The impact of the 2019 coronavirus disease (COVID-19) pandemic is still being freveltaled, and little is known about the impact on hospital operations of the loss of outpatients and inpatients due to COVID-19 effect of COVID-19-induced outpatient and inpatient losses on hospital operations in many counties. ThereforeHence, we aimed to exploringe whether hospitals have aadopted profit- compensation activities following the first after the 2020 first-wave of the utbreak of COVID-19 outbreak in China in 2020. 2616589 inpatient. A total of 2,616,589 hospitalization records forrom 2018, 2019, and 2020 were extracted from 36 tertiary hospitals in a western province; a in China; we applied a difference-in-differences event study design was used to estimate the dynamic impaeffect of COVID-19 on total inhospitalized patient costs’ total expenses before and after the last confirmed case. We Afoun increase in meand that average total costs perexpenses for each patient of betweenincreased by 8.7% andto 16.7% can be found in the first 25 weeks after urban reopening andthe city reopened and hospital admissions returned to normal hospitalization. It indicates that hospitals experienced . Our findings emphasize that the increase in total inpatient expenses was mainly covered by claiming expenses from health insurance and was largely driven by an increase in the expenses for laboratory tests and medical consumables. Our study documents that there were profit compensatingon activityies in hospitals after the first 2020 first-wave of the outbreak of COVID-19 in China in 2020,, which was driven by the reduction inloss of hospitalization admissions during that waveis wave outbreak.

- profit compensation activities

- COVID-19

- hospital

1. Introduction

2. Brief Introduction to China’s Healthcare Delivery System

China’s healthcare delivery system is a complex network of public and private providers, governed by policies and regulations aimed at ensuring access to basic health services for its large and diverse population. China has a three-tiered system for healthcare delivery: health organizations and providers operate at county, township, and village levels in rural areas, and at municipal, district, and community levels in urban areas [27][28]. Primary care services are provided at community health centers and township healthcare centers, secondary care is provided by district and county hospitals, and tertiary care is provided by large specialty and general hospitals in major cities. Public hospitals are owned and operated by the government, and are organized into tiers according to their level of service. They are typically the largest and most well-funded providers, with strong links to medical education and research institutions. Public hospitals dominate the market for specialized and tertiary care, and employ 64% of practicing physicians, handle 82% of inpatients and 40% of outpatients, and account for about half of China’s total healthcare spending [28][29]. Private hospitals, on the other hand, are owned and operated by nongovernmental entities or individuals. They are generally smaller and provide more specialized services than public hospitals, such as cosmetic and reproductive medicine. Historically, private hospitals have been less regulated than their public counterparts, but recent reforms have sought to improve their quality and increase their role in the healthcare delivery system. The private sector has experienced a vast expansion in China’s hospital market in the past decades for both healthcare supply capacity and delivered care [29][30], but the public health sector is the main healthcare provider [27][28].3. Compensation Mechanism of Chinese Public Hospitals and Its Potential Influence by COVID-19

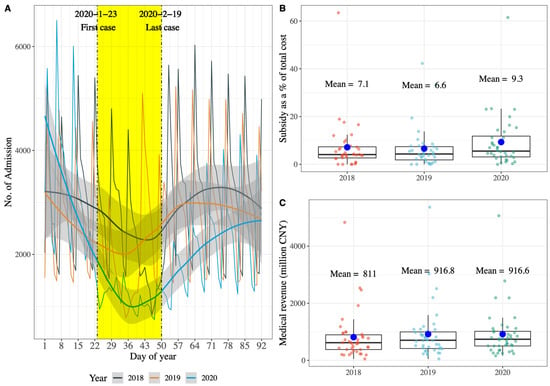

Public hospitals in China have been mainly compensated by service charges, drug sales, and government budget allocations in the past decades. However, since 2012, the compensation mechanism of Chinese public hospitals has undergone a relatively large reform, starting with county-level public hospitals and extending to municipal-level public hospitals in 2016. This round reform focused on four interrelated areas: removing the drug mark-up, increased budget allocation, adjustments of fee schedules, and reforming payment methods [28][29], as a consequence that public hospitals revenue from service charges and government budget allocations only. Moreover, removing the up to 15% markup for drug sales from public hospitals in China brought about a reduction in drug expenditures expected by the policymakers [30][31][32][33][34][35][31,32,33,34,35,36], however, an increase in expenditures for diagnostic tests or medical consumables and hospitalization was observed from different aspects [30][31][32][34][31,32,33,35], which was not expected by the policymakers, and government subsidies to public hospitals increased slightly by 2–5% in the 2 to 6 years after the policy was implemented [35][36]. All this evidence suggests that China’s public hospitals rely heavily on medical service charges to sustain their operations and development. As mentioned, hospitals in many countries experienced an admission loss during the first encounter with COVID-19 in 2020; It also can be observed a significant admission loss of tertiary hospitals, in line with other studies (Figure 1A) [14][16][14,16]. In addition, it can be found that public hospitals of these tertiary hospitals in China received more subsidies for the loss of service charges caused by the admission loss; government subsidies as a percentage of total costs increased from 6.6% in 2019 to 9.3% in 2020 (Figure 1B), however, it is complicated because medical revenue of tertiary hospitals did not decrease between 2019 and 2020 (Figure 1C). Therefore, it can be hypothesized that tertiary hospitals in China have profit compensation motive and activities when observing that the admission count returned to normal after strict measures were relaxed.