Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

A green balanced scorecard allows businesses to monitor their environmental progress and energy use, as well as quantify their achievements toward decreasing their ecological footprint. Businesses have made it a priority to build an energy-efficient management system based on the Sustainable Balanced Scorecard, which will help them achieve their organization’s environmental strategic goals.

- business

- energy management system

- energy efficiency

- environmental footprint

1. Introduction

The Balanced Scorecard is a tool for strategy implementation and management. Its development addresses both the challenge of efficiently assessing corporate performance and the important issue of successfully implementing strategy [1][2]. Organizations that already have a defined plan might speed up their speedier and more successful execution by adhering to the principles chosen. When developing a plan, several management teams initially assumed that all their members agreed with it. However, the original Balanced Scorecard (BSC) discovered that each team member interpreted strategy extremely differently. They could not agree on who the target consumers were, what the distinctive value offer was, or how innovation and shared services fit into the plan. The process of developing the Balanced Scorecard resulted in clarification and agreement on what the plan was and how it might be achieved. Organizations that did not have an explicit or common plan utilized the Balanced Scorecard approach to generate business unit strategies. The scorecard incites an extensive management dialogue to determine strategy. The Balanced Scorecard introduces a new shared language and infrastructure for strategy. Strategy maps and templates serve as the foundation for strategic conversations. As a result, having a clear approach that everyone knows and agrees on will reduce the time it takes to create the initial Balanced Scorecard [3].

On the other hand, businesses do not need to wait until they have reached an agreement on a plan before developing a scorecard. They can utilize the process of creating the scorecard as a tool for a parallel process that eventually results in the strategy. The Balanced Scorecard enables financial outcomes to be measured in connection to customers and operations while also enabling the development of organizational capacities and capabilities [4]. Unlike other systems, the performance assessment information acquired highlights the importance of financial and non-financial indicators being included in employee information at all levels of the hierarchy. Front-line workers must comprehend the ramifications of their job, while senior management must understand how to reach the long-term financial objectives set in the process of converting their vision into strategy while achieving the day-to-day short-term ones [1][5].

In recent years, the demand for environmentally conscious business initiatives has grown, and the benefits of green entrepreneurship are increasing, leading to the treatment of environmental consequences from corporate operations [6]. Environmental protection actions may be an arm of developing a specialized know-how with large export potential and competitive advantages, generating surplus value for the economy and thousands of new jobs. In terms of environmental management, the business climate is continually changing, resulting in a new situation in which environmental commodities become economic products and enter the realm of corporate activity [7]. The economy no longer views the environment as an endless resource that is perpetually renewed and self-healing [8]. In addition to the production costs, the environmental costs can be calculated either directly or indirectly. Green entrepreneurship’s key industries meet the demand for both continuity and innovation. Thus, environmental adaptation of traditional production actions and methods is associated with continuity, slow progress, and transition, whereas exclusively green economic actions form the basis of the new economic world.

Although green activities are unquestionably beneficial to the environment, the effects of such policies on a company’s profitability may be both positive and negative [9]. On the one hand, green practices may boost profitability by helping to distinguish products and services in the market, improving the corporate image for investors and consumers (both existing and new). Green practices, on the other hand, may impair profitability owing to the increased expenses associated with their adoption, implementation, and maintenance [10]. The Green Balanced Scorecard, which may provide a framework for integrating non-financial measurements into business operations and evaluations, can help to reconcile these competing challenges by aligning sustainability measures with corporate strategy. Through the above method, businesses can clarify the link between sustainability objectives and their performance, strategy, and profitability [11].

2. The Role of the Green Balanced Scorecard to the Rational Management of Energy in Businesses

Energy management is the continuous and regular monitoring, control, and improvement of an organization’s energy use to save energy and reduce energy expenditures [12][13]. Minor steps such as checking monthly energy bills and upgrading to energy-saving lightbulbs fall under the purview of energy management. It might imply more comprehensive upgrades such as adding insulation or installing a reflective roof to cover or enhance heating and cooling equipment to maximize their energy performance. Additionally, energy management can cover more complex operations, such as developing financial predictions for commissioning renewable energy services and implementing other changes for clean energy usage and lower energy expenses in the next few years [14]. Technology is used in more advanced energy management strategies. Utility tracking software, for example, forecasts future energy demand and sets energy budgets, which assists a company’s strategic decision-makers in ensuring that its energy management strategy aligns with its objectives and financial planning. Enterprise management software makes use of IoT, sophisticated connectivity, and big data to enable a company to benefit from energy data analytics for improved facility management and to assist with energy consumption and management difficulties [15][16].

Despite the role of technology, the Balanced Scorecard (BSC) developed by Kaplan and Norton (1992), which has proven to be one of the most extensively used instruments in management strategy, can serve as another tool to aid in energy management operations. Furthermore, Hansen and Schaltegger (2012) identified the four objectives reviewed by the traditional BSC—finance, customers, internal procedures, and learning and growth—as ignoring the inclusion of sustainability issues and so needing to be modified to the changing business environment [17]. While the traditional BSC framework can assist managers in matching business sustainable development goals with firm strategy, experts in the field argue that the framework should include economic, social, and environmental factors. Key economic data should be addressed in the usual BSC from a financial approach [2][18]. As a result of incorporating the dimension of sustainability into the traditional BSC, a focus on the social and environmental measuring criteria may be placed. To begin, the required environment and society indicators, goals, and accompanying Global Reporting Initiatives (GRI) must be included into the conventional BSC framework to include the social and environmental metrics in the present four BSC frameworks. The GRI may assist managers by providing a wide range of performance and department-specific metrics.

Thus, based on the above insights of experts in the field, developing a BSC for a given business sector and identifying the social and environmental variables relevant to the business sector plans can be characterized as a critical task. Many studies have investigated the use of the Sustainable Balanced Scorecard (SBSC) in different sectors for the sustainable continuity of businesses [5]. Although, neither has further investigated the contribution of SBSC in the energy efficiency of a business. Specifically, an efficient energy performance is dependent on the development of a sustainable balanced scorecard, which implies that businesses must define targets that relate to the organization’s strategy for energy efficiency and long-term continuity. A group of crucial success criteria will then serve as a representation or driver of these goals and translate into a set of actions or initiatives. The following are some of the most vital categories of critical success criteria to investigate and comprehend: (i) political aspects that include government, energy, and industry policies, as well as renewable energy industry policies and worldwide environmental challenges, such as greenhouse gas reduction targets, (ii) technology criteria include advancements in renewable energy technology and technical assessment criteria, such as the cost of creating renewable energy, (iii) market considerations include worldwide energy prices, market demand (local and even external) for renewable energy-related businesses, domestic industry development, and (iv) natural resource factors including renewable energy availability [5].

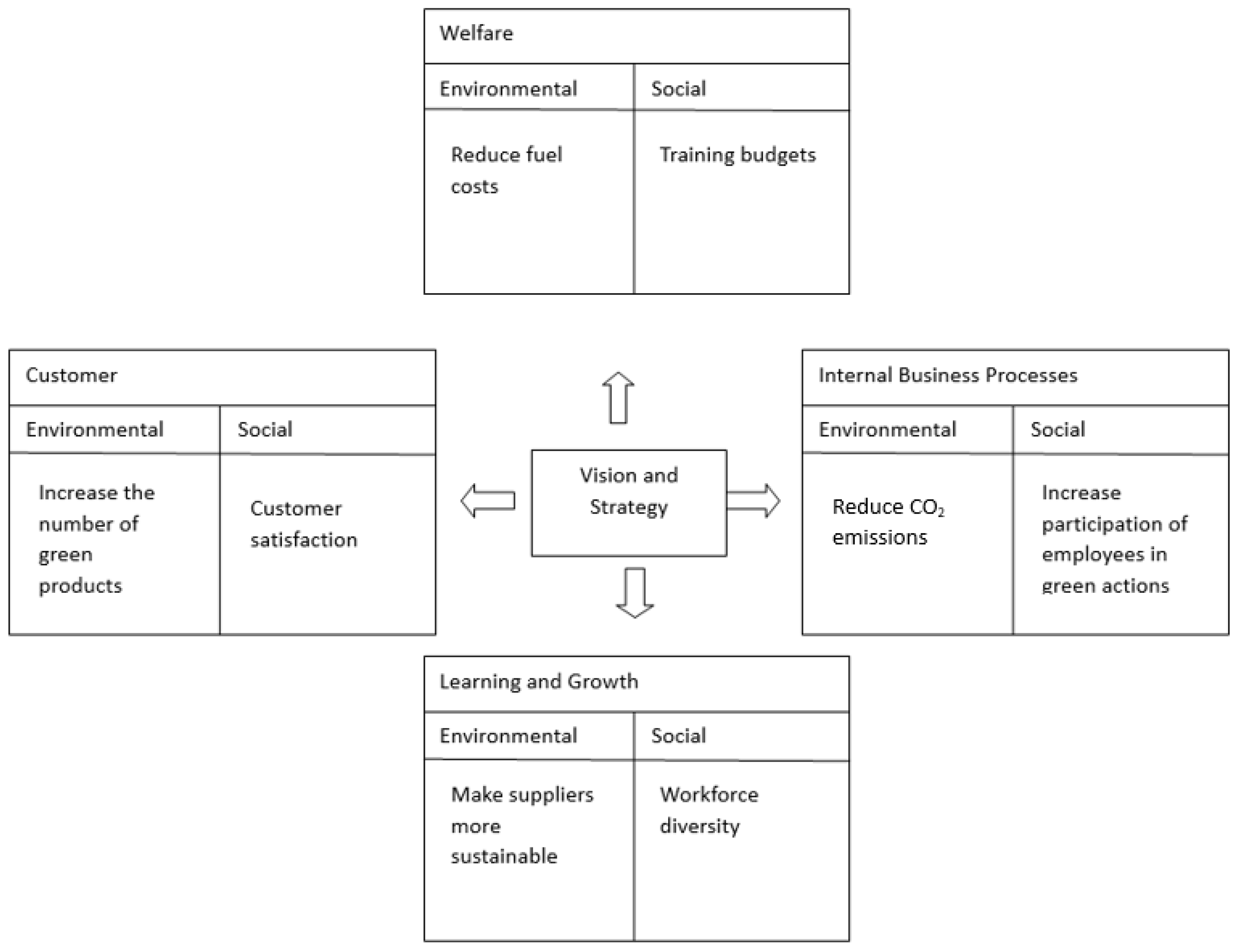

Based on the above, an example of the SBSC model that businesses may use is based on four perspectives, from which the vital success criteria, key performance indicators, and objectives should be defined. Thus, learning and growth, customers, internal business processes, and welfare are four insights on which enterprises’ SBSC should be founded in order to achieve energy efficiency and sustainability [13]. The first three concepts are not significantly different from Kaplan and Norton’s initial viewpoints. However, the category of welfare replaces the original financial viewpoint at the top of the strategy plan since, for an organization, local community prosperity is the most important strategic objective, which will be demonstrated by optimizing the long-term stakeholder value [19]. Figure 1 depicts the SBSC that might be utilized if a company wishes to be more energy efficient and sustainable, where the objectives, initiatives, measurements (KPIs), and targets for each viewpoint must be presented [20][21][22]. The objectives indicated inside each viewpoint must work together to solve the relevant key-related question.

Figure 1. Sustainable Balanced Scorecard. Source: Own elaboration.

This entry is adapted from the peer-reviewed paper 10.3390/en16186432

References

- Tawse, A.; Tabesh, P. Thirty years with the balanced scorecard: What we have learned. Bus. Horiz. 2023, 66, 123–132.

- Agarwal, S.; Kant, R.; Shankar, R. Exploring sustainability balanced scorecard for performance evaluation of humanitarian organizations. Clean. Logist. Supply Chain 2022, 3, 100026.

- Wang, J.-S.; Liu, C.-H.; Chen, Y.-T. Green sustainability balanced scorecard—Evidence from the Taiwan liquefied natural gas industry. Environ. Technol. Innov. 2022, 28, 102862.

- Faraji, O.; Ezadpour, M.; Dastjerdi, A.R.; Dolatzarei, E. Conceptual structure of balanced scorecard research: A co-word analysis. Eval. Program Plan. 2022, 94, 102128.

- Torgautov, B.; Zhanabayev, A.; Tleuken, A.; Turkyilmaz, A.; Borucki, C.; Karaca, F. Performance assessment of construction companies for the circular economy: A balanced scorecard approach. Sustain. Prod. Consum. 2022, 33, 991–1004.

- Jum’a, L.; Zimon, D.; Ikram, M. A Relationship Between Supply Chain Practices, Environmental Sustainability and Financial Performance: Evidence from Manufacturing Companies in Jordan. Sustainability 2021, 13, 2152.

- Song, W.; Han, Y.H.; Sroufe, R. Substitution and complementarity dynamics in configurations of sustainable management practices. Int. J. Oper. Prod. Manag. 2022, 42, 1711–1731.

- Stauropoulou, A.; Sardianou, E.; Malindretos, G.; Evangelinos, K.; Nikolaou, I. The effects of economic, environmentally and socially related SDGs strategies of banking institutions on their customers’ behavior. World Dev. Sustain. 2023, 2, 100051.

- Mirza, N.; Afzal, A.; Umar, M.; Skare, M. The impact of green lending on banking performance: Evidence from SME credit portfolios in the BRIC. Econ. Anal. Policy 2023, 77, 843–850.

- Tan, L.; Kong, T.L.; Zhang, Z.; Metwally, A.S.M.; Sharma, S.; Sharma, K.P.; Eldin, S.M.; Zimon, D. Scheduling and Controlling Production in an Internet of Things Environment for Industry 4.0: An Analysis and Systematic Review of Scientific Metrological Data. Sustainability 2023, 15, 7600.

- Kirchherr, J.; Hartley, K.; Tukker, A. Missions and mission-oriented innovation policy for sustainability: A review and critical reflection. Environ. Innov. Soc. Transit. 2023, 47, 100721.

- Tran, T.A.; Aguilar, R.R.; Munapo, E.; Thomas, J.J.; Vasant, P.; Panchenko, V. Energy efficiency management for the industrial manufacture engineering. Next Energy 2023, 1, 100031.

- Bosu, I.; Mahmoud, H.; Hassan, H. Energy audit and management of an industrial site based on energy efficiency, economic, and environmental analysis. Appl. Energy 2023, 333, 120619.

- Nathaphan, S.; Therdyothin, A. Effectiveness evaluation of the energy efficiency and conservation measures for stipulation of Thailand energy management system in factory. J. Clean. Prod. 2023, 383, 135442.

- Daly, D.; Carr, C.; Daly, M.; McGuirk, P.; Stanes, E.; Santala, I. Extending urban energy transitions to the mid-tier: Insights into energy efficiency from the management of HVAC maintenance in ‘mid-tier’ office buildings. Energy Policy 2023, 174, 113415.

- Zhang, P.; Hao, D. Enterprise financial management and fossil fuel energy efficiency for green economic growth. Resour. Policy 2023, 84, 103763.

- Schaltegger, S.; Hansen, E.G.; Lüdeke-Freund, F. Business Models for Sustainability: Origins, Present Research, and Future Avenues. Organ. Environ. 2012, 29, 3–10.

- Chen, H.-M.; Wu, H.-Y.; Chen, P.-S. Innovative service model of information services based on the sustainability balanced scorecard: Applied integration of the fuzzy Delphi method, Kano model, and TRIZ. Expert Syst. Appl. 2022, 205, 117601.

- Hansen, E.G.; Schaltegger, S. The Sustainability Balanced Scorecard: A Systematic Review of Architectures. J. Bus. Ethics 2014, 133, 193–221.

- Vardopoulos, I.; Konstantopoulos, I.; Zorpas, A.A.; Limousy, L.; Bennici, S.; Inglezakis, V.J.; Voukkali, I. Sustainable metropolitan areas perspectives through assessment of the existing waste management strategies. Environ. Sci. Pollut. Res. 2020, 28, 24305–24320.

- Vardopoulos, I.; Tsilika, E.; Sarantakou, E.; Zorpas, A.A.; Salvati, L.; Tsartas, P. An Integrated SWOT-PESTLE-AHP Model Assessing Sustainability in Adaptive Reuse Projects. Appl. Sci. 2021, 11, 7134.

- Moustairas, I.; Vardopoulos, I.; Kavouras, S.; Salvati, L.; Zorpas, A. Exploring factors that affect public acceptance of establishing an urban environmental education and recycling center. Sustain. Chem. Pharm. 2022, 25, 100605.

This entry is offline, you can click here to edit this entry!