2. Oil Price as an Exogenous Variable

This line of study relies on the global nature of the crude oil market and presumes that large variations in the price of oil are historically driven by supply disruption as a result of political events and OPEC decisions. It assumes that oil prices are exogenous to macroeconomics variables and discards the source of oil price shocks in their analyses. Among those, some studies, such as Wang et al.

[5][11], Brown and Yücel

[6][12], Panagiotidis and Rutledge

[7][13], Pindyck

[8][3], Serletis and Rangel-Ruiz

[9][14], and Serletis and Herbert

[10][15], show that there is a stable and asymmetric relationship between the crude oil price and natural gas price in a way that the oil price dominantly derives the natural gas price, but not the other way around. On the contrary, other studies such as Bachmeier and Griffin

[11][16], Drachal

[12][17], and Zhang and Ji

[13][18] show that, in the long run, there is no relationship or a very weak relationship between the prices of crude oil and natural gas. Serletis and Rangel-Ruiz

[9][14] show that there are no shared stochastic trends between West Texas Intermediate (WTI) crude oil prices and Henry Hub natural gas. They attribute this to the deregulations of the natural gas market in the United States. Hailemariam and Smyth

[14][19] argue that since the shale gas revolution in 2008 the price of natural gas has been determined based on its supply and demand in the natural gas market. In the short run, studies such as Hartley et al.

[15][5] and Brown and Yücel

[6][12] show that seasonal factors, such as weather and natural disasters, and oil inventories have a significant impact on natural gas prices, which makes them deviate from oil prices.

Yücel and Guo

[16][20] is one of the first studies that investigated a cointegrating relationship between oil, natural gas, and coal prices from 1947 to 1990 in the U.S. They show that oil and natural gas are not cointegrated when using the full sample because the natural gas market was heavily regulated before 1974. However, their results verify that the cointegration exists episodically in sub-samples. For example, one can find a long-run relationship between oil and natural gas prices for the 1974–1990 time span in a way that the oil price drives natural gas prices—see also Hou and Nguyen

[17][21], Hailemariam and Smyth

[14][19], and Aruga

[18][22], who verify Yücel and Guo’s results over the 1974–1990 period. Similarly, Bachmeier and Griffin

[11][16]’s study does not support the idea of a primary energy market as they show that oil, natural gas, and coal are very weakly integrated in the U.S. They argue that the end products of oil and natural gas are used in different sectors, while in the short-run, little possibilities of interfuel substitution exist. For example, oil and natural gas products, mostly heating oil and methane, can compete in residential and commercial heating or in power plants, while gasoline, which is mostly produced from oil, does not have a considerable successor to natural gas in the transportation sector. In contrast, Barcella

[19][23] argues that fuel oil and natural gas are significant substitutes in the electric power sector and that is why crude oil and natural gas prices are highly correlated in the liberalized U.S. gas market. Therefore, the state of the transmission channels, discussed in the previous sections, is used to explain how the hydrocarbon prices are integrated with the crude oil prices. They attribute either changes in the state of market structure and regulations (i.e., oil-indexed versus gas-on-gas contracts), supply-side interruptions and developments, or demand-side changes in oil and gas derivatives to co-movements in the prices.

The liberalization of natural gas markets refers to the deregulation and structural reforms that lead to the gas-on-gas competition in liquid spot and futures markets rather than long-term contracts with prices determined in advance and frequently linked to the crude oil or heavy fuel price (a system known as oil-indexation). Some studies such as Barton and Vermeire

[20][24] and Heren

[21][25] believe that the liberalization of gas markets in the U.K. has weakened the linkage between crude oil and gas prices since the spot and futures markets were first established in 1995–1996. Asche et al.

[22][26] employ cointegration models and show that the U.K. natural gas market and Brent oil are integrated in an interim period (1995–1998) when the U.K. gas market was liberalized in 1995 but not yet linked to the Continental gas markets through the U.K.–Mainland Europe Interconnector gas pipeline at the end of 1998. They do not find any evidence of cointegration for the period after opening the Interconnector between 1998 and 2002. In contrast to Asche et al.

[22][26], Panagiotidis and Rutledge

[7][13] and Drachal

[12][17] show that a long-run equilibrium relationship between U.K. gas and oil prices exists over the period 1996–2003. Panagiotidis and Rutledge

[7][13] believe that the differences in results with Asche et al.

[22][26] could stem from the inclusion of the electricity price in their study. These studies do not represent a general consensus on the relationship between crude oil and natural gas prices. This lack of consensus across studies is mainly due to either methodological or some other factors such as data, time period, and location of the study.

3. Oil Price as an Endogenous Variable

There has been considerable improvement in econometrics methods to identify the causes underlying oil price shocks in the last two decades. These studies are mostly built on Kilian

[23][6]’s article, in which he shows how the price of oil is disengaged. Kilian

[23][6] initiates an index to capture the changes in the real global economic activity and employs the structural Vector AutoRegressive (VAR) model to decompose the evolution of the real oil prices into three different sources: shocks to the global supply of crude oil, shocks to the global demand for all industrial commodities (including crude oil) that are driven by the global business cycle, and oil-market-specific demand shocks (also referred to as precautionary demand shocks). Since Kilian

[23][6], the literature has departed from the earlier studies that mostly treat the price of oil as exogenous and incorporates supply and demand shocks to the real price of oil. Kilian’s approach has resulted in the formation of new extensive literature to study the effects of the oil shocks. Some studies have examined the effect of oil price shocks on macroeconomic and financial variables. For more detail, see the review papers of Kilian

[24][35] and Herrera et al.

[25][36]. In this section,

rwe

searchers review the studies that augment Kilian

[23][6]’s structural VAR model to include the real price of hydrocarbons and investigate the response of the real price of hydrocarbons to the structural shocks in the crude oil market.

Jadidzadeh and Serletis

[26][1] and Zamani

[27][37] both augment Kilian

[23][6]’s model and incorporate the real price of natural gas as the fourth variable to investigate the impact of those structural shocks in the oil market on natural gas prices. The former uses the monthly U.S. natural gas wellhead price from 1976:1 to 2012:12, and the latter uses the monthly U.S. natural gas imported price from 1989:1 to 2014:12. Both of these studies show that supply shocks in the oil market do not have a statistically significant impact on the real price of natural gas, but it increases the real price of natural gas after 12 months. The response of gas prices to the oil supply shocks measured by the impulse response functions are only statistically significant based on one-standard error bands. The demand shocks that are explained by an unexpected increase in the global demand for all industrial commodities have an immediate and sustained increase in the real price of natural gas. Finally, expectations in the oil market captured by the precautionary demand for oil has an immediate and sustained increase in natural gas prices.

Jadidzadeh and Serletis

[26][1] employ the forecast-error-variance decomposition to quantify the share of the oil market structural shocks on the variation of natural gas prices over different time horizons. They find that in the short-run the oil market shocks do not demonstrate a considerable effect on the variations in the real natural gas prices. For example, all three structural shocks account for less than one percent fluctuations in the real price of natural gas in the first month, while the contribution of the structural shocks increases as the forecast horizon increases. However, in the long run, 45% of the variation in the real price of natural gas originates from the three structural shocks in the crude oil market. The largest contributor to the variation in the real natural gas prices is the aggregate demand shocks (which explain more than 16% of the variation), followed by the contribution of precautionary demand shocks and oil supply shocks (accounting for about 16% and 13% of the variation, respectively) to the long-run variation in the real price of natural gas. The remaining variation (about 55%) in the real price of natural gas is from the shocks that are specific to the natural gas markets or generally other shocks.

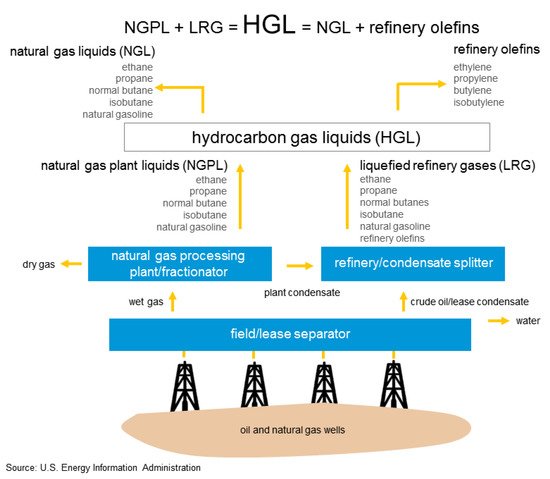

A recent study by Jadidzadeh and Serletis

[1][7] investigates the impact of structural shocks in the crude oil market on the price of ethane, propane, normal butane, isobutane, and natural gasoline over the period from January 1985 to April 2020. The results are very similar to what was presented in Jadidzadeh and Serletis

[26][1] and Zamani

[27][37] for natural gas prices. Although the supply-side shocks in the crude oil market do not demonstrate statistically significant impulse responses, a negative (one standard deviation) shock in the supply of crude oil would tend to increase each NGL’s price after six months temporarily. A positive (one standard deviation) demand shock, either in the aggregate demand shock or the precautionary demand shock, represents an immediate and persistent increase in NGL prices. The forecast-error-variance decompositions show that in the short-run (first three months horizon), the oil market’s structural shocks explain 23%, 34%, 44%, 50%, and 67% of the variation in ethane, propane, normal butane, isobutane, and natural gasoline prices, respectively. In the long run, the share of structural shocks accounts for approximately 55% of fluctuations in the prices of NGLs.