The core model in this paper, “CoVaR”, is an abbreviation for “Conditional Value at Risk”, which has been increasingly applied in the field of systemic risk and can be used for analyzing the systemic risk in different perspectives.

The core model in this paper, “CoVaR”, is an abbreviation for “Conditional Value at Risk”, which has been increasingly applied in the field of systemic risk and can be used for analyzing the systemic risk in different perspectives. The idea of CoVaR was first proposed by Adrian and Brunnermeier [1]. This model has experienced several years of development and was published in the 12th issue of American Economic Review in 2016. The basic concept and methodology of the CoVaR were originally built based on Value at Risk (VaR), which measures the maximum loss of a financial institution at a certain confidence level. The prefix of CoVaR, namely “Co”, shows that “VaR” is conditional. CoVaR is defined as the VaR of the financial system conditional on a financial institution, while ΔCoVaR refers to the difference between the CoVaR when the institution is in distress and the CoVaR when the institution is in a normal state, which captures the contribution of the institution to the systemic risk of the financial system [2].

In this paper, the main research questions are as follows. How can we effectively measure the contribution of each bank to the systemic risk of the banking industry? Is the systemic risk changing over time? For China, do the systemically important banks change, and which bank contributes the most to the systemic risk? We first build a series of Conditional Value at Risk (CoVaR) models to measure the systemic risks in the Chinese banking industry with a static and dynamic model through overall analyses and year-by-year analyses. We further extend the study to analyze the contribution of a bank in extreme circumstance to the systemic risk, and modify the dynamic model by incorporating the roles of Fintech and non-bank financial institutions. Another type of systemic risk, namely bank exposure, is also studied. Furthermore, we compare the results of the traditional indicator approach and the market-based CoVaR models, and we provide possible reasons and make suggestions for improving financial supervision and maintaining financial stability.

- bank

- financial stability

- systemic risk

- CoVaR

- systemically important banks

- Fintech

- digital economy era

1. InHistroductionory

The idea of CoVaR was first proposed by Adrian and Brunnermeier[1]. This model has experienced several years of development and was published in the 12th issue of American Economic Review in 2016. The basic concept and methodology of the CoVaR were originally built based on Value at Risk (VaR), which measures the maximum loss of a financial institution at a certain confidence level. The prefix of CoVaR, namely “Co”, shows that “VaR” is conditional. CoVaR is defined as the VaR of the financial system conditional on a financial institution, while ΔCoVaR refers to the difference between the CoVaR when the institution is in distress and the CoVaR when the institution is in a normal state, which captures the contribution of the institution to the systemic risk of the financial system[2].

In this paper, the main research questions are as follows. How can we effectively measure the contribution of each bank to the systemic risk of the banking industry? Is the systemic risk changing over time? For China, do the systemically important banks change, and which bank contributes the most to the systemic risk? We first build a series of Conditional Value at Risk (CoVaR) models to measure the systemic risks in the Chinese banking industry with a static and dynamic model through overall analyses and year-by-year analyses. We further extend the study to analyze the contribution of a bank in extreme circumstance to the systemic risk, and modify the dynamic model by incorporating the roles of Fintech and non-bank financial institutions. Another type of systemic risk, namely bank exposure, is also studied. Furthermore, we compare the results of the traditional indicator approach and the market-based CoVaR models, and we provide possible reasons and make suggestions for improving financial supervision and maintaining financial stability.

The world has entered an era of digital economy. Tapscott originally proposed the concept of the digital economy [3][4]. With the development of science and technology, the understanding of the digital economy has become clearer. According to a G20 report, the digital economy is defined by the economic activities where the digitized information and knowledge are considered as critical production factors with the development of modern information network, which boosts the growth and optimizes the economic structure[5]. The International Monetary Fund (IMF) defines a broad form of digital economy by the digitalization in all sectors of the economy. The use of the Internet could be considered as an exact example of the digitalization, and the 21st century is an era of the digital economy. During the period, a series of economic activities that incorporate data and the Internet grow quickly and change the society[6]. In the digital economy era, Fintech, a combination of finance and technology, emerges and is playing an increasingly important role. Furthermore, the traditional concept of financial supervision needs to be developed and updated in the digital economy era.

The world has entered an era of digital economy. Tapscott originally proposed the concept of the digital economy [3,4]. With the development of science and technology, the understanding of the digital economy has become clearer. According to a G20 report, the digital economy is defined by the economic activities where the digitized information and knowledge are considered as critical production factors with the development of modern information network, which boosts the growth and optimizes the economic structure [5]. The International Monetary Fund (IMF) defines a broad form of digital economy by the digitalization in all sectors of the economy. The use of the Internet could be considered as an exact example of the digitalization, and the 21st century is an era of the digital economy. During the period, a series of economic activities that incorporate data and the Internet grow quickly and change the society [6]. In the digital economy era, Fintech, a combination of finance and technology, emerges and is playing an increasingly important role. Furthermore, the traditional concept of financial supervision needs to be developed and updated in the digital economy era.

In the digital economy era, for the financial industry, Fintech brings opportunities as well as challenges, and the supervision of systemic risk should be developed further. Due to the significant externality and the strong contagion effect of systemic risk, there is a strong need to strengthen the financial supervision of systemically important financial institutions (SIFIs) and forestall systemic risk, especially in the post-crisis era. Since the outbreak of the international financial crisis in 2008, there has been a persistent reform of the global financial regulatory system. One important part of this reform is to improve the regulatory framework and fortify the supervision of SIFIs. The international financial crisis shows that big financial institutions contribute seriously to the systemic risk, which promotes the reform of financial supervision, aiming at preventing the risk of the “too big to fail” financial institutions. However, as Greene et al. pointed out, an institution smaller in size did not indicate that it was less risky. They took an example of the event of Long-Term Capital Management (LTCM). An institution with relatively small size, could affect financial stability [7].

In the digital economy era, with the booming development of Fintech, we could focus on the systemic risk that a big institution causes, and we should also consider the systemic risk that may be induced by a small institution. In the era of the digital economy, the development of the information technology accelerates the speed for customers to enjoy financial services, and they have access to more and more diversified and even customized financial products. However, the risk will not disappear in the digital economy era. Compared with big institutions with relatively strong supervision, small institutions may be more sensitive to the financial environment and take more risks in terms of financial innovations, making them more prone to accumulating risk. Moreover, the digital economy era enables the institution to transfer the risk to the financial system faster and more seriously with possibly a more inconspicuous manner than before. Therefore, the importance of assessing the systemic risks of all institutions, especially the small institutions, should be precisely measured and should not be overlooked.

The Chinese government has always been attaching great importance to systemic risk prevention and ensuring financial stability. In recent years, the understanding of the significance for the financial sector to better prevent systemic risk has reached a new height. As Chinese president Xi Jinping pointed out in the National Financial Work Conference in 2017, finance is the lifeblood of the real economy. Therefore, a new committee, namely the State Council Financial Stability and Development Committee (SCFSDC), was announced to be set up in the conference. Further, the role of the central bank in China (People’s Bank of China, PBC) in macroprudential management and forestalling systemic risk should be strengthened [8]. In the report of the 19th National Congress, improving the financial supervision system and guarding against systemic risk were set as tasks for economic reform [9]. In 2018, the PBC, the CBIRC (China Banking and Insurance Regulatory Commission), and the CSRC (China Securities Regulatory Commission) jointly released a guideline for improving the supervision of SIFIs. The aims of this guideline were to recognize SIFIs, enhance the financial regulatory system, and maintain financial stability [8]. In 2019, PBC established the Macroprudential Policy Bureau (MPB) to evaluate and identify SIFIs [9]. The PBC also paid more attention to the financial supervision in the digital era and launched the pilot of supervision on Fintech innovations, aiming at improving the professionalism, the unity, and the penetration of the financial supervision [12].

In this paper, we aim to measure the systemic risks of China’s banks in the digital economy era. The reasons are as follows. First, China is a bank-based country, and the banking industry plays an important role in its financial system. In China’s financial system, because of a high proportion of the banking industry, the systemic risk of the financial system is likely to be contributed most to by the banking industry [11]. In addition, according to the latest report of the Financial Stability Board (FSB), four Chinese banks (Bank of China (ZGYH), Industrial and Commercial Bank of China (GSYH), Agricultural Bank of China (NYYH), and China Construction Bank (JSYH)) are included in the list of global systemically important banks [14]. Moreover, as a developing country, China’s banking industry has seen rapid growth in terms of scale. Furthermore, the total assets of the Chinese banking industry in 2018 were ranked first in the world [15,16]. Besides, we collect the data of China’s top 25 banks and the top 10 banks in the world in 2018, according to the report released by “The Banker” [17] on 30 June 2019 (see Table 1 and Table 2). China’s banks play an important role in the world, and China’s “Big Four Banks” (GSYH, JSYH, NYYH, ZGYH) topped the list in both 2018 and 2019 [18]. The tier 1 capital of China’s “Big Four Banks”, three banks in the United States, a bank in the United Kingdom, and a bank in Japan account for 51.915%, 34.232%, 6.950%, and 6.903% of the total Tier 1 capital of the top 10 banks in the world. Additionally, there are currently a few studies that measure the systemic risk in developing economies according to Khiari and Ben Sassi [19]. Therefore, our research on developing countries could be interesting and enrich existing studies. Thus, it is of great significance to study the systemic risks of China’s banks, not only for financial stability in China, but also for financial stability throughout the world, as the Chinese banking industry plays an more and more important role in the world.

In the digital economy era, for the financial industry, Fintech brings opportunities as well as challenges, and the supervision of systemic risk should be developed further. Due to the significant externality and the strong contagion effect of systemic risk, there is a strong need to strengthen the financial supervision of systemically important financial institutions (SIFIs) and forestall systemic risk, especially in the post-crisis era. Since the outbreak of the international financial crisis in 2008, there has been a persistent reform of the global financial regulatory system. One important part of this reform is to improve the regulatory framework and fortify the supervision of SIFIs. The international financial crisis shows that big financial institutions contribute seriously to the systemic risk, which promotes the reform of financial supervision, aiming at preventing the risk of the “too big to fail” financial institutions. However, as Greene et al. pointed out, an institution smaller in size did not indicate that it was less risky. They took an example of the event of Long-Term Capital Management (LTCM). An institution with relatively small size, could affect financial stability[7].

In the digital economy era, with the booming development of Fintech, we could focus on the systemic risk that a big institution causes, and we should also consider the systemic risk that may be induced by a small institution. In the era of the digital economy, the development of the information technology accelerates the speed for customers to enjoy financial services, and they have access to more and more diversified and even customized financial products. However, the risk will not disappear in the digital economy era. Compared with big institutions with relatively strong supervision, small institutions may be more sensitive to the financial environment and take more risks in terms of financial innovations, making them more prone to accumulating risk. Moreover, the digital economy era enables the institution to transfer the risk to the financial system faster and more seriously with possibly a more inconspicuous manner than before. Therefore, the importance of assessing the systemic risks of all institutions, especially the small institutions, should be precisely measured and should not be overlooked.

The Chinese government has always been attaching great importance to systemic risk prevention and ensuring financial stability. In recent years, the understanding of the significance for the financial sector to better prevent systemic risk has reached a new height. As Chinese president Xi Jinping pointed out in the National Financial Work Conference in 2017, finance is the lifeblood of the real economy. Therefore, a new committee, namely the State Council Financial Stability and Development Committee (SCFSDC), was announced to be set up in the conference. Further, the role of the central bank in China (People’s Bank of China, PBC) in macroprudential management and forestalling systemic risk should be strengthened[8]. In the report of the 19th National Congress, improving the financial supervision system and guarding against systemic risk were set as tasks for economic reform[9]. In 2018, the PBC, the CBIRC (China Banking and Insurance Regulatory Commission), and the CSRC (China Securities Regulatory Commission) jointly released a guideline for improving the supervision of SIFIs. The aims of this guideline were to recognize SIFIs, enhance the financial regulatory system, and maintain financial stability[8]. In 2019, PBC established the Macroprudential Policy Bureau (MPB) to evaluate and identify SIFIs[9]. The PBC also paid more attention to the financial supervision in the digital era and launched the pilot of supervision on Fintech innovations, aiming at improving the professionalism, the unity, and the penetration of the financial supervision [12].

In this paper, we aim to measure the systemic risks of China’s banks in the digital economy era. The reasons are as follows. First, China is a bank-based country, and the banking industry plays an important role in its financial system. In China’s financial system, because of a high proportion of the banking industry, the systemic risk of the financial system is likely to be contributed most to by the banking industry[11]. In addition, according to the latest report of the Financial Stability Board (FSB), four Chinese banks (Bank of China (ZGYH), Industrial and Commercial Bank of China (GSYH), Agricultural Bank of China (NYYH), and China Construction Bank (JSYH)) are included in the list of global systemically important banks[14]. Moreover, as a developing country, China’s banking industry has seen rapid growth in terms of scale. Furthermore, the total assets of the Chinese banking industry in 2018 were ranked first in the world[15][16]. Besides, we collect the data of China’s top 25 banks and the top 10 banks in the world in 2018, according to the report released by “The Banker” [17]on 30 June 2019 (see Table 1 and Table 2). China’s banks play an important role in the world, and China’s “Big Four Banks” (GSYH, JSYH, NYYH, ZGYH) topped the list in both 2018 and 2019[18]. The tier 1 capital of China’s “Big Four Banks”, three banks in the United States, a bank in the United Kingdom, and a bank in Japan account for 51.915%, 34.232%, 6.950%, and 6.903% of the total Tier 1 capital of the top 10 banks in the world. Additionally, there are currently a few studies that measure the systemic risk in developing economies according to Khiari and Ben Sassi[19]. Therefore, our research on developing countries could be interesting and enrich existing studies. Thus, it is of great significance to study the systemic risks of China’s banks, not only for financial stability in China, but also for financial stability throughout the world, as the Chinese banking industry plays an more and more important role in the world.

Currently, the systemic risk evaluation approaches for identify the systemic importance of the SIFIs, could be divided into two categories: the indicator approach and the market-based approach. The indicator approach is built based on judgment from experience, which assesses the systemic importance of a financial institution from different perspectives[20]. Based on the report of the Basel Committee on Banking Supervision (BCBS)[21][22], we illustrate the indicator system (

Currently, the systemic risk evaluation approaches for identify the systemic importance of the SIFIs, could be divided into two categories: the indicator approach and the market-based approach. The indicator approach is built based on judgment from experience, which assesses the systemic importance of a financial institution from different perspectives [20]. Based on the report of the Basel Committee on Banking Supervision (BCBS) [21,22], we illustrate the indicator system (

See Full Text: https://doi.org/10.3390/math8020180

) which contains the main indicators used to access systemically important global and domestic banks. This system comprises four or five major categories of indicators, and each major category consists of several subindicators. When measuring the systemic importance of a bank, we first calculate each subindicator and derive the index of each major category with equal weight, and then we obtain the systemic importance index with equal weight.

In comparison with the indicator approach, the market-based approach directly measures the contribution of a financial institution to the whole financial system based on daily or quarterly data derived from financial markets, and identifies the systemically important financial institutions via the quantitative results. This method can capture more characteristics of financial institutions based on the market data than the traditional indicator approach.

The CoVaR model, a market-based approach, is chosen as the core model for the following reasons. First, the traditional supervision focuses on the individual risks of financial institutions using risk indicators, including VaR, but it does not consider the risk at a system-wide level, especially the spillover effect of an institution to the system. CoVaR can efficiently measure the contributions of the institution to the systemic risk. As Adrian and Brunnermeier [2] pointed out, there are two situations in the banking industry: (1) There are some large banks in the banking system, and these banks are highly interconnected. When they are in distress, the risks transfer to the other banks, and cause a system-wide effect in the industry. (2) There are some small banks, but they may cause a herd effect and possibly engender a crisis. The spillover effect of a bank on systemic risk can be modeled with CoVaR. Second, the CoVaR model can measure the contribution to the system when a financial institution is in distress and in a normal state. It can also evaluate the exposure of an institution when the system is in distress (i.e., when a crisis breaks out). Third, we apply the CoVaR model based on data from the financial markets and can capture the changes in systemic risk contributions dynamically.

The CoVaR model, a market-based approach, is chosen as the core model for the following reasons. First, the traditional supervision focuses on the individual risks of financial institutions using risk indicators, including VaR, but it does not consider the risk at a system-wide level, especially the spillover effect of an institution to the system. CoVaR can efficiently measure the contributions of the institution to the systemic risk. As Adrian and Brunnermeier [2] pointed out, there are two situations in the banking industry: (1) There are some large banks in the banking system, and these banks are highly interconnected. When they are in distress, the risks transfer to the other banks, and cause a system-wide effect in the industry. (2) There are some small banks, but they may cause a herd effect and possibly engender a crisis. The spillover effect of a bank on systemic risk can be modeled with CoVaR. Second, the CoVaR model can measure the contribution to the system when a financial institution is in distress and in a normal state. It can also evaluate the exposure of an institution when the system is in distress (i.e., when a crisis breaks out). Third, we apply the CoVaR model based on data from the financial markets and can capture the changes in systemic risk contributions dynamically.

As the CoVaR model is built based on data from financial markets, it has been applied in an increasing number of studies, domestically and internationally. Drakos and Kouretas measured the contribution of listed financial institutions to systemic risk based on the daily data of the United Kingdom (UK) and the United States (US) financial institutions from 2000 to 2012. Based on the data, the authors found that all financial institutions had increased their contributions to systemic risk in the wake of the global financial crisis. In addition, for UK, banks contributed the most to the systemic risk; for US, the financial institutions that contributed the most to the systemic risk were US domestic banks [23]. Deng measured the risk spillover effects of financial institutions by using the CoVaR model based on quarterly data. Deng’s study suggested that during the sample period of 2010–2017, when the banking industry was in distress, the spillover effect on the whole financial market was stronger than those of the other types of the financial institutions. The study also measured the spillover effect when other financial industry is in distress. The results showed that the Chinese banking industry could withstand external shocks from other financial industries well, and the value of the risk spillover effect was not high [24]. Using the CoVaR model, Wang et al. used 14 banks as a sample. The research showed that the sizes of HXYH and XYYH were not large compared to the state-owned banks in China (in this paper, we denote the banks by the acronyms of the Chinese pinyin names for brevity). Meanwhile, the results showed that the risk spillover effects of these two banks on the Chinese banking system are even higher than those of the state-owned banks, including ZGYH and GSYH [25]. Verma et al. built a CoVaR model to analyze the Indian banking industry. Their study was based on the weekly frequency data of Indian banks, including state-owned banks and private banks, and they found that the state-owned banks were more stable in the times of crisis than private banks [26]. Girardi and Ergün analyzed the systemic risk contributions of 74 financial institutions during the sample period from 2000 to 2008 with a dynamic CoVaR model. They found that depository institutions contributed more to the systemic risk than other financial institutions. Moreover, they observed a positive and statistically significant effect of size on ΔCoVaR [27]. López-Espinosa et al. measured the systemic risk contributions of international large banks with the data spanning from 2001 to 2009, and the results showed that the average systemic risk contributions is higher in the crisis times than those in the pre-crisis times [28]. In addition, CoVaR can also be used in the related areas (e.g., the spillover effect in the debt market). Zheng et al. [29] found that since 2006, the liquidity risk indicators of big banks including ZGYH, JSYH, GSYH and JTYH had been relatively stable. The risk indicators of the joint-stock banks were highest, while the fluctuations of the risk indicators of the city commercial banks were also high. They used the CoVaR model to analyze the spillover effect of the liquidity risk of banks with the quarterly data of 14 banks derived from financial reports. The results showed that the joint-stock banks contributed the most to the risks of the whole banking system. The authors believed that for the joint-stock banks, their motivations to pursue profit are stronger than those of the other banks, and they are thus more active in the interbank market, thereby contributing more risk. Reboredo and Ugolini modeled the systemic risk of the European sovereign debt markets during the period of 2000–2012 with the CoVaR model. They found that there was a similar trend of the systemic risk across all debt markets [30]. Bernal et al. pointed out that ΔCoVaR is a useful method, which assesses the effect of the financial distress of a single financial institution. They applied the method in measuring the spillover effect of the bond market in a country to the Eurozone bond market [31].

As the CoVaR model is built based on data from financial markets, it has been applied in an increasing number of studies, domestically and internationally. Drakos and Kouretas measured the contribution of listed financial institutions to systemic risk based on the daily data of the United Kingdom (UK) and the United States (US) financial institutions from 2000 to 2012. Based on the data, the authors found that all financial institutions had increased their contributions to systemic risk in the wake of the global financial crisis. In addition, for UK, banks contributed the most to the systemic risk; for US, the financial institutions that contributed the most to the systemic risk were US domestic banks[23]. Deng measured the risk spillover effects of financial institutions by using the CoVaR model based on quarterly data. Deng’s study suggested that during the sample period of 2010–2017, when the banking industry was in distress, the spillover effect on the whole financial market was stronger than those of the other types of the financial institutions. The study also measured the spillover effect when other financial industry is in distress. The results showed that the Chinese banking industry could withstand external shocks from other financial industries well, and the value of the risk spillover effect was not high[24]. Using the CoVaR model, Wang et al. used 14 banks as a sample. The research showed that the sizes of HXYH and XYYH were not large compared to the state-owned banks in China (in this paper, we denote the banks by the acronyms of the Chinese pinyin names for brevity). Meanwhile, the results showed that the risk spillover effects of these two banks on the Chinese banking system are even higher than those of the state-owned banks, including ZGYH and GSYH [25]. Verma et al. built a CoVaR model to analyze the Indian banking industry. Their study was based on the weekly frequency data of Indian banks, including state-owned banks and private banks, and they found that the state-owned banks were more stable in the times of crisis than private banks[26]. Girardi and Ergün analyzed the systemic risk contributions of 74 financial institutions during the sample period from 2000 to 2008 with a dynamic CoVaR model. They found that depository institutions contributed more to the systemic risk than other financial institutions. Moreover, they observed a positive and statistically significant effect of size on ΔCoVaR [27]. López-Espinosa et al. measured the systemic risk contributions of international large banks with the data spanning from 2001 to 2009, and the results showed that the average systemic risk contributions is higher in the crisis times than those in the pre-crisis times[28]. In addition, CoVaR can also be used in the related areas (e.g., the spillover effect in the debt market). Zheng et al.[29] found that since 2006, the liquidity risk indicators of big banks including ZGYH, JSYH, GSYH and JTYH had been relatively stable. The risk indicators of the joint-stock banks were highest, while the fluctuations of the risk indicators of the city commercial banks were also high. They used the CoVaR model to analyze the spillover effect of the liquidity risk of banks with the quarterly data of 14 banks derived from financial reports. The results showed that the joint-stock banks contributed the most to the risks of the whole banking system. The authors believed that for the joint-stock banks, their motivations to pursue profit are stronger than those of the other banks, and they are thus more active in the interbank market, thereby contributing more risk. Reboredo and Ugolini modeled the systemic risk of the European sovereign debt markets during the period of 2000–2012 with the CoVaR model. They found that there was a similar trend of the systemic risk across all debt markets[30]. Bernal et al. pointed out that ΔCoVaR is a useful method, which assesses the effect of the financial distress of a single financial institution. They applied the method in measuring the spillover effect of the bond market in a country to the Eurozone bond market[31].

2. Development

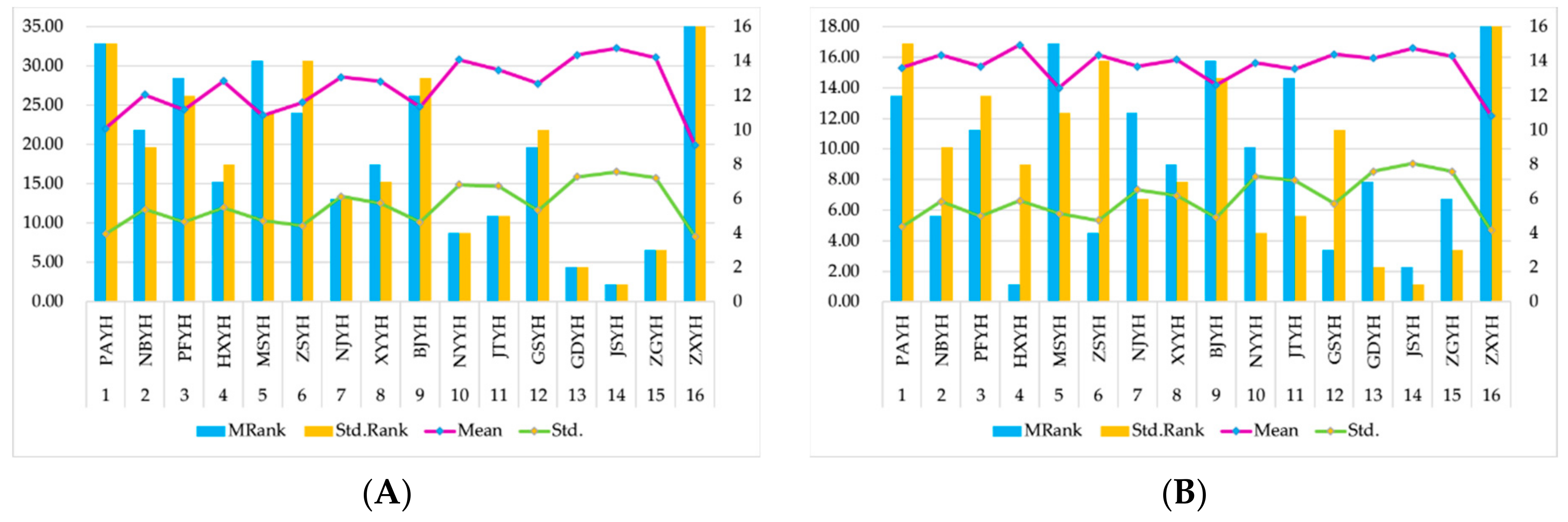

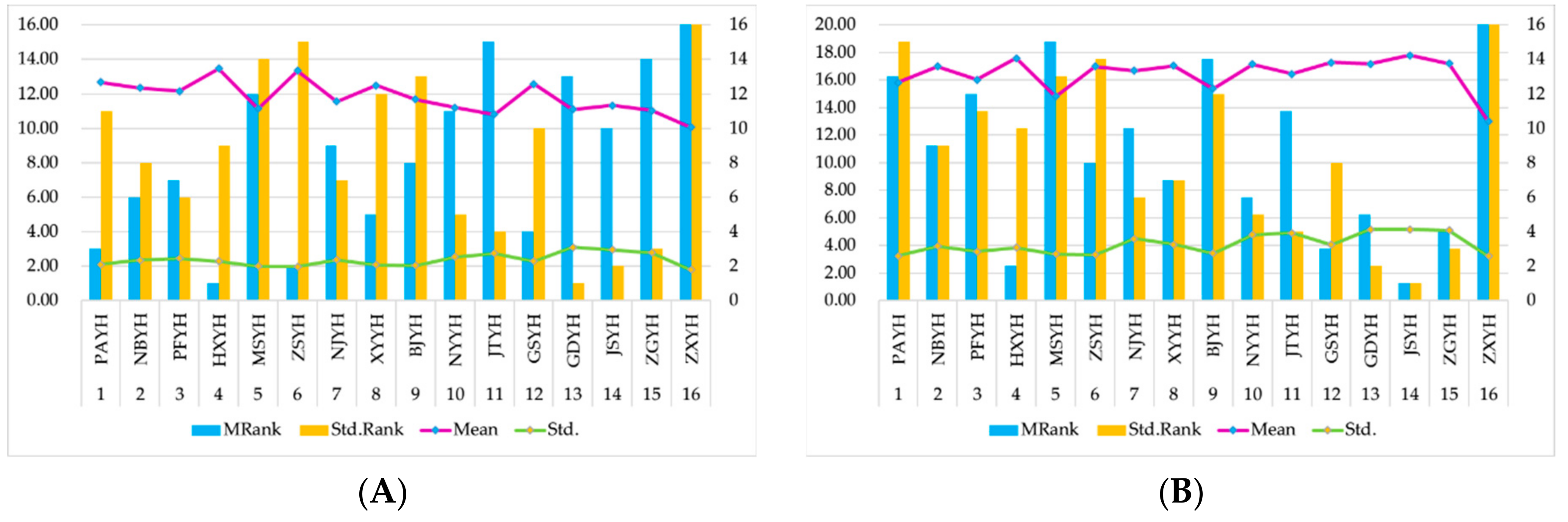

We contribute to the existing studies in several perspectives. First, in this paper, based on the daily data derived from financial markets, we build a series of CoVaR models and calculate the CoVaR when the sample banks are in a normal state or in distress. On this basis, we derive their contributions to systemic risk, namely ΔCoVaR. Typically, the papers related to systemic risk measurement using CoVaR focus on an overall analysis of the banks during the sample period. We introduce a year-by-year analysis, which can capture the dynamic changes of systemic risks and the rankings of systemic importance. For instance, see Figure 1 and 2. Second, for the first time, we jointly build static CoVaR, dynamic CoVaR, and Exposure CoVaR models for analyzing China’s listed banks. The contributions can be subdivided into three parts: (1) Based on the daily data derived from the financial markets, the traditional static CoVaR model is constructed to measure the systemic risk contribution (ΔCoVaR) of the sample banks with the combination of a year-by-year analysis and an overall analysis. (2) Considering the “time-varying” characteristics of the returns of the banking system and banks, seven kinds of state variables are introduced to establish a dynamic CoVaR model. (3) On the basis of the dynamic CoVaR model, the role of the return series of the banking system and those of a bank in the model are reversed, and the Exposure CoVaR model is established to calculate the risk exposure of a single bank when the whole banking system is unstable. Third, we also consider the extreme circumstance that a bank faces by using a 1% quantile. This further enrich the analysis of China’s banks’ systemic risk contribution. Fourth, we take the effects of Fintech and non-bank financial institutions into considerations, and modify the base model. Fifth, we conduct the indicator approach, and analyze the results based on the indicator approach and the CoVaR models by introducing Spearman’s rank correlation. The results of statistical tests enrich the existing studies. We provide possible explanations and suggestions for improving financial supervision and maintaining financial stability.

We contribute to the existing studies in several perspectives. First, in this paper, based on the daily data derived from financial markets, we build a series of CoVaR models and calculate the CoVaR when the sample banks are in a normal state or in distress. On this basis, we derive their contributions to systemic risk, namely ΔCoVaR. Typically, the papers related to systemic risk measurement using CoVaR focus on an overall analysis of the banks during the sample period. We introduce a year-by-year analysis, which can capture the dynamic changes of systemic risks and the rankings of systemic importance. For instance, see Figure 1 and 2. Second, for the first time, we jointly build static CoVaR, dynamic CoVaR, and Exposure CoVaR models for analyzing China’s listed banks. The contributions can be subdivided into three parts: (1) Based on the daily data derived from the financial markets, the traditional static CoVaR model is constructed to measure the systemic risk contribution (ΔCoVaR) of the sample banks with the combination of a year-by-year analysis and an overall analysis. (2) Considering the “time-varying” characteristics of the returns of the banking system and banks, seven kinds of state variables are introduced to establish a dynamic CoVaR model. (3) On the basis of the dynamic CoVaR model, the role of the return series of the banking system and those of a bank in the model are reversed, and the Exposure CoVaR model is established to calculate the risk exposure of a single bank when the whole banking system is unstable. Third, we also consider the extreme circumstance that a bank faces by using a 1% quantile. This further enrich the analysis of China’s banks’ systemic risk contribution. Fourth, we take the effects of Fintech and non-bank financial institutions into considerations, and modify the base model. Fifth, we conduct the indicator approach, and analyze the results based on the indicator approach and the CoVaR models by introducing Spearman’s rank correlation. The results of statistical tests enrich the existing studies. We provide possible explanations and suggestions for improving financial supervision and maintaining financial stability.

Figure 1. The results of the mean and standard deviations of ΔCoVaR (In the figure, we calculate the daily ΔCoVaR (the difference between the Conditional Value at Risk (CoVaRs) when the bank is in distress and in a normal state) of each bank, and then derive the corresponding mean and standard deviation for each bank): (A) 2015; (B) 2016.

Figure 2. The results of the mean and standard deviations of ΔCoVaR (In the figure, we calculate the daily ΔCoVaR (the difference between the Conditional Value at Risk (CoVaRs) when the bank is in distress and in a normal state) of each bank, and then derive the corresponding mean and standard deviation for each bank): (A) 2017; (B) 2018.

3. Findings

In this paper, based on the static, dynamic, and modified CoVaR models, we quantitatively measure the systemic risk of 16 China’s listed commercial banks during the period of 2011–2018. Our findings and suggestions are as follows.

In this paper, based on the static, dynamic, and modified CoVaR models, we quantitatively measure the systemic risk of 16 China’s listed commercial banks during the period of 2011–2018. Our findings and suggestions are as follows.

First, the market-based CoVaR approach, which is a useful complement for the indicator approach, could provide more information for strengthening financial supervision than the traditional indicator approach. The indicator system as well as the statistical tests clearly shows that the systemically important banks identified by the indicator approach are always big banks. However, we can conclude that for China, the systemic importance of a bank could not be simplified as the bank size rankings. Besides, the bank size rankings are not always positive and sometimes even negatively correlated with the rankings of systemic risk indicators (i.e., rankings of systemic importance) in the digital economy era. The conclusion still holds true when we assume that a bank is in extreme circumstance or considers the effects of Fintech and non-bank financial institutions.

First, the market-based CoVaR approach, which is a useful complement for the indicator approach, could provide more information for strengthening financial supervision than the traditional indicator approach. The indicator system as well as the statistical tests clearly shows that the systemically important banks identified by the indicator approach are always big banks. However, we can conclude that for China, the systemic importance of a bank could not be simplified as the bank size rankings. Besides, the bank size rankings are not always positive and sometimes even negatively correlated with the rankings of systemic risk indicators (i.e., rankings of systemic importance) in the digital economy era. The conclusion still holds true when we assume that a bank is in extreme circumstance or considers the effects of Fintech and non-bank financial institutions.

Second, the systemic risk changes over time. Based on the CoVaR models, we measure the systemic risk of 16 listed banks from 2011 to 2018, year by year, and integrate an overall analysis of the sample banks during the entire sample period. It is found that the levels of systemic risk vary across different time periods with the changes in domestic and international economic and financial situations. In the era of the digital economy, information transfers faster than before and customers can enjoy the benefits in the era, while we also need to know that the risk could also transfer faster. The periodical assessment of the systemic risk in the digital economy era could provide on timely early warning for regulators to avoid the accumulation of the risk and the occurrence of a crisis.

Second, the systemic risk changes over time. Based on the CoVaR models, we measure the systemic risk of 16 listed banks from 2011 to 2018, year by year, and integrate an overall analysis of the sample banks during the entire sample period. It is found that the levels of systemic risk vary across different time periods with the changes in domestic and international economic and financial situations. In the era of the digital economy, information transfers faster than before and customers can enjoy the benefits in the era, while we also need to know that the risk could also transfer faster. The periodical assessment of the systemic risk in the digital economy era could provide on timely early warning for regulators to avoid the accumulation of the risk and the occurrence of a crisis.

Third, based on both the static CoVaR model and the dynamic CoVaR models which introduce the state variables, the systemic importance rankings of banks change over time. Therefore, we suggest that the financial supervision of SIFIs requires dynamic evaluation, and the dynamic model is an enhanced model of the traditional static model, which contains more information and is time-varying, and it should be further developed for financial supervision. Furthermore, for China, the year-by-year analyses show that systemically important banks change over time, especially the bank which contributes the most to systemic risk. Interestingly, some SOE banks (big banks) are systemically important, and these banks are also identified by the indicator approach due to their huge sizes. However, the results based on the market data indicate that some SOE banks are not always systemically important, and some JOI and CCB banks (small banks) are identified as the systemically important banks. The base and extended models support the following view, which coincides with the point that we propose in the introduction section: small banks could also contribute to systemic risk and cause a systemic effect in the digital economy era. We contribute to the existing studies with empirical evidence and theoretical analysis.

Third, based on both the static CoVaR model and the dynamic CoVaR models which introduce the state variables, the systemic importance rankings of banks change over time. Therefore, we suggest that the financial supervision of SIFIs requires dynamic evaluation, and the dynamic model is an enhanced model of the traditional static model, which contains more information and is time-varying, and it should be further developed for financial supervision. Furthermore, for China, the year-by-year analyses show that systemically important banks change over time, especially the bank which contributes the most to systemic risk. Interestingly, some SOE banks (big banks) are systemically important, and these banks are also identified by the indicator approach due to their huge sizes. However, the results based on the market data indicate that some SOE banks are not always systemically important, and some JOI and CCB banks (small banks) are identified as the systemically important banks. The base and extended models support the following view, which coincides with the point that we propose in the introduction section: small banks could also contribute to systemic risk and cause a systemic effect in the digital economy era. We contribute to the existing studies with empirical evidence and theoretical analysis.

Overall, we suggest that in the digital economy era, the measurement of systemic risk and the identification of systemically important banks should be based on more and more market-based approaches, including the CoVaR model. Besides, with the development of Fintech and non-bank financial institutions, we should develop more models that incorporate the effects of these financial activities. In addition, the financial supervision, especially the reform of the macroprudential framework, should deeply consider the systemic risk contributions of not only big banks but also small banks, which may be not as large as the SOE banks in China but remain systemically important to the banking system. Differential supervision should be further developed to maintain financial stability not only in China but also around the world.

Overall, we suggest that in the digital economy era, the measurement of systemic risk and the identification of systemically important banks should be based on more and more market-based approaches, including the CoVaR model. Besides, with the development of Fintech and non-bank financial institutions, we should develop more models that incorporate the effects of these financial activities. In addition, the financial supervision, especially the reform of the macroprudential framework, should deeply consider the systemic risk contributions of not only big banks but also small banks, which may be not as large as the SOE banks in China but remain systemically important to the banking system. Differential supervision should be further developed to maintain financial stability not only in China but also around the world.

References

- Adrian, T.; Brunnermeier, M.K. CoVaR. NBER Working Paper 2011, 10, 1–45.

- Adrian, T.; Brunnermeier, M.K. CoVaR. Am. Econ. Rev. 2016, 106, 1705–1741.

- Tapscott, D. The Digital Economy: Promise and Peril in the Age of Networked Intelligence, 1st ed.; McGraw-Hill: New York, NY, USA, 1995; pp. 1–368. [Google Scholar]

- Tapscott, D. The Digital Economy Anniversary Edition: Rethinking Promise and Peril in the Age of Networked Intelligence, 2nd ed.; McGraw-Hill: New York, NY, USA, 2014; pp. 1–449. [Google Scholar]

- G20 Digital Economy Development and Cooperation Initiative. Available online: http://www.g20chn.org/English/Documents/Current/201609/P020160908736971932404.pdf (accessed on 20 September 2018).

- Measuring the Digital Economy. Available online: https://www.imf.org/~/media/Files/Publications/PP/2018/022818MeasuringDigitalEconomy.ashx (accessed on 28 February 2018).

- Greene, E.F.; McIlwain, K.L.; Scott, J.T. A closer look at “too big to fail”: National and international approaches to addressing the risks of large, interconnected financial institutions. Cap. Mark. Law J. 2010, 5, 117–140.

- Xi Launches Financial Reforms. Available online: http://www.chinadaily.com.cn/china/2017-07/17/content_30135404.htm (accessed on 20 August 2017).

- Secure a Decisive Victory in Building a Moderately Prosperous Society in All Respects and Strive for the Great Success of Socialism with Chinese Characteristics for a New Era. Available online: http://english.qstheory.cn/2018-02/11/c_1122395333.htm (accessed on 26 March 2018).

- China Improves Supervision of Systemically Important Financial Institutions. Available online: http://en.people.cn/n3/2018/1128/c90000-9522675.html (accessed on 1 December 2018).

- The Organization Structure of People’s Bank of China. Available online: http://www.gov.cn/xinwen/2019-02/02/content_5363338.htm (accessed on 12 February 2019).

- PBC Launched the Pilot of Supervision on Fintech Innovations. Available online: http://www.gov.cn/xinwen/2019-12/06/content_5458990.htm (accessed on 31 December 2019).

- Li, D.K. Banking Industry Contributed the Most to China’s Systemic Risk. Insight China 2012, 6, 18. Available online: https://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFDN1214&filename=KACZ201206009 (accessed on 6 January 2019).

- 2019 List of Global Systemically Important Banks (G-SIBs). Available online: https://www.fsb.org/wp-content/uploads/P221119-1.pdf (accessed on 26 November 2019).

- China’s Economic Development in the Past 70 Years. Available online: http://economy.gmw.cn/2019-09/26/content_33189822.htm (accessed on 30 September 2019).

- The Total Assets of China’s Banking Financial Institutions Reached 268 Trillion RMB. Available online: http://finance.china.com.cn/news/20190225/4905682.shtml (accessed on 25 February 2019).

- The Top 1000 World Banks (2019). Available online: https://www.thebanker.com/Top-1000 (accessed on 30 June 2019).

- Jiang, H.C.; He, Y.F. Applying Data Envelopment Analysis in Measuring the Efficiency of Chinese Listed Banks in The Context of Macroprudential Framework. Mathematics 2018, 6, 184.

- Khiari, W.; Ben Sassi, S. On Identifying the Systemically Important Tunisian Banks: An Empirical Approach Based on the ΔCoVaR Measures. Risks 2019, 7, 122.

- Xu, C. The Literature Review of the Methods Related to the Identification of Systemically Important Financial Institutions. Stud. Int. Financ. 2011, 11, 57–64. Available online: https://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFD2011&filename=GJJR201111008 (accessed on 2 November 2017).

- A Framework for Dealing with Domestic Systemically Important Banks. Available online: https://www.bis.org/publ/bcbs233.pdf (accessed on 6 June 2017).

- Global Systemically Important Banks: Updated Assessment Methodology and the Higher Loss Absorbency Requirement. Available online: https://www.bis.org/publ/bcbs233.pdf (accessed on 2 February 2018).

- Drakos, A.A.; Kouretas, G.P. Bank Ownership, Financial Segments and the Measurement of Systemic Risk: An Application of CoVaR. Int. Rev. Econ. Financ. 2015, 40, 127–140.

- Deng, X.F. Research on the Return and Spillover Effect of the Financial industry. Contemp. Econ. 2019, 2, 27–30. Available online: https://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFDLAST2019&filename=DAJJ201902010 (accessed on 16 February 2018).

- Wang, W.; Zhang, Y.; Wang, Y.X. The Measurement of Systemic Risk Based on Dynamic CoVaR and the Research on Financial Regulation. Financ. Theory Pract. 2018, 12, 47–54. Available online: https://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFDLAST2019&filename=JRLS201812008 (accessed on 16 December 2018).

- Verma, R.; Ahmad, W.; Uddin, G.S.; Bekiros, S. Analysing the Systemic Risk of Indian banks. Econ. Lett. 2019, 176, 103–108.

- Girardi, G.; Ergün, A.T. Systemic Risk Measurement: Multivariate GARCH Estimation of CoVaR. J. Bank. Financ. 2013, 37, 3169–3180.

- López-Espinosa, G.; Moreno, A.; Rubia, A.; Valderrama, L. Short-Term Wholesale Funding and Systemic Risk: A Global CoVaR Approach. J. Bank. Financ. 2012, 36, 3150–3162.

- Zheng, D.; Yan, Y.R.; Lei, L. The Spillover Effect of Liquidity Risk in China’s Commercial Banks: A Dynamic CoVaR Approach. Financ. Econ. 2019, 1, 39–51. Available online: https://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CJFQ&dbname=CJFDLAST2019&filename=CJKX201901005 (accessed on 2 February 2019).

- Reboredo, J.C.; Ugolini, A. Systemic Risk in European Sovereign Debt Markets: A CoVaR-copula Approach. J. Int. Money Financ. 2015, 51, 214–244.

- Bernal, O.; Gnabo, J.Y.; Guilmin, G. Economic Policy Uncertainty and Risk Spillovers in the Eurozone. J. Int. Money Financ. 2016, 65, 24–45.