South Korea's policy to expand national forests is implemented through the purchase of private forests. However, several problems are found in this process.

- national forest expansion

- private forest purchase

- standing tree value

- appraisal

- individual factors

1. Private Forest Purchase Status

1.1. Purchase Target and the Unit Price

Private forest purchase has led to the consistent distribution of national forests in areas with low national forest ratios in Korea. Between 1992 and 2003, the KFS (Korea Forest Service) began purchasing private standing trees via loans and profit-sharing schemes. Between 2004 and 2007, forests for management and public interest improvement/preservation were purchase targets.

In 2007 in particular, purchases focused on protected forests where the exercise of property rights was restricted. From 2008 to 2013, targets were soil protection, landscape, and forests in need of ecological conservation. In 2014, the priorities shifted to healing forests. As a result of these changes, from 2015 to the present, arboretum buffers and forest road land were considered as purchasing targets.

Purchases between 2004 and 2005 were based on the goal commitment system aligned with the annual purchase value from the previous year. From 2006 to 2007, purchase value was determined regardless of the budget. Market prices have been applied since 2008. The goal commitment system is more focused on achieving the target amount rather than securing forest management land. Furthermore, since a seller may not be satisfied with a proposed sale price compared to the standard fixed price, it may be difficult to secure a target purchase. On this basis, the cause of the adjustment from the standard price to the appraisal price and the market price is a way to narrow the disagreement between the seller and buyer.

1.2. Private Forest Purchase Records

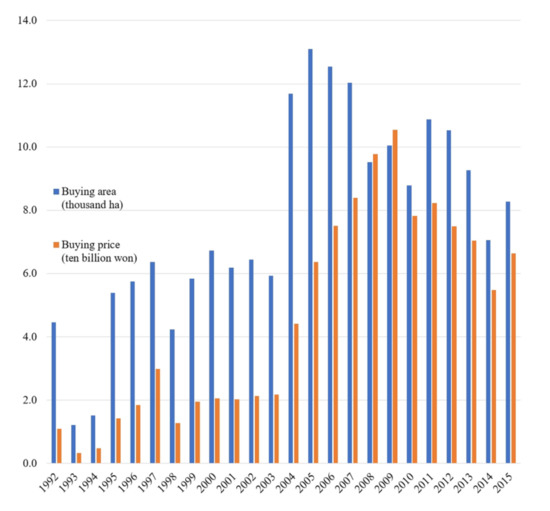

In private forest purchases, from 1992 to 2015 the area of land purchased for forest management was 184 thousand ha, with a purchase value of around KRW 109.6 billion. The KFS purchased approximately 5–6 thousand ha of private forest annually until 2003. From 2004 to 2007 the annual area purchased increased to around 12–13 thousand ha. Since 2011, however, the trend has been decreasing, with only 8.3 thousand ha of private forest purchased in 2015. Overall, compared to before 2004, the purchased area of private forests has roughly doubled since 2004 [30,31] [1][2] (Figure 2). This trend reflects the KFS’s interest either in forest restoration and rehabilitation to improve the quality of lifestyle or in the private forest for land conservation and the creation of pleasant natural environments.

Figure 2. Private forest purchase records.

2. Private Forest Purchase Procedure

Private forest purchases begin with the forest owner submitting written consent to placing a forest under the jurisdiction of the KFS. Following this, the steps to complete the purchase are feasibility review, field investigation, review of the suitability of purchase target, appraisal, calculation of purchase value and consultation on the purchase, the conclusion of the sales contract, land transaction contract notice and real estate transaction contract report, application for ownership transfer registration, and payment. Additionally, the appraisal procedure consists of a field survey, a price formation factor analysis, the selection of appraisal methods, appraisal value determination, and appraisal report reply.

Concerning the selection of appraisal companies, two appraisal companies are selected based on recommendations from the KFS and the forest owner, respectively. However, the choice of appraisal company is a frequent source of disagreements about conflicts of interest, since both the KFS and the forest owner have a direct economic interest in the outcome of the sale. To increase public confidence, therefore, we recommend that the appraisal company should be selected either by a neutral institution or via a competitive bidding system. Issues such as whether appraisal companies should be selected by the parties involved, under-compensation for reducing costs, or overcompensation for conflict resolution have been extensively studied in the literature [32,33,34,35][3][4][5][6]. The studies in question have argued that in the interests of autonomy and credibility, recommendations for or selection of appraisal companies should be made by third parties.

3. Private Forest Purchase Case Analysis

3.1. Standing Tree Appraisal Criteria

Article 17 (1) of the “Appraisal Rule,” the Korean government stipulates that when conducting forest appraisals, companies must differentiate between forest land and standing trees. However, the KFS usually excludes the standing tree survey from private forest purchases; its inclusion is required only when the value of standing trees has a significant bearing on decisions over the purchase price, or when an owner specifically requests it [36][7].

Even though the standing tree surveys were included in public forest purchases made by the KFS in 2011, surveys involving areas under 30 ha have been omitted since 2012. Even though a standard exists, the survey is rarely conducted during private forest purchases, which accounts for its absence from the appraisal record.

However, according to Article 14 (1) of the Enforcement Decree of the National Forest Administration and Management Act, the KFS is required to conduct a standing tree survey in the case of sales or exchange of semi-reserve national forests, so that the value of standing trees (including bamboo) can be included in the planned price. The Forest Service annually produces timber through tree cutting in national forests, which helps to further raise revenue. In 2015 profits from timber sales amounted to KRW 25.9 billion. The KFS recognizes the value of timber in its own right, even when this does not correspond to the value of a private forest as an expansion of the national forest system. While recognizing the value of standing trees on the one hand, on the other hand, the KFS paradoxically ignores the value of private forests as expansions of the national forest. This contradiction is from the outcome of having to secure large areas of national forest with only a small budget.

3.2. Standing Tree Appraisal Cases

After scrutinizing the criteria used by appraisal companies, we found that the value of standing trees is disregarded due to the lack of clear government guidelines for standing tree appraisal. Additionally, because of the low economic value of standing trees, the long history of forest trading practices, and government regulations, appraisal companies conflate the value of standing trees with that of forest land.

In this manner, appraisals that omit the value of standing trees may be an obstacle to national forest expansion policy due to forest owners’ increasing distrust of the KFS itself. Therefore, it is imperative to insist that the government provide clear appraisal guidelines, that differentiate between forest land and standing trees to assess their respective values separately. It is equally necessary to establish criteria for accurately estimating the value of standing trees [37][8]. To this end, it is urgent to develop a database system to establish appraisal criteria for standing tree value in terms of timber value by species, as well as to calculate the value of standing trees for private forest purchase per ha in connection with the forestry system of agencies.

3.3. Forest Land Appraisal Criteria

Forest land-appraisal criteria reflect market values, among which the public Comparison approach of the official land value is applied. However, according to Article 12 of the Appraisal Rule, an appraisal amount is determined by comparing it to the current market value calculated using a sales comparison approach. This approach to official land prices involves both objective and subjective criteria. Objective criteria include the official land prices comparative standard land parcels, time adjustment, and regional factors. Subjective criteria include individual and other factors (Table 1).

Table 1. Forest land appraisal criteria.

| Basis Value | Comparison Approach for Official Land Prices (Market Value) | ||

|---|---|---|---|

Table 3. Selection of comparative standard land parcels and comparative target land parcels in determining other factors by case.

| Case (Year) |

AC | CoSLP/CoTLP | Unit Cost (KRW/m2) |

Price Type | Base Period |

|---|---|---|---|---|---|

| Appraisal factors | Objective criteria | Official prices for comparative standard land parcels | Official land value criteria for standard parcels in neighboring areas | ||

| Time adjustment | Comparison of land price fluctuation rates and use in the same area | ||||

| Regional factors | Comparison of regional characteristics and land prices | ||||

| Subjective criteria | Individual factors | Access conditions, natural conditions, other conditions (forest stand conditions), and administrative conditions | |||

| Other factors | Comparison with official land prices for comparative standard land parcels, time adjustment, regional factors, and individual factors |

Among the subjective criteria, individual factors affect forest land prices through the unique features of every parcel of forest land. A comparison of individual factors refers to the processes which compare and reflect the gap between the individual characteristics of the purchase targets and the comparative standard land parcels [38][9].

Comparison between individual factors of forest land is divided into four categories: access conditions, natural conditions, other conditions (forest stand conditions), and administrative conditions. This study analyzed the comparative values of individual factors through five appraisal cases. As a result, it represents that discrepancy between appraisal companies concerning administrative conditions as the objective condition is the same or insignificant (difference of 0.05; case 2) since the comparative standard land parcels in question were selected either from surrounding or the same administrative area. However, access, natural, and other conditions (forest stand conditions), as the subjective conditions of appraisers of a forest road, or the gradient of forest land affect the value assessed by each appraisal company. In the case of access conditions, differences from 0.01 to 0.05 were shown in other cases except for cases 1–1, 2, and 5. In the case of natural conditions, differences from 0.01 to 0.03 were shown in other cases except for case 3. In the case of other conditions (forest stand conditions), a difference of 0.03 was found in case 2. In consequence, it shows that the subjective decision of the appraiser has a great influence on the calculation of appraisal price (differences from 0.08 to 0.043) (Table 2).

Table 2. Individual factors according to specific appraisal cases.

| Case | AC | Subjective Condition | Objective Condition | Individual Factor Value (w × x × y × z) |

|||

|---|---|---|---|---|---|---|---|

| AcCon ( | |||||||

Differences between appraisal companies in determinations of unit price based on official land prices for comparative standard land parcels, individual factors, and other factors range from 100.0% (case 4; the same amount) to 109.7% (case 1–2), which are within the permissible range of 110%. However, differences between determined unit prices and final appraisal prices varied greatly depending on the companies involved, ranging from KRW 0 (case 4) to KRW 18,916 thousand (case 1–2). In the individual factors belonging to the subjective factors, even though each case is in the same place, the difference in value varies from as little as 0.005 (cases 1–1 and 2) to as many as 0.043 (cases 3 and 4) among appraisers. Furthermore, for other factors, in all cases except cases 3 and 5, the difference between the values was as little as 0.05 (case 4) to as many as 0.1 (cases 1–1, 1–2, 1–3, and 2). As a result, there was a clear difference in the calculated unit price of each case. Therefore, in each case except for case 4 (the determined unit price is the same due to a slight difference in the calculated unit price), the unit price determined was all evaluated differently despite being in the same place, and this resulted in a difference in the final appraisal price. (Table 4). Discrepancies in appraisal price resulting from differences between appraisers’ evaluation criteria can undermine the credibility of forest owners. For this reason, accurate evaluations of forests that include both land area and standing trees are needed. To this end, a higher level of expert knowledge and ongoing training of appraisers are required, to assure forest owners of both the credibility and fairness of appraisal results.

Table 4. Determination of unit price for private forest by case and final appraisal price.

| Case | AC | AVoL | TiAd | ReF | InF | OthF | CUP | DUP | Ar | AP | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| w) | NaCon (x) | OthCon (y) | AdCon (z) |

|||||||||||||||

| 1 a | 1–1 | A | 0.86 | 0.86 | 1.00 | 1.00 | 0.740 | |||||||||||

| 1 a | 1-1 | A | 600 | 1.00606 | 1.00 | |||||||||||||

| B | 0.86 | 0.87 | 1.00 | 1.00 | 0.748 | |||||||||||||

| 1–2 | A | 0.86 | 0.88 | 1.00 | 1.00 | 0.760 | ||||||||||||

| B | 0.89 | 0.87 | 1.00 | 1.00 | ||||||||||||||

| 1 (2015) |

A | A-1 | 1661 | Sales price | 2014 | |||||||||||||

| 0.740 | 1.40 | 625 | 620 | 303,174 | 187,967,880 | A-2 | 1883 | |||||||||||

| B | Sales price | 2014 | ||||||||||||||||

| 600 | 1.00606 | 1.00 | 0.748 | 1.50 | 677 | A-3 | 904 | Sales price | 2014 | 0.744 | ||||||||

| 680 | 303,174 | 206,158,320 | ||||||||||||||||

| 1-2 | A | 600 | 1.00606 | 1.00 | 0.760 | 1.40 | 642 | 640 | 315,273 | 201,774,720 | A-4 a | 45 | ||||||

| B | Appraisal precedent (auction) | 2014 | 600 | 1.00606 | 1.00 | 0.774 | 1.50 | 701 | 700 | 315,273 | 220,691,110 | 1–3 | A | 0.91 | 0.88 | 1.00 | 1.00 | 0.800 |

| A-5 | 2 | Appraisal precedent (auction) | ||||||||||||||||

| 1-3 | A | 2015 | 600 | 1.00606 | 1.00 | 0.800 | 1.40 | B | 0.90 | 0.90 | 1.001.00 | 0.810 | ||||||

| 676 | 670 | 83,603 | 56,014,010 | B | B-1 | 1628 | Sales price | 2015 | 2 | 2–1 | C | 1.00 | 0.78 | 1.02 | 1.00 | 0.796 | ||

| B-2 | 1628 | Sales price | 2015 | D | 1.00 | 0.75 | 1.05 | 1.05 | ||||||||||

| B-3 | 0.788 | |||||||||||||||||

| 1833 | Sales price | 2014 | 3 | 3–1 | E | |||||||||||||

| 520 | Sales price | |||||||||||||||||

| B | 600 | 1.00606 | 1.00 | 0.810 | 1.50 | 733 | 730 | 83,603 | 61,030,190 | |||||||||

| 2 | C | 320 | 0.99972 | 1.00 | 0.796 | 2.05 | 520 | 520 | 1,044,694 | 543,240,880 | ||||||||

| D | 320 | 0.99972 | 1.00 | 0.788 | 1.95 | 491 | 490 | 1,044,694 | 511,900,060 | B-4 1.24 | a | |||||||

| 3 | 1163 | 0.97 | 1.00 | 1.00 | 1.203 | |||||||||||||

| Sales price | 2012 | E | 840 | 1.01164 | 1.00 | 1.203 | 1.20 | 1230 | 1230 | 132,396 | 162,847,080 | F | 1.20 | 0.97 | 1.00 | |||

| B-5 | 1361 | Sales price | 1.00 | 1.160 | ||||||||||||||

| 2012 | ||||||||||||||||||

| F | 840 | 1.01164 | 1.00 | 1.160 | 1.20 | 1183 | 1180 | 132,396 | 156,227,280 | 4 | 4–1 | G | 1.40 | 1.15 | 1.00 | |||

| 2 (2015) |

C | C-1 | 1.00 | a | 656 | |||||||||||||

| 4 | G | 490 | 1.01256 | 1.00 | 1.610 | |||||||||||||

| Sales price | 2012 | 1.653 | 1.40 | 1150 | 1160 | 175,331 | 203,383,960 | H | 1.45 | 1.14 | 1.00 | 2014 | ||||||

| H | 490 | 1.01256 | 1.00 | 1.653 | ||||||||||||||

| 1.00 | 1.610 | 1.45 | 1158 | 1160 | 175,331 | 5 | 5–1 | I | 1.10 | 1.03 | 1.00 | 1.00 | 1.113 | |||||

| I | 560 | 1.00440 | 1.00 | J | 1.10 | 1.05 | 1.00 | 1.00 | 1.155 | |||||||||

Notes: AC = Appraisal company, AcCon = Access condition, NaCon = Natural condition, OthCon = Other condition (forest stand condition), AdCon = Administrative condition. a Case 1 is an appraisal that considered three regions as a case.

Most appraisal companies appraise individual factors as either “predominant” or “inferior,” without specifying the criteria or basis for such assessments. Kim et al. [39] [10] have argued critically that comparison values of individual factors differ depending on the appraisers. This is because individual factors are based on subjective judgments of how the target land parcel compares with other standard land parcels. Thus, they stress the need for a method that independently compares the value of individual factors by scientific analysis of GIS (Geographic Information System).

The Other Factors category refers to the final revised factors resulting from the comparison approach using official land prices. Under Article 14, paragraphs 3, 5 of the “Appraisal Rule,” target land values are revised about Other Factors, including normal purchase or appraisal cases for areas adjacent to the target land parcel or similar areas within the same Entitlement Area. Although the purpose of this adjustment is to review the fairness and reliability of the appraisal, the selection of comparative target land parcels (purchase cases or appraisal cases) is based on appraisers’ subjective judgment rather than independently defined criteria.

Since the selection of comparative standard land parcels is based on the subjective judgment of appraisers, different examples are selected by each appraisal company. The range of comparative target land parcels selected also varies widely, from only one to as many as nine (Table 3). In other words, the number of comparative target land parcels selected varies depending on appraisers’ experience and expertise. This also leads to differences either in the revision value of comparative standard land parcels or in the prices for standard land parcel appraised by each company. This inconsistent selection in appraisals leads to frustration concerning transparency and fairness.

| C-2 | ||||||||||||||

| 203,383,960 | ||||||||||||||

| C-3 | ||||||||||||||

| 570 | ||||||||||||||

| Sales price | ||||||||||||||

| 2014 | ||||||||||||||

| 1.133 | 1.55 | 988 | 990 | 30,446 | 30,141,540 | C-4 | 800 | Appraisal precedent (auction) | 2011 | |||||

| J | 560 | 1.00440 | 1.00 | 1.155 | 1.55 | 1007 | 1010 | 30,446 | 30,750,460 | D | D-1 | 315 | Appraisal precedent (auction) | 2008 |

| D-2 | 930 | Appraisal precedent (auction) | 2014 | |||||||||||

| D-3 | 520 | Appraisal precedent (auction) | 2014 | |||||||||||

| D-4 a | 570 | Appraisal precedent (auction) | 2014 | |||||||||||

| D-5 | 380 | Appraisal precedent (auction) | 2012 | |||||||||||

| D-6 | 545 | Appraisal precedent (auction) | 2012 | |||||||||||

| D-7 | 605 | Appraisal precedent (auction) | 2012 | |||||||||||

| D-8 a | 656 | Sales price | 2012 | |||||||||||

| D-9 | 535 | Sales price | 2012 | |||||||||||

| 3 (2015) |

E | E-1 a | 1034 | Sales price | 2015 | |||||||||

| E-2 | 1411 | Sales price | 2015 | |||||||||||

| E-3 | 1500 | Appraisal precedent (auction) | 2010 | |||||||||||

| F | F-1 | 1243 | Sales price | |||||||||||

| 5 | 2010 | |||||||||||||

| F-2 | 1411 | Sales price | 2015 | |||||||||||

| F-3 a | 1034 | Sales price | 2015 | |||||||||||

| F-4 | 1500 | Appraisal precedent (auction) | 2010 | |||||||||||

| 4 (2015) |

G | G-1 a | 936 | Sales price | 2014 | |||||||||

| G-2 | 900 | Appraisal precedent (auction) | 2011 | |||||||||||

| H | H-1 | 920 | Sales price | 2013 | ||||||||||

| H-2 a | 930 | Sales price | 2014 | |||||||||||

| H-3 | 1100 | Appraisal precedent (auction) | 2011 | |||||||||||

| 5 (2016) |

I | I-1 a | 985 | Appraisal precedent (auction) | 2015 | |||||||||

| J | J-1 a | 985 | Sales price | 2015 | ||||||||||

Notes: AC = Appraisal companies, CoSLP = Comparative standard land parcel, CoTLP = Comparative target land parcel. a Comparative standard land parcels. The remainder is comparative target land parcels for the revision of other factors in comparative standard land parcels.

In an analysis of factors that influence pricing in the sales comparison approach, Yang and Yoo [38] [9] have argued for the importance of selecting/applying appropriate cases, as well as that decision-making, should be based on objective criteria for individual factors. They also argue that the other factors category is in urgent need of revision, to ensure fairness by minimizing discrepancies in the application rate of sales prices by each standard land parcels. Byeon [40] [11] has indicated that among the factors determining appraisal prices, the official land prices of standard land parcels, individual factors, and other factors have a strong influence on pricing. Keeping in mind that individual or other factors are based on appraisers’ subjective criteria, more expert knowledge in appraisers and techniques for independently quantifying these factors is required.

Notes: AR = Appraisal region, AC = Appraisal company, AVoL = Appraisal value of the land (KRW/m2), TiAd = Time adjustment, Ref = Regional factors, InF = Individual factors, OthF = Other factors, CUP = Calculated unit price (KRW/m2), DUP = Determined unit price (KRW/m2), Ar = Area (m2), AP = appraisal price. a Case 1 is an appraisal that considered 3 case standard land parcels as a case.

References

- KFS. 2013 Statistical Yearbook of Forestry; KFS: Deajeon, Korea, 2013; pp. 26–27, 422.

- KFS. 2016 Statistical Yearbook of Forestry; KFS: Deajeon, Korea, 2016; pp. 42–43, 172.

- Kim, S.J.; Choi, S.H. Effectiveness & problems about the improvement of the real estate appraisal for the compensation price of land for public use. Korea Real Estate Rev. 2008, 18, 49–61. (in Korean with English abstract).

- Heo, K.M. Improvements for a selection system of appraisal business operators of compensation appraisals. Public Land Law Rev. 2009, 43, 131–150. (in Korean with English abstract).

- Heo, K.M. Research on task of officially notified/announced land price & certification system of real estate appraisers in Korea. Public Land Law Rev. 2011, 52, 115–140. (in Korean with English abstract).

- Lee, Y.S. A Study on Improvements for Compensation Appraisals in Public Projects. MD Thesis, Konkuk University: Seoul, Korea, 2011. (in Korean with English abstract).

- State Forest Administration and Management Act. Available online: http://www.law.go.kr/LSW/eng/engLsSc.do?menuId=2§ion=lawNm&query=state+forest&x=0&y=0#liBgcolor0 (accessed on 11 September 2020).

- Cho, D.K. Adequacy of introducing forest land pension and the counter plan of the appraisal industry. Apprais Stud. 2014, 13, 53–65. (in Korean with English abstract).

- Yang, J.W.; Yoo, S.J. An empirical analysis on determinants of officially announced land price by sales comparison approach. J. Resid Environ. Inst. Korea 2014, 12, 267–279. (in Korean with English abstract).

- Kim, T.W.; Kang, I.J.; Park, D.H.; Hwang, D.Y. Method to objectify individual factors of GIS-based real estate appraisal. J. Korean Soc. Geospat. Inf. Sci. 2015, 23, 35–41. https://doi.org/10.7319/KOGSIS.2015.23.4.035 (in Korean with English abstract).

- Byeon, U. Analysis of Factors Influencing Land Appraisal Price Decisions. MD Thesis, Pusan National University: Busan, Korea, 2011. (in Korean with English abstract).