Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Others

In spite of the significant progress towards sustainable cosmetics, mass-produced sustainable packaging has proven to be a challenge. The complexity of environmental, economic, social, technological, and policy considerations in conjunction with varying consumer behaviors and corporate goals can make it difficult to select an optimal strategy across heterogeneous supply chain components spread over the globe, and the cost and effort of developing, testing, and validating alternative strategies discourages empirical exploration of potential alternatives.

- sustainable cosmetics

- sustainable packaging

- sustainability strategies

- consumer behavior

1. Introduction

Personal care and beauty are important components of well-being. The development of chemicals to replace more expensive natural ingredients, as well as innovations in production techniques for improved quality and consistency in the 19th century, led to rapid growth in the cosmetics industry starting in the 20th century [1]. This growth was supported on the consumer side by increased prosperity, population growth and aging, and the presence of more women in the workplace [2]. The global beauty and personal care market was worth around USD 565 billion in 2022 and is projected to be worth USD 758 billion by 2025 [3]; and is estimated to be the third fastest market overall in terms of growth [4].

The cosmetics industry has faced concerns in terms of animal testing, health, and environmental impact, including for packaging, since the 1970s [1,2]. Animal testing is still permitted in 80% of the world [5]. Less than 20% of the 12,000 industrial and synthetic chemicals in cosmetics products are considered safe [6,7], and these often reach the aquatic environment directly or indirectly [8,9,10]. In addition to concerns regarding surfactants, chemicals such as UV filters, parabens, and triclosan are now considered emerging contaminants [11] as information accumulates regarding their ubiquity and their impact [12], including their toxicity to microorganisms and crustaceans [13]. Fake and chemical cosmetics containing toxic ingredients remain a concern in developing countries such as Malaysia [14]. Microplastics are a serious concern, and regulatory prohibitions on microbeads in cosmetics have only started to come into force, suggesting a long road ahead in reversing the damage they have caused [4,15].

Regulations on plastic waste are increasing in number, such as the EU Waste Framework Directive 2018/751 [16] and the French AGEC law [17]. Color cosmetics packaging is not the direct focus of such laws as it is not one of the largest polluters. Sustainability efforts in this area must then be consistent with regulatory needs and infrastructure availability, which have not always been designed for this type of packaging, and cosmetics packaging waste must not interfere with waste management practices in other areas.

There is also increasing consumer interest in sustainable packaging and plastic-free cosmetics [18,19,20]. Large cosmetics companies have set up impressive goals for packaging [21], and several cases are mentioned in the scientific [22,23,24,25,26,27,28] and trade [20,29,30,31,32,33,34] literature. Yet, popular brands typically do not offer sustainably packaged color cosmetics, leading to “consumer helplessness in this regard, and a belief that changes should be led by cosmetics producers and government regulatory action” [35].

The scientific literature specifically directed toward sustainable cosmetics packaging, especially for color cosmetics, is extremely sparse. A systematic review of sustainable circular packaging design for the cosmetics industry has noted that topics such as the circular economy, sustainable package design, and the cosmetics sector have not been considered in conjunction; similarly, consumer behavior has been studied on purchase intentions related to green products or packaging [36]. Reviews of the literature on sustainable cosmetics [28,37,38] have systematized the information into areas such as sourcing, manufacturing, packaging, distribution, and consumer and post-consumer issues to provide an overview of the situation following the structure outlined in [37], as well as typical corporate strategies. However, the available number of references directly related to cosmetics packaging sustainability are either in the low single digits or include case studies and gray literature. In terms of best practices with regard to design and life cycle thinking (LCT), most LCT in cosmetics is related to evaluating a specific product’s environmental impact rather than developing new methodologies customized for cosmetics products [38]. A review of green purchase behavior with an aim of extending it to green cosmetics found a significant lack of consensus in the general literature, presumably due to a lack of separation of different product types, and suggested color cosmetics and personal health segments be treated differently [39]. For color cosmetics, where brand and quality are key, the focus could be on process improvements and appropriate policy support could be directed towards this end [39].

The environmental impacts of any particular packaging system depend on “issues relating to its purpose, the length and nature of the supply chain, and recovery, re-use and disposal options”, and “the interaction between environmental, commercial and social performance requirements also needs to be considered on a case-by-case basis” [40]. For claims of recyclability, even the post-recycle market is now relevant [41,42], and scrap prices can be volatile [43]. The scant literature on color cosmetics packaging confirms that the relative environmental impact of products depends on specific details, such as which parts can be recycled [21] and the disposal techniques used [44], and that attempts to decrease certain environmental impacts can worsen others [45]. The empirical nature of technology makes it difficult to anticipate the entire range of possible effects due to synergistic effects, delayed effects, cause–effect chains, and even abuse [46,47]. The actual impact of a cosmetics package may only be discernible after its implementation. Implementations based on technological innovation and developments involve high fixed costs [26]. Any guidelines based on the prior literature that could help narrow down the myriad of potential pathways towards sustainability could be valuable.

2. Background

Globalization helped create large cosmetics multinational corporations (MNCs) which often off-shored production and manufacturing facilities to developing economies [27]. Companies such as L’Oreal acquired Helena Rubenstein, while Unilever acquired Rimmel and Faberge, and Revlon bought Max Factor and Almay. By 2000, L’Oreal had 16.8% of the global market share, followed by Estee Lauder (10.9%), P&G (9.3%), Revlon (7.1%), and Avon (4.7%), with the top 10 accounting for 62.1% of the global market [1,2]. These cosmetics firms typically outsourced packaging [2]. Under deregulation, plastics production shifted to Asia, and post-consumption waste was also often sent to developing economies for disposal. Land-based plastics constitute almost 70–80% of ocean pollution via runoff from rivers and the coastline, which is overwhelmingly from Asian rivers [48]. Large cosmetics companies with sufficient clout to ensure adherence to terms by suppliers could outsource packaging to China, and at times, this had a substantial impact on the business models of cosmetics packaging producers in countries such as Turkey [49]. Nevertheless, products sold in specific markets required localization, and in many markets, western products have since been replaced by local, traditional ones [27]. Established companies may find it difficult to develop and implement new technological solutions and often use third-party collaboration with NGOs and other companies, followed by a scale-up [26].

Rising awareness of environmental and social issues led to an opportunity for smaller cosmetics companies in a market dominated by multinationals. Companies such as Burt’s Bees, Tom’s of Maine, and The Body Shop were all interested in the ethical dimension of consumer marketing and in creating an aesthetic that was biocentric and ethical, rather than anthropocentric, going beyond skin-deep beauty [50]. Cosmetic companies in the British Union for the Abolition of Vivisection (BUAV) were significantly smaller than those not in the association and were concentrated on a small segment of the industry, such as soaps and skin care products, implying a far greater impact in markets for the latter group [2]. BUAV member companies were more concerned about the environmentally acceptable attributes of their products with non-BUAV members satisfied with one or two attributes while continuing to develop products with animal testing for certain consumer segments, although there was internal disagreement within BUAV members as well regarding ’cruelty-free’ products [2]. However, the survival rate of startups is typically low and even though the timing of several ’enviropreneurs’ was in line with customer needs, they were often driven more by founder values rather than detailed customer needs analysis, and many boutique companies stalled. The Body Shop has since been bought by L’Oreal, and then sold to Natura [22,51], which is representative of many such startups, while large companies have often re-assimilated their divisions focused on sustainability into traditional ones [52].

There is a convergence in corporate social responsibility (CSR) and the circular economy (CE) amongst cosmetics MNCs, and CSR reports of eight cosmetics MNCs show a focus on CE that is is not observable in the CSR actions of SMEs [53]. MNCs fall under mandatory reporting requirements, and several of the statements are goals, such as objectives of zero waste in landfill and more than 90% recycling, or a recycling rate of 50%. Using the same sample, in terms of the adoption or pursuit of CE objectives, only four of the companies were clear about their CE objectives, and none of the firms used circularity ratios, although some used alternative sustainability ratios [54]. A sample of sustainable reports for the Italian cosmetics industry for the period 2014–2019 shows terms related to the environment to be somewhat more frequent but also shows CE to be under-reported for governance, strategy, management, and performance, indicating the need for greater institutional, regulatory, and stakeholder pressure on companies [55]. International cosmetics companies are increasingly creating lines using natural products, particularly for shampoos in conjunction with large chemical manufacturers who have set up lines for natural raw materials and who support fair trade and social programs in various countries [56]. A sample of eight small and large cosmetics companies in Brazil suggests the companies to be focused on environmental aspects in design and sourcing and that while CSR compliance is improving, compliance with design for sustainability (DfS) principles is still in its early stages [57]. Organizations with innovation power such as Natura, a Brazilian cosmetics multinational with 5000 organizations in its supply chain, can proactively introduce innovation to further green supply chain management, while companies that cannot innovate may simply be resigned to palliative social efforts and greenwashing [58]. Informal CSR may allow SMEs to benefit more from radical innovation rather than incremental gains in efficiency [59,60]. In plastics waste management, startups have attempted strong sustainability while optimizing for environmental impact, as opposed to weakly sustainable firms that were motivated by competition, competitive advantage, and financial motivations and optimized on economic factors while incorporating environmental variables [61]. Startups, though, occupied niche markets with limited scope for growth and were at a disadvantage in terms of access to technical expertise and financing [61].

The cosmetic industry has made significant attempts towards minimizing environmental and social impacts, including for packaging. Natura and its brands have been mentioned often in the literature with regard to environmental innovation, such as refillable packaging based on plastic film that reduces transportation impact and waste; products 100% free of animal ingredients; the use of plastic from sugercane; reductions in the products’ water and carbon footprints; and annual sustainability reporting since 2001, with a focus on achieving the use of Brazil’s biodiversity in a sustainable manner [22,23]. Case studies also include L’Oreal, which has set a goal to have 95% biobased materials, derived from abundant minerals or from circular processes [24], and has 10 rules for eco-design, including the use of safe packaging in terms of environment and health; reduction in material usage and unnecessary packaging; preference to large formats; the use of less impactful materials and those that come from sustainably managed sources; not shifting burdens to other parties; reusable packages; consumer guidance for appropriate disposal; and facilitating post-use management, which have been implemented in its sustainable product optimization tool [25]. The company also uses technological advancements and third-party collaborations for waste management, similar to L’Occitane [26]. DM Cosmetics has introduced greener packaging and inks; Frosch has introduced 100% high-density polyethylene from post-consumer recyclables; ZAO has developed bamboo packaging; and P&G is facilitating recycling through its PureCycle program, while Estee Lauder’s MAC cosmetics has introduced Back-to-M.A.C. to return primary packaging for recycling [27]. Certain P&G brands also have resusable, recyclable, and refillable packages, while companies such as Lush (see also [22]) have, at times, removed all packaging, and several smaller companies have adopted similar approaches to reduce, reuse, and recycle [26].

3. Product Development Pitfalls

A brand represents the core characteristics of a company, and consumers on the whole form positive associations with brands they perceive to be credible and consistent over time [168]. Brand identity is a significant asset, and using a product while knowing it activates different areas in the brain compared to using it without being aware of the brand [169]. Positive brand associations override the basic pleasure response, and products should conform to the brand image [170]. Prior ’good’ practices, developed over many years, may have helped establish brand characteristics that may be difficult to modify, and such attempts could even be counterproductive, such as with New Coke. Individuals expect the same brand experience across platforms, including apps [171]. While MNCs create separate divisions and brands for sustainable products, the same company selling environmentally friendly products in one division and those with a high environmental impact in others, or engaging in animal testing in markets that require them while selling ’cruelty-free’ products elsewhere, could lead to perception problems. Empathy virtue is a significant factor in emotional attachments to brands, and multinational corporations buying sustainable startups can be problematic in this regard [172]. Green products are often more costly to produce and are subjected to greater uncertainty, and if successful, could also reduce sales of the existing traditional products of a company, implying little intrinsic motivation to introduce such products [173].

Packaging is often the first and only contact the customer has with a product before purchase, and the quality of the product and its ingredients must often be inferred from the packaging [174]. For beauty products, which have an implicit promise towards making the customer more beautiful, where beauty is itself an abstract concept, consumers may rely on visual cues for forming efficacy beliefs [175]. Proctor & Gamble suggests shoppers decide about a product in 3–7 s, just as they notice it, and brand awareness is key towards expectations of functionality in the absence of prior usage [176]. Even when product characteristics are known, given that most purchase decisions are made at the point of sales for such goods, a brand using a distinctive packaging can simplify the decision for the consumer [177], who may have to look through thousands of products within a few minutes during a typical shopping trip to a store. On the other hand, consumers may only use contextual cues primarily for unfamiliar brands, which implies sustainable packaging information will have a greater impact for unfamiliar brands [168].

Several factors such as shape, color, material, textual and artistic features [178], and convenience and functionality [177], are relevant to consumer purchase behavior. Visual elements, including color, shape, symbols, and text, remain critical towards developing emotional connections with consumers [179]. Package design remains important for impressions of quality as well, and in an eye tracking experiment with four lipsticks (Urban Decay, priced on average at GBP 16, Dior at GBP 25, L’Oreal at GBP 5, and Clinique at GBP 12), respondents, without knowing the lipsticks’ prices, found the L’Oreal lipstick to be of the highest quality, while Urban Decay and Dior were ranked as low-quality, although the results could be subjected to the sample selection bias towards younger consumers [180]. Respondents listed material and color as the most attractive elements and stated that purchase intention was triggered by package attractiveness; plastic was the most preferred material in hairstyle, skin care, as well as makeup products, followed by glass, suggesting a preference for its user-friendliness and practicality [180]. Forty-six percent of US female cosmetics customers, with younger buyers being at 50%, suggested packaging to be influential or very influential to the purchase decision regardless of whether it was primary or secondary, sustainable, refillable, or made of plastic and glass [181].

Packaging can be extremely important for luxury price items [69], and with increased dependence on online delivery, especially for younger shoppers, the ’deboxing’ experience has gained added emphasis on social media [181]. Companies are even developing packaging suitable for e-commerce [182]. However, sustainability characteristics are significantly behind attractiveness and functionality [181]. Similar results have been observed for perfumes, where verbal design was found to be more significant than visual due to the preference for the brand name, and several additional features were more important than environmental benefits [183].

4. Sustainable Packaging Strategies

Sustainable packaging can be based on plastics, paper (see, for e.g., [308,309]), glass, and metal [310,311,312] and can be minimalist, biodegradable, recyclable, refillable, or otherwise reusable. It is important to consider such post-use characteristics during the design phase itself [313]. For the packaging of organic cosmetics, the amount of packaging material should be reduced to the minimum necessary, and the amount of packaging material that can be reused or recycled should be increased, while the use of plastic materials (PVC, polystyrene, etc.), which are not biodegradable, is forbidden [314].

The literature provides some analyses for sustainable cosmetics packaging. The eco-design of cosmetics tubes using LCA for varying quantities of mineral fillers, as well as post-consumer recycled material, has shown that lower-environmental-impact solutions were also lower in economic costs, and that the environmental impact of different stages varies by product; not all indicators may be better for sustainable solutions, including, for instance, freshwater eutrophication, and the allocation scheme used for the burden of recycling can also impact results [45]. In a direct comparison of powder cases, the design of durable packages was found to significantly outperform techniques such as dematerialization in terms of flimsier products, and it was noted that recycling could only help if packaging materials were fully recycled, which could depend on the user and the infrastructure [21]. In a comparison of a 120 mL glass bottle with an HDPE cap weighing 188.78 and 17.53 g, respectively, a 150 mL PET bottle with an HDPE cap weighing 25.59 and 7.55 g, respectively, and a 200 mL PET bottle with an HDPE cap weighing 77.1 and 21.65 g, respectively, for a total volume of 1800 mL, the 150 mL PET bottle was found to be the most environmentally friendly, and the glass bottle was found to be the least environmentally friendly. Additionally, the contributions of the various stages, such as manufacturing and post-disposal, were different across the products and varied with the disposal technique used [44]. While plastic production uses 40% less electricity than cardboard, the latter is overall more sustainable as it is produced from renewable sources and can be recycled easily, and if not recycled, it decomposes quickly in nature [315]. Processes such as 3-D printing can support sustainable manufacturing by reducing waste, energy use, and carbon emissions and have also found widespread environmental applications, such as for improving air quality monitors, filters, and membranes [316]. The EPA provides data on the proportion of materials being recycled, landfilled, or incinerated for commonly used materials, such as glass, aluminum, paper, and plastics [317].

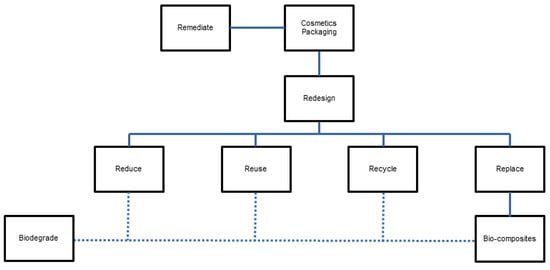

Plastics comprise a significant proportion of packaging and packaging waste [318]. Several articles have reviewed the various types of plastics, the harm they cause, and waste management strategies [319,320,321]. Figure 1 suggests several approaches towards reducing plastic waste, including the remediation of waste already present [318,322], redesigning the package to reduce the quantity of packaging, creating reusable [323] or recyclable packages, or replacing plastic with other materials, especially biocomposites. Products using alternate materials could also be designed for reduction, reuse, or recycling or could be removed from the environment via biodegradation. The use of post-consumer recycled plastic is another option (e.g., [45]).

Figure 1. Options for plastic waste.

Techniques such as fungi-based bioremediation for plastic pollution are being researched, but there is a need to promote the biodegradability of petroleum-based polymers by eliminating biocides and antioxidant stabilizers while incorporating pro-oxidants [318,322]. Factors that can affect plastic degradation via pathways such as biodegradation, photodegradation, chemical degradation, and thermal degradation are complex and may interact and interfere with each other [324], and degradation can result in the release of atmospheric microplastics and nanoplastics, as well as harmful chemicals. Microplastics, once introduced, are difficult to remove in wastewater treatment plants; cannot be collected centrally; and with their large specific area and strong adsorption characteristics, can collect a large number of toxic and harmful substances, which make degradation more challenging. While degradation methods have been studied for specific cases, an environmentally friendly and efficient method that can be widely used in practice has not been identified as of yet [324]. Reducing microplastics may require a combination of strategies involving minimizing the loss of pre-production plastic pellets via initiatives such as Operation Clean Sweep®, extending producer responsibility, banning certain types of single-use plastics, supporting the recycling market via taxes on the use of unrecycled material or incentivizing the production of recycled plastics and initiating educational campaigns, developing bioplastics and biodegradable plastics, and improving wastewater treatment technology [325].

This entry is adapted from the peer-reviewed paper 10.3390/cosmetics10050139

This entry is offline, you can click here to edit this entry!