Columbia Business School (CBS) is the business school of Columbia University in the City of New York in Manhattan, New York City . Established in 1916, Columbia Business School is one of the oldest business schools in the world. It is one of six Ivy League business schools, and is among the most selective of top business schools.

- business school

- business schools

- cbs

1. History

The school was founded in 1916 with 11 full-time faculty members and an inaugural class of 61 students, including 8 women. Banking executive Emerson McMillin provided initial funding in 1916, while A. Barton Hepburn, then president of Chase National Bank, provided funding for the School's endowment in 1919. The School expanded rapidly, enrolling 420 students by 1920, and in 1924 added a PhD program to the existing BS and MS degree programs.[1][2]

In 1945, Columbia Business School authorized the awarding of the MBA degree. Shortly thereafter, in the 1950s, the School adopted the Hermes emblem as its symbol, reflecting the entrepreneurial nature of the Greek god Hermes and his association with business, commerce and communication.[3]

In 1952, CBS admitted its last class of undergraduates. The school currently offers executive education programs that culminate in a Certificate in Business Excellence (CIBE) and full alumni status, and several degree programs for the MBA and PhD degrees. In addition to the full-time MBA, the school offers four Executive MBA programs: the NY-EMBA Friday/Saturday program, the EMBA-Global program (launched in 2001 in conjunction with the London Business School), the EMBA-Americas program launched in 2012,[4] and the EMBA-Global Asia program (launched in 2009 in conjunction with the London Business School and the University of Hong Kong Business School). Students in jointly run programs earn an MBA degree from each of the cooperating institutions.

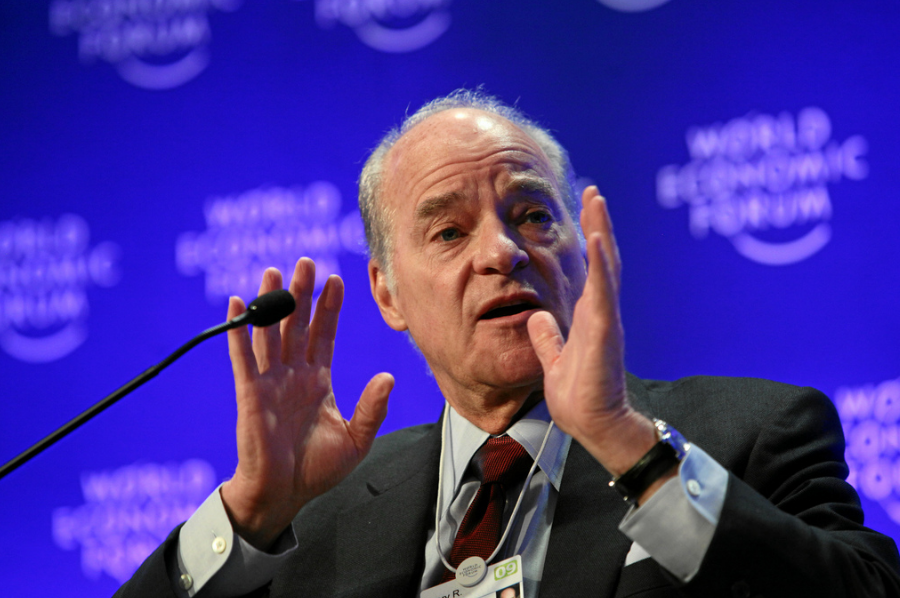

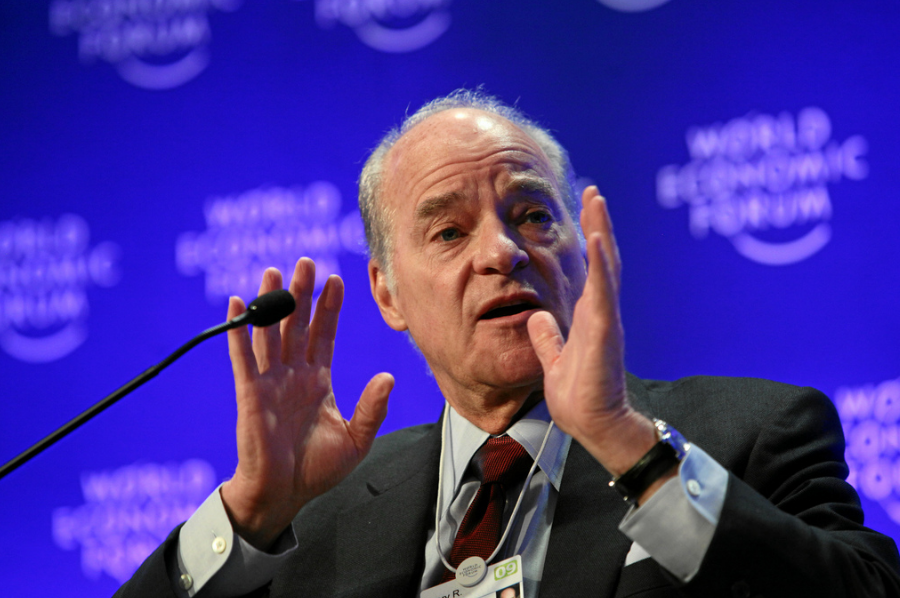

On July 1, 2004, R. Glenn Hubbard became Columbia Business School's eleventh dean. Hubbard, the former chair of President Bush's Council of Economic Advisers, has worked at the intersection of the private, government and nonprofit sectors and played an active role in shaping national and international economic policy, including the deregulation policy leading up Wall Street bank failures in 2008. In Charles Ferguson's 2010 documentary, Inside Job, when prompted, Hubbard strongly maintains that his political and financial connections to government and Wall Street firms do not create any potential academic conflict of interest.

2. Campus

Today, Columbia Business School is primarily housed in Uris Hall, a recently renovated 1960s structure at the center of Columbia's Morningside Heights campus. An auxiliary space, Warren Hall, is situated on Amsterdam Avenue and is shared with the law school. Relocation is planned for a more spacious facility at Columbia's new campus on 125th Street in Manhattanville, currently under construction.[5]

In October 2010, Columbia Business School announced that alumnus Henry Kravis, the billionaire co-founder of private-equity firm Kohlberg Kravis Roberts (KKR & Co.), pledged $100 million to fund expansion of Columbia Business School, the largest gift in its history. The donation will go toward construction of the business school’s new site in the Manhattanville section of New York City, where Columbia University is extending its campus. One of the school’s two new buildings will be named for Kravis.[6] The buildings will be designed by Diller Scofidio + Renfro.[7] In December 2012, Ronald Perelman also donated $100 million to the construction of the second business school building.

3. MBA Program

The Columbia MBA Program is highly competitive with an admission rate of 16% for the 2017 entering class.[8] The student body is highly accomplished and diverse. Students in the class that entered in 2009 come from 61 countries and speak more than 50 languages.[9]

The revised core curriculum, launched in the fall of 2008, represents about 40% of the degree requirement.[10] It consists of 2 full courses and 12 half-term courses including Corporate Finance, Financial Accounting, Managerial Statistics, Managerial Economics, Leadership, Operations Management, and Marketing Strategy.[11] While the first year of the program is usually devoted to completing the requirements of the core curriculum, the second year provides students with the opportunity to choose from the more than 130 elective courses available at the School and supplement them with more than 4,000 graduate-level classes from the University's other graduate and professional schools.[12] Among the most popular electives at Columbia Business School are the Economics of Strategic Behavior, Financial Statement Analysis and Earnings Quality, Launching New Ventures, Modern Political Economy, and the Seminar in Value Investing.[12]

Columbia Business School has a firm grade non-disclosure policy, stating that students refrain from disclosing specific class grades, GPAs, or transcripts until they accept full-time, post graduation positions.[13] Students enter Columbia's MBA program in two tracks. The traditional fall term is approximately 550 students, while the January term "J-Term" is approximately 200 students. Students entering in the fall are divided into eight clusters of approximately 65 students that take all first year core classes together. J-Term students are broken into three clusters. The J-Term is aimed at students who want an accelerated 18-month program who usually plan to return to their previous job, are company sponsored, and will not pursue a summer internship because they take classes during the summer.

The recently launched Columbia CaseWorks program utilizes the faculty’s research and industry experience and brings that perspective into the classroom through the development of new cases and teaching materials.[14] Beginning in orientation and continuing through core classes and electives, students are immersed in cases that use faculty research to address real-world business issues. Columbia CaseWorks challenges students to debate corporate decision making and to develop appropriate recommendations and solutions. During their first year, students study and discuss an integrated case that focuses on a single company and is incorporated into several core courses. This encourages students to think about a company holistically, analyzing it from the perspective of various disciplines.[15]

In 2013, the median starting base salary was $110,000, with a median $30,000 signing bonus and a median $20,000 of other guaranteed compensation.[16] According to Forbes magazine, 90% of billionaires with MBAs who derived their fortunes from finance obtained their master's degree from one of three schools: Harvard Business School, Columbia Business School, or The Wharton School at the University of Pennsylvania.[17].

3.1. Academic Divisions

The School's faculty are divided into five academic units:[18]

- Lorne Abony, MBA 2003, owner of the Austin Aces; former CEO of Mood Media

- Robert Agostinelli, MBA 1981, Founder of Rhône Group

- Mitch Albom, MBA 1983, American best-selling author, journalist, screenwriter, Tuesdays with Morrie, The Five People You Meet in Heaven

- Robert Amen, MBA 1973, Chairman and CEO of International Flavors and Fragrances

- César Alierta, MBA 1970, CEO of Telefónica

- Mauricio García Araujo, MBA, president of the Central Bank of Venezuela from 1987 to 1989

- J.T. Battenberg, CEO of Delphi Automotive Systems

- Louis Bacon, MBA 1981, Chairman of Moore Capital Management

- Koos Bekker, MBA 1984, Chairman of South Africa-based multinational mass media company Naspers

- Prince Amedeo of Belgium, Archduke of Austria-Este, MBA 2014, member of the Belgian Royal Family

- Michael Bellavia, MBA 1999, CEO of Animax Entertainment

- Robert R. Bennett, MBA 1982, CEO of Liberty Media Corporation

- Wolfgang Bernhard, MBA 1988, Member of the Board of Management of Daimler AG

- Erskine Bowles, MBA 1969, Former White House Chief of Staff; President of the University of North Carolina system

- Warren Buffett, MS 1951, CEO of Berkshire Hathaway

- Kevin Burke, MBA, Chairman and CEO of Consolidated Edison

- Arthur Burns, PhD 1934, Chairman of the Federal Reserve

- Paul Calello, MBA 1987, Chairman and CEO of Credit Suisse's investment banking division

- Jeff Campbell, MBA 1967 Former Chairman and CEO of Burger King

- Édouard Carmignac, MBA 1972, French investment banker and fund manager

- Russell Carson, MBA 1967, Founder of Welsh, Carson, Anderson & Stowe

- Tracey Chang, MBA 2011, China Central Television anchor; Miss New York USA in 2009

- Max C. Chapman, MBA, Former President and CEO of Kidder, Peabody & Co.

- Jerome Chazen, MBA 1950, Co-founder of Liz Claiborne

- Penny Chenery, MBA, American sportswoman who bred and raced Secretariat, 1973 winner of the Triple Crown

- Tos Chirathivat, MBA 1988, CEO of Central Group

- Howard L. Clark, Jr., MBA 1968, Chairman and CEO of Shearson Lehman Brothers

- Peter A. Cohen, MBA 1969, Chairman and CEO of Shearson Lehman Brothers

- Accounting

- Decision, Risk, and Operations

- Finance and Economics

- Management

- Marketing

3.2. Areas of Focus

Though there are no official tracks within Columbia Business School, many students choose to focus on a particular area in order to gain deeper knowledge in a specific discipline. Columbia Business School offers the following areas of focus:[19]

- Accounting

- Consulting

- Decision, Risk and Operations

- Entrepreneurship

- Finance and Economics

- Healthcare and Pharmaceutical Management

- Human Resource Management

- International Business

- Management / Leadership

- Marketing

- Media

- Private Equity

- Real Estate

- Social Enterprise

- Value Investing

As part of its MBA curriculum, Columbia Business School offers the Value Investing Program at the Heilbrunn Center for Graham & Dodd Investing, for a handful of selected business school students.[20] The program includes Applied Value Investing and Special Situations Investing. Adjunct professors include hedge fund managers, such as Joel Greenblatt,[21] Paul Sonkin,[22] Ken Shubin Stein and William Von Mueffling.[23] The program also features an extensive list of guest speakers which include Seth Klarman, Michael Price, Bill Nygren, Charles Brandes, David Einhorn and Chris Browne. Notable graduates of the value investing program include Warren Buffett, Mario Gabelli, Leon G. Cooperman, Chuck Royce, Paul Sonkin and William von Mueffling.

Columbia Business School's Entrepreneurship Program trains students for four career paths: entrepreneurship in new ventures, entrepreneurship in large organizations, private equity financing and social entrepreneurship.[24] Consequently, entrepreneurship among Columbia MBA students is on the rise, with 20 students in the MBA Class of 2007 starting their own businesses directly after graduation.[25] To supplement its Entrepreneurship Program, the Business School launched, in June 2012, an entrepreneurship lab in downtown Manhattan, an incubator space for entrepreneurs.

Columbia Business School has a strong presence in consulting. All top five new MBA employers are consulting firms, with McKinsey alone offering positions to 50 new graduates in 2014. Over 30% of new graduates choose a career in consulting.[26]

3.3. MBA Rankings

Template:Infobox business school rankings

For 2017, national rankings of Columbia’s MBA program include #6 by Forbes ,[27] #9 by Bloomberg Businessweek,[28] and #9 by U.S. News and World Report.[29] In global rankings, Columbia was ranked #9 by The Economist[30] and #7 by the Financial Times in 2018.[31]

In its 2017 ranking of the top-20 business schools in the Americas, the Financial Times ranked Columbia #2.[32]

3.4. Dual-Degree Programs

Columbia Business School students can combine an MBA with one of ten other professional degrees. In general, a dual degree requires one less year than it would take to complete the two degrees separately. Candidates must apply separately to Columbia Business School and the other degree program.[33]

Dual degrees offered with the following schools include:

- Todd Combs, MBA 2002, hedge fund manager, tapped as a potential successor of Warren Buffett as CIO of Berkshire Hathaway

- Rocco B. Commisso, MBA 1975, Chairman and CEO of Mediacom

- David Philbrick Conner, MBA 1976, CEO of Oversea-Chinese Banking Corporation

- School of Architecture, Planning and Preservation

- College of Dental Medicine

- School of Engineering and Applied Science

- School of International and Public Affairs

- School of Journalism

- School of Law[34][35]

- School of Nursing

- College of Physicians and Surgeons

- School of Public Health

- School of Social Work

3.5. Student Life

The Columbia Business School Follies is a student club that works throughout each semester to put together a production in which students write, choreograph, and perform comedy skits. It achieved notoriety in 2006[36][37][38] for "Every Breath Bernanke Takes", its video parody of the Police song "Every Breath You Take". It purports to be from Glenn Hubbard, Dean of the Business School, in response to Hubbard's being a runner-up to the Fed Chairmanship assumed by Ben Bernanke.

3.6. Admission to the MBA Program

Key Admission Stats – Columbia MBA:[39]

Average GPA of admits: 3.5

Average GMAT of admits: 724

Average Age of admits: 28

Admission requirements include a bachelor's degree or its equivalent from an accredited institution, three essays, two letters of recommendation, a GMAT or GRE score and a TOEFL or PTE score for international applicants.

4. Executive MBA Programs

Columbia offers various executive MBA programs.

The Executive MBA (EMBA) Friday/Saturday Program is a 20-month graduate program designed for individuals that are looking to enhance their education without interrupting their careers. The EMBA program is taught on campus at Columbia University by full-time faculty. The first year of classes consists of the same core curriculum as the Full-Time MBA program. Executive education is the focus of the second year. This Friday/Saturday program is targeted at individuals with approximately 10 years of work experience.[40]

The Executive MBA (EMBA) Saturday Program is a 24-month graduate degree program designed for individuals that are looking to enhance their education, but cannot take any time away from work. This program is the same as the Friday/Saturday program, with the exception that classes only meet on Saturdays over a longer period of time.

In addition to the New York-based EMBA Program, Columbia offers three partner programs to meet the differing needs and geographical distribution of prospective students.[41] Because students in the partner EMBA programs must satisfy the separate requirements of each school, they earn an MBA degree from each participating university. Likewise, they become alumni of each university and business school and may avail themselves of all programs and privileges afforded to alumni.

- Leon G. Cooperman, MBA 1967, Founder, Chairman, and CEO of Omega Advisors

- Alexander Crutchfield, MBA 1984, Senior Managing Director of Oasis Partners

- Robert Daniel, MBA, United States Congressman from Virginia

- Charles A. Davis, MBA, CEO of Stone Point Capital

- John T. Dillon, MBA 1971, Chairman and CEO of International Paper

- David LeFevre Dodd, MS 1921, PhD 1930, Father of value investing

- Blair Effron, Founder of Centerview Partners

- Charles E. Exley, Jr., MBA 1954, Former Chairman and CEO of NCR Corporation

- Meyer Feldberg, MBA 1965, former president of the Illinois Institute of Technology and dean of Columbia Business School

- George Fellows, MBA, CEO of Callaway Golf Company

- Lewis Frankfort, MBA 1969,

- [

- 62

- ]

- Chairman and CEO of Coach

- Michael Fries, MBA, CEO, Vice-Chairman of Liberty Global

- Eric Fromm (born 1958), tennis player

- Keiko Sofia Fujimori, MBA 2008, Peruvian politician.

- Gen Fukunaga, MBA 1989, Founder and CEO of Funimation Entertainment

- Jill Furman, MBA 1997, co-producer of musical

- Hamilton

- Mario Gabelli, MBA 1967, Chairman and CEO of GAMCO

- Gabriele Galateri di Genola, MBA 1972, Chairman of Assicurazioni Generali, former Chairman of Telecom Italia and CEO of Fiat

- Mark Gallogly, MBA 1986, Founder of Centerbridge Partners

- Julian Geiger, MBA, Former Chairman and CEO of Aeropostal

- Philip Geier, MBA 1958, Former Chairman and CEO of Interpublic Group of Companies

- Michael Goodkin, MBA 1968, Quantitative finance entrepreneur, founder of Arbitrage Management Company and Numerix

- The EMBA-Global Americas & Europe program is a 20-month program administered in partnership with the London Business School. The program enrolls approximately 70 students from around the world per year. Courses are taught by the full-time faculty of both schools. During the first year, the core curriculum classes alternate monthly between the campuses of Columbia University and the London Business School. The core curriculum is similar to that offered in the regular EMBA programs offered separately by each school, but with a more transnational-business emphasis. Second year classes may be selected from the portfolio of EMBA classes offered at either or both partner schools.[42]

- The EMBA-Global Asia, run jointly with the London Business School and the University of Hong Kong. This 20-month program follows a curriculum similar to the EMBA-Global program. Classes are held in Hong Kong, London, New York, and Shanghai.

4.1. EMBA Rankings

- #2 worldwide, #2 US Program, Businessweek, 2011 Executive MBA Rankings[43]

- #2 worldwide, Financial Times, 2010 Executive MBA Rankings, Global-EMBA program[44]

- #3 US Program, #13 worldwide. Financial Times, 2010 Executive MBA Rankings, Berkeley-Columbia program[44]

- #4 US Program, #15 worldwide. Financial Times, 2010 Executive MBA Rankings, NY-EMBA program[44]

- #5 US News and World Report 2010 Rankings[45]

- #4 BusinessWeek Executive MBA Rankings, NY-EMBA program[46]

- #9 Wall Street Journal Executive MBA Rankings, 2010, NY-EMBA program[47]

5. MS Programs

Columbia Business School offers three separate Master of Science degrees in Management Science & Engineering, Financial Economics and Marketing. Admission to the programs is extremely competitive: in 2011, there were 543 applicants to the Financial Economics program and only 10 students were accepted.[48]

6. Doctoral Program

The degree of Doctor of Philosophy (PhD) is offered by the Graduate School of Arts and Sciences and is administered by the Business School. Admission is highly competitive with 894 applicants in 2010 for positions in an entering class of 18 students (2%).[49] A PhD in Management or Business is a common precursor to an academic career in business schools.

Throughout the program, students become familiar with research methods and the literature of their major fields through research projects and directed reading.[50] Doctoral candidates begin the program mastering basic research tools by studying subjects such as economics, behavioral science and quantitative methods, in addition to completing course work and examinations in the major field of study. The completion of course work and qualifying examinations normally requires two to three years.

The research phase begins as early as the first year, when students serve as research assistants, and continues throughout their time at the School.[50] Students gradually become more involved in the design and execution of research and, by the end of the second year, have typically produced at least one paper suitable for publication, often as coauthor with a faculty member. The later years of the program are dedicated to original research and the creation of the dissertation.

Recent Columbia Ph.D. program graduates have placed in the following institutions: Harvard Business School, Wharton School, London Business School, Kellogg School of Management, Cornell University, University of Notre Dame, Stern School of Business, University of Minnesota, Fordham University, Polytechnic University, Baruch College, University of Washington, EWHA Womans University, Hong Kong University of Science and Technology, University of Toronto, IAE Business and Management School, Universidad Austral, and University of Texas at Austin.[51]

7. Executive Education

Columbia Business School Executive Education offers custom non-degree programs for organizations[52] and open-enrollment non-degree programs for individuals[53] in topics including management, finance, leadership, marketing, social enterprise, and strategy. The school also offers executive certification programs, including the Advanced Management Program,[54] the Certificate in Business Excellence[55] and the Senior Leaders Program for Nonprofit Professionals.[56]

8. CIBE

The Certificate in Business Excellence (CIBE) is awarded to students who complete a total of 18 program days of executive education within a four-year period.[25] Any executive education program at Columbia Business School can be applied toward the completion of the certificate.[25]

Recipients of the CIBE are granted full alumni status with Columbia Business School,[57][58] including the following alumni benefits:[25]

- James P. Gorman, MBA 1987, Chairman and CEO of Morgan Stanley

- Michael Gould, MBA 1968, Chairman and CEO of Bloomingdale's

- Ronald Grant, MBA 1993, Former President and COO of AOL LLC

- Alexander Haig, MBA 1955, United States Secretary of State

- N. Robert Hammer, MBA, Chairman and CEO of CommVault Systems

- Ernest Higa, MBA 1976, Japanese-American entrepreneur

- Fred Hochberg, MBA 1975, Chairman and President of the Export–Import Bank of the United States

- Joan Hornig, MBA 1983, jewelry designer

- Walter E. Hussman, Jr., MBA 1970, CEO of WEHCO Media and publisher of the

- Arkansas Democrat-Gazette

- Philippe Jabre, MBA 1982, CEO of Jabre Capital Partners

- Rachel Jacobs, MBA 2002, CEO of ApprenNet killed in the 2015 Philadelphia train derailment

- Philip J. K. James, MBA 2005, founding CEO of Lot18 and Snooth

- Mike Jeffries, MBA 1968, CEO of Abercrombie and Fitch

- Irving Kahn, MBA, oldest living active investment professional

- Elle Kaplan, MBA 2005, Founder and CEO of LexION Capital Management

- Robert Kasten Jr., MBA 1966, U.S. Senator from Wisconsin 1981 to 1993.

- Bill Keenan, MBA 2016, former professional hockey player and author

- James W. Keyes, MBA 1980, CEO of Fresh & Easy and former Chairman and CEO of Blockbuster Inc., 7-Eleven

- Jamie Kern, MBA 2004, co-founder and CEO of It Cosmetics

- Martin Kihn, MBA 2001, writer and digital marketer

- Timothy Kopra, MBA 2013, NASA astronaut

- Henry Kravis, MBA 1969,

- [

- 62

- ]

- Founder of Kohlberg Kravis Roberts & Co.

- Sallie Krawcheck, MBA 1992,

- [

- 62

- ]

- CEO and co-founder, Ellevest, former Chairman and CEO Sanford Bernstein, former CEO Citigroup Global Wealth Management

- Irvine Laidlaw, Baron Laidlaw, MBA 1965, Scottish businessman and member of the House of Lords

- Bill Lambert, MBA 1972, Co-Founder of Wasserstein Perella & Co.

- Eugene Lang, MS 1940, Chairman of the Eugene M. Lang Foundation

- Frank Lautenberg, BS 1949, U.S. Senator from New Jersey

- Leonard Lauder, MBA 1955, Chairman emeritus of the Estée Lauder Companies; son of Estée Lauder

- Rochelle Lazarus, MBA 1970, Chairman and CEO of Ogilvy & Mather

- Jeffrey Loria, MBA 1968, Owner of the Florida Marlins

- Emilio Lozoya, MBA 1972, Secretary of Energy of Mexico; father of Pemex CEO Emilio Lozoya Austin

- Li Lu, MBA 1996, Chinese-American investment banker, fund manager, and investor; one of the student leaders of the Tiananmen Square student protests of 1989

- William J. Lynch, Jr., MBA, CEO of Barnes & Noble

- Mauricio Macri, MBA 1985, incumbent President of Argentina

- Federico Marchetti, MBA 1999, founder of online retailer YOOX Group

- Mark Mays, MBA 1989, President and CEO of Clear Channel Communications

- Gail J. McGovern, EMBA 1987, CEO of the American Red Cross

- Nancy McKinstry, MB 1984, CEO and Chairman of the Executive Board of Wolters Kluwer

- Joern Meissner, PhD 2005, professor at Kühne Logistics University; founder of test-prep company Manhattan Review

- Yuzaburo Mogi, MBA 1961, Chairman and CEO of Kikkoman

- Paul Montrone, PhD 1996, Chairman and CEO of Fisher Scientific

- David Neithercut, MBA 1982, CEO of Equity Residential

- Akinlabi Olasunkanmi, MBA, Nigerian Senator and Federal Minister of Youth Development

- Kenneth Ouriel, MBA 2009, Former CEO of Shaikh Khalifa Medical City in Abu Dhabi, United Arab Emirates; vascular surgeon

- Christopher O'Neill, MBA 2005, British-American businessman and husband of Princess Madeleine of Sweden

- Vikram Pandit, MBA 1980, PhD 1986, CEO of Citigroup

- Alan Patricof, MBA 1957, Founder of Apax Partners

- Michael A. Peel, MBA 1983, Former VP of Human Resources at Yale University and Fellow of The National Academy of Human Resources.

- Jean-Marc Perraud, MBA 1972, Former CFO of Schlumberger

- Charles R. Perrin, MBA 1969, Chairman of Warnaco; Former CEO of Duracell, Former CEO of Avon Products

- Lionel Pincus, MBA 1956, Founder and Chairman of Warburg Pincus

- Ian Plenderleith, MBA 1971, Former Deputy Governor, South African Reserve Bank

- Srikumar Rao, PhD 1980, speaker, author, creator of Creativity and Personal Mastery (CPM) course

- Anna Rawson, MBA 2015, Australian professional golfer and model

|

9. Research Centers, Programs, and Institutes

Research centers, special programs, institutes, and cross-disciplinary areas at Columbia Business School include:[59]

- Arthur J. Samberg Institute for Teaching Excellence

- The Behavioral Lab

- The Center for Decision Sciences

- Center for Excellence in Accounting and Security Analysis

- Center on Global Brand Leadership

- Center on Japanese Economy and Business

- Columbia Institute for Tele-Information

- Columbia University Center for International Business Education Research

- Competitive Strategy

- Decision Making and Negotiations

- Eugene Lang Center for Entrepreneurship

- Healthcare and Pharmaceutical Management Program

- The Heilbrunn Center for Graham & Dodd Investing

- Jerome A. Chazen Institute of International Business

- The Media Program

- The Paul Milstein Center for Real Estate

- Private Equity Program

- Program for Financial Studies

- Program on Social Intelligence

- Richard Paul Richman Center for Business, Law, and Public Policy

- The Sanford C. Bernstein & Co. Center for Leadership and Ethics

- The Social Enterprise Program

- W. Edwards Deming Center for Quality, Productivity and Competitiveness

10. People

10.1. Faculty

Columbia Business School employs 136 full-time faculty members,[60] including Joseph Stiglitz, the 2001 Nobel laureate in economics who also teaches at the university's School of International and Public Affairs; and Bernd Schmitt, the Robert D. Calkins Professor of International Business. The current Dean is the former Presidential Council of Economic Advisors Chairman Glenn Hubbard. Hedge fund gurus Joel Greenblatt and Ken Shubin Stein are currently adjunct professors. Bruce Greenwald teaches Value Investing and Economics of Strategic Behavior electives. Adam Dell, brother of Dell Inc. CEO Michael Dell, is a venture capitalist who teaches Business Innovation and Technology. Jonathan Knee teaches Media, Mergers, and Acquisitions and is the author of a book titled "The Accidental Investment Banker". James Freeman teaches Investment Banking and is the CEO of a boutique investment bank by the same name. Frederic Mishkin, member of the Board of Governors of the Federal Reserve System, returned to teach at CBS starting fall 2008.[61] Rita Gunther McGrath is a well known member of the strategy faculty and the author of four books on the subject, most recently The End of Competitive Advantage: How to Keep Your Strategy Moving as Fast As Your Business (2013, Harvard Business Review Publishing)

10.2. Alumni

Columbia Business School has over 44,000 living alumni. Some of the more notable alumni include the following:

- Mark Reckless, MBA 1999, UK Independence Party politician; Member of parliament for Rochester and Strood

- Antony Ressler, MBA 1985, co-founder of the private equity firm Apollo Global Management and Ares Management

- Joyce M. Roche, MBA 1972, former CEO of Girls, Inc. and director of AT&T

- Xavier R. Rolet, MBA 1984, CEO of the London Stock Exchange

- Donna Rosato, MBA 2000, journalist, reporter for

- Money Magazine

- David S. Rose, MBA 1983, American entrepreneur, founder of New York Angels

- Benjamin M. Rosen, MBA 1961, Former Chairman and CEO of Compaq

- Louis Rossetto, MBA 1973, Founder and Editor-in-Chief of Wired Magazine

- Jordan Roth, MBA 2010, president and majority owner of Jujamcyn Theaters

- David Sainsbury, MBA 1971, Chairman of Sainsbury's

- Arthur J. Samberg, MBA 1967, Chairman and CEO of Pequot Capital

- Thomas Sandell, MBA 1989, Swedish billionaire hedge fund manager

- David C. Schmittlein, PhD 1980, Dean of MIT (Sloan)

- Keith Sherin, EMBA 1991, Chairman and CEO of GE Capital

- Shin Dong-bin(Akio Shigemitsu), MBA 1980, Billionaire Chairman of Lotte Group

- António Pedro dos Santos Simões, MBA, CEO of HSBC UK

- Lewis A. Sanders, MBA 1995, former chairman and CEO of AllianceBernstein

- Harvey Schwartz, MBA 1996, president and COO of Goldman Sachs

- David E. Simon, MBA 1985, Chairman and CEO of Simon Property Group

- Robert F. Smith, MBA 1994, founder of Vista Equity Partners, wealthiest African-American

- Jerry Speyer, MBA 1964, CEO of Tishman Speyer Properties

- Jonathan Stein, MBA 2009, Founder and CEO of Betterment

- Jon Steinberg, MBA 2003, President of BuzzFeed

- Robert J. Stevens, MBA 1987, Chairman and CEO of Lockheed Martin

- Patrick Stokes, MBA 1966, Former Chairman and CEO of Anheuser-Busch

- Henry Swieca, MBA 1982, Co-Founder of Highbridge Capital Management, Founder of Talpion

- Washington SyCip, MBA 1943, founder of the Asian Institute of Management and Sycip Gorres Velayo & Co.

- Diana Taylor, MBA 1980, 42nd Superintendent of the New York State Banking Department; domestic partner of former mayor Michael Bloomberg

- Sidney Taurel, MBA 1971, Chairman and CEO of Eli Lilly and Company

- Alfred P. Thorne, PhD 1959, British Guiana-born development economist

- Lynn Tilton, MBA 1987, businesswoman; Collateralized loan obligation creator, owner, and manager; owner of Patriarch Partners, largest woman-owned business in the United States

- Umayya Toukan, PhD 1987, Governor of the Central Bank of Jordan

- Joseph M. Tucci, MBA 1984, President and CEO of EMC Corporation

- Ira Trivedi, MBA 2008, Indian novelist, yoga teacher, and entrepreneur

- Percy Uris, BS 1920, American real estate developer and namesake of Uris Hall, the business school building of Columbia

- Martín Varsavsky, MBA 1985, Argentine/Spanish serial entrepreneur, founder of Jazztel, Ya.com and Fon

- Eduardo Verano De la Rosa, MBA 1978, Columbian Governor of Atlántico

- Joseph Vittoria, MBA 1959, Former Chairman and CEO of Avis

- Robert K. Watson, MBA 2006, Founder of LEED

- Eudora Welty, MBA 1932, American author, winner of the Pulitzer Prize in 1973; recipient of the Presidential Medal of Freedom

- Benjamin Wey, MSLD 2013, Chinese-born American Wall Street financier and CEO of New York Global Group

- Gerri Willis, MBA, news journalist for Fox Business Network

- Peter Woo, MBA 1972, Chairman of Hong Kong Trade and Development Council, Wheelock & Co, and The Wharf Holdings Limited

- Jerome J. Workman, Jr., CSEP 2004, CIED 2004, CIBE 2006, prolific author, inventor, and editor of scientific reference works on the subject of spectroscopy; and a noted analytical spectroscopist.

- Seungpil Yu, MBA 1971, PhD 1979, Chairman and CEO of Yuyu Pharma (South Korea)

- Ariel Elizarov, AMP 2016, CIBE 2016, Founder of Lazarus Enterprises

- Tshilidzi Marwala, AMP 2017, Vice-Chancellor and Principal of the University of Johannesburg

References

- "Archived copy". Archived from the original on May 2, 2015. https://web.archive.org/web/20150502220219/http://www8.gsb.columbia.edu/about-us/history. Retrieved 2015-04-08.

- Metre, Thurman William Van (July 21, 2018). "A History of the Graduate School of Business, Columbia University". Columbia University Press. https://books.google.com/books?id=wmXOAAAAMAAJ&source=gbs_ViewAPI.

- "Archived copy". Archived from the original on December 12, 2011. https://web.archive.org/web/20111212203915/http://www7.gsb.columbia.edu/alumni/news/New-Visual-Identity. Retrieved 2011-06-10.

- "Columbia Launches New EMBA-Americas Program". https://www.veritasprep.com/blog/2012/05/columbia-launches-new-emba-americas-program/. Retrieved 2018-04-13.

- "Columbia University Announces Business School Plan to Move in First Phase of Proposed Expansion in Manhattanville". Columbia University. http://www.columbia.edu/cu/news/06/11/bschool.html. Retrieved December 30, 2007.

- "KKR's Kravis pledges $100 mln to Columbia". Reuters. October 5, 2010. https://www.reuters.com/article/idUSN0520346620101005. Retrieved October 10, 2010.

- Russell, James S. (January 12, 2011). "Columbia Business School Picks Diller Scofidio for New Campus". Bloomberg. https://www.bloomberg.com/news/2011-01-12/columbia-business-school-picks-diller-scofidio-for-new-6-3-billion-campus.html.

- "MBA Class Profile". Columbia Business School. http://www.gsb.columbia.edu/programs/mba/admissions/class-profile. Retrieved August 25, 2017.

- "Columbia Business School 2007 Employment Report" (PDF). Columbia Business School. http://www.columbia.edu/cu/business/career/employmentreport/2007/CBS_EmployReport2007.pdf. Retrieved April 4, 2008.

- "Columbia Business School MBA Core Curriculum". Columbia Business School. http://www4.gsb.columbia.edu/mba/academics/curriculum/corecurriculum. Retrieved April 4, 2008.

- "Columbia Business School MBA Program Core Curriculum". Columbia Business School. http://www4.gsb.columbia.edu/mba/academics/curriculum/corecurriculum. Retrieved April 4, 2008.

- "Columbia Business School MBA Program Electives". Columbia Business School. http://www.gsb.columbia.edu/mba/academics/curriculum/electives. Retrieved April 4, 2008.

- "Archived copy". http://cbsgba.com/culture/grade-non-disclosure-gnd.

- "About CaseWorks". Columbia Business School. http://www.gsb.columbia.edu/caseworks/about. Retrieved April 4, 2008.

- "Archived copy". http://www4.gsb.columbia.edu/mba/academics/versatile.

- Columbia Business School Employment Report – 2011 http://www7.gsb.columbia.edu/recruiters/employmentreport

- Forbes: Billionaire Clusters https://www.forbes.com/2009/04/02/billionaire-clusters-harvard-skull-and-bones-goldman-business-billionaires-wealth.html

- "Academic Divisions | Faculty and Research". Columbia University. http://www8.gsb.columbia.edu/faculty-research/divisions. Retrieved 24 December 2015.

- "Columbia Business School MBA Program: Areas of Focus". Columbia Business School. http://www.gsb.columbia.edu/mba/academics/areasoffocus. Retrieved April 6, 2008.

- "Heilbrunn Overview". Columbia Business School. http://www.gsb.columbia.edu/valueinvesting/coursesfaculty/overview. Retrieved April 4, 2008.

- "Joel Greenblatt – Columbia Business School Faculty Staff Directory". Columbia Business School. http://www4.gsb.columbia.edu/cbs-directory/detail/494813/Joel+Greenblatt. Retrieved December 30, 2007.

- "Paul Sonkin – Columbia Business School Faculty Staff Directory". Columbia Business School. http://www4.gsb.columbia.edu/cbs-directory/detail/494773/Paul+Sonkin. Retrieved December 30, 2007.

- "William Von Mueffling – Columbia Business School Faculty Staff Directory". Columbia Business School. http://www4.gsb.columbia.edu/cbs-directory/detail/494834/William+Von+Mueffling. Retrieved December 30, 2007.

- "Entrepreneurship Career Paths". Columbia Business School. http://www4.gsb.columbia.edu/entrepreneurship/program/careers. Retrieved April 4, 2008.

- "Columbia Business School". http://www4.gsb.columbia.edu/execed/certificate/learn-more/.

- "Columbia Business School Consulting Program". Columbia Business School. http://www8.gsb.columbia.edu/consulting/. Retrieved October 30, 2015.

- "Best Business Schools 2017". https://www.forbes.com/business-schools/.

- "These Are The Best Graduate Business Schools of 2017". https://www.bloomberg.com/graphics/2017-best-business-schools/.

- "US News and World Report MBA Rankings 2018". https://www.usnews.com/best-graduate-schools/top-business-schools/mba-rankings.

- "2017 MBA & Business School Rankings - Which MBA? - The Economist". https://www.economist.com/whichmba/full-time-mba-ranking.

- "Business school rankings from the Financial Times - FT.com". http://rankings.ft.com/businessschoolrankings/global-mba-ranking-2018.

- "Financial Times Ranking of Rankings". The Financial Times. 2017. https://www.ft.com/content/2a9bdebe-cbbf-11e7-8536-d321d0d897a3. Retrieved February 28, 2018.

- "Dual Degrees | Programs". Columbia University in the City of New York. http://www8.gsb.columbia.edu/programs/mba/academics/dual-degrees. Retrieved 3 November 2016.

- "Columbia Law and Business Schools to launch 3-year joint JD/MBA degree". December 4, 2010. http://www.ibtimes.com/articles/88722/20101204/jd-mba-joint-degree-columbia-new-program.htm.

- "Columbia adds three-year J.D./MBA program - National Law Journal". http://www.law.com/jsp/nlj/PubArticleNLJ.jsp?id=1202476249394&Columbia_adds_threeyear_JDMBA_program&slreturn=1&hbxlogin=1.

- Levitt, Steven D. (May 2, 2006). "The Best Economics Humor Ever". New York Times. http://freakonomics.blogs.nytimes.com/2006/05/02/the-best-economics-humor-ever/. Retrieved April 6, 2008.

- "Dean-a-Go-Go". BusinessWeek. http://www.businessweek.com/bschools/content/may2006/bs20060510_7468.htm. Retrieved April 6, 2008.

- Henderson, Nell (April 27, 2006). "A Fed Wannabe Feels Students' Sting". Washington Post. https://www.washingtonpost.com/wp-dyn/content/article/2006/04/26/AR2006042602529.html. Retrieved April 6, 2008.

- School, Columbia Business. "MBA Class Profile". https://www8.gsb.columbia.edu/programs/mba/admissions/class-profile.

- "Columbia Business School EMBA Overview". Columbia Business School. http://www.gsb.columbia.edu/emba/overview/. Retrieved April 4, 2008.

- "EMBA: Partner Programs". Columbia University. 2008. http://www4.gsb.columbia.edu/emba/overview/partner/. Retrieved April 26, 2008.

- "FAQs". London Business School. Archived from the original on December 18, 2007. https://web.archive.org/web/20071218192454/http://www.london.edu/emba-global/faqs.html. Retrieved April 26, 2008.

- "Terms of Service Violation". http://www.businessweek.com/bschools/rankings/index.html.

- "EMBA Rankings 2010" (PDF). The Financial Times. http://rankings.ft.com/exportranking/emba-rankings-2010/pdf. Retrieved February 1, 2011.

- "Executive MBA – Best Business Schools". US News & World Report. http://grad-schools.usnews.rankingsandreviews.com/best-graduate-schools/top-business-schools/executive. Retrieved May 2, 2009.

- "The Top Executive MBA Programs". BusinessWeek. The McGraw-Hill Companies Inc.. http://bwnt.businessweek.com/bschools/emba_rankings_2009/. Retrieved December 30, 2007.

- "Leadership Ranks". The Wall Street Journal. September 29, 2010. https://www.wsj.com/public/resources/documents/EMBA-Top-25-Ranking.html. Retrieved February 1, 2011.

- "Columbia Business School MS Financial Economics Candidaite Profile". http://www7.gsb.columbia.edu/ms/financialeconomics/admissions/profile.

- "Columbia Business School Doctoral Program Admissions Statistics". Columbia Business School. http://www.gsb.columbia.edu/phd/learnmore/statistics. Retrieved October 6, 2010.

- "Columbia Business School Doctoral Program Overview". Columbia Business School. http://www.gsb.columbia.edu/phd/academics/overview. Retrieved April 4, 2008.

- "Columbia Business School Doctoral Program Placement". Columbia Business School. http://www.gsb.columbia.edu/phd/whycolumbia/placement/. Retrieved April 4, 2008.

- School, Columbia Business. "Programs for Organizations". https://www8.gsb.columbia.edu/execed/programs-for-organizations.

- School, Columbia Business. "Programs for Individuals". https://www8.gsb.columbia.edu/execed/programs-for-individuals.

- School, Columbia Business. "Advanced Management Program". http://www8.gsb.columbia.edu/execed/program-pages/details/814/AMP.

- School, Columbia Business. "Earn A Certificate". http://www8.gsb.columbia.edu/execed/why-columbia/cibe.

- School, Columbia Business. "Senior Leaders Program for Nonprofit Professionals". http://www8.gsb.columbia.edu/execed/program-pages/details/118/SLP.

- "Columbia Business School". http://www4.gsb.columbia.edu/execed/connected/article/481114/A+Conversation+with+Keith+Sanders:+On+Earning+Alumni+Status/.

- Staff, Peterson's Guides (November 1, 2005). "Bricker's International Directory 2006". Peterson's. https://books.google.com/books?id=wdbtQGSVaScC&pg=PA1390&dq=%22certificate+in+business+excellence%22+and+%22alumni+status%22/.

- "Faculty & Research". Columbia Business School. http://www.gsb.columbia.edu/faculty-and-research. Retrieved November 26, 2010.

- "Columbia Business School MBA Program: Faculty". Columbia Business School. http://www.gsb.columbia.edu/mba/academics/faculty. Retrieved April 6, 2008.

- "Fed Governor Mishkin resigns effective August 31". Reuters. May 28, 2008. https://www.reuters.com/article/ousiv/idUSN2843825720080529?sp=true. Retrieved May 29, 2008.

- "2006 Employment Report" (PDF). Columbia Business School. http://www.columbia.edu/cu/business/career/employmentreport/2006/er2006.pdf. Retrieved December 30, 2007.