You're using an outdated browser. Please upgrade to a modern browser for the best experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Optimistic managers tend to make investment decisions more frequently, while those who are more risk-averse adopt a more cautious approach. Mimicry was also identified as an influential factor in investment decisions, with executives likely to be influenced by the choices of their peers. Furthermore, intuition bias was also identified as a positive factor in the investment decision-making process, enabling managers to capitalize on their experience and tacit knowledge for more appropriate and timely choices.

- behavioral finance

- overconfidence

- optimism

- risk-taking

- mimicry

1. Introduction

Standard finance is a widely-studied model that dominates the field of finance. It is based on two distinct assumptions: rational markets and rational economic man. The rational markets hypothesis postulates that financial markets quickly and accurately incorporate all relevant information into asset prices. This theory suggests that investors find it difficult to consistently outperform the market, since prices reflect all available knowledge as well as the true intrinsic value of assets. The rational economic man refers to the theoretical representation of an individual who makes economic decisions logically, rationally evaluating costs and benefits, and maximizing utility or profit. According to this conception, rational economic man is supposed to be perfectly informed, able to process information objectively, and to make coherent choices according to his preferences.

In fact, different researchers like Fama (1991) and Agrawal and Tandon (1994) have proven that there are three main types of anomalies that contradict the efficient market hypothesis (Fundamental Anomalies, Technical Anomalies and Calendar Anomalies). Also, other researchers like Katona (1975) and Thaler (2000) criticize the bases of Homo economicus and assume that people are neither perfectly rational nor perfectly irrational. These studies have raised compelling arguments that challenge the dominant notions of standard finance, and highlight the role of cognitive biases and other psychological factors in influencing economic decisions. hence, the emergence of behavioral finance.

Behavioral finance, a branch of behavioral economics, is defined as the application of psychology to finance and become a very hot and interesting topic. It disputes the two concepts in standard finance mentioned above. According to Pompian (2012), behavioral finance can be broken down into two subtopics: Behavioral Finance Macro (BFMA) that examines the efficient market hypothesis, detects and describes their anomalies. And, Behavioral Finance Micro (BFMI) which focuses on individual investors and investigates their behaviors and biases.

Behavioral corporate finance, a subfield of BFMI, emphasizes that managers are not fully rational and states that several factors can influence their financial decisions, namely: heuristics, behavioral biases, personality traits, moods and emotions.

2. SMEs Investment Decisions

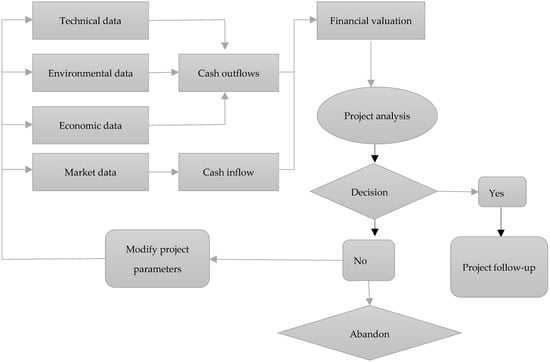

The Figure 1 illustrates the financial evaluation process. Its importance lies in the fact that the company must take into account and plan for all the financial consequences of its decisions.

Figure 1. Financial evaluation of decisions (Adapted from St-Pierre 2018).

To carry out this evaluation, it is necessary to identify all the financial parameters linked to the project, which will enable people to determine the cash flows coming in (such as sales forecasts) and the cash flows going out (such as costs associated with preparation, equipment purchases, etc.). The data needed to calculate these cash flows come from a variety of sources and of different natures, such as technical, environmental, economic and market data. The data collected will be classified according to their nature (income or expenses) and analyzed using investment selection methods such as NPV (Net Present Value), IRR (Internal Rate of Return), ROI (Return on Investment), PI (Profitability Index), and Payback Period. All this enables the entrepreneur to make a decision about the viability of the project. The figure illustrates that the decision-maker can go back and make changes to make the project more financially viable for the company.

However, SMEs find it difficult to implement a decision-making process that enables them to achieve the best possible results. In most cases, due to their lack of financial knowledge, SME managers tend to use very intuitive methods, such as personal intuition or payback period, to make investment decisions. This trend has been confirmed by a number of studies and research studies (Scott et al. 1972; Peel and Wilson 1996; Lazaridis 2004; Hasan 2013; Gveroski and Jankuloska 2017; Zhao and Zhang 2019).

3. Manager’s Behavioral Biases and Investment Decisions

3.1. Overconfidence

Overconfidence bias refers to the propensity to overestimate one’s abilities, knowledge and ability to predict and control the future.

Managerial overconfidence can be defined in two complementary ways. Firstly, it involves the overestimation of the information available to the manager, i.e., the belief that he or she has all the information needed to make accurate decisions, which is known as “miscalibration” (Acker and Duck 2008). The manager believes he has all the relevant data, without taking into account the limits of his knowledge. Secondly, managerial overconfidence refers to the overestimation of the leader’s own skills, known as the “better-than-average effect”, as described by Camerer and Lovallo (1999). Overconfident leaders believe they are superior to the average in terms of skills and abilities, leading them to take excessive risks and minimize potential obstacles.

This overconfidence bias is commonly observed in business leaders, as it is often necessary to assume such roles (Hiller and Hambrick 2005). Overconfident leaders overestimate their knowledge, minimize risks and exaggerate their ability to control events (Malmendier et al. 2011).

Since the 2000s, researchers have been investigating the relationship between overconfidence and financial decisions. It has been consistently found that overconfident managers tend to overestimate the chances of success of their investment projects (Sammoudi and Hazami-Ammar 2017).

In an efficient market, the presence of overconfidence, manifested in a misperception of investment opportunities, impacts investment decisions (Malmendier and Tate 2005). Overconfidence has a positive effect on the frequency and premium of acquisitions, but a negative impact on shareholder wealth (Smaoui Chabchoub 2010).

3.2. Optimism

According to Pompian (2006), excessive optimism refers to a positive, idealistic view of the future. When individuals project themselves into the future, they tend to overestimate the likelihood of positive experiences, while underestimating the risks of facing negative ones. This tendency was demonstrated in the life expectancy experiment conducted by Puri and Robinson (2007).

Excessive optimism manifests itself as a preference for favorable prospects (Sammoudi and Hazami-Ammar 2017). The introduction of this bias to the corporate domain was carried out by Heaton (2002). His work demonstrated that “optimistic” managers tend to systematically overestimate the probability of good company performance, while underestimating the probability of poor performance. As a result, portfolio managers tend to overestimate their ability to outperform the market, and also have a biased view of their past performance.

Optimistic managers tend to perceive their company’s projects as more profitable than they really are. They believe that external investors underestimate the value of the company’s securities, such as bonds or shares. As a result, optimistic managers are more inclined to commit to investment projects because of their positive perception of the projects’ potential for success.

According to research by Heaton (2002) and Malmendier and Tate (2005), optimism plays a key role in managers’ investment decisions. When managers are optimistic, this means that they believe the market is undervaluing their company, leading them to assign a higher value to it (Fairchild 2005). This optimistic outlook leads managers to overestimate future earnings and cash flows, prompting them to make potentially riskier investment decisions or to invest more in new projects.

3.3. Risk-Taking Behavior

Using prospect theory, researchers can identify three distinct categories of risk-taking behavior among leaders:

-

The risk-averse leader relies on established procedures, norms and standards, and looks to the actions of others for inspiration when making decisions. He prefers to align himself with past practices and decisions when evaluating available options.

-

Unconscious risk-takers undertake actions with a high probability of unfavorable outcomes, without fully recognizing the potential risks and threats involved. This behavior results from their reduced perception of risk and the associated level of threat.

-

The risk-taking executive, on the other hand, is influenced by the anticipation of gains or losses. After a failure, they are more inclined to choose the riskiest option to recoup their losses. Conversely, after a success, he gains confidence in his decision-making abilities, attributing success to his skills rather than luck. As a result, he may underestimate the role of luck in his past successes and continue to take risks to maintain his perceived success.

Risk-taking is a notion that expresses the willingness to commit oneself to actions whose outcome is uncertain, but which have the potential to pay off handsomely. This disposition is generally associated with typically entrepreneurial behavior (Barringer and Bluedorn 1999).

More generally, risk-averse decision-makers tend to overestimate the probability of incurring losses from uncertain or unpredictable strategic choices. Conversely, those who are inclined to take risks take the opposite approach, overestimating the chances of making significant gains. In other words, risk aversion translates into a reluctance on the part of decision-makers to accept potential losses (Kahneman and Lovallo 1993).

It has been established in the literature that productive investments present a high degree of irreversibility, making disinvestment virtually impossible or too costly in the event of results falling short of expectations. Consequently, it can be assumed that risk-averse decision-makers, who favor options with a low probability of loss over those offering high profitability, will adopt a less dynamic behavior in terms of productive investment than those who are more open to risk-taking. Thus, a direct link can be established between the degree of risk-taking of decision-makers and the level of productive investment by the company (Sauner-Leroy 2004).

3.4. Mimicry

Economic agents have a propensity to follow similar decisions simultaneously, and to conform in a gregarious way. This behavior is often the result of voluntary or unconscious imitation of the models they seek to identify with, corresponding to a process of adaptation to group norms (Grawitz 2004). Research by Nofsinger and Sias (1999) has shown that mimicry can occur within a group of investors where transactions are made in the same direction, reflecting a herd mentality. This translates into mutual imitation in their transactions.

According to Corazzini and Greiner (2007), the main sources of mimicry include revenue externalities, correlated effects and social preferences. Income externalities occur when the actions of each agent affect the income of other agents, prompting them to adopt herd behavior in order to maintain a certain equilibrium. Correlated effects refer to the fact that agents behave in a similar way due to common external constraints they encounter. Social preferences indicate that decision-makers, whether agents or managers, adopt the same strategic choices as their predecessors, ignoring available information and favoring that used by the former. This creates a mimetic cascade in which decisions are repeatedly reproduced.

Mimicry on the part of SME managers can lead them to adopt investment strategies that resemble those employed by successful counterparts. For example, if a manager observes that a competitor has achieved profitability through investments in a particular sector, he or she may be tempted to imitate these actions in order to reproduce similar results (Belanes and Hachana 2010). This can lead to uninformed investment decisions. While these decisions can be successful, they can also end in failure.

3.5. Intuition

Intuition can be defined in two ways. Firstly, it represents the ability to grasp truth immediately, without recourse to reasoning. Secondly, it is the ability to foresee or guess. To have intuition is to have flair (Kammoun and Benslimane 2011).

Intuition is therefore an unconscious mode of operation based on the accumulation of subconscious knowledge acquired over years of experience. It differs from, but is not necessarily opposed to, reason, and can be used simultaneously with a simplified analytical process. Intuition enables people to quickly grasp a situation or make decisions without the need for deliberate, rational thought. It can be seen as a form of “tacit knowledge” that results from accumulated experience and manifests itself spontaneously, almost instinctively (Kammoun and Gherib 2008).

The majority of SME managers are extremely intuitive. In fact, they rely entirely on their intuition when making investment decisions, often with above-average degrees of reliance, depending on the problem at hand. The main reason they rely on their intuition is that they are faced with a high degree of uncertainty. A feeling of calm is an essential indicator of a good intuitive decision, while anxiety indicates just the opposite. Furthermore, anger is a major obstacle to the use of their intuitive abilities. Finally, most of those questioned confirmed that they often discuss the use of their intuition with others. This may in fact enhance their sixth sense, encouraging them to rely on their intuition as often as possible, to the point of declaring that they have put into practice at least one specific method or technique to make it more effective and developed. This reinforces the idea that the use of intuition is not a matter of chance, but rather the result of a real awareness on the part of managers, who see their intuitive faculties as a genuine decision-making tool.

This entry is adapted from the peer-reviewed paper 10.3390/ijfs11040120

References

- Fama, Eugene. 1991. Efficient Capital Markets: II. The Journal of Finance 46: 1575–617.

- Agrawal, Anup, and Kishore Tandon. 1994. Anomalies or illusions? Evidence from stock markets in eighteen countries. Journal of International Money and Finance 13: 83–106.

- Katona, George. 1975. Psychological Economics. New York: Elsevier.

- Thaler, Richard. 2000. From Homo Economicus to Homo Sapiens. Journal of Economic Perspectives 14: 133–41.

- Pompian, Michael M. 2012. Behavioral Finance and Investor Types: Managing Behavior to Make Better Investment Decisions. Hoboken: John Wiley & Sons.

- St-Pierre, Josee. 2018. La Gestion Financière des PME, 2nd ed. Québec: Presse de l’Université du Québec, pp. 25–44.

- Scott, D. F., Otha L. Gray, and Monroe Bird. 1972. Investing and financing behavior of small manufacturing firms. MSL Business Topics 20: 29–38.

- Peel, Michael J., and Nicholas Wilson. 1996. Working capital and financial management practices in the small firm sector. International Small Business Journal 14: 52–68.

- Lazaridis, Loannis. 2004. Capital budgeting practices: A survey in the firms in Cyprus. Journal of Small Business Management 42: 427–33.

- Hasan, Maruf. 2013. Capital budgeting techniques used by small manufacturing companies. Journal of Service Science and Management 6: 38–45.

- Gveroski, Miroslav, and Aneta Risteska Jankuloska. 2017. Determinants of Investment Decisions in Smes. Balkan and Near Eastern Journal of Social Sciences 3: 71–78.

- Zhao, Rui, and Xiaoyan Zhang. 2019. Analysis of Investment Decisions of SMEs. Paper presented at 2019 International Conference on Management, Education Technology and Economics (ICMETE 2019), Fuzhou, China, May 25–26; Amsterdam: Atlantis Press, Volume 82, pp. 427–30.

- Acker, Daniella, and Nigel W. Duck. 2008. Cross-cultural Overconfidence and Biased Self-attribution. The Journal of Socio-Economics 37: 1815–24.

- Camerer, Colin, and Dan Lovallo. 1999. Overconfidence and Excess Entry: An Experimental Approach. The American Economic Review 89: 306–18.

- Hiller, Nathan J., and Donald C. Hambrick. 2005. Conceptualizing Executive Hubris: The Role of (Hyper-) Core Self-Evaluations in Strategic Decision-Making. Strategic Management Journal 26: 297–319.

- Malmendier, Ulrike, Geoffrey Tate, and Jon Yan. 2011. Overconfidence and Early-Life Experiences: The Effect of Managerial Traits on Corporate Financial Policies. The Journal of Finance 66: 1687–733.

- Sammoudi, Houda, and Sourour Hazami-Ammar. 2017. Biais comportementaux des dirigeants et structure du capital des PME Tunisiennes. Vie et Sciences de l’Entreprise 203: 63–96.

- Malmendier, Ulrike, and Geoffrey Tate. 2005. CEO Overconfidence and Corporate Investment. The Journal of Finance 60: 2661–700.

- Smaoui Chabchoub, Aida. 2010. Excès de Confiance et Optimisme des Dirigeants: Cas des Firmes Initiatrices d’une Acquisition. Defended on 17-12-2010 at Montpellier 2 in Cotutelle with the University of Sfax (Tunisia). Available online: https://www.theses.fr/2010MON20205 (accessed on 7 August 2023).

- Pompian, Michael. 2006. Behavioral Finance and Wealth Management. Hoboken: Wiley Finance, pp. 9–13.

- Puri, Manju, and David T. Robinson. 2007. Optimism and economic choice. Journal of Financial Economics 86: 71–99.

- Heaton, John B. 2002. Managerial Optimism and Corporate Finance. Financial Management 31: 33–45.

- Fairchild, Richard. 2005. The Effect of Managerial Overconfidence, Asymmetric Information, and Moral Hazard on Capital Structure Decisions. SSRN Electronic Journal.

- Barringer, Bruce R., and Allen C. Bluedorn. 1999. The Relationship between Corporate Entrepreneurship and Strategic Management. Strategic Management Journal 20: 421–44.

- Kahneman, Daniel, and Dan Lovallo. 1993. Timid Choices and Bold Forecasts: A Cognitive Perspective on Risk Taking. Management Science 39: 17–31.

- Sauner-Leroy, Jacques-bernard. 2004. Managers and Productive Investment Decisions: The Impact of Uncertainty and Risk Aversion. Journal of Small Business Management 42: 1–18.

- Grawitz, Madeleine. 2004. Lexique des Sciences Sociales. Paris: Dalloz.

- Nofsinger, John, and Richard Sias. 1999. Herding and Feedback Trading by Institutional and Individual Investors. The Journal of Finance 54: 2263–95.

- Corazzini, Luca, and Ben Greiner. 2007. Herding, social preferences and (non-) conformity. Economics Letters 97: 74–80.

- Belanes, Amel, and Rym Hachana. 2010. Biais Cognitifs et Prise de Risque Managériale: Validation Empirique dans le Contexte Tunisien. Management International 14: 105–19.

- Kammoun, Mohja, and Olfa Zeribi Benslimane. 2011. L’utilisation de l’intuition dans la prise de décision des dirigeants de PME: Proposition d’une échelle de mesure multidimensionnelle. In XXe Conference of AIMS. Nantes: Audencia School of Management.

- Kammoun, Mohja, and Jouhaina Ben Boubaker Gherib. 2008. L’intuition et la prise de décision stratégique dans les PME. XVIIème Conférence de AIMS VII: 1–26.

This entry is offline, you can click here to edit this entry!