Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Studies on the housing market often focus on understanding the dynamics of housing demand, while investigations into the supply side, particularly construction costs, have received relatively less attention.

- full-cost pricing

- tendering theory

- construction cost index

- house price index

1. Introduction

Early research on residential construction costs primarily examined productivity in homebuilding [1]. In a related study, Rosenthal [2] explored the connection between construction costs and structure value, finding evidence of their co-integration. Despite the crucial role of construction in the housing market, there is limited direct empirical research examining the relationship between construction costs and housing prices [3][4]. While the impact of construction costs on house prices has been implicitly studied in previous literature, there is a noticeable gap when it comes to understanding how house prices impact construction costs. Few studies have delved into this aspect, leaving a significant area of research unexplored. This presents an opportunity for further investigation and research, as understanding this relationship could provide valuable insights into the dynamics of the housing and construction markets.

To bridge this research gap, this study is uniquely positioned to conduct an empirical investigation in Auckland, New Zealand—a global city known for its costly construction sector provides an ideal setting to examine and analyse the dynamics between housing prices and construction costs in depth. This approach aligns with the suggestions of Adams and Fuss [5], who argue that studying the effects of house prices on construction costs in conjunction with the impact of construction costs on house prices could prevent the overestimation of effects and provide a more accurate understanding of the industry conditions. Specifically, researchers are testing two competing theories that explore the connection between housing prices and construction costs in this study: the tendering theory [6] and the full-cost pricing theory [7]. Despite the theoretical base of these pricing theories, a significant research gap exists in their empirical implications and validation, particularly within the context of the market structure of the construction industry. This research gap by providing empirical evidence supporting the application of these pricing theories within the construction industry. Researchers argue that the choice of theory is contingent upon the local market structure, with monopoly markets more likely to favour the adoption of full-cost pricing, while monopolistic competition is more aligned with the tendering theory.

According to the tendering theory [6], construction tendering prices represent optimal mark-ups and remain unaffected by fluctuations in market demand. In this theory, bidders set their tender prices based on cost estimates plus a constant percentage mark-up, aiming to secure a predetermined fraction of contracts. The winning bid is determined by the cost estimate plus a mark-up derived from a probability density function. In a rational and competitive market, all bidders would apply a consistent mark-up, adjusting only for differences in the original cost estimate. Thus, tendering theory suggests that tendering is a process that facilitates communication between buyers and builders, reflecting the price at which both parties are willing to transact services. Housing prices, therefore, should not influence construction tendering costs in a competitive market.

On the contrary, full-cost pricing theory [7] argues that the construction industry’s inherent uncertainty makes cost estimation and pricing challenging. As per this theory, the prevailing pricing policy in the industry is based on absorption or full-cost pricing. This approach primarily considers production costs such as labour, materials, plant, and overheads. If construction prices are cost-based, any differences in contract amounts would directly stem from variations in production costs. Therefore, the construction industry pricing practice aligns more with marketing discipline principles rather than neo-classical economics [8]. Following the full-cost pricing policy, construction tenders are highly influenced by market demand, including housing prices. Full-cost pricing is widely adopted as a pricing strategy in construction service industries. Backman [9] notes the widespread belief that ‘prices are or should be determined by costs of production’, and Gabor [10] suggests that cost estimates are often used to gauge competitors’ likely quotes. The practice of full-cost pricing aims to minimise any potential loss and maximise profitability [11]. In markets characterised by an oligopolistic structure, collusion among a few large construction firms can significantly impact the overall market. Thus, determining construction costs can be influenced by market demand and housing prices.

If the full-cost pricing theory holds, it will imply that the escalating house price index could exert further upward pressure on already high construction costs. This outcome could necessitate strategic adaptations by industry players, such as cost management initiatives or shifts in project scopes, to maintain project feasibility in the face of rising costs. On the other hand, if the tendering pricing theory is supported, this would suggest a potential lead-lag relationship between rising construction costs to higher house prices. This finding could have profound implications for the Auckland housing market, potentially exacerbating existing affordability issues and influencing policy discussions around housing and construction industry regulations. Furthermore, this research could contribute to the broader understanding of pricing mechanisms in the construction industry, providing a basis for more informed decision-making by stakeholders. This is particularly relevant given the current uncertainties in the industry, such as the decrease in sales from group housing companies and the significant number of issued residential consents for multi-unit homes that have not yet started construction.

2. Background of the Housing Development Market in New Zealand

New Zealand’s construction industry has experienced steady growth over the past five years, contributing approximately 18.6 billion New Zealand dollars to the country’s gross domestic product (GDP) in the year ending September 2022. This highlights the significant role of the construction sector in New Zealand’s economy as it addresses the infrastructure and housing needs of the growing population.

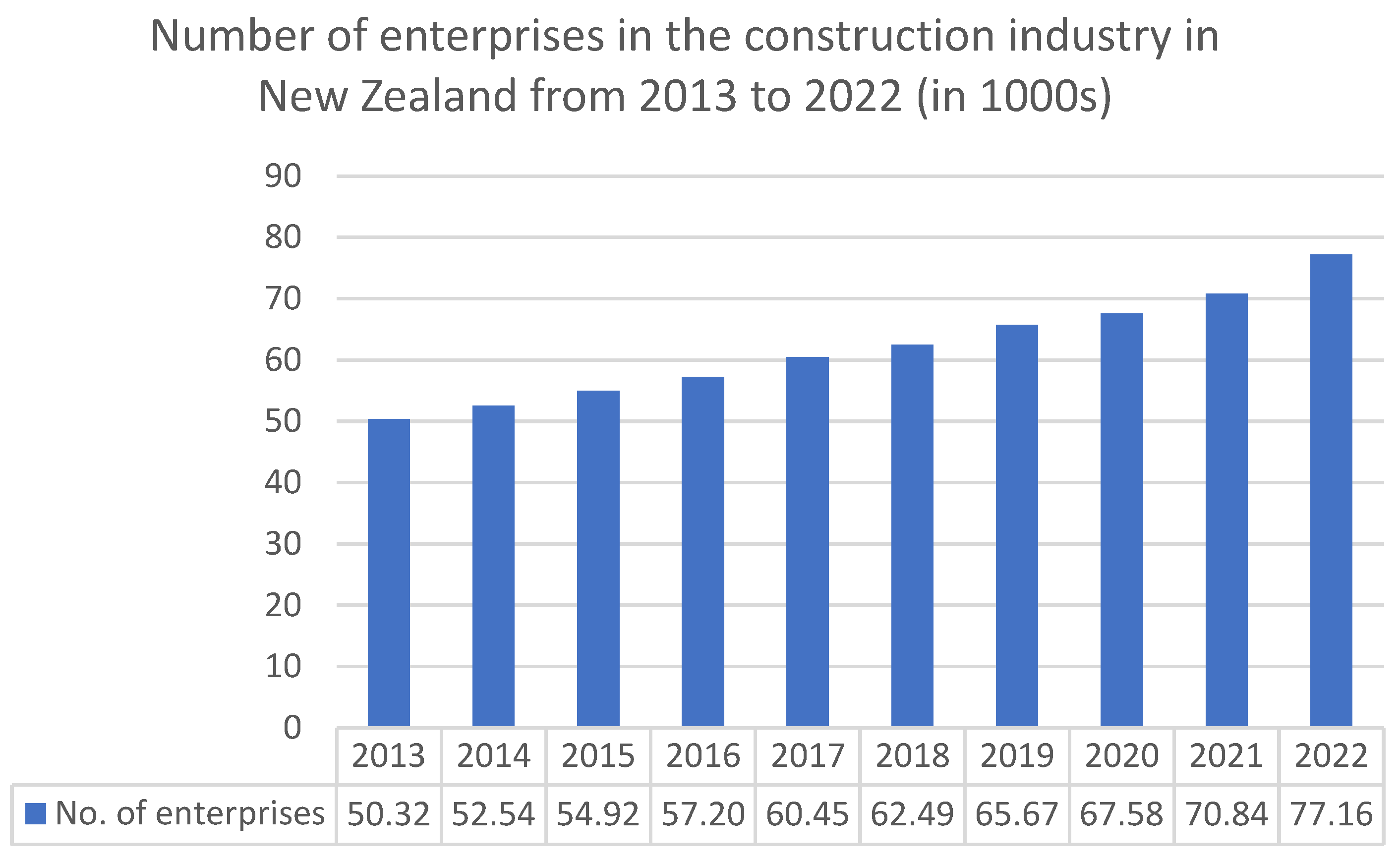

The number of enterprises operating in the construction industry has also shown an upward trend, projected to increase from around 38,000 in 2013 to over 50,000 by 2022. This growth signifies a vibrant and expanding construction landscape in New Zealand.

The construction industry has been a major employer, with the number of people employed in the sector fluctuating over time. As of June 2022, it was estimated that approximately 250,000 individuals were working in construction-related roles. Moreover, businesses providing services related to the construction industry are expected to create more job opportunities, with projections indicating an increase from around 100,000 jobs in 2013 to over 130,000 by 2022.

The value of building work completed in New Zealand has been substantial, reaching approximately $7 billion NZD as of June 2022. This includes both residential and non-residential construction projects. Specifically, the value of residential building work is projected to grow from around $20 billion NZD in 2018 to over $25 billion NZD by 2022, emphasising the significant investment in the residential housing sector.

Residential building consents, a key indicator of construction activity, are also on the rise. The value of residential building consents issued in New Zealand is expected to increase from around $12 billion NZD in 2017 to over $16 billion NZD by 2022. Furthermore, the number of residential building consents for all dwellings is projected to rise from approximately 30,000 in 2017 to over 40,000 by 2022, reflecting the increasing demand for new housing units.

In 2022, it is anticipated that around 45,000 building consents will be issued for houses, while approximately 15,000 consents will be issued for apartments, further demonstrating the diverse nature of residential construction in New Zealand.

Overall, the construction industry in New Zealand is experiencing growth and is expected to continue its upward trajectory. However, challenges such as labour shortages and rising material costs need to be addressed to ensure sustainable development and meet the evolving needs of the population. These statistics provide valuable insights into the construction industry’s scale and importance in New Zealand’s economy, laying the foundation for understanding the implications and impact of Full-Cost Pricing and Tendering Theory in this dynamic sector.

3. Full-Cost Pricing

According to the article by Hall and Hitch [12], firms often set prices based on full costs plus a standard mark-up. The price is determined by the total costs incurred in the production of a good or service, including both direct and indirect costs. The mark-up is then added to this total cost to determine the selling price. This mark-up is typically determined by the desired rate of return and the perceived market conditions. However, the exact setting of the mark-up can vary between firms and industries. The mark-up is often expressed as a percentage of the total cost and is set to cover profit margins and any potential cost variances [13].

Housing demand does influence the housing price under the full-cost pricing theory. However, the extent of this influence can vary depending on the market structure and conditions. In a perfectly competitive market, builders are price takers and cannot influence prices. However, in markets with less competition, builders have more discretion to set prices and may adjust their prices in response to changes in housing demand. The article by Baumol et al. [14] suggests that market demand, and hence the housing price, plays a role in full-cost pricing. Builders often consider the demand elasticity when setting prices. If demand is inelastic, firms may set a higher price, while if demand is elastic, builders may set a lower price to increase sales volume. For instance, in the airline industry, Borenstein and Rose [15] found that price dispersion due to systematic peak-load pricing should be correlated with the variability in airlines’ fleet utilisation rates and airports’ operations rates.

The full-cost pricing theory could lead to higher profits in monopoly or oligopoly markets. This is because firms in these markets have greater market power and can set prices above marginal cost. However, the extent of these profits depends on the elasticity of demand and the ability of the firm to differentiate its product from others. The paper by Krugman [16] provides an interesting perspective on this. It suggests that shifts in the perceived elasticity of demand could arise from shifting market share in an oligopolistic market. The basic rule of Cournot competition in the constant elasticity case is that a firm will face a perceived elasticity of demand equal to E/s, where E is the market elasticity and s is the firm’s market share. The higher the import market share, the lower the elasticity of demand perceived by the foreign firm and, thus, the higher its price for any given marginal cost. Similarly, the higher the import share, the higher the elasticity of demand perceived by the domestic firm and, thus, the lower the domestic firm’s price. This implies that in an oligopolistic market, the full-cost pricing theory could potentially lead to higher profits, depending on the firm’s market share and the elasticity of demand. Borenstein and Rose [15] found that monopolists have the most negligible price dispersion, followed by symmetric duopolists and market players in competitive markets. This suggests that firms in monopoly or oligopoly markets may be able to use full-cost pricing to increase their profits by reducing price dispersion, essentially the bid-ask spread associated with the agent negotiation process [17].

Several other factors can also influence pricing decisions under the full-cost pricing theory, especially the cost of products or services. In the construction industry, different factors contribute to the total construction cost. The land cost is the most significant for residential housing development, directly impacting the overall construction cost. The holding cost during the land holding period and expenses related to materials, labour, infrastructure, amenities, and government fees further add to the overall cost [18][19][20]. The land cost, constituting approximately 15% to 25% of the overall development cost, plays a crucial role [21]. Research by Ho and Ganesan [21] indicates that land supply levels significantly affect housing prices, with a two-year lag effect in Hong Kong. Likewise, Oikarinen and Peltola [22] found that the price of undeveloped land is influenced by the value of developed projects, demonstrating a correlation between house prices and undeveloped land prices. Studies have also explored the relationship between construction costs and housing prices. Tsai [23] examined the construction cost index and house price index and found that construction costs influence housing prices in Taiwan. The findings supported the perspective that construction costs affect housing prices from the supply side. In addition, the interdependence between land prices and housing prices is evident, where high land costs contribute to increased housing prices, and higher housing prices may elevate land prices [23]. Other factors, such as material costs, labour costs, and government fees, also contribute to the overall construction cost [24][25]. Mansur et al. [24] identified fuel prices, production costs, high demand, and price manipulation as key factors affecting house prices. Kamal et al. [25] highlighted the impact of construction material costs and labour costs on housing prices, emphasising their influence from a developer’s perspective.

4. Tendering Theory

Tendering Theory, as revisited by Runeson and Skitmore [7], provides a unique perspective on pricing in industries where each object is unique. This concept is supported by the findings in the first document [8]. This theory departs from the traditional view of the tendering process, extending beyond the winning tender as determining the price of an individual contract. It involves price derivation based on estimated costs and mark-ups, operating under simultaneous bidding with individual valuations, transparent market information, and many bidders, creating a competitive equilibrium [8].

The tendering theory assumes constant mark-ups unaffected by variations in demand, with the price calculated as costs plus a constant mark-up [7]. This aligns with the findings in the second document, which confirms that the theory excludes the possibility of systematic variations in the mark-up [7]. It does not account for potential activities and counter-strategies of competitors. Any differences between competitors arise from the necessity to estimate the cost prior to the execution of the contract and any aberrations caused by the process of submitting a single, unchangeable bid [8].

The competition among rational market participants results in similar cost estimations and constant price mark-ups, leading to consistency in construction prices unless slight differences in project design exist [8]. The Tendering Theory also posits that a change in demand will not change tendering behaviour, as this would represent a systematic change in strategy, and systematic changes are excluded by assumption [8]. It states that tender prices will only change if costs or the composition or number of competitors change [8].

In contrast, full-cost pricing theory considers total costs and aims to achieve satisfactory profits without direct consideration of market competition [8]. In an oligopoly market structure, where large companies may cooperate and have consensus, the impact of ignoring market competition in the full-cost pricing strategy can be minimised. The price of construction services becomes relevant to the property market, and higher housing prices provide room for satisfactory profits [7].

5. Discussion

The Granger-causality test and ARDL bound test results show the short-run and long-run relationship between HPI and CCI, respectively. The results do not only support each other but also imply different pricing mechanisms. In the short run, the result implies that construction companies in the industry would adjust their prices based on prevailing house prices; this could be seen as a reflection of the full-cost pricing theory, where firms adjust their mark-ups quickly to align with current market conditions, and this immediate response could be driven by the need to maintain profitability in a rapidly changing market. This indicates that these firms have closely monitored market fluctuations and adjusted their mark-ups on relatively short notice. This could be due to sudden changes in market demand, economic conditions, or other factors that can cause house prices to change rapidly. The firm’s ability to quickly adjust its mark-ups in response to these changes shows its agility and adaptability in managing its pricing strategies in the face of market volatility.

In the long run, the ARDL bound test results suggest that construction firms have been considering long-term trends in house prices when setting their mark-ups. This again aligns with the full-cost pricing theory, which allows for strategic planning and gradual adjustments of the mark-up based on long-term market trends. This strategic approach to pricing is a key aspect of the full-cost pricing theory and contrasts with the tendering theory, which does not account for long-term market trends in its pricing strategy. The observed long-term adjustments in mark-ups further support adopting the full-cost pricing theory in the construction industry. The test results also suggest a long-term relationship where an increase in house prices leads to the initiation of more building projects. This increased demand for construction over time eventually leads to an increase in construction costs. This also aligns with the full-cost pricing theory, where prices are determined by total costs (which would increase with increased demand) plus a standard mark-up. The lag in response could be attributed to the time it takes to initiate new construction projects, which includes planning, the permission of building consents, sourcing materials, and other preparatory activities, which is another explanation of the long-run relationship.

The finding also aligns with the four-quadrant model raised by Dipasquale and Wheaton [26]. In Dipasquale and Wheaton’s four-quadrant model, the property market is determined by four significant sectors: the space market, ownership market, new construction, and new stock. The space market reflects the relationship between housing stock and rent price level. The rent price level influences the ownership of houses and determines the house price level in the market; when the rent price is high, the cash flow of income-generating properties as an investment is high, which turns the house into a valuable choice asset investment. Therefore, the house price would be increased when the rent price level is high. In the new construction market, the developers’ decision-making would be influenced by the asset price of houses. Developers would increase the volume of constructions when the asset price of houses is high since the project would become more profitable. When the volume increases, the demand for the raw material and labour for the construction will increase, and then the construction cost will also increase.

In the result, the house price index granger caused the consent number, consent area and consent value, which fit the logic of the four-quadrant model. As stated before, due to several factors from the demand side, such as the high population of Auckland, immigration from overseas, income and mortgage interest rate, overseas investors also actively engaged in the New Zealand property market, especially in the Auckland property market, before 2018. These actions increased the demand for properties in Auckland. When the demand for property in Auckland increases, given that the stock of property cannot change immediately, the rent price level is pushed up. The increase in rent price will cause the growth of asset price of properties, and the high value of properties will encourage developers to start more constructions and then increase the construction cost. In DiPasquale and Wheaton’s model [26], when the construction number increases, the housing stock in the market will also increase, and the increased stock would drop the rent price and the asset price consequently. However, the housing demand in Auckland is exceptionally high due to the low-interest rate in the study period, and the effect of changing house supply on the house price is relatively small compared with the effect of extremely high demand on the house in Auckland. Therefore, in the result, researchers are not able to achieve a significant result that construction cost granger causes the house price.

The result of both the Granger-causality test and ARDL bound test shows that the property price leads to the construction price, but not the other way around, which supports the full-cost pricing and shows that the construction company would adjust the construction price by following the property price. The booming market provides the opportunity for construction companies to adopt the full-cost pricing strategy since the full-cost pricing strategy would allow them to maximise their profit by adding a satisfactory profit margin, and the amount of price that developers are willing to pay for construction would increase as the property price increase since the developers would have a wider profit margin in the up-rising market. This finding provides evidence that market conditions can influence the pricing strategies of construction companies and highlights the importance of adapting pricing strategies to maximise profits in changing economic environments. It also adds to the understanding of how full-costing pricing theory can be used effectively in the construction industry, providing a potential framework for construction companies to enhance their pricing strategies during booming property markets.

The results suggest that the HPI leads to changes in the CCI, implying that construction costs in the market follow house prices. When house prices are high, it stimulates more property development projects. Given that construction material costs do not change rapidly, the increased demand for construction materials drives up the overall price of construction materials, thereby increasing the overall construction costs of properties. This finding is consistent with Tsai’s study [23], which found that the HPI in Taiwan leads to changes in the CCI and the rental price index.

Despite the significant role of construction cost in housing supply in the market [27], the results do not provide evidence that the supply side causes high housing prices in Auckland. Instead, researchers propose that high housing prices in Auckland are primarily driven by demand-side factors. As previous literature [27][28][29] suggested, demand-side factors in the housing market include income, mortgage interest rates, unemployment rates, and population growth. In contrast, the low mortgage interest rate from 2010 to 2020, coupled with the high population density in Auckland, likely contributed to the high demand for housing, leading to increased house prices. Therefore, even though construction cost is a significant factor on the supply side of the market, researchers do not observe its contribution to the high house price level in Auckland, as the rapid increase in house prices appears to be primarily driven by demand-side factors.

The findings validate the full-cost pricing theory’s presence in Auckland’s construction industry. This suggests that large construction companies may establish pricing based on property market demand and housing prices. This pricing strategy seems to stem from the unique market structure of Auckland’s construction industry, which is primarily controlled by a handful of large firms. The significant influence of the house price index (HPI) on the construction cost index (CCI), as demonstrated by the results, bolsters this interpretation.

In an oligopolistic market, large corporations can set prices considering multiple factors, such as land costs, material costs, labour costs, and government fees, in addition to a standard mark-up. During periods of high house prices, these companies find more leeway to accommodate increased construction costs while maintaining their mark-up, subsequently boosting their profits. This trend aligns with the full-cost pricing theory, indicating that these large firms predominantly govern pricing in Auckland’s construction industry.

However, it is important to note that this oligopolistic structure may also result in reduced competition and elevated prices for consumers. Companies can legally ‘collude’ to set prices in such a market, focusing on property market demand and house prices rather than competition. Consequently, this could lead to inflated construction costs and, ultimately, increased house prices. To counteract this, fostering competition in the construction industry becomes crucial. To support small construction companies, the government could contemplate measures such as reducing the tax burden for small businesses and minimising the cost and time required to apply for building consent. By doing this, it could potentially undermine the dominance of large firms, stimulate competition, and potentially lead to more affordable housing prices in Auckland.

Moreover, the construction industry in New Zealand is characterised by a high number of participants, and this number has been growing over recent years. In 2009, there were around 53,000 participants in the construction industry. However, after the global financial crisis, the number dipped, reaching its lowest point in 2012 before starting to recover in 2013. Since then, the number of market participants has been rising sharply. By 2018, there were a total of 61,860 construction companies (Figure 1). Despite these numbers, the competition in the market may not be as high as the total number of participants suggests.

Figure 1. The number of market participants in the construction industry.

As per data from 2018, the largest residential construction company, G J Gardner, held around 4.6 percent of the market share, while the second-largest, Mike Greer, accounted for 2.3 percent. The top ten most prominent construction companies collectively held 16.8 percent of the market share. This trend of large construction companies owning more market shares has been growing over the past two decades. Among the top 100 construction companies, they occupied around 40 percent of the market share, given that the total amount of companies is over 60,000. It is clear that even though there are over 60,000 companies in the construction industry, the largest 100 companies hold more than 40 percent of the market share.

It is suggested that more stringent health and safety requirements may make it difficult for small businesses to operate and expand, contributing to the dominance of large companies. In addition, larger construction firms may offer more cost-efficient prices due to economies of scale, particularly at a time when housing affordability is a significant issue in New Zealand, especially in Auckland. As a result, people tend to opt for more cost-effective choices. Thus, in light of the monopolistic market structure and dominant large construction companies, the government needs to undertake strategic measures to foster a competitive environment, especially for small businesses, in Auckland’s construction industry.

Further validation of the findings can be supported by incorporating insights from Australasian studies. For instance, research by Ma et al. [30] revealed that in Australia, owner-occupier and investor demand significantly contribute to house price increases, with investor demand exerting an even greater influence. Conversely, they found that the new housing supply does not have a significant impact on mitigating rising house prices.

This understanding underscores the limited role of the supply side in shaping market dynamics, a similar sentiment from the research which concludes that construction costs do not significantly alter house prices in Auckland, and the pricing strategy of constructions would follow the housing market dynamics. It raises the possibility that, similar to the Australian market, demand factors, particularly those driven by investment, might dominate Auckland’s housing market dynamics. Over the past decades, such demands have contributed to escalating house prices, disrupting the conventional demand-supply equilibrium, and then transferred to the construction market as the increased demand for construction services and materials.

While the research asserts the need to foster a competitive construction industry, these findings also underline the importance of managing demand-side factors for the efficient operation of both the real estate market and the construction industry. Support for these implications can also be found in the study of the supply-constraint housing market [31]. Their study on Hong Kong’s real estate market found no relationship between house prices and supply before the reform of the land supply system. However, when the government reformed the land supply to a demand-oriented system, house prices began to influence the housing supply, but ‘…proactive supply of land to the market might not have impacted on the housing market price level as the society would have hoped…’. This suggests that managing supply-side factors alone may not be sufficient to maintain a stable real estate market, reinforcing the emphasis on demand-side interventions” [32].

Both Australia and Hong Kong markets have demonstrated the prevailing impact of demand-side factors on housing prices and limited force from supply. These findings, combined with the research in Auckland, underline a common trend: while supply-side factors such as construction costs and housing supply could play a certain role, it is the demand-side, particularly those steered by investors, significantly drives the housing prices. As a result, to maintain a balanced and efficient real estate market and a healthy construction industry, policy interventions need to adopt a broader perspective that include both supply and demand factors, with a special emphasis on curbing investment-driven demand [33].

This entry is adapted from the peer-reviewed paper 10.3390/buildings13071877

References

- Quigley, J.M. Government and Technical Progress; Chapter residential construction; Pergamon Press: Oxford, UK, 1982.

- Rosenthal, S.S. Residential buildings and the cost of construction: New evidence on the efficiency of the housing market. Rev. Econ. Stat. 1999, 81, 288–302.

- Olsen, E.O. The demand and supply of housing service: A critical survey of the empirical literature. Handb. Reg. Urban Econ. 1987, 2, 989–1022.

- Smith, L.B.; Rosen, K.T.; Fallis, G. Recent developments in economic models of housing markets. J. Econ. Lit. 1988, 26, 29–64.

- Adams, Z.; Füss, R. Macroeconomic determinants of international housing markets. J. Hous. Econ. 2010, 19, 38–50.

- Gates, M. Bidding strategies and probabilities. J. Constr. Div. 1967, 93, 75–110.

- Runeson, G.; Skitmore, M. Tendering theory revisited. Constr. Manag. Econ. 1999, 17, 285–296.

- Skitmore, M.; Runeson, G.; Chang, X. Construction price formation: Full-cost pricing or neoclassical microeconomic theory? Constr. Manag. Econ. 2006, 24, 773–783.

- Backman, J. Price Practices and Price Policies; The Ronald Press: New York, NY, USA, 1953.

- Gabor, A.; Granger CW, J. Pricing, Principles and Practices; Heinemann Educational Publishers: Portsmouth, UK, 1977.

- Gates, M. Statistical and economic analysis of a bidding trend. J. Constr. Div. 1960, 86, 13–35.

- Hall, R.L.; Hitch, C.J. Price theory and business behaviour. Oxf. Econ. Pap. 1939, 2, 12–45.

- Horngren, C.T.; Datar, S.M.; Foster, G.; Rajan, M.V.; Ittner, C. Cost Accounting: A Managerial Emphasis; Pearson Education India: Noida, India, 2009.

- Baumol, W.J. Contestable markets: An uprising in the theory of industry structure. Am. Econ. Rev. 1982, 72, 143–157.

- Borenstein, S.; Rose, N.L. Competition and price dispersion in the US airline industry. J. Political Econ. 1994, 102, 653–683.

- Krugman, P.R. Pricing to Market When the Exchange Rate Changes; MIT Press: London, UK, 1986.

- Xiong, C.; Cheung, K.S. Understanding sellers’ agents in the residential property market. Int. J. Strateg. Prop. Manag. 2021, 25, 179–189.

- Somerville, C.T. Residential construction costs and the supply of new housing: Endogeneity and bias in construction cost indexes. J. Real Estate Financ. Econ. 1999, 18, 43–62.

- Mariadas, P.A.; Selvanathan, M.; Hong, T.K. A study on housing price in klang valley, Malaysia. Int. Bus. Res. 2016, 9, 103–109.

- Donald, J.G.; Winkler, D. The dynamics of metropolitan housing prices. J. Real Estate Res. 2002, 23, 29–46.

- Ho, W.K.; Ganesan, S. On land supply and the price of residential housing. Netherlands, J. Hous. Built Environ. 1998, 13, 439–452.

- Oikarinen, E.; Peltola, R. Dynamic Linkages between Prices of Vacant Land and Housing–Empirical Evidence from Helsinki; Paper presented at the ENHR International Conference Ljubljana; Aboa Centre for Economics: Turku, Finland, 2006; Volume 6.

- Tsai, I. Housing supply, demand and price: Construction cost, rental price and house price indices. Asian Econ. J. 2012, 26, 381–396.

- Mansur, S.A.; Abdul Hamid, A.R.; Yusof, N.A. Rising trend in construction cost and housing price. J. Adv. Res. Bus. Manag. Stud. 2016, 3, 94–104.

- Kamal, E.M.; Hassan, H.; Osmadi, A. Factors influencing the housing price: Developers’ perspective. Int. J. Humanit. Soc. Sci. 2016, 10, 1676–1682.

- DiPasquale, D.; Wheaton, W.C. The markets for real estate assets and space: A conceptual framework. Real. Estate Econ. 1992, 20, 181–198.

- Kenny, G. Modelling the demand and supply sides of the housing market: Evidence from Ireland. Econ. Model. 1999, 16, 389–409.

- Vargas Walteros, C.; Novoa Hoyos, A.; Arias Ardila, A.D.; Peña Ballesteros, A.S. Analysis of demand and supply in the Colombian housing market: Impacts and influences 2005–2016. Int. J. Hous. Mark. Anal. 2018, 11, 149–172.

- Yiu, C.Y. Are central banks’ monetary policies the future of housing affordability solutions. Urban Sci. 2023, 7, 18.

- Ma, L.; Reed, R.; Liang, J. Separating owner-occupier and investor demands for housing in the Australian States. J. Prop. Investig. Financ. 2019, 37, 215–232.

- Li, L.H.; Cheung, K.S. Housing price and transaction intensity correlation in Hong Kong: Implications for government housing policy. J. Hous. Built Environ. 2017, 32, 269–287.

- Li, L.; Wong SK, K.; Cheung, K.S. Land supply and housing prices in Hong Kong: The political economy of urban land policy. Environ. Plan. C Gov. Policy 2016, 34, 981–998.

- Wong, S.K.; Cheung, K.S.; Deng, K.K.; Chau, K.W. Policy responses to an overheated housing market: Credit tightening versus transaction taxes. J. Asian Econ. 2021, 75, 101330.

This entry is offline, you can click here to edit this entry!