles and Syncronicity: The Temporl Role of Context in Team Behaviour. In Research on Managing Groups and Teams: Groups in Context; Elsevier Science: Amsterdam, The Netherlands, 1999.

- Winter, M.; Smith, C.; Morris, P.; Cicmil, S. Directions for Future Research in Project Management: The Main Findings of a UK Government-Funded Research Network. Int. J. Proj. Manag. 2006, 24, 638–649.

- de Bakker, K.; Boonstra, A.; Wortmann, H. Does Risk Management Contribute to IT Project Success? A Meta-Analysis of Empirical Evidence. Int. J. Proj. Manag. 2010, 28, 493–503.

- PMI. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 6th ed.; Project Management Institute: Newtown Square, PA, USA, 2017.

- Jiang, J.J.; Klein, G.; Discenza, R. Information System Success as Impacted by Risks and Development Strategies. IEEE Trans. Eng. Manag. 2001, 48, 46–55.

- Wallace, L.; Keil, M.; Rai, A. Understanding Software Project Risk: A Cluster Analysis. Inf. Manag. 2004, 42, 115–125.

- Geraldi, J.; Lee-Kelley, L.; Kutsch, E. The Titanic Sunk, so What? Project Manager Response to Unexpected Events. Int. J. Proj. Manag. 2010, 28, 547–558.

- Mikes, A.; Kaplan, R. Towards a Contingency Theory of Enterprise Risk Management; Harvard Business School: Boston, MA, USA, 2013; pp. 1–43.

- Sommer, S.C.; Loch, C.H. Incomplete Incentive Contracts under Ambiguity and Complexity. SSRN Electr. J. 2004.

- Besner, C.; Hobbs, B. The Paradox of Risk Management; a Project Management Practice Perspective. Int. J. Manag. Proj. Bus. 2012, 5, 230–247.

- Meyer, A.D.E. Managing Project Uncertainty: From Variation to Chaos. MIT Sloan Manag. Rev. 2002, 43, 60–67.

- Barki, H.; Rivard, S.; Talbot, J. An Integrative Contingency Model of Software Project Risk Management. J. Manag. Inf. Syst. 2001, 17, 37–69.

- Marle, F. An Assistance to Project Risk Management Based on Complex. In Complexity; Hindawi Ltd.: London, UK, 2020; Volume 2020.

- Tavares, B.G.; da Silva, C.E.S.; de Souza, A.D. Risk Management Analysis in Scrum Software Projects. Int. Trans. Oper. Res. 2019, 26, 1884–1905.

- Buganová, K.; Šimíčková, J. Risk Management in Traditional and Agile Project Management. Transp. Res. Procedia 2019, 40, 986–993.

- Fitsilis, P. Comparing PMBOK and Agile Project Management Software Development Processes. Adv. Comput. Inf. Sci. Eng. 2008, 378–383.

- Alquier, A.M.B.; Tignol, M.H.L. Risk Management in Small- and Medium-Sized Enterprises. Prod. Plan. Control 2006, 17, 273–282.

- Marcelino-Sádaba, S.; Pérez-Ezcurdia, A.; Echeverría Lazcano, A.M.; Villanueva, P. Project Risk Management Methodology for Small Firms. Int. J. Proj. Manag. 2014, 32, 327–340.

- Neves, S.M.; da Silva, C.E.S.; Salomon, V.A.P.; da Silva, A.F.; Sotomonte, B.E.P. Risk Management in Software Projects through Knowledge Management Techniques: Cases in Brazilian Incubated Technology-Based Firms. Int. J. Proj. Manag. 2014, 32, 125–138.

- Testorelli, R.; Ferreira de Araújo Lima, P.; Verbano, C. Fostering Project Risk Management in SMEs: An Emergent Framework from a Literature Review. Prod. Plan. Control 2020, 33, 1304–1318.

- Testorelli, R.; Verbano, C. An Empirical Framework to Sustain Value Generation with Project Risk Management: A Case Study in the IT Consulting Sector. Sustainability 2022, 14, 12117.

- Husted, B.W. A Contingency Theory of Corporate Social Performance. Bus. Soc. 2000, 39, 24–48.

- Ragas, A.A.M.A.; Chupin, A.; Bolsunovskaya, M.; Leksashov, A.; Shirokova, S.; Senotrusova, S. Accelerating Sustainable and Economic Development via Scientific Project Risk Management Model of Industrial Facilities. Sustainability 2023, 15, 12942.

- Mendelow, A. Stakeholder Mapping. In Proceedings of the 12nd International Conference on Information Systems, New York, NY, USA, 16–18 December 1991.

- Mitchell, R.K.; Agle, B.R.; Wood, D.J.; Mitchell, R.K. Toward a Theory of Stakeholders Identification and Salience. Acad. Manag. Rev. 1997, 22, 853–886.

- Murray-Webster, R.; Simon, P. Making Sense of Stakeholder Mapping. PM World Today 2006, 3, 5.

This entry is offline, you can click here to edit this entry!