1. Introduction

Biopesticides are biodegradable, action-specific, and can respond to chemical-pesticide-mediated pest resistance issues [1][8]. Sustainable agriculture driven by biopesticides enhances social adequacy and economic productivity and provokes environmental protection. All three dimensions together constitute the tripartite concept of sustainable development. Biopesticides have great authority in sustainable agricultural management due to their satisfying characteristics of controlling both the green chemistry principles (GC principles) and the tripartite concept of sustainable development [2][9]. In recent years, biopesticides have grown in popularity and are thought to be more safe than conventional pesticides. Biopesticides are more focused on the target pests and, by their very nature, are less harmful than traditional pesticides. Biopesticides can also be used sparingly and are rapid to disintegrate without leaving any unfavorable residues, which could lessen the need for conventional pesticides in integrated pest management (IPM programs) [3][10].

2. Global Market of Biopesticides

Currently, the USD 56 billion worldwide pesticide market is anticipated to have a biopesticide market of between USD 3 and 4 billion

[4][11]. With compound annual growth rates of 14.1%

[5][12], it is estimated that the development of biopesticides will outpace that of chemical pesticides

[4][11].

The US biopesticides market is now estimated at roughly USD 205 million, with a predicted increase to nearly USD 300 million by the end of the decade. North America consumes approximately 40% of the world’s biopesticide production. The market for European biopesticides was predicted to be worth over USD 135 million in 2005 and reached approximately USD 270 million by 2010, with Oceanic and European countries accounting for 20% of global sales, respectively

[6][13], as depicted in

Figure 1. Sales of chemical pesticides are anticipated to decrease, whereas sales of biopesticides are predicted to expand moderately in South and Latin America, which, together, account for 10% of the global biopesticide market. As the mega-economies of China and India increase their usage of biopesticides, the Asian market—while still relatively small—presents a significant opportunity for biopesticides. According to India’s agricultural ministry, biopesticides currently account for only 2.89% of the 100,000 metric tons of pesticides sold worldwide, but are expected to grow by an estimated 2.3% annually

[6][13].

Figure 1.

Global market and use of biopesticides.

There are more than 200 items accessible on the US (United States) market and 60 comparable products on the EU (European Union) market. Fewer biopesticides have been registered in the European Union than in Brazil, the United States, China, and India due to their extremely drawn-out and challenging registration procedures

[7][14]. Only five microbial products were reported to be sold in the UK compared to ten in Germany and fifteen in each of France and the Netherlands

[8][15]. In Nigeria, the minimal utilization of biopesticides is a consequence of poor infrastructure, expensive costs, and governmental policies. A total of 327 biopesticides were registered in China. A total of 11 species of microorganisms were used to create 270 bacterial biopesticides, of which,

B. thuringiensis was used to create 181 biopesticides

[9][16]. In Kenya, out of 868 registered products, 20 microbial pesticides are authorized for use. The list includes one baculovirus, nine entomopathogenic-fungi-based products, nine products based on

Bacillus thuringiensis, and one product based on an entomopathogenic nematode

[10][17].

Bacterial products, particularly those from Bt, are increasingly commonly employed. The biopesticide sector has traditionally placed a high priority on the production of Bt, which is currently the primary bacterium used to control agricultural pests. Its strong position in the biopesticide sector is demonstrated by the fact that, according to the Centre for Agriculture and Bioscience International (CABI 2010), 200 Bt-based products occupy more than 53% of the global biopesticide market, with the USA and Canada consuming approximately 50% of this total

[8][15].

Bacillus thuringiensis, which accounts for over 70% of all bacterial biopesticide use, is followed by

B. subtilis and

B. fluorescens. In addition to bacterial insecticides, fungi are now being employed as pesticides. Approximately 60% of the market for fungal biopesticides is made up of

Beauveria species, and 60% of the market for viral biopesticides is made up of nucleopolyhedrosis virus. In general, smaller farms are more likely to use predator and virus biopesticides. Nematodes hold the largest market share (approximately 60%) among the “other” class of biopesticides

[11][18].

By 2023, biopesticides were estimated to expand at an average annual rate of 8.64% and make up more than 7% (USD 4.5 billion) of the global crop protection industry

[12][19]. In terms of market size, biopesticides are anticipated to catch up to synthetics between the late 2040s and the early 2050s, but there are significant uncertainties surrounding the uptake rates, particularly in regions such as Africa and Southeast Asia, which account for a large portion of the projections’ flexibility

[5][12].

Although the usage of biopesticides is rising by approximately 10% annually on a global basis, it appears that the industry will need to expand even more in the future if these pesticides are to play a significant part in replacing chemical pesticides and eliminating the existing over-reliance on them

[13][20]. Future market growth for biopesticides is closely correlated with biological control agent research. In order to improve the cooperation of businesses and research institutes on this problem, several scientists from various research institutes have conducted some studies. The agriculture industry can and should profit from the coexistence of biopesticides and chemical pesticides as it appears that biopesticides cannot yet totally replace chemical pesticides. In this context, it is envisioned that large-scale industrial development will be facilitated by speeding up the practical application of research findings

[3][10].

3. Categories of Biopesticides

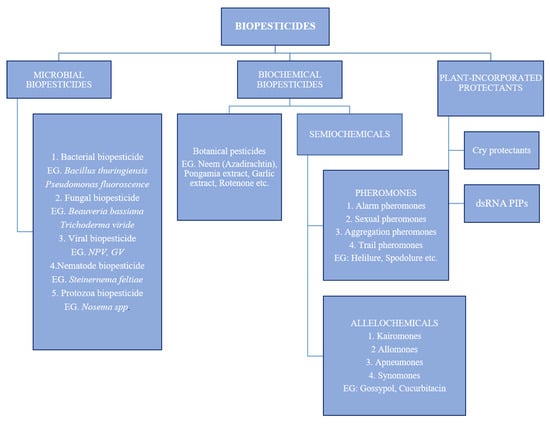

The US Environmental Protection Agency (EPA) has identified three main categories for biopesticides as summarized in Figure 2.

Figure 2.

The three categories of biopesticides with examples.

(1) Microbial biopesticides—Microorganisms (bacteria, fungi, viruses, protozoans, or nematodes) are the main component of microbial pesticides. Although each individual active ingredient in microbial pesticides is quite specialized for its intended pest(s), they can control a wide variety of pests

[14][21]. These biopesticide classes have been effective in reducing weeds, plant diseases, and insect pests

[15][22]. Microbial biopesticides can be applied to crops in a variety of ways, including as live organisms, dead organisms, and spores

[1][8]. Microbial pesticides work to reduce disease by producing a toxin that is particular to the pest that is being controlled. The effect of microbial infections is brought about by the pathogen’s infiltration through the skin or stomach of the insect, which leads to pathogen proliferation and the host’s, i.e., insect’s, death. The microbial pathogens generate insecticidal toxins that are crucial in their pathogenesis. Although their structure and toxicity might vary greatly, the majority of toxins generated by microbial infections are known to be peptides

[14][21]; for example,

Verticillium leconi, Metarhizium anisopliae, Bacillus thuringiensis, etc. Baculoviruses have a good prospect for the management of pests belonging to the orders Lepidoptera (butterflies and moths), Hymenoptera (sawflies), and Coleopteran (beetles). Chemical insecticides can be replaced with microbial pesticides since they are more effective. The insect pathogenic bacterium

B. thuringiensis is the most commonly used microbial biopesticide (Bt). When bacterial spores develop, a protein crystal known as the Bt-endotoxin is produced. When ingested by insects that are vulnerable, this substance can lead to the lysis of gut cells

[15][22]. The target insect species is determined by the Bt crystalline protein’s binding to the insect gut receptor

[16][23]. Depending on the species, they are more or less pathogenic to the target pest

[17][24].

(2) Biochemical pesticides—Biochemical pesticides are organic compounds that use non-toxic methods to control pests. These are employed to modify an insect’s physiology, behavior, and even control

[17][24]. Semiochemicals are also included in this group of biopesticides

[18][25]. They might come from insects, animals, or plants. These categories of biopesticides include compounds such as plant growth regulators that prevent breeding and population expansion, as well as compounds such as pheromones that either repel or attract pests. When signals intended to cause a behavioral response are instead delivered to another organism, control becomes apparent

[19][26]. The fast-acting insecticidal chemicals pyrethrins, which are generated by

Chrysanthemum cinerariaefolium, are a common example of secondary metabolites that plants make to prevent herbivores from feeding on them

[20][27]. Neem (

Azadirachta indica) oil, an insecticide derived from the seeds of the neem tree, is the most popular botanical substance. At least two insect-killing chemical substances, azadirachtin and salannin, are produced by the neem tree. Azadirachtin inhibits insect feeding and controls growth

[15][22].

(3) Plant-incorporated protectants (PIPs)—PIPs are biopesticidal compounds that are made by plants from genetic material that has been incorporated into the plant. For instance, researchers may insert the gene for the Bt pesticide protein into the genetic material of the plant. The pest-killing substance is then produced by the plant rather than the Bt bacterium. EPA regulates the protein and its genetic makeup but not the plant itself

[21][28]. This is also referred to as the non-conventional pest control product

[15][22]. PIPs are biopesticides that are directly expressed in the tissue of genetically modified (GM) crops in order to defend them against pests such as viruses and insects. When eating on the transgenic crop tissue, insect pests ingest PIPs. Cry protein and double-stranded ribonucleic acid are examples of PIPs (dsRNA). There are various Cry protein types, each having a distinctive structure and toxicity that is exclusive to particular insect groups. Cry1 proteins poison Lepidoptera (such as the corn borer), whereas Cry3 proteins poison Coleoptera (such as the corn rootworm). The first-generation insecticidal PIPs were cry proteins. Recently, the next-generation dsRNA PIPs received approval. The first dsRNA PIP authorized by the FDA interferes with the synthesis of the Snf7 protein, a crucial vacuolar sorting protein, in order to kill the maize rootworm (

Diabrotica virgifera virgifera)

[22][29].

4. Regulation of Biopesticide

Various regulations are being developed globally to register, monitor, and control the quality of these biopesticides

[9][16]. To manage the regulatory activities, countries promoting them establish a variety of regulatory bodies, including committees, boards, and special organizations. These regulatory authorities create the dossier specifications for biopesticides and periodically update the dossier in light of regional and global demands

[23][40].

In the United States, the biopesticides are largely regulated by three federal agencies. The Food and Drug Administration (FDA), the Animal and Plant Health Inspection Service (USDAAPHIS), and the Environmental Protection Agency (EPA) are the organizations. The USDAAPHIS is in charge of ensuring that these biopesticides are available for field and laboratory tests. If the studies demonstrate no obvious harmful effects on the environment or human health, the EPA encourages their usage on such grounds. Additionally, it permits the sale of pesticides under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA Act) and assures safety against pesticide residue in food and feed under the FFDCA Act (Federal Food, Drug, and Cosmetic). Furthermore, these biopesticides are evaluated by the FDA to see if they pose a risk to food, feed, or animals

[23][40].

In China, the Institute for the Control of Agrochemicals of the Ministry of Agriculture is in charge of registering and regulating biopesticides. They are broadly categorized into six categories: botanical, microbial, biochemical, biological, genetically modified organisms (GMOs), and agro-antibiotics based on Chinese data requirements for pesticide registration. For the use of biotechnology products such as plant-incorporated pesticides, Canada, Japan, Australia, New Zealand, and Argentina have also developed science-based regulatory review systems that employ a proportionate-risk assessment approach. These systems depend on a trade-off between risks and benefits when making regulatory decisions

[23][40]. Furthermore, a number of African nations use a variety of guidelines to create systems for the registration and control of biopesticides in the management of pests and diseases. A regional inventory of the regulatory environments was conducted by six country representatives from the West African region’s Kenya, Uganda, Ethiopia, Tanzania, Nigeria, and Ghana as part of the Commercial Products (COMPRO II) project, which is overseen by the International Institute of Tropical Agriculture (IITA)

[24][41]. Whereas the registration of biopesticides in EU (European Union) nations appears to be more challenging than in the rest of the world because the dossier is provided along with toxicological and environmental testing, it also requires efficacy evaluation. The Directive 91/414/EEC (EU 1991), which was created for chemical pesticides initially, also governed microbes, botanicals, and pheromones in the EU. The particular regulations for microorganisms were introduced to the Directive 91/414 by the amendments 2001/36/EC (EC 2001) and 2005/25/EC (EC 2005), while a new plant protection law was added to the EU in 2009

[24][41].

The Central Insecticides Board and Registration Committee (CIBRC) in India is the agency responsible for enforcing the Insecticides Act of 1968 and the Insecticides Rules of 1971, which govern the use of biopesticides

[25][42]. As the highest-ranking advisory organization, CIB maintains a robust network of prominent researchers from all relevant areas. The RC is responsible for issuing registrations and licenses to aspiring biopesticide producers. This entire process adheres to a prescribed method. The novel biopesticide formulation is thoroughly examined using a number of quality control techniques, and any possible risks to human health or the environment are adequately assessed

[26][32].

To guarantee the safety of people and animals, this board provides technical advice to the federal and state governments on issues pertaining to the production, marketing, distribution, and use of all insecticides, including biopesticides. After carefully inspecting their formulations and confirming the efficacy, toxicity, and packaging data provided by the importer or manufacturer, the registration committee of the CIBRC issues licenses to public and private businesses for the large-scale production, distribution, and sale of biopesticides to stakeholders. The Insecticides Act’s sections 9(3B) (provisional registration for a novel active ingredient used in India) and 9(3) (regular registration) allow manufacturers to register new products

[25][42]. This system lowers commercial barriers to product development by enabling commercial producers of those microbial pesticides assessed as generally safe to receive provisional registration and carry on market development while the product is pending full registration. Less information is required for registration under 9(3)B than under 9(3). For example, 9(3) B requires efficacy data on specific crops from two places over two seasons, whereas 9(3) requires the same from three locations. In terms of the content, virulence of the organism as measured by LC50, moisture content, shelf life, and secondary non-pathogenic microbial load, the CIB’s set quality requirements must be met. Protocols have been established for evaluating these quality attributes

[27][43].

The other regulatory bodies in India are the Central Integrated Pest Management Centre (CIPMC), Faridabad, the National Centre for IPM (NCPM) under the Indian Agricultural Research Council, and the Directorate of Biological Control, and the marketing of biopesticides to farmers is the responsibility of the Ministry of Agriculture and Farmers Welfare and the Department of Biotechnology (DBT). In addition to the aforementioned regulatory agencies, the Department of Biotechnology (DBT) funds research towards the creation of biopesticides. The National Agricultural Research System (NARS) and the National Accreditation Board (NBA) similarly carry out biopesticide quality control tests and instruct state agricultural departments in quality control procedures. In this regulatory chain, the latter is crucial in ensuring that biopesticides are distributed to farmers at a sustainable rate

[27][43].

However, the legislative frameworks that were initially created for chemical pesticides and insecticides still play a significant role in the regulation of biopesticides and biocontrol agents. The intent of the legislation is the fundamental of the problem. The Act and the Rules’ guiding principles treat biologicals such as chemicals because they were created to handle chemical pesticides

[28][44]. Therefore, the evaluation of risks of biopesticides ought to be based on relevant scientific data rather than regulations that apply to synthetic compounds. As a consequence, it is necessary to alter the standards so that they reflect the nature of the various categories pertaining to the biopesticide active ingredients

[7][14].

On the other hand, the major impediment to the commercialization of biopesticides is their regulatory approval

[29][45]. The research and commercialization of pest control solutions involves a number of stakeholders, including scientists, regulators, marketers, and end users. Although some members of this chain are frequently involved from the very beginning of the development process, there are still many problems to be solved: marketers frequently disagree with the regulators and scientists, leaving end users perplexed by perceived flaws in the finished product

[13][20]. The fact that these items typically contain live organisms or products generated from them, there are issues with the regulatory processes as well as barriers to importing and exporting them. Additionally, it has been noted that registration fees are often exceedingly expensive

[24][41]. The commercialization of biopesticides thus clearly depends on regulation, which is frequently viewed as a development barrier. Despite the fact that regulations differ from nation to nation, the key concerns are that (i) regulations do not distinguish between living organisms and synthetic molecules, (ii) expensive testing is necessary irrespective of the size of the potential market, making niche biopesticide markets unprofitable, and (iii) the registration process can be extremely drawn out

[30][46].

Thus, the governments can set policies at the international level by holding conferences, workshops, and meetings to raise the status of biopesticides and bioformulations. Governments should establish regulatory standards that would be globally accepted. Currently, problems with registration, use, import, and export occur since different countries have distinct rules and regulations. Therefore, there is a need for a common policy surrounding the use of biopesticides, and the regulation can draw up uniform actions or regulations that might be approved globally

[31][32][33][47,48,49].